Approfondir Thala Protocol : le premier protocole DeFi bâti sur la monnaie stable native d'Aptos

TechFlow SélectionTechFlow Sélection

Approfondir Thala Protocol : le premier protocole DeFi bâti sur la monnaie stable native d'Aptos

En partant de la stablecoin elle-même, créer davantage de fonctionnalités produits, de scénarios d'utilisation et de possibilités de collaboration.

Looking back at the cryptocurrency market over the past month, signs of recovery seem to be emerging. Amid various narratives and sector rotations, the new public chain Aptos has stood out: within just 20 days starting from mid-January, Aptos’ price surged from $4 to as high as $20, with particularly strong trading activity in Asian markets, especially South Korea.

Under the axiom that “pumping is justice,” attention tends to focus on market sentiment, and discussions about when to enter or exit positions on Aptos are everywhere; however, in contrast to this market excitement, the actual development of the Aptos chain remains relatively quiet.

Statistics from DefiLlama show that the total TVL (Total Value Locked) on Aptos amounts to only $53 million, ranking 31st among all public chains. The number of ecosystem projects and the volume of stablecoins on-chain also lag significantly behind other popular new public chains.

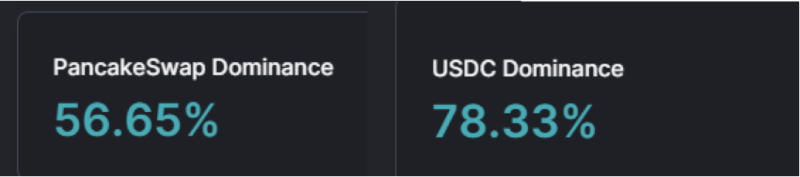

Longitudinal data comparisons clearly highlight Aptos' current ecosystem weaknesses—particularly the lack of native DeFi and stablecoins. Pancakeswap alone accounts for more than half of Aptos’ total TVL, while the USDC stablecoin holds nearly 80% market share on-chain.

By comparison, major blockchain platforms and DeFi applications such as BSC, Curve, and AAVE are actively developing their own stablecoins as part of strategic growth to gain competitive advantages.

Native stablecoins serve as value anchors within a blockchain's ecosystem, capable of stimulating liquidity and generating yield, which is crucial for building successful DeFi applications and attracting users. Aptos’ absence in this area undoubtedly undermines its long-term competitiveness. However, where there’s a problem, there’s often a solution: the pioneer filling this native stablecoin gap has quietly emerged—Thala Protocol.

Built using the Move language, the project launched MOD (“Move Dollar”), a native stablecoin on Aptos, and complemented it with its own AMM and Launchpad to form a relatively complete product suite;

When Aptos performs strongly in the market, value is more likely to spill over into its ecosystem projects. And repeated patterns in the crypto space suggest that early movers who fill critical gaps often present greater opportunities—making them worth monitoring and understanding early.

On February 25, the project launched its testnet. After hands-on experience, the full picture of Thala Protocol is gradually coming into view, and we will provide an in-depth analysis here.

Stablecoin MOD: Thala’s Value Anchor

In Thala, the stablecoin forms the foundation of the entire protocol. To address the lack of a native stablecoin on Aptos, the protocol introduces MOD (“Move Dollar”). As the name suggests, MOD is built on the Move language and serves as a store of value, medium of exchange, and unit of account on-chain. Moreover, MOD is designed primarily for the Aptos ecosystem, enabling interaction with various other DeFi protocols within it.

Beyond the name, however, MOD’s design mechanism deserves closer attention.

Unlike algorithmic stablecoins like UST, MOD adopts a DAI-like model based on collateralized debt positions (CDPs) and over-collateralization to manage the issuance and redemption of the stablecoin. Collateralized Debt Positions (CDPs), commonly referred to as vaults in DeFi, are essentially smart contract-based lending systems.

When a user wishes to mint (borrow) MOD from the protocol, they must deposit a certain amount of other assets as collateral into the vault. When the user repays (burns) MOD to the protocol, they can reclaim their previously deposited collateral. If the total value of the collateral falls below a certain safety threshold, the collateral is subject to liquidation. Importantly, this collateralization is over-collateralized: users can only borrow less MOD than the total value of their collateral, and each MOD is pegged 1:1 to the US dollar. For example, to borrow 1 MOD, the required collateral might have a total value of $1.50.

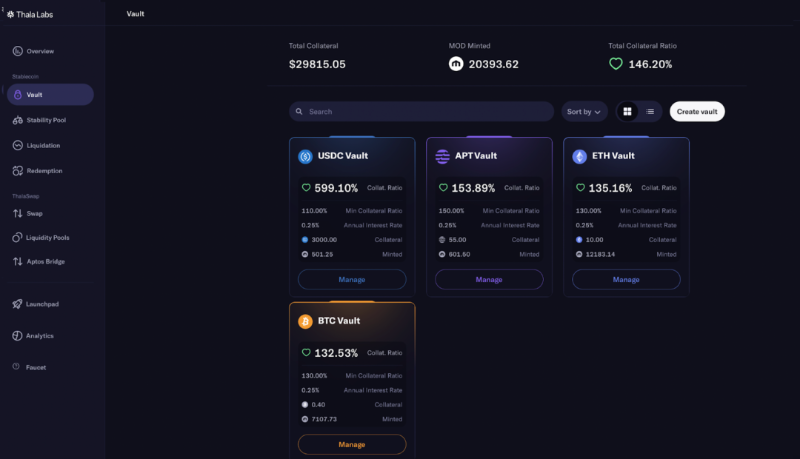

So, what specific assets serve as over-collateral in the Thala Protocol?

According to the official documentation, MOD supports both native Aptos and multi-chain assets, with ongoing focus on yield-generating collateral types, including but not limited to liquid staking derivatives, liquidity pool tokens (LP tokens), and certificate-of-deposit tokens.

From the current product interface, supported over-collateral assets already include USDC, APT, ETH, and BTC. Users can freely select any vault and click the “Manage” button to deposit or redeem assets. Additionally, the real-time collateralization ratio displayed in the top-right corner is around 146%, indicating that the total value of collateral exceeds the total value of issued MOD.

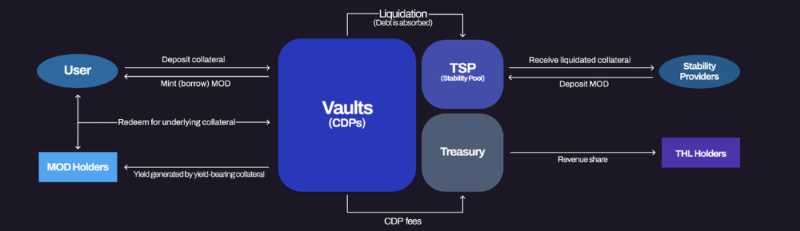

Having understood MOD’s design mechanics, we can now better map out the entire workflow related to MOD and further analyze how the stablecoin is created, circulated, used, and who benefits:

-

Users deposit assets into vaults and mint/borrow MOD through over-collateralization, reclaiming their collateral under normal conditions;

-

Holders of MOD can earn yield via staking or rebase mechanisms;

-

Fees generated from borrowing and redeeming MOD—such as interest, redemption fees, and liquidation penalties—are directed into Thala’s treasury and distributed as rewards to holders of the protocol token (THL);

-

If the price of collateral drops below a threshold, liquidation is triggered. At this point, the vault’s collateral cannot cover the borrowed MOD, resulting in a shortfall.

-

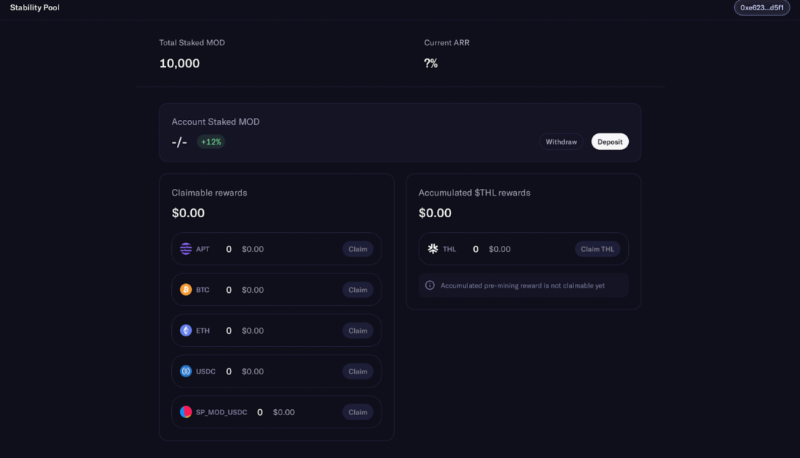

To cover this shortfall, the “Stablecoin Pool”—designed to maintain vault stability—comes into play: when liquidation occurs due to falling collateral prices, others can deposit MOD into this pool, allowing them to purchase the collateral assets at a “discount.”

The MOD used to buy the collateral fills the previous deficit caused by liquidation, and those providing MOD act as LPs (liquidity providers) in the stablecoin pool, earning returns. On the product’s stability pool page, users can see multiple asset rewards available for staking MOD, and simply clicking “Claim” allows them to realize these liquidation-related gains.

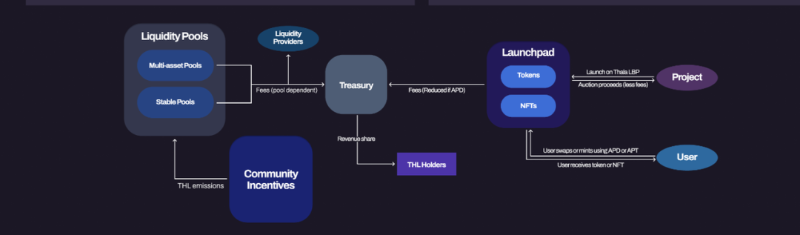

When stepping back from the technical details of MOD to consider its strategic value, its role as a value anchor becomes even clearer: starting from the stablecoin itself to create additional product features, use cases, and collaboration opportunities.

For the Thala Protocol itself, the existence of MOD gives users stronger incentives to engage with the platform. Whether participating in the yield-bearing stability pool or borrowing stablecoins to seek higher returns, users must operate within Thala’s ecosystem. Furthermore, due to mechanisms involving borrowing and repaying MOD, transaction fees generated can be distributed to THL (Thala’s protocol token) holders, forming a key source of value accrual for the token.

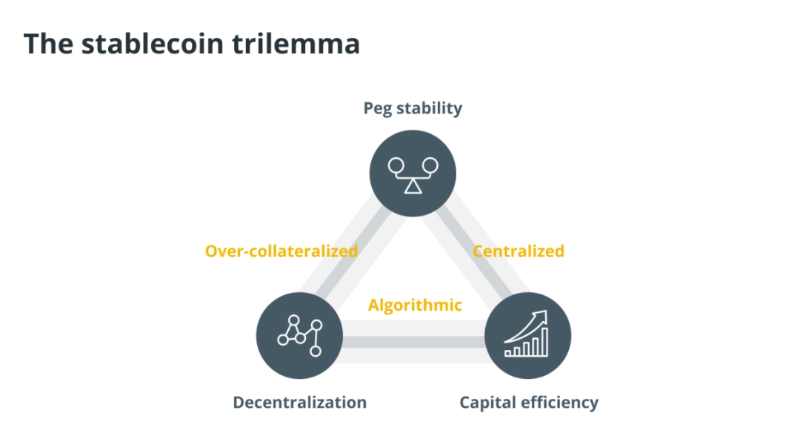

For the broader Aptos ecosystem beyond Thala, the minting and supply of MOD can provide liquidity sources for other DeFi projects, spawning additional use cases and utilities. However, it’s important to remember that MOD remains an “over-collateralized” stablecoin. While serving as a value anchor, it may still face the classic “stablecoin trilemma”—the challenge of simultaneously achieving price stability, decentralization, and capital efficiency.

Mechanisms such as over-collateralization and the stability pool help ensure MOD’s peg to $1 and achieve decentralization via smart contracts. However, over-collateralization inherently reduces capital efficiency, as the “excess” portion of assets represents opportunity cost. Can locked-up assets generate further yield and liquidity?

Clearly, Thala recognizes this issue and aims to overcome this trilemma through Thala Swap, closely tied to the MOD stablecoin.

Thala Swap: Providing Liquidity for the Stablecoin

To enhance MOD’s capital efficiency, liquidity, and utility, Thala Protocol introduced another product: Thala Swap, a DEX based on an automated market maker (AMM) mechanism.

Within Thala Swap, the MOD stablecoin acts as a base asset and is integrated into three different types of pools to generate liquidity. While earning yield, it interacts with various assets according to different pool configurations.

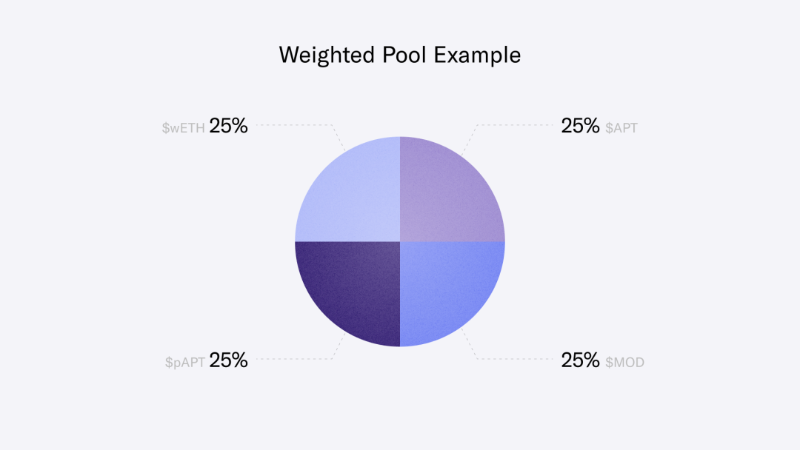

Weighted Pools: Permissionless creation with customizable token weights and counts

Typically, AMM-based pools contain only two assets, each weighted at 50%. In contrast, Thala’s weighted pools allow users to permissionlessly create pools with varying numbers of tokens and custom weight allocations. For instance, as shown below, users can create a pool comprising THL, MOD, APT, and wETH, each representing 25%.

A clear advantage here is increased swap options. With four assets in one pool, each can trade against the others, meaning there are six possible exchange pairs among THL-MOD-APT-wETH. More swapping possibilities theoretically increase user trading activity, thereby increasing fee revenue for liquidity providers.

Additionally, the inclusion of MOD in these pools does not require strong price correlation with other assets, making it a favorable and secure option for pool strategies. Since weighted pools are permissionless, MOD is more likely to be added across diverse pools, enhancing its liquidity and expanding user strategy options.

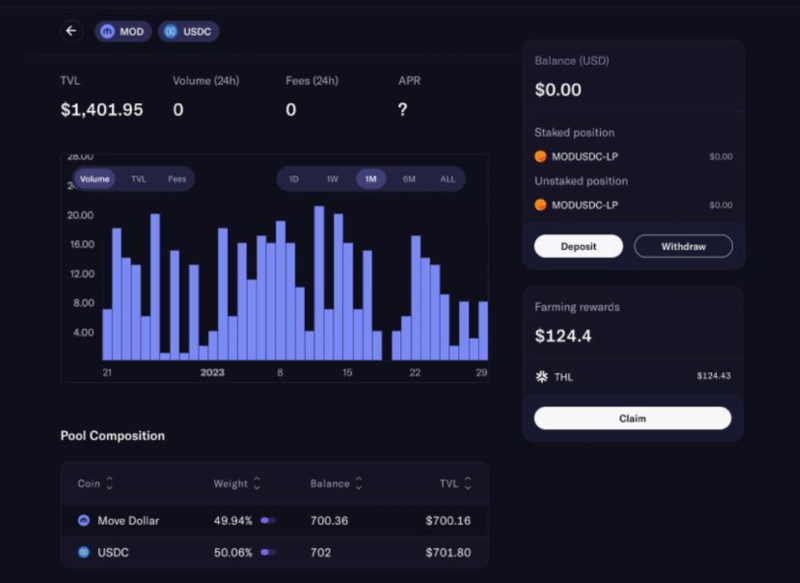

Stable Pools: Designed for equivalent asset swaps

Traditional AMM pools perform well when swapping disparate assets, but struggle in specific scenarios. For example, when exchanging wETH and ETH, or stETH and ETH—assets of equal value—standard AMM pools tend to be inefficient.

Thala Swap’s Stable Pools take inspiration from Curve’s design, optimized specifically for such cases—stablecoins, synthetic/wrapped assets, and staking derivatives—enabling low-cost exchanges.

As shown below, users can find a MOD-USDC stable pool within the Swap function. Both stablecoins are pegged to the USD and typically hold a 1:1 value. Users can deposit assets to become LPs and earn yield, or swap one stablecoin for another within the pool.

For non-native stablecoins entering the Aptos ecosystem wishing to participate in MOD-based pools, they can first swap into MOD via the stable pool. This effectively facilitates cross-chain liquidity inflow into Aptos.

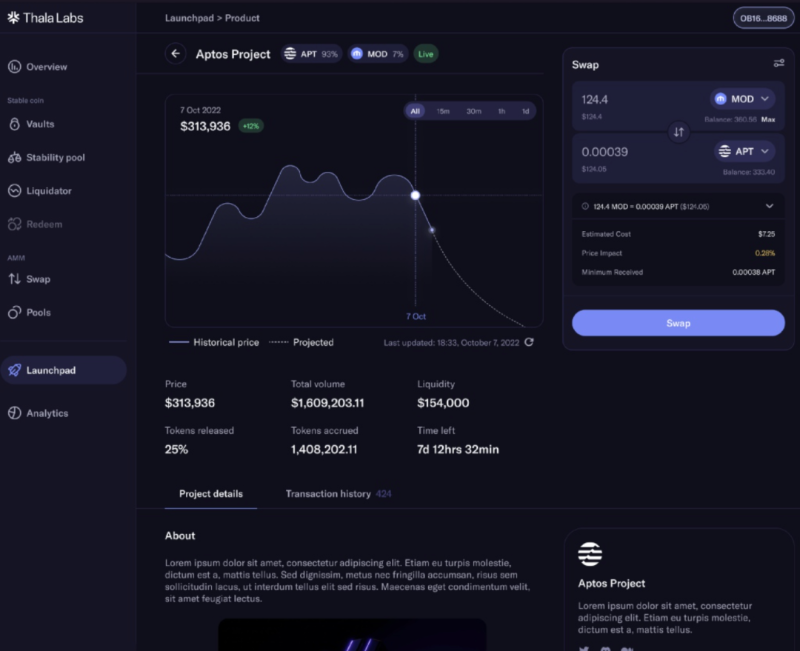

Liquidity Bootstrapping Pools: Permissioned weighted pools ideal for new asset launches

The ability to allocate multiple assets with customizable weights makes weighted pools a powerful tool for launching new assets. Similar to Balancer’s design, Liquidity Bootstrapping Pools (LBPs) are special weighted pools that guide user participation in asset swaps by adjusting the initial and final weights of two assets over a set period.

Experienced DeFi users will quickly recognize that this mechanism functions as an improved Dutch auction: if the newly issued asset starts with a lower weight in the pool, its relative price will be higher. Over time, as trading pressure fluctuates, the price of the distribution asset gradually decreases until both assets reach equal weight in the pool.

This LBP mechanism enables fairer and easier distribution of new tokens compared to traditional IDO methods, increasing the likelihood of adoption by other projects within the Aptos ecosystem. When ecosystem projects wish to launch their tokens, the LBP functionality effectively turns Thala Swap into a launchpad:

Projects on Aptos can directly launch such LBPs on Thala Swap, quickly executing token distributions by setting parameters like weights and duration. From the user perspective, an LBP appears as an auction for a new token.

As shown above, users can access Thala’s Launchpad page to view detailed information about new projects, relevant links, token distribution schedules, and use the designated assets to acquire the new token under prevailing market conditions.

The Launchpad acts as a force multiplier for growing the Aptos ecosystem: given the ease of pool creation and the support of the MOD stablecoin, Aptos-based projects may prioritize Thala Swap for new asset launches, objectively fostering MOD’s circulation across diverse ecosystem projects.

A plausible vision emerges: Thala Protocol could evolve into a comprehensive on-chain DeFi platform integrating stablecoin issuance, primary markets (via Launchpad), and secondary markets (via Swap), leveraging MOD and the launchpad to strengthen collaborations with other Aptos projects and attract users through diverse pooling strategies and yield opportunities.

Outlook

Thala’s testnet has only been live for a few days, yet already over 25,000 participants have joined. While it’s too early to definitively assess its future trajectory, based on current developments, Thala demonstrates solid potential and capability in refining its product.

Even during the broader market downturn in October last year, the project secured a $6 million seed round led by Shima Capital, White Star Capital, and Parafi Capital, with participation from strategic investors including BECO Capital, LedgerPrime, Infinity Ventures Crypto, Qredo, Kenetic, Big Brain Holdings, Karatage, Saison Capital, and Serafund.

Looking ahead, one undeniable truth is that competition among new public chains extends beyond performance narratives. Ultimately, the strength of a blockchain must be judged through its ecosystem and applications. Thala Protocol, by providing stablecoins, liquidity, and ecosystem-building tools to Aptos, is directly addressing Aptos’ core shortcomings—lack of ecosystem depth and native stablecoins.

Judging from the product’s features and design philosophy, the over-collateralized MOD achieves both decentralization and stability, while integrating with Thala Swap to maximize capital efficiency and push the boundaries of the stablecoin “impossible trinity.” Meanwhile, the combination of MOD + Swap + Launchpad reveals an inward-outward value creation flywheel:

-

Internally: enabling MOD to generate yield and usage scenarios, openly encouraging diverse trading pairs to promote MOD’s use within the protocol;

-

Externally: incentivizing Aptos ecosystem projects to interact their treasury assets with MOD, promoting MOD’s adoption across the Aptos ecosystem.

As more applications deeply integrate and collaborate with MOD, the number of trading pairs listed on Thala will grow, liquidity will deepen, and more projects will launch their tokens on the Launchpad—potentially establishing Thala as a foundational pillar of the Aptos DeFi ecosystem, with a promising future ahead.

Bienvenue dans la communauté officielle TechFlow

Groupe Telegram :https://t.me/TechFlowDaily

Compte Twitter officiel :https://x.com/TechFlowPost

Compte Twitter anglais :https://x.com/BlockFlow_News