A Guide to Last Week's Top-Performing DeFi and NFT Projects

TechFlow Selected TechFlow Selected

A Guide to Last Week's Top-Performing DeFi and NFT Projects

Last week, some new narratives/trends emerged or continued to develop.

Written by: kezfourtwez, Parsec Research

Compiled by: TechFlow

DeFi

The post-merge hype is gradually fading, and ETH along with major L2s (LDO, OP) are cooling down. But the merge date is now roughly set, and when it arrives, all eyes will surely return to merge-related trades. Meanwhile, some new narratives/trends have emerged or continued brewing over the past week.

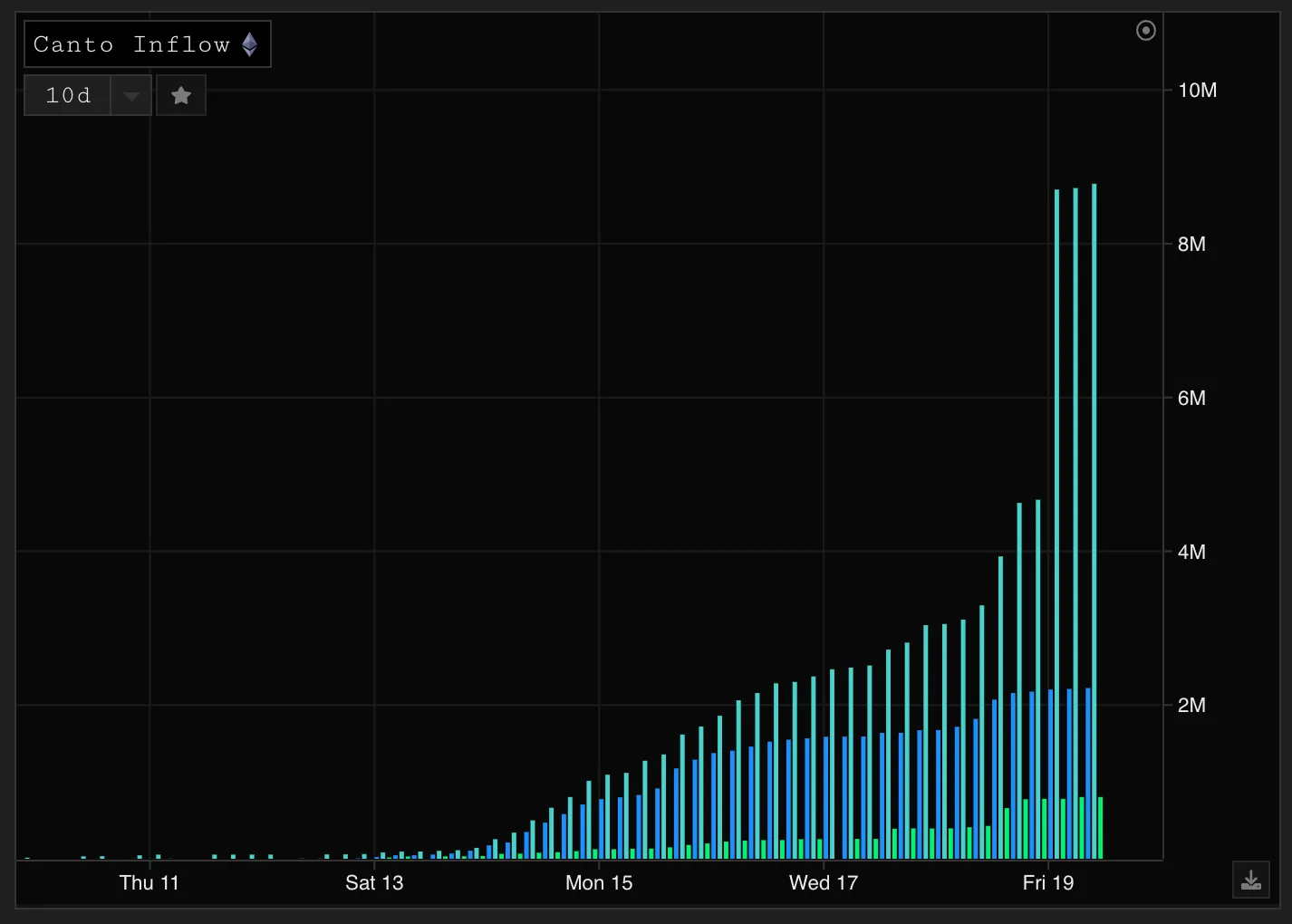

Canto/DogeChain

Canto, a "Layer 1 blockchain built for DeFi," soft-launched last weekend. Over time, it has attracted some capital. But from a dollar perspective, it’s been quite low-key. Currently, Canto is rolling out AMM and compound-style lending protocols.

Dogechain also entered the public spotlight, unapologetically focused on meme coins. Dogechain dominated the entire space's attention for 36 hours last week. However, aside from generating memes, Dogechain doesn’t offer much that’s particularly interesting. In theory, this demand for meme coins could potentially redirect attention toward BSC, whose retail trading volume remains below average levels.

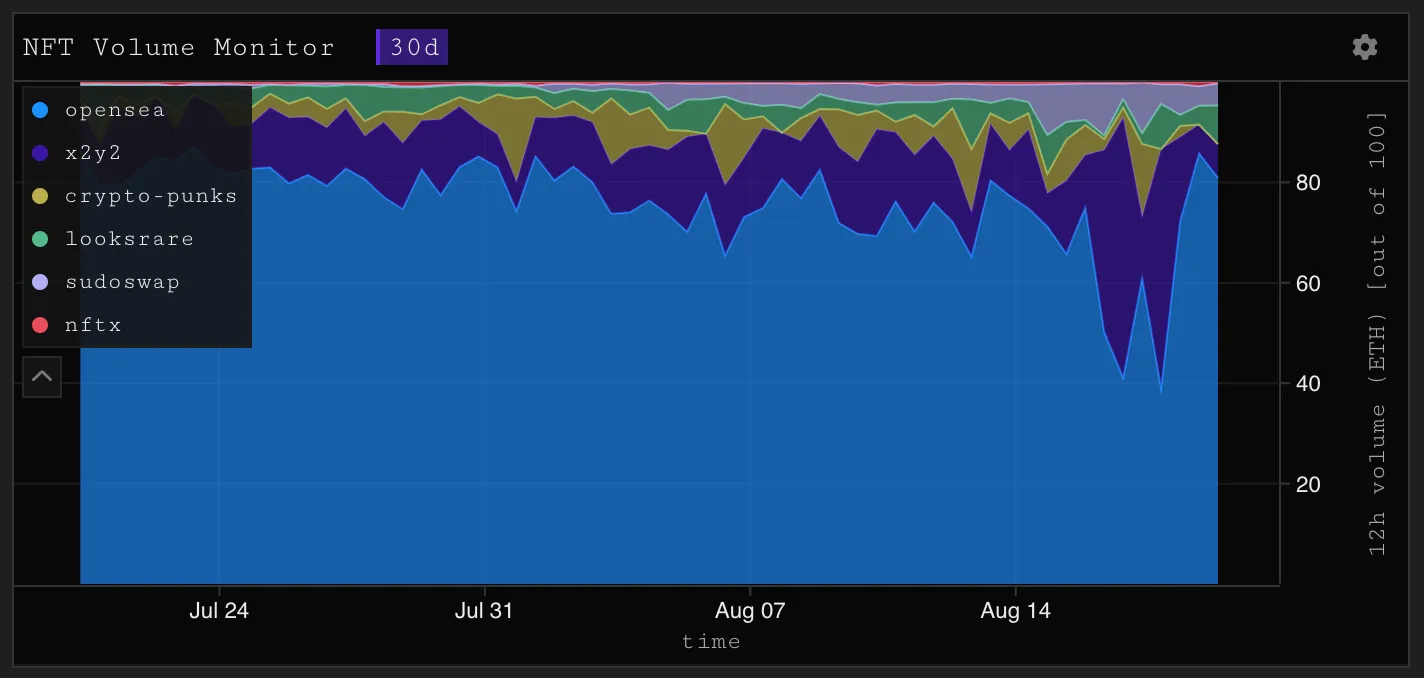

Sudoswap

Sudoswap is arguably the first protocol I've seen that truly bridges DeFi and NFTs. As its market share gradually surpasses 10%, Sudoswap has become a beacon in an otherwise weak NFT market. Liquidity providers (LPs) are rapidly adding liquidity to new NFTs (such as Webaverse/8liens), and some LPs are actively market-making (e.g., incoom.eth).

Some projects have even started launching directly on Sudoswap by listing seller orders from the team instead of using traditional mint mechanisms—this is one reason behind Sudoswap’s explosive trading volume growth. Given Sudoswap’s strong performance, $XMON has become the best-performing on-chain asset since its bottom.

Arbitrum / “Real Yield”

The season for Optimism was never meant to come (at this stage). Many L2 prices have gradually collapsed on CEXs, while the Arbitrum ecosystem has shown some strength—through new project launches and sustained usage/activity of existing ones:

- GMX has risen more than threefold since its June lows;

- Dopex options;

- Umami USDC vault;

- Mycelium launch;

Umami sits at the forefront of the emerging "Real Yield" narrative, and RedactedV2 recently launched ETH-denominated yield as a cornerstone. In my view, avoiding native token-based yields is certainly beneficial for projects.

Overall, the Arbitrum ecosystem remains one of the strongest non-ETH Layer 1 ecosystems—not only hosting solid established projects but also seeing many new native projects slowly go live. With Nitro’s release and Odyssey updates later this month, both could act as catalysts to drive attention in a market currently lacking sustained narratives.

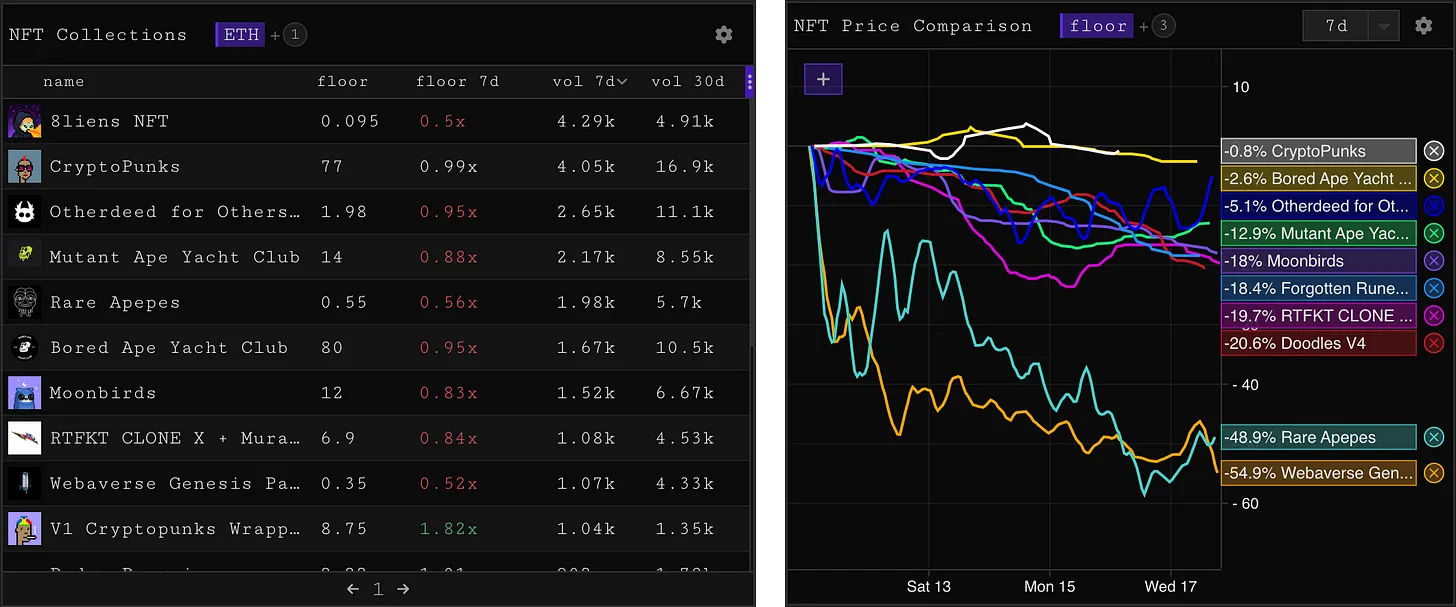

NFT Market

Although some new projects saw decent trading volume at mint, they struggled to maintain prices near their initial highs. Blue-chip NFTs also performed poorly—perhaps some NFTs we once called blue chips won't deserve that title much longer.

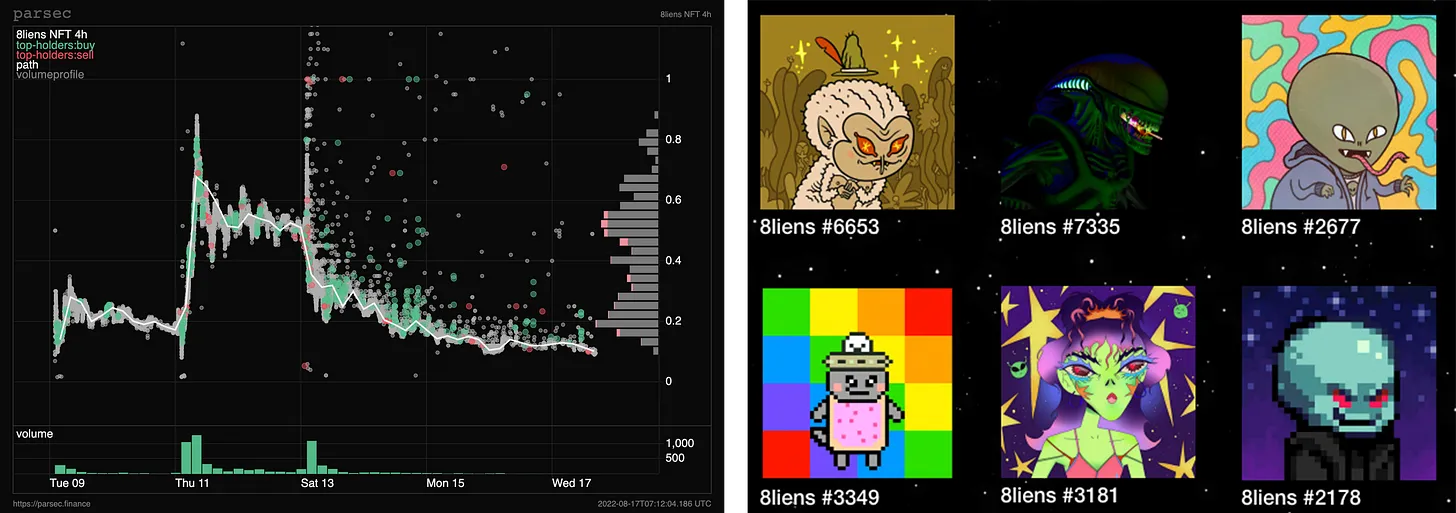

- 8liens topped the weekly volume charts with 4.3k ETH traded, experiencing meteoric rises and falls, ending the week with a floor price up 0.5x.

- Webaverse ranked ninth in weekly trading volume with 1.07k ETH traded, and its floor price increased by 0.52x.

- Rare Apepe YC, a project from a few weeks ago, still held fifth place with less than 2000 ETH traded, and its floor price rose by 0.55x.

- Cryptodickbutts recently rose from 2 ETH to 3.2 ETH shortly after its one-year anniversary.

- Moonbirds, Doodles, and CloneX all dropped more than 18%.

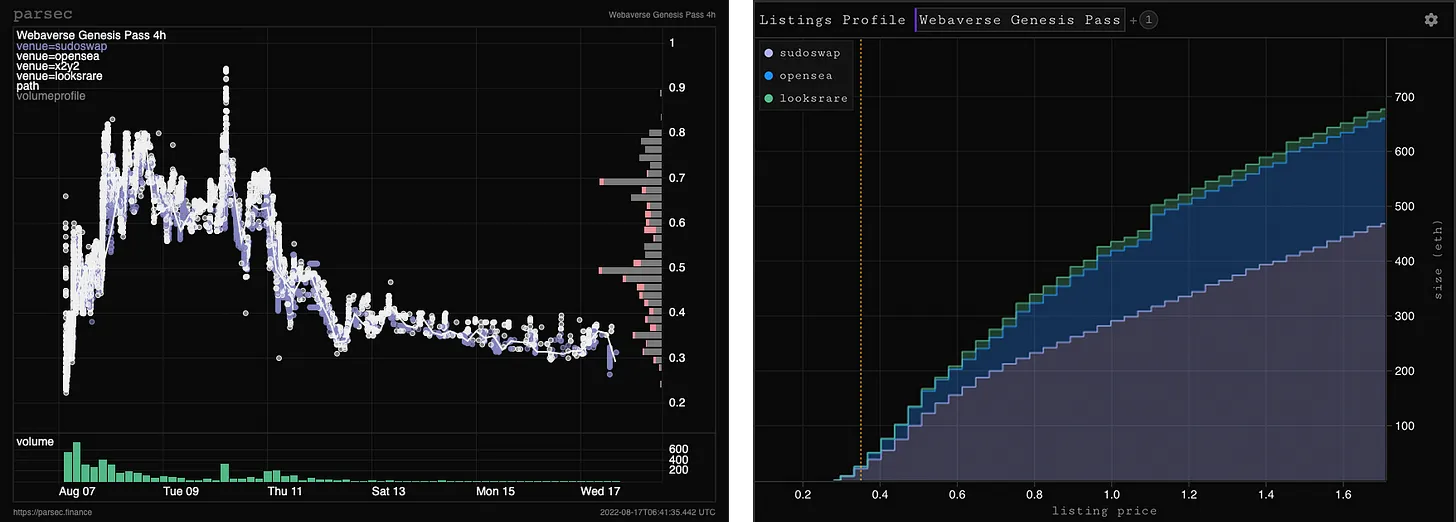

Webaverse

This week’s hot topic was Webaverse and the auction of its Genesis Pass. In short, Webaverse is an AI- and VR-powered, browser-based open metaverse, proud of its open-source values:

- Open to all;

- Transparent;

- User privacy and ownership;

- Diverse and inclusive;

- Community-driven and governed;

By staying browser-based, fully open-source, and focusing on collaborative building using universal formats like Three.js, WebGL, and WebXR, Webaverse promotes inclusivity, accessibility, and creativity. Anyone can build on top of Webaverse, and they strongly encourage it. "Upstreet" is their first attempt—an MMO built using the Webaverse engine. Anyone can join Upstreet; Genesis Pass holders receive a plot of land, including lore and items tied to that land, plus future airdrop rewards from the Webaverse team. After the auction ended, the Pass price fell back to 0.45 ETH.

Webaverse appears to be the first project where listings on Sudoswap outnumber those on OpenSea. All in all, it's a super interesting project—I personally love it. In my opinion, it seems to be the first genuine crypto-native competitor to Yuga’s The Otherside. So far, the only downside I see is that unlike Otherside, Webaverse does not leverage improbableIO’s scalability solutions.

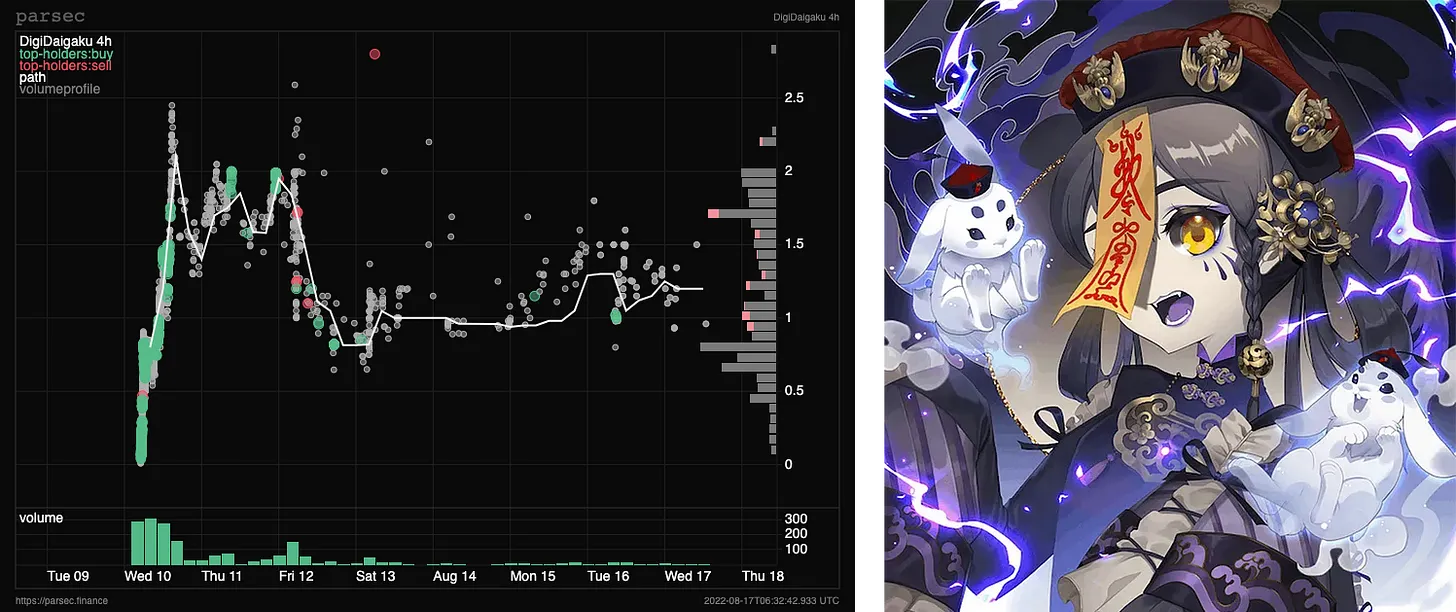

Digidaigaku

Free mint, stealth launch—Digidaigaku gained strong momentum immediately after its mint last Wednesday. Within the next eight hours, its floor price surged from 0 to over 2 ETH. It comes from Gabriel Leydon, who founded mobile games in 2013 with total revenue exceeding hits like Candy Crush and Clash of Clans. Before Digidaigaku’s release, Leydon tweeted that he and his partners had recently launched a Web3 gaming studio called "Limit Break," backed by a long list of VCs including FTX, Coinbase, and Paradigm. At the end of the tweet, Leydon hinted at a surprise—we can only assume an airdrop—though whether it’s related to Limit Break remains to be seen.

The top five holders collectively own 18% of the supply, though none have sold a single NFT—they’ve actually accumulated during the rise. After reveal, the price dropped to around 0.7 ETH but has since rebounded to 1.1 ETH, with a total of 13,000 ETH traded.

8liens

Another new project, 8liens saw massive volume after its free mint last Wednesday and now leads the weekly volume charts with 4.3k ETH traded. It features zero royalties and a CC0 license. The team retained 10% of the supply but hasn’t sold any yet. The project involves several notable figures—it was founded by crypto OGs Debussy and Scalynelson, with Bharat Krymo and Phon Ro serving as advisors.

8liens launched with intense heat—the floor price initially spiked to 0.2 ETH, then, driven by sentiment, soared to around 0.8 ETH. Post-reveal correction brought it back down to 0.2 ETH, followed by a slow decline to its current floor of 0.09 ETH. From my experience and observation, when it first started posting on Discord and Twitter, it felt somewhat mysterious. During whitelist phases, more information about the founders and background was released on Twitter, which is when real FOMO kicked in. Yet even a project generating such high volume appears unable to sustain its floor price in today’s market environment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News