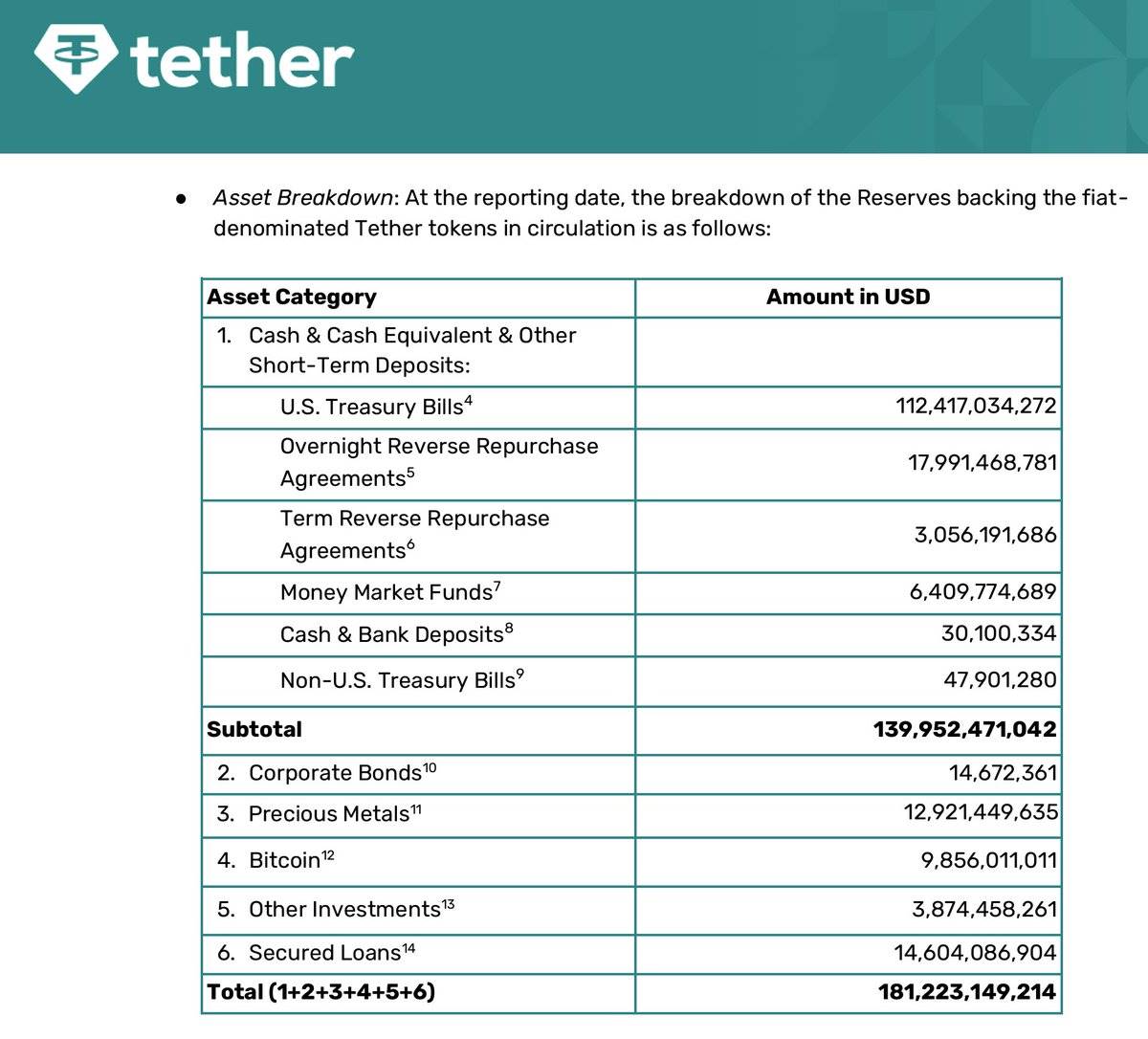

TechFlow, November 30 — According to Arthur Hayes, co-founder of BitMEX, posting on X: "Tether is engaged in a massive 'interest rate trade,' and this is just the beginning. Judging from their audit report, they are clearly betting on the Federal Reserve cutting interest rates—once that happens, their current interest income will be severely compressed. In response, they've started buying gold and Bitcoin, which theoretically should surge when 'money prices fall' (i.e., interest rates drop). However, if the combined value of gold and BTC falls by about 30%, Tether’s equity would be completely wiped out, potentially rendering USDT technically insolvent. I’m certain that some major players and exchanges will soon demand real-time balance sheets from Tether to assess its solvency risk. Grab your popcorn—the mainstream media is likely to go wild over this story, especially editors suffering from 'TDS' (Trump Derangement Syndrome), who have long wanted to target Lutnick and Cantor due to their support for this stablecoin."