Social Tokenization: How Web3 Is Transforming Online Social Interactions and Business Models?

TechFlow Selected TechFlow Selected

Social Tokenization: How Web3 Is Transforming Online Social Interactions and Business Models?

Speculative social or SocialFi could become the beginning of "real-world assets" we've never imagined before.

Author: Matti

Translation: TechFlow

Anti-Social Media and Web3 Commerce

I've always believed that social media is becoming increasingly anti-social. The short-form video trend driven by TikTok has no inherent social nature at its core; an algorithm takes user-generated content (UGC) and recommends it to users. It's about attention optimization driven by algorithms and random strangers.

Given Web3’s ambition to completely transform the social media landscape, it's worth considering how well it fits into the growing non-social trends online. Although these platforms were initially designed to facilitate social interaction, they have instead fostered anti-social behaviors such as outrage culture, conflict, and obsessive idol worship.

I originally set out to explore how social media became anti-social and how Web3 might adapt to this anti-social future. But in the process, I realized that Web3 represents both the present and future of online social and commercial interactions in the new era.

From Social to Anti-Social

Facebook catalyzed mass adoption of social media. Its success began with the introduction of the news feed—a space initially for friends chatting, which later turned into a battleground for global keyboard warriors.

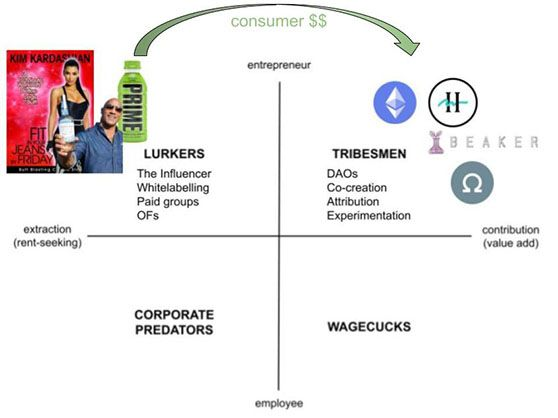

Social media platforms are fundamentally designed around competition for likes, followers, subscribers, and other engagement metrics—indirect measures of personal social capital. Over time, these platforms have become adept at converting social capital into financial capital, giving rise to a class of content creators—i.e., influencers.

Eugene Wei described a pivotal moment in Twitter’s evolution—the introduction of performance-based ranking of tweets, akin to a "battle royale":

“We’re now in the late era of Twitter, where nearly every tweet desperately seeks favorites and retweets. Everyone is a trained commentator or comedian. Full of opinion-driven content and aphorisms.”

While not quite a zero-sum game like battle royale, the ability to gain status and potential monetization is largely anti-social. Recall the mundane life updates during social media's early days—posts not crafted for likes. People once said what they wanted to say; now they say what they think others want to hear—or what the algorithm will pick up.

Why are these elements anti-social?

-

It's largely a game of financial capital extraction

-

It’s an imitation game designed to provoke conflict or outrage to attract more attention

-

It is managed by non-human entities—algorithms

-

Performance isn’t social activity—the distinction between performer and audience is clear (at best, pseudo-social).

Over time, social media followers and performers have become increasingly detached from genuine social aspects, often unaware, primarily locked in self-desire feedback loops. As Rene Girard would say, social media is designed to propagate infinite desire. It has enabled entirely new behavioral patterns we couldn't have predicted before.

This is why social media has facilitated the shift from hippie culture to flex culture.

“The authenticity-driven ironic culture of the early 2000s has given way to an era where people genuinely want to be influenced and sincerely engage, even if it feels cringeworthy.”

TikTok introduced the next level of anti-social behavior. It has almost no social components—just randomly generated user content and an algorithm optimized to maximize dopamine delivery from the screen. There’s little intent beyond discovery—only the next dopamine hit, possibly triggering the next purchase: shoes, watches, one-night stands, or other items.

We are relentlessly moving toward a more anti-social, financialized mirror culture—a computer screen that traps us in a rich world of escapism. As Toby Shorin put it:

“Class mobility may be gone, but at least we can own nice things.”

In crypto culture, we continue the great myth of multigenerational wealth—the idea of rapid class mobility. Imagine building a product that combines both: satisfying anti-social desires while offering hope for fast upward mobility.

TikTok-fueled get-rich-quick schemes have already ventured into crypto via tokens and NFTs. With the emergence of Ponzi-like social apps like friend.tech, Web3 is turning the prospect of absorbing influencer culture into reality.

Embedded in Culture

“Volatility-as-a-service” positions crypto products (and culture) as relevant only when dependent on volatility. The key insight is that volatility is a feature of cryptocurrency, not a bug.

While it expresses hope for speculation as a transitional trait, crypto culture rarely abandons speculation—especially as a user acquisition strategy—because it depends on capital inflows. This is why I define Web3 as a mindset among internet users: “Come for the volatility, stay for the technology.”

But somewhere in between lies a product—it’s fluid, usually represented by a token.

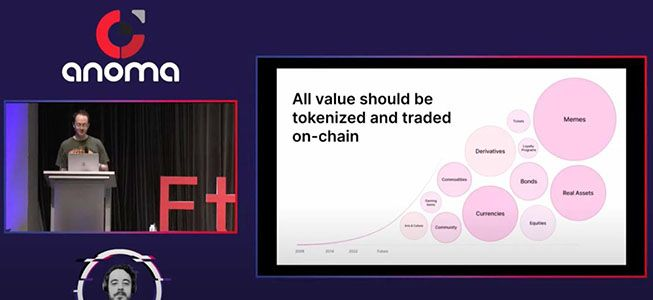

People cannot understand crypto through existing product lenses because crypto is something else—it’s highly fluid, with products shifting narratives, but ultimately—the token *is* the product.

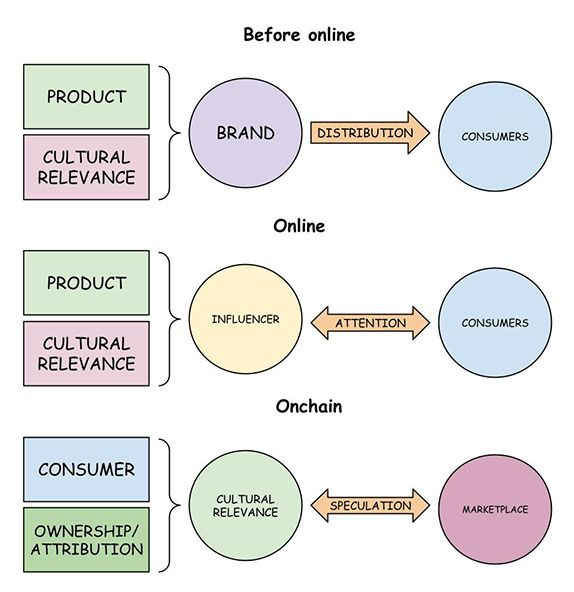

In this sense, you're buying culture, and the product is secondary. This aligns with my earlier point: flex culture is the product first; brands embed themselves into culture through memes and influencers.

Today, we’re entering a new realm where culture itself becomes a product, and tokens are the cultural artifacts you can acquire.

Web3 Social = Ponzi Social

Crypto is primarily about money and embedded financial tools within networks. As Joel John noted, crypto culture relies on capital flows. The influencer era, rooted in monetizing social capital (followers and engagement), seems like a perfect match.

friend.tech is a speculative social game—a proof-of-concept and potentially an innovation trigger for similar experiments in Web3. While the grand vision of Web3 social media is user ownership of data and social graphs, we may end up with just a better capital extraction game.

Although friend.tech essentially serves remnants of the lifestyle era—primarily enabling individuals with established social capital to extract more financial capital—it also allows followers to capture a share of the upside. Personal casinos run by influencers begin here, but there may be ways to escape them. Perhaps even in this dystopian vision, there's a glimmer of hope.

While friend.tech is one of the first successful applications of Web3 social (unsurprisingly leveraging a Ponzi mechanism for early advantage), it’s an interesting experiment that could introduce more social rather than anti-social behaviors.

As influencers become brands themselves, they can launch white-label products top-down—pushing merchandise to fans. As mentioned, brands achieve cultural relevance through influencer collaborations and memes. But what if we could collectively own a meme? Welcome to the tribal era.

Over the past decade or so, social media inserted a layer of desire between observer and product. Web3 could change this by adding attribution. If the former is represented by influencers, the latter will be marked by tokenized culture.

Owny Fans

As people gained freedom over the past two decades to create and distribute information, the future will enable them to own and monetize culture and its fruits.

“Tokens can attribute social recognition by recording sources and origins of creativity, while also directing financial value to those who own these ideas.” (Aleksia Vujicic on co-creation)

Previously, products were the main content; today, (sub)culture is the product, and physical goods are auxiliary. DAVID PHELPS wrote: “Play that isn’t taken seriously can be very serious belief systems,” and Shorin adds:

“Compared to users, believers may have higher lifetime customer value. Founders can easily design a culture—with various decorations, upgrade opportunities, and permanent extraction models.”

Web3 creates tools for rapid global capital formation and enables ownership—shares in ideas or products. As new tribes or sects form online, they share an idea and the will to realize it. They don’t need to rely on anyone to give them a product.

Especially if they can naturally tie the product to ideological loyalty using tokens. Nothing is stronger than a cult—except a cult with its own currency.

Whether OlympusDAO, BAYC, or any meme coin, these demonstrate bottom-up driven cultures where participants are directly tied to success. Volatility is an effective user acquisition strategy. Cultural strength determines how long the game lasts and whether microeconomics remain sustainable.

Brands are a form of worship, and now they begin to build from the bottom up. Subcultures become the product—not top-down. This suggests subcultures justify the product. European football clubs are prototypes of this model (perhaps why more private capital seeks entry and commercialization).

If you can’t see the product, you’re probably the product. This is often true in Web3. Products appear everywhere—tokens rise and fall, some rebound, others fade forever. Meanwhile, we spend most of our time entertained.

Web3 Is Commerce

Ethereum itself is a brand. Ethereum’s brand is its strongest moat. At an abstract level, owning ETH is a bet on the increasingly visible consumption of Web3. Perhaps in the future, we’ll understand ETH as Nike and SOL as Adidas—a matter of consumer choice, not essential difference.

friend.tech proves we can tokenize almost anything without being bound by formal legal agreements that would make such open relationships official. Consumer brands sell the idea that owning their product earns you admiration, though they never guarantee it. Buyers seek precisely this silent promise of status.

The idea behind selling creator shares is that you’ll be accepted into your idol’s inner circle—but we shouldn’t expect creators to feel obligated to entertain fans simply because they own a few shares. In other words, status matters more than utility.

Speculative social or SocialFi could become the starting point for “real-world assets” we’ve never considered before. Instead of thinking about putting government bonds on-chain, we should consider how to introduce and grow consumer culture while embedding new forms of product—like status within token ownership.

Perhaps we haven’t yet recognized that Web3 *is* commerce—a novel form built on a new type of product: the token. Tokens bundle together culture and product. A product is the subject of a reflexive narrative that can change form over time. Similarly, conspicuous consumption is fundamentally a means to certain ends (status, pleasure, stimulation, etc.), and so are tokens.

Yet there are also more targeted social tribes in the market. Today, we see them emerging in DeSci (Degen Science), such as mission-driven brands like VitaDAO or HairDAO, where various products and future monetization flow back to token holders.

Through the simple casino of friend.tech, we’ve entered a new phase of social interaction—we’re transforming online commerce into a more bottom-up, attribution-based culture built around token networks. In my view, this challenges traditional notions of business and converts meme premiums of tokens into brand purchasing power.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News