Narrative Wedge: Profit and Survival Guide

TechFlow Selected TechFlow Selected

Narrative Wedge: Profit and Survival Guide

The underlying logic remains that you can deploy capital into a liquid asset during a bear market and achieve better returns than in early-stage venture investments within that narrative.

Written by: JOEL JOHN

Translated by: TechFlow

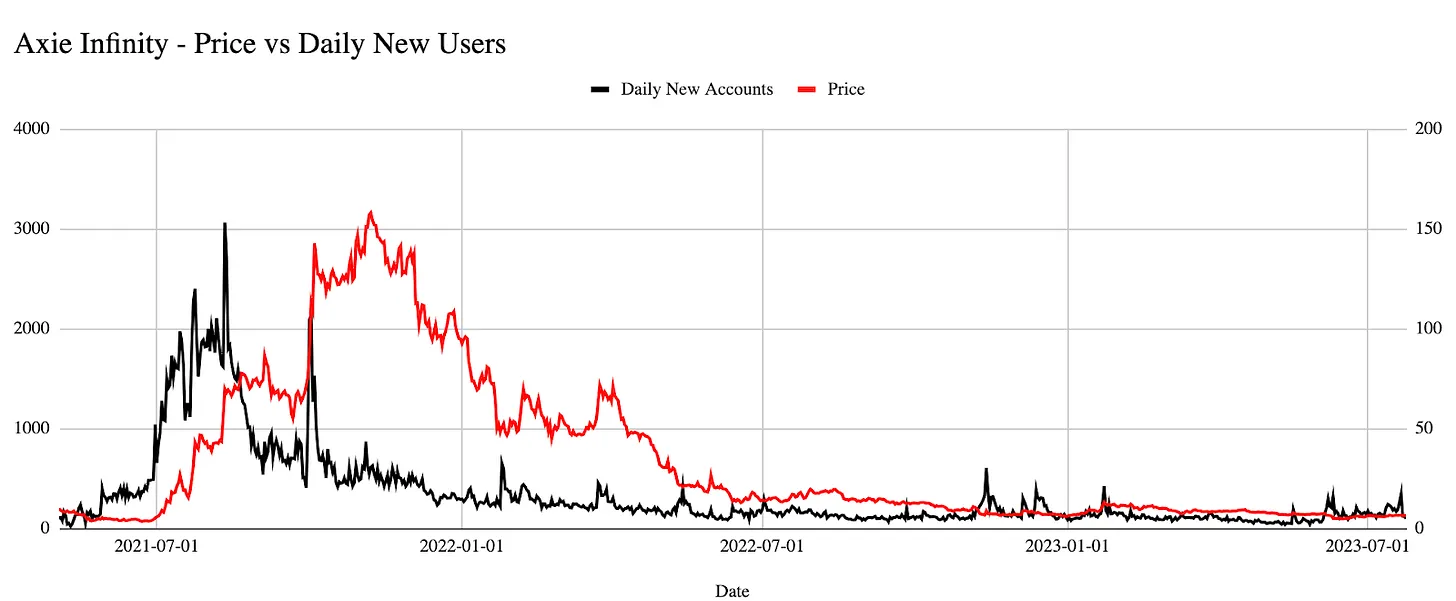

Over the past week, I've had an observation. You could have invested in Axie Infinity at the beginning of the gaming hype, walked away, and come back to find your returns exceeding those of most Web3 game venture capitalists. Axie's price once dropped to $0.14 but has now risen to $6—a 40x return.

At its peak, it was over 1000x. The reason is that most seed-stage Web3 gaming ventures are either far from liquidity or may die before raising more funds in the current market environment. But there are flaws in my thinking:

-

Seed-stage ventures shouldn’t expect returns within an 18–24 month timeframe.

-

I assumed investors allocated capital to Axie Infinity when gaming was still an obscure narrative.

Yet the underlying logic remains: you can invest in a liquid asset during a bear market and achieve better returns than early-stage venture deals in that narrative. This paradox led me to reflect on risk ranges in crypto, how attention precedes venture investment. This article summarizes my thoughts on how narratives drive funding and attention in our industry.

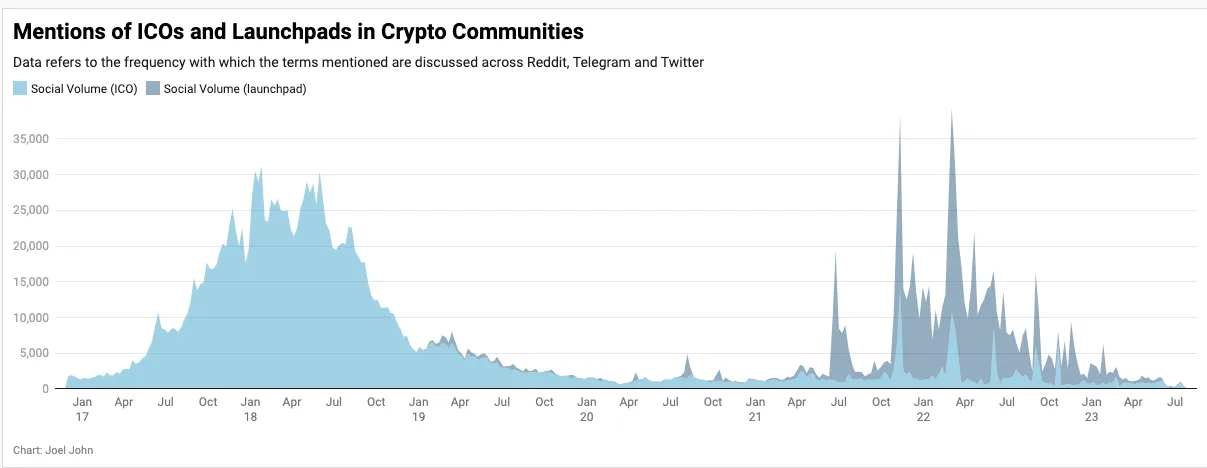

Before we begin, let’s look at some numbers. According to data from my tracking product, nearly 1,300 out of over 3,500 tokens had fewer than 10 wallets transferring them last month. Among 14,000 dApps tracked by DappRadar, fewer than 150 have 1,000 users. In this industry, our attention quickly shifts from one asset to another. Our confidence in fundraising mechanisms follows a similar pattern. The chart below shows mentions of ICOs and launch platforms across major crypto communities over recent years.

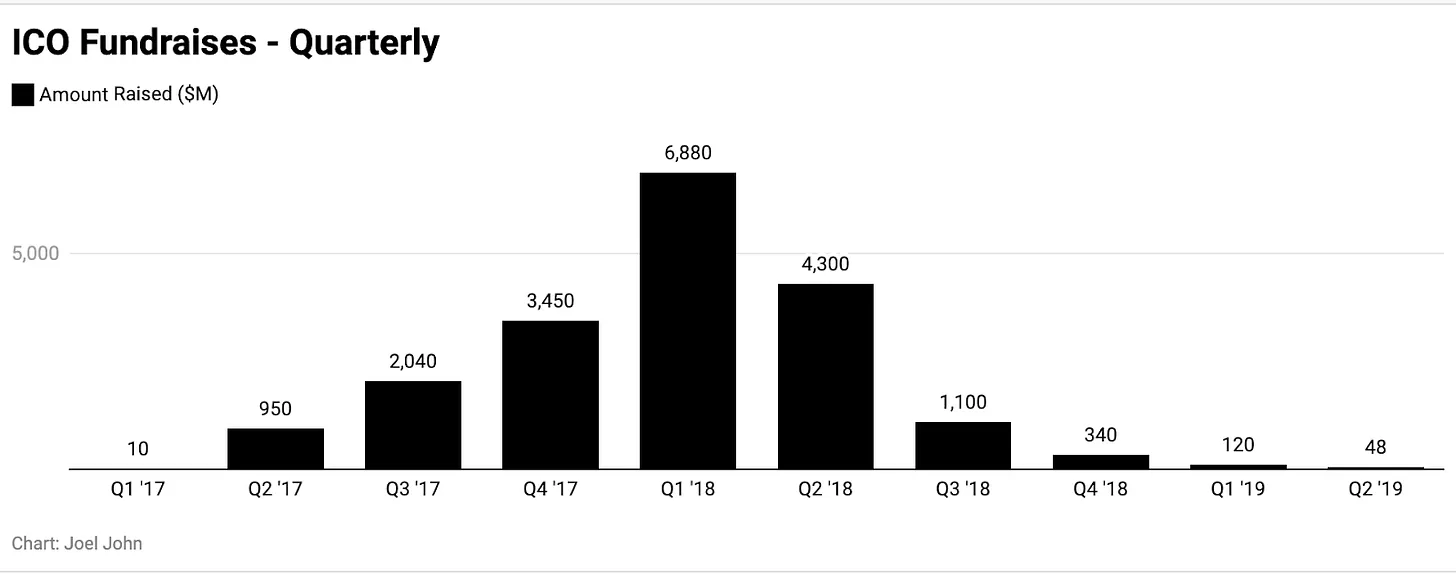

If you were around in 2017, you might have thought venture capital would change everything. Many startups funded during that cycle no longer exist. Depending on sources, crypto raised between $19 billion and $60 billion from retail and institutional participants that year. Yet the survival rate of those ICO projects matches what we traditionally see among startups.

You can see the results in the chart above from January 2019 to January 2021—the golden age of crypto venture capital. Interest in ICOs rapidly faded. Investors saw a brief window where ambitious founders could no longer access retail capital for building. Startup valuations ranged from $5M to $10M. Founders and investors had to collaborate just to survive.

One reason founders turned to VCs was a better understanding of the risks of launching tokens too early. You’d spend time managing communities, doing legal work for compliance, and tying your net worth to a liquid asset—all while running a company. A founder might wake up 20% poorer because someone on Discord criticized their team member and decided to dump all their tokens on an exchange with only $10,000 in liquidity.

Years passed, and we’re back to launchpad season—exchanges acting as gatekeepers deciding which ventures get millions from retail investors. While there are more filters now, at least they offer retail investors better terms than the multi-billion dollar valuations seen during the 2017 ICO boom.

I chose the case of ICOs giving way to launchpads because relevant data exists. Enough time has passed since the ICO boom to understand what happened afterward. If you look at newer themes like DeFi, NFTs, or Web3 gaming, public discussion interest has largely vanished.

But unlike ICOs, the stories of DeFi, Web3 gaming, and NFTs are still evolving.

Narratives That Fade Away

DeFi has moved from the peak of inflated expectations into a phase of enlightenment. No real competitor to Uniswap emerged. Aave and Compound dominate lending markets (for spot, over-collateralized assets). Iterations of these products will increasingly target consumers or institutions and move beyond pure speculation.

Robert Leshner shifting focus to launch a mutual fund, Stani moving to Lens (Web3 social), shows how long-time industry founders are preparing for the next wave.

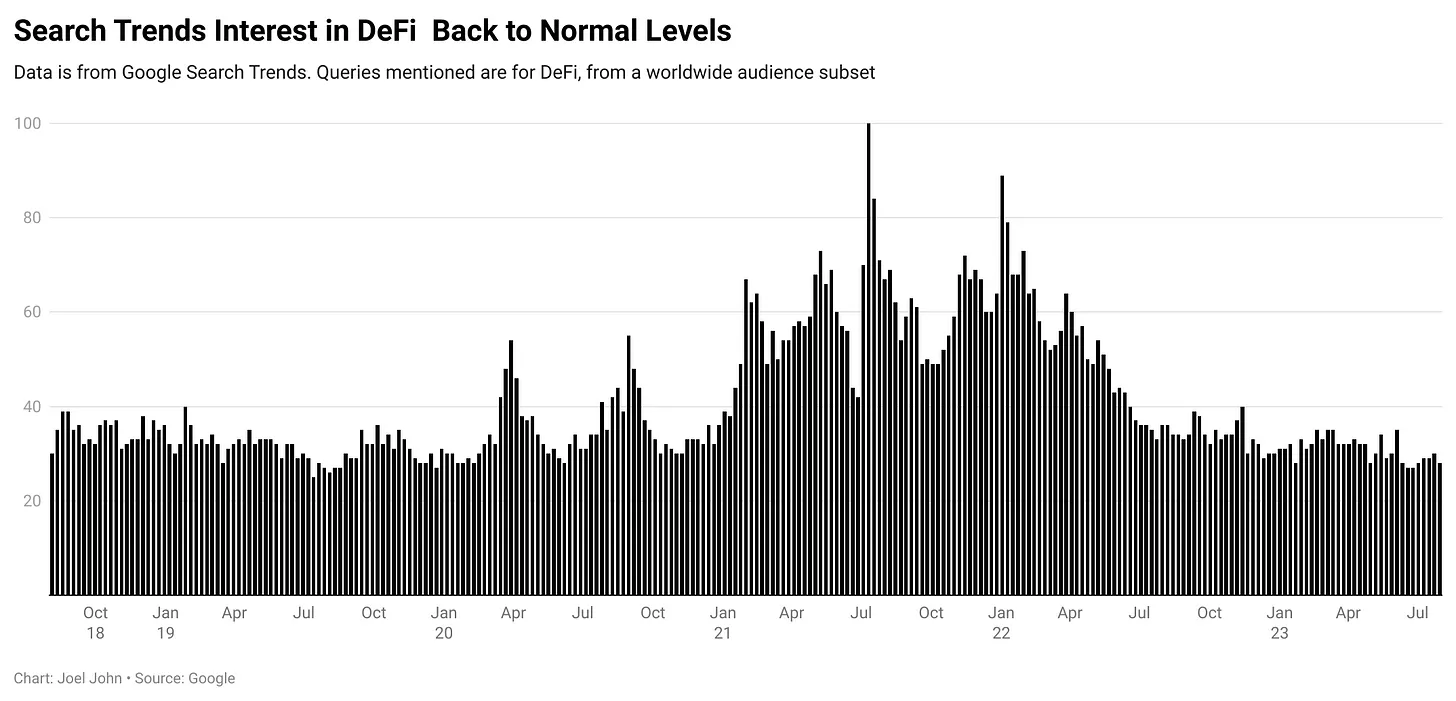

Google search trends, TVL, and user counts are good indicators of attention and capital flow in DeFi. As of now, capital in DeFi platforms has dropped from a high of $160 billion to a low of $40 billion.

Looking at user count data, usage has declined by 50% over the past few months. But compared to March 2020, at the very start of DeFi Summer, user numbers have still grown 100-fold.

In other words, although interest and usage have declined, user numbers within these product categories remain vastly higher than before. However, if you examine search trends for the same functionality, you see a completely different story.

Interest has returned to 2018 bear market levels. It's as if no one cares about the space anymore. I checked data for NFTs and ChatGPT—they show similar trends. Alien-related searches are rising. (Maybe we should start investing in alien services.)

Taken together, here are my observations from the DeFi data:

-

Narratives build momentum at the start of bull markets.

-

They are usually triggered by technological developments.

-

Early participants in specific domains gain outsized returns as narrative and usage scale simultaneously.

-

Compound, Uniswap, and Bored Apes are all examples where narrative tailwinds combined with product usage delivered outsized returns to investors.

The challenge is that you must invest in narratives that may disappear before attracting enough users. We may need to return to Axie Infinity to untangle this further.

Timing Is Everything

I return to Axie because it neatly encapsulates several themes:

-

By 2021, Axie had been listed and undergoing roughly two years of product development.

-

It was arguably undervalued at the time.

-

Axie marked the beginning of the Web3 gaming narrative.

To be clear, this isn't an evaluation of Axie itself. I'm optimistic about what the team can achieve, and we've internally debated the Web3 gaming thesis. I remain a fan of Sky Mavis and their work on consumer-grade blockchain applications. Our focus here is on price and user activity.

If you look at the chart above, you’ll notice a surge in users before Axie’s price spiked to $150. On-chain analysts likely observed the extent of new user inflows and priced it accordingly before July 2021.

But by October, as new user growth began to decline, Axie became more of an asset than a product. This is a trap all on-chain products are prone to. Hyper-financialization of in-game assets means a hedge fund in New York can pay guild members playing the game. The model for earning in-game rewards depends on continuous inflow of liquidity into in-game assets—sometimes from speculators and institutions.

Between July 2021 and January 2022, many investors formed convictions while observing the trend and wrote theses on how the industry would evolve. Founders also recognized the difficulty of building DeFi dApps and believed gaming was the next big thing—just as many founders today are diving into AI.

The real risk came in the 18 months after January 2022. Do you see the steady decline in new users on the chart above? That reflects shrinking user bases across all Web3-native gaming apps. Tools built on the edge—like a "Steam for Web3 games"—quickly struggle to find users.

This misreading of short-term price surges as genuine consumer demand is a trap many founders fall into. The risk for founders is that without sustained appeal, follow-on funding becomes difficult in the current market.

Founders may be in the right market but miss the timing. The danger lies in shutting down operations before sufficient attention or capital flows into the category.

As a venture investor, on one hand, you see liquid markets rewarding traders handsomely; on the other, you compete with founders who entered the space alongside you. It’s not a pleasant experience for any participant.

My takeaways:

-

Markets often price narratives in the short term.

-

Given the liquidity of Web3 investments, liquid assets may exit within a quarter.

-

Given the illiquidity of venture capital, startups may lack a market when their product launches, as product development takes time.

-

This often leads to slow death and betting on user return. Products effectively become bets on "bull market return."

The exception occurs when a category grows large enough to sustain interested users, and you’ve built something unique. Ironically, DeFi has crossed this chasm. At a scale of 3 million users, DeFi founders no longer worry about new entrants.

Crypto-native investors entering via venture capital are either evangelists or pioneers. Either they have distribution and influence to launch a new category, or foresight to recognize a new industry emerging. If they rely solely on price action to form new theses, they enter late. They likely won’t see an exit unless it's a business scalable to IPO or acquisition—both rare in the token world.

Another way founders are impacted is through business model evolution. For example, due to royalty-free markets like Blur, effective NFT royalty rates have dropped from ~2.5% to 0.6% over the past year. At the time of writing, about 90% of NFT transactions collect zero royalties.

Essentially, any business built on the assumption that traditional artists would flood into the space—and need tools to earn revenue—has collapsed. Last year, countless creator economy startups had to pivot as the model shifted.

For all emerging technologies, chaos is a way of life in crypto.

Free

Let’s step back to the late 2000s. After a long day at school, you log into Facebook to chat with friends. YouTube offers endless entertaining videos. Ads appear throughout, but you rarely pay a cent. The internet built habits before monetization.

In contrast, Web3’s obsession with ownership and exclusivity has created small user bases. According to their blogs, Arkham Intelligence has over 100K users. Nansen’s V2 product has registered over 500K users today. Dune hosts one of the largest communities of data scientists in the industry. They share one common trait: free access.

The genius of the internet was making users bear little cost for most actions. In return, it gained influence. Web3’s great danger is how costly every interaction can be. Paying $8 to own an image on a blockchain isn’t appealing to users who don’t need online identity.

Why pay $50 for an ENS when users have had free email addresses for decades? Axie Infinity initially required $1,200 worth of NFTs to play. Guild models relied on this high barrier. Last year, they launched a free-to-play version, realizing the danger of maintaining such a high entry cost.

Today, Reddit masterfully combines “free” and “ownership.” With 400 million monthly active users, Reddit is a giant. So far, about 15 million wallets have collected their collectibles—roughly double DeFi’s peak monthly user count. Accounts with specific years and traits are allowed to purchase collectibles from Reddit.

Here, most users still use the “free” product, while only a small fraction mint, trade, and own collectibles. Distribution is solved via a website already running for 18 years.

Rabbithole and Layer3 fit this model perfectly. They don’t charge users but reward curiosity with value for exploring new on-chain opportunities. According to the Layer3 founder’s tweet, the product enabled about 15 million on-chain actions for crypto-curious individuals.

A shift in product strategy is underway. Visit Beam.eco, and you’ll see a wallet set up in under 10 seconds. Asset.money helps you collect NFTs in under three clicks. Users don’t worry about gas fees, onboarding, or wallet setup. Of course, security trade-offs exist. This mirrors how email evolved from self-hosted servers to third-party providers like Hotmail and Google.

Barter Trade

Remember when I said narrative alone can’t determine the timing of crypto venture investment? The oldest trick in the book escapes this trap:

-

Attract and retain a user base;

-

Steadily accumulate value over a long timeframe.

Some tokens in the industry have succeeded at this. When I think of DeFi, I think of Uniswap. Despite attacks on royalties, OpenSea remains relevant. The venture tail is a big bet on how and when attention and capital flow.

The only way to escape unhealthy reliance on investor or speculator capital is to tap into the purest form of capital available to all businesses: their customers’ attention. As venture funding contracts, more startups (and protocols) will need to find users who genuinely care about their products.

The most relevant example I found is Manifold.xyz. The product focuses on helping creators mint NFTs relatively easily. According to TokenTerminal, they generated over $1 million in fees last month. Are they the best performer? Probably not. Are they relevant in today’s market? Absolutely.

I’ve noticed a common trait among participants who successfully weather market cycles: first-mover advantage. It’s a recurring story.

Small teams enter an industry when sentiment peaks. They watch the market shrink. Usually, fewer than five players remain willing to build as competition exits. When attention and capital return, they’re most likely to scale. From this perspective, as long as you survive, the narratives big investors abandon are the ones you should embrace.

Not long ago, joining Web3 was “cool.” Now, mentioning you work in the space might feel awkward. Teams feel pressured to fabricate metrics to stay relevant. We often see founders inflate product stats via airdrops and volume farming.

For founders, here’s a survival memo:

-

Understand the difference between VCs betting on narratives and those deeply researching your sector.

-

Early market entry is itself a moat. But it also means months—or longer—before anyone believes in your product. Most of your pitching becomes investor education. It’s both a blessing and a curse.

-

In markets where peers collapse, survival is the ultimate game. Keeping expenses minimal to survive is usually the right call.

-

Consumer attention usually precedes investor capital. Talking to users before pitching to investors helps iterate on the product.

-

If product-market fit isn’t found within a meaningful timeframe, shutting down makes sense.

Given that crypto markets are highly liquid, investing (time or money) requires understanding which stage of the narrative you're in. The trap often lies in spending years building in a collapsing sector. Personally, I don’t believe Web3 gaming is over. Its story continues to be written by countless founders who still believe in the space.

The trap lies in confusing public market price action with private market investment opportunities. By the time a product launches, the narrative may already be dead. Follow-on funding may vanish. Consumers may not care. This is a tough battle many founders will face in the coming quarters.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News