What are the pros and cons of dollarization in the crypto industry, and what impact does it have on the dollar system?

TechFlow Selected TechFlow Selected

What are the pros and cons of dollarization in the crypto industry, and what impact does it have on the dollar system?

The dollarization of the crypto market since 2018 and its external impact on the crypto market.

[Note] This article is the second part of Solv Research Group's in-depth analysis on the recent crypto market crash, focusing on the factual developments of dollarization in the crypto market since 2018 and its external implications.

TL;DR

The 2022 crypto market crash differs from 2018 in two key aspects:

First, because crypto projects generally raise funds in stablecoins, the industry’s “productive sector” has suffered less impact compared to 2018;

Second, this crisis primarily affected centralized financial institutions engaged in large-scale collateralized and credit lending—often long-term supporters of digital assets like BTC/ETH—who were forced to liquidate collateral under short-term debt pressures, exacerbating a cascading collapse in liquidity.

The backdrop for this situation is the dollarization and secularization of the crypto industry. Since 2018, the crypto industry has gradually adopted U.S. dollar-pegged stablecoins as its base currency, effectively achieving dollarization. As it now depends on externally sourced dollar liquidity, the crypto sector has transformed from a self-proclaimed "sovereign digital economy" aiming to issue its own currency into a "secular" industry within the broader U.S. dollar economy. This shift carries profound and complex consequences—not only for the crypto industry itself but potentially significant implications for the U.S. dollar system in the near future.

Background

Those who lived through the 2018–2020 bear market may naturally compare the current market collapse with the steep decline between August and December 2018. However, the crypto market in 2022 is significantly different from that of 2018.

The biggest difference lies in narrative. In 2018, the entire crypto industry revolved around three narratives: public blockchains, exchanges, and blockchain applications across industries—most of which ultimately proved unfounded. Over the past two years, however, several new directions have rapidly emerged in the crypto space—such as DeFi, NFTs, GameFi, and Web3—which feature relatively clear, real-world value creation logic and distinct competitive advantages, making them mainstream media darlings. Even amid a bear market, there remains broad confidence that success in these areas is only a matter of time.

For any emerging industry, a fresh and compelling narrative is undoubtedly crucial. But at the same time, another less visible yet potentially deeper transformation has taken place beneath the surface: the dollarization of the crypto industry.

Dollar Stablecoins Become Crypto’s Base Currency

In 2018, the crypto industry was largely “coin-based,” with all fundraising and investments conducted in BTC or ETH—even seeing cases where institutions used BTC/ETH to settle trade payments for goods and services. After 2018, however, dollar-pegged stablecoins such as USDT and USDC gained solid ground and experienced explosive growth after 2020. The entire crypto ecosystem shifted its funding, valuation, and transaction medium to dollar stablecoins. The U.S. dollar has de facto become the crypto market’s medium of exchange, unit of account, and store of value—indicating that the crypto industry has been dollarized.

A direct indicator of crypto dollarization is the dramatic rise in issuance of so-called "dollar stablecoins."

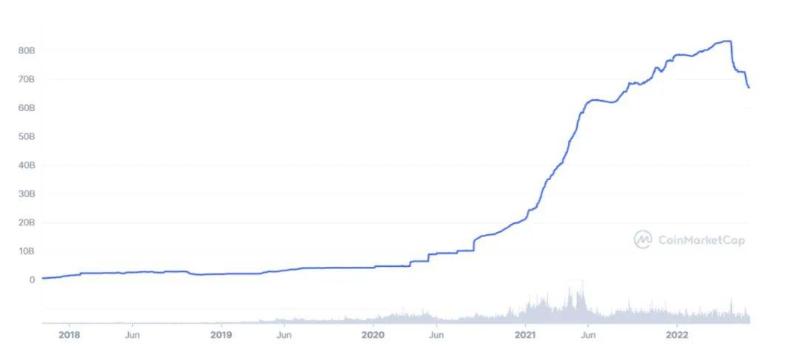

Figure 1. Tether (USDT) issuance growth since 2018

Tether (USDT)’s issuance grew from $1.3 billion in early 2018 to $66.7 billion today—an increase of 50.3x. Prior to the Luna collapse triggering a contraction in USDT supply, its peak issuance reached $83.2 billion.

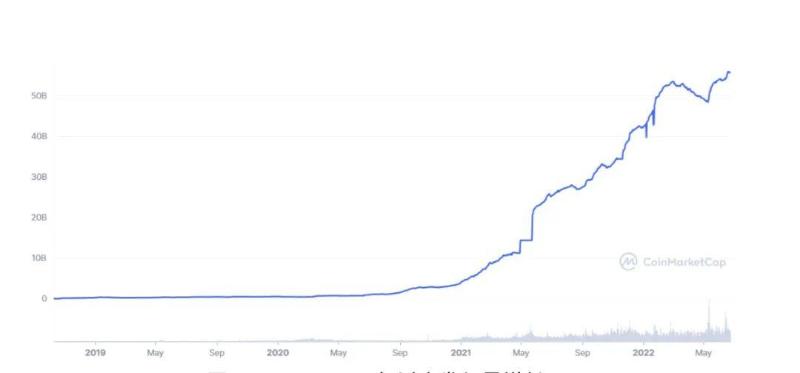

Figure 2. USDC issuance growth since 2018

In contrast, another regulated dollar stablecoin, USDC, has seen continuous growth—from $1.32 million in October 2018 to $55.8 billion today—and appears poised to overtake USDT.

The largest algorithmic stablecoin, DAI, had just surpassed $100 million in issuance in February 2020, peaked at $10.3 billion in February 2022, and despite subsequent contractions, still maintains an issuance of $6.8 billion.

Overall, since 2018, the total scale of dollar stablecoins in the crypto market has grown more than 100-fold—only tripling between 2018 and 2020, but surging 31-fold between 2020 and 2022 alone.

Pros and Cons of Crypto Dollarization

The massive inflow of U.S. dollars into the crypto market has profoundly altered the industry’s internal structure and operational dynamics, resulting in distinct characteristics during this downturn—bringing both benefits and drawbacks.

An obvious benefit is that due to crypto dollarization, the industry’s fundamental base has remained temporarily stable during this market crash.

Recall the market crash in late 2018, when many projects held BTC and ETH as funding, and as token prices plummeted, development teams could no longer afford operating expenses, forcing project termination. This led to a severe “species extinction” event in the crypto industry, with an estimated 99% of projects dying out. In any nascent industry, projects are the primary product. Widespread project failures left the crypto industry nearly devoid of fundamentals, contributing to the exceptionally long and suffocating 2018–2020 bear market.

Today’s situation is entirely different. This market crash has mainly impacted centralized financial institutions within the industry, while crypto projects themselves have suffered comparatively less. Most innovative crypto projects launched over the past two years raised capital in dollar stablecoins, leaving many projects relatively safe—a critical factor in stabilizing the industry’s foundation. Of course, if liquidity shortages persist long-term, more projects will inevitably fail, but conditions are far better than in 2018. Indeed, this crisis may even help the crypto industry undergo healthy consolidation. Therefore, we can reasonably expect that the recovery of the crypto market and industry this time will be stronger than during the last bear cycle.

However, crypto dollarization is a deeply consequential shift—one that introduces as many problems as it solves.

The crypto industry originated from the vision of “private digital currencies,” essentially aiming to create parallel, sovereign virtual economies in digital space, independent of the physical world. In its early days, the ability to generate financial resources through distributed consensus—without relying on established financial powers—inspired true idealists and laid the foundation for crypto’s initial achievements. Whether feasible or not, this was an extraordinary, inspiring, and idealistic goal.

Precisely because of this utopian ambition, the crypto industry also attracted criticism. Many people still fail to grasp Bitcoin’s value proposition. In reality, their confusion isn’t about whether consensus can serve as value backing, nor about blockchain’s technical merits. Their deeper concern lies elsewhere: subconsciously, they recognize that Bitcoin and crypto aim to establish a “quasi-national” sovereign economic entity. And here arises their skepticism: how can a decentralized network of unarmed individuals, lacking enforcement or coercive power, possibly build such a sovereignty-like organization? How could real-world nation-states, armed with military force, tolerate such a competing economic system?

This is where crypto skeptics demonstrate insight—but also reveal a blind spot. If the global monetary system were cohesive and stable, crypto would indeed struggle to survive. Yet after the 2008 global financial crisis, the Jamaica System—built on credit-based dollars—was severely weakened, with deep cracks appearing in its foundation. Bitcoin and cryptocurrencies emerged precisely within these fissures. Because of these vulnerabilities, once the crypto economy reaches sufficient scale, major sovereign economies may find it more practical to co-opt and regulate it rather than eliminate it. Coordinated global suppression lacks political feasibility, whereas integration requires only tolerance and strategic guidance to gradually absorb it into existing monetary frameworks.

Now it appears this reformist path has achieved initial success. We do not believe a mastermind orchestrated this process, but the U.S. dollar decision-making apparatus has shown notable flexibility. Allowing private digital dollar issuance on a scale reaching hundreds of billions has become the bedrock of crypto dollarization. Other sovereign economies had similar historical opportunities but, for various reasons, did not pursue this path—effectively ceding this high-potential, emerging industry to the U.S. dollar.

After dollarization, crypto has gradually drifted from its idealistic stance as a “quasi-sovereign economy” and evolved into a secular industry within the dollar system—Web3 being a representative direction of this secularized crypto industry. Following this reformist transformation, crypto can no longer create its own money—the lifeblood of the system must come from outside. To access U.S. dollars, assets like BTC and ETH—once hailed as “digital currencies”—have been downgraded to “highly liquid digital assets.” Their roles as mediums of exchange and units of account are discarded; instead, they either attract dollars via price appreciation expectations or serve as collateral, discounted heavily to extract liquidity.

The crypto industry is now being tamed by the dollar, becoming a traditional sector dependent on the U.S. financial system for survival and growth. No wonder classical internet VCs and Wall Street are increasingly interested in Web3, and why U.S. regulators are showing growing friendliness toward crypto—it fits comfortably within their domain. The entire industry relies on dollar infusions to function, uses dollars for accounting and operations, and will inevitably fall under strong influence from U.S. financial authorities in the future.

Certainly, crypto still contains novel elements—DeFi, token incentives, DAOs, transparency, permissionless access, etc.—but as long as it uses the U.S. dollar as its base currency, it remains nothing more than a chaotic, fast-growing, highly creative,创业板-style dollar colony. Its growth serves dollar interests.

Impact of Crypto Dollarization on the Dollar System

Some might question: if U.S. financial authorities cannot directly regulate dollars circulating in the crypto market, why support—or at least tolerate—the growth of crypto dollarization? Why allow a dollar-denominated economy to emerge beyond their control? Doesn’t this undermine the dollar’s credibility? Doesn’t it complicate dollar regulation? Won’t it exacerbate illegal activities like money laundering, crime, terrorist financing, and capital flight—and make Federal Reserve monetary policy harder to implement?

To date, we have not heard official responses from U.S. financial authorities on these concerns. However, media reports suggest that some digital economy experts and crypto practitioners have discussed these issues with U.S. regulators. Some argue that the dominance of dollar stablecoins in crypto benefits the U.S. dollar; others propose that given the success of compliant private dollar stablecoins (especially USDC), the Fed may no longer need to issue an official digital dollar. These accounts offer glimpses into how U.S. financial authorities may view this pivotal issue.

While we lack direct insight into official U.S. attitudes and strategies toward crypto dollars, analyzing a parallel case may illuminate the underlying logic.

Here, comparing “private crypto dollars” to the vast circulation of physical U.S. dollar bills overseas proves highly instructive.

We know that dollars exist in two main forms: physical cash and account-based dollars.

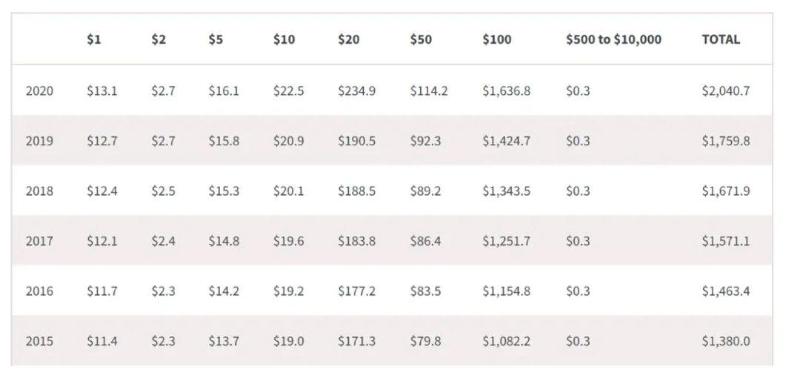

As of 2020, approximately 50.3 billion U.S. dollar bills were in circulation, worth $2.04 trillion, with over 60% circulating outside the United States. Among $100 bills, 80% circulate abroad. This means a massive offshore physical dollar economy exists.

Figure 3. Circulation of U.S. dollar banknotes, 2015–2020 (Source)

U.S. financial authorities likewise struggle to effectively regulate this vast offshore cash economy, leading to widespread issues involving money laundering, crime, and terrorist financing. While many readily accuse Bitcoin of facilitating illicit finance, in that shadowy realm, physical dollar bills reign supreme—surpassing Bitcoin in both scale and prevalence.

Given this, why doesn’t the U.S. strictly control the outflow of paper dollars? On the contrary, many dollar bills are actively deployed overseas through U.S. military and intelligence operations. What is the logic behind this?

The logic is actually quite simple.

Abroad, there is substantial demand for stable-value currencies. Some needs are legitimate, others exist in gray zones. This demand is real—if the dollar doesn’t fill it, other currencies like euro or yen will. For the U.S., it’s preferable that the dollar dominates this vast market rather than ceding it to rivals.

Of course, this creates regulatory challenges, so the U.S. adopts several measures:

First, tiering the dollar. All physical dollar bills are issued by the U.S., as are all account-based dollars (bank dollars), but they differ: cash is “gray,” lower-tier money, potentially linked to illicit activity; account dollars are “white,” higher-tier money, subject to strict tracking and oversight.

Second, strictly distinguishing usage. Large domestic transactions, international trade, and financial settlements require account dollars—cash is not accepted.

Third, tightly controlling conversion from cash to account dollars. The process of turning illicit cash into clean, high-tier account dollars is precisely what constitutes “money laundering”—a criminal activity the U.S. aggressively combats globally.

Although this strategy creates enormous complications for U.S. financial and law enforcement agencies—requiring complex extraterritorial jurisdiction—the overall benefits far outweigh the costs. It strengthens the dollar’s global dominance and gives the U.S. a powerful tool for global governance.

Understanding this logic makes it easier to comprehend the U.S. approach to crypto market dollarization.

Many readily criticize the disorder in crypto markets and the inevitable speculation and crime associated with rapid innovation. Yet such criticism hasn’t stopped the market’s explosive growth. If millions worldwide are adopting crypto technologies, and if crypto and Web3 are destined to become multi-trillion-dollar markets, how should the U.S. respond? Should it clamp down harshly, stand aside and criticize, or proactively engage to lead?

It now appears the U.S. is extending its overseas cash dollar strategy—choosing the third path: encouraging, or at minimum tolerating, private digital dollar stablecoins to dominate this new frontier.

A brief comparison reveals that crypto dollars share key characteristics with offshore paper dollars from the U.S. perspective:

First, private crypto dollars like USDC/USDT are created based on fiat dollars, so although labeled “private,” they are in fact a third form of the U.S. dollar—like cash, a lower-tier dollar;

Second, crypto dollars have limited use and cannot be directly used for real-world payments;

Third, conversion from crypto dollars to account dollars is strictly regulated.

As long as these three conditions hold, U.S. financial authorities can effectively manage crypto dollars—using mechanisms fundamentally similar to those for physical cash.

In November 2021, this emerging digital economy briefly reached $3 trillion—larger than India’s economy and ranking fifth globally. Though volatile and now reduced to around $1 trillion, as crypto and Web3 mature, this economy is likely to stabilize and potentially grow into the tens of trillions. This offers renewed support for the dollar’s global position—especially valuable at a time when the dollar faces structural challenges and declining dominance. A dollarized, fast-growing, global digital economy is nothing short of a blessing for the U.S. dollar.

How did the dollar achieve this dominant position so effortlessly? Was this outcome inevitable or accidental? Have other currencies had similar opportunities in history? These are questions worthy of study by historians of the digital economy. For now, however, crypto market dollarization stands as a basic fact.

That said, this trend is not yet irreversible. We observe that NFT and Web3 gaming markets still widely use native crypto assets like ETH and SOL for payments, granting these digital assets “quasi-currency” status. Though their transaction volume accounts for less than 1% of the total market, it remains a noteworthy phenomenon. If Web3 broadly adopts native digital assets as payment methods, then as Web3 expands, the crypto economy might evolve toward a “multi-currency standard.” Whether this is a fleeting phase or a lasting trend remains to be seen.

Finally, as global dynamics shift—particularly with major historical events like the Russia-Ukraine war—will other nations enter the competition for crypto base currencies? Could we see a global contest among sovereign digital currencies within the crypto economy? These are important topics, though beyond the scope of this article series.

In the next article of this series, we will analyze the mechanisms of dollar liquidity creation and allocation within the crypto industry, revealing how the current market liquidity collapse unfolded, and offering recommendations for improvement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News