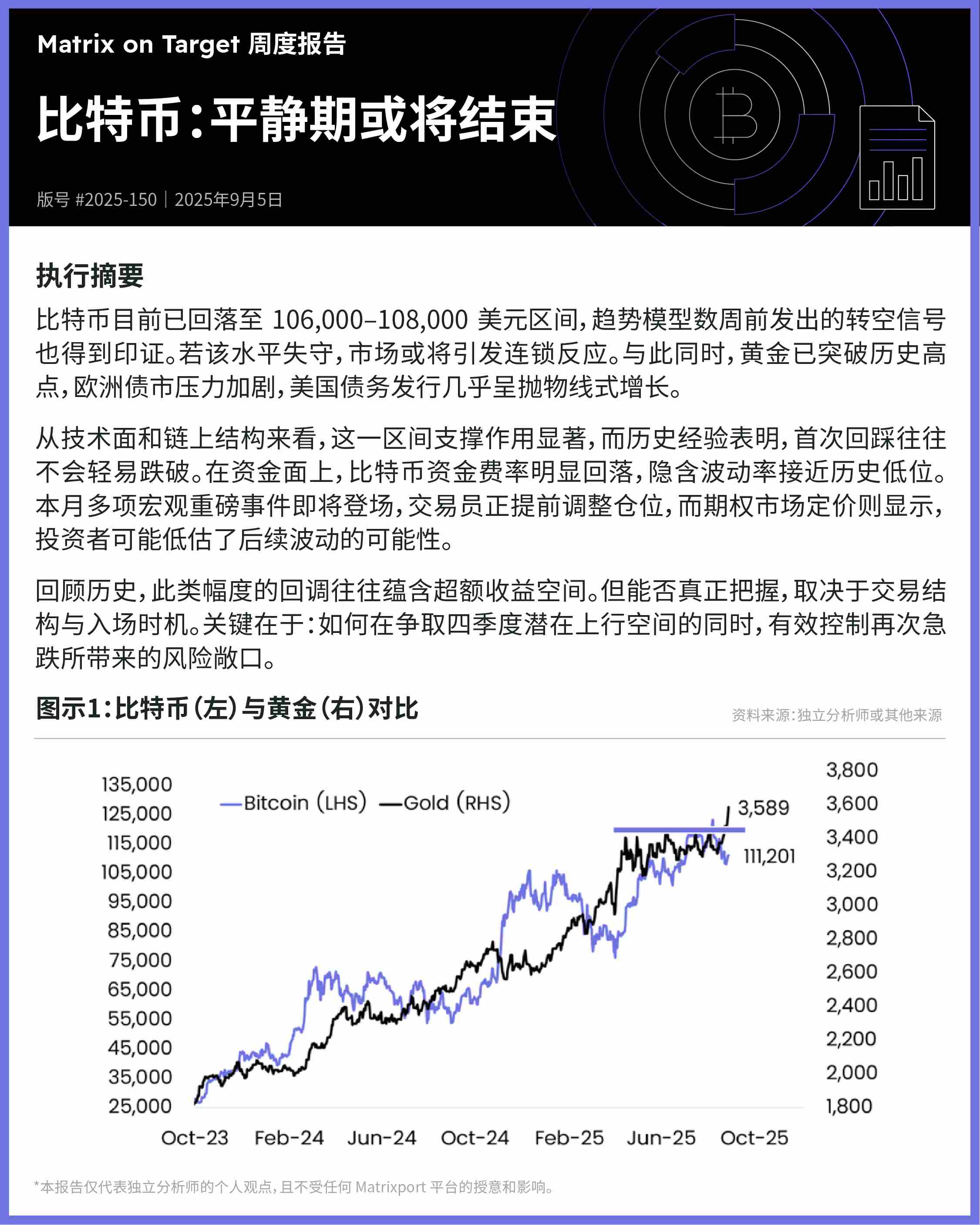

TechFlow news, September 5 — Matrixport released its weekly report stating, "Bitcoin has now retreated to the $106,000–$108,000 range, confirming the bearish signal from the trend model issued several weeks ago. If this level is breached, it may trigger a chain reaction in the market. Meanwhile, gold has broken through its historical high, pressure in European bond markets is intensifying, and U.S. debt issuance is growing almost parabolically.

From a technical and on-chain structural perspective, this range shows significant support strength, and historical experience suggests that such initial retests often do not easily break below. On the funding side, Bitcoin funding rates have clearly declined, and implied volatility is approaching historic lows. With several major macro events scheduled this month, traders are adjusting their positions early, while options market pricing indicates investors may be underestimating the potential for future volatility.

Historically, pullbacks of this magnitude often contain substantial excess return potential. However, successfully capturing these gains depends on trading structure and entry timing. The key lies in how to effectively capture potential upside in the fourth quarter while managing the risk exposure from another sharp decline."