The Right Way to Participate in IEOs: Insights from Valuation Logic and Historical Data

TechFlow Selected TechFlow Selected

The Right Way to Participate in IEOs: Insights from Valuation Logic and Historical Data

For investors, the long-term gameplay value of Launchpool is clearly lower than that of Launchpad.

By CapitalismLab

Another batch of investors got burned in the MAV IEO. Recently, more people have been rushing into Binance Launchpad/Launchpool projects only to get rekt at peak prices. Although the market has rebounded somewhat, many are still unable to recover their losses.

This article walks you through the basic valuation logic for different types of crypto projects to avoid blindly buying at the top. It also reviews and compares the historical performance of Launchpool and Launchpad, offering sharp insights into their differences, similarities, and speculative strategies.

A. Valuation Logic

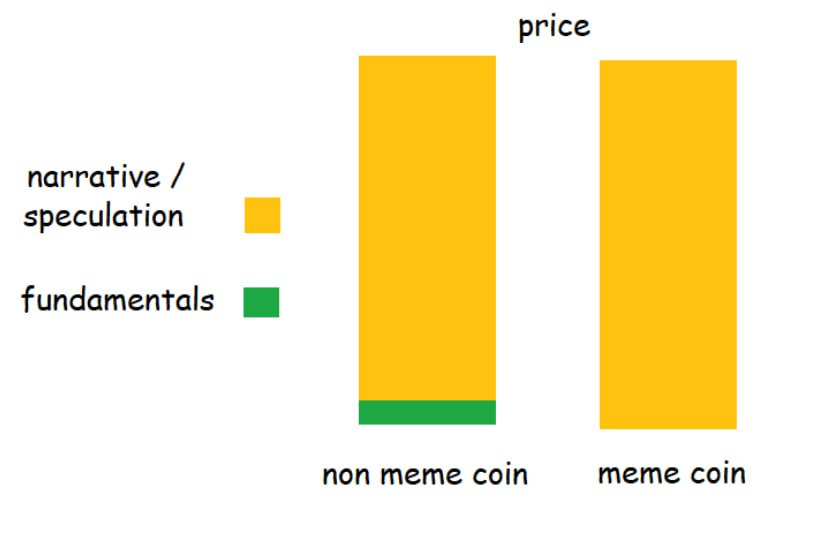

If a token isn’t a “meaningless governance token” or a memecoin, its value can theoretically be assessed based on rights granted to holders. However, since cryptocurrency is ultimately an attention game, fundamentals often pale in comparison to narrative power. Therefore, valuation usually relies primarily on benchmarking against similar projects.

For example, MAV belongs to the DEX sector within DeFi. Common metrics used to evaluate DeFi protocols include Total Value Locked (TVL) as a measure of scale, along with less commonly used indicators like total fee revenue and protocol income to assess profitability. For DEXs specifically, trading volume (Vol) serves as an additional metric for measuring business activity. As for the token itself, two key figures are market cap (mcap) and fully diluted valuation (FDV), reflecting short-term and long-term liquidity respectively.

As shown in Biteye’s valuation comparison chart, TVL or fee income is used as the operational benchmark, with corresponding mcap/FDV-based valuations provided. Of course, data can sometimes be misleading—using just one week of fees to estimate MAV's value is problematic because MAV had a public airdrop and listing on Binance, attracting numerous farmers who artificially inflated trading volume, making these numbers inherently bloated (3/n).

Applying finer logic and common sense helps too. An MAV price above $0.5 would push its FDV close to PancakeSwap’s. Despite MAV’s close ties to Binance, it will never be as favored as CAKE. Thus, expecting a price exceeding $0.5 due to Binance support is unrealistic. Previously, Hashflow—a DEX that launched via Binance Launchpool—currently has an FDV around $400M, implying a fair MAV price below $0.2.

Therefore, anyone rushing in citing “trust in Binance’s judgment” at $0.5 is clearly overpaying—well beyond what a Launchpool debut could reasonably justify. The current market price of ~$0.45 already represents a relatively high level.

DeFi projects, being application-focused and having some actual revenue-generating capacity, are relatively easier to evaluate. In contrast, user activity metrics for Layer 1 blockchains are mostly driven by mercenary yield farmers, rendering them nearly useless. Only TVL remains marginally meaningful. Compared to data, blockchain projects tend to place greater emphasis on team background and affiliations—one reason why VC-backed narratives dominate this space, where strong pedigrees seem to automatically command $10B+ valuations.

Recall our earlier speculative valuation of ARB, where we estimated a 2x OP FDV based on TVL and ecosystem development. After launch, ARB’s price diverged sharply from our prediction, proving us wrong—at least initially. Yet after some time, as OP’s price continued falling, ARB eventually did achieve a 2x OP FDV.

B. FDV Is Not Just a Number

FDV = Total token supply × current price

When evaluating projects, many prefer using market cap (mcap) rather than FDV for comparisons. This is often because newly launched hot projects have low circulating supplies, making mcap appear deceptively favorable. But FDV is far more than just a theoretical figure.

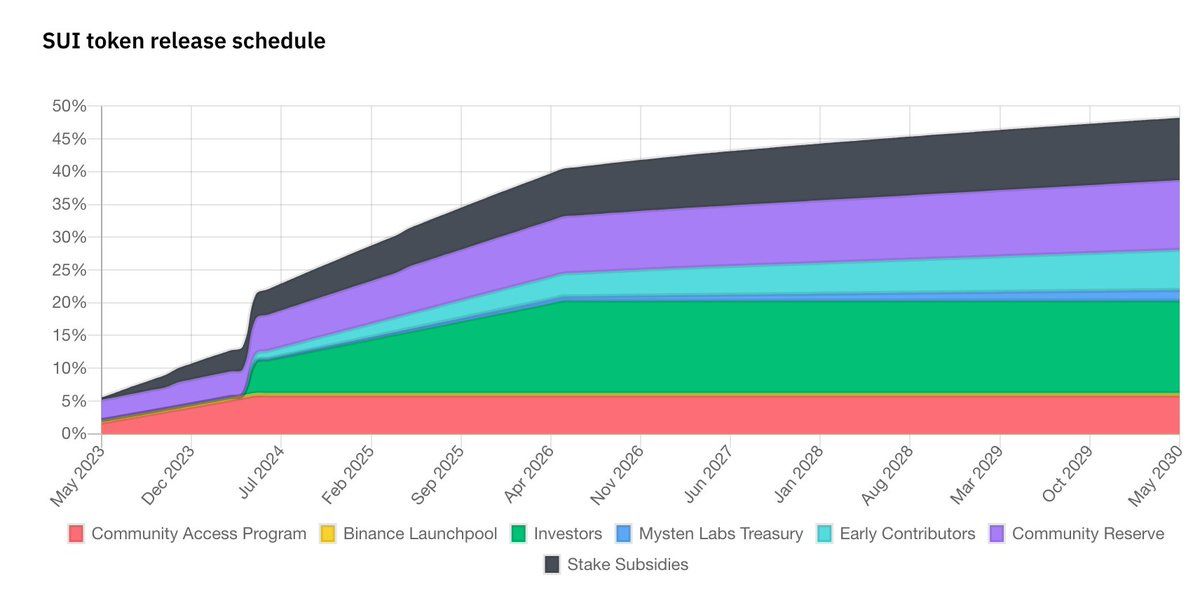

Take SUI, for example—a project jointly IEOed by OKX, Bybit, and Bitget, which narrowly avoided Blur’s fate by getting 40M tokens dumped into Binance Launchpool for free. Since its listing, SUI’s price has steadily declined.

Recently, it was revealed that the team secretly unlocked and sold tokens early, calling it “flexible tokenomics.” This exemplifies the painful process of mcap gradually converging toward FDV—newly released tokens become selling pressure.

Even if SUI had followed its official unlock schedule strictly, the release pace would still be extremely aggressive. Market hype and short-term speculation pushed SUI’s FDV above $10B at launch, while mcap remained under $1B—temporarily sustainable thanks to market enthusiasm. But without fundamental improvements, the inevitable conversion of that $10B FDV into actual circulating supply naturally leads to price depreciation over time.

C. Launchpool & Launchpad: Differences, Similarities, and Speculation

Many recently referred to MAV as a certain phase of a Launchpad project—but in fact, it’s a Launchpool project. What’s the difference between Launchpool and Launchpad? Launchpool distributes tokens for free; Launchpad requires BNB holders to pay for allocations. This distinction alone reflects Binance’s relative level of endorsement.

Especially for projects launching on Binance, Launchpad implies stronger implicit backing compared to Launchpool. We’ve previously explored the overall return statistics of Launchpad projects in a tweet thread.

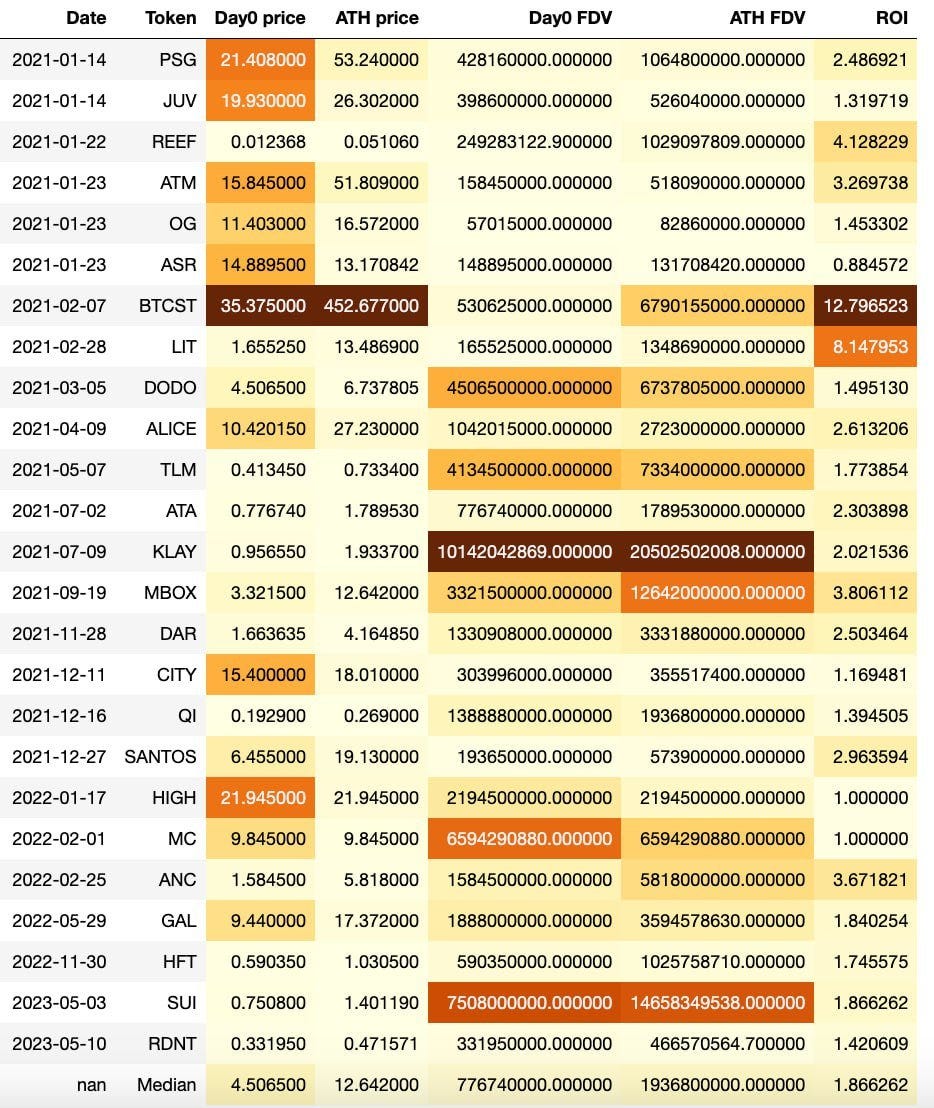

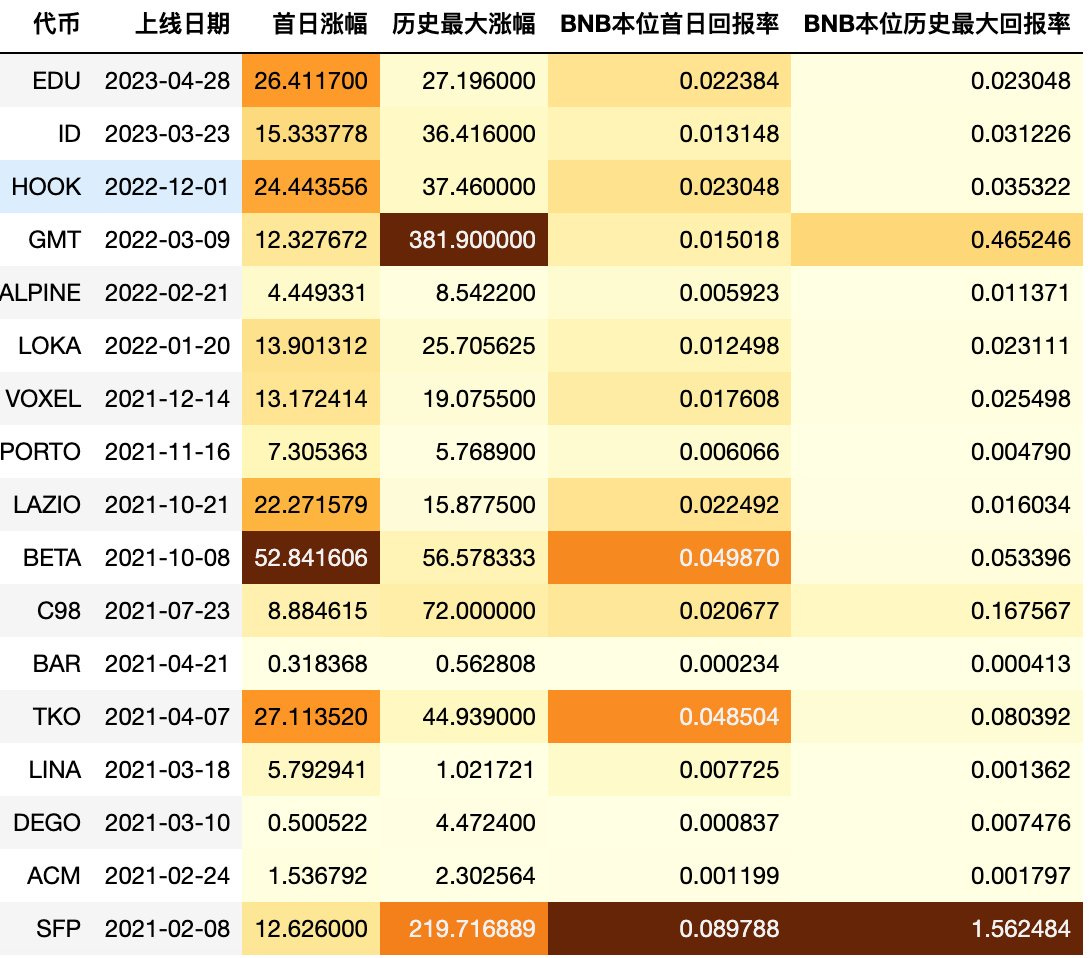

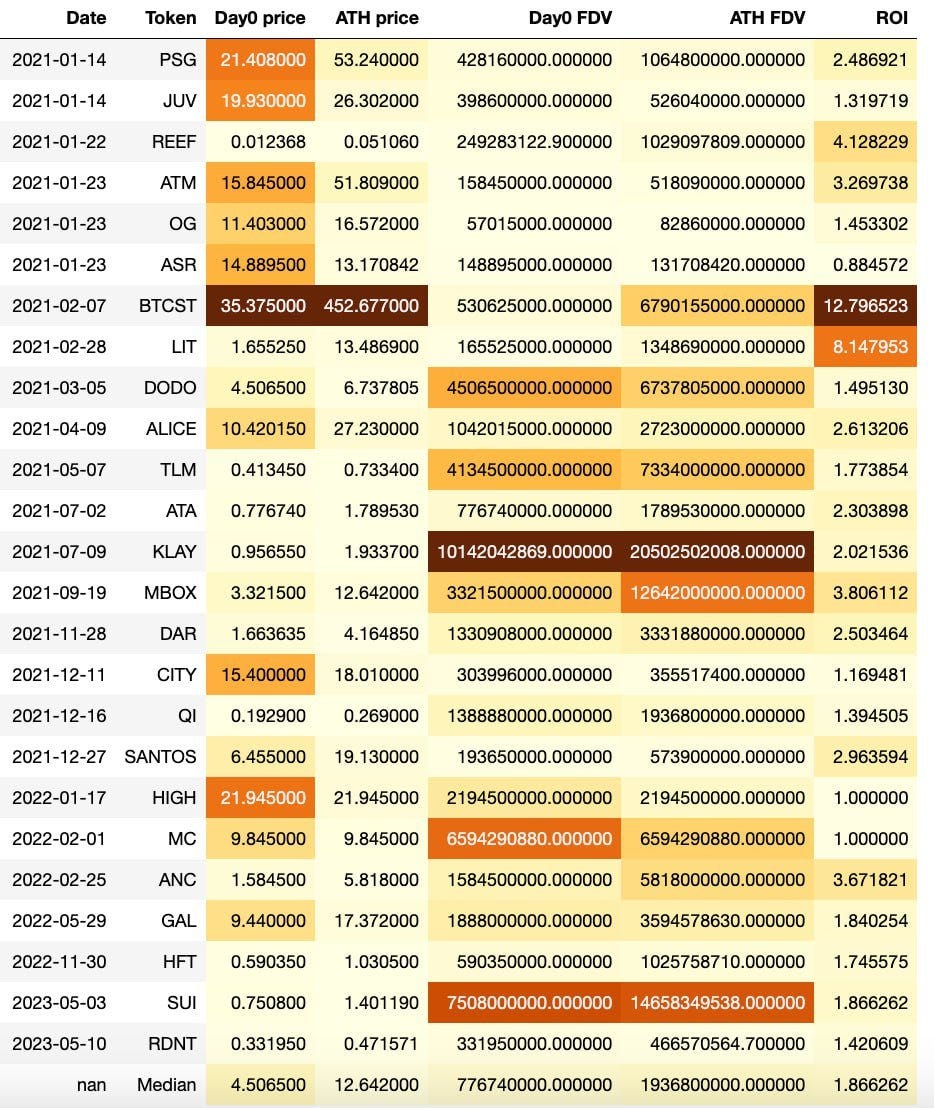

Today, let’s analyze both from the perspective of users rushing at listing—examining opening price (first-day average), all-time high (ATH), corresponding FDV, and ROI from buying at open and selling at ATH. The top chart shows Launchpool data; the bottom one shows Launchpad data. Focus particularly on the median values in the last row (15/n).

Historically, Launchpool projects have significantly underperformed compared to Launchpad ones. Assuming purchase at first-day average price and sale at ATH, the median ROI for Launchpad projects is 2.9x, whereas for Launchpool it’s only 1.9x.

Moreover, two Launchpool projects peaked immediately at launch—buyers have been trapped ever since—while no such case exists among Launchpad projects (though note: using first-day average price enables easy cross-project comparison but doesn't tell the full story; EDU, for instance, likely remains underwater for those who bought on day one).

Why is this so? We observe that ATH FDVs are actually quite similar between Launchpad and Launchpool, hovering around $1.9B. However, the median first-day FDV for Launchpool (~$780M) is notably higher than that of Launchpad (~$460M).

The main reason lies in liquidity distribution. Launchpad typically allocates about 5% of total supply, while Launchpool—being free distribution—usually offers much less, often under 2%. While Launchpool tokens open at inflated prices, most BNB holders immediately sell upon listing. Higher initial prices benefit them directly, giving Binance little incentive to correct this imbalance.

For investors, the long-term speculative value of Launchpool projects is clearly lower than that of Launchpad. Therefore, extra caution is required with Launchpool launches—robust valuation analysis and conservative positioning are essential. Blindly rushing in and holding long-term easily leads to getting stuck in deep drawdowns.

If you don’t want to do detailed valuation work, use the $460M median first-day FDV of Launchpad projects as a reference point: once a Launchpool application project exceeds this FDV at listing, the probability of achieving high returns going forward becomes quite low.

Summary

Benchmarking against similar projects is the most common valuation method. Launchpool projects generally underperform Launchpad ones. Due to limited liquidity, their prices often open inflated, requiring greater caution. Some Launchpool projects peak immediately at launch and remain deeply underwater, while Launchpad projects rarely—if ever—result in permanent losses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News