Hotcoin Research: Gold Hits New High Then Pulls Back; BTC Breaches Key Moving Average—Market Logic Is Fragmenting

TechFlow Selected TechFlow Selected

Hotcoin Research: Gold Hits New High Then Pulls Back; BTC Breaches Key Moving Average—Market Logic Is Fragmenting

The current market is at a critical juncture—highly sensitive and shaped by the interplay of technical and macro factors—where any forecast should be viewed as a probabilistic test of key levels, not a deterministic path.

Crypto Market Performance

Currently, the total crypto market capitalization stands at $2.8 trillion, with BTC accounting for 59.2% ($1.65 trillion). Stablecoin market cap totals $30.58 billion, down 0.99% over the past 7 days; USDT represents 60.59% of this total.

Among the top 200 projects on CoinMarketCap, most declined while a minority rose: BTC fell 7.44% over 7 days, ETH fell 10.91%, SOL fell 8.68%, HYPE rose 29.78%, and SENT rose 40.03%.

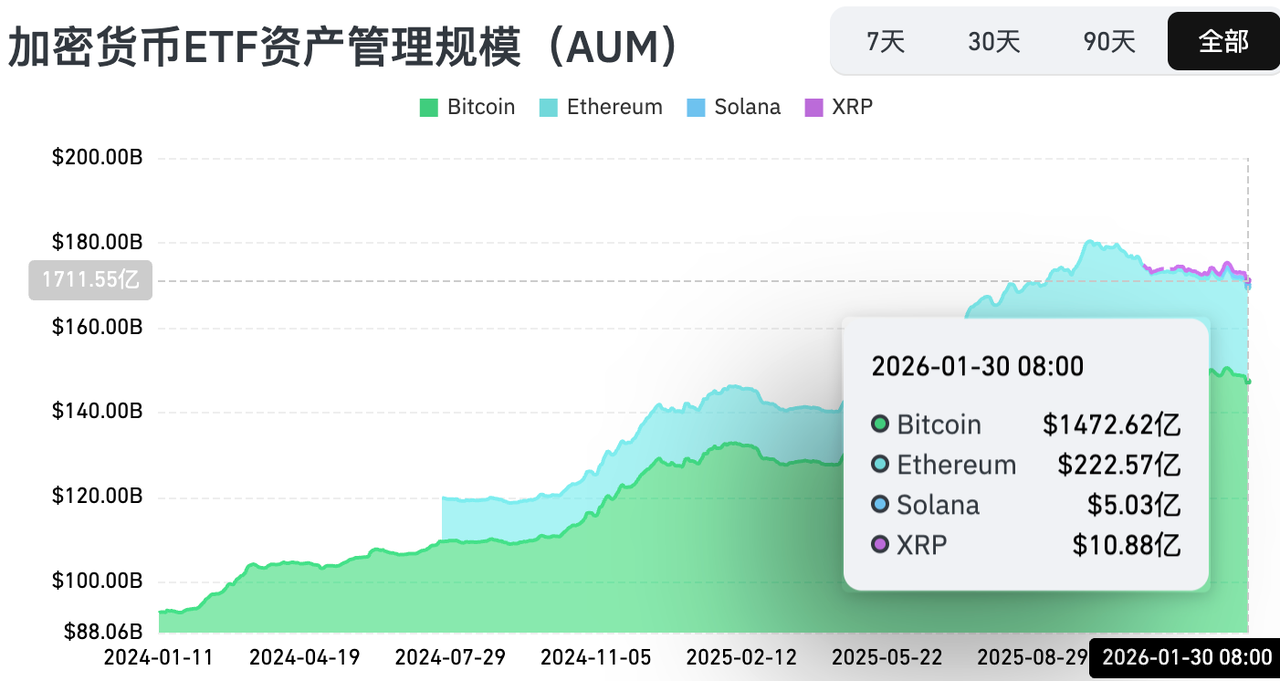

This week, U.S. spot Bitcoin ETFs recorded net outflows of $1.487 billion; U.S. spot Ethereum ETFs recorded net outflows of $327.5 million.

Market Outlook (Feb 2–8):

The current RSI stands at 35.17 (weak zone), the Fear & Greed Index at 21 (fear zone), and the Altseason Index at 41 (neutral, up from last week).

This week, gold, silver, and BTC surged sharply ahead of the Fed’s policy announcement—only to pull back rapidly afterward. Markets now sit at a highly sensitive inflection point where technical and macro factors are tightly interwoven. Any forecast should thus be viewed as a probabilistic test of key levels—not a deterministic roadmap. Investors should observe carefully:

- Technical Lifeline: BTC’s 50-week moving average

This is currently the most watched technical indicator. If BTC closes above this level consistently (e.g., for 2–3 weeks), it may reverse short-term weakness; failure to sustain above it will intensify downward pressure.

- Funding Barometer: U.S. Spot Bitcoin ETF Flows

A window into institutional sentiment. Last week’s outflows weighed on markets; sustained net inflows next week would provide critical support.

- Macro Environment: Fed Policy Expectations

Post-FOMC, shifting market expectations around rate cuts continue to influence all risk assets. Any commentary or data related to interest rates could trigger volatility.

Understanding the Present

Weekly Recap: Key Events

- Jan 26: The U.S. Navy’s “Abraham Lincoln” Carrier Strike Group arrived in the Middle East; spot gold hit an all-time high above $5,000/oz;

- Jan 26: According to the Seoul Economic Daily, Cha Myung-hoon—the majority shareholder and Chairman of the Board of Korean crypto exchange Coinone—is considering selling part of his stake. Through his personal firm The One Group (3.430%) and direct holdings (19.14%), he holds a combined 53.44% of Coinone. Coinone representatives confirmed ongoing discussions with overseas exchanges and domestic financial institutions regarding equity investment partnerships—but no final structure has been decided;

- Jan 30: Geopolitical tensions escalated further as the U.S. deployed additional naval forces to the Middle East;

- Jan 30: The Cryptocurrency Market Structure Act (CLARITY Act) passed the Senate Agriculture Committee—but partisan divisions between Democrats and Republicans deepened;

- Jan 29: Citrea—a Bitcoin ZK-rollup project backed by Founders Fund and Galaxy Ventures—launched its mainnet, introducing DeFi lending backed by BTC, structured products, and ctUSD, a native USD stablecoin, aiming to integrate “idle Bitcoin” into full DeFi and payment ecosystems;

- Jan 30: Binance announced plans to gradually convert its $1 billion stablecoin reserve into Bitcoin, completing the shift within 30 days; if market volatility causes the reserve value to fall below $800 million, Bitcoin will be added to restore the $1 billion target;

- The Hidden Hand Behind Gold’s Surge: Tether—the “crypto printing press”—has accumulated 140 tons of gold;

- Jan 29: SEC Chair Paul Atkins told CNBC in an interview that “now is the time” to allow crypto assets in 401(k) retirement accounts—a statement that heightened market attention on crypto’s path into mainstream finance;

- Jan 30: Donald Trump announced on Truth Social his intention to nominate Kevin Warsh—a seasoned economist and former Fed governor—as the next Federal Reserve Chair.

Macroeconomic Updates

- Jan 28 at 22:45 (GMT+8): The Bank of Canada held its benchmark rate steady at 2.25%;

- Jan 29 at 03:00 (GMT+8): The Federal Reserve held its benchmark rate steady at 3.75%;

- Jan 29: U.S. initial jobless claims for the week ending Jan 24 totaled 209,000—above the 205,000 consensus and up from the prior week’s revised figure of 210,000 (previously reported as 200,000);

- Jan 30: Per CME’s “FedWatch” tool: Probability of a 25-basis-point cut by March stands at 15.3%, with an 84.7% chance of unchanged rates; probability of a cumulative 25-basis-point cut by April is 29.7%, unchanged rates at 67.2%, and a cumulative 50-basis-point cut at 3.2%; probability of a cumulative 25-basis-point cut by June is 48.3%, unchanged rates at 33.7%, and a cumulative 50-basis-point cut at 16.4%.

ETF Updates

From Jan 26–30, U.S. spot Bitcoin ETFs recorded net outflows of $1.487 billion. As of Jan 30, Grayscale’s GBTC had cumulatively outflowed $25.658 billion and currently holds $13.366 billion; BlackRock’s IBIT holds $65.095 billion. Total U.S. spot Bitcoin ETF market cap stands at $111.691 billion.

U.S. spot Ethereum ETFs recorded net outflows of $327.5 million.

Looking Ahead

Industry Conferences

- Consensus Hong Kong 2026 will be held Feb 11–12 in Hong Kong, China;

- ETHDenver 2026 will take place Feb 17–21 in Denver, USA;

- EthCC 9 will run Mar 30–Apr 2 in Cannes, France. The Ethereum Community Conference (EthCC) is one of Europe’s largest and longest-running annual Ethereum events—focused on technology and community development.

Project Updates

- Aster will launch its sixth airdrop campaign—“Convergence”—from Feb 2 to Mar 29, 2026, distributing 0.8% of total supply (~64 million ASTER tokens);

- MagicBlock—a blockchain gaming engine—will initiate BLOCK token presale on Feb 5;

- Berachain granted Nova Digital (a fund under Brevan Howard) special refund rights in its Series B financing: Nova Digital may request a full refund within one year after TGE, with the deadline set for Feb 6, 2026. Crypto lawyers note this may violate Most Favored Nation (MFN) clauses and SEC anti-fraud requirements.

Key Events

- The Securities and Futures Commission (SFC) of Hong Kong requires licensed virtual asset providers to transition to its new Suspicious Transaction Reporting (STR) system by Feb 2 to enhance automation and analytical capabilities—improving both STR analysis and financial intelligence dissemination efficiency;

- Feb 4 at 21:15 (GMT+8): U.S. ADP Employment Change (Jan, in thousands);

- Feb 5 at 20:00 (GMT+8): UK Bank Rate Decision (to Feb 5);

- Feb 5 at 21:15 (GMT+8): Eurozone ECB Deposit Facility Rate (to Feb 5);

- Feb 5 at 21:30 (GMT+8): U.S. Initial Jobless Claims (week ending Jan 31, in thousands);

- Feb 6 at 21:30 (GMT+8): U.S. Unemployment Rate (Jan).

Token Unlocks

- Ethena (ENA): 40.63 million tokens unlock on Feb 2, valued at ~$6.19 million (0.55% of circulating supply);

- XDC Network (XDC): 840 million tokens unlock on Feb 5, valued at ~$30.61 million (5% of circulating supply);

- Hyperliquid (HYPE): 9.92 million tokens unlock on Feb 6, valued at ~$308 million (2.79% of circulating supply);

- Bouncebit (BB): 29.77 million tokens unlock on Feb 7, valued at ~$1.31 million (2.97% of circulating supply).

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, transforms professional analysis into your practical edge. Our weekly “Insights” and in-depth reports dissect market dynamics; our exclusive “Hotcoin Select” program—powered by AI + expert curation—identifies high-potential assets to reduce trial-and-error costs. Each week, our analysts also host live sessions on Hotcoin Live to unpack trending topics and anticipate market shifts. We believe empathetic companionship paired with expert guidance empowers more investors to navigate cycles—and capture Web3’s value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News