Was the "halving" the only driving factor behind the bull markets of 2013, 2017, and 2021?

TechFlow Selected TechFlow Selected

Was the "halving" the only driving factor behind the bull markets of 2013, 2017, and 2021?

The logic behind "halving" driving a bull market involves not only the circumstances but also cost factors.

The Emotion and Logic Behind Halving

Many people believe the impact of "halving" on #Bitcoin is—scarcity, which fuels sentiment around hoarding and speculating on BTC.

In fact, "halving" refers to a halving of production: with the same network-wide cost (hash power) spent on mining, the output of BTC is cut in half.

If network hash power were also halved, BTC mining costs would remain unchanged. However, due to expectations (expectations of rising BTC prices) and sunk costs (mining hardware costs are sunk; miners will continue as long as revenue exceeds variable operating costs), BTC hash power is likely to be higher than before the halving.

Therefore, as long as hash power exceeds pre-halving levels, BTC mining costs—or production costs—increase. As more high-cost BTC is mined, the price is pushed upward. That’s why BTC bull market peaks don’t occur near halving events, but typically over a year afterward.

Thus, the logic behind "halving"-driven bull markets involves not just scarcity, but also cost factors. Of course, cost doesn't determine price—especially for crypto, where prices falling below production cost is common, haha.

LTC Halving

Some believe that LTC's 2023 halving significantly underperformed compared to 2019, leading to concerns that this cycle’s BTC halving may also disappoint.

The Litecoin halving occurred in August 2019, yet its price peak happened in June. This was clearly influenced by halving-related sentiment.

But do you think it's a coincidence? In June 2019, the Federal Reserve began cutting interest rates!

Macroeconomics and Bull Markets

Many crypto enthusiasts dismiss macroeconomics, as BTC and U.S. stocks haven't historically shown strong correlation.

However, BTC may never have truly escaped macroeconomic cycles.

We know:

BTC’s first halving: November 28, 2012 — peak reached ~12 months later (November 2013).

Second halving: July 9, 2016 — peak reached ~17 months later (December 2017).

Third halving: May 12, 2020 — peak reached ~18 months later (November 2021).

What we might have missed:

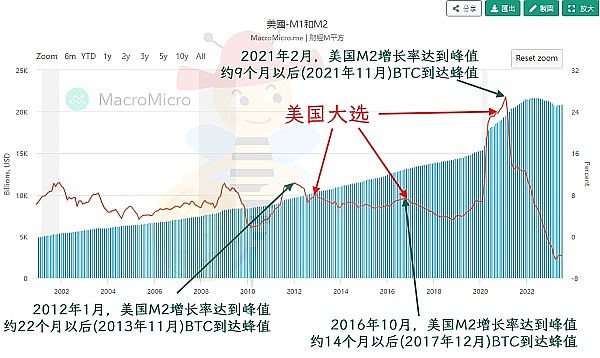

U.S. M2 growth peaked in January 2012 — BTC peak ~22 months later (November 2013).

U.S. M2 growth peaked in October 2016 — BTC peak ~14 months later (December 2017).

U.S. M2 growth peaked in February 2021 — BTC peak ~9 months later (November 2021).

The most accurate pattern (???):

U.S. presidential election: November 2012 — BTC peak ~12 months later (November 2013).

U.S. presidential election: November 2016 — BTC peak ~12 months later (December 2017).

U.S. presidential election: November 2020 — BTC peak ~12 months later (November 2021).

As TechFlow has analyzed multiple times, Satoshi designed BTC to halve every four years—and unless miners rush to mine early, halvings tend to occur roughly one month after each U.S. presidential election (inauguration time). Satoshi’s design absolutely considered U.S. policy and economic cycles—it's not something TechFlow made up!

As seen in the chart, the last three U.S. elections coincided with peaks or minor peaks in U.S. M2 money supply growth. As long as M2 growth is positive, liquidity is expanding; when near a peak, it indicates an accelerating monetary easing phase. TechFlow interprets this as looser monetary policy during election periods possibly supporting economic prosperity.

Monetary expansion leads to abundant dollar liquidity in markets, some of which flows into speculative assets.

2015

By now, the conclusion is clear.

BTC’s quadrennial bull markets are driven both by "halving" and macroeconomic factors.

The key driver behind LTC’s explosive rally during halving may not be the halving itself, but macro conditions. Therefore, LTC’s weak performance during its 2023 halving shouldn’t cause undue concern. We don’t need to worry excessively about whether there will be a bull market in 2025, or even about LTC itself.

The bullish impact of BTC halving still holds. The Fed will eventually cut rates, and dollar liquidity will transition from tightening back to an accommodative environment.

From 2006–2007, the Fed maintained high interest rates for about 14 months. Current estimates suggest the most pessimistic scenario is rate cuts by late next year, while optimistic forecasts point to Q2 next year.

Therefore, influenced by macro factors, the bull market cycle may be delayed—not brought forward to late 2024, but potentially pushed to 2026. Exact timing remains uncertain.

When to Buy the Dip?

On the topic of timing the bottom, we should wait for this month’s release of the Fed’s dot plot, which may reveal two turning points.

The end of rate hikes is the first turning point; the start of rate cuts is the second. These turning points may trigger modest sentiment rebounds, but optimism should be cautious. After all, since 1960, U.S. M2 money supply is experiencing negative growth for the first time—indicating tight dollar liquidity. Even after rate cuts begin, rates will still be relatively high, and prior high-rate loans will enter a period of repayment stress, posing ongoing risks.

TechFlow believes patience is still needed before buying the dip. Note that recently some altcoins have seen active pumps—some may offer short-term opportunities, but long-term exposure to altcoins should remain highly cautious.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News