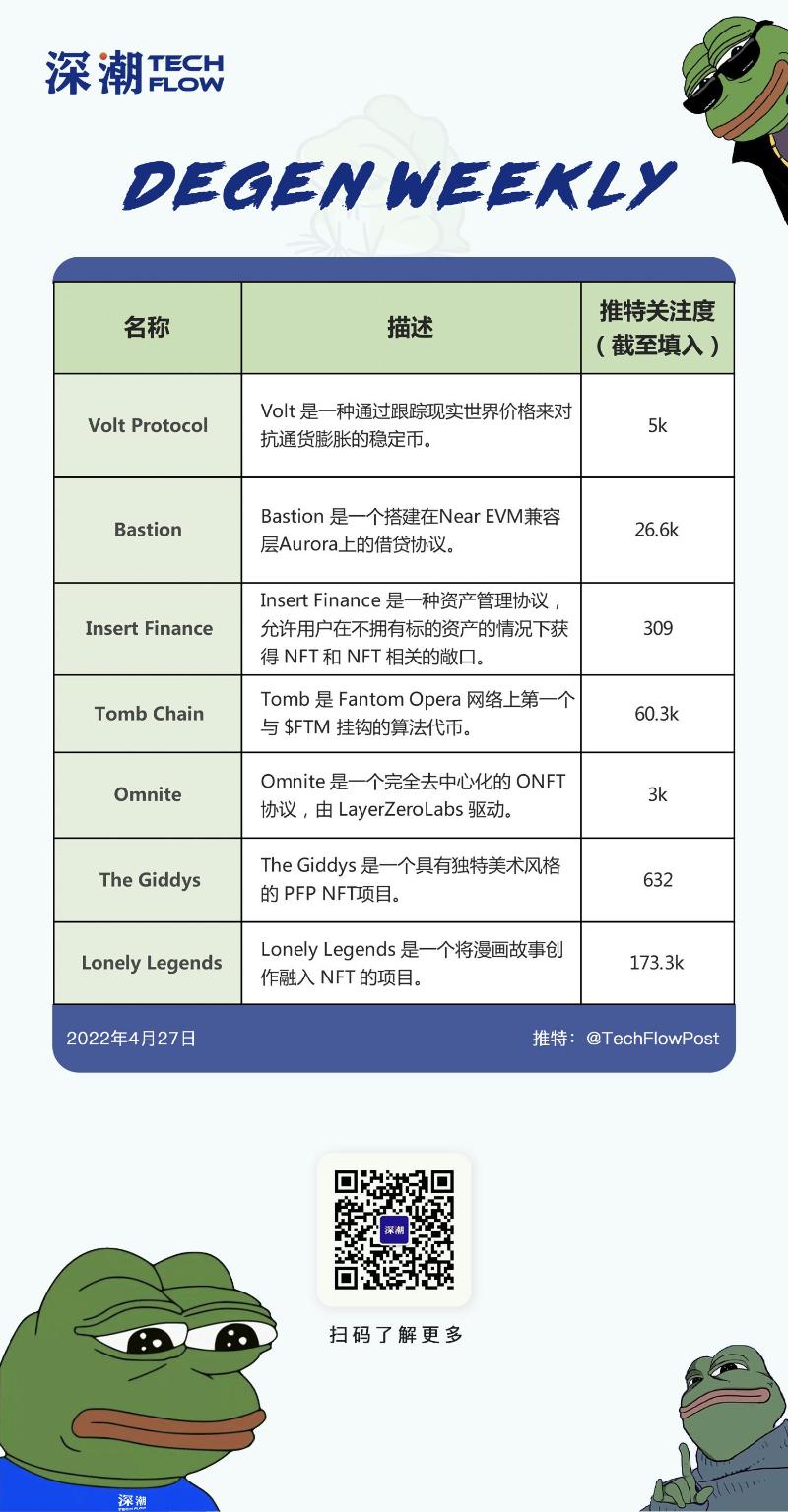

Degen Weekly: An Inflation-Resistant Stablecoin Social Experiment, an Innovative Project Combining Comics and NFTs

TechFlow Selected TechFlow Selected

Degen Weekly: An Inflation-Resistant Stablecoin Social Experiment, an Innovative Project Combining Comics and NFTs

An introduction to some early projects.

Written by: TechFlow intern

Degen Weekly is a new series we've launched to quickly introduce emerging projects each week. Some of these projects may only have a few hundred Twitter followers—very early stage, high-risk, uncertain returns—and most haven't even issued tokens yet. This content is purely for enthusiasts' research and analysis purposes and does not constitute any investment advice. In this edition, we’re also including NFT projects as a new addition. However, I'm still new to the NFT space and actively learning, so none of this should be taken as investment advice.

Volt Protocol

Over time, inflation erodes savers’ purchasing power. Unpredictable inflation rates make financial planning difficult when the value of money itself keeps changing. Last year, the US dollar depreciated by 7.9% and the euro by 5.9%, marking the highest inflation in 39 years. Volt offers a solution—an innovative stablecoin that tracks real-world prices instead of pegging its value to devaluing fiat currencies. This represents a novel exploration within the stablecoin sector, as inflation is a challenge every country seeks to address. VOLT starts at $1 and is designed to adjust over time based on Consumer Price Index (CPI) data.

VOLT issuance operates through two main mechanisms: the Peg Stability Module (PSM) and Fuse debt issuance. Similar to MakerDAO’s DAI, VOLT can be minted via over-collateralized debt positions or by depositing stablecoins into the PSM. The Peg Stability Module allows users to mint or redeem VOLT at the current target price shown by the Volt Price Oracle in exchange for accepted stablecoins. All proceeds from VOLT minting are immediately deployed to yield-generating venues selected by governance. Conversely, when users wish to redeem their VOLT for stablecoins, they can swap at the current VOLT target price, and the PSM will withdraw stablecoins from yield venues to deliver to users in exchange for VOLT.

Bastion

Bastion is a decentralized lending protocol that algorithmically sets interest rates based on supply and demand. Built on Compound’s model, it operates on Aurora, Near’s EVM-compatible layer.

Judging by recent momentum, Near has gained significant attention and attracted substantial capital via its Rainbow Bridge. It's reasonable to expect its ecosystem to benefit. Lending is core infrastructure for any DeFi ecosystem. By building on Aurora and leveraging Near’s superior user experience, Bastion aims to create a competitive lending protocol powered by an autonomous interest rate engine offering higher capital efficiency, fast transactions, ultra-low fees, and precise liquidations.

Insert Finance

Insert Finance is an asset management protocol that leverages existing NFT financial infrastructure to provide accessible, NFT-based yield opportunities, enabling every user to discover their own NFT Alpha.

Current NFT financial tools are largely unfriendly to retail users. Key issues include: most tools are designed for whales and advanced users; the majority of potential DeFi users lack the time or resources to DYOR on NFT monetization strategies; and the NFT finance space is fragmented, further increasing the time and cognitive load required for sustainable profit strategies.

Therefore, Insert Finance provides a pathway for both DeFi newcomers and experts alike. Here are some example use cases:

NFT holders can deposit their NFTs into vaults to generate continuous yield;

ETH-centric NFT art and PFP holders can hedge against price volatility;

New traders gain access to mid-to-high-tier NFT financial infrastructure solutions.

Tomb Chain

Tomb is the first algorithmic token on the Fantom Opera network pegged to $FTM, aiming to bring liquidity and new use cases to the Opera network. Its underlying mechanism dynamically adjusts $TOMB supply to track price movements relative to $FTM.

Unlike previous algorithmic tokens, $TOMB isn’t pegged to a stablecoin but directly to $FTM. Tomb.Finance believes in the potential of Fantom Opera, capturing and providing value from FTM’s future growth. Beyond existing and upcoming use cases like FTMPad, $TOMB aims to become the primary transactional medium on Fantom Opera—achieved by offering a mirrored liquid asset to $FTM.

Omnite

Omnite is a cross-chain NFT protocol powered by LayerZero. It enables NFTs to move across blockchain networks in a fully decentralized manner without relying on centralized custodians.The Omnite Foundation provides integration tools that allow platforms with simplified UIs to bridge and mint cross-chain NFT collections. Future governance will transition to a DAO, though all features are currently in testing.

The Giddys

The Giddys is an early-stage NFT project with a total supply of 10,000 unique, original artworks featuring a roadmap and refined artistic style. Notably, the creator is a Web2 designer, and while the NFTs currently offer no utility, the team has committed to collaborating with an artist—worth keeping an eye on.

Lonely Legends

Lonely Legends is a collection of 5,555 generative avatar NFTs. The Dutch auction has concluded. Its standout feature is that each NFT becomes part of the project’s comic storyline, updated weekly. Comic scenes will be airdropped and/or raffled to holders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News