Hong Kong Web3 New Paradigm: Front Store, Back Office, Global Expansion

TechFlow Selected TechFlow Selected

Hong Kong Web3 New Paradigm: Front Store, Back Office, Global Expansion

Integrate China's production capacity in Hong Kong (including Singapore) to deliver products and services globally.

What Is "Front Shop, Back Factory"?

In 1978, Taiping Handbag Factory—the first Chinese enterprise operating under the “Three Comes, One Compensation” model—was established in Dongguan.

"Front shop, back factory" (English: "front shop, back factory") was an economic cooperation model between Guangdong Province and Hong Kong during the early stages of China’s reform and opening-up. Under this model, Hong Kong served as a transit hub for exporting goods produced in mainland China to regions such as Europe and North America. However, this model gradually declined after China joined the World Trade Organization. Since then, Hong Kong has transitioned into a region dominated by finance and high-tech industries.

In Web3, we are seeing a resurgence of this model—one that we believe could become mainstream: leveraging China's production capacity, integrating resources through Hong Kong (and including Singapore), and delivering products and services globally. We summarize this approach in eight characters: "front shop, back factory, overseas growth."

Mainland China: The Back-Factory Advantage

We are now entering a period of rapid development in Web3, with startups emerging like mushrooms after rain. In such a fiercely competitive environment, the advantages of the back-factory model become increasingly evident. This model offers three key strengths.

1.1 Cost-Effective Scaling of Teams

The data above is incomplete but indicates a clear trend: leading companies are building larger and larger teams. While many small Web3 startups still exist, post-Series B companies often need to scale beyond 100 employees—Uniswap being one example. Hiring and operations in Silicon Valley are extremely costly, compounded by complex regulations and cultural differences, making team expansion difficult. Silicon Valley may be ideal for seed-stage startups, but in later stages, establishing technical and operational back-end teams in China provides significant competitive advantages.

1.2 Ideal for Internal Competition-Based Incubation

Many Web3 sectors are becoming more standardized and modular, with innovation often arising from internal competition. In DeFi, for instance, it’s no longer a solo game—some teams have developed over 20 protocols on the same blockchain, achieving business synergy and even using internal competition mechanisms to drive innovation. In these highly capital- and labor-intensive fields, large teams capable of coordinated execution and internal competition hold a distinct advantage over small, hacker-led teams. As the learning curve for Solidity flattens and information flows freely, the ability to imitate and iterate often outweighs pure originality. High-quality forking has become a viable entrepreneurial path—precisely where China-based “back factories” excel.

1.3 Hardware Supply Chain Advantages

We are tracking two emerging sectors: Creator Economy, including Music NFTs and entertainment economies, and DePIN (Decentralized Physical Infrastructure Networks). While conceptual innovation in these areas may originate in Silicon Valley, implementation reveals that operational talent and parts of the supply chain reside in Asia—and especially in China.

For the Creator Economy, massive participation from creators is essential—designers, writers, musicians, artists, and others whose professional base in China is vast, offering immense content creation capacity.

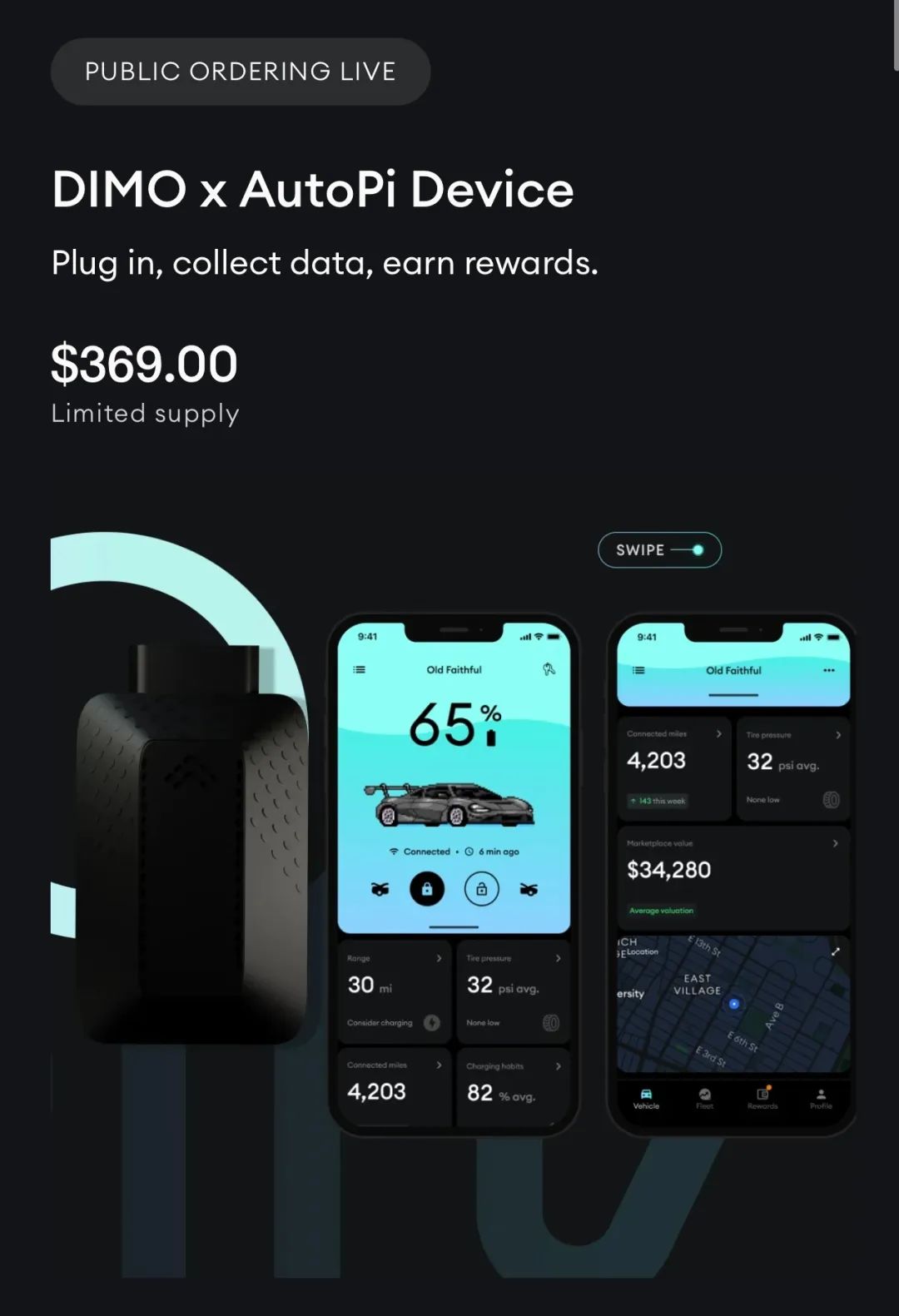

Take DePIN, for example—a project type requiring substantial hardware output to reduce network operating costs. A leading DePIN hardware manufacturer we’ve invested in maintains supply chains in both China and Vietnam, supplying hardware to seven DePIN projects including DIMO, Hivemapper, and React. For these overseas-native Web3 projects, this company serves as a critical strategic partner.

Dimo Device (Source: Dimo official website)

Therefore, the “back factory” holds all three of these advantages. As long as operations remain compliant within China, these capabilities can be effectively exported to international markets.

Front Shop in Hong Kong: A Financial and Investment Hub

Our recent trip to Hong Kong was eye-opening, though practical implementation requires attention to two aspects. In summary: there are two individuals worth watching closely, and two key signals awaiting confirmation.

The two individuals are John Lee and Xiao Feng. John Lee expressed openness toward virtual asset innovation and confirmed that a licensing regime will soon be implemented. Xiao Feng affirmed that tokenization is inevitable for Web3 applications, delivered a speech titled “Three Token Models for Web3 Applications,” and announced the HSK ecosystem incentive token. These two figures signal unprecedented acceptance of Web3 and tokens in Hong Kong—from both political and business leadership—endorsing what was once the most sensitive topic.

The two signals are:

1. Shifting regulation from targeting specific entities to regulating behaviors. Instead of blanket declarations that virtual assets are illegal or that certain nationalities cannot trade or issue tokens, the new framework protects activities that comply with Hong Kong laws and regulatory standards.

2. Oversight and protection for OTC transactions.

Currently, these two signals have not fully materialized—we must wait and observe.

Another advantage of Hong Kong is its favorable investment and financing environment. Many mocked the scene as “more money than projects,” but this is actually a strength. From angel investing to potential listings on the Hong Kong Stock Exchange, entrepreneurs can directly engage with VCs, PEs, and family offices—all within one location. This is far more efficient and pragmatic than the old notion of “going to Silicon Valley to find a16z.”

Thus, Hong Kong functions as a legitimate and well-regulated place to set up shop, while also enabling effective management of back-end operations. Its ease of fundraising gives it real appeal and strategic logic.

Overseas Growth: Placing Markets, R&D, and BD Abroad

“Front shop, back factory” only completes half the value chain. To thrive, Web3 companies must fully integrate into global markets; otherwise, they risk remaining constrained—or facing serious business risks. There are three primary growth strategies, often lacking among Asian-origin projects.

Growth Strategy One: From Community to Community

Part of Web3 innovation addresses clear efficiency needs; another part emerges from deep research into user behavior, uncovering new solutions. These post-decentralization demands arise only in places where Web3 ideology is most radical. Take Daniel Allen, a musician we’ve backed—he signed himself under a DAO, directly distributing earnings to token holders and governance participants. This model is already active in Los Angeles’ NFT circles. The governance tools, copyright systems, and infrastructure involved present entrepreneurial opportunities. We helped restructure his decentralized streaming tech stack, identified relevant tools, and began building. Having teams embedded in core Western communities allows us to detect user habits early, enabling our Asian teams to build responsive products and rapidly meet market demand.

Source: Daniel Allen’s Twitter

Growth Strategy Two: Achieving Decentralized Legitimacy

For Asian teams, the distinction between being seen as “local dogs” versus “legitimate players” isn’t mere prejudice—it’s a real pain point in Web3. Because blockchains involve high-value transactions and data transfers, we must ensure future operations are on-chain and sufficiently decentralized. I believe it remains essential to engage with overseas public chains, ecosystems, and their core teams—even if they don’t enter Hong Kong immediately. Building strong relationships, participating in hackathons, promoting our products, and integrating them into existing ecosystems is crucial. Gaining legitimacy brings endorsements and traffic—both immensely valuable.

For example, a decentralized storage rollup project we invested in had its founding team conduct in-depth research on Ethereum’s technical roadmap and strategic direction. They successfully embedded their product into Ethereum’s tech stack, ultimately securing a grant from the Ethereum Foundation and validating the protocol’s decentralized legitimacy. This kind of strategically significant work is a key differentiator against competitors.

Growth Strategy Three: Global Liquidity

Web3 is a 24/7 global value exchange network, inherently requiring extensive virtual asset trading and liquidity. Projects must align with global market trends rather than regional micro-markets. Therefore, building a network of global participants and qualified investors is essential. Further elaboration is unnecessary here.

Finally

We’ve observed several teams successfully applying this full “front shop, back factory, overseas growth” model—with remarkable results. This will become a central theme in our future investments and explorations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News