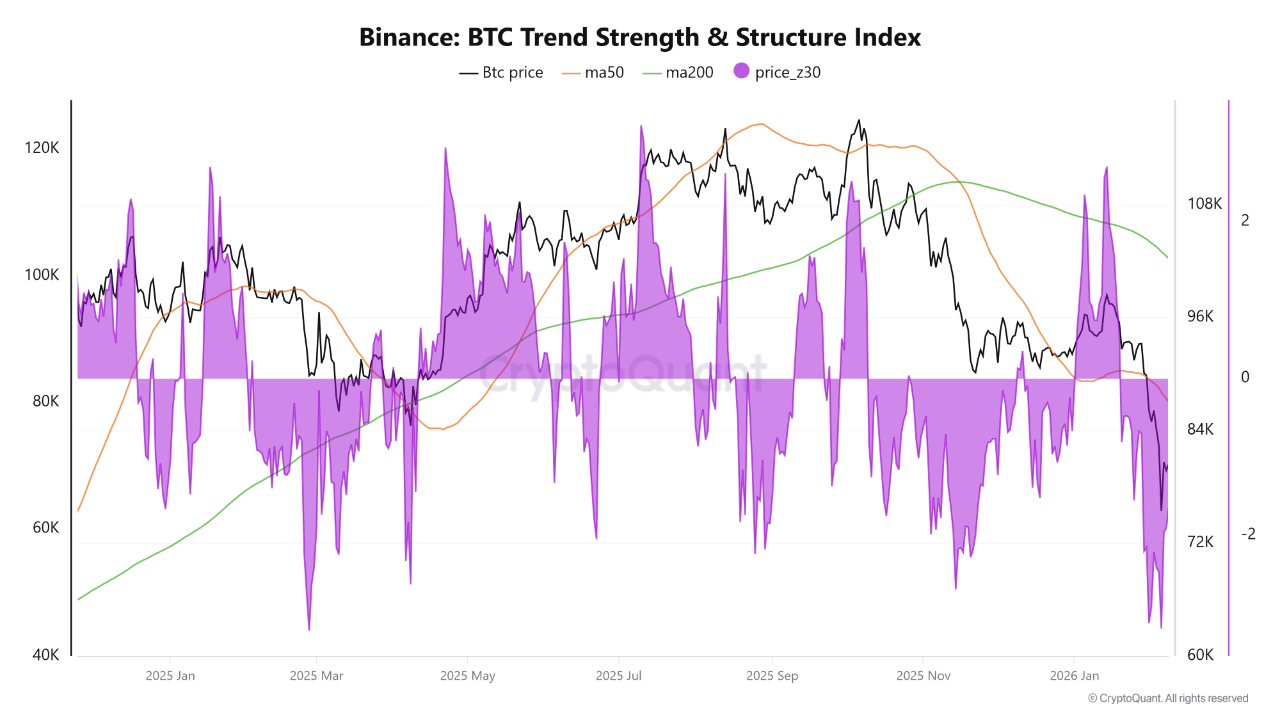

TechFlow News, February 10: CryptoQuant data shows that Bitcoin’s price has fallen below both its 50-day and 200-day moving averages. The widening gap between these longer-term moving averages suggests that the correction following the prior upward move may be entering a prolonged “repricing” phase.

Additionally, CryptoQuant’s Price Z-Score currently stands at -1.6, indicating that Bitcoin’s price is trading below its statistical mean—a condition typically associated with increased selling pressure and weakening trend momentum. Historically, similar Z-Score ranges have more often corresponded to extended bottoming periods rather than swift rebounds.

In the derivatives market, crypto analyst Darkfost notes that seller dominance is intensifying. Data reveals that last Sunday’s monthly net active volume swung sharply negative to -$272 million, while Binance’s active buy/sell ratio dropped below 1—both signals pointing to significantly heightened selling pressure. Currently, futures trading volume remains notably higher than spot inflows; a stronger spot buying demand will be required to trigger a rebound.