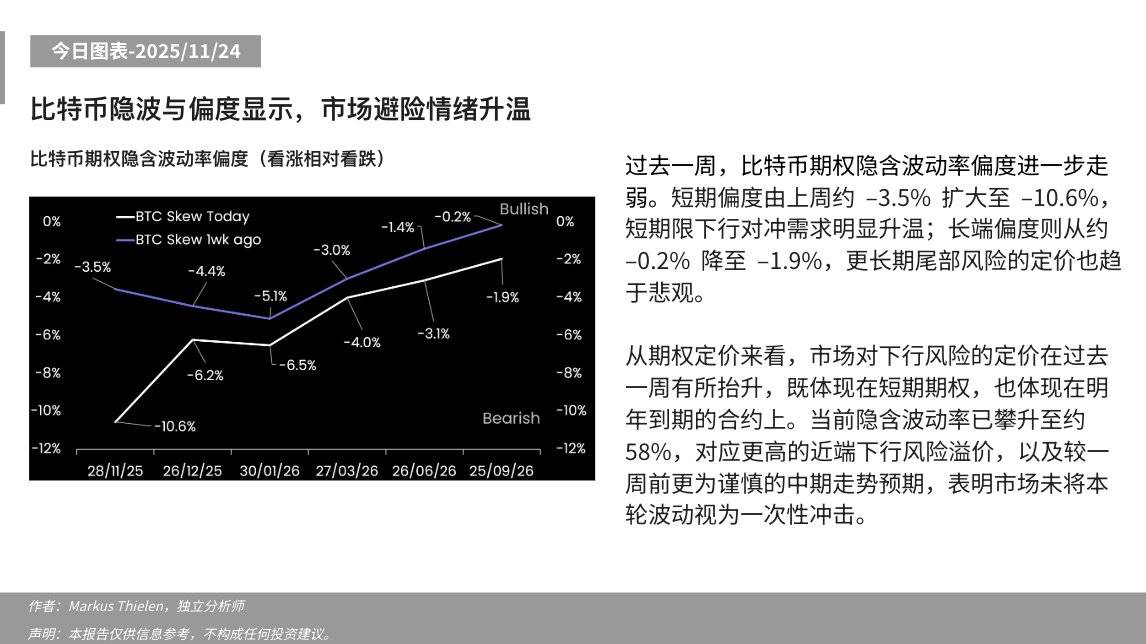

TechFlow news, November 24 — Matrixport released a chart today stating, "Over the past week, Bitcoin options implied volatility skew has weakened further. Short-term skew widened from approximately -3.5% last week to -10.6%, indicating a clear rise in demand for short-term downside hedging; long-term skew declined from around -0.2% to -1.9%, reflecting increasingly pessimistic pricing for longer-term tail risks.

From an options pricing perspective, the market's assessment of downside risk has risen over the past week, evident both in short-term options and in contracts expiring next year. Current implied volatility has climbed to about 58%, corresponding to higher near-term downside risk premiums and a more cautious medium-term outlook compared to a week ago, suggesting the market does not view this round of volatility as a one-off shock."