Following sportswear giants Adidas and Nike, Puma rebrands to join the NFT race

TechFlow Selected TechFlow Selected

Following sportswear giants Adidas and Nike, Puma rebrands to join the NFT race

In every market, there are always some aggressive companies and others more conservative. But in the circle of international sportswear brands, there seems to be a consensus: NFTs are a battle that must be fought.

Author: Zhou Zhou, Huxiu Financial Team

As Nike and Adidas thrive in the NFT world, Puma could no longer sit still.

Recently, Puma—the German publicly listed sportswear brand and third-largest global athletic company—changed its name on Twitter from "PUMA" to "PUMA.eth". This new name is itself an NFT. Industry insiders believe this rebranding signals a strategic upgrade for Puma, indicating its continued exploration into the NFT space.

According to Huxiu's observations, major global sportswear brands have now embraced NFTs—Nike, Adidas, Under Armour, Asics, New Balance... even domestic Chinese brands like Anta and Li-Ning. Most well-known sportswear companies have begun some form of NFT initiative.

NFT (non-fungible token), often described as a digital asset, typically appears in the form of images, audio, or video and is recorded on blockchain-based digital ledgers. In the virtual worlds humans are building, every flower and blade of grass could become an NFT. Today, increasing numbers of designers are creating diverse NFTs. NFT marketplaces are establishing virtual museums, allowing each collector to curate their own unique "personal museum." Exceptional NFT designs gain value through market competition, amplified by network effects and financial appreciation, eventually forming IPs akin to Mickey Mouse, Iron Man, or Doraemon, thus generating powerful IP economies.

The integration of international sportswear brands with NFTs represents one manifestation of such IP-driven economies. Take the Bing Dwen Dwen NFT, for example: once it became a household IP icon, it could not only serve as a brand ambassador for apparel lines but also be adapted into animated films—or even form the foundation for theme parks like Disney or Universal Studios built around multiple IPs—generating massive revenue for design teams and entire related industries. Of course, just as NFTs are one development within a century-old Western IP economy, IP creation is merely one application of NFTs.

In every market, some companies take bold initiatives while others remain conservative. Yet among global sportswear brands, there appears to be a shared consensus: NFTs are too important to ignore.

Puma: Long Overshadowed by Nike and Adidas

As the world’s third-largest sportswear brand, Puma has long hoped to stand shoulder-to-shoulder with Nike and Adidas, yet consistently lags behind them across key metrics.

— On revenue: According to the latest comparable data from Q3 2021 financial reports, Nike generated $12.2 billion, Adidas $6.5 billion, while Puma earned just $2.1 billion.

— On net profit: Q3 2021 figures show Nike at approximately $1.5 billion, Adidas around $500 million, and Puma about $200 million.

— On market capitalization: As of February 25, Nike stood at $219.5 billion, Adidas at $45 billion, and Puma at $13.6 billion.

Clearly, despite being labeled the third-largest international sportswear brand, Puma still trails far behind the top two. That said, compared to other renowned global brands like Asics and Under Armour, Puma holds a stronger position.

However, Puma—a so-called industry pillar—has recently realized it's falling behind in marketing innovation. Whether compared to higher-performing peers like Nike and Adidas or lower-performing ones like Under Armour and Asics, all have already captured a share of the NFT market, while Puma remains idle.

Particularly telling is industry leader Nike, which has invested aggressively in NFTs thanks to its deep pockets.

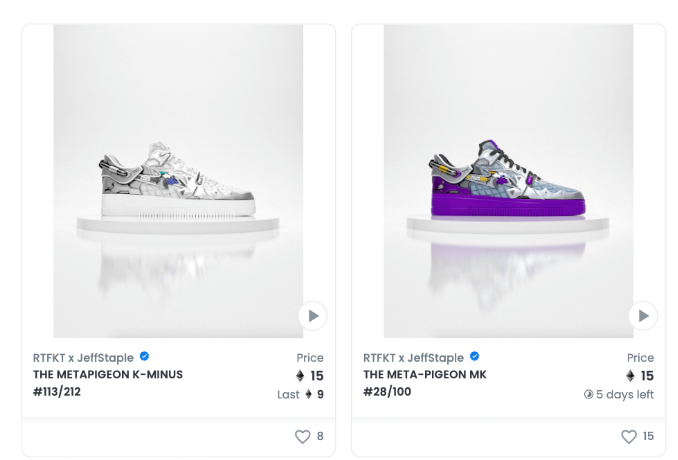

In December 2021, Nike acquired virtual sneaker company RTFKT. The New York Times estimated the deal cost Nike $200 million. RTFKT specializes in NFT sneakers and once sold over 600 pairs in just seven minutes at the beginning of 2021, earning more than $3 million.

RTFKT’s NFT Sneakers

Currently, a single pair of RTFKT NFT sneakers costs roughly 10 ETH (about 170,000 RMB), nearly a hundred times the price of premium physical Nike shoes.

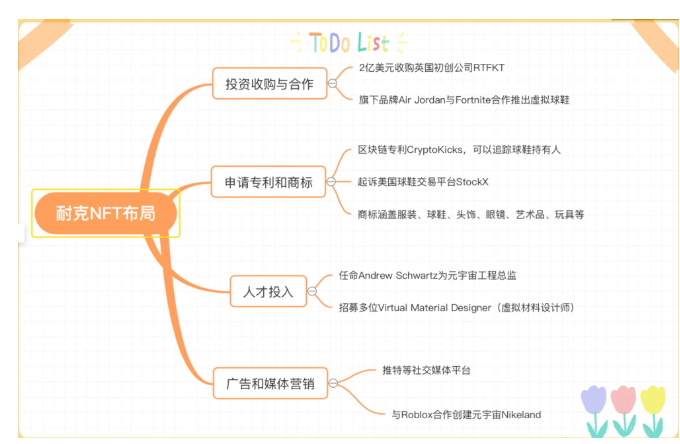

Nike’s NFT strategy is comprehensive—it includes investing in and acquiring specialized NFT sneaker firms, partnering with blockchain companies, recruiting NFT talent, and actively securing relevant trademarks.

Nike’s Full NFT Strategy (Chart by Huxiu)

Nike is also one of the most forward-thinking sportswear giants in terms of technology. As early as 2019, it was reported that Nike filed a patent called “Cryptokicks”—at a time when NFTs were still largely obscure. Major brands place high importance on authenticity and uniqueness of footwear. Nike’s patent enables product traceability and anti-counterfeiting measures: when a customer buys a Nike sneaker, they receive a uniquely generated NFT for that shoe. Since NFTs are recorded on blockchain ledgers and inherently unique, they guarantee the authenticity of the physical product.

As a fellow German sportswear brand, Puma’s longtime rival Adidas is also keeping pace.

In mid-December last year, Adidas launched 30,000 NFTs under its “Into the Metaverse” collection, priced at $800 (around 5,000 RMB) each. They sold out almost instantly, bringing in close to $24 million on its first try—an amount nearly half of Adidas’ Q3 net profit of $500 million.

Adidas is also the most collaborative sportswear brand in the NFT space. It has entered The Sandbox (a blockchain-based virtual gaming world), partnered with Coinbase (a cryptocurrency exchange), and formed alliances with three key partners: Bored Ape Yacht Club NFT; Punk Comics NFT; and AR company G-Money.

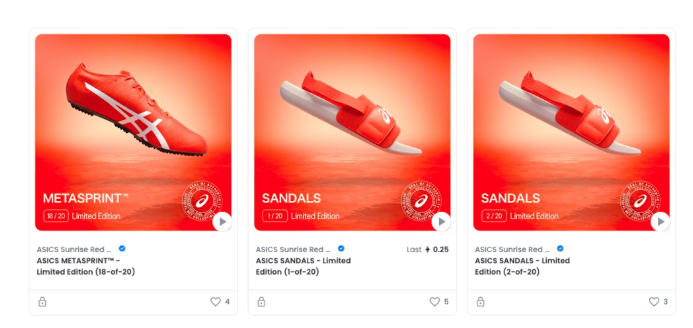

Market leader Nike invests heavily; number two Adidas builds wide networks. Even Asics, neither third nor fourth, claimed the title of first company to release NFT sneakers. In mid-July 2021, Asics debuted nine NFT sneaker designs on OpenSea.

Huxiu observed that although Asics’ NFT sneakers are priced much lower than Nike’s—many at 0.2 ETH (3,386 RMB)—they still cost significantly more than regular Asics physical shoes.

Asics NFT Sneakers

While other brands have forged their own distinct paths in NFT development, Puma is now seeking change.

Rename: Planting Roots Where the Youth Gather

To differentiate itself from other global sportswear brands, Puma first looked to innovate around its brand logo.

Whether Nike, Adidas, Under Armour, or Asics, their logos are abstract symbols—simple and effective, but lacking concrete imagery. Puma, however, features a leaping puma in its logo, symbolizing speed and agility.

Even before the official rename, Puma had already begun consciously collecting NFTs of pumas and other feline animals, organizing them into a browsable “museum” experience that left a strong impression. These include: Gutter Cat #1110, Lazy Lions NFT, Cool Cats NFT, and Kuddle Koala NFT.

Today, both international NFT platforms and domestic digital collectible platforms launched by Alibaba and Tencent commonly aggregate individual or corporate NFT collections into “museums.” Many Web3 users enjoy browsing others’ collections, and recognition of these collections often translates into brand affinity.

For instance, the author owns only two NFTs (digital collectibles) on Whale Explore, Alibaba’s NFT platform, yet already has nearly 20 followers. Observations suggest many NFT enthusiasts have purchased dozens of items and carefully designed their own “NFT museums” to showcase their digital assets.

A Domestic Digital Collectibles Platform

NFT platforms are emerging as new social spaces—precisely why Nike, Adidas, and Puma refuse to miss this opportunity. Anywhere youth gather, sportswear brands will follow.

By collecting feline-themed NFTs, Puma has attracted NFT and Web3 enthusiasts on Twitter, growing its follower base to 1.8 million—and counting. Simultaneously, its selective curation reinforces user perception of the brand identity.

Another breakthrough in Puma’s NFT strategy is the “rename”—changing its Twitter handle from PUMA to “PUMA.eth”.

Updating names and bios on Twitter to signal commitment to crypto and Web3 is common practice. Sequoia Capital previously changed its mission statement from “helping daring founders build iconic companies” to “from idea to execution, we help daring people build great DAOs.” However, among global sportswear brands, Puma is the first to purchase an .eth domain NFT and adopt this renaming tactic.

Other companies owning .eth domains include Budweiser, which acquired Beer.eth for 30 ETH. Notably, Puma ranks 13th on the .eth leaderboard, which ranks Twitter accounts by popularity based on follower count.

Whether Puma, Budweiser, or Sequoia Capital, the ultimate goal of renaming is to align with their target audiences. Sequoia has allocated 25% of its funds to the crypto sector, believing its clients may shift from startups to DAOs. Puma and Budweiser, serving individual consumers, recognize that more users are migrating toward NFTs and Web3, prompting proactive moves into this space.

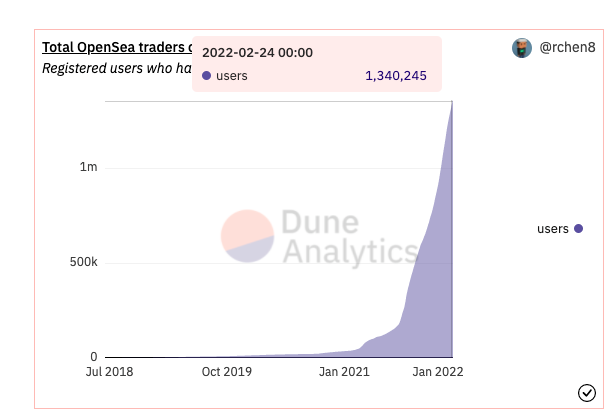

OpenSea User Count

According to Dune Analytics, as of February 24, 2022, OpenSea alone had over 1.34 million NFT users—a number continuing to grow rapidly. Reports indicate Alibaba’s NFT digital collectibles platform has surpassed five million users. Huxiu observes Tencent’s NFT platform also boasts significant traction: according to public data, each NFT series launch attracts over 100,000 participants competing for limited editions.

With vast numbers of new users entering the market, sportswear giants continue doubling down on NFT investments.

Today, Puma not only posts job listings on LinkedIn for a “Cultural Innovation Manager” with deep knowledge of NFTs, the metaverse, and DAOs, but also sponsors popular athletes involved in blockchain, including Lamelo Ball, Stephen Curry, and Michael Jordan.

A Long-Planned 'Cultural War'

An industry insider told Huxiu: There are already hundreds of NFT digital collectibles platforms in China of varying sizes—more than 30 of which the author has personally engaged with—alongside countless NFT series. Yet fewer than 1% may survive in the long run.

This mirrors the “Group Buying Wars” of the internet era around 2010, when over 5,000 group-buying startups emerged. By 2014, only about 100 remained; today, just a few like Meituan dominate.

Currently, the most prominent NFTs—such as CryptoPunks and Bored Apes (BAYC)—each carry distinct cultural identities. Behind CryptoPunks lies artistic inspiration from Andy Warhol, with variations in skin tone and hairstyle reflecting global racial diversity. Similarly, the Bored Ape team includes creators of diverse ethnicities—each ape representing a unique aesthetic vision.

Artists use NFTs to merge modern technology with contemporary human consciousness, offering users symbolic identities. This is partly why Adidas chose to partner with the Bored Ape Yacht Club and Puma teamed up with CatBlox—they deliver culturally resonant values to users.

So far, only the Bing Dwen Dwen NFT has achieved notable international influence, bolstered by the Winter Olympics and the panda’s global appeal. China still lacks an NFT phenomenon born purely from market forces.

NFTs originated and gained traction overseas nearly three years ago, but only entered China in the second half of 2021. Most Chinese NFT companies have existed for less than six months, whereas many foreign projects—like RTFKT and Bored Ape—were founded one to two years ago and are now valued at hundreds of millions of dollars. Opensea, the leading NFT marketplace, is already valued at $1.5 billion. These diverse ventures offer sportswear giants like Nike and Adidas a wealth of strategic options.

Currently, Chinese sportswear giants limit their NFT (digital collectible) efforts to releasing crude, image-based digital collectibles—a constraint stemming from the short history and narrow public adoption of digital collectibles in China. But with tech giants entering the space and startups flooding in, it’s likely that within one or two years, China will see a wave of NFT projects and platforms valued at over 100 million yuan.

Anta and Li-Ning aren’t short on capital—they’re missing only a culturally defining IP that captures the spirit of the age and resonates widely, along with a healthy supporting blockchain ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News