A Step-by-Step Guide to Analyzing How Token Unlocks Impact Price

TechFlow Selected TechFlow Selected

A Step-by-Step Guide to Analyzing How Token Unlocks Impact Price

What impact will the project's unlock have on the price of the tokens you hold, will it go up or down?

Author: Onchain Wizard

Translation: TechFlow

How do token unlocks affect the price of tokens you hold—will they go up or down?

Let’s explore some methods that, once mastered, allow you to conduct deeper analysis on upcoming token unlocks.

How to Identify Upcoming Unlocks?

Unlocks Calendar and Token Unlocks are two of the best tools for checking token unlock schedules. If you're tracking a specific token not listed on either platform, you can refer directly to the project’s tokenomics documentation to calculate major unlock dates.

It's important to note that when circulating supply is significantly smaller than fully diluted valuation (and the unlock amount is large), the unlock is very likely to create substantial selling pressure.

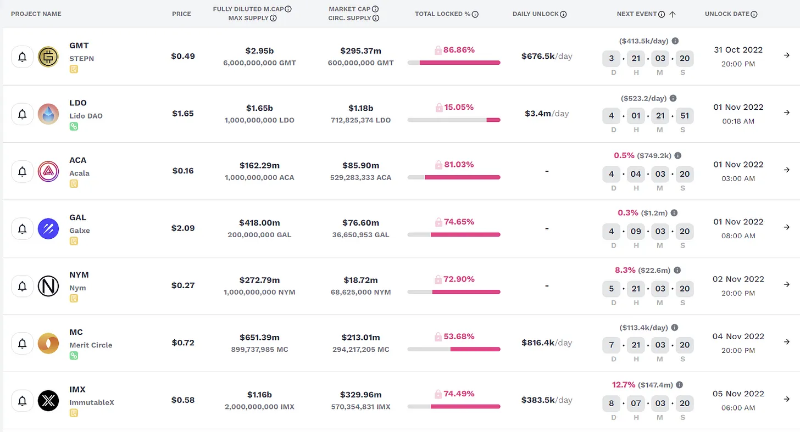

Looking at recent token unlock data, you’ll see two upcoming unlocks—NYM and IMX—with 8–12% of their circulating market cap set to unlock.

However, some unlocks differ from others, so it's essential to dig deeper yourself to assess how much impact an unlock might have on the token.

For example, YGG had an unlock in September that triggered a 28% drop in its token price, underperforming ETH by 42%. AXS was another case I flagged in September, falling 26% over the past 30 days while ETH rose 14%.

So how can we research these events?

Researching Unlocks:

First, consider the worst-case scenario → what could cause serious negative price impact?

You should first examine the proportion of supply entering the market (usually easy to find for most major tokens), then compare it with the token’s trading volume on centralized exchanges (CEX) or liquidity on decentralized exchanges (DEX). But many stop here—I’ve seen cases where large unlocks didn’t crush a token with low liquidity (e.g., ALICE)—so we need to go deeper.

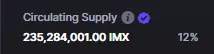

The first real step in unlock analysis begins with who is unlocking. For instance, looking at IMX’s upcoming unlock, the current circulating supply is about 235 million tokens. On November 5, approximately 259 million tokens will be unlocked—more than the entire current circulating supply.

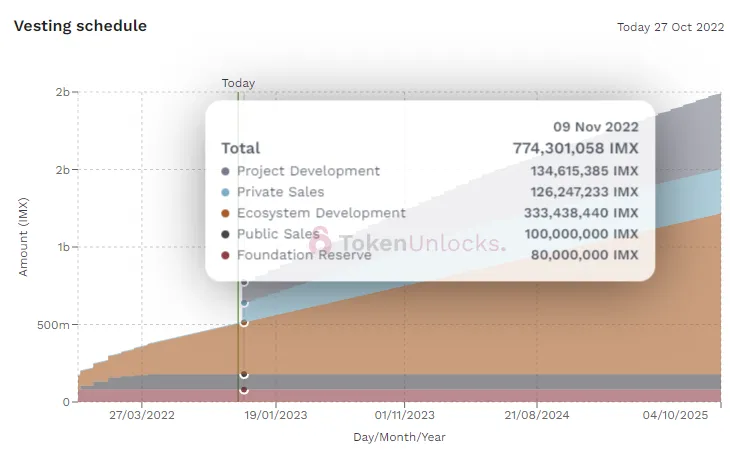

120 million of the unlocked tokens come from private investors. While I haven't found solid data confirming their purchase price, speculation ranges from $0.025 to $0.10. This is their first major unlock, offering them 6x to 20x returns—providing strong motivation to sell. Another 680 million tokens will unlock in November, also from the private round.

Although the project claims these are long-term holders who won’t sell, in this macroeconomic and financial environment, who would leave $680 million on the table in a project with a FDV exceeding $1 billion?

The remaining unlocked tokens come from “project development” allocations, which will be re-locked, so they won’t add immediate selling pressure.

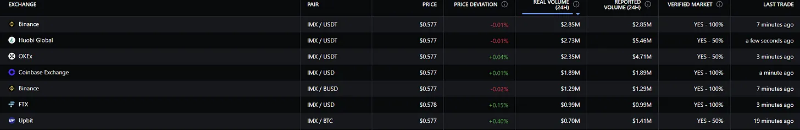

Next, once you determine how many unlocked tokens are likely to be sold, assess how much liquidity exists in the token’s market. For IMX, trading volume is quite weak (under $3 million on most CEXs), so compared to a potential $68 million in sales, this outlook isn’t promising for the token’s price.

Another angle: what are smart money wallets doing? Are they slowly selling before the unlock? Or is there an upcoming catalyst you may have missed?

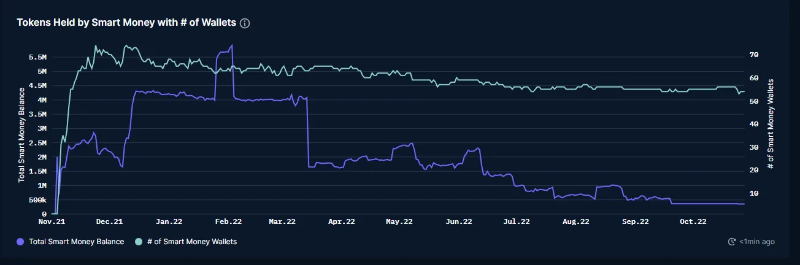

In the case of IMX, smart money balances have been declining almost all year:

You can also review the token’s history to get a rough sense of which smart money holders are long-term supporters versus those prone to dumping—especially since some smart money consists of early or private investors.

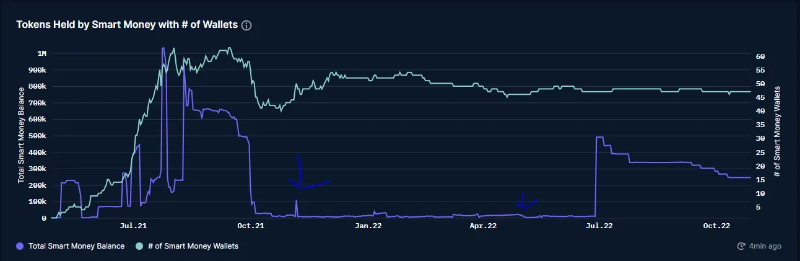

Take AXS as an example—some funds sold or transferred their tokens immediately upon unlock.

Going further, monitor historical holder behavior during previous unlocks.

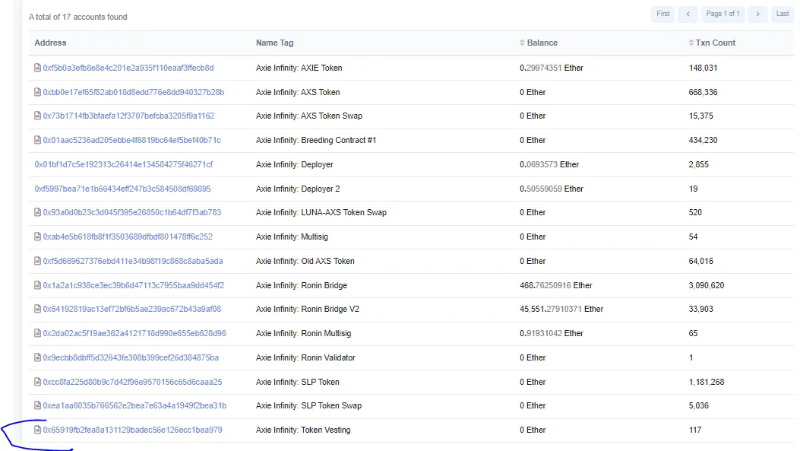

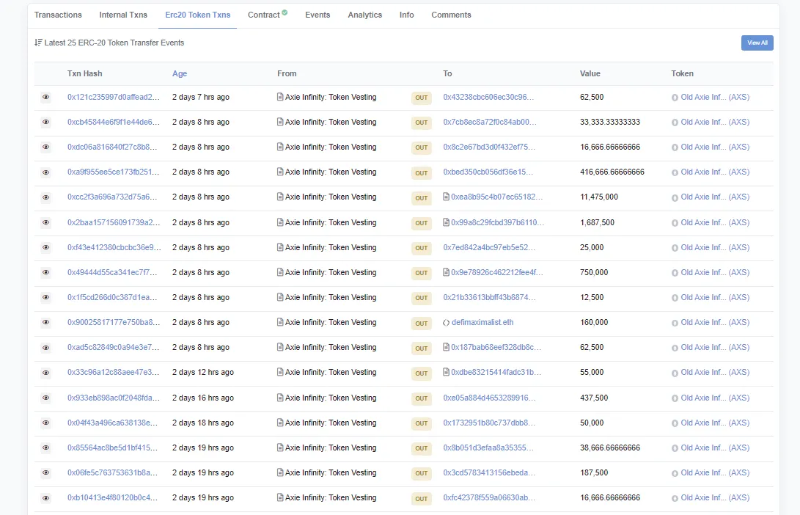

You should trace the token contract to identify where unlocks occur, who receives the tokens, and what subsequent holder actions look like. Let’s take AXS as an example: if you browse AXS’s labeled accounts, you can track where unlocked tokens were transferred.

You can identify major recipients of AXS and monitor their behavior.

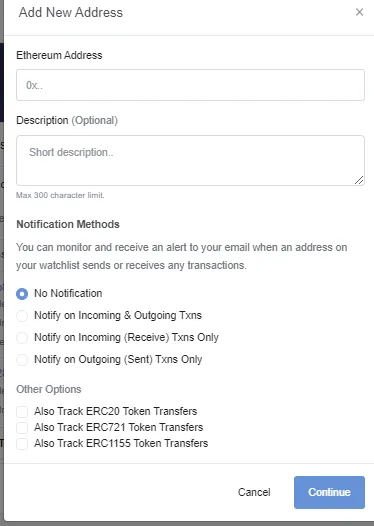

I also like setting temporary Etherscan alerts on such contracts to pinpoint exactly when the unlock starts.

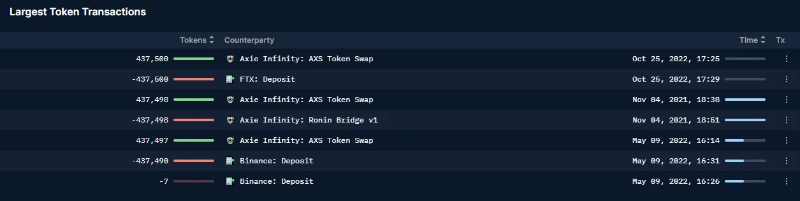

From transaction details, we can see Arca: 0xe05A884D4653289916D54Ce6aE0967707c519879 received 437,000 AXS and immediately sent them to FTX (likely sold).

If you examine Arca’s historical behavior around unlocks, you’ll notice this is a consistent pattern.

Using a token wallet analyzer, you can see that tokens received during previous airdrops were all subsequently sent out or sold.

If you want to go truly deep, you can build a chart of all unlockers to gain a real understanding of the selling pressure facing the token.

Simply review addresses and run this process on key ones to understand their historical behavior—you can monitor them in real time to see if they’re dumping.

Summary

If you're familiar with unlock research, this whole process isn’t difficult.

But I haven’t seen anyone compile all these tools together before, so I thought it worth sharing. While I don’t recommend shorting these tokens outright, unlock research mainly helps you avoid holding them. If you do plan to short, pair this unlock analysis framework with broader project research to identify deteriorating metrics, giving your trade more confidence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News