Understanding Element 2.0: The Next-Gen Community-Driven NFT Aggregation Marketplace

TechFlow Selected TechFlow Selected

Understanding Element 2.0: The Next-Gen Community-Driven NFT Aggregation Marketplace

Element 2.0, a rising star in the NFT marketplace, is a community-governed NFT aggregation trading platform.

Since last year, trading platforms such as OpenSea, Gem, and LooksRare have gradually entered our view. In particular, OpenSea has almost become the primary gateway for most of us entering the NFT market. Like many others, the author began here, learning fundamental NFT market concepts such as minting, trading, auctions, bidding, and listing, eventually becoming an "NFT pro." Later, I was introduced to two aggregators—Gem and Genie—and since then have developed a strong reliance on the powerful tooling these aggregators offer.

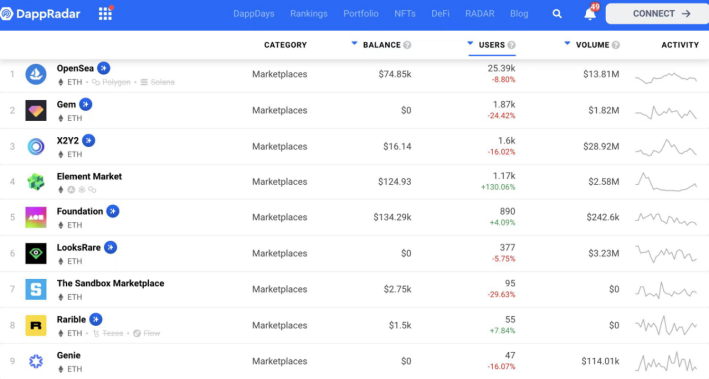

According to recent Dappradar NFT marketplace rankings, Element has significantly surpassed the second-largest aggregator market, Genie, in both trading volume and user count, challenging GEM's long-held leadership position and poised to become the leading NFT aggregation marketplace on Ethereum. In fact, this product team secured a $11.5 million Series A investment at inception last year from top-tier investors including Sequoia, SIG, Dragonfly Capital, Draper Dragon, and Ince.

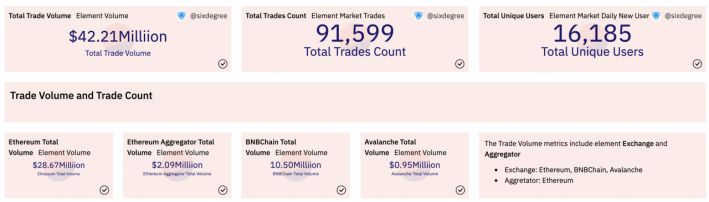

Here, I will provide a detailed introduction to Element 2.0—the rising star among NFT marketplaces and a community-governed NFT aggregation trading platform. I checked Element’s transaction data on Dune Analytics: since April 15, Element 2.0 has achieved a multi-chain trading volume of $42.2 million (equivalent to 22,000 ETH), with 16,185 unique user addresses completing 91,599 transactions.

In fact, this product team secured a $11.5 million Series A investment at inception last year from top-tier investors including Sequoia, SIG, Dragonfly Capital, Draper Dragon, and Ince.

Here, I will provide a detailed introduction to Element 2.0—the rising star among NFT marketplaces and a community-governed NFT aggregation trading platform.

1. Aggregating Cross-Market Listings and Orders to Fundamentally Solve Liquidity Issues

NFTs are built on the ERC721 base protocol and possess distinct non-fungible characteristics. Compared to fungible ERC-20 tokens, they struggle to achieve sufficient liquidity—a widely recognized challenge in today’s market. Therefore, whoever solves the liquidity problem gains favor among traders and opens up greater growth potential.

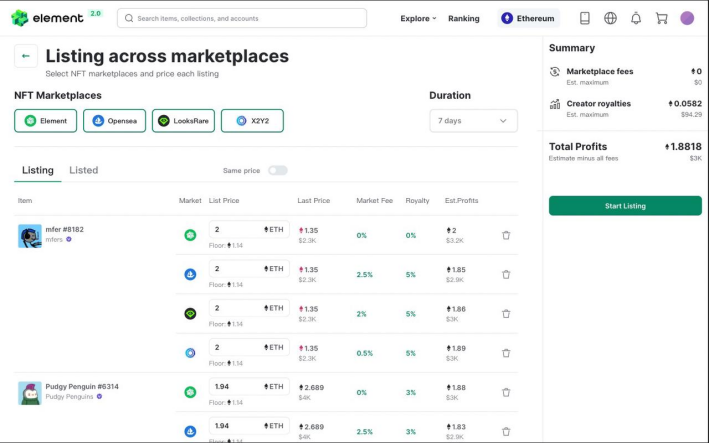

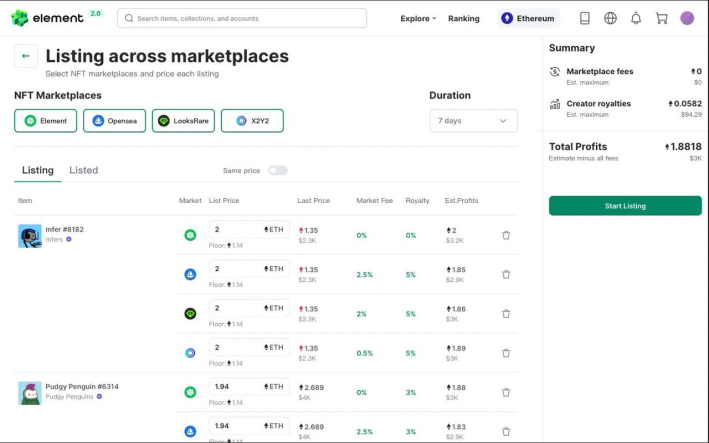

Aggregated listings from Element, OpenSea, LooksRare, and other marketplaces

First, Element enables access to a highly comprehensive range of NFT assets. Its aggregation protocol currently integrates NFT orders from multiple marketplaces including OpenSea and LooksRare. Community discussions indicate that Element is actively integrating even more order sources.

One-stop multi-marketplace listing

A community moderator told me that supporting additional third-party marketplaces and enabling cross-market aggregation will be a core strategy for the Element product team going forward. During use, users can avoid jumping back and forth between exchanges and directly list across the industry’s largest user traffic pool.

From this perspective, Element isn't competing directly with marketplaces like OpenSea or LooksRare. The NFT space remains a rapidly growing market. By aggregating orders across multiple platforms and enabling cross-market listings, Element builds larger asset and user pools, enhancing overall NFT liquidity and expanding the entire market.

2. Proprietary ElementEx Trading Protocol: Up to 49% Gas Savings and Enhanced Tools for Higher Efficiency

On OpenSea, users can only buy or sell one NFT at a time. When purchasing large quantities, users must execute multiple transactions. To secure the best price, they often need to jump between different marketplaces, consuming significant gas fees and time—during which the desired NFT might be snatched by someone else.

Similarly, listing multiple NFTs for sale suffers from extremely low efficiency. Whoever solves these efficiency and cost issues stands to gain more users.

The ElementEx protocol saves up to 49% in transaction gas while ensuring security and high performance.

During my use of Element, I clearly noticed lower transaction gas fees compared to OpenSea. I found the reason in their official documentation: it stems from the built-in ElementEx trading protocol in Element 2.0.

The ElementEx protocol design team is very open about their approach:

1. Not fully relying on Solidity programming. There are transmission cost differences between Solidity and assembly language. ElementEx uses assembly directly, reducing communication overhead during contract execution.

2. Splitting ERC721 and ERC1155 contracts, separating import functions for buying, selling, basic, and advanced features, thereby reducing redundant computation.

3. Storing order status using binary bits, reusing bit fields within the order structure and sharing storage slots to improve efficiency and reduce costs.

If this sounds complex, I summarize it into three key points: sophisticated optimizations in reducing transmission costs, minimizing redundant computation, and improving storage efficiency.

It's estimated that using the ElementEx protocol reduces gas costs by nearly 49%, while also improving contract interaction speed and performance—outperforming industry giant OpenSea’s Seaport protocol. I deeply admire the team’s strong technical capabilities and meticulous handling of trading contracts.

The completeness of the ElementEx protocol development has enabled several powerful tool-like features that greatly simplify operations and enhance trading efficiency—such as bulk purchases, collection-wide offers, and mixed payments. The technical team also provides comprehensive APIs and SDKs. For API details, visit https://api.element.market/openapi/

The ElementEx protocol code is open-source and audited for security by Certik. Audit details available at this link.

Bulk Purchase Tool

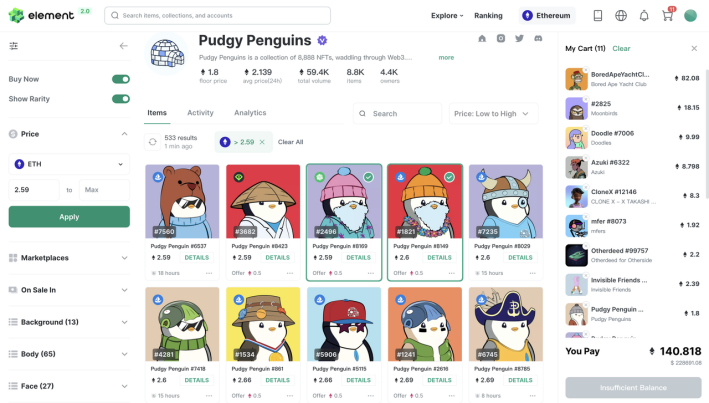

Previously on OpenSea, users could only buy one NFT at a time—an inefficient process. Element’s bulk listing tool allows users to add selected NFTs to a cart and complete payment with one click, boosting efficiency. Bulk purchases also save gas, saving both time and money.

Bulk Listing Tool

I tested the bulk listing feature: multiple assets from different collections can be listed simultaneously across multiple markets—all integrated onto a single page. After selecting owned NFTs and setting prices across markets, users can complete multi-asset, multi-market listings with a single click.

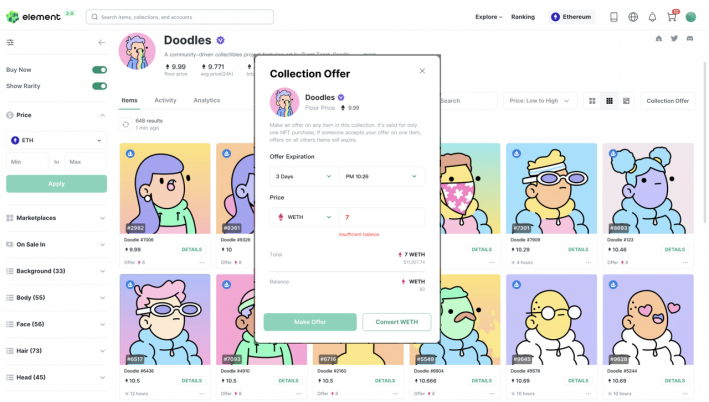

Collection Offer Tool

I frequently use the Offer function and have successfully snagged low-priced NFTs several times. However, making individual offers is time-consuming. Element’s thoughtful Collection Offer feature allows users to submit offer bids for all assets in a collection with just one action.

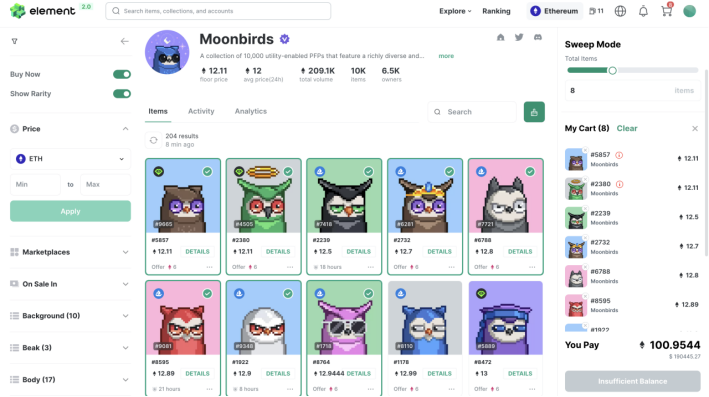

Quick Sniping Tool

While bulk purchase already greatly simplifies trading, usability wasn’t seamless. After trying Element’s Quick Sniping tool—with its clever slider design—I found it smooth and intuitive to select NFTs from lowest to highest floor price and add them to the cart for one-click checkout. The user experience keeps getting more refined.

3. Full-Chain Data Processing Capability: Multi-Dimensional Data Tracking at Minute-Level Speed

The marketplace is a battlefield—successful trades require split-second decisions, and data acts as signal flares. Users need easy access to key decision-making metrics, which requires robust data processing infrastructure.

Comprehensive Data Processing Workflow:

1. Data Collection: Raw on-chain data retrieved from blockchain nodes;

2. Data Processing: Raw data is processed via streaming or batch extraction, transformation, and loading;

3. Data Integration & Analysis: Data is aggregated and computed, with results reported and output in real time.

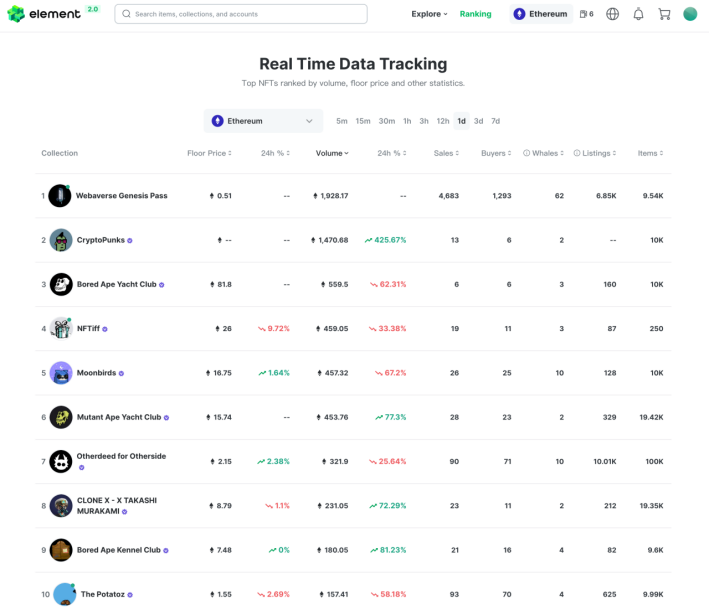

Element outputs these integrated data results, offering minute-level real-time tracking and updates on key metrics such as trading volume, floor price, number of buyers and sellers, whale holdings, holder addresses, and listing counts.

Two standout data points I appreciate: first, real-time data updated every few seconds, from 5 minutes to 7 days. Second, inclusion of whale user counts and buyer/seller address numbers.

It would be even better if the product team could take the next step and integrate real-time minting activity from primary markets.

4. Visualized Data Charts to Assist Investment Decisions

Mining on-chain data can yield sustained alpha returns. Leveraging its robust data processing capabilities, Element delivers beautiful, visualized data charts. In comparison, data visualizations offered by other NFT marketplaces remain overly simplistic. Still, there's room for improvement—I sincerely hope the product team continues investing in this area.

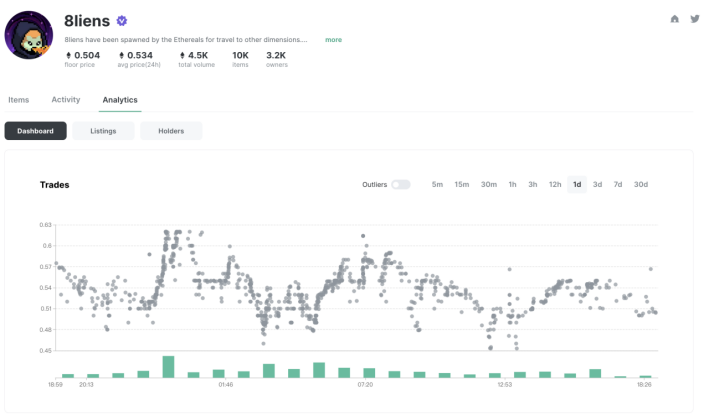

Transaction Price Scatter Plot

I discovered that Element’s transaction price scatter plot is a treasure trove—it clearly reveals price fluctuation trends, dense trading zones, volume-price relationships, support/resistance levels, divergence patterns, and cyclical规律 of uptrends and downtrends—helping users identify optimal timing for trades.

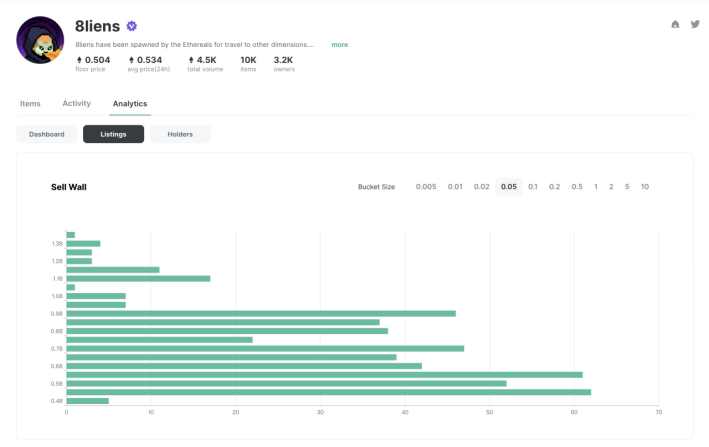

Sell Order Pressure Wall

Listing is an art—sometimes buying well matters less than selling well. The Sell Order Pressure Wall visually illustrates selling pressure. At a glance, you see the full distribution of sell orders. Element’s fine-grained design shows pricing down to 0.005 ETH increments, revealing even minor sell-side pressures. Here’s a tip: when listing, set your price slightly below the heaviest sell-pressure zone to increase chances of a quick sale.

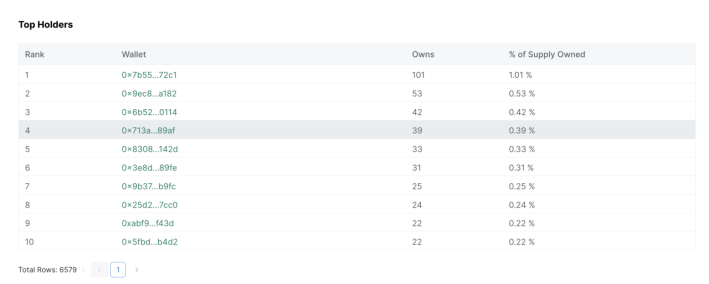

Top Holders

The Top Holders section quickly reveals major holders’ positions—such as project teams, whales, KOLs, or institutions—similar to peeling back equity structures in stocks to uncover the real power behind a project.

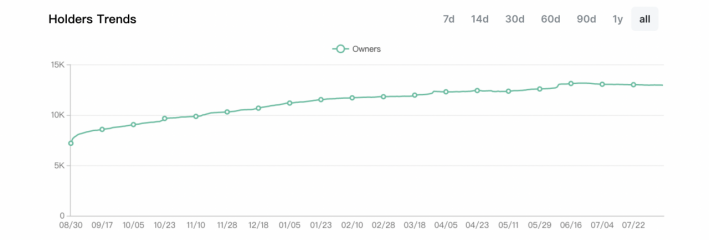

Holder Trends

When choosing a project, I typically prefer those with steadily increasing holder counts—indicating growing consensus and adoption.

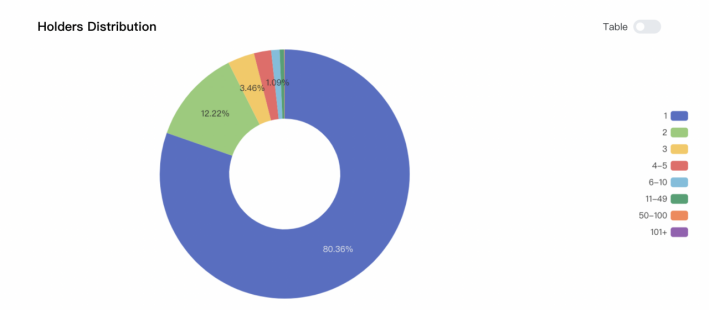

Holder Distribution

Holder distribution focuses on unique addresses and token concentration. A small insight: the higher the proportion of unique holders, the lower the concentrated sell pressure tends to be, making floor price increases easier when positive catalysts emerge. Conversely, if most NFTs are held by a few addresses (high concentration), coordinated buying or selling may occur, leading to sharp price surges or crashes.

5. Vibrant Community Ecosystem and Highly Engaged Moderators

Strong blockchains are built on community consensus. Whether at the infrastructure or application layer, even the best technologies and products require community support and engagement. Conversely, an ideal community needs fertile ground—real use cases and sustainable business development. Core teams build products, communities promote them, and product iterations rely on community feedback—creating a virtuous cycle.

Element has such fertile ground. Through deep immersion in the Element community, I observed enthusiastic exchanges and knowledge sharing—users recommend useful tools, discuss promising new NFT projects, and moderators actively onboard and mentor newcomers.

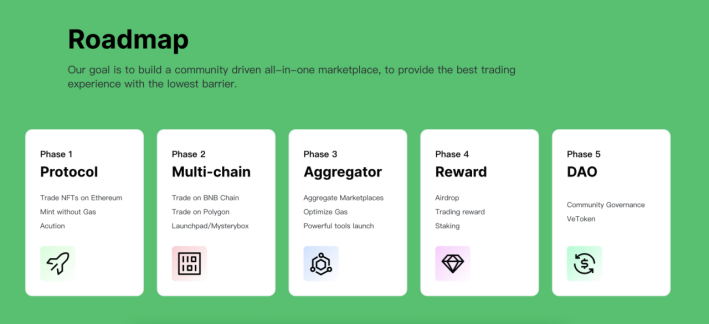

Element Official Roadmap

On Element’s brand homepage, its goal is clearly stated: to build a community-led, one-stop aggregation marketplace. Token-based governance and gradual transition toward DAO governance are explicitly outlined in the roadmap.

With a solid product foundation, community-driven momentum fuels ongoing ecosystem development. Beyond proposing and voting on governance matters, users can also vote on the iteration direction of Element’s functional modules—effectively letting the community act as a steering wheel for product and ecosystem evolution. Recently, the community eagerly anticipated the rollout of bulk listing; the development team responded swiftly, implemented the feature, and received widespread praise.

On another front, contributors to the ecosystem receive incentives—for example, inviting new users, driving trading activity, or contributing in other ways. This continuous reinforcement of community consensus promotes healthy ecosystem growth.

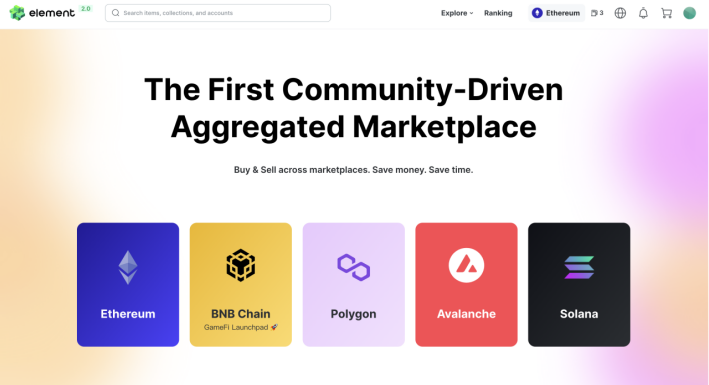

6. Additional Highlights from User Experience

Upon first visiting the Element website, users are presented with a clear, intuitive display of integrated blockchain ecosystems, along with dedicated landing pages for different blockchain-based marketplaces. This differs significantly from OpenSea’s integration approach for chains like Ethereum, Polygon, and Solana. After entering a specific blockchain marketplace, the system remembers your preference for future visits.

First-time entry to Element’s chain-specific landing page

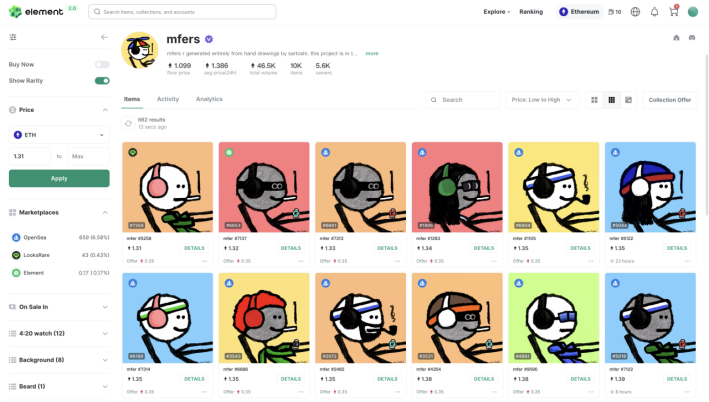

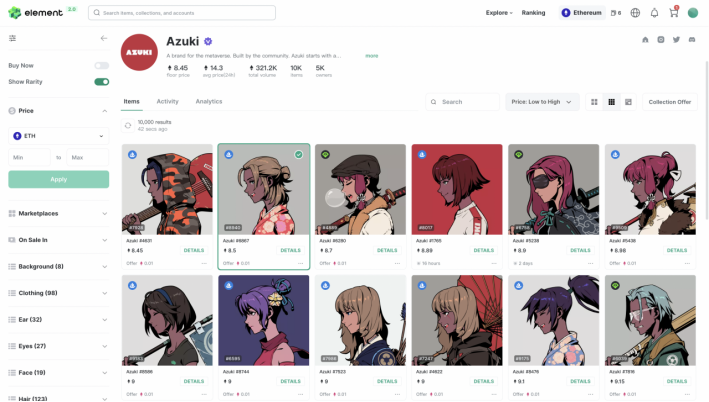

Element’s asset trading page integrates core data, external links, filters, rarity scores, aggregated order sources, collection-wide offers, and shopping cart functionality—all while maintaining a clean structure and clear user guidance, making it highly user-friendly.

Element Asset Trading Page

During usage, I noticed Element continuously monitors whether collectibles are being purchased in real time and alerts accordingly.

7. Can Element 2.0 Ride the Next Wave?

In the 1990s, during the early internet era, most companies focused on providing web content—portals like Yahoo and AOL dominated the scene, sparking intense competition among content providers (the so-called ICP era). Yet, two young entrepreneurs believed that instead of content itself, enabling users to “conveniently access content” was far more important—leading them to found Google.

Today, globally, fewer than 1 million users have completed NFT transactions, with a small number of top-tier NFT projects capturing the vast majority of trading volume. However, as diverse Web3 projects continue emerging, NFTs—as foundational assets in Web3—will attract increasing capital and users, expanding the NFT marketplace landscape. Just as we witnessed cryptocurrency users grow from millions in 2017 to hundreds of millions today, it’s highly likely we’ll soon see NFT trading users reach a similar scale.

From this perspective, the NFT market is still in its infancy. While most marketplaces remain focused on enabling basic NFT buying and selling, Element is already committed to helping users trade NFTs “more efficiently, conveniently, and at lower cost.” I look forward to seeing Element grow into a unicorn in the Web3 space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News