Japan Cryptocurrency Market Report: Industry Trends and Future Outlook Research

TechFlow Selected TechFlow Selected

Japan Cryptocurrency Market Report: Industry Trends and Future Outlook Research

This report will primarily focus on Japan's rapidly growing NFT and blockchain gaming sector.

Key Takeaways

-

To ensure market stability and investor asset security, the Japanese government has established strict regulations, posing challenges for small-scale cryptocurrency projects.

-

Japan's strong gaming foundation makes it an ideal region for blockchain gaming development.

-

Popular Japanese blockchain games include "My Crypto Heroes," "Captain Tsubasa RIVALS," and "Crypto Spells." Additionally, LINE's NFT subsidiary plans to launch five user-centric NFT games in 2023.

-

Japan's NFT industry features three characteristics: extensive intellectual property (IP), low FUD levels, and strong, tightly-knit project communities.

-

This article introduces three major Japanese NFT projects: Murakami Flowers, Crypto Ninja Partners, and MetaSamurai.

-

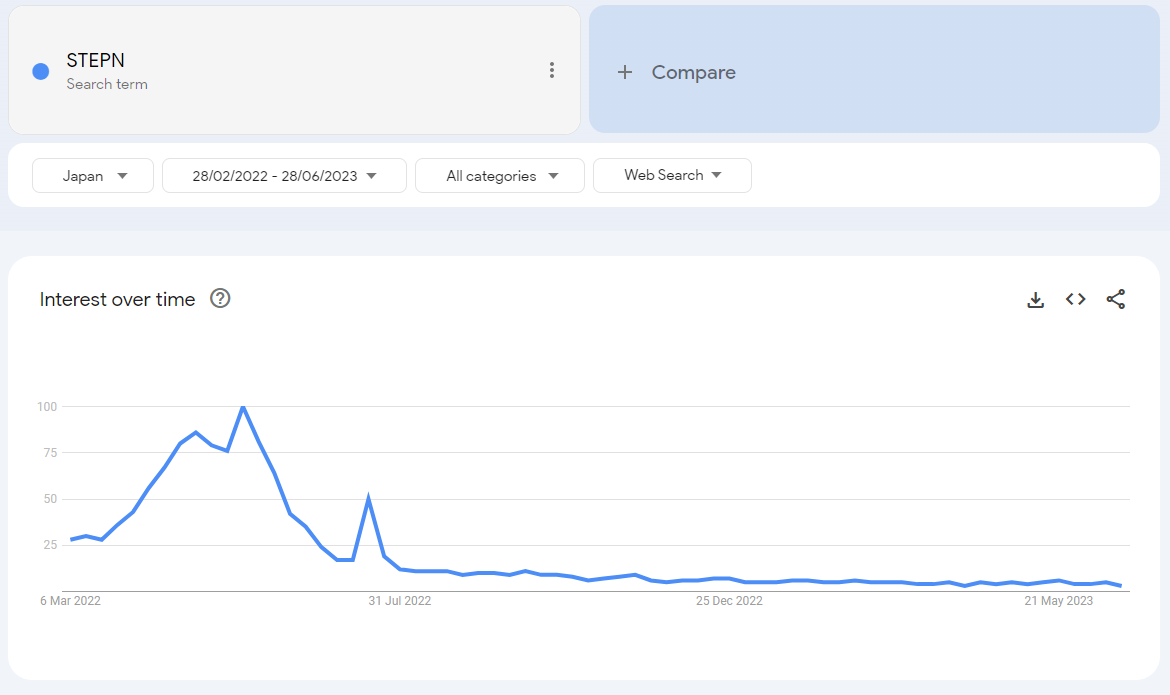

STEPN exemplifies successful entry into Japan’s market. Through timely launch, localization, and active community building, it captured significant attention in Japan.

Introduction

Globally, Japan is a unique market with vast potential in finance and investment, supported by a robust retail forex sector and thriving stock trading industry.

Due to early cryptocurrency hacks, the Japanese government adopted a cautious regulatory stance toward the crypto industry. Even today, Japan's available crypto assets remain relatively limited under oversight from the Financial Services Agency (FSA).

However, Japan approved Bitcoin as a legal payment method in 2017, laying the groundwork for rapid growth in the cryptocurrency sector. While initially skeptical, recent developments show increasing governmental support as Japan's blockchain industry evolves.

In April 2023, the ruling party’s Web3.0 project team released a white paper proposing measures to promote Japan’s crypto industry. In June 2023, Japan passed the revised Funds Settlement Act in the upper house, becoming the world’s first country to enact a stablecoin law.

Yet due to policy restrictions, direct token investments and issuances are prohibited in Japan, limiting domestic DeFi development. As a result, NFTs and blockchain gaming are widely seen as key drivers of Japan’s crypto market.

This report focuses on Japan’s rapidly growing NFT and blockchain gaming sectors. With its advanced gaming industry and globally recognized anime IPs, Japan’s NFT and crypto gaming scene is flourishing and holds immense future growth potential. By analyzing successful blockchain companies in Japan, we will explore their strategies for success, examine challenges they face, and identify opportunities within this fast-evolving market.

Japan's Blockchain Gaming Landscape

Japan is one of the most dynamic gaming markets globally. Thanks to popular platforms like PlayStation (PS) and Nintendo, most people are familiar with Japan’s game industry. Beyond traditional gaming, Japan’s blockchain gaming sector is also rising rapidly.

Beyond global influence, Japan ranks among the top countries in per capita gaming revenue. Japanese gamers have a deep passion for games and are willing to spend generously, making the market highly profitable.

Japan is renowned not only for its thriving traditional gaming but also for its rapidly emerging blockchain gaming industry.

Future Potential of Blockchain Gaming in Japan

Blockchain games leverage blockchain technology to integrate on-chain assets such as cryptocurrencies and NFTs, offering players a more secure and transparent gaming experience.

In blockchain games, players truly own in-game assets. All gameplay activities—including transactions and exchanges—are recorded on the blockchain. This integration enables a more transparent and vibrant in-game economy where players can earn real economic value through time and effort spent playing.

"My Crypto Heroes," an Ethereum-based RPG battle game launched in November 2018, was Japan’s first mature blockchain game. Since launch, it has ranked among the top globally in transaction volume and daily active users. As of January 1, 2023, its initial sales reached 16,000 ETH.

Major players in Japan’s gaming industry are actively engaging in the crypto space. These include leading public companies such as Line, whose NFT subsidiary plans to release five user-centric NFT games in 2023. MIXI has joined the Oasys blockchain as a validator. Additionally, Japan hosts strong native crypto companies like Double Jump and CryptoGames.

Overall, Japan’s blockchain gaming industry has three defining characteristics:

-

Strong Foundation: Japan’s long-standing and rich tradition in gaming provides a solid base for the development of blockchain gaming.

-

Limitless Potential: Japanese gamers are known for spending heavily on high-quality games, giving the blockchain gaming market enormous profit potential.

-

Mobile-First Focus: Mobile gaming dominates over PC or console gaming in Japan, prompting many developers to prioritize blockchain mobile games.

Case Studies of Japanese Blockchain Games

This section introduces three popular Japanese blockchain games and explores their opportunities and challenges.

My Crypto Heroes

MCH Verse & My Crypto Heroes (@mycryptoheroes) / Twitter

"My Crypto Heroes (MCH)" is a Japanese-developed NFT game created by double jump.tokyo. Its economy centers around the GUM token. Since launching in November 2018, MCH has attracted a large global user base and transaction volume, enabling some players to earn real income.

The core gameplay involves collecting and training historical hero characters, then using them in battles within dungeons (referred to as Nodes). Some heroes and in-game items exist as NFTs that players can trade.

From an economic perspective, MCH’s primary cycles include:

-

Missions: Players use heroes to battle and earn rewards including experience points, crafting materials, and expansion items.

-

PVP (Player vs Player): Players gain ranking points and tradable items by participating in battles.

-

Marketplace: Players can buy and sell items and heroes using the in-game currency GUM.

-

Land Activities: Players belong to virtual nations called “Lands” and participate in collection events. These increase land value and distribute dividends in GUM.

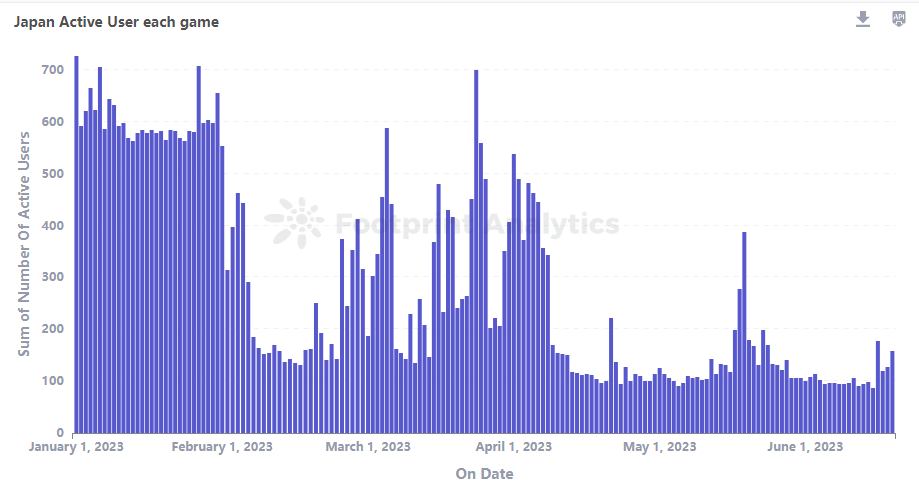

According to Footprint Analytics data, although My Crypto Heroes hasn't consistently maintained high user counts, it experienced several notable spikes in engagement. Despite modest peaks, the game successfully cultivated a loyal long-term user base across multiple cycles.

Recently, the development team expanded its capabilities by launching "MCH Verse"—a Layer 2 Optimistic Rollup built on Oasys, a gaming-focused Layer 1 blockchain. This strategic move leverages the scalability of blockchain technology to enhance user experience and interoperability within the Verse ecosystem.

Although many mobile blockchain games minimize on-chain resource usage by favoring off-chain development to avoid complex functionalities, MCH continues to lead Japan’s crypto gaming market by rapidly adopting and integrating new technologies to improve gameplay.

Captain Tsubasa RIVALS

Captain Tsubasa -RIVALS- (@TsubasaRivalsJA) / Twitter

"Captain Tsubasa – RIVALS" is a blockchain game based on the iconic manga series "Captain Tsubasa." With over 70 million copies sold in Japan and more than 70,000 followers on Twitter, the game leverages the manga’s enduring popularity and massive fanbase, combining football themes with a dual-token mechanism to deliver a high-quality gaming experience.

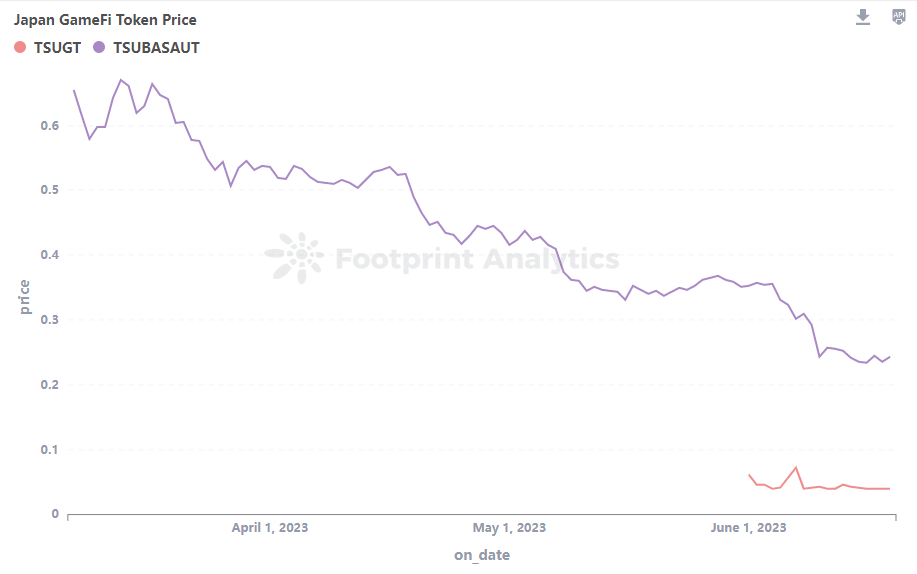

The game features two tokens: TSUBASAUT and TSUGT, serving as utility and governance tokens respectively. Inspired by Axie Infinity’s model, separating reward and governance systems helps balance the in-game economy, boost user activity, and reduce token price volatility.

However, since its launch, TSUBASAUT has shown a steady decline in USD value—likely due to its unlimited supply and primary use for player cashouts. The operating company implemented a balancing system aiming to stabilize TSUBASAUT prices, but results so far have been limited.

Similar issues plague other blockchain games like Axie Infinity and STEPN. For prospective players, understanding how Captain Tsubasa – RIVALS sustains long-term user liquidity is crucial before starting.

In contrast, TSUGT has remained stable since launch. With a fixed supply and direct utility tied to key gameplay functions like upgrades, TSUGT demonstrates greater reliability. Currently, the team, investors, and advisors collectively hold 37% of the tokens, which will be gradually released over 12 months post-lockup, helping maintain supply-demand balance and build a sustainable token ecosystem.

Despite the dual-token design, the game mechanics are quite simple: each player uses three character cards, compares numerical values across three rounds, and determines the winner. Strategic depth comes from choosing the order of number deployment.

In practice, the game has faced criticism for being too simplistic—essentially just comparing numbers—and requiring NFT purchases to play at all.

Nonetheless, despite these drawbacks, Captain Tsubasa – RIVALS showcases the potential of merging Japanese IP with blockchain gaming, demonstrating new possibilities at the intersection of NFTs, intellectual property, and interactive entertainment.

Crypto Spells

Crypto Spells (Kurisupu) Official Japanese Account (@crypto_spells) / Twitter

"Crypto Spells" is a popular strategy-based digital collectible card game launched by Crypto Games in 2019. Its gameplay closely resembles titles like Hearthstone and Gods Unchained. Featuring an integrated wallet (supporting iOS and Android), it lowers the barrier to entry for newcomers unfamiliar with crypto.

Crypto Spells operates on a Layer 2 system ("TCG Verse") running atop Oasys L1—similar to My Crypto Heroes—with the goal of further scaling blockchain-based gaming. Recently, they launched a new series called "NFTWars," allowing verified NFT holders to create custom game cards. By expanding the NFT holder base, this initiative gives players opportunities to earn OAS (Oasys’ native token). This ecosystem has global expansion potential.

In Crypto Spells, players build decks of 30 cards, with up to two copies of any single card allowed. Players may also add three skills to their deck, enhancing strategic variety and competitiveness. Through gameplay, players accumulate battle points used to mint new cards and potentially obtain rare NFT cards.

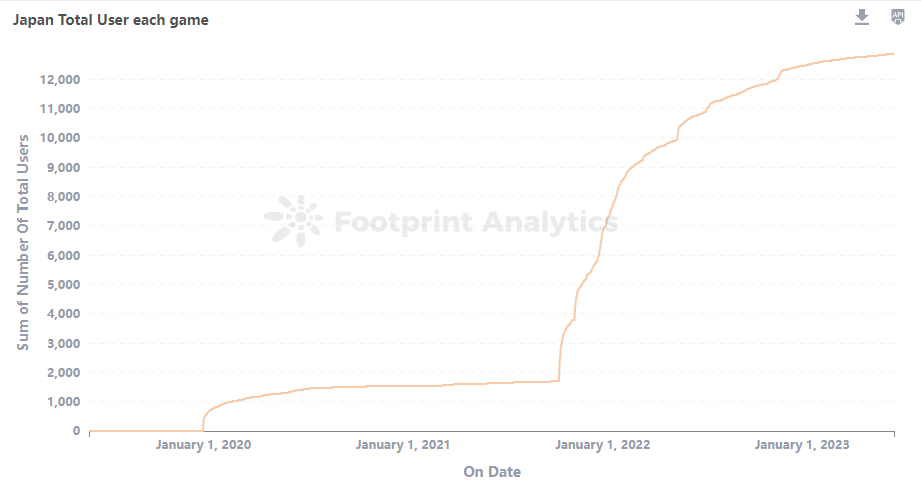

Starting in Q4 2021, Crypto Spells saw significant growth in total user count.

However, when examining active user data, the game appears to struggle maintaining momentum. While attracting new users, active user growth remains limited. Closer integration between players and the game universe (Verse) could shift this dynamic, improving engagement and retention.

Given Japan’s deep gaming culture, Crypto Spells regularly hosts official and unofficial tournaments—many community-led. Events occur both online and offline, drawing fans beyond the crypto space. Emphasizing skill-based competition, Crypto Spells fosters a game-first ecosystem. Winners receive rare NFT prizes tradable on secondary markets.

Japan's NFT Market

Japan boasts not only a rich video game heritage but also the world’s largest pool of intellectual property (IP). These cultural assets have achieved global recognition.

Beloved Japanese anime like Naruto, Dragon Ball, and Ghost in the Shell command millions of fans worldwide, providing a solid foundation for blockchain gaming and NFT industries.

As a result, Japan’s NFT community exhibits distinct aesthetics and preferences unlike those elsewhere.

Japan’s Unique Path in NFT Development

Non-fungible tokens (NFTs) are unique digital assets whose value stems from uniqueness and irreplaceability. NFTs use blockchain technology to guarantee ownership and authenticity.

Since early 2018, NFTs have sparked excitement in Japan’s crypto space. By 2021, amid global NFT mania, they gained widespread popularity in Japan.

Japan’s NFT development follows a distinct path independent of global trends. The market primarily builds on domestic anime and idols, leveraging existing IP content and collaborating with fan communities—making local development the focus.

However, with the rise of Bored Ape Yacht Club (BAYC), collector-focused NFT projects emerged. Takashi Murakami’s "Murakami Flowers" became Japan’s first project to establish an overseas user base. Murakami’s international acclaim through collaborations with luxury brands like Louis Vuitton and Hublot helped bring Japanese NFTs into the global spotlight.

Japanese people deeply cherish their national culture and art, naturally supporting homegrown projects. Murakami showcased Japanese culture via NFTs, and this cultural pride became a key driver behind public support.

Additionally, local acceptance of NFTs is growing. Japan’s “Furusato Nozei” tax program allows taxpayers to donate part of their taxes to local governments and receive regional gifts in return.

Recently, some local governments began issuing NFTs as thank-you gifts—a uniquely Japanese approach blending rural revitalization with digital art, highlighting the aesthetic and resource potential of Japan’s digital art scene.

Overall, Japan’s NFT industry has three main characteristics:

-

Rich IP Resources: Japan possesses abundant popular IPs—from anime and manga to video games—that can be leveraged to create compelling NFT collections.

-

Low FUD Levels: Japan’s crypto gaming community rarely experiences fear, uncertainty, and doubt (FUD), likely due to cultural tendencies to avoid direct criticism or complaints—especially evident among NFT newcomers and startup communities.

-

Tightly-Knit Communities: Japan’s crypto communities are smaller in scale, facilitating stronger cooperation, shared goals, and more efficient, closely connected networks.

Overview of Popular Japanese NFT Projects

Murakami Flowers

Murakami.Flowers Official (@MFTMKKUS) / Twitter

Takashi Murakami is a world-renowned Japanese artist celebrated for his colorful works and distinctive artistic style. His Murakami.Flowers project (shortened as M.F) is a comprehensive initiative encompassing art, design, and digital creation. Centered around the digital concept of “108”—comprising 108 backgrounds and 108 small flowers—the number references Buddhist notions of earthly desires or obstacles, symbolizing the artist’s attempt to transcend worldly constraints through digital art.

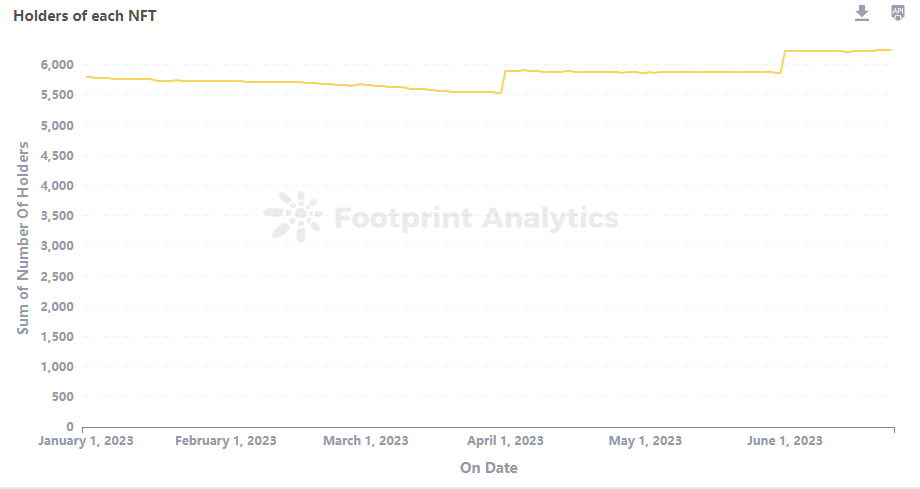

The series consists of 11,664 NFTs (108×108). Distribution includes a whitelist presale allocating 3,000 to RTFKT CloneX holders with Murakami Drip and 500 to other event participants. Murakami himself retains about 4,000, while the remaining 6,751 are available for public sale.

Pricing: whitelist participants pay 0.0727 ETH; public sale price is 0.108 ETH. Each wallet is limited to one purchase. Actual sales occurred in April 2023, with each buyer receiving a "seed" NFT that later evolves into a unique flower.

Although NFT prices have declined continuously since September 2022, Murakami remains actively involved, continuously expanding the M.F universe.

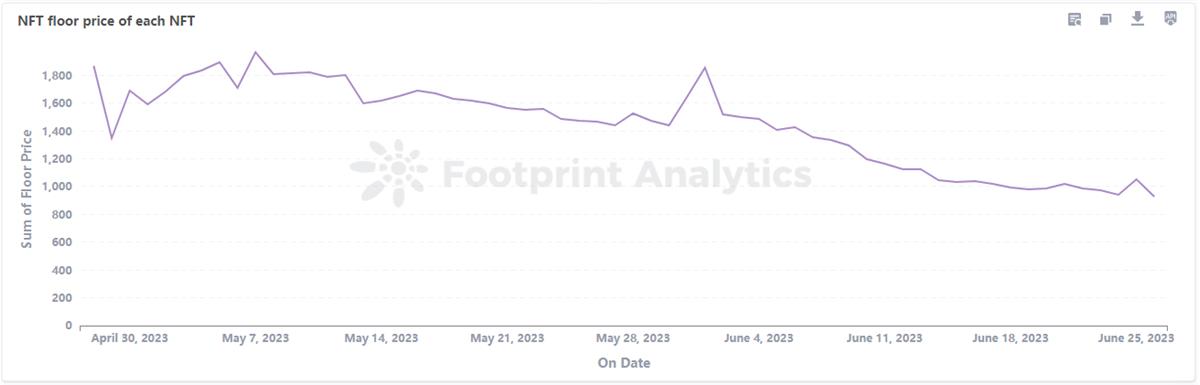

Murakami.Flowers Official (M.F) Price

Unlike typical NFT projects, M.F holders received airdrops including sub-series NFTs and physical goods such as original T-shirts, Tamagotchi-like toys called "Flower Go Walk", and trading card collectibles based on M.F.

In terms of market activity, the floor price of the M.F series continues to decline, currently trading around $600, second only to Crypto Ninja Partners (introduced below).

Floor prices are determined by actual market participants, and privileged groups—such as whitelist recipients—have significant influence on real trading prices. Despite declining floor prices, NFT art is just one facet of Murakami’s broader vision, and he continues to expand the project into wider creative directions.

Crypto Ninja Partners

Official CNP (CryptoNinja Partners) (@cnp_ninjadao) / Twitter

Crypto Ninja Partners (CNP) is a Japan-themed NFT series that originated from a community called NinjaDAO. Though not a formal DAO, NinjaDAO brought together numerous Japanese crypto enthusiasts. Two key figures—Ikehaya (a Japanese NFT KOL and web marketer) and Road (another core contributor)—led CNP’s development.

The CNP NFT series launched in May 2022 at an initial price of just 0.001 ETH, comprising 22,222 units. While initial NFT sales typically range from 0.05–0.08 ETH, CNP aimed for accessibility, enabling even NFT newcomers to participate affordably. Holders benefit from potential appreciation rather than starting at a high cost like 0.08 ETH.

This strategy proved highly successful, earning holder trust and driving the floor price above 2 ETH, establishing CNP as one of Japan’s most successful NFT projects.

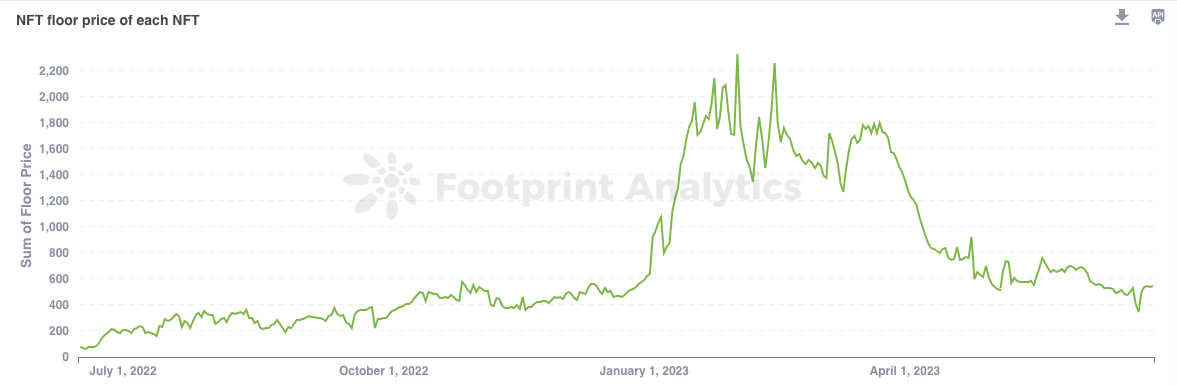

Crypto Ninja Partners (CNP) Floor Price

CNP’s strategy included distributing numerous sub-series and family series whitelists to holders at 0.001 ETH. In early stages, this effectively boosted project activity by granting priority minting rights. However, as market conditions worsened, CNP struggled to attract new users.

Since launch, founders and community members have promoted the project through various channels, using key characters as community IPs to aid operations and marketing. The community has enhanced CNP’s brand impact by developing mobile games and exclusive holder apps. Additionally, CNP holders enjoy exclusive services at over 160 partner restaurants, hotels, and venues across Japan, including special discounts.

CNP’s emphasis on community sets it apart from other projects mentioned here, showcasing Japan’s strengths in IP creation.

MetaSamurai

1BLOCK STUDIO®︎ (@1block_official) / Twitter

Presented by the Los Angeles and Tokyo creative team "1BLOCK®︎", MetaSamurai is a series of 3,333 unique 3D avatar NFTs. The project aims to empower creators and build a brand in digital fashion.

MetaSamurai is a series presented by the Los Angeles and Tokyo creative team "1BLOCK®︎", featuring 3,333 unique 3D avatar NFTs. The project’s vision is to establish a digital fashion brand and empower creators.

Its core philosophy is "I GOT YOUR BACK," symbolizing MetaSamurai’s commitment to supporting its NFT holders. This phrase originates from a story of two warriors fighting back-to-back, protecting each other. It draws inspiration from samurai loyalty to their lords and Hachiko, the dog who waited over a decade for his deceased owner—core inspirations behind the artwork.

The NFT series began minting in June 2022, with a public sale price of 0.05 ETH.

In 2022, prices fluctuated near the initial level, but beginning in early 2023, the series saw significant appreciation.

Another unique aspect is its collaboration with numerous Japanese companies and brands, including partnerships with "Ghost in the Shell," "Ghost in the Shell STAND ALONE COMPLEX," "BEAMS CULTUART," "Coach," "Lupin the Third," and "Atmos x Space Brothers."

1Block treats MetaSamurai not just as a standard NFT series but as a digital fashion brand—setting it apart from typical NFT projects. The highly anticipated MetaSamurai 2 series will introduce personalized wearable products, opening new perspectives for fashion brands and fostering original project development.

Japan’s Venture Capital Landscape

While Japan’s startup ecosystem may not be as vibrant, its venture capital industry is robust. Notably, Japan’s Limited Partnership Act (LP Act) imposes specific limitations on investments. Currently, the LP Act prohibits investors from investing in tokens, restricting full participation by Japanese VCs in the crypto and blockchain sectors.

As of January 1, 2023, Japan’s most active crypto-sector VC investors by funding round were Global Brain, East Ventures, and SoftBank. In terms of total funding amount, the top three were Global Brain, SoftBank, and Z Venture Capital.

Japan’s VC industry is less active than others, characterized by careful and meticulous investment approaches. According to Siddarth Pai, co-founder and CFO of 3one4 Capital: “Japanese investors view investment as an equal partnership based on mutual advantage, so VCs tend to be cautious, careful, and deliberate.”

Traditional VC firms like SoftBank Vision Fund, East Ventures, and Global Brain play vital roles in supporting Japanese startups. Japan’s stable economy and capital markets have nurtured numerous investment institutions, some of which allocate funds to venture capital and startups. Economic stability also reduces investment risk compared to less stable economies.

Despite challenges like aging population and economic stagnation, Japan’s large economic base and domestic market remain attractive to global investors and tech firms. Moreover, while Japanese investors are traditionally conservative, they are increasingly open to supporting startups and venture funds, fueling growth in Japan’s entrepreneurial environment.

Overall, while Japan’s venture capital scene may lack the pace of other countries, its prudent, research-driven approach, combined with support from traditional VCs and growing openness to risk, makes it an ideal destination for startups and investors alike.

STEPN Case Study: Overseas Project Success in Japan

STEPN was the first game to implement a "Move to Earn" economic model and achieve major success in Japan’s crypto market.

STEPN’s core gameplay allows players to purchase sneaker NFTs and earn in-game tokens (GST) by walking, jogging, or running outdoors. These tokens can upgrade existing sneakers or craft new ones. STEPN succeeded in Japan due to several key factors.

First, timing was critical. Launched around late 2021, STEPN entered during favorable macroeconomic conditions. After the November 2021 bull run, many individuals had surplus capital. Increased liquidity heightened willingness to invest in in-game items. While market conditions are beyond a project’s control, they remain a pivotal factor in success.

Moreover, Japanese players generally possess higher spending power compared to players elsewhere. They often invest heavily in NFTs, sometimes committing five- or six-figure amounts to maximize in-game returns.

Such spending levels are rare in other gaming markets. For example, Axie Infinity, popular in the Philippines, thrives on scholarship models. Players can rent three Axies at low cost to join guilds, entering with minimal upfront investment.

From launch, STEPN targeted Japan specifically. Before global players joined the economy, Japanese users leveraged their strong purchasing power to shape internal market dynamics, achieving healthier market health and liquidity above global averages. Despite typically lower global community engagement, STEPN successfully adapted to local norms, creating a positive feedback loop—resulting in more discussions about STEPN in Japan than in other major markets.

Source: Google Trends

Precise GPS tracking is another advantage. STEPN requires accurate GPS to prevent cheating and maintain economic integrity while enabling real-time staking. Many Japanese users own iPhones with precise GPS systems, making it easy to start playing and earning.

Gacha mechanics—common in Japanese mobile games—allow players to exchange in-game tokens for random items. Long a growth driver in Web2 mobile games, STEPN successfully integrated this concept, boosting player engagement and interest.

At peak popularity, STEPN players earned approximately $3,000 daily just by walking. The game’s user-friendliness and generous rewards triggered a viral craze, even achieving mainstream crossover appeal.

Other projects can learn from STEPN’s success. However, macroeconomic conditions and external factors significantly impact performance in Japan’s market.

What Makes Successful Blockchain Projects in Japan?

Successful Japanese blockchain projects adopt several operational strategies, including building strong communities, localizing offerings, and earning user trust through sustained operations.

Strong Community

One hallmark of a successful blockchain project is a dedicated community of supporters and loyal users. Such communities help raise awareness, increase engagement, and ensure long-term sustainability. Community vitality can be fostered through events, user incentives, and transparency.

Localization

Localization is crucial for blockchain projects targeting Japan. Given Japan’s strong cultural identity and dominant use of Japanese in daily life, overseas projects must adapt to local regulations, translate content, collaborate with local KOLs and media, and host localized events. Engaging local audiences enhances visibility and user acquisition.

Long-Term Operations

A successful blockchain project must withstand risks and adapt to market changes. Developing viable products and concepts requires stable operations amid market fluctuations. Japanese consumers tend to be cautious and hesitant toward new technologies, so projects must build reputations gradually and operate sustainably to succeed.

Beyond these traits, forming partnerships with local KOLs, VCs, projects, and media can amplify reach, build credibility, and drive mutual growth. This is especially important in Japan, where industry giants—particularly in traditional sectors—still dominate. Startups should leverage innovation to form alliances with these established players, accelerating growth through synergy.

Opportunities and Challenges in Japan’s Crypto Industry

Japan’s robust and mature traditional financial system provides a solid foundation for its blockchain and Web3 industries.

Regulatory compliance remains central to Japan’s crypto market. To ensure market stability and investor protection, Japan enforces strict regulations in the blockchain sector. While these rules protect the industry, they pose challenges for early-stage crypto projects. High compliance costs and tax burdens hinder market entry and growth. Lengthy token listing approvals also contribute to perceptions of market stagnation and erode confidence.

Historically, Japan prioritizes financial stability and caution. While this protects traders from major risks, it may limit innovation and market flexibility. Since innovation drives crypto success, this constraint may explain why Japan lags behind other nations in the sector.

The good news is that in April 2023, the ruling party’s Web3.0 task force released a white paper recommending policies to advance Japan’s crypto industry. In June 2023, Japan passed the revised Funds Settlement Act in the upper house, becoming the world’s first nation to legalize stablecoins.

Japanese institutional investors are showing growing interest in crypto and gaining clearer recognition of its potential. Rising market interest could significantly boost the entire industry, bringing greater liquidity, stability, and credibility—ultimately attracting more retail and institutional investors.

Japan’s gaming market and rich IP resources have already demonstrated tremendous potential. Combined with unique cultural traits and a powerful financial system, Japan is poised to become a global leader in Web3. By fully leveraging its strengths and promoting innovation and growth, Japan has the opportunity to lead the future of the global Web3 industry.

Footprint Analytics is a structured data platform bridging Web2 and Web3. Using cutting-edge AI technology, we offer the first no-code analytics platform and unified API in the crypto space, enabling users to quickly access NFT, GameFi, and DeFi data across more than 26 blockchains.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Rokubunnoni, Inc. is an independent media company in the cryptocurrency and blockchain space, active since 2018. Our mission is to report on innovative blockchain technologies and products with impartiality, provide in-depth knowledge to readers, and contribute to the development of Web3.

Media : https://crypto-times.jp/

Research Report Distribution : https://ct-analysis.io/

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News