Why NFTFi Will Drive the Next Bull Market?

TechFlow Selected TechFlow Selected

Why NFTFi Will Drive the Next Bull Market?

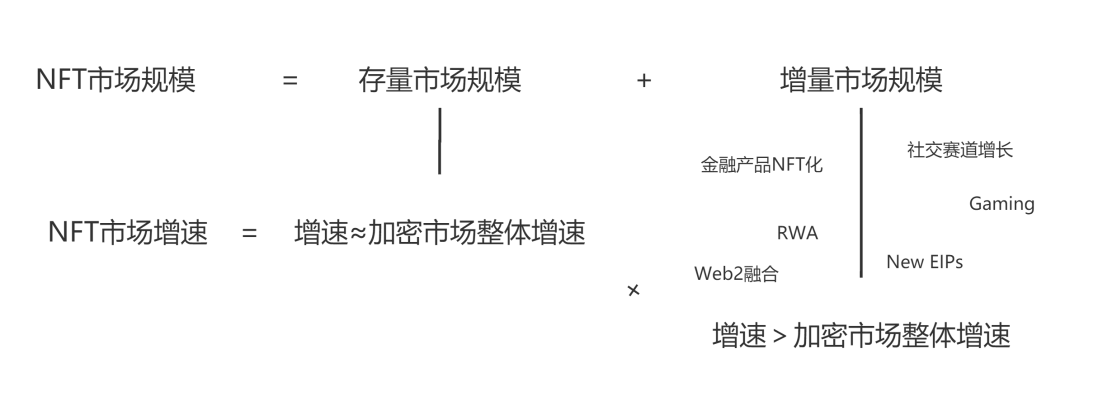

In medium to long cycles, the growth rate of the NFT market will significantly outpace that of the cryptocurrency market.

Author: Loki, Xinhuo Technologies

I. We Are on the Eve of an NFTfi Boom

First and foremost, it's important to clarify that while the NFT and NFTfi markets have clearly gone through a notable downturn, this does not mean they have lost their growth potential. In fact, NFTfi remains one of the markets with the highest potential for exponential growth.

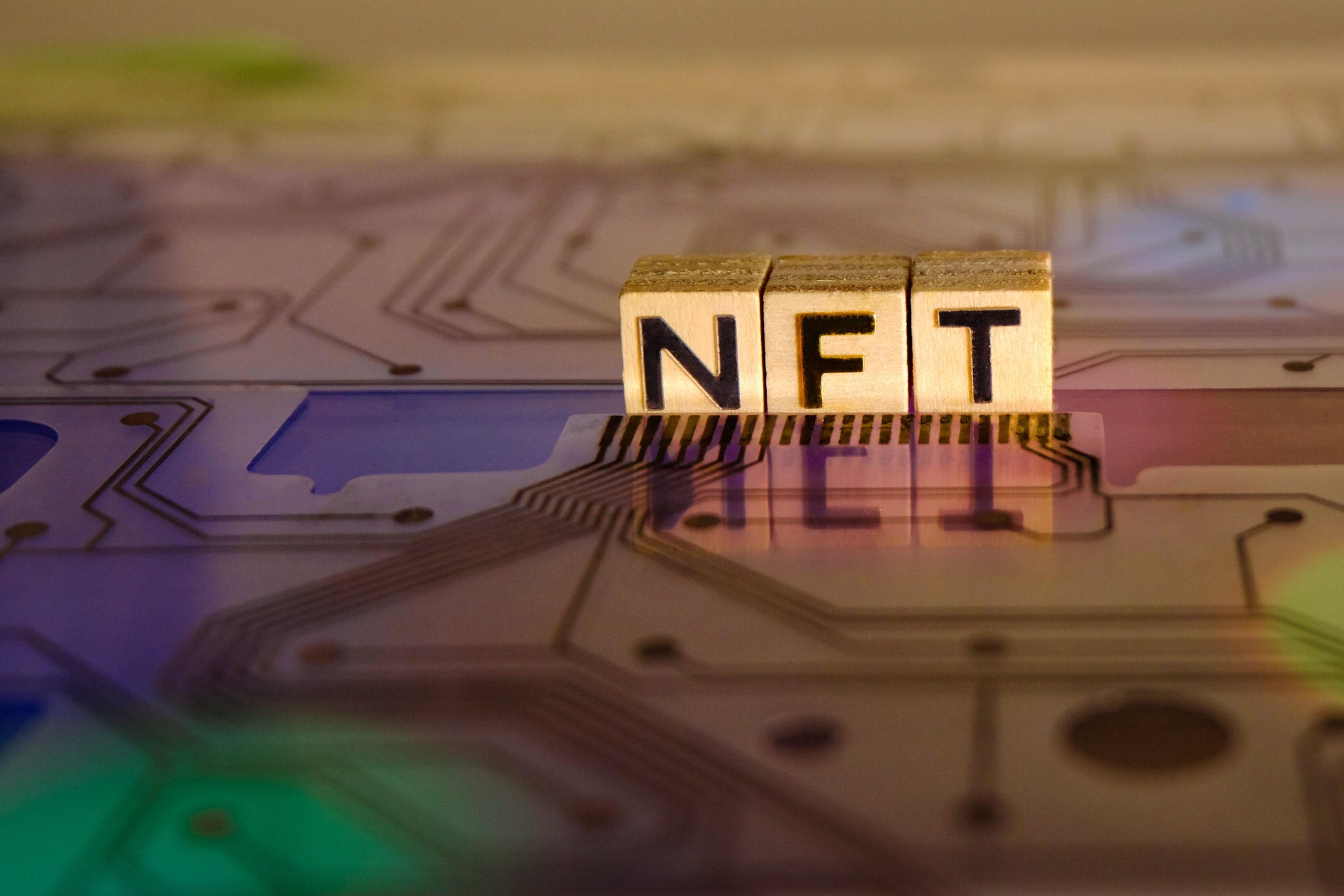

Following the technology maturity curve, when a new technology emerges, it initially surges rapidly to its peak, followed by a possible bubble burst, before gradually climbing again toward stable, widespread adoption.

Throughout the development of the crypto industry, this trajectory has been repeatedly validated—from BTC’s emergence, to the PoW craze, ICO boom, and DeFi Summer.

Source: Google

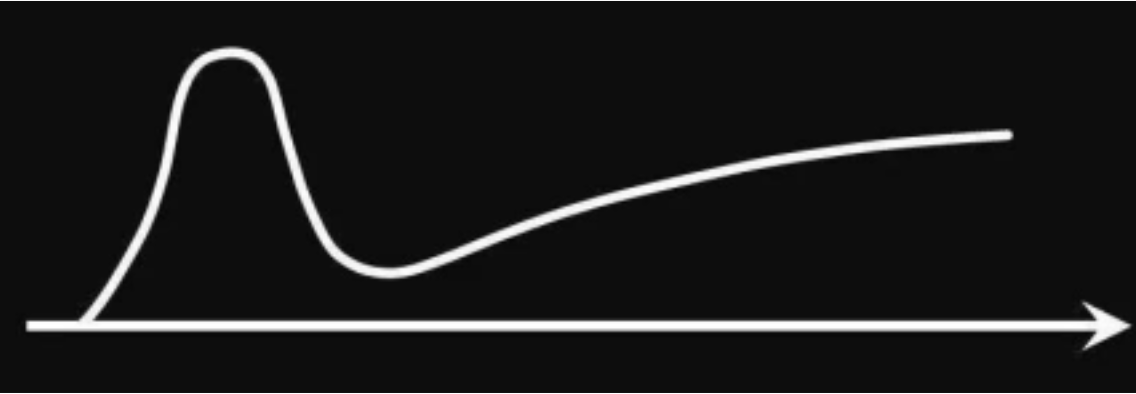

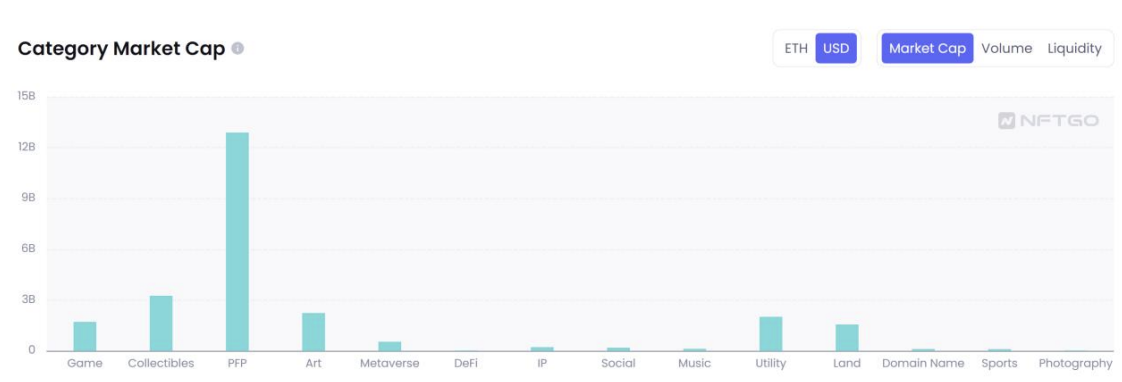

When discussing the market potential of NFT/NFTfi, two key data points from the previous report are essential: NFT market capitalization and NFT category distribution.

Based on data from March 2023, the "core market" of high-value, high-liquidity NFTs was valued at only $5.9 billion—approximately 4.2% of the stablecoin market cap (relative to the DeFi sector) and 2.7% of ETH’s market cap (relative to the ETH LSDfi sector).

Source: Public data compilation

Category distribution helps explain this phenomenon: PFP, Art, and Collectibles account for over 75% of total market cap, followed by Utility, Land, and Game categories.

Due to their inherent characteristics, most current NFTs lack rigid real-world use cases or revenue-generating capabilities, leaving them caught between becoming blue-chip assets or facing liquidity droughts.

From a capital perspective, PFP, Art, and Collectibles primarily represent speculative and social demand—demand strength closely tied to overall market liquidity. As such, their market size moves in tandem with the broader crypto market, unable to break through the “macro cap” ceiling, making significant outperformance unlikely.

Source: NFTGo

However, PFP dominance won’t last forever. Emerging product categories deserve greater attention—identity ecosystems represented by ENS and SBTs, utility NFTs in gaming/social/education, and financial NFTs and RWA opportunities led by SOLV and the ERC-3525 protocol. The structural growth potential brought by non-PFP NFTs far exceeds systemic growth opportunities.

Take Financial NFTs as an example: average annual crypto fundraising from 2020–2022 was around $30 billion. If just 10% of future fundraising were conducted via NFTs or SFTs (semi-fungible tokens), this would generate $30 billion (fundraising level) + $30 billion (investment level) = $60 billion in new market value. Additionally, if 10% of DeFi TVL migrated to NFTfi, another $4.8 billion would be added. These two areas alone could increase today’s NFT market size by 183%.

As shown below, from a macro view, the PFP-dominated existing market is constrained by the scale of fungible token markets. But the incremental market possesses relative independence—and may even surpass fungible token markets in size. NFT/NFTfi lacks no narratives; growth above the broader crypto market’s pace is slow but sure.

II. Sector Outlook: The Market Potential for Trading and Lending Is Far From Tapped

In the first part of this report (“Panoramic Research on the NFTfi Landscape”), we focused on outlining the current state of the NFTfi market. By sector, NFT trading and NFT lending have already gained initial scale, with future development centered on integration and efficiency improvements. My view remains unchanged: improving liquidity is both the first and final goal of NFT trading. Despite Blur’s rapid rise over the past year, I believe it is still far from reaching its ultimate form. Over recent months, I’ve discussed further improvements in NFT trading with many friends—including members of major teams—and so far, the ideas I’ve gathered include:

-

Using veToken (or time-locking) mechanisms to lock LPs, providing predictable, sustained liquidity supply (well-suited for AMM integration)

-

Establishing a dedicated liquidation protocol (or oracle with liquidation functions) to act as counterparty and improve buyer-side liquidity

-

Building NFT-based options/dual-currency wealth management protocols (other derivatives also offer similar composability), acting as counterparty to enhance buyer-side liquidity

-

Partial fractionalization (this approach applies to lending too, though personally I’m not a fan)

-

Using LSD assets as underlying to provide liquidity, lowering liquidity provision costs

-

Combining INO with OHM mechanics to establish AMM-style NFT trading pools from initial issuance

-

Exploring applicability of vAMM + issuing reverse IL positions or synthetic asset models

Of course, these are still preliminary ideas—solving one problem often reveals more. I welcome further discussion with anyone interested in this space.

The second opportunity lies in lending. Given that NFTfi, Bendao, Paraspace, and Blur already offer numerous high-quality solutions, the space appears slightly crowded. In my view, short-term opportunities lie in yield optimization, while long-term potential lies in aggregation. Short-term yield optimization can draw from FT-sector practices: p2p matching to optimize point-to-pool rates, introducing yield-bearing returns, reusing assets (LSD & LP), and potentially interbank-like borrowing. Long-term aggregation is more abstract: if we model borrowing and lending demand as a scatter plot, peer-to-peer lending consists of isolated dots, while pool-based lending forms dynamic continuous curves. The next challenge then mirrors trading—we need denser points and lines. Derived strategies include lending aggregation and enhanced composability with trading and derivatives.

III. Sector Opportunities: Three Growth Drivers, Two Demands, and 2+N Implementation Models for Derivatives

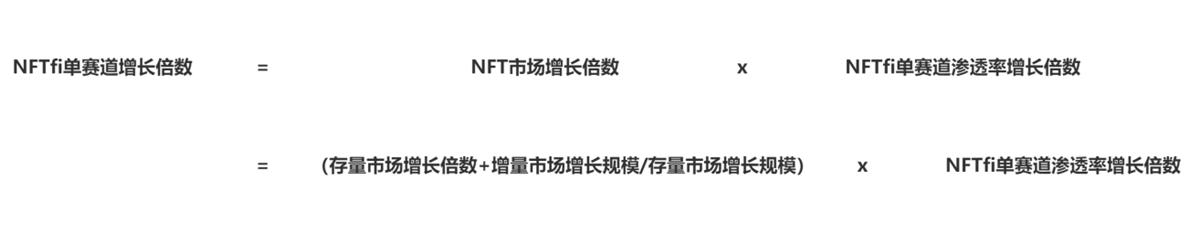

The third opportunity is derivatives. I treat it separately because, compared to the prior two sectors, it represents a much bluer ocean. As previously noted in earlier reports, NFT derivatives show extremely low market penetration—whether measured by active user accounts or compared horizontally against fungible tokens. Based on the market size breakdown below,

the NFTfi sector enjoys three layers of growth drivers: growth of the existing NFT market (positively correlated with the broader crypto industry), growth of the incremental market, and growth in market penetration. For derivatives, the third factor—penetration—offers the highest multiplicative potential.

Incidentally, non-PFP assets offer greater combinability with NFTfi. They may exhibit more predictable volatility and stronger value backing—such as bills or certain utility NFTs generating cash flows (potentially coin-denominated)—enabling more reliable valuation and trading. Thus, the boost to NFTfi from incremental market growth is nonlinear.

A second source of confidence in NFT derivatives comes from demand. Historical crypto market trends show derivatives often thrive during bear markets—driven by actual demand.

Generally, derivative demand stems from hedging (or risk swapping) and speculation. Risk aversion and reduced investment options under constrained capital conditions during bear markets both fuel demand for derivatives.

Additionally, one of the earliest sources of crypto derivative demand came from BTC/ETH miners. Today, Blur, NFT lending, and NFT staking all generate yields on NFTs, creating pure hedging demand. Real users and real protocol revenues for NFT derivatives are therefore foreseeable.

The third point to address is how to build a strong NFT derivatives product. A full analysis of NFT derivatives would require extensive coverage, so index products, options, structured products, etc., may be explored in future专题reports. Here, we focus on futures contracts.

First, we must identify viable methods for enabling NFT futures trading. Due to NFTs’ inherent scarcity and low listing rates, delivery-based products are unsuitable for constructing NFT futures (though perhaps suitable for options). The remaining toolkit includes five models. Among them, orderbook perpetuals and vAMM have already been implemented, while other models are being explored by various teams.

Source: 0xLoki compilation

Next, what are the critical issues in FT derivatives?

I believe the core is still liquidity, specifically three aspects:

1) How to price?

2) Who provides liquidity (or acts as counterparty) when liquidity is insufficient?

3) How to liquidate or handle insolvency?

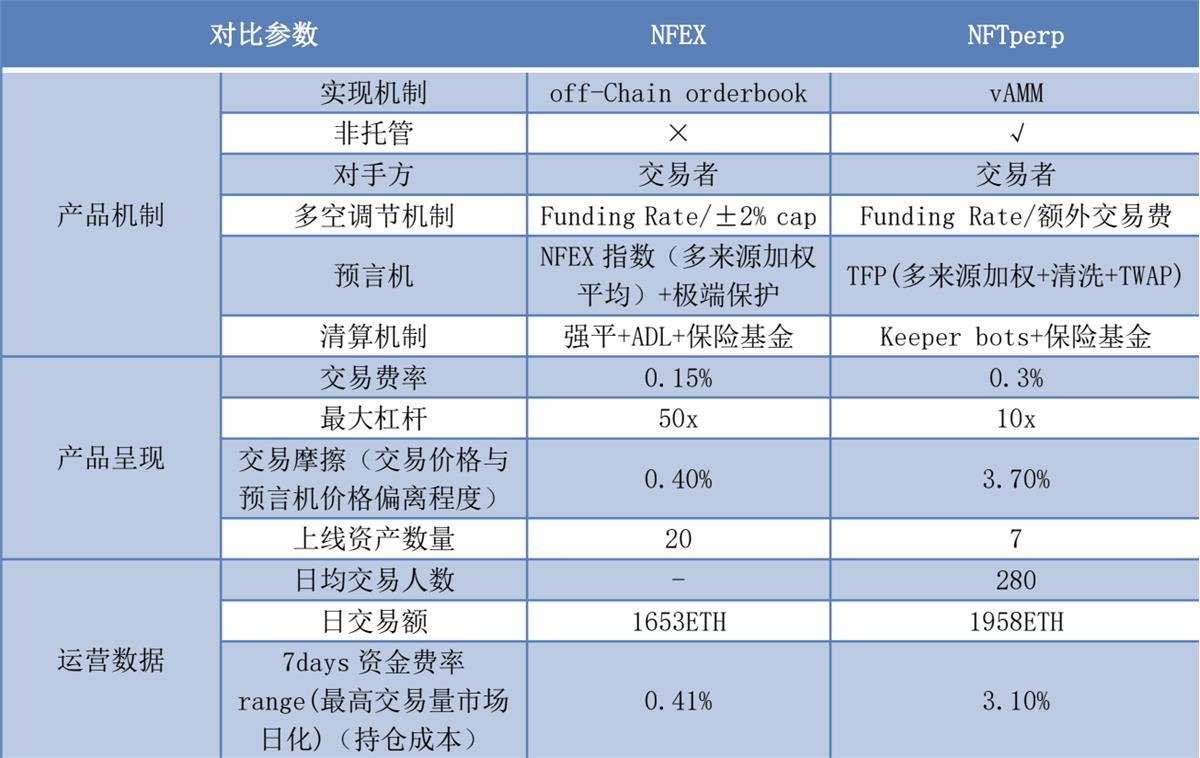

Currently, NFEX and NFTperp have provided initial answers to these three questions using perpetual contracts and vAMM models.

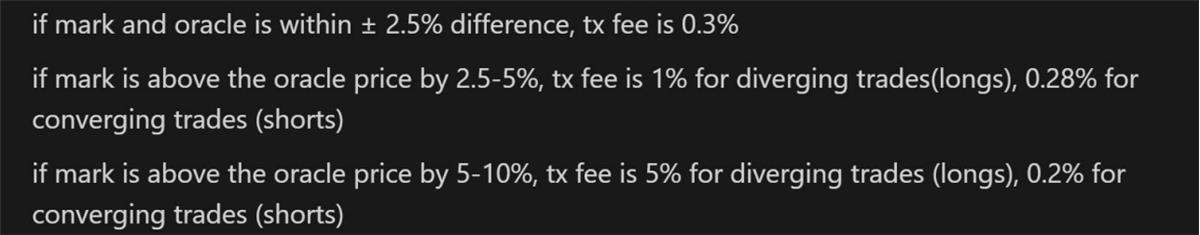

Moreover, a defining feature of the NFT derivatives market is extreme imbalance between long and short positions, requiring higher sophistication in Funding Rate and dynamic opening fee mechanisms—another key differentiator in product evaluation.

Source: 0xLoki compilation

Comparatively, NFEX and NFTperp have similar metrics, each with strengths and weaknesses. NFEX offers lower trading fees, broader asset coverage, and faster listing cycles. NFTperp provides non-custodial solutions but suffers from significant price deviation due to skewed long/short ratios.

Although NFTperp implements Funding Rate + additional transaction fees to mitigate this, the solution remains inadequate (long positions face triple-digit annualized funding rates).

Source: 0xLoki compilation

IV. Final Thoughts: Accumulate Resources, Move Slowly

Overall, my outlook is this: over medium to long timeframes, the NFT market will grow significantly faster than the broader crypto market; NFTfi will grow much faster than the NFT market as a whole; and NFT derivatives will grow even faster than NFTfi. Sector tides follow market tides—when liquidity is abundant, overinvestment inevitably follows, with ample capital available to subsidize and sustain inflated valuations.

But in the long run, whether in primary or secondary markets, pure spending and hype will fade. It is during this phase that protocols capable of achieving complete commercial loops and generating real revenue/value will survive and emerge from the valley of death. The market will once again return to being driven by technology and demand.

One final note: although now isn't an ideal time to launch tokens, among leading NFTfi protocols, Bendao and Blur have already launched theirs. NFTFi might ultimately choose not to. However, Opensea (already issued NFTs), Paraspace, NFEX, and NFTperp are highly likely to issue tokens—something worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News