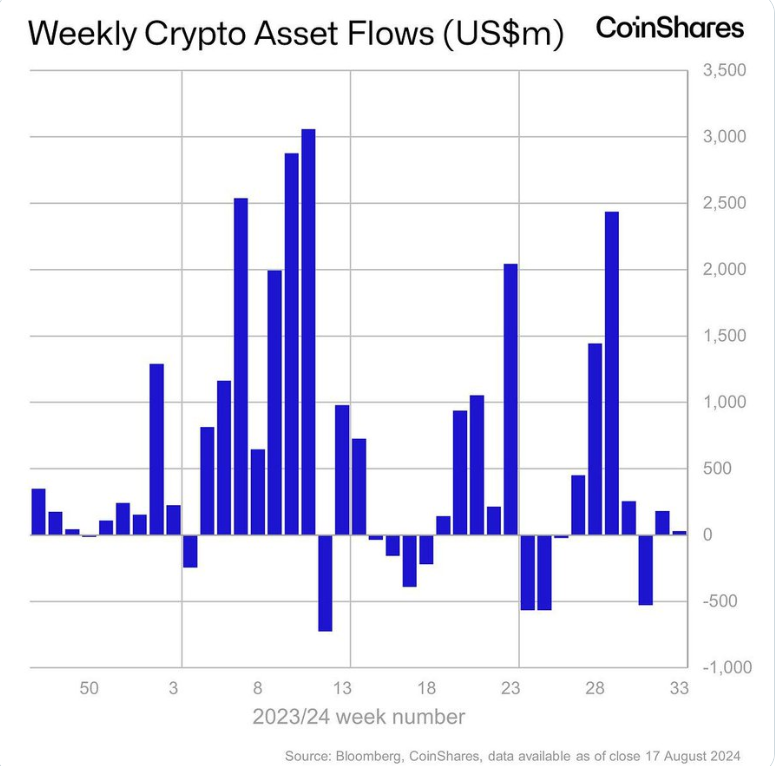

TechFlow news, according to CoinShares' latest weekly report, digital asset investment products saw a modest net inflow of approximately $30 million last week. This occurred against the backdrop of recent macroeconomic data reducing the likelihood of a 50 basis point rate cut by the Federal Reserve in September.

Bitcoin attracted the largest inflow, reaching $42 million. Ethereum saw only $4.2 million in inflows, yet active fund movements occurred between new and existing providers: new providers drew in $104 million, while Grayscale experienced outflows of $118 million.

Notably, Solana suffered a record $39 million outflow, primarily due to a sharp decline in trading volume of its dependent meme coins.

Last week, the weekly trading volume of investment products dropped to $7.6 billion, nearly 50% lower than the previous week.