Crypto Macro Monthly Report: Global Risk Aversion Rises, Risk Assets May Face Short-Term Pressure

TechFlow Selected TechFlow Selected

Crypto Macro Monthly Report: Global Risk Aversion Rises, Risk Assets May Face Short-Term Pressure

U.S. economic slowdown and rising bond yields create a bottoming opportunity for the crypto market.

Author: WealthBee

1 Slowing Momentum in the U.S. Economy

Based on economic data released in August, signs of deceleration have begun to emerge in the U.S. economy—this once high-speed locomotive.

U.S. CPI rose 3.2% year-on-year in July, ending a 12-month consecutive decline, compared to an expected 3.3% and a prior 3.0%. Core CPI increased 4.7% YoY, slightly below the forecast of 4.8%, unchanged from the previous reading. Although CPI ticked up, it remained below expectations, highlighting the effectiveness of the Federal Reserve's rate hikes.

Labor market indicators also show signs of moderation. Nonfarm payrolls increased by 187,000 in July, falling short of market expectations. Average hourly earnings rose 4.5% YoY in Q2, down from 4.8% in Q1. Indeed’s latest salary tracker shows annual wage growth in job postings at 4.7%, down from 5.8% in April and 8% in July last year. The labor market has been a key reference for the Fed’s monetary policy due to the close correlation between wage and price inflation. The current cooling in wage growth is undoubtedly aligning the labor market with the Fed’s tightening stance.

Similarly, the U.S. August Markit Services PMI came in at 51 (expected 52.2, prior 52.3), while the Manufacturing PMI stood at 47 (expected 49.3, prior 49). Manufacturing remains in contraction territory, and service sector expansion fell short of forecasts.

Multiple economic indicators suggest a slowdown this month. However, single-month data are insufficient to determine long-term trends, and the U.S. economy still maintains strong underlying momentum. Powell delivered a hawkish speech at the Jackson Hole symposium, stating that given the resilience of the U.S. economy, further rate hikes remain possible.

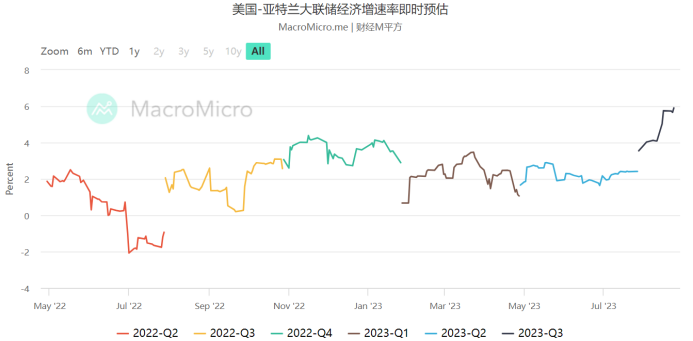

Market opinions are divided: the Atlanta Fed GDP model predicts a 5.8% growth, yet Fitch downgraded the U.S. credit rating.

The Atlanta Fed’s GDPNow model forecasts a 5.9% GDP growth for Q3 based on currently available data. However, the market notes that the data inputs—such as July retail sales, auto sales, and housing starts—reflect only short-term conditions. As new data arrive, the model’s projections will continue to adjust accordingly.

On one hand, models project an overly optimistic outlook; on the other, Fitch downgraded municipal bond ratings linked to U.S. sovereign credit to "AA+", marking its first downgrade since launching the rating in 1994. Blackstone’s Stephen Schwarzman echoed the sentiment, calling Fitch’s move “data-driven.” Fitch not only downgraded municipal bonds but also signaled potential downgrades for dozens of U.S. banks, including JPMorgan Chase. Institutions broadly criticize the federal government’s persistent fiscal and debt challenges, and Fitch’s downgrade may reflect a broader consensus of growing concern.

2 Bond Yields Surge Amid Heightened Risk Aversion

In August, the sharp rise in U.S. Treasury yields became a striking phenomenon across global financial markets, with both short- and long-term yields climbing rapidly. The 10-year and 30-year Treasury yields hit their highest levels since 2007 and 2011, respectively, while short-term rates such as those for 1-year, 2-year, and 5-year notes remained elevated and range-bound for months.

It’s not just U.S. Treasuries—the yields on Japanese, German, and other developed-market government bonds have also remained high.

Why have Treasury yields risen so sharply? The recent spike in rates is largely a rapid response to ongoing rate hikes. With the U.S. economy showing sustained strength, many economists no longer anticipate a recession this year, reinforcing market expectations for further Fed tightening and pushing interest rates higher. Additionally, Fitch’s concerns over deteriorating fiscal risks have weakened investor confidence in U.S. debt, inevitably increasing the cost of financing through bond issuance.

The surge in Treasury yields has significantly pressured risk assets. Major U.S. equity indices declined across the board this month. Cryptocurrencies, including Bitcoin, experienced a concentrated sell-off on August 18 and have yet to recover. Despite Nvidia—the so-called "global AI leader"—maintaining a high plateau and hitting new highs, most other tech heavyweights continued a downtrend. In its Q2 earnings report, Nvidia posted revenue that doubled YoY, exceeding estimates by 22%; EPS grew more than fourfold, surpassing forecasts by nearly 30%. Its Q3 revenue guidance of $16 billion (±2%) represents a 170% YoY increase and exceeds expectations by 28%, far above market predictions. Subsequently, Nvidia announced a $25 billion share buyback program, sending shockwaves through the market and fueling investor optimism. Analysts rushed to raise price targets, with the most bullish forecasts reaching $1,100 per share (Rosenblatt).

As the "biggest arms dealer of the AI era," Nvidia continues to dominate. Indeed, AI remains the most certain and expansive frontier in today’s technology landscape. Typically, when a major company exceeds expectations for two consecutive quarters, it signals healthy coordination across the supply chain—indicative of an emerging industry ecosystem. Amid the pressure from rising Treasury yields, AI may be the most resilient sector in U.S. equities, potentially attracting institutional consolidation.

3 Crypto Market Bottoming: Volatility, Sentiment, and New Opportunities

The crypto market is now exhibiting classic bottoming characteristics.

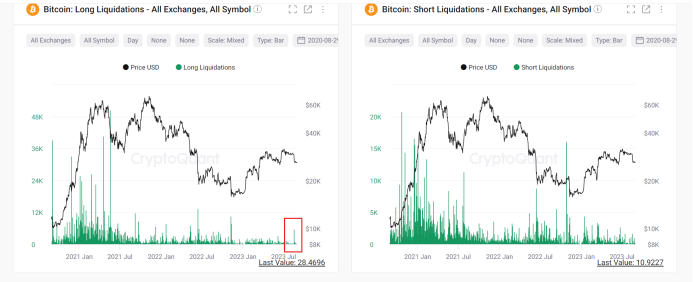

First, Bitcoin’s sudden plunge in August triggered widespread long liquidations and intensified market volatility. On the 18th, the crypto market experienced a “quake”: major cryptocurrencies crashed simultaneously, with Bitcoin dropping as low as $24,220 and Ethereum to $1,470.53, neither of which has recovered. As previously noted, this crash was primarily driven by a concentrated release of risk-off sentiment rather than specific negative news. Within 24 hours, total liquidations reached $990 million—a 737.87% increase from the previous day—highlighting significant long-side deleveraging.

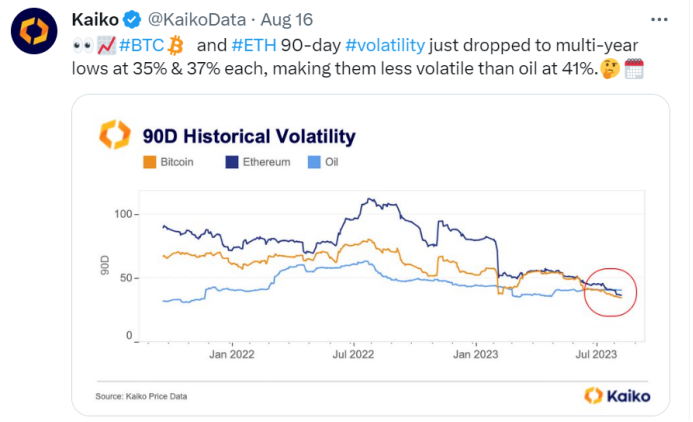

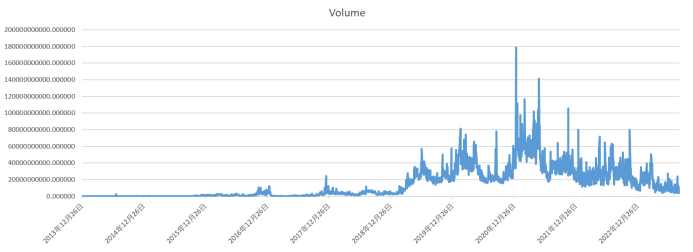

Second, Bitcoin’s volatility and trading volume are both at historical lows, reflecting subdued price action. This month, Europe’s Jacobi Asset Management launched the Jacobi FT Wilshire Bitcoin Spot ETF, listed on Euronext Amsterdam on August 15. Yet, the market reacted indifferently, followed by a panic-driven selloff. This demonstrates fragile market sentiment and weak confidence. One hallmark of a secondary market bottom is insensitivity to positive news coupled with extreme sensitivity to negative triggers, often resulting in cascading sell-offs. Both market and sentiment indicators point toward a likely bottom formation in crypto.

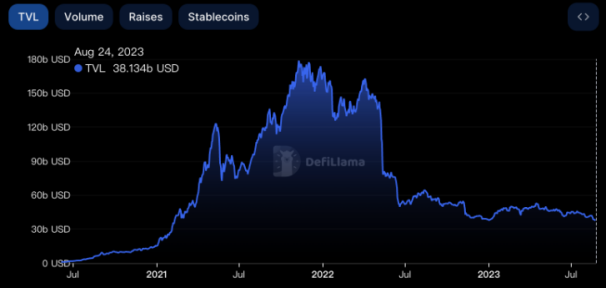

Additionally, DeFi TVL (total value locked) has continued its downtrend, reaching its lowest level since February 2021—currently around $38.13 billion. This marks a drop of over 70% from the peak of over $170 billion during the “DeFi Summer” of 2021.

On the flip side, positive developments for Web3 continue globally. So far this year, nearly ten major financial institutions—including BlackRock—have filed applications with the SEC for spot Bitcoin ETFs. On August 30, reports emerged that a U.S. federal court approved Grayscale Investments’ application to launch the country’s first Bitcoin ETF, overturning the SEC’s previous rejection and paving the way for approval.

Meanwhile, regulatory frameworks for crypto are maturing worldwide. Hong Kong, in particular, is accelerating its crypto-friendly initiatives—from the Vice President of HKUST urging faster support for Hong Kong dollar-pegged stablecoins, to Chief Executive John Lee publicly stating that the government is “fully exploring stablecoin regulation,” to HashKey Exchange enabling compliant trading for “Hong Kong drifters.” Hong Kong’s pace toward becoming a crypto hub is quickening. The city’s first batch of licensed crypto exchanges, including HashKey Exchange and OSL Digital Securities, received approval from the Securities and Futures Commission (SFC) in August to offer virtual asset trading services to retail investors. As one of the world’s top three financial centers, Hong Kong’s progress in establishing a regulated digital asset trading environment offers renewed hope for the future of crypto assets.

4 Conclusion

China and the U.S. economies are experiencing a divergence: the resilience of the U.S. economy contrasts with China’s temporary pressures, casting uncertainty over global investors. Risk aversion dominated secondary markets this month, with underwhelming performance in both U.S. equities and China’s A-shares. The crypto market endured a brutal selloff, wiping out many leveraged positions.

Nevertheless, the crypto market is showing clear signs of bottoming, navigating what may be the darkest hour before dawn. From the licensing of Hong Kong’s first regulated crypto exchanges to the imminent launch of a spot Bitcoin ETF, these developments signal that Web3 innovation is still in its early stages. From a market perspective, the current crypto cycle has been gradually forming a base with an upward bias. Future catalysts could propel prices past the $30,000 resistance level, potentially ushering in a new wave of gains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News