1kx Partner Peter: Challenges and Solutions in Designing Token Networks

TechFlow Selected TechFlow Selected

1kx Partner Peter: Challenges and Solutions in Designing Token Networks

Creating a sustainable token network involves multiple aspects and requires coordination and operations among participants.

Written by: Peter‘pet3rpan’

Translated by: TechFlow

Building a sustainable token network involves multiple aspects and requires coordination and operations among participants. However, since most founders are primarily skilled in technical areas, achieving this coordination and operation is difficult, which negatively impacts the sustainability of token networks. In this article, 1kx partner Peter‘pet3rpan’ will focus on these issues and offer some solutions to address them.

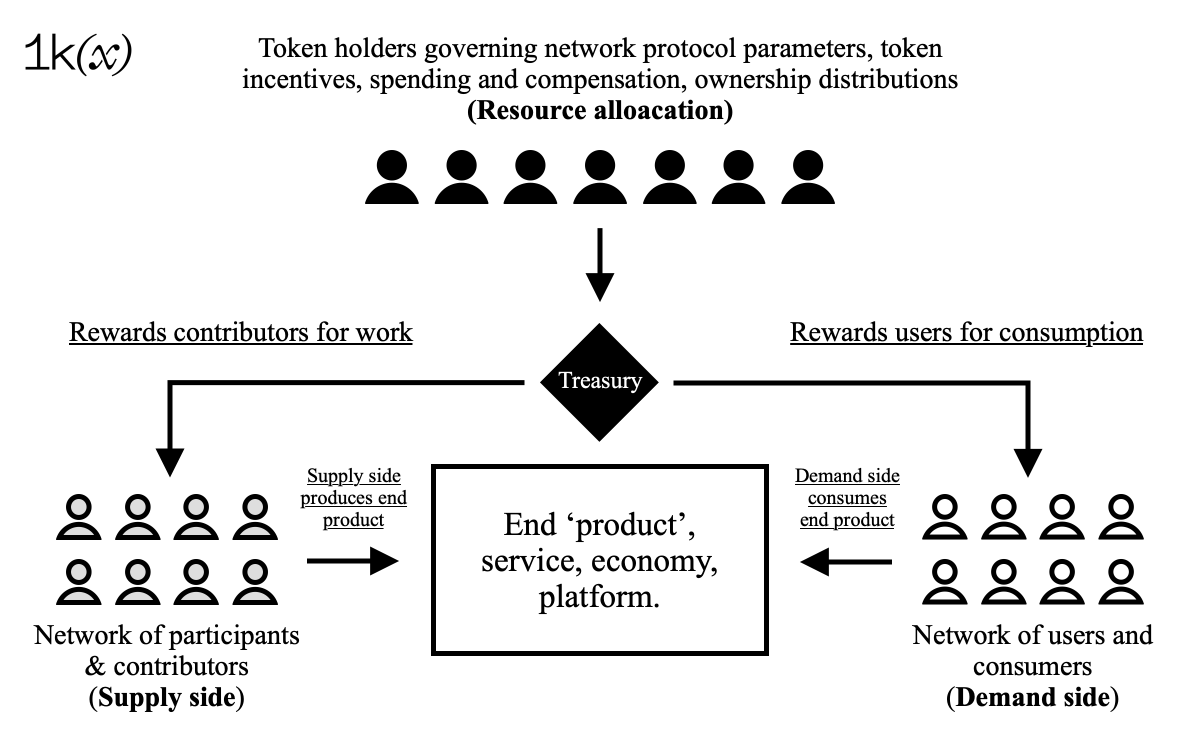

The operational focus of most token networks can be summarized into three key areas:

- Supply generation;

- Demand creation;

- Resource allocation.

Network building is hard. Every network must solve the same problems. Below are observations and thoughts on addressing these challenges:

We can model most token networks as markets (supply and demand) composed of participants who coordinate to produce an end market—whether it's a product, service, economy, or platform (serving suppliers and consumers)—that could not be achieved individually.

Most problems stem from a lack of practical understanding of how decentralized participant networks coordinate at scale. This is a skill that most founders typically overlook in early stages (focusing instead on product development).

A network needs better or cheaper supply than alternatives to generate demand. Without incentives for demand or participation, supply won't emerge. You need to plan incentives and spending around bootstrapping such a network.

Most problems can be debugged through this lens, and most critical network-building challenges arise here:

1. Being overly naive about network coordination;

2. Poor resource allocation and governance;

3. Unsustainable network engagement fit.

Being Overly Naive About Network Coordination

Product development and network building are fundamentally different domains. Many founders excel technically but few are skilled in network coordination—requiring a shift in mindset.

Before decentralization, centralized companies usually generate most of the supply and demand for a project. However, once you launch your network, it’s the participants—not the core team—who drive supply and demand from that point onward.

Too many teams launch tokens with a “build it and they will come” mentality, without seriously considering how their network can grow in a more scalable way than the team ever could.

As a result, many teams end up creating token incentive models that don’t meaningfully scale network growth—because they never truly considered how network participants could contribute toward network goals.

Thus, they spend funds on poorly designed participation programs, which often lead to temporary increases in supply or demand due to token incentives—but with unsustainable unit economics overall.

In many cases, compared to every dollar spent on a centralized team, growth efficiency is much lower—and often results in negative value units. TLDR; it’s better to remain centralized.

Teams need to think carefully about how to properly coordinate network participants before launching a token or launching the network itself.

This means implementing coordination frameworks capable of replacing the labor previously driven by the core team in generating supply or demand.

Whether through human-based coordination or engineered programmatic approaches to incentivize contributions that replace core team workflows, effectively building such a participant network takes significant time.

Too many teams naively treat launching a token as the end goal, when in reality it's just the beginning. In fact, the moment you launch your token—you've just opened a faucet through which capital rapidly flows out of your network.

Suddenly, you face a funding problem that needs solving within months, while trying to build a solution that realistically requires at least two years to mature properly. This ultimately leads to network losses, inability to grow, failure to gain market share, etc.

Poor Resource Allocation and Governance

Without an operational framework explaining how token holders should make decisions and spend money, most networks spend irresponsibly and continuously dilute the purchasing power of their tokens over time.

Ideally, every $1/ETH spent in tokens or capital should result in one incremental unit of supply or demand. We should measure output per dollar spent and ideally improve it over time.

In many DAOs, annual budgets are set for different functional departments—an approach I find terrible. We don’t need marketing for the sake of marketing.

We should fund growth, not just activity for its own sake.

Only when you start measuring outputs can you identify and eliminate incompetence within contributor networks. This is already an epidemic affecting most DAOs, with the worst cases being those where decisions are made politically rather than objectively.

Unsustainable Network Engagement Fit

When participants are subsidized with token rewards, it’s easy to mistake network engagement under such conditions as genuine, sustainable supply/demand.

While token incentives are powerful for bootstrapping initial participation or retaining contributors long-term, they often give networks a false sense of having built something sustainable—especially during bull markets, which is incorrect.

Network engagement fit: refers to a state where participants engage naturally with the network at launch—even without subsidy—driven by intrinsic economic incentives.

What does this look like? It might resemble a community-run NFT lending underwriting DAO that pools knowledge, capital, and strategy to generate profits on NFT lending platforms.

It might look like KRPDM, an art collecting DAO that drives trading volume for art collectibles on fxhash while generating profit by collecting and selling its own pieces. Or like Ribbon Finance vaults bringing volume to Opyn’s options protocol.

The key point across all these examples is a symbiotic relationship between participants and the network itself, where everyone has a natural economic motivation to participate in the network/protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News