7 Speculations on the Future of NFTs: RWA Rights, Loyalty Points, Membership Cards, O2O Ticketing Proofs...

TechFlow Selected TechFlow Selected

7 Speculations on the Future of NFTs: RWA Rights, Loyalty Points, Membership Cards, O2O Ticketing Proofs...

The darkest hour: Where is the breakthrough for the next NFT cycle?

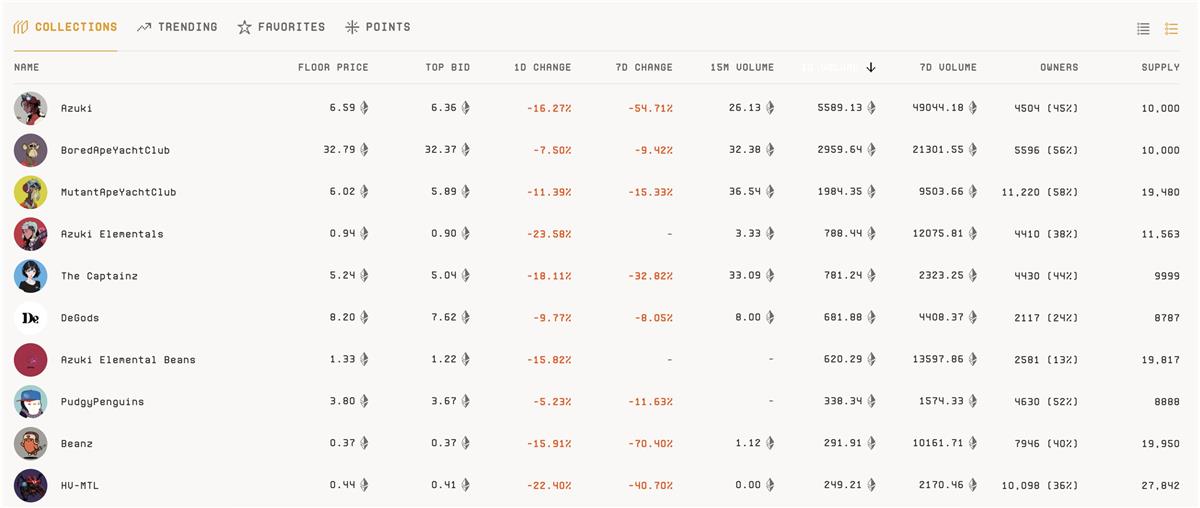

As the floor prices of once-so-called "blue-chip NFTs" continue to decline, Azuki Elemental and Memeland's recent minting results underwhelm, and BAYC's new game launch fails to generate strong FOMO, the NFT market is facing an unprecedented crisis. The PFP narrative—mythologized during bull markets with ample liquidity—is gradually collapsing under the test of time. Alarmingly low project survival rates, combined with winner-takes-all arrogance and the difficulty of managing expectations, have collectively led to today’s across-the-board downturn in the NFT market (PS: WeirdoGhostGang remains resilient).

So today, let’s briefly explore possible breakthrough directions for the next NFT cycle. Below are my personal thoughts—feel free to share your views in the comments. [PS: The following ideas are listed from easiest to hardest to implement.]

I. Loyalty Membership Cards

Similar to a Pass card model, holding an NFT grants VIP membership to a project, brand, or platform. Beyond identity distinction, holders can enjoy exclusive services, discounts, point redemption, prize raffles, digital goods, and physical gifts. In essence, whitelist perks offered by NFT projects already reflect this model.

Pros: Flexible entry barriers, can be set high or low

Cons: Requires ongoing operations and partnerships

II. Data Storage Devices

Music NFTs can be seen as a demonstration of data storage functionality. NFTs aren't limited to storing text, images, audio, or video—they represent a relatively accessible path into creator economies. What people buy isn’t just the NFT itself, but the underlying data or content it carries.

Pros: Simple functionality, diverse formats

Cons: High content demands, potential paywalls

III. Game Access Codes

Games can range from small browser-based titles (like subway parkour or monkey box games on 4399/7K7K) to full-scale AAA productions (e.g., Phantom Galaxies, Ultiverse). NFTs can serve as early access passes or proof of status for high-spending players.

Pros: High entertainment value, low user learning curve

Cons: Short game lifecycle, high development requirements

IV. IRL (In Real Life) Utility Tokens

In a post-pandemic world where people crave physical interaction, real-world experiences—dining, entertainment, travel, shopping—carry strong appeal. These experiential benefits allow NFT holders to meet offline and create shared memories, while also boosting brand loyalty and consumption.

Compared to intangible online loyalty cards, the success of IRL utility depends entirely on the quality of offline service delivery.

Pros: Direct tangible benefits, intuitive user experience, broad target audience

Cons: Time-intensive, high costs, complex operations

V. O2O (Online-to-Offline) Ticketing Proof

Imagine being able to access museums, art exhibitions, concerts, and music events simply by presenting an NFT in your wallet—how convenient would that be? Industry players like Ticketmaster and NFT-TiX have already explored NFT-based ticketing solutions.

Pros: Transparent, traceable, lower distribution costs

Cons: Long implementation chain, outdated industry practices, privacy verification challenges

VI. Credential & Experience Verification

As non-fungible tokens, NFTs can function similarly to SBTs (Soulbound Tokens). For Web3 users, especially those actively participating in early-stage projects ("airdrop farmers"), earning early NFTs serves as proof of participation—whether through social media tasks or on-chain transactions. These NFTs become part of one’s verifiable on-chain resume.

Moreover, the reputation value of Web3 users’ on-chain activity remains underexplored. Converting work experience into an NFT for professional endorsement or consulting credentials could be a promising future direction.

Pros: Clear and visible, well-defined rights and responsibilities

Cons: Risk of forgery, ecosystem challenges around circulation

VII. RWA (Real World Assets) Rights

Real World Assets (RWA) aren’t a new concept, but when wrapped in Web3 narratives and tokenized into divisible units, they may represent steps toward a true "Metaverse"—mapping real-world assets into fragmented ownership rights, bonds, or bundled financial products. The emergence of lending protocols further incentivizes participation. NFTs can play a role here too. As boundaries between ERC20, ERC721, and ERC1155 blur, fractionalizing NFTs into fungible tokens or airdropping tokens to NFT holders has become common practice. Even initiatives like CityDAO could experiment in this space, expanding their storytelling and utility potential.

Pros: Low entry barrier, high return expectations, vast market potential

Cons: Regulatory risks, challenges in delivering real-world utility, risk of repackaging low-quality assets

To wrap up with some food for thought:

What do you think will define the next NFT cycle?

Which practical use cases will emerge to drive the next bull market?

What kind of Web3 project (not limited to NFTs) can endure market cycles and bring 100 million people into Web3?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News