A Brief Analysis of the Global Regulatory Landscape for Virtual Assets

TechFlow Selected TechFlow Selected

A Brief Analysis of the Global Regulatory Landscape for Virtual Assets

This article will outline the current progress of the most important trends of 2023 from the perspective of an industry observer.

Author: Alfred, LD Capital

The ideal state of the crypto world is a decentralized, permissionless system governed by digital rules—an idea that seems at odds with traditional regulation. Yet today, the development of the crypto industry is rapidly converging with regulatory bodies around the globe. While many native crypto enthusiasts may dislike this trend, frequent legislative developments and regulatory movements have become central to the industry's evolution.

We believe sovereignty and mathematical order will remain core values in the future. However, for any new technology to be widely adopted within the existing global order and scaled rapidly worldwide, navigating and integrating with regulation is an unavoidable necessity. This article outlines, from an industry observer’s perspective, the current progress of the most important trends in 2023 (* Given common regulatory practices across jurisdictions, this article primarily uses "virtual assets" to refer broadly to crypto and digital assets).

1. Singapore – A Leader in Virtual Asset Regulation

Following the collapses of Three Arrows Capital and FTX, Singapore’s regulators have taken a more cautious and stringent approach, slightly slowing its pace of growth. Nevertheless, thanks to its stable policies and open environment, Singapore remains one of the top destinations globally for Web3 companies and entrepreneurs.

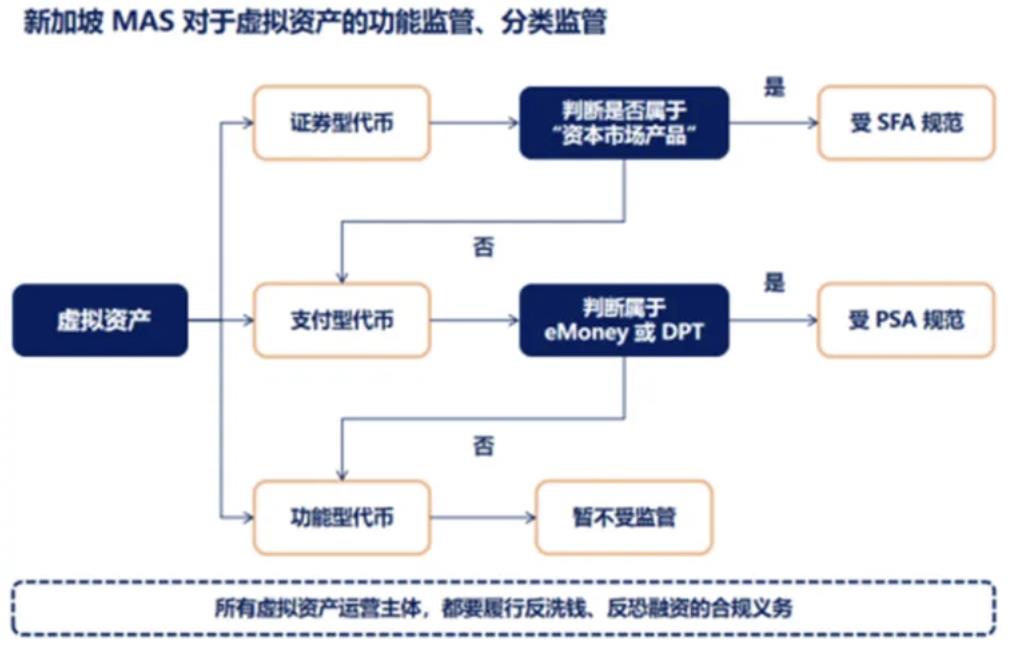

1.1 MAS’s Three-Category Virtual Asset Regulatory Framework

The Monetary Authority of Singapore (MAS), serving as both the central bank and comprehensive financial regulator, oversees the Web3 sector. MAS adopts a functional and classification-based regulatory approach to bring virtual asset activities into a legal framework.

According to the revised *Guidelines on Digital Token Offerings* published by MAS in May 2020, virtual assets are categorized into three types based on their functions and characteristics: Security Tokens, Payment Tokens, and Utility Tokens. Among these, Payment Tokens include eMoney (electronic money) and DPTs (Digital Payment Tokens)—cryptocurrencies used primarily for payments (e.g., BTC, ETH).

Source: Web3 Xiao Law

Security Tokens fall under the Securities and Futures Act (SFA), Payment Tokens are regulated under the Payment Services Act (PSA), while Utility Tokens currently lack specific regulatory guidelines. Assets falling under SFA or PSA must obtain approval from MAS and secure relevant licenses before operating legally. Additionally, all virtual asset activities—like other financial operations—must comply with anti-money laundering (AML) and counter-terrorism financing (CFT) requirements.

1.2 Launch of Final Stablecoin Regulatory Framework

On August 15, 2023, MAS announced the final version of its stablecoin regulatory framework, aiming to ensure that stablecoins regulated in Singapore maintain high value stability. This makes Singapore one of the first jurisdictions globally to formally integrate stablecoins into its regulatory system.

Under the framework, a stablecoin is defined as a Digital Payment Token (DPT) issued in Singapore and pegged to the Singapore dollar or any G10 currency—a single-currency stablecoin (SCS) designed to maintain a relatively constant value. Issuers of such SCSs must meet key requirements across four areas: value stability, capital adequacy, redeemability at par, and disclosure transparency.

When properly regulated, stablecoins can serve as trusted mediums of exchange supporting innovation—including “on-chain” buying and selling of digital assets. Only issuers meeting all framework requirements can apply to MAS for recognition and use the label “MAS-Regulated Stablecoin.” This label enables users to easily distinguish MAS-regulated stablecoins from other digital payment tokens, including unregulated so-called “stablecoins.” Users choosing to transact with non-MAS-regulated stablecoins should make informed decisions regarding the associated risks.

2. Hong Kong – Accelerating Virtual Asset Development at Full Speed

After years of relative silence, Hong Kong reignited its embrace of the virtual asset industry starting October 31, 2022, with the release of the *Hong Kong Policy Statement on Development of Virtual Assets* by the Financial Services and Treasury Bureau. Since then, it has rolled out policy after policy in 2023 to demonstrate its commitment. According to the Hong Kong Financial Development Council’s 2022/23 annual report, Hong Kong aims to position itself as a global leader in developing virtual assets and complementary technologies.

2.1 Hong Kong’s Dual-Licensing Regime

Hong Kong currently employs a “dual licensing” regime for virtual asset trading platform operators. One license applies to platforms dealing in “security tokens,” governed by the Securities and Futures Ordinance (SFO); the other covers “non-security tokens” and falls under the licensing regime of the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill.

The Securities and Futures Commission (SFC) previously stated that the nature and features of virtual assets may evolve over time, meaning the distinction between security and non-security tokens could shift. Therefore, to ensure compliance, virtual asset platforms are advised to hold both licenses.

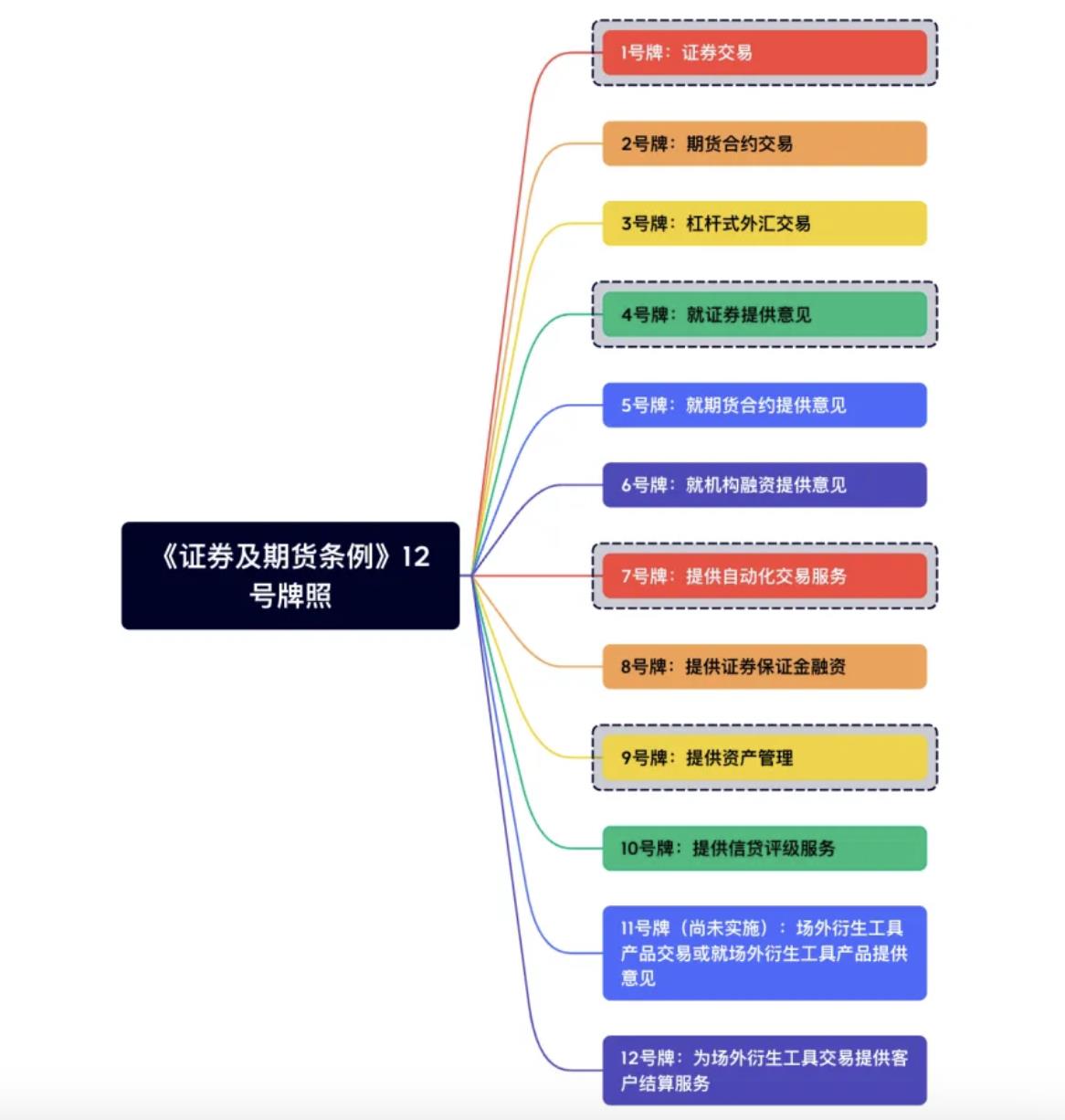

(1) Type 1 and Type 7 Licenses under the SFO

Hong Kong already had a robust licensing system prior to recent changes. If a virtual asset qualifies as a security token, related business activities require corresponding securities licenses. Currently, three main licenses are mandatory for operating a virtual asset business: Type 1 (dealing in securities), Type 7 (providing automated trading services), and VASP license. Depending on actual operations, firms may also need Type 4 (advising on securities) and Type 9 (asset management) licenses.

Source: LD Capital

(2) VASP License

The Virtual Asset Service Provider (VASP) licensing regime stems from the *Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance*. In December 2022, Hong Kong’s Legislative Council passed the bill in its third reading and gazetted it, marking the city’s first legislation specifically regulating virtual assets.

According to the *2022 Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance*, virtual assets are defined as cryptographically secured digital value represented in units of account or stored economic value; usable as a medium of exchange for goods/services, debt repayment, or investment; eligible for voting on matters related to virtual assets; and transferable, storable, or tradable electronically. The SFC or Secretary for Financial Services and the Treasury may expand or narrow the definition via official gazette. The VA definition under the AMLO covers most major cryptocurrencies, including BTC, ETH, stablecoins, utility tokens, and governance tokens.

Existing virtual asset platforms holding Type 1 and Type 7 licenses must also apply for a VASP license but can follow a simplified application process. On August 3, HashKey and OSL upgraded their licenses through this fast-track procedure and quickly received approval to offer retail services—expanding their client base from professional investors to retail users.

Additionally, the AMLO provides transitional arrangements for “existing virtual asset exchanges,” setting June 1, 2024, as the deadline. Platforms holding Type 1 and Type 7 licenses but not yet licensed as VASPs are recommended a 12-month transition period. Those unwilling to apply must prepare to wind down their Hong Kong operations in an orderly manner, with closure required by May 31, 2024. Simply put, after June 1, 2024, only VASP-licensed exchanges may operate legally in Hong Kong.

2.2 Accelerating Stablecoin Development

Regarding stablecoins, the SFC clarified in its consultation summary that the Hong Kong Monetary Authority (HKMA) released the *Consultation Conclusions on Crypto Assets and Stablecoins* in January 2023, stating that regulatory frameworks for stablecoins would be implemented in 2023/24, establishing a licensing regime for stablecoin-related activities. Until formal regulations take effect, the SFC maintains that stablecoins should not be made available for retail trading.

On May 18, the HKMA launched the “Digital Hong Kong Dollar” pilot program, selecting 16 companies from finance, payments, and tech sectors to participate in the first round of trials in 2023. The pilot explores six potential use cases: comprehensive payments, programmable payments, offline payments, tokenized deposits, Web3 transaction settlements, and tokenized asset settlements. At the Wanxiang Blockchain Week on September 19, Hong Kong Legislative Council member David Chu indicated that regulations for Hong Kong dollar-pegged stablecoins might launch by June next year.

3. UAE – Building the First Tailored Virtual Asset Regime

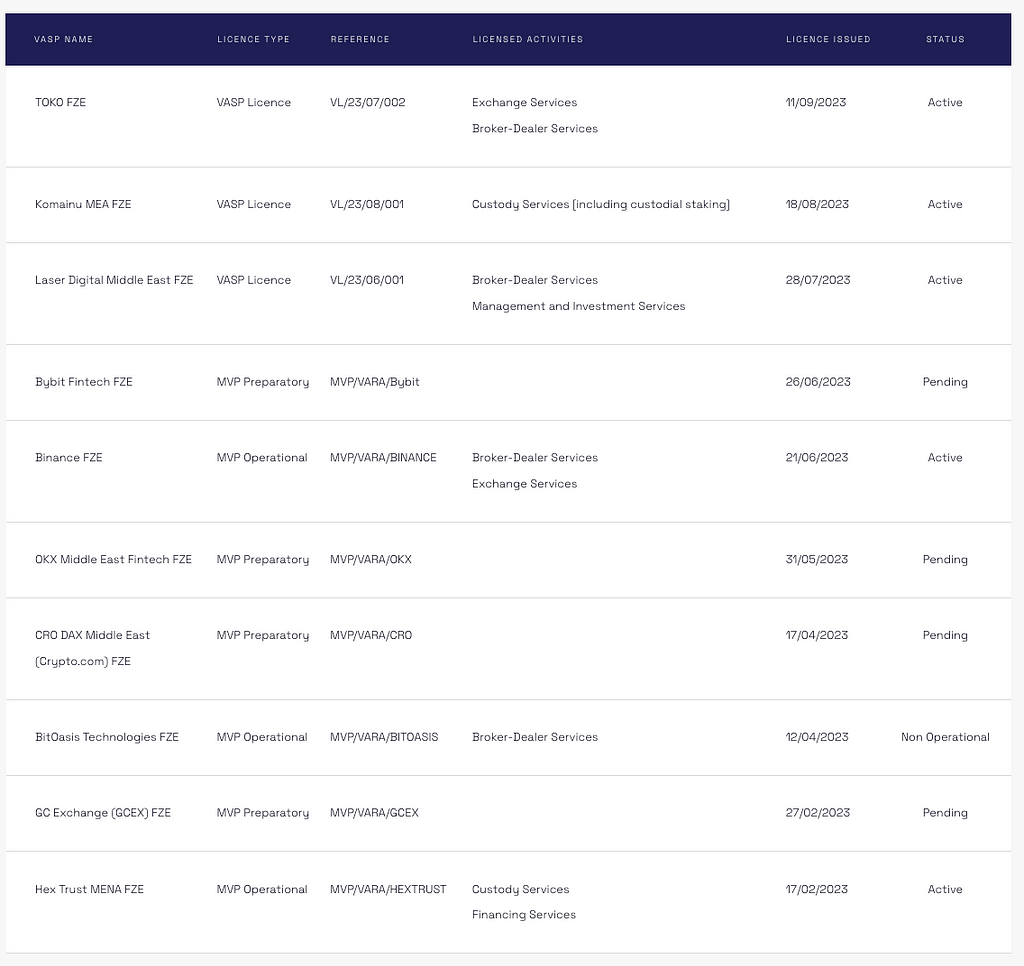

Established in March 2022, the Dubai Virtual Assets Regulatory Authority (VARA) is the world’s first government agency solely dedicated to regulating the virtual asset industry. VARA oversees virtual asset-related activities in Dubai (including special development zones and free zones, excluding the Dubai International Financial Centre). Prior to this, Binance, OKX, Crypto.com, Bybit, and others had obtained MVP licenses and established offices in Dubai.

On February 7, 2023, following the approval of Dubai Emirate Virtual Asset Regulatory Law No. 4 of 2022, VARA officially released the 2023 Virtual Assets and Related Activities Regulations. These regulations took immediate effect and require all market participants offering virtual asset services in the UAE (excluding ADGM and DIFC financial free zones) to obtain approval and licensing from either the UAE Securities and Commodities Authority (SCA) or VARA.

VARA identifies seven distinct virtual asset (VA) activities: advisory services, brokerage/dealer services, custodial services, exchange services, lending services, management/investment services, and transfer/settlement services. The licensing process consists of four stages: provisional license, preparation, Minimum Viable Product (MVP) license, and Full Market Product (FMP) license. MVP license holders cannot offer services to general retail consumers until they receive full FMP approval (though they may serve qualified retail and institutional investors in Dubai).

Source: VARA Public Registry

The Dubai government has taken one of the boldest and most proactive approaches toward virtual asset development—not only establishing an independent regulator and tailored policies but also aggressively advancing AI and metaverse initiatives, positioning itself as a major international player in the virtual asset space.

4. Europe – The EU Introduces the Most Comprehensive Unified Virtual Asset Regulatory Framework

4.1 European Union

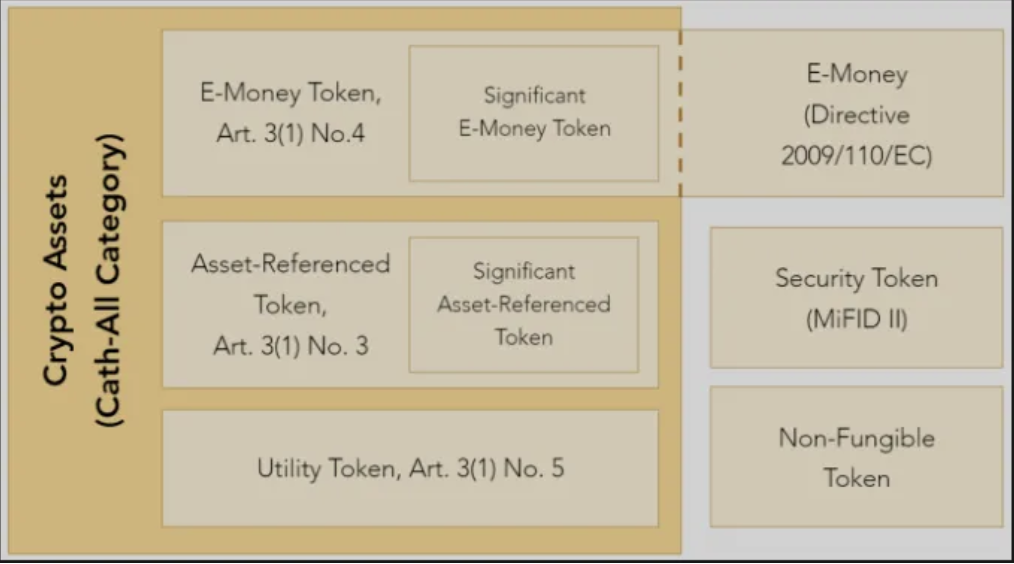

On May 31, 2023, the European Union formally signed the landmark Markets in Crypto-Assets Regulation (MiCA), which was published in the Official Journal of the European Union (OJEU) on June 9. This marks the emergence of the world’s most complete and clearly structured unified virtual asset regulatory framework. MiCA establishes a common regulatory regime across all 27 EU member states, creating a single market serving approximately 450 million people.

Spanning 150 pages, MiCA offers a comprehensive (and complex) regulatory framework where companies and individuals can refer to specific chapters for detailed provisions. Key components include scope and definitions, classification of crypto-assets and related regulations, rules for crypto-asset service providers (CASPs), and supervisory authorities. Under MiCA, any company offering crypto-assets to the public must publish a fair, clear white paper warning of risks without misleading potential buyers, register with regulators, and maintain adequate bank-like reserves for stablecoins.

Source: LD Capital

MiCA defines crypto-assets as “digital representations of value or rights…using distributed ledger technology or similar technology, capable of being transferred and stored electronically.” In terms of classification, MiCA divides crypto-assets into Electronic Money Tokens (EMTs), Asset-Referenced Tokens (ARTs), and other crypto-assets. EMTs maintain stable value by referencing a single official currency (governed under Chapter IV); ARTs reference another value, right, or combination—including multiple currencies—to maintain stability (covered under Chapter III); Utility Tokens grant access to goods or services provided by the issuer (addressed in Chapter V). Notably, MiCA does not yet provide clear regulatory treatment for security tokens or NFTs, and practical applications will be needed to clarify how existing market tokens fit into this framework.

Source: Mayer Brown

MiCA will enter into force after an 18-month transition period, becoming fully applicable on December 30, 2024. By mid-2025, the European Commission will assess whether additional legislation is needed to address NFTs and decentralized finance (DeFi).

4.2 United Kingdom

Following the EU’s MiCA, the UK has accelerated its own legislative efforts. On June 19, 2023, the UK House of Lords approved the Financial Services and Markets Bill (FSMB), which received royal assent on June 29. Royal assent is a procedural step after parliamentary approval, officially enacting the bill into law and bringing crypto promotions under formal regulatory oversight, including enhanced supervision of crypto marketing.

UK Financial Services Minister Andrew Griffith stated that post-Brexit, the UK now controls its own financial services rulebook, allowing crypto asset regulation to support safe adoption domestically. On July 28, the UK and Singapore agreed to jointly develop and implement global regulatory standards for cryptocurrencies and digital assets.

5. United States – A Pivotal Player in Virtual Asset Development

In recent years, the U.S. Securities and Exchange Commission (SEC) has aggressively enforced regulations, making the U.S. one of the strictest jurisdictions globally. Yet traditional financial institutions and crypto enterprises in the U.S. continue pushing for industry growth and regulatory integration. Since 2022, U.S. lawmakers have introduced over 50 digital asset bills to Congress. Today, U.S. regulation acts as both a major constraint and a potential catalyst for future development—especially given its role in governing the flow of dollars, the primary source of liquidity in the crypto world.

5.1 SEC vs. CFTC

(1) SEC and the Howey Test

The U.S. Securities and Exchange Commission (SEC) is an independent federal agency and quasi-judicial body established under the Securities Exchange Act of 1934. It oversees U.S. securities markets and is the highest authority in the nation’s securities industry. The SEC exercises powers granted by Congress to prevent corporate fraud, misinformation, insider trading, and violations of securities laws, subjecting offenders to civil litigation.

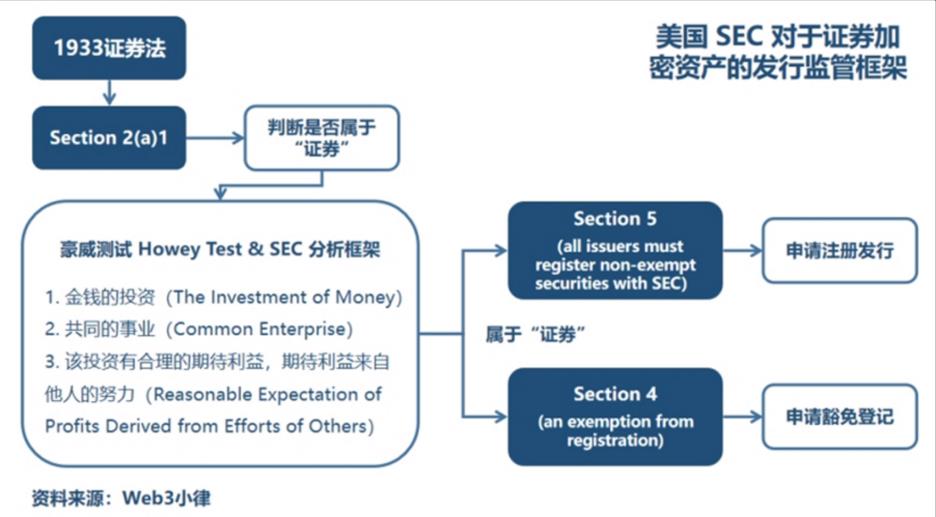

As crypto assets with financial characteristics have evolved, the SEC applies its April 3, 2019 framework titled *Framework for 'Investment Contract' Analysis of Digital Assets* to determine whether a particular crypto asset constitutes a security—and thus falls under the Securities Act of 1933 and Securities Exchange Act of 1934. The key analytical tool is the “Howey Test”: Is there an investment of money? Is it in a common enterprise? Does the investor expect profits derived from the efforts of others? Both the SEC and federal courts emphasize the flexibility (and subjectivity) of the Howey Test. If a crypto asset satisfies this test, it will be classified as a security and brought under SEC regulation.

Source: Web3 Xiao Law

(2) Challenges Posed by SEC Regulation to Crypto

Current SEC Chair Gary Gensler has repeatedly stated publicly that except for fully decentralized cryptocurrencies like Bitcoin, most crypto tokens satisfy the investment contract criteria and should be treated as “securities.” This means their offerings and sales must either register with the SEC or qualify for exemptions. Consequently, most crypto intermediaries must also comply with securities laws.

Classifying tokens as securities implies significant compliance costs for issuers and platforms adapting to the U.S.’s mature and stringent regulatory regime. They would face ongoing audits and enforcement actions. More critically, applying outdated regulations without adaptive revisions could fundamentally alter how the crypto industry operates, stifling current operations and future innovation.

(3) CFTC Embraces Crypto but Remains Strict

The Commodity Futures Trading Commission (CFTC), established in 1974, is an independent U.S. government agency authorized by Congress to administer and enforce the Commodity Exchange Act (CEA) and related regulations. It primarily regulates futures, options, and derivatives markets.

CFTC Chair Rostin Behnam recently noted clear differences between the CFTC and SEC in their crypto regulatory approaches. He believes many crypto assets—such as BTC and ETH—are commodities rather than securities. He criticized the SEC’s enforcement-heavy strategy: “I strongly oppose enforcement-led regulation. I’ve done my best to stay transparent.” He likened financial innovation to national interest and compared crypto innovation to past structural milestones, such as the electronic shift in trading two decades ago.

However, the CFTC has recently shown its tough side, taking enforcement action against three DeFi projects involving derivatives. Opyn, Inc., ZeroEx, Inc., and Deridex, Inc.—U.S.-based blockchain firms—were penalized and settled. While some previously viewed the CFTC as friendly due to its openness compared to the SEC, recent actions show that the CFTC can be even stricter in certain domains.

5.2 Spot Bitcoin ETF

(1) What Is a Spot Bitcoin ETF?

An ETF, or Exchange-Traded Fund, is an open-ended investment fund traded on exchanges. An ETF holds a portfolio of underlying assets and issues shares representing partial ownership. As an index-tracking product, it allows investors to gain exposure to a diversified basket of assets—such as financial stocks, energy stocks, or commodities—through a single trade, enabling risk diversification.

A spot Bitcoin ETF directly invests in physical Bitcoin holdings. Its price tracks the real-time market value of Bitcoin, allowing investors to buy and sell shares on conventional stock exchanges without holding actual cryptocurrency, thereby gaining exposure to Bitcoin’s price movements.

(2) Why Is a Spot Bitcoin ETF So Important?

ETFs simplify investment processes and lower entry barriers, attracting more investors. Once approved, a spot Bitcoin ETF introduces a new legal investment vehicle into traditional finance. Leveraging the massive distribution networks and credibility of major asset managers, it could funnel trillions of dollars into the market. As the largest cryptocurrency, Bitcoin’s ETF approval could catalyze the creation of compliant products for other digital assets, driving broader capital inflows and accelerating overall industry growth.

(3) Current Status of ETF Applications

Multiple major U.S. asset managers—including BlackRock, Fidelity, ARK, Bitwise, WisdomTree, and Valkyrie—have submitted applications for spot Bitcoin ETFs. The SEC must respond to each application by one of four deadlines—either approving, rejecting, or postponing. The SEC did not approve any applications at the first deadline. Many expect critical decisions around mid-October.

Source: Bloomberg, Planet Daily

Former SEC Chair Jay Clayton and Wintermute co-founder Evgeny Gaevoy have both said approval of a spot Bitcoin ETF is inevitable—it’s just a matter of time. While speculation is growing about positive news in October, the author believes formal approval is more likely to occur next year.

5.3 Others

(1) Stablecoins

This year, Republican members of the U.S. House Committee on Financial Services proposed a new stablecoin regulatory draft bill, aiming to shift regulatory authority over stablecoins from the SEC to federal and state banking and credit union regulators. However, it failed to pass in the Democrat-majority Senate. In August, global payments giant PayPal announced PYUSD, a U.S. dollar-pegged stablecoin for transfers and payments, issued by Paxos Trust Co. and backed by U.S. dollars, short-term Treasuries, and cash equivalents. On August 16, Circle’s Chief Strategy Officer Dante Disparte called for swift stablecoin legislation in the U.S.

(2) RWA

Real World Assets (RWA) represent one of the fastest-growing sectors in the U.S., with Treasury-backed RWAs becoming significant assets in crypto. On September 8, the Federal Reserve published a working paper on tokenization, analyzing its scale, benefits, and risks, signaling increasing attention to asset tokenization. On September 7, industry leaders—including Aave Companies, Centrifuge, Circle, Coinbase, Base, Credix, Goldfinch, and RWA.xyz—announced the formation of the Tokenized Assets Coalition (TAC), committed to bringing the next trillion-dollar asset class on-chain through tokenization, education, and advocacy.

(3) DeFi and NFTs

Recently, DeFi and NFTs have become focal points for U.S. regulators. As mentioned earlier, the CFTC took enforcement actions against three DeFi protocols, all of which settled. In August and September, the SEC took regulatory actions against Impact Theory, LLC (a Los Angeles-based entertainment company) and Stoner Cats 2 LLC for issuing unregistered securities. Impact Theory, LLC resolved the case by introducing an investor compensation plan.

While the U.S. boasts the most sophisticated financial system and high regulatory standards, it has faced criticism this year. Compared to other jurisdictions that have enacted new laws, U.S. regulators tend to apply existing frameworks to crypto without introducing adapted regulations—hindering innovation and growth. Despite this, the U.S. continues to host highly innovative firms and powerful traditional interests involved in Web3, who will keep pushing for regulatory change. External regulatory developments and the 2024 U.S. election may prove pivotal.

6. Japan and South Korea – Key Players in the Virtual Asset Ecosystem

6.1 Japan

Japan was an early entrant into cryptocurrency but suffered a major setback in 2014 when Mt. Gox—the world’s largest Bitcoin exchange at the time—was hacked and collapsed. The incident resulted in losses of up to 850,000 BTC, and creditor repayments have taken nine years and counting. On September 21, the trustee overseeing the Mt. Gox bankruptcy delayed payouts by another year—from October 31, 2023, to October 31, 2024.

Following the Mt. Gox incident, Japan implemented stricter oversight of the crypto industry, adopting clearer and more defined control policies than many other nations. In 2017, Japan amended its *Payment Services Act*, bringing crypto exchanges under regulatory purview via a licensing system administered by the Financial Services Agency (FSA).

With rapid industry growth in recent years, Japan began rolling out proactive policies starting in 2022. On June 1, 2022, Prime Minister Fumio Kishida declared in the Diet: “The arrival of the Web3 era may drive Japan’s economic growth. I firmly believe Japan must push forward decisively from a political standpoint.” Soon after, Japan established the METI Web3 Policy Office and the LDP Web3 Project Team to accelerate Web3 adoption.

In April 2023, the ruling party’s Web3.0 Task Force released a white paper proposing measures to boost Japan’s crypto industry. In June 2023, Japan’s *Act on Settlement of Funds Amendment Bill* passed the upper house, making it one of the first countries to enact stablecoin legislation. The Ethereum developer conference “EDCON 2024” will also be hosted in Japan.

6.2 South Korea

South Korea is among the most enthusiastic crypto-trading nations. In 2017, this country of over 50 million people accounted for 20% of global Bitcoin trading volume and became the largest market for Ethereum. Over subsequent years, the government introduced measures to curb speculative behavior, including trader eligibility checks and exchange registration requirements. Nonetheless, crypto trading remains extremely active. When a token gains traction among Korean traders and lists locally, its price often surges far above levels on global exchanges—a phenomenon known as the “Kimchi premium.”

Amid this fervor, South Korea’s regulatory landscape has evolved rapidly alongside other regions. In June, the National Assembly passed the *Virtual Asset User Protection Act*, establishing a regulatory framework aimed at protecting investors and fostering a healthy, transparent, and standardized market. The Financial Services Commission plans to proceed with second-stage legislation. The act will take effect one year after promulgation, expected in July 2024.

Recently, South Korea has also advanced infrastructure initiatives. On September 12, three major securities firms—Shinhan Investment & Securities, KB Securities, and NH Investment & Securities—formed the “Token Securities (ST) Alliance” to jointly build foundational infrastructure. On September 21, Busan City approved the “Busan Digital Asset Exchange Establishment Plan and Future Roadmap,” aiming to launch the exchange in November and begin full operations in the first half of 2024. Busan also plans to transform into a “Blockchain City” centered around the exchange and establish a 1 trillion KRW (~$75 million) Blockchain Innovation Fund.

7. G20 – Championing a Global Virtual Asset Regulatory Framework

Currently, virtual asset regulations vary significantly across jurisdictions, creating operational challenges and higher compliance costs for projects and firms. It also opens doors for regulatory arbitrage. The G20, representing 85% of global GDP, 80% of trade, and two-thirds of the world’s population, is actively advocating for a unified global regulatory framework for virtual assets.

On September 9, 2023, G20 leaders expressed support for recommendations from the Financial Stability Board (FSB) and International Monetary Fund (IMF) on regulating crypto asset activities, markets, and global stablecoins. They agreed to discuss advancing the proposed roadmap at their October meeting. At the New Delhi summit on September 11, G20 leaders reached consensus on the rapid implementation of a cross-border crypto framework. Starting in 2027, this framework will facilitate global information sharing on crypto transactions, with countries automatically exchanging data annually across jurisdictions—including transactions conducted on unregulated exchanges and wallet providers. (The G20 comprises Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, South Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the UK, the US, and the EU.)

The G20’s efforts in virtual asset regulation are positive. However, given its composition of diverse political ideologies and competing interests—and amid a broader trend of deglobalization and great-power rivalry—substantive policy implementation may progress slowly.

8. Conclusion

1. Compliance costs for crypto firms remain high under current regulations. Although various jurisdictions have introduced legislation, differing definitions, classifications, and regulatory methods for virtual assets force companies and individual investors to navigate fragmented compliance regimes across regions.

2. Virtual assets’ innovative and unique nature calls for tailored regulatory frameworks. Given their lifecycle—mining, staking, issuance, trading, transfer, payment, lending, derivatives—and hybrid characteristics (e.g., a token serving payment, security, and utility functions), forcing them into legacy, unmodified regulatory systems creates misalignment. New, purpose-built regulations based on broad consensus are better suited. Balancing innovation and oversight requires nuanced policymaking.

3. Integration through iterative adaptation is inevitable. More virtual asset regulations will take effect in 2024. Adapting to regulatory environments will be long and challenging. Yet, to attract fresh liquidity and enable mass adoption, the path forward lies in gradually integrating with regulation while evolving existing systems—this dual transformation is now essential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News