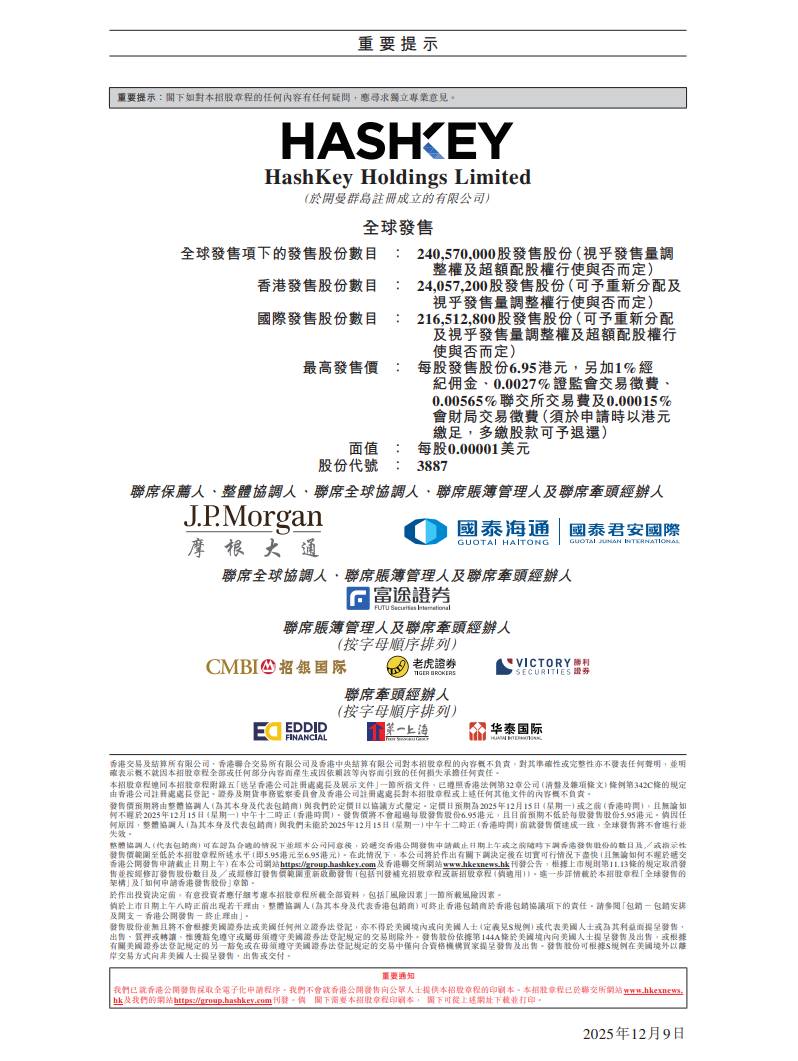

TechFlow news, December 9 — According to the Hong Kong Economic Times, HASHKEY HLDGS (new stock code: 03887) will open its public offering from December 9 to December 12. HASHKEY, parent company of Hong Kong-licensed virtual asset exchange Hashkey Exchange, plans to issue 240 million shares, with 10% offered to the Hong Kong public. The offering price ranges from HK$5.95 to HK$6.95 per share, aiming to raise up to HK$1.67 billion. Each lot consists of 400 shares, with a minimum investment of HK$2,808. HASHKEY is expected to list and commence trading on December 17. JPMorgan, Cathay Haisheng Securities, and Guotai Junan International are joint sponsors.

As of October 31, the company held HK$1.48 billion in cash and cash equivalents, along with digital assets totaling HK$570 million. Among the digital assets, mainstream tokens accounted for 89%, including ETH, BTC, USDC, USDT, and SOL.

As of the end of September, platform assets exceeded HK$19.9 billion, with 3.1% held in hot wallets and 96.9% in cold wallets. Cumulative spot trading volume on the exchange reached HK$1.3 trillion. The core business is transaction facilitation services, contributing nearly 70% of total revenue. Over the past three years, HASHKEY reported losses of HK$590 million, HK$580 million, and HK$1.19 billion respectively. For the first six months of this year, the company's shareholders' loss attributable to equity holders was HK$510 million, representing a 34.8% year-on-year narrowing, while revenue declined 26.1% year-on-year to HK$280 million.

In terms of shareholding structure, Lu Weiding, investor of HASHKEY and chairman of Wanxiang Group, is one of the controlling shareholders, holding 43.2% of the shares and having the right to exercise voting rights over 22.9% of shares through the employee shareholding platform. Hashkey founder Xiao Feng holds 16.3% of the shares; other investors collectively hold 17.6%. HASHKEY has secured nine cornerstone investors, including UBS AM Singapore, Fidelity Funds, CDH, Trustone Capital, Infini, Zhiyuan Holdings (00990), Lutong, Space Z PTE. LTD., and Shining Light Grace Limited, committing a total investment of USD 75 million (approximately HK$590 million).

Net proceeds from the offering will be allocated as follows:

-

40%: Technology and infrastructure upgrades

-

40%: Market expansion and ecosystem partnerships

-

10%: Operations and risk management

-

10%: Working capital and general corporate purposes