What interesting new projects are worth watching during a bear market?

TechFlow Selected TechFlow Selected

What interesting new projects are worth watching during a bear market?

Some interesting early-stage projects, 90% of which have not yet launched their products or issued tokens.

Written by: BurstingBagel

Compiled by: TechFlow intern

This article aims to list some interesting early-stage projects I've recently come across, along with a quick overview of what they plan to do—90% of these projects haven't launched their product or issued tokens yet.

@Entanglefi is the first cross-chain protocol that leverages synthetic derivatives to unify liquidity and liquidity value across L1 and L2 ecosystems. In simple terms, it allows me to seamlessly interact with LPs on one chain from another chain.

@dammfinance provides secure undercollateralized loans to market makers who have strong on-chain credit histories. Market making is capital-intensive, so over-collateralization isn't always feasible. @dammfinance's undercollateralized model ensures lenders' funds remain safe.

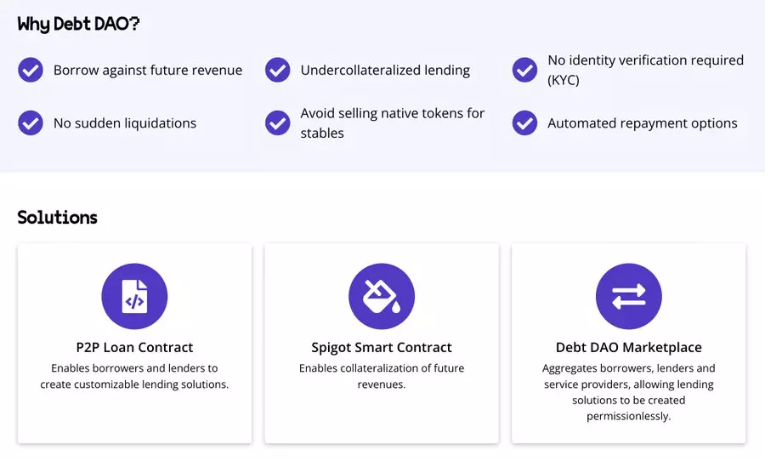

@debtdao also offers undercollateralized lending but implements revenue-sharing financing contracts between borrowers and lenders. Revenue generated from the borrower’s product/service automatically repays accrued interest on their loan.

@split_finance is building an automated arbitrage DEX aggregator with innovative trading tools. They aim to democratize arbitrage opportunities, which means better rates for DEX traders. Planned features include gasless trading, trailing stop-loss, and copy trading.

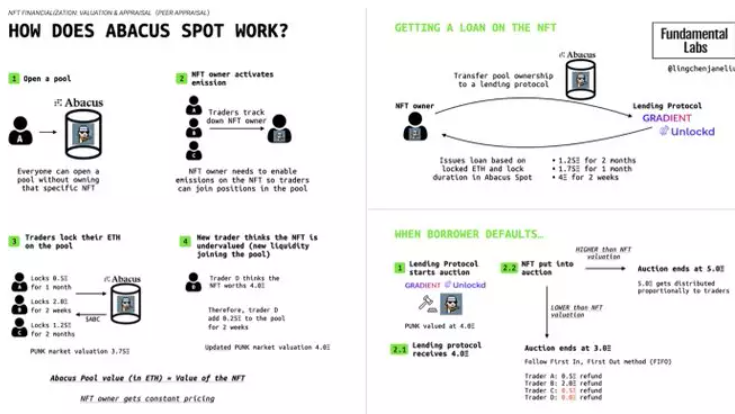

@abacus_wtf is creating an NFT valuation system. Accurate NFT appraisals will enhance composability and capital efficiency for NFT financial products (like NFT lending). NFT collections can stake $veABC to incentivize valuations of their collection.

@guzzolenefinace is to @abacus_wtf what Curve is to Convex—in the simplest terms, it’s designed for staking $veABC.

@GradientFinance offers loans against any NFT, even 1/1 pieces! Thanks to their collaboration with @abacus_wtf—notice a trend here?

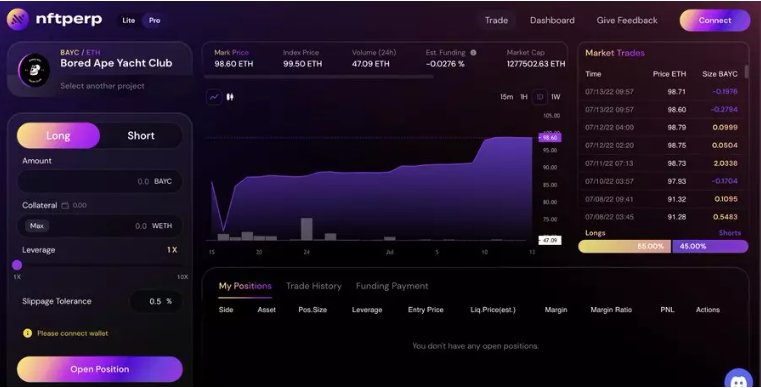

@nftperp does exactly what its name suggests: offering perpetual contracts for NFTs on Arbitrum. It’s about time someone created a simple way to go long or short on NFTs and hedge positions.

@MimicryProtocol is an NFT prediction market operating on a global collateral pool. This enables infinite liquidity and even zero-slippage trading.

@Timeless_Fi tokenizes yield, enabling users to amplify returns, hedge yield exposure, and trade future yield fluctuations. There’s significant potential for integration with other DeFi protocols—I’m excited to see what this team builds.

@y2kfinance allows users to effectively go long or short on different stablecoins. Simply put, if you anticipate a depeg event or want protection while earning yield, this might be the place to be.

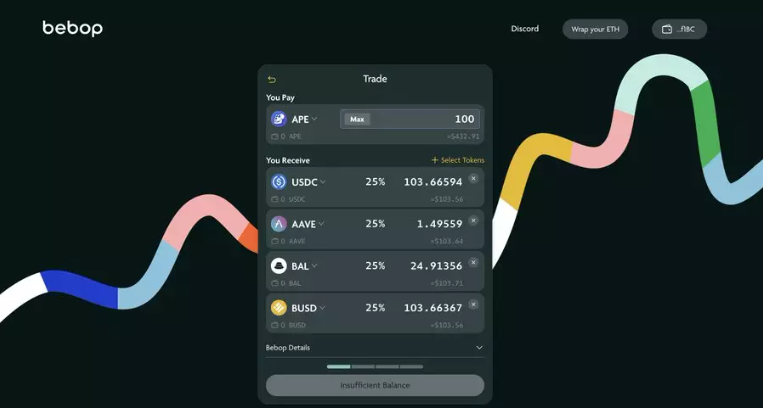

@bebop_dex is a zero-slippage decentralized exchange that supports trading from one asset to multiple assets and vice versa. Their UI/UX is sleek and clean.

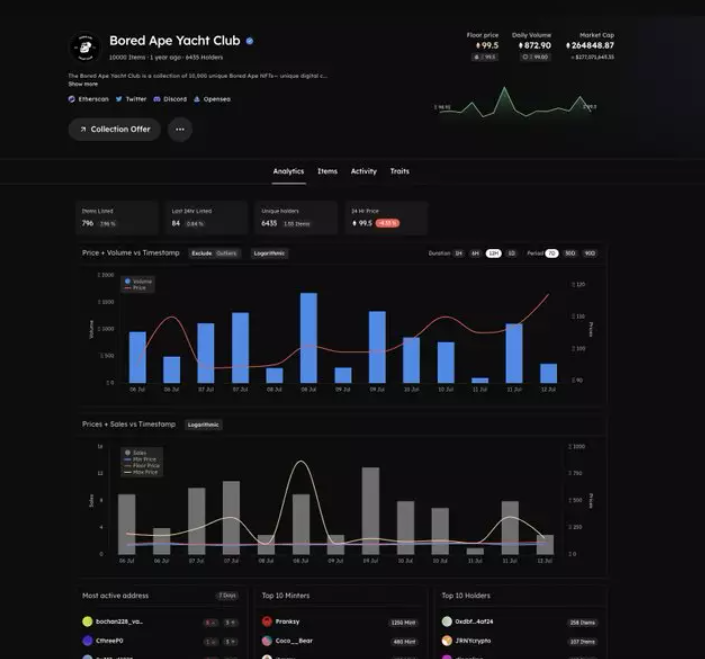

@golom_io is an NFT marketplace that aggregates listings across the entire NFT market and displays analytics for NFT collections. Staking their token grants 0.5% of sales fees—it’s essentially a hybrid of @blur_io and @LooksRare.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News