Web3 Job Market Review 2025: Who Is Earning, and Who Is Just Working for Pay?

TechFlow Selected TechFlow Selected

Web3 Job Market Review 2025: Who Is Earning, and Who Is Just Working for Pay?

The spark still exists.

Author: antoniayly, TechFlow

In 2025, the crypto industry presents a subtle buzz. Various ETFs are lining up for listing, regulatory frameworks are being rolled out across countries, and traditional institutions are succumbing to FOMO—crypto seems to be embraced by old money as a trendy new asset class. On social media, people share screenshots of $10,000 monthly salaries or stable arbitrage strategies, tempting many outsiders to jump in.

But behind the hype, what is the real experience of working in Web3? Who is hiring? What kind of talent are they seeking? How much are they paying? For those trying to enter or already in the space, are they thriving, lost, or regretful?

To answer these questions, we surveyed major industry job portals including web3.career, cryptojobslist, Dejob, abetterweb3, major exchange career pages, Solana and Arbitrum ecosystem job boards, analyzing over 18,000 job postings and over 2,700 job seeker profiles to explore:

-

The 2025 hiring trends, popular roles, salary structures, and geographic distribution across different types of Web3 companies—to glimpse what preparations Web3 firms are making;

-

The skill sets, salaries, remote work ratios, layoff experiences, and most-loved/most-hated/dream companies among Chinese-speaking Web3 job seekers—to paint a realistic portrait of the industry’s talent landscape.

Summary:

-

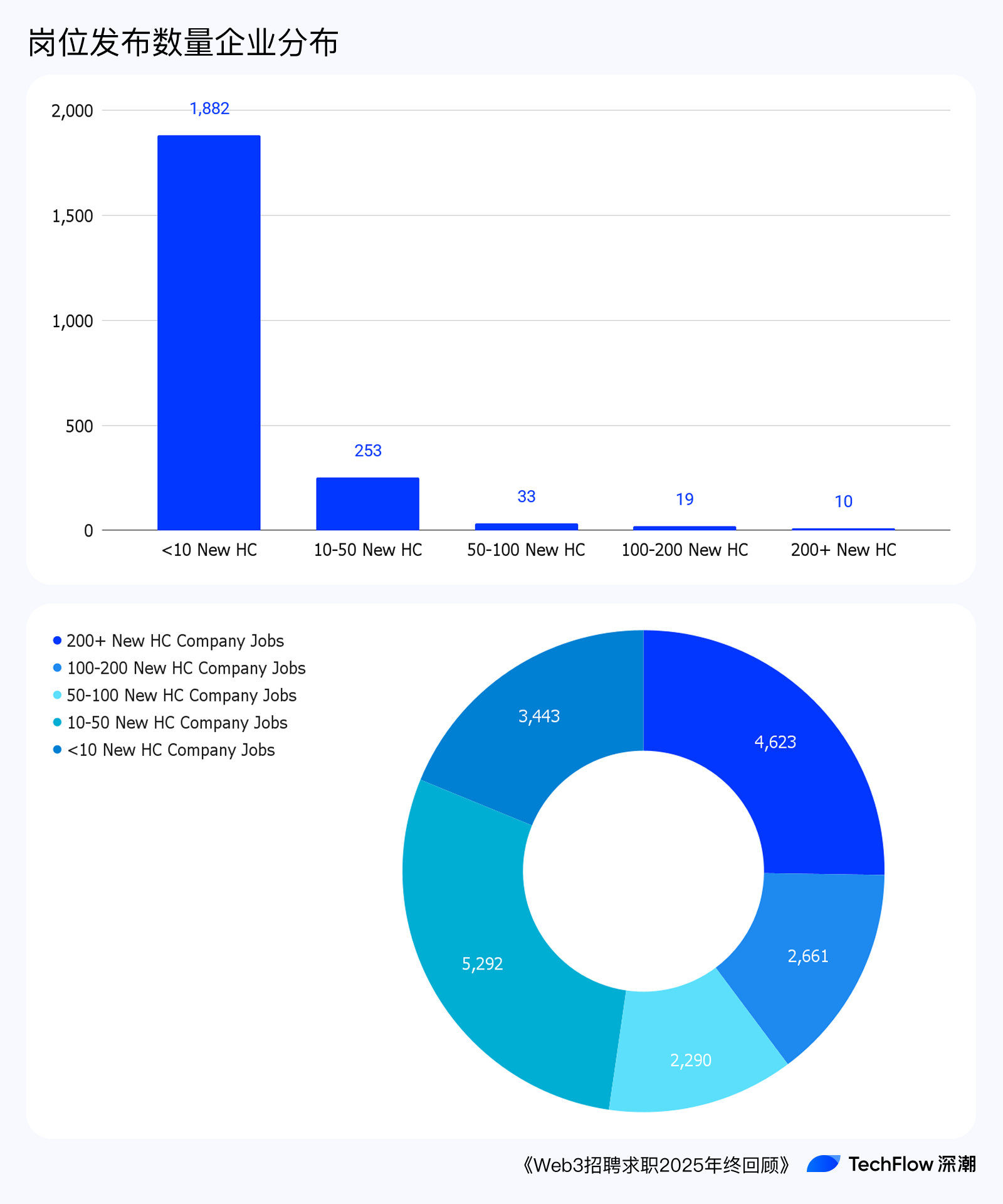

The job market shows a strong Matthew effect: only dozens of large Web3 companies have over 100 headcounts (HC), yet their positions account for 40% of all jobs.

-

Engineers (developers) make up 32% of all job openings; "compliance"-related roles rank 7th in top 10, reflecting the industry's active transformation amid the compliance wave.

-

Tech stack demand centers on AI, blockchain, and backend development; native chain languages like Solidity and Move remain relatively niche.

-

90% of jobs support remote work; 8.8% offer part-time roles (33.7% among Chinese-language job posts).

-

Chinese-speaking candidates earn 70–80% less than global peers; in RMB terms, their pay aligns with mid-to-small-sized internet firms in China.

-

Many Chinese job seekers come from major Web2 tech giants; 10% have over 10 years of professional experience.

-

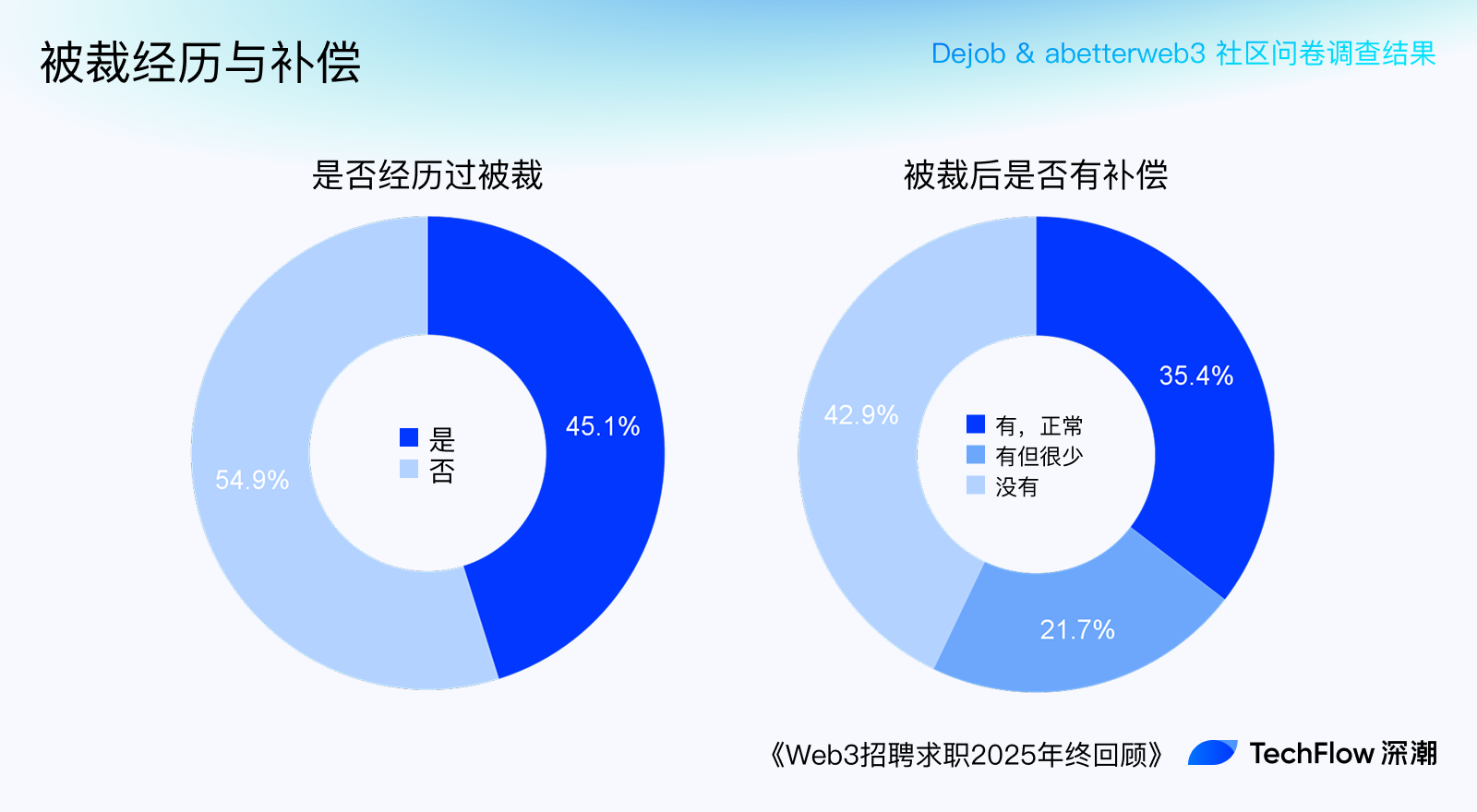

Nearly half have experienced layoffs, with no compensation received afterward.

-

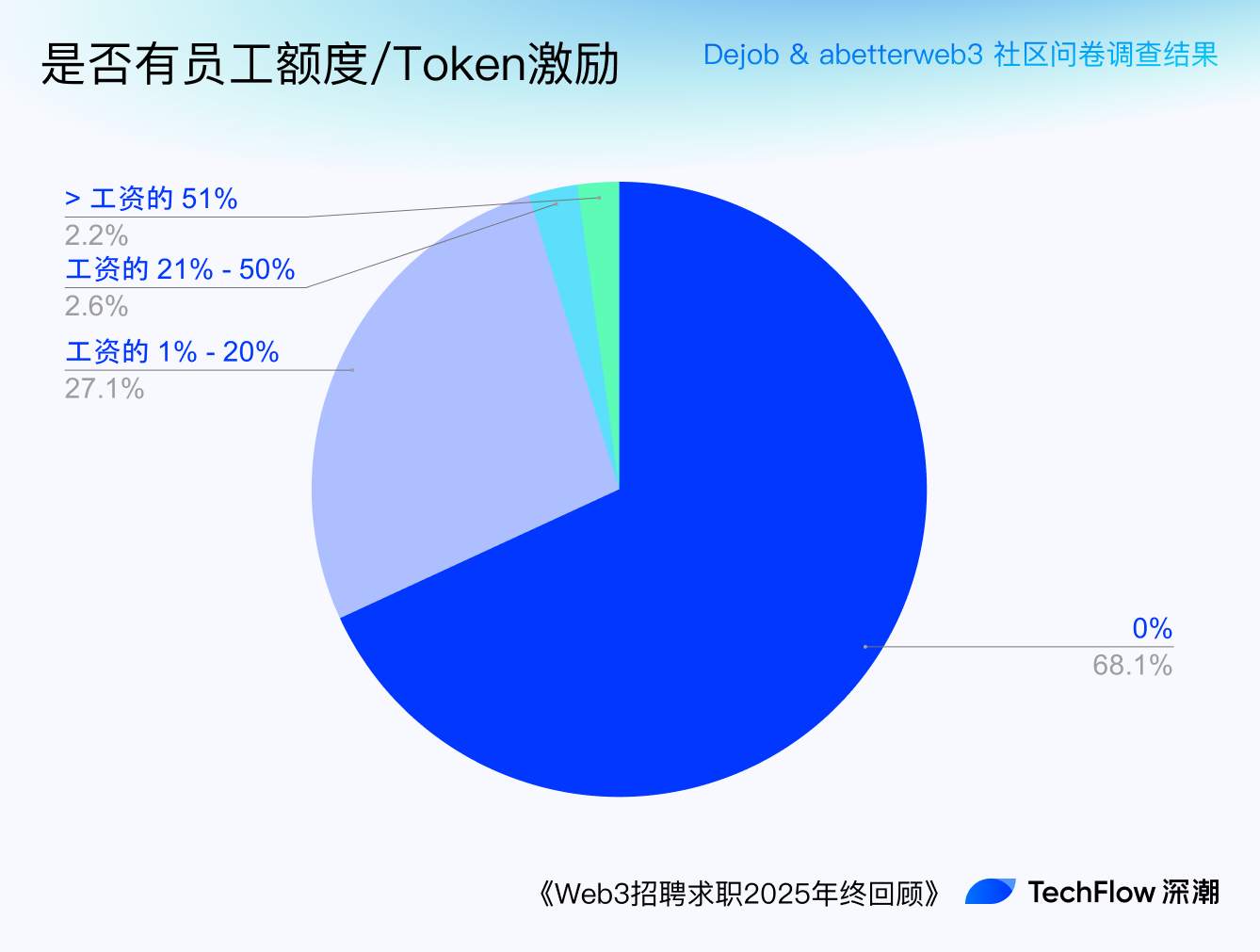

Close to 70% receive no token or equity incentives at work.

-

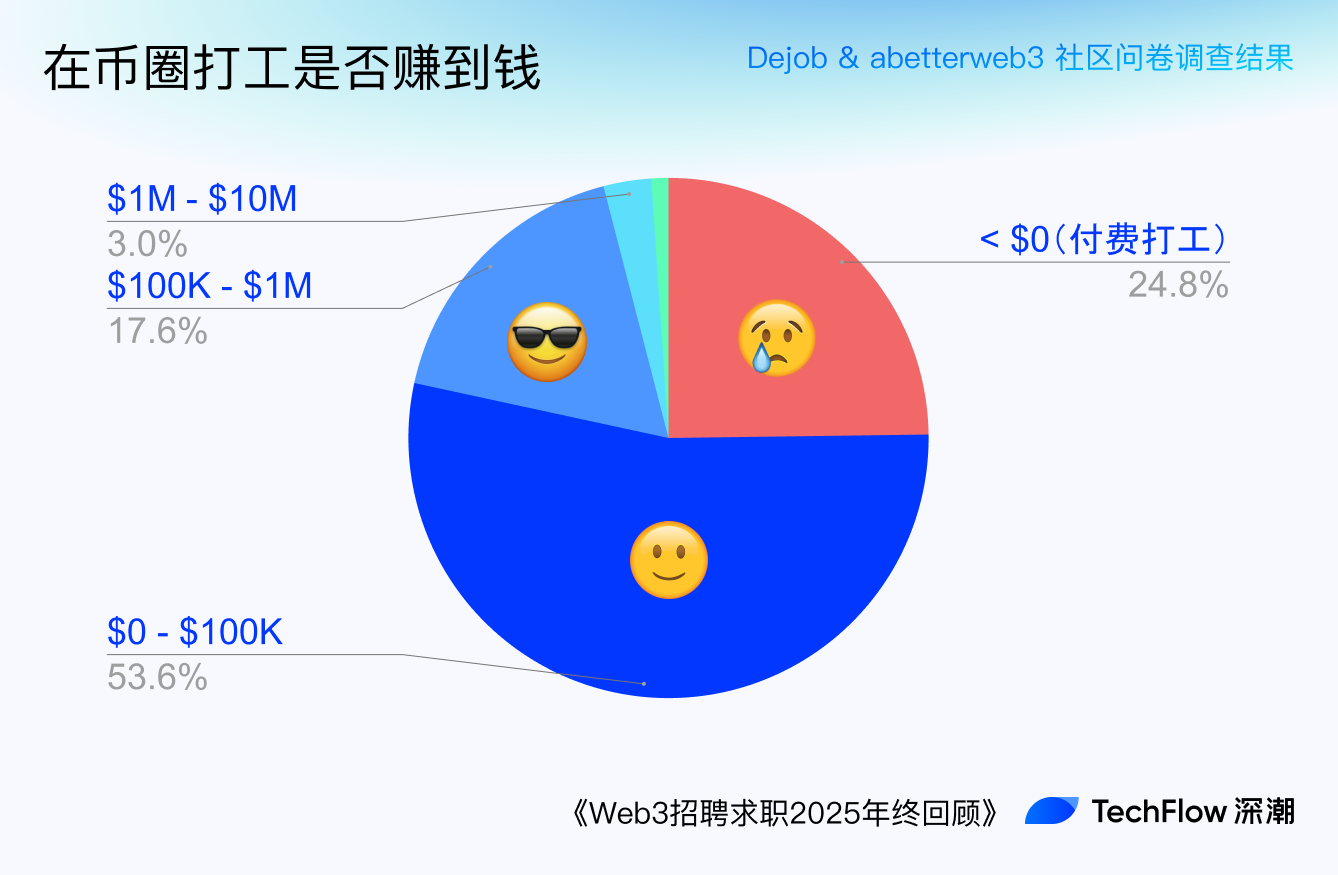

25% of survey respondents are effectively “paying to work” (net financial loss since entering crypto).

-

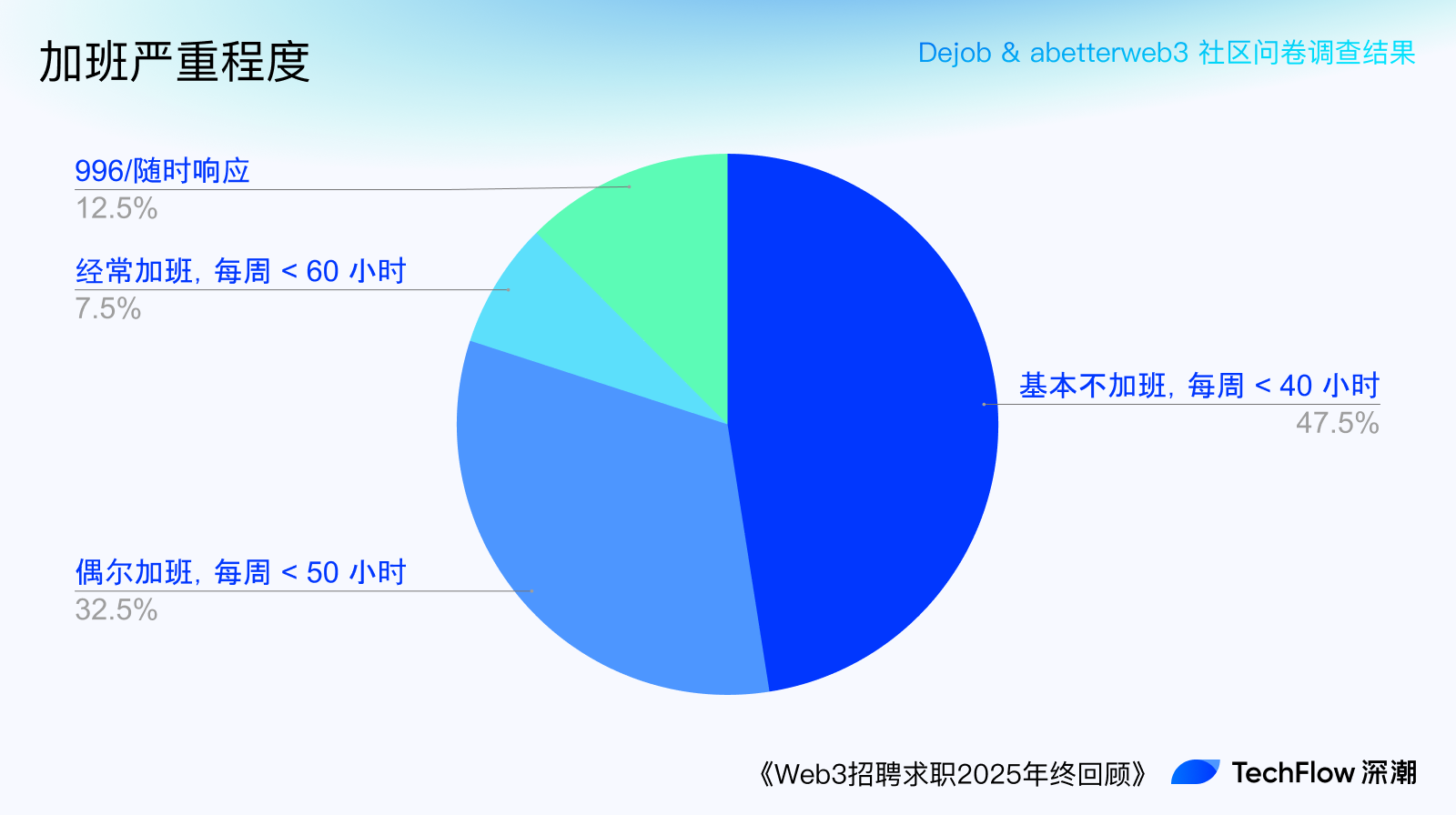

80% work 40–50 hours per week, indicating relatively mild overtime.

A PDF version of this article is available for browsing or downloading on other devices. Access it via the link below👇

https://docsend.com/view/sgnw468tnq2gjf2e

1. Web3 Hiring: Preparing for the Next Compliance Era

1.1 Who Is Hiring

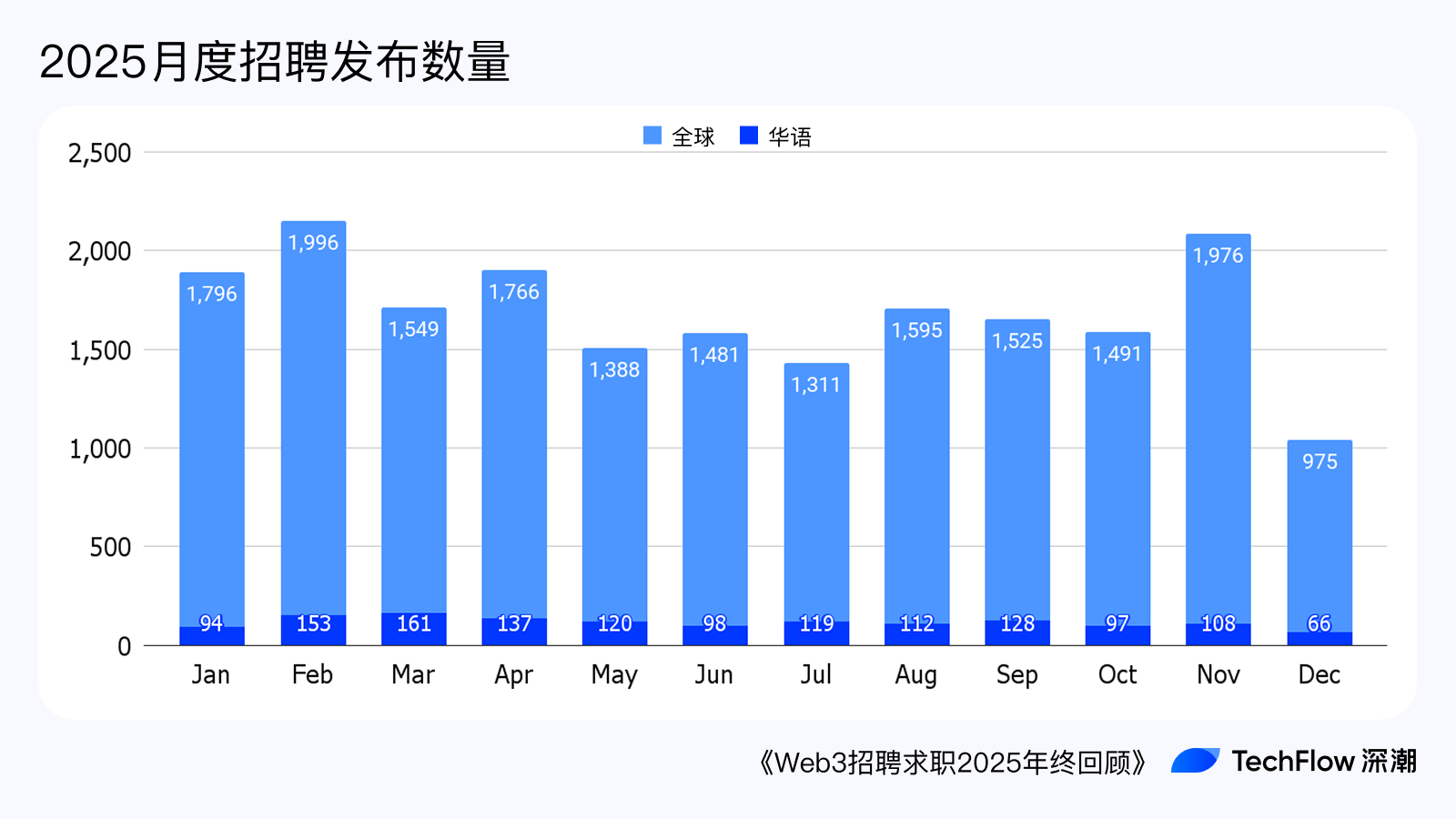

The Web3 job market in 2025 remained relatively stable throughout the year, though fluctuations in certain months reveal common hiring patterns.

Job postings rose in January and February, typically due to companies allocating roles based on annual plans. A surge before December may reflect staff departures or job hopping ahead of the Christmas/New Year holidays, creating numerous vacancies.

The sharp drop in HC (Head Count) in December reflects the month’s role as a closing and vacation period.

For Chinese-speaking regions, where January and February often coincide with Lunar New Year, many companies plan hires in March and April, leading to peaks during those months.

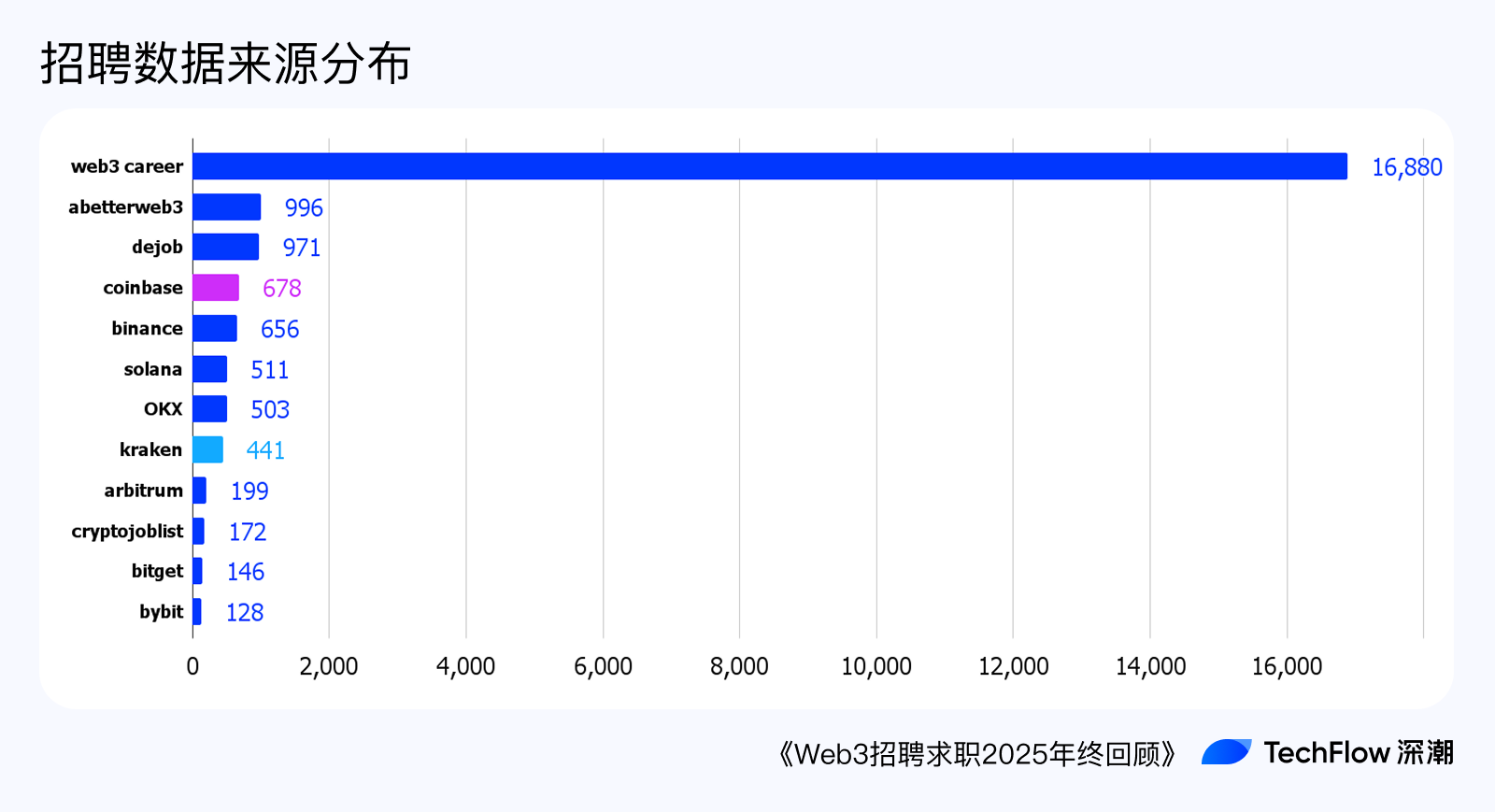

Among recruitment channels, web3.career emerged as the top choice for both employers and job seekers due to its efficient remote job filtering and extensive listings, far surpassing others in volume.

Next are Chinese-focused platforms Dejob and abetterweb3. Many Chinese founders prefer native-language collaboration, driving demand for fluent Chinese talent.

Then come official career pages of major exchanges such as Binance, OKX, Coinbase, etc. However, since exchanges often post on both Chinese and international platforms, there may be data overlap.

The Solana ecosystem job board posted 515 roles in 2025 (traced back to April 2025). For Ethereum, we focused on the Arbitrum ecosystem job page, which published 194 roles annually. These two serve as primary gateways for non-exchange chain-based ecosystem jobs.

Compared to December 2024, Solana’s job page saw significant growth (298 → 514, +72.5%), while other platforms showed varying degrees of decline—though OKX may have simply underutilized its official page last year.

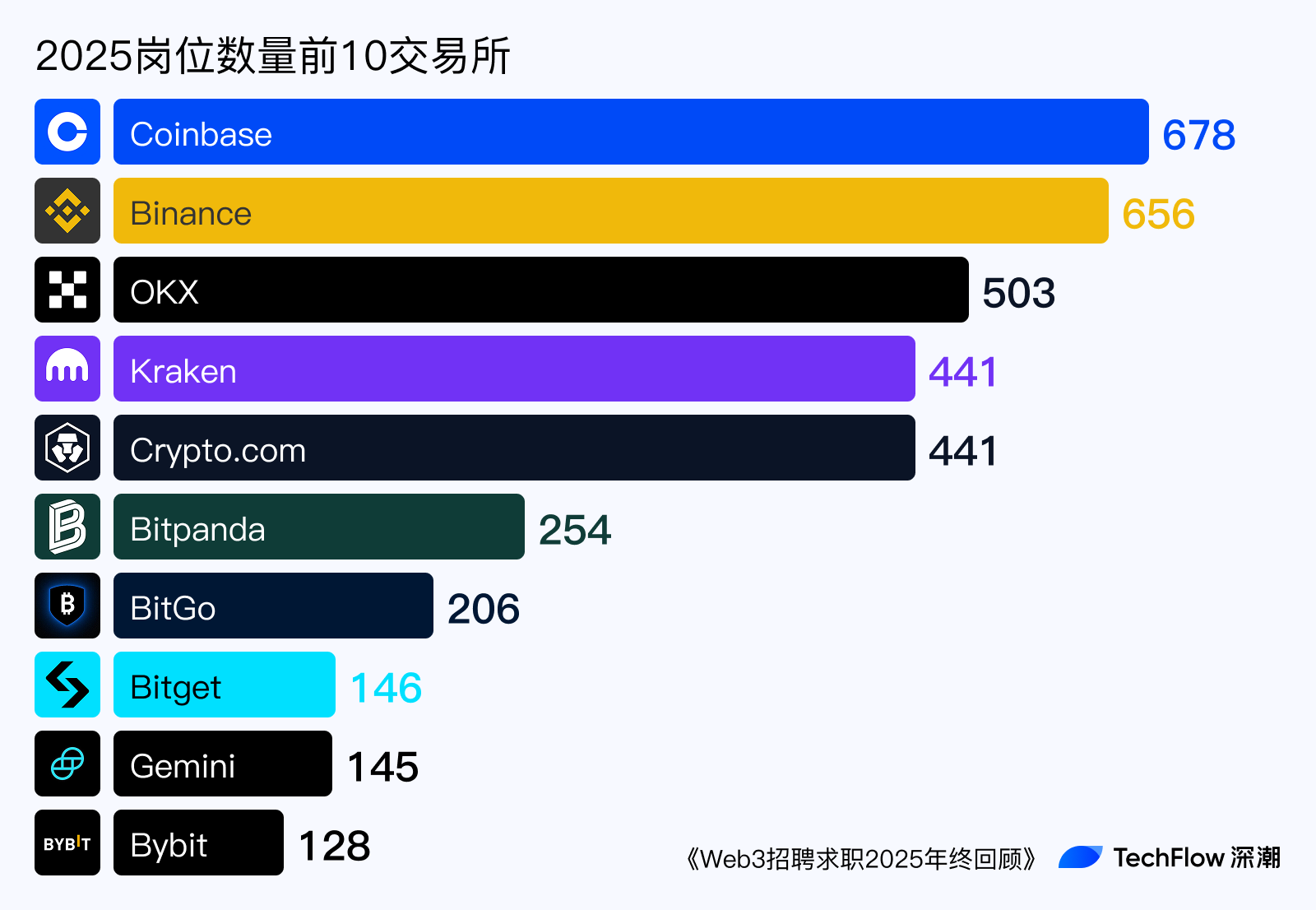

Across all channels, the top 10 exchanges by 2025 job volume were:

Coinbase, as a long-standing U.S.-based compliant exchange, aggressively expanded amid this year’s regulatory tailwinds. Other exchanges grew at normal rates, neither overly aggressive nor conservative—fitting the volatile bull-bear cycle typical of crypto.

However, exchanges frequently adjust business lines, possibly resulting in repeated job postings and cancellations.

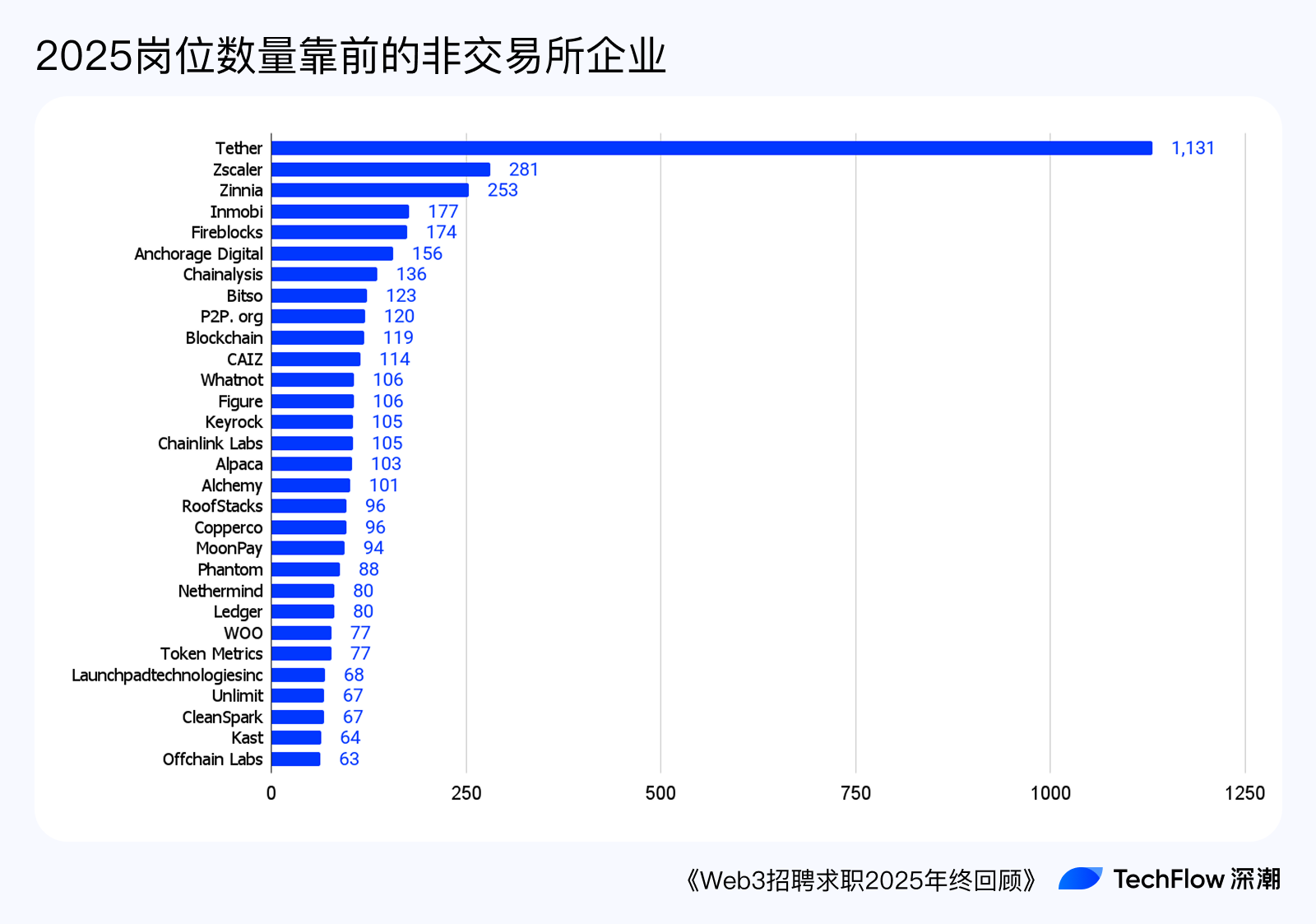

Among non-exchange companies, Tether stood out with over 1,000 HCs, demonstrating strong profitability and resilience. Other sectors lagged clearly behind exchanges, with high-volume employers mainly concentrated in mature areas like security and custody services.

It’s evident that top-tier firms dominate hiring: only dozens of companies posted over 100 jobs annually, yet they accounted for 40% of total positions. Hundreds of mid-sized firms posting 10–50 jobs each contributed nearly 30%. Meanwhile, over 1,800 companies posted fewer than 10 jobs, collectively making up just 18% of total openings.

1.2 What Roles Are Being Hired

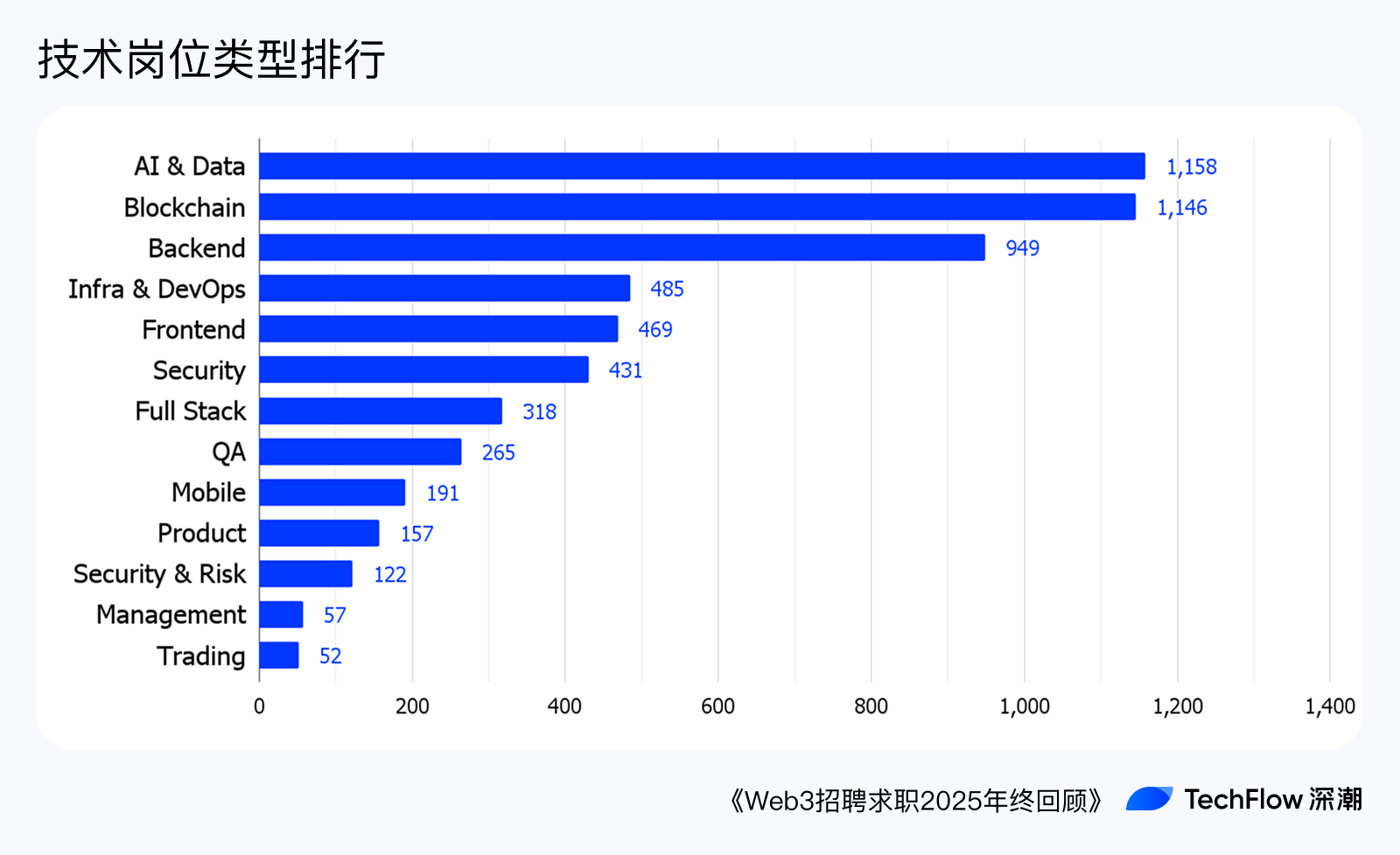

In terms of role categories, the top 10 among 18,508 valid data points were:

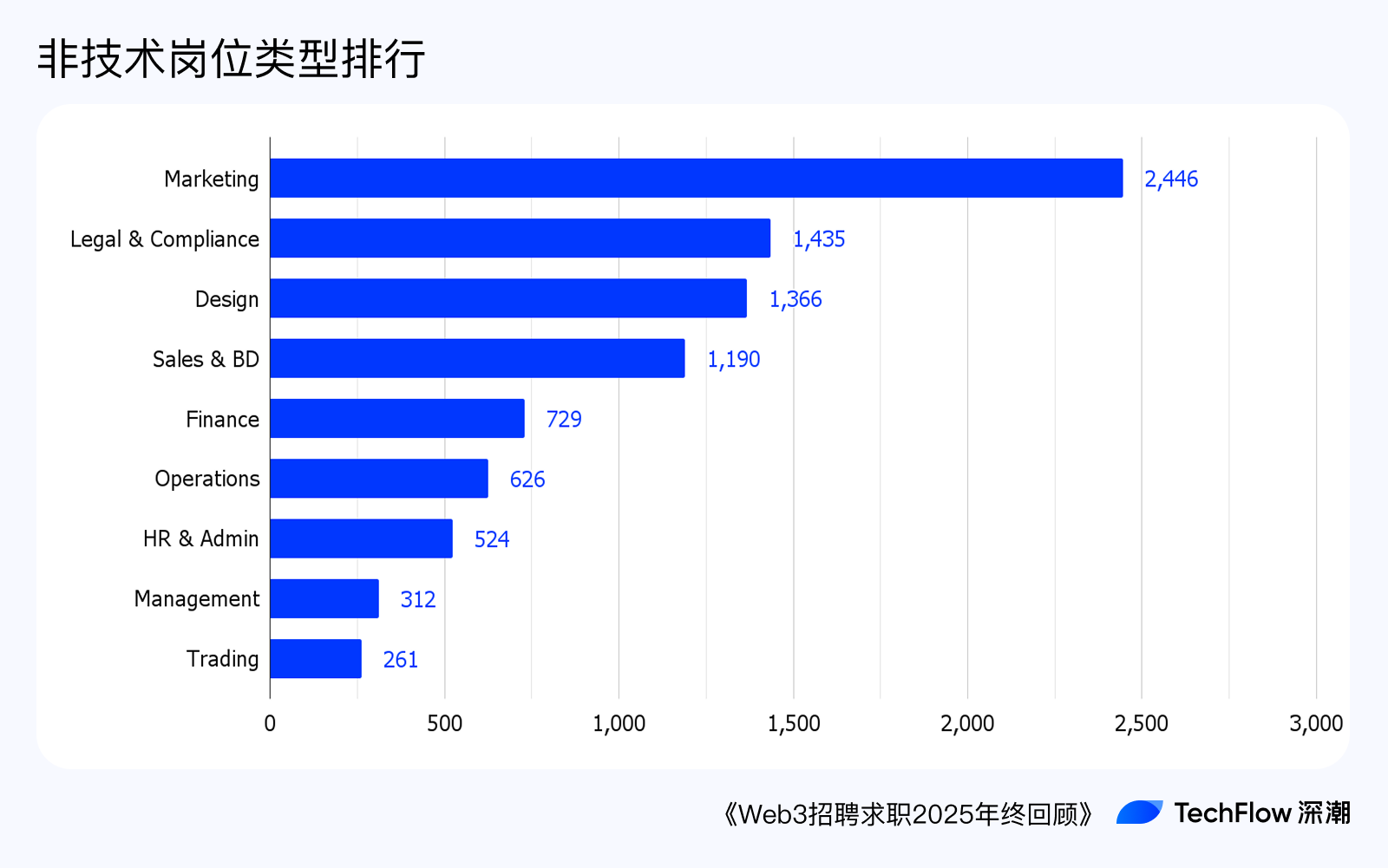

Engineers (developers) naturally lead demand, making up 32% of all job openings. Marketing follows closely, underscoring that user acquisition and growth remain evergreen priorities.

Notably, "compliance"-related roles ranked 7th in the top 10, signaling proactive adaptation by ambitious firms amid the sweeping compliance trend.

Technical roles in high demand include:

-

AI & Data – 1,158 roles

-

Blockchain – 1,146 roles

-

Backend – 949 roles

-

Infra & Operations – 485 roles

-

Frontend – 469 roles

-

Security – 431 roles

-

Full-stack – 318 roles

-

QA – 265 roles

-

Mobile – 191 roles

-

Product (technical product) – 157 roles

AI/data and blockchain development leads by a wide margin, followed by backend, infrastructure, operations, and security—roles critical to decentralized networks—then frontend, full-stack, QA, and mobile, transitioning gradually toward end-user layers.

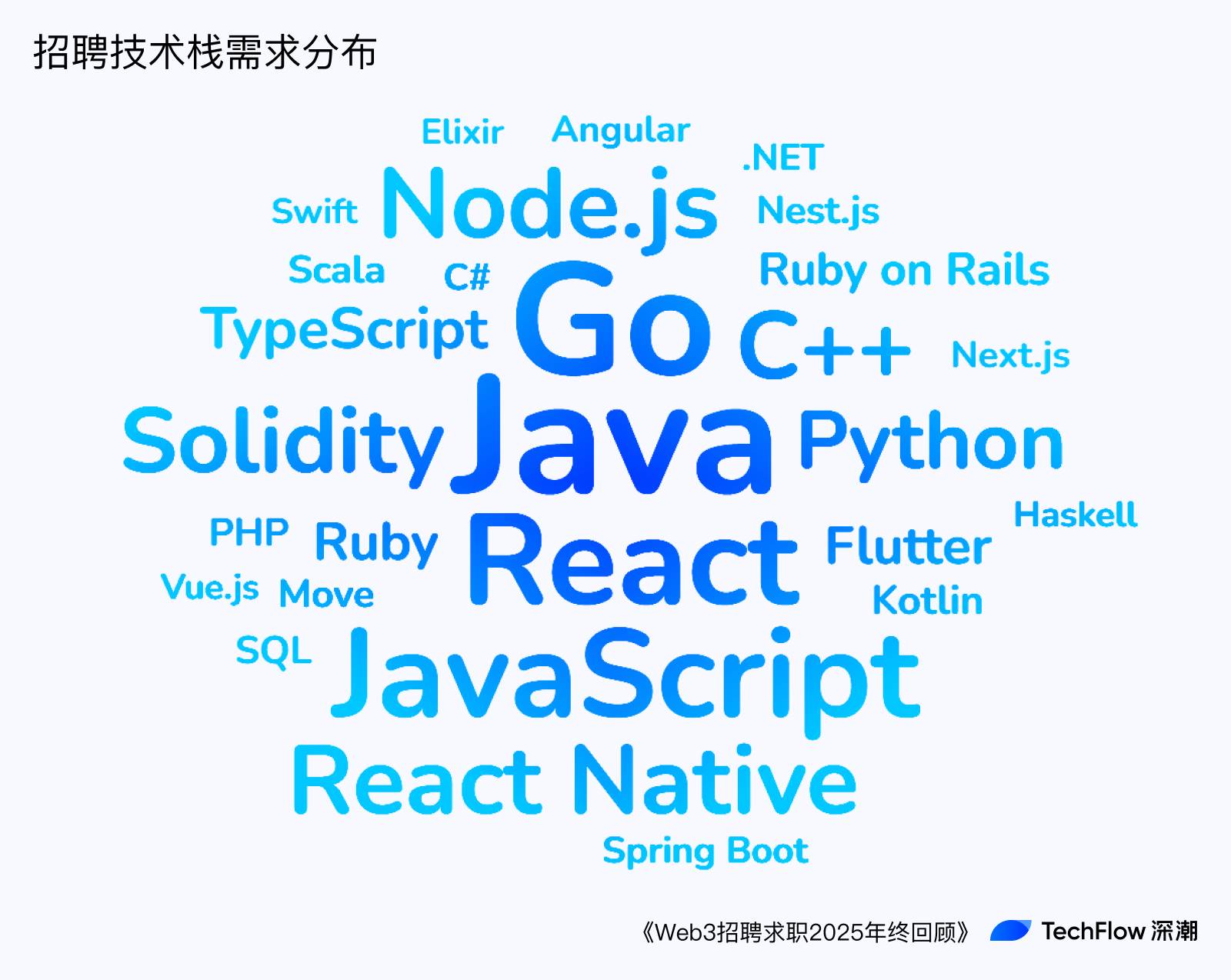

In programming languages, mainstream backend languages like Rust, Java, and Go dominate. Rust stands out due to its performance and safety advantages.

Frontend stacks like JavaScript/TypeScript and React follow closely, reflecting strong demand for frontend and full-stack developers.

Languages such as Node.js, C++, Kotlin, Ruby, and Scala have niche use cases. Chain-native languages like Solidity and Move remain relatively obscure.

Among non-technical roles, legal/compliance makes up a significant portion. As previously noted, legal and compliance functions are now essential for established crypto firms entering a new chapter.

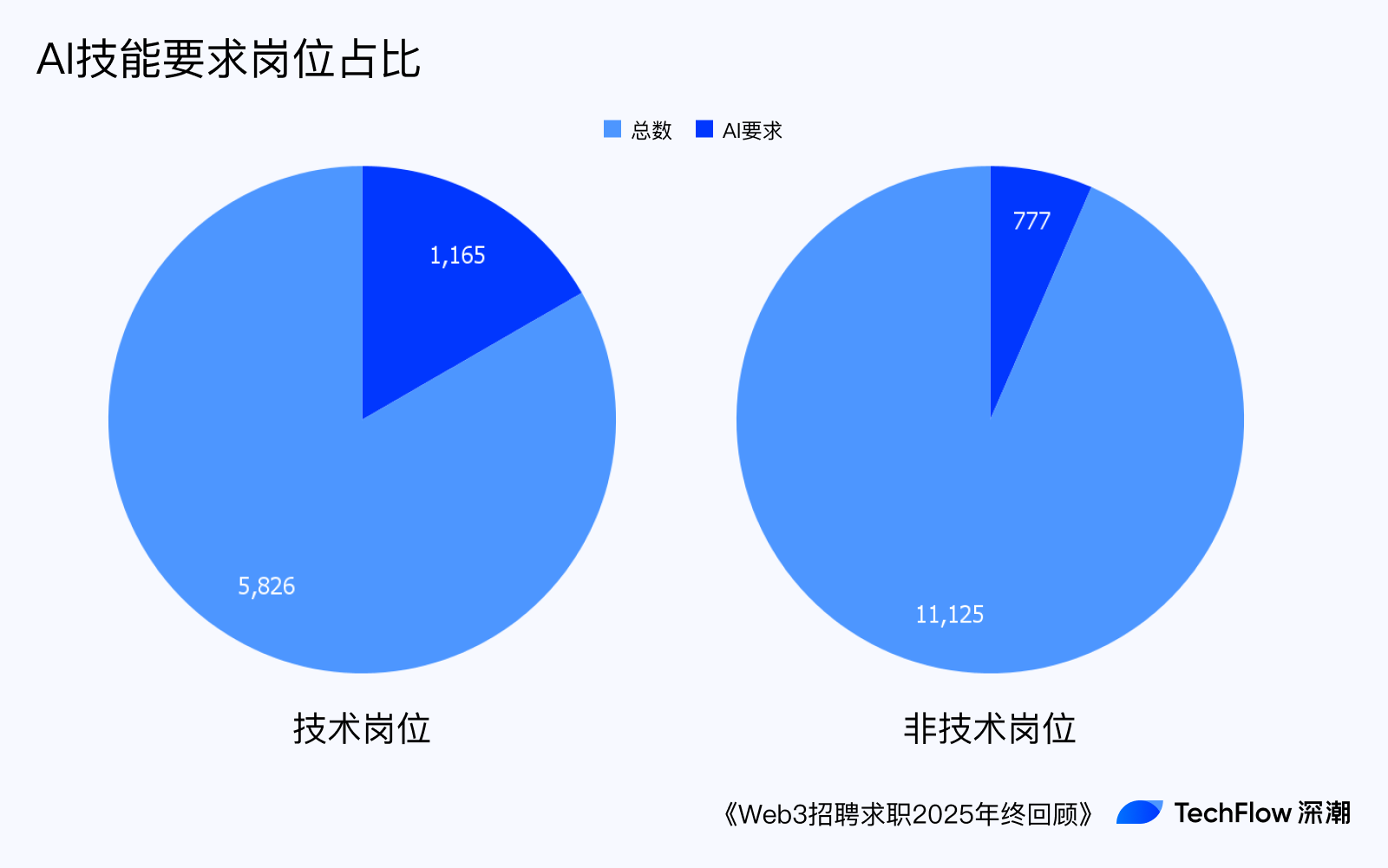

Notably, AI-related skill requirements appear consistently across both technical and non-technical roles.

1.3 Compensation Levels

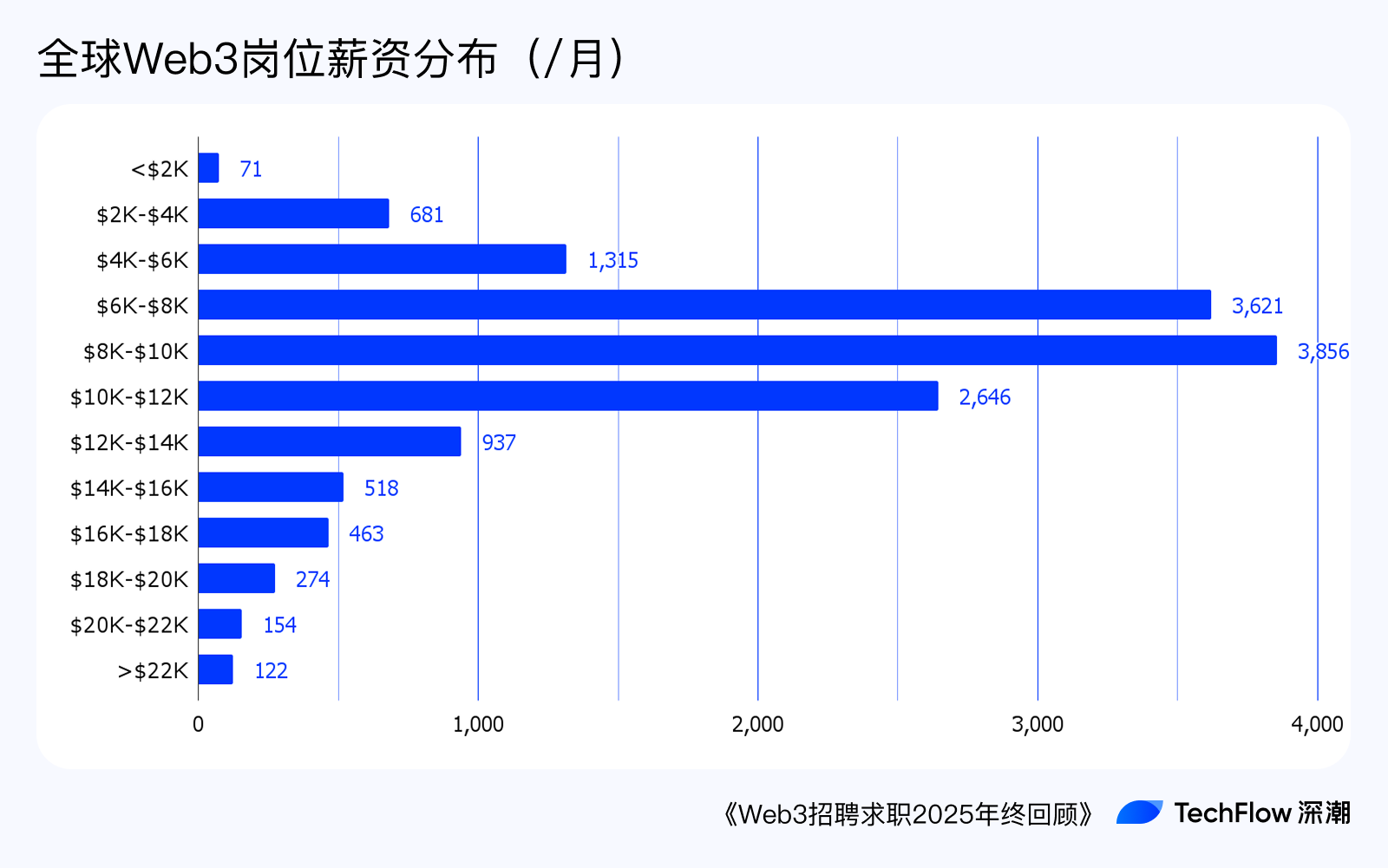

Regarding salary distribution, among 14,659 job postings disclosing pay, the $6,000–$12,000 monthly range is most concentrated. Yet there are also many entry-level roles at $2,000–$4,000 and high-paying roles above $12,000.

Top 10 highest-paid technical roles globally (median of min/max salary):

-

Data: $11,667 – $17,500

-

Zero-knowledge proofs: $11,521 – $17,084

-

Cloud engineer: $11,733 – $15,733

-

Solana development: $6,792 – $13,959

-

Cloud computing: $9,140 – $12,315

-

Java development: $7,875 – $12,292

-

TypeScript development: $9,184 – $11,829

-

Mobile development: $9,870 – $11,778

-

Backend development: $9,035 – $11,752

-

Golang development: $8,042 – $11,709

Data and zero-knowledge proof roles command the highest salaries, with monthly caps reaching $17,500 (~125,000 RMB). These roles require advanced math, cryptography, and algorithm skills, and talent scarcity justifies the premium. Cloud engineers and Solana developers—aligned with current tech trends—also rank highly.

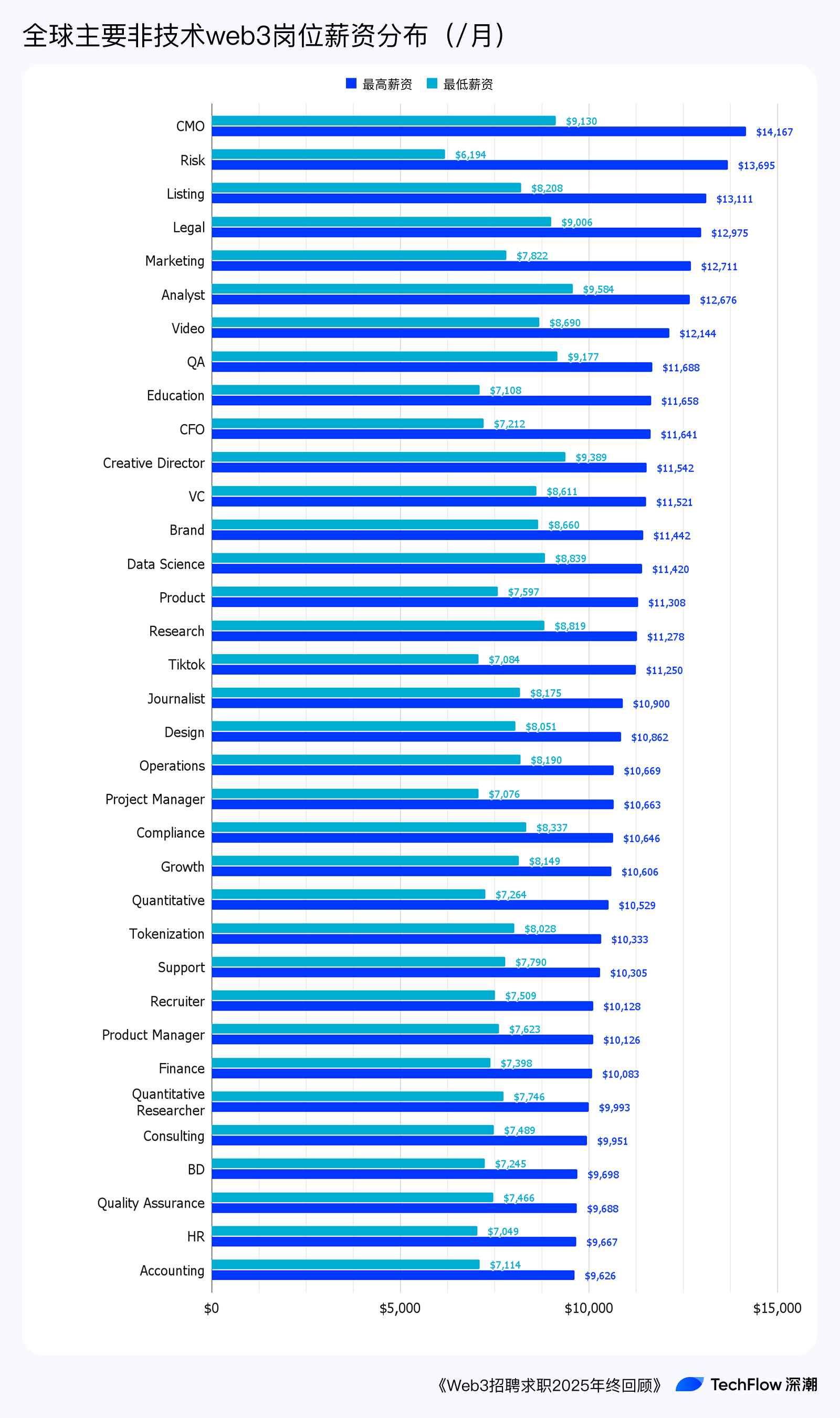

Top 10 non-technical roles by global monthly salary:

-

Data analysis: $11,667 – $17,500

-

CMO: $9,130 – $14,167

-

Risk management: $6,194 – $13,695

-

Listing department: $8,208 – $13,111

-

Legal: $9,006 – $12,975

-

Marketing: $7,822 – $12,711

-

Analyst: $9,584 – $12,676

-

Video production: $8,690 – $12,144

-

QA: $9,177 – $11,688

-

User education: $7,108 – $11,658

Listing teams, central to connecting projects, exchanges, and users, earning top pay is expected.

High pay for CMOs and marketing roles reflects ongoing demand for skilled marketers to build strong communities.

High compensation for risk and legal roles highlights their scarcity in the industry.

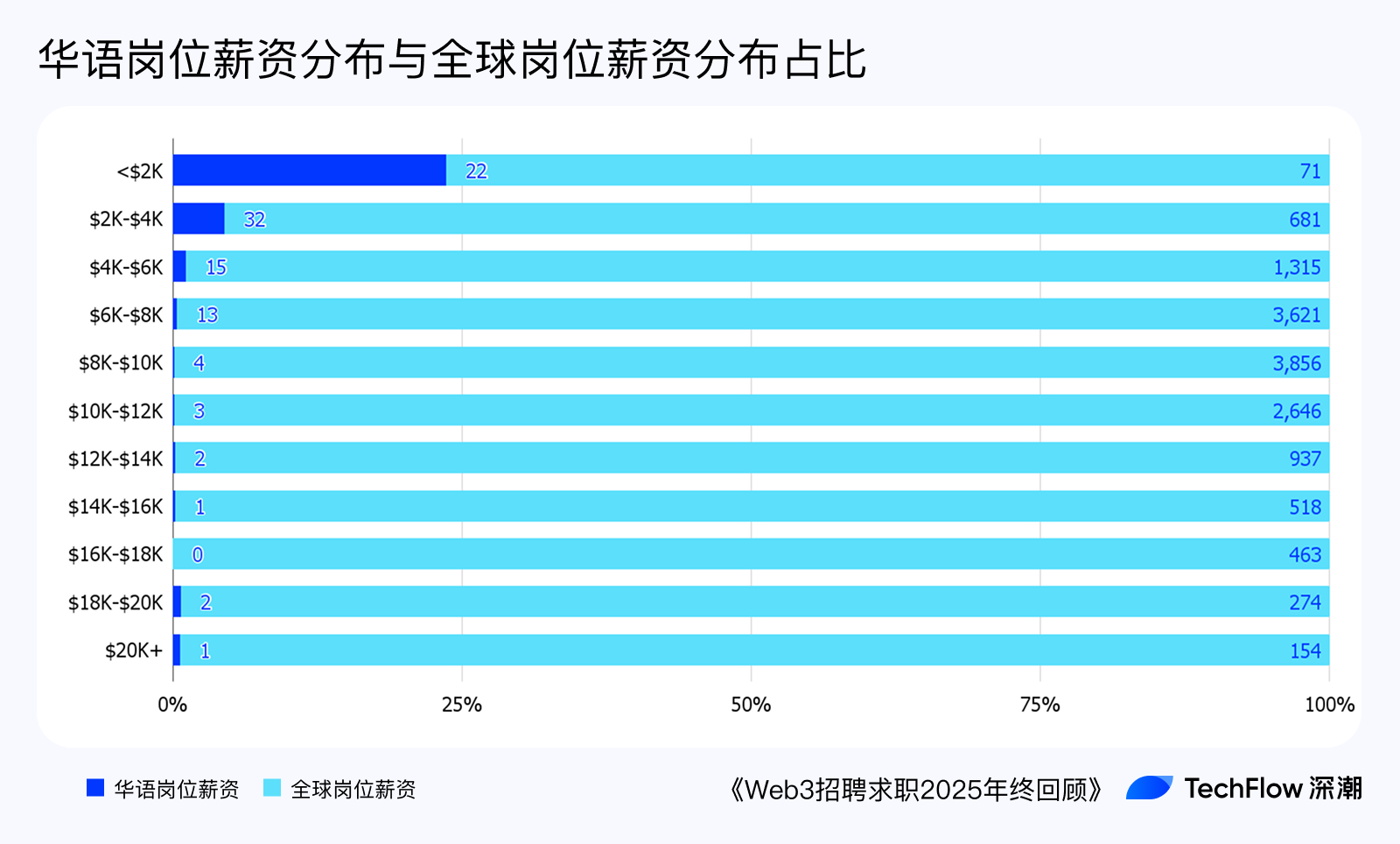

However, in the abetterweb3 Chinese-language job database, salaries for both technical and non-technical roles plummet sharply, mostly clustered around $2K–$4K (approx. ¥14,000–¥28,000), matching levels at most mid-to-small Chinese internet firms.

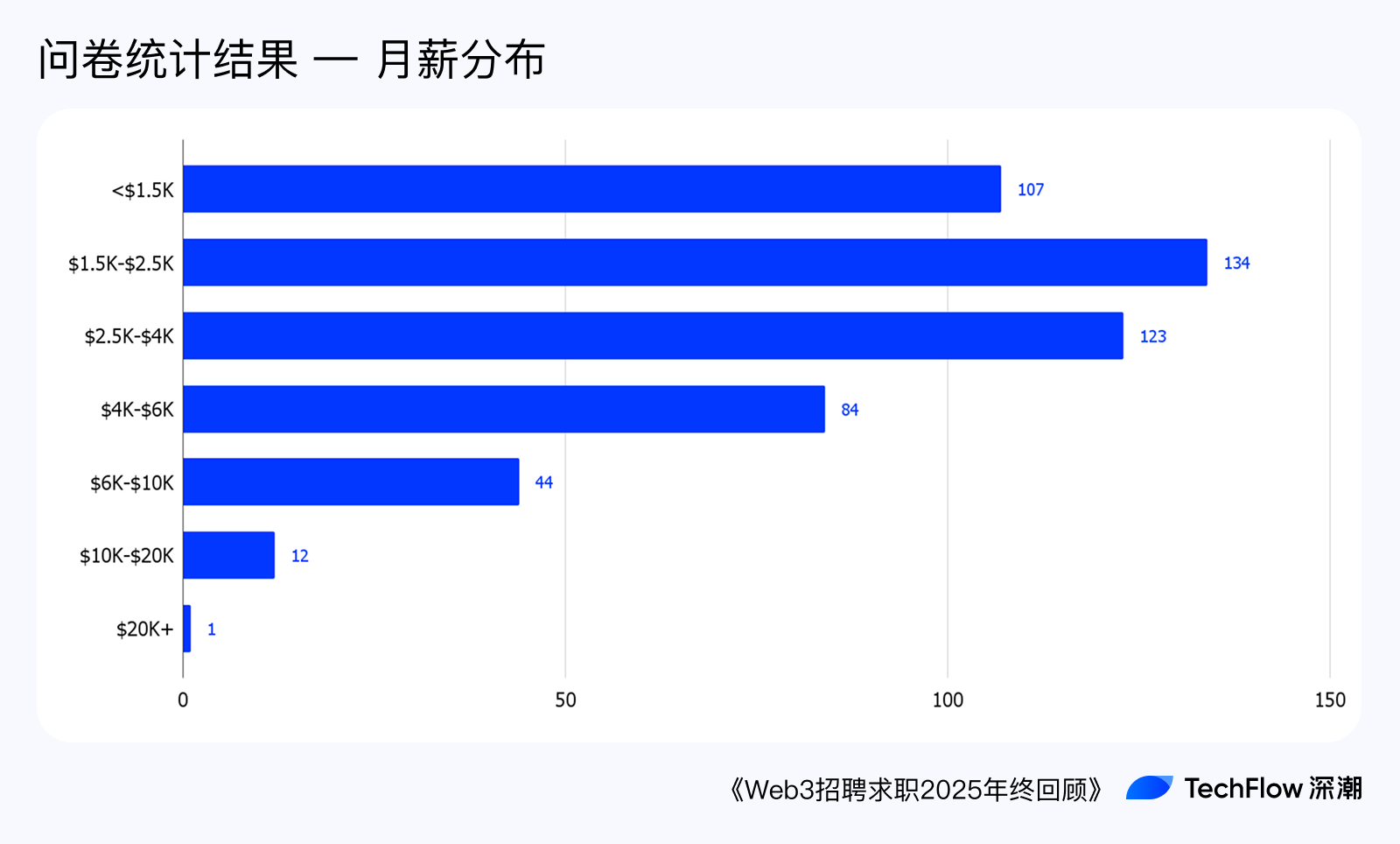

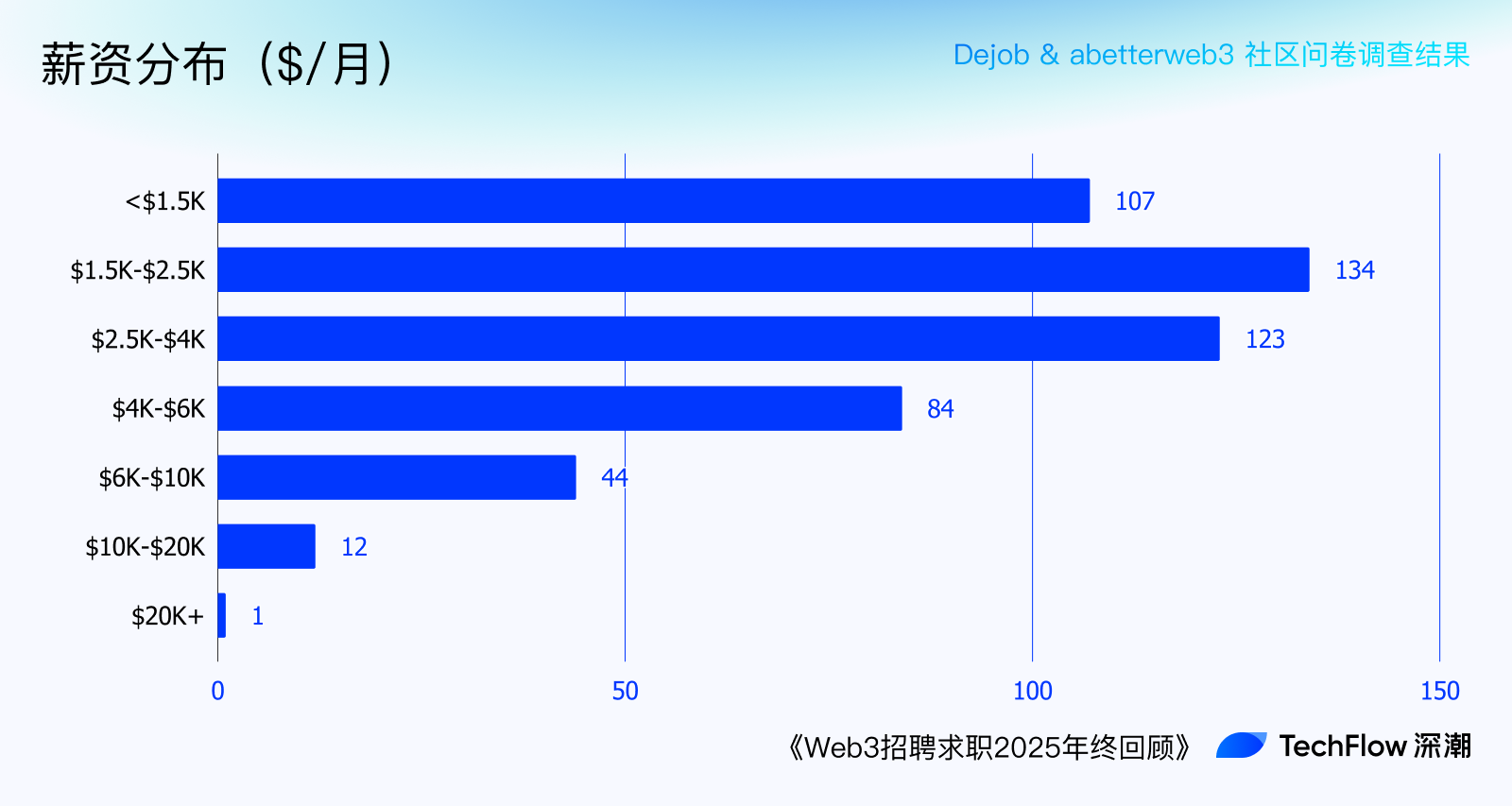

The salary statistics from our collected survey data are even more grim: over 20% earn less than $1,500/month (~10,000 RMB), with the majority falling between $1,500–$4,000 (~10,000–28,000 RMB). This may stem from the lack of regulatory oversight in East Asian Web3 markets—low or unpaid wages benefit employers, leaving workers powerless, with career sustainability dependent solely on finding a decent boss.

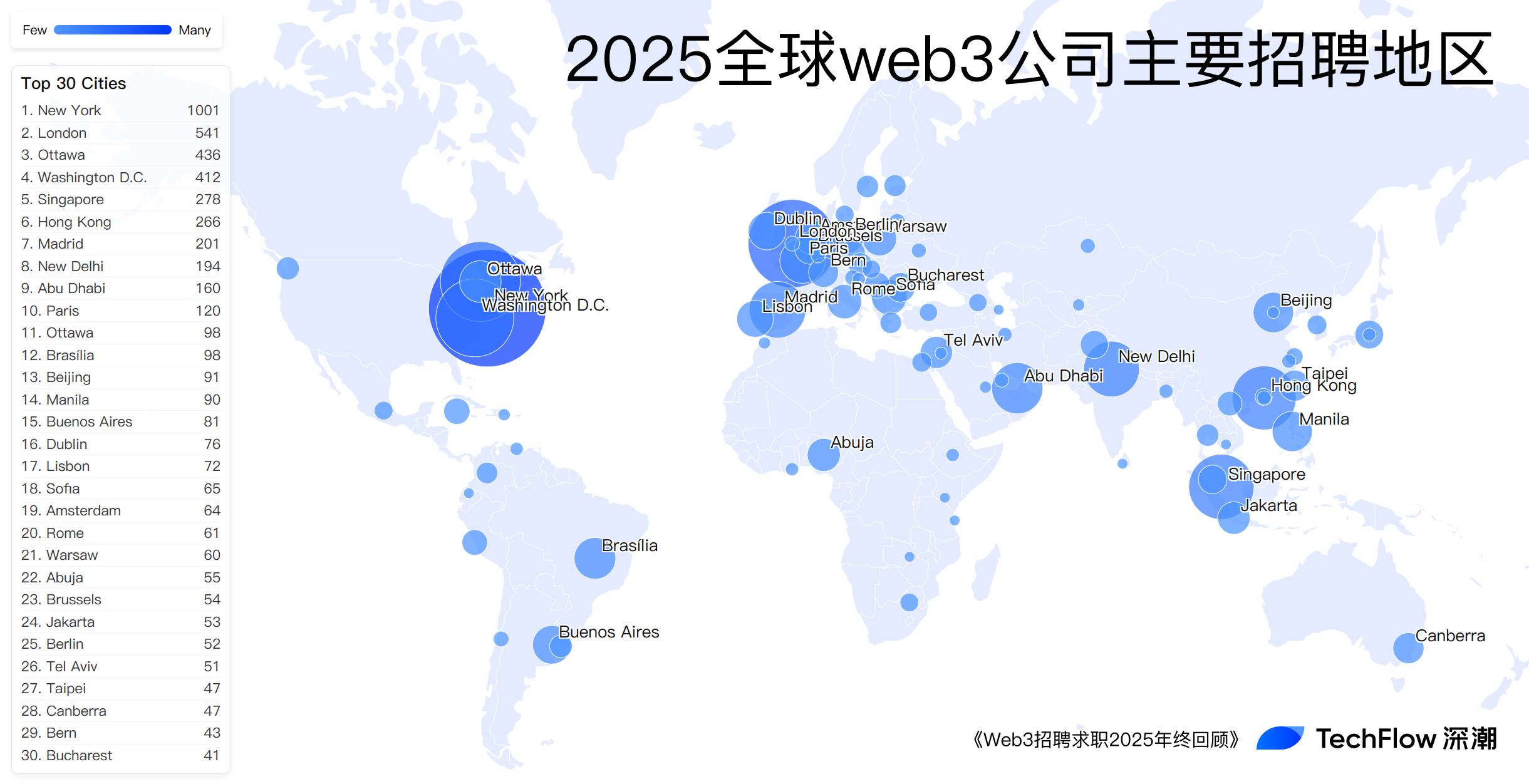

From job postings specifying location requirements, the U.S. and UK naturally became hubs for global crypto startups amid the compliance wave.

Canada, Singapore, Hong Kong, and Dubai, as global financial centers with active investment and talent inflow, also host numerous Web3 firms.

Compared to pre-2021, mainland China has seen near-total disappearance of Web3 hiring due to repeated strict regulations. Only scattered teams remain in relatively open cities like Shanghai, Shenzhen, Beijing, Hangzhou, and Chengdu.

In salary rankings, beyond typical Western cities, two European cities—Warsaw and Prague—and two Asian cities—Shanghai and Shenzhen—unexpectedly entered the top 10 highest-paying Web3 locations (see chart below).

This may relate to local company types (e.g., star infra or exchange firms), presence of senior or managerial (C-level) roles.

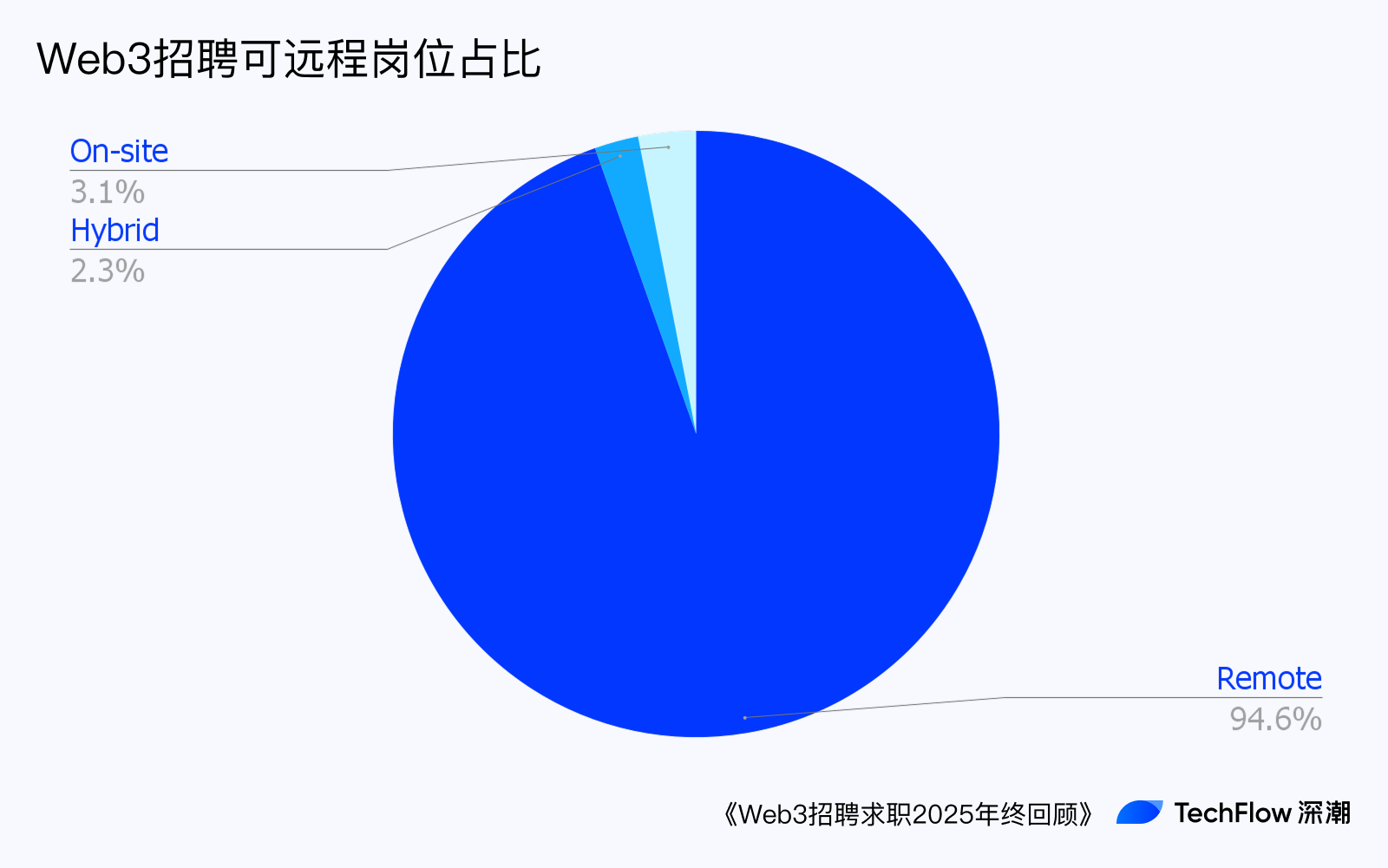

Notably, among 5,467 valid data points, remote roles reached 5,171, accounting for 94.6%.

This reflects Web3’s nomadic cultural DNA—after years of navigating global regulatory crackdowns, Web3 firms have long adapted by minimizing geographical constraints on talent, opting for loose collaboration to ensure discreet survival.

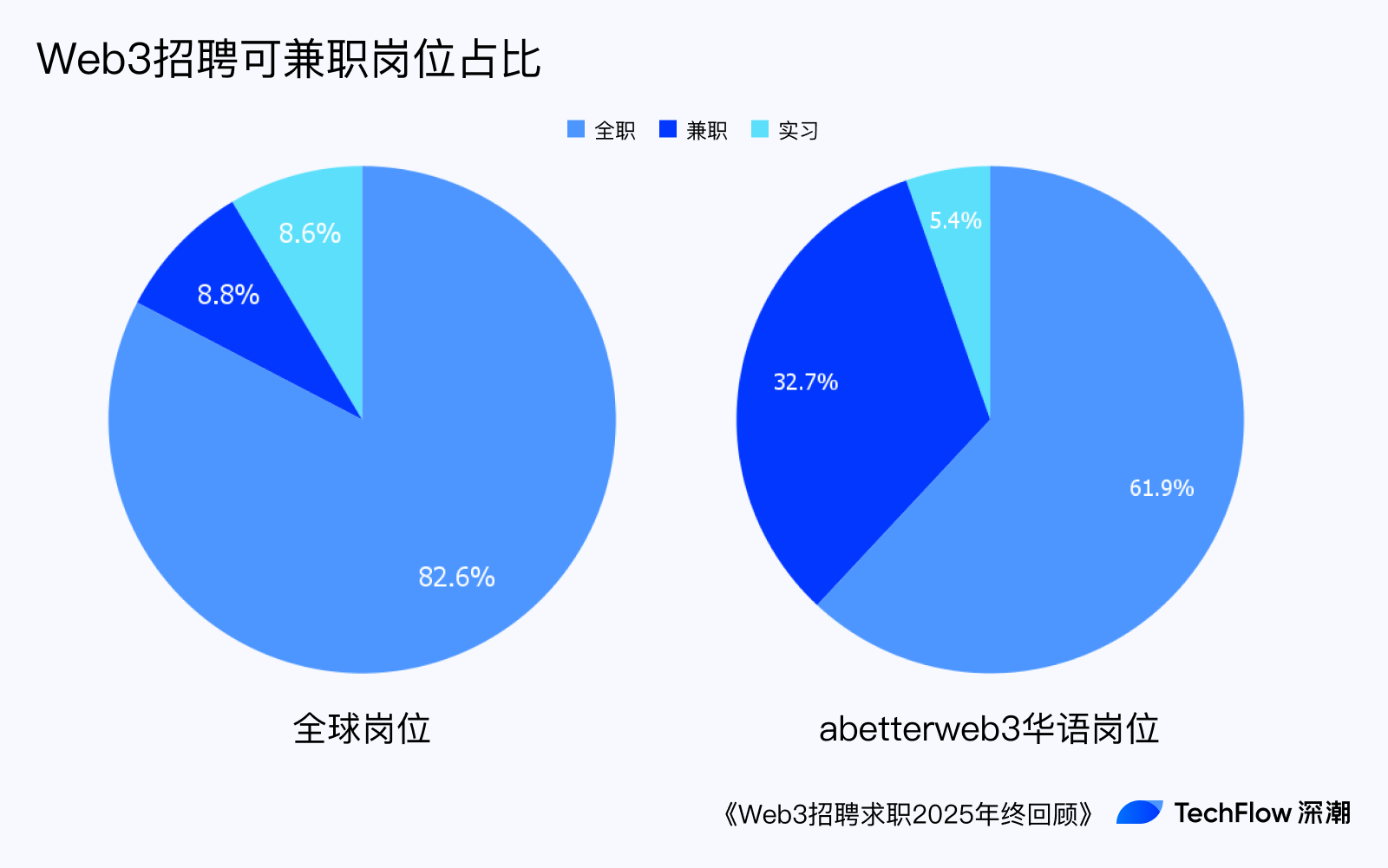

An interesting data point: part-time (Part-time / Contract) roles make up 8.8% globally, but rise to 33.7% in Chinese-language job postings.

This form of part-time work differs from side gigs like e-commerce common in traditional internet firms—it involves genuinely working for multiple projects or companies simultaneously to earn multiple incomes. This may tie into Web3’s widely accepted culture of anonymous collaboration.

2. Chinese-Speaking Web3 Job Seekers: Transformation and Intensifying Competition Inside and Outside the Walled Garden

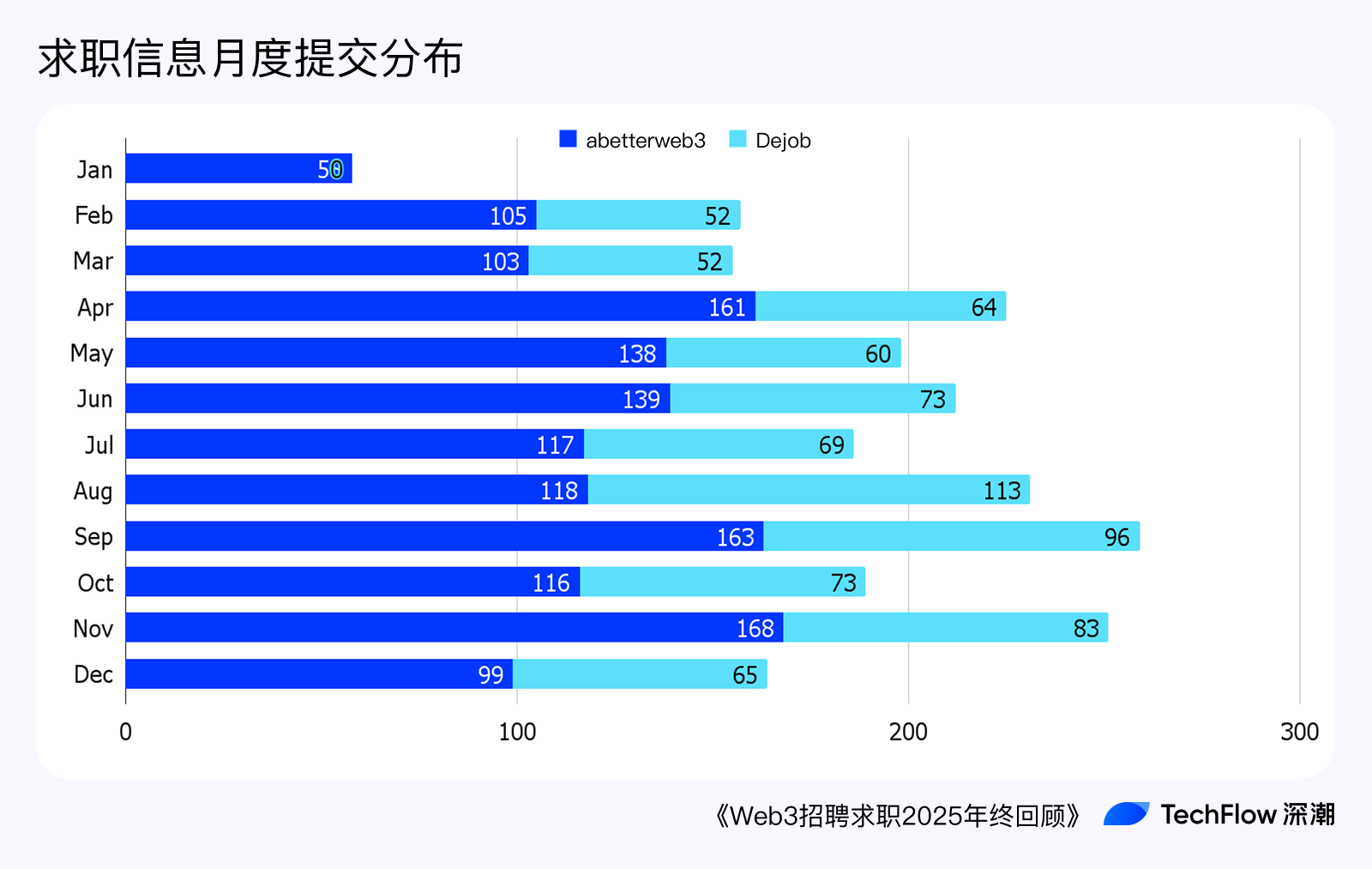

Based on job seeker data (2,666 entries total) from two major Chinese-speaking Web3 platforms, abetterweb3 and Dejob, we uncover some uncomfortable truths beneath the surface.

Submission trends show gradual increase from early to mid-year, with little fluctuation otherwise—no clear "March/April peak" or "September/October surge" typical of traditional hiring cycles.

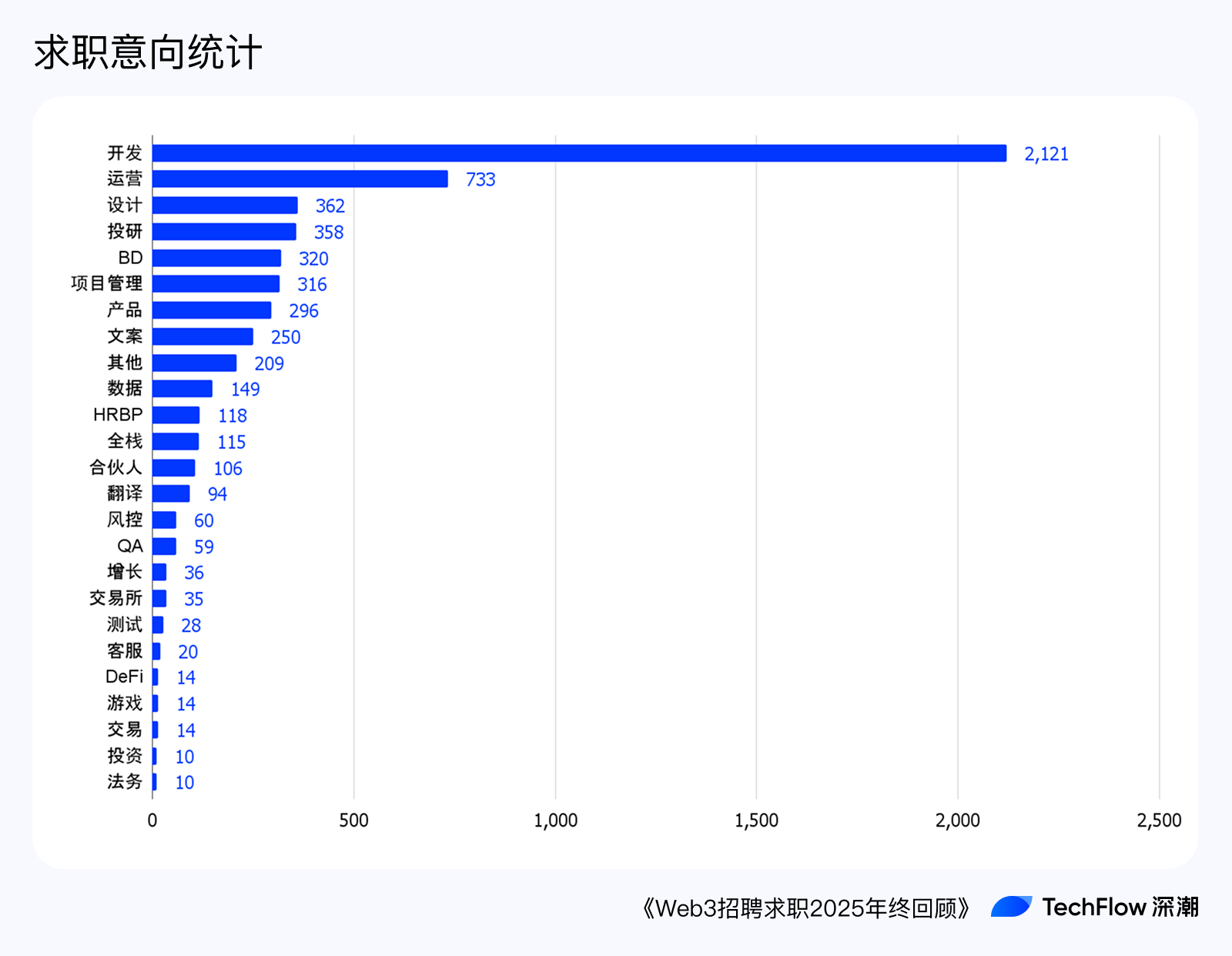

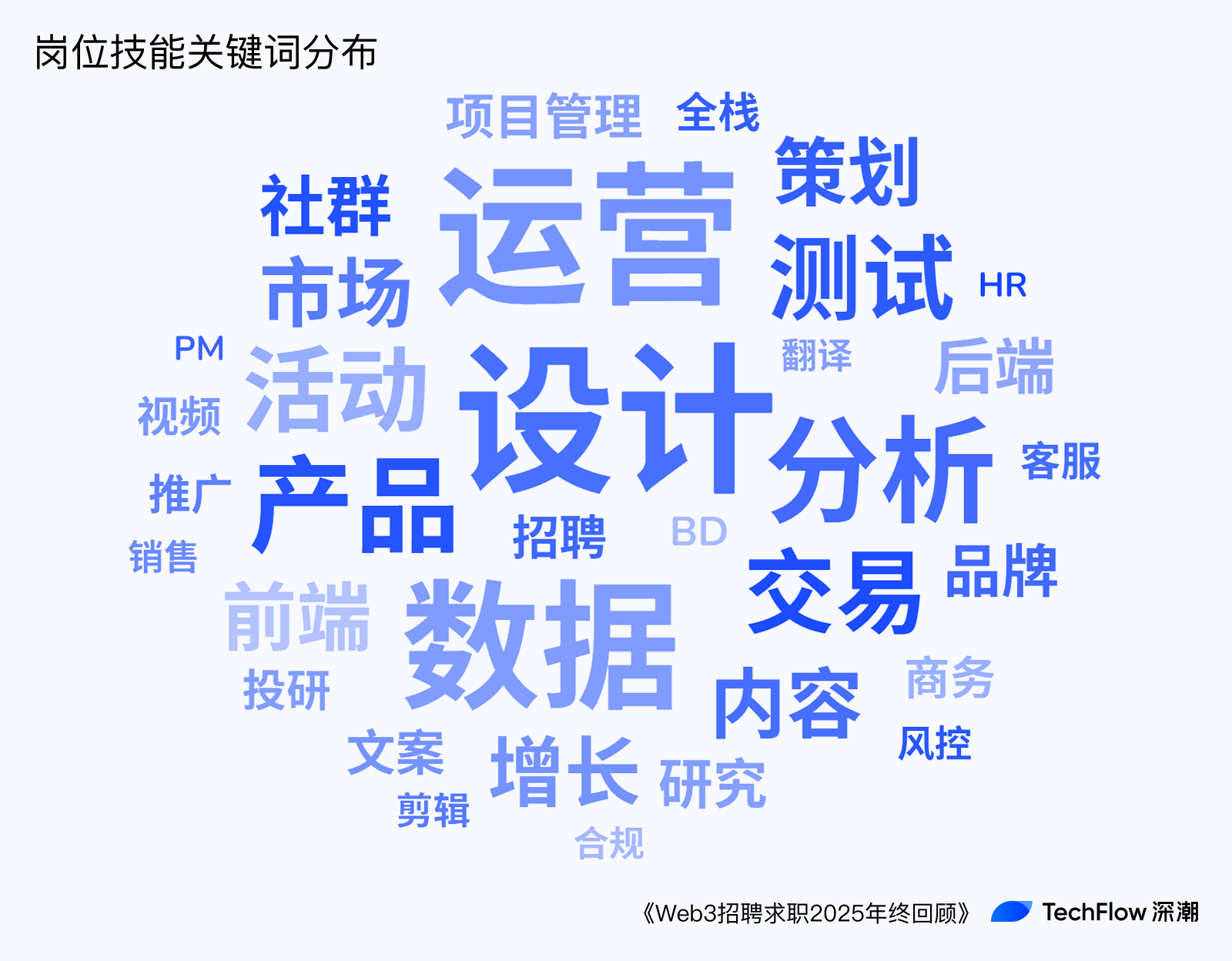

Top 10 most sought-after roles: Development, Operations, Frontend, Backend, Research, BD, Project Management, Product, Design, Copywriting—covering most core roles in the industry.

The 106 mentions of "partner" suggest strong entrepreneurial culture in crypto, but also indicate a lack of mature startup matching mechanisms, forcing entrepreneurs to express intentions via job platforms.

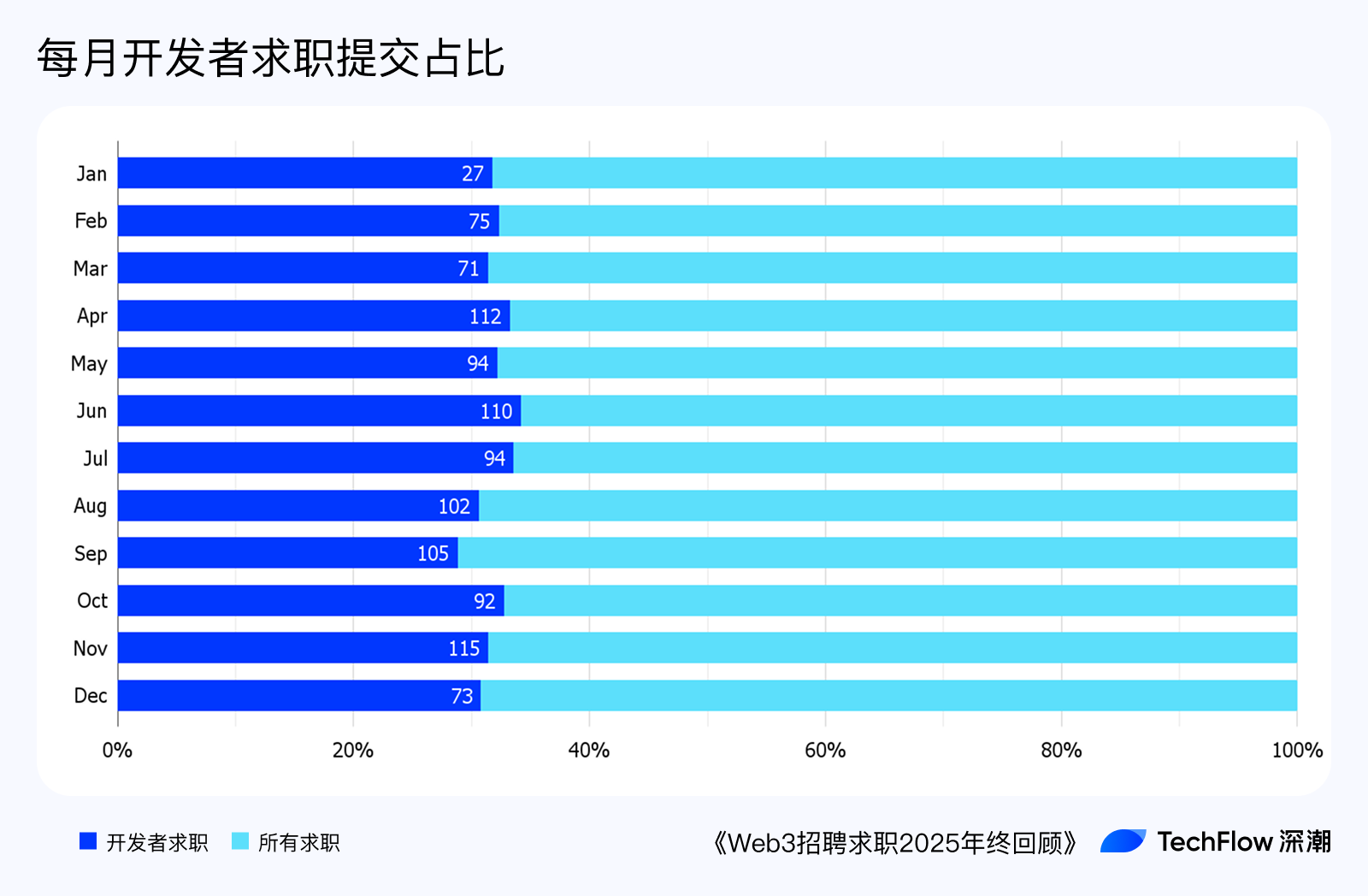

Developer applications consistently account for about 30% of total submissions monthly.

The active job-seeking behavior of technical talent reflects not only continued influx into the industry, but also likely indicates that available HC falls far short of applicant volume, causing severe competition on the job-seeker side.

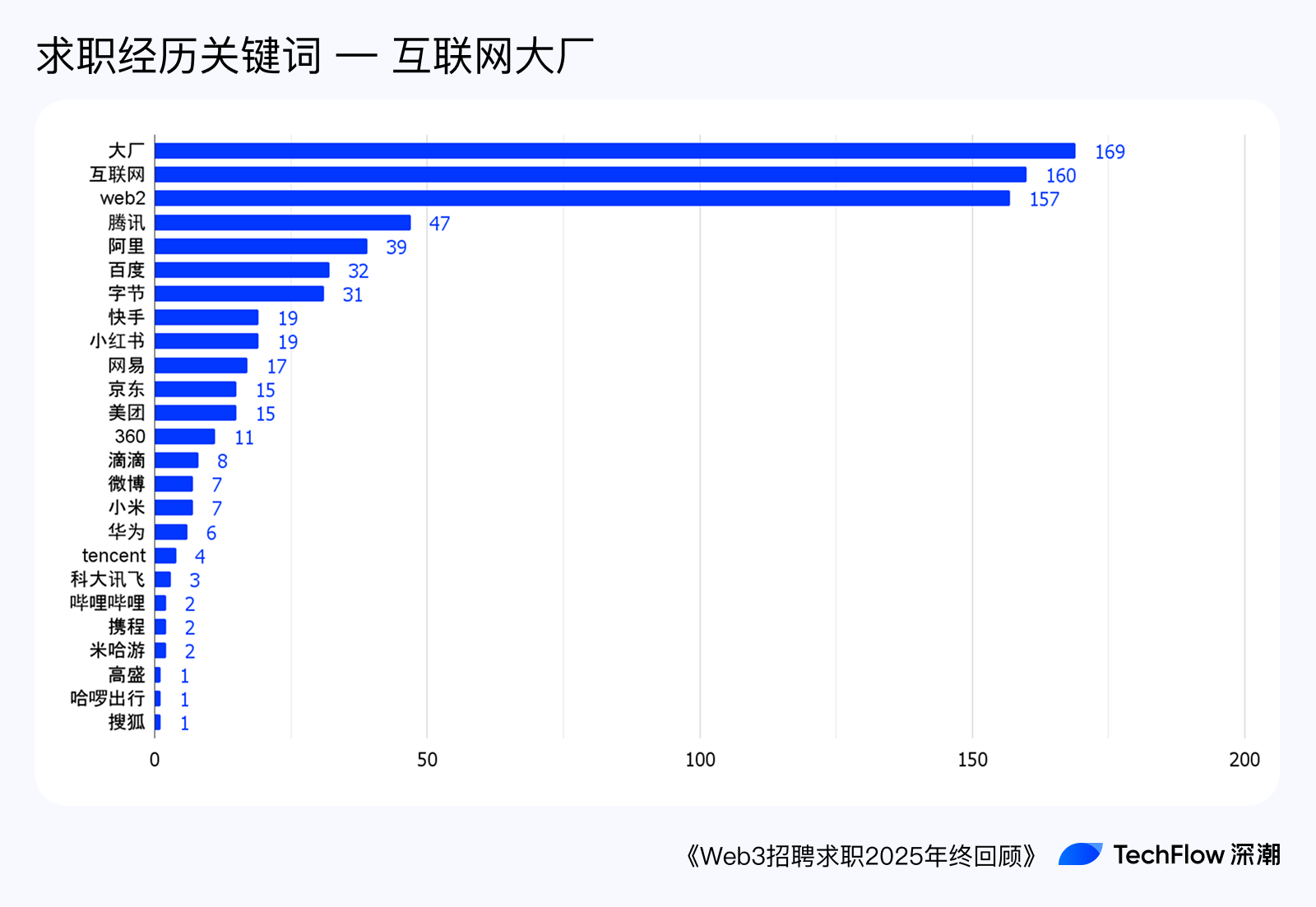

Notably, many applicants mentioned prior experience at major Chinese internet firms like BAT.

This suggests professionals from mature tech companies may be actively seeking transitions, possibly due to widespread "age 35 ceiling" pressures.

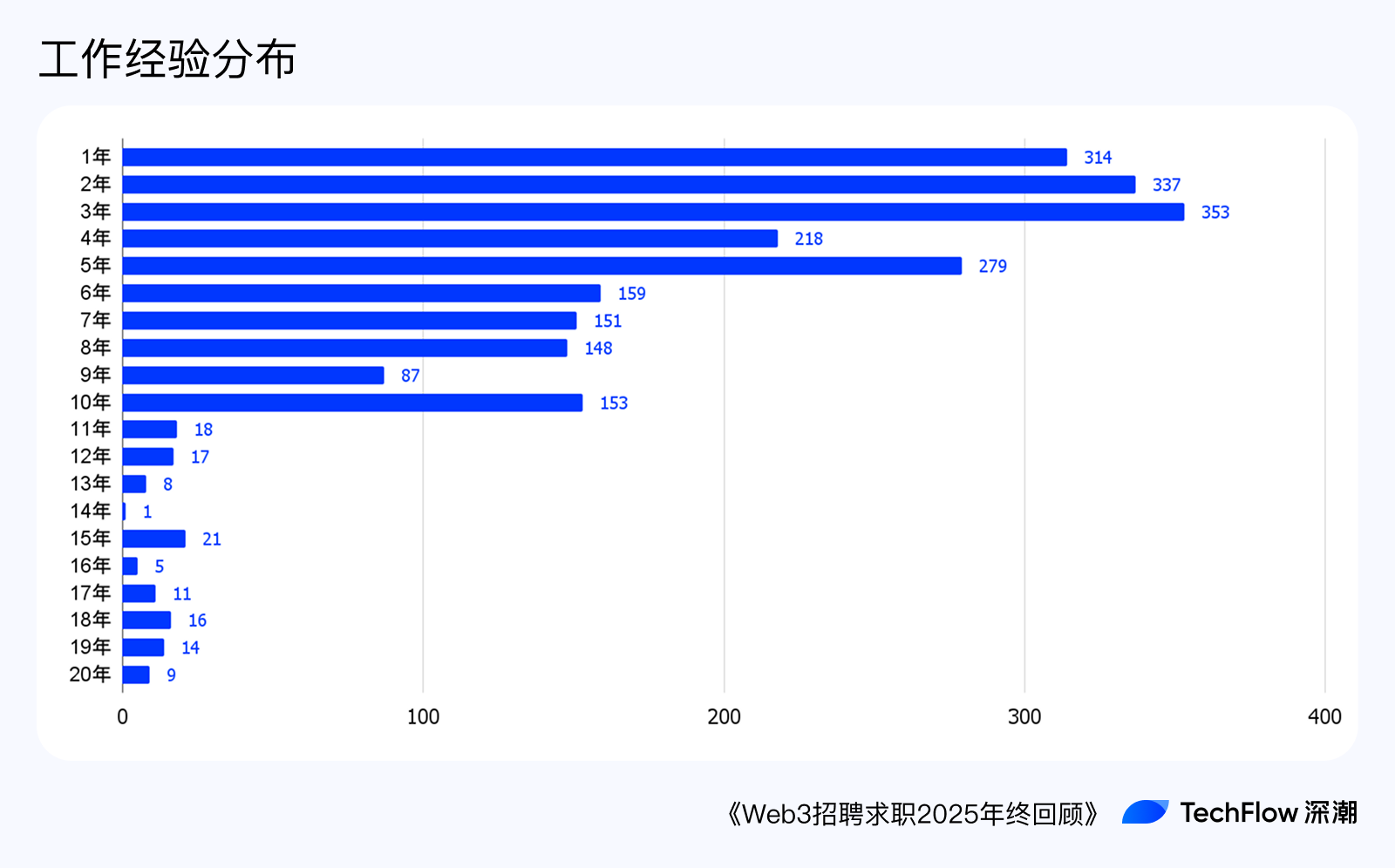

In terms of work experience, newcomers (1–3 years) make up 30%, but there are also many veterans with 7–8 or even over a decade of experience.

Though not the majority, each number represents individuals reluctantly stepping out of their comfort zones.

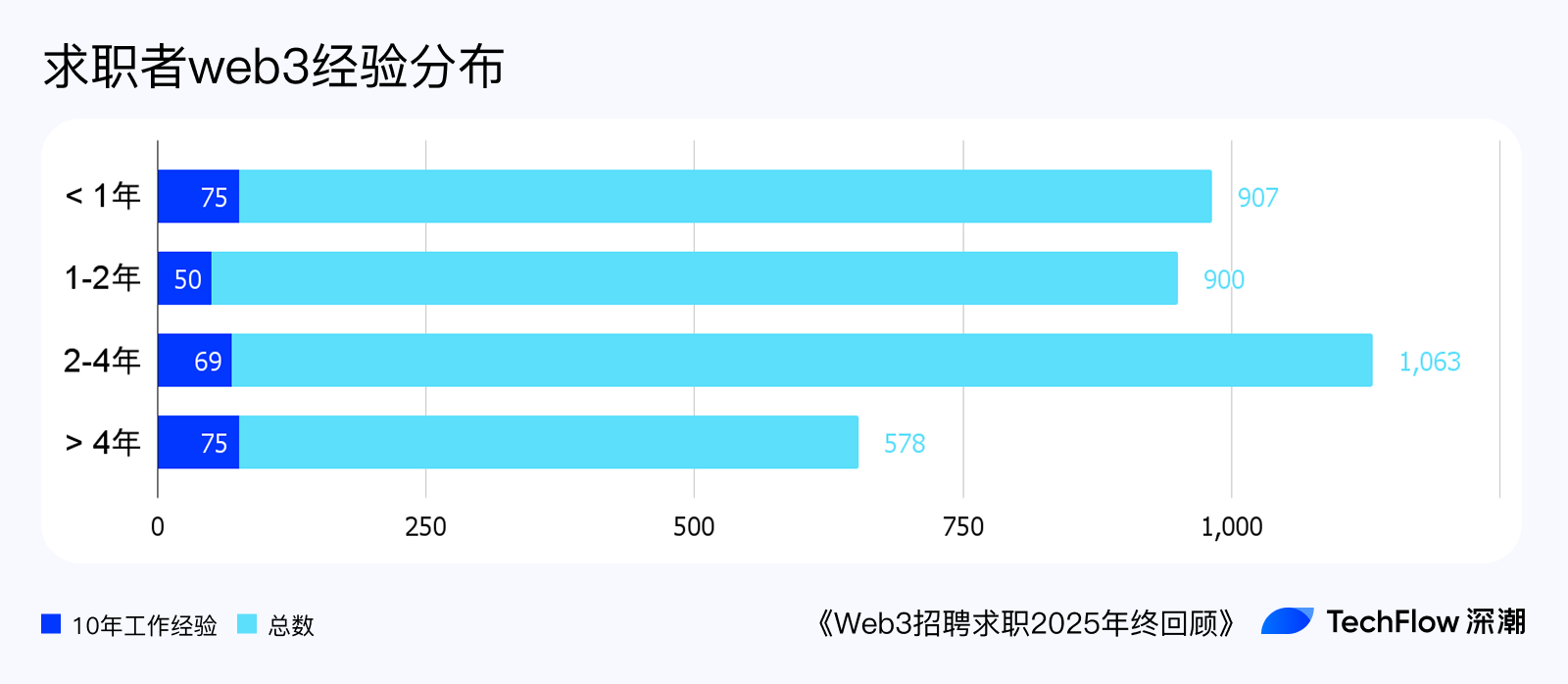

Regarding Web3 experience, half of all applicants have known Web3 for less than two years.

This means that even in 2025, through dedicated Web3 hiring channels, many curious newcomers are actively seeking entry.

Of course, this could also stem from seasoned Web3 talent moving via referrals rather than public job platforms.

Among those with over 10 years of experience, most still have limited Web3 knowledge, potentially facing transition difficulties, as most Web3 firms highly value native crypto experience.

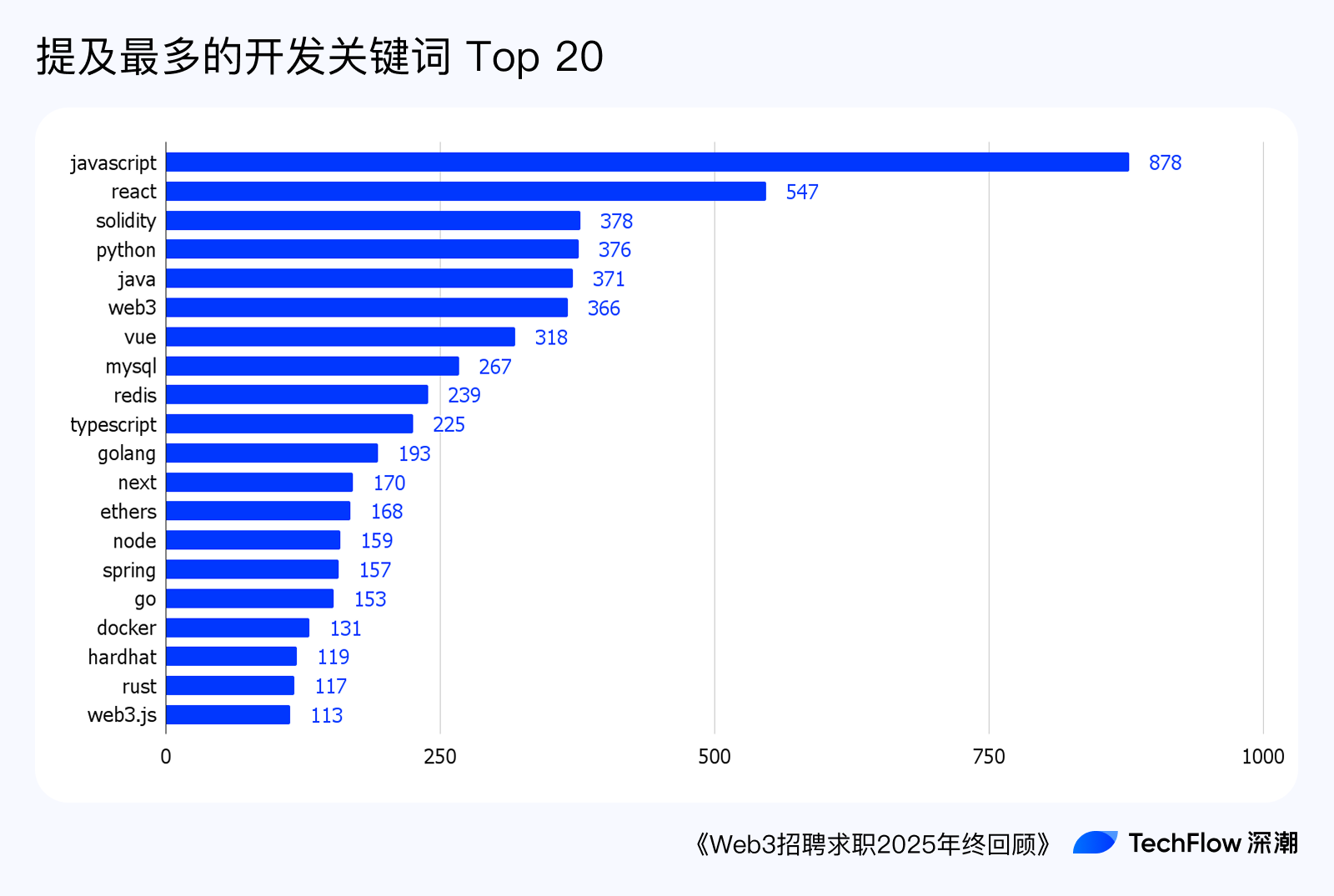

In descriptions of past experience and technical skills, frontend stacks like JavaScript, React, and Vue appear frequently. Backend skills center on mainstream languages like Golang and Python. Blockchain-specific languages like Solidity and Move remain relatively niche. (A battlefield of “the world’s best programming language.”)

In role capabilities, verbs like design, operate, analyze, product, and research stand out.

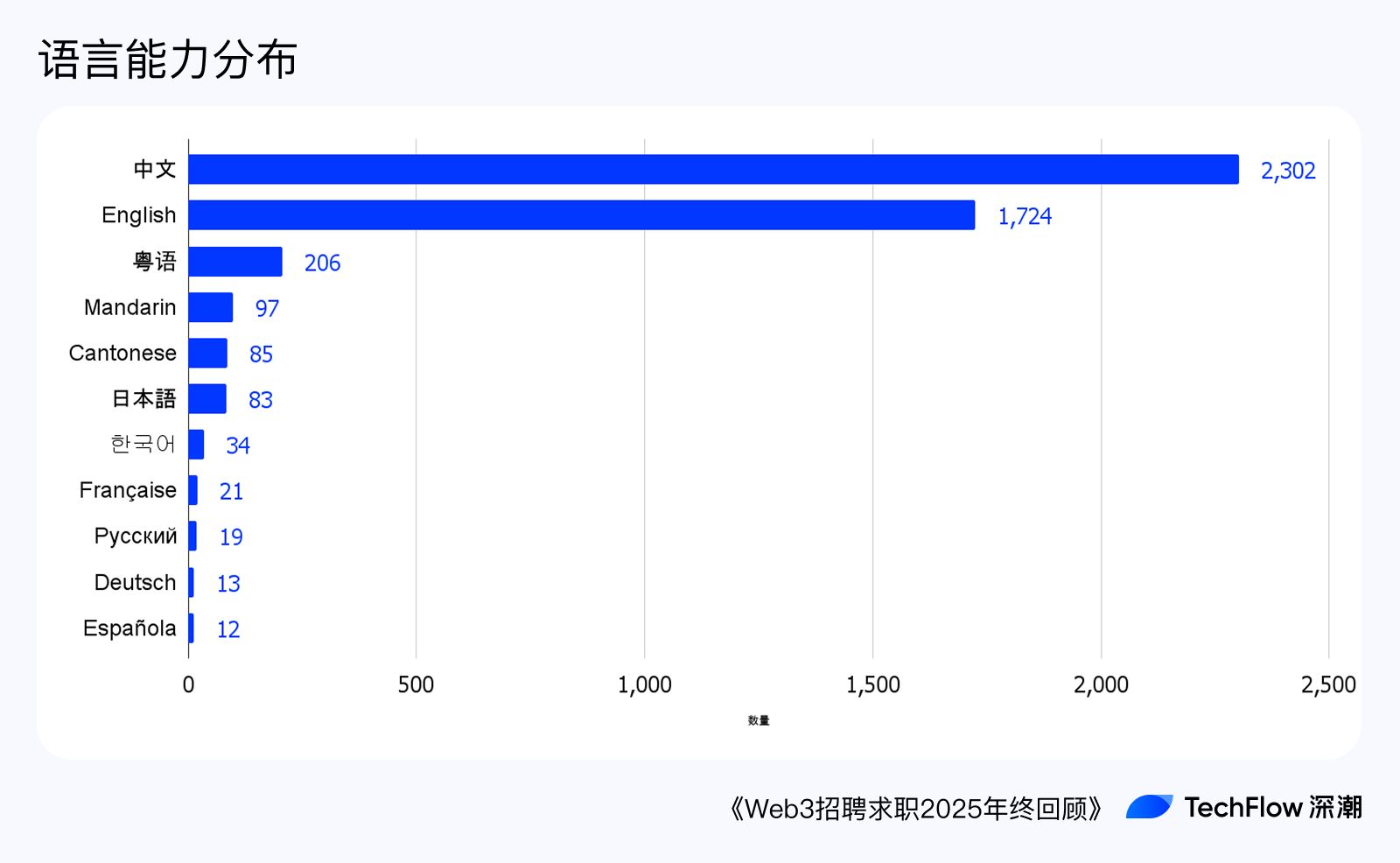

Language proficiency: over 62% selected both Chinese and English, indicating bilingualism is a must-have skill.

Speakers of Cantonese, Japanese, Korean, and other minor languages are scarce but crucial for specific markets (e.g., Hong Kong, Japan, Korea).

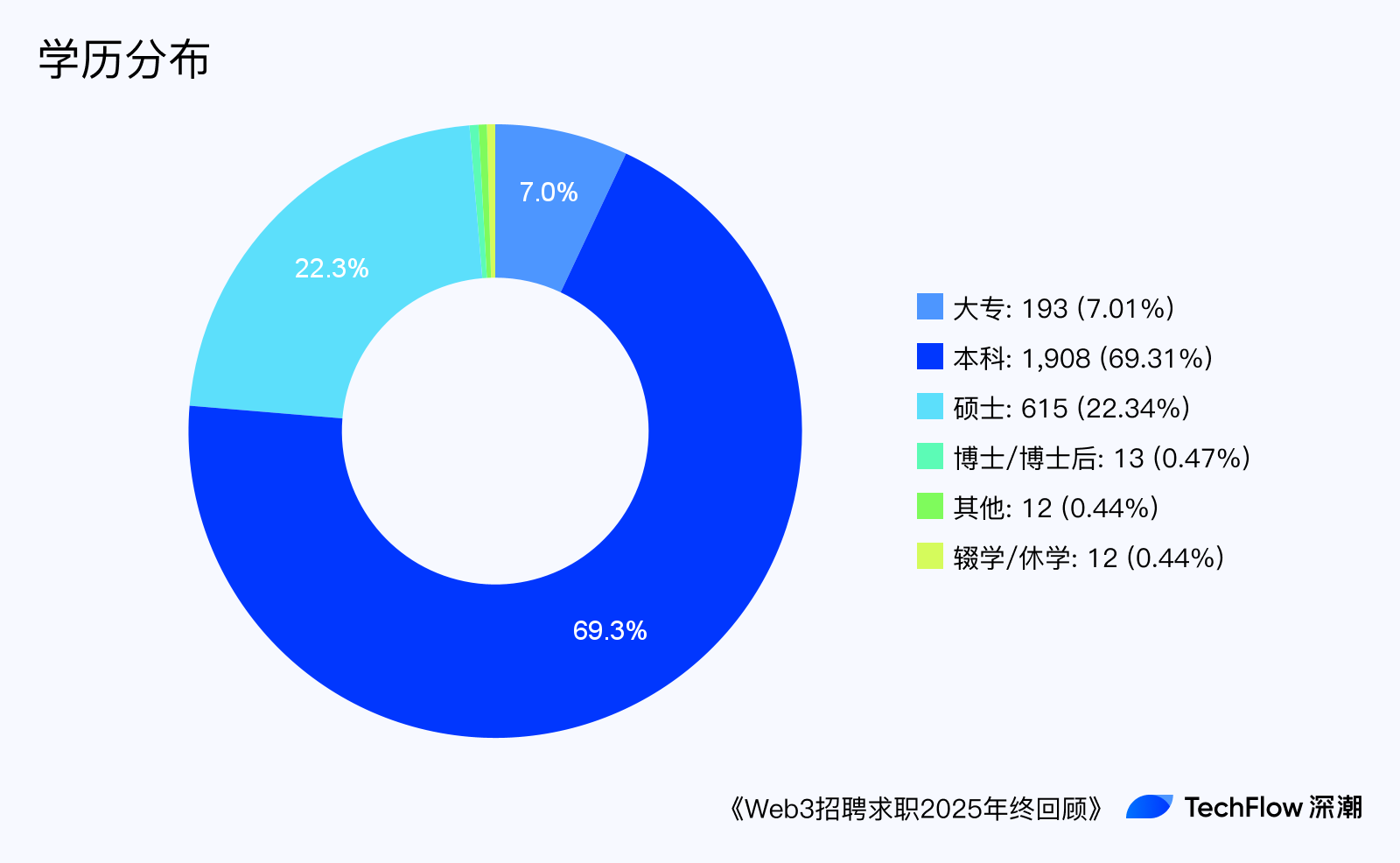

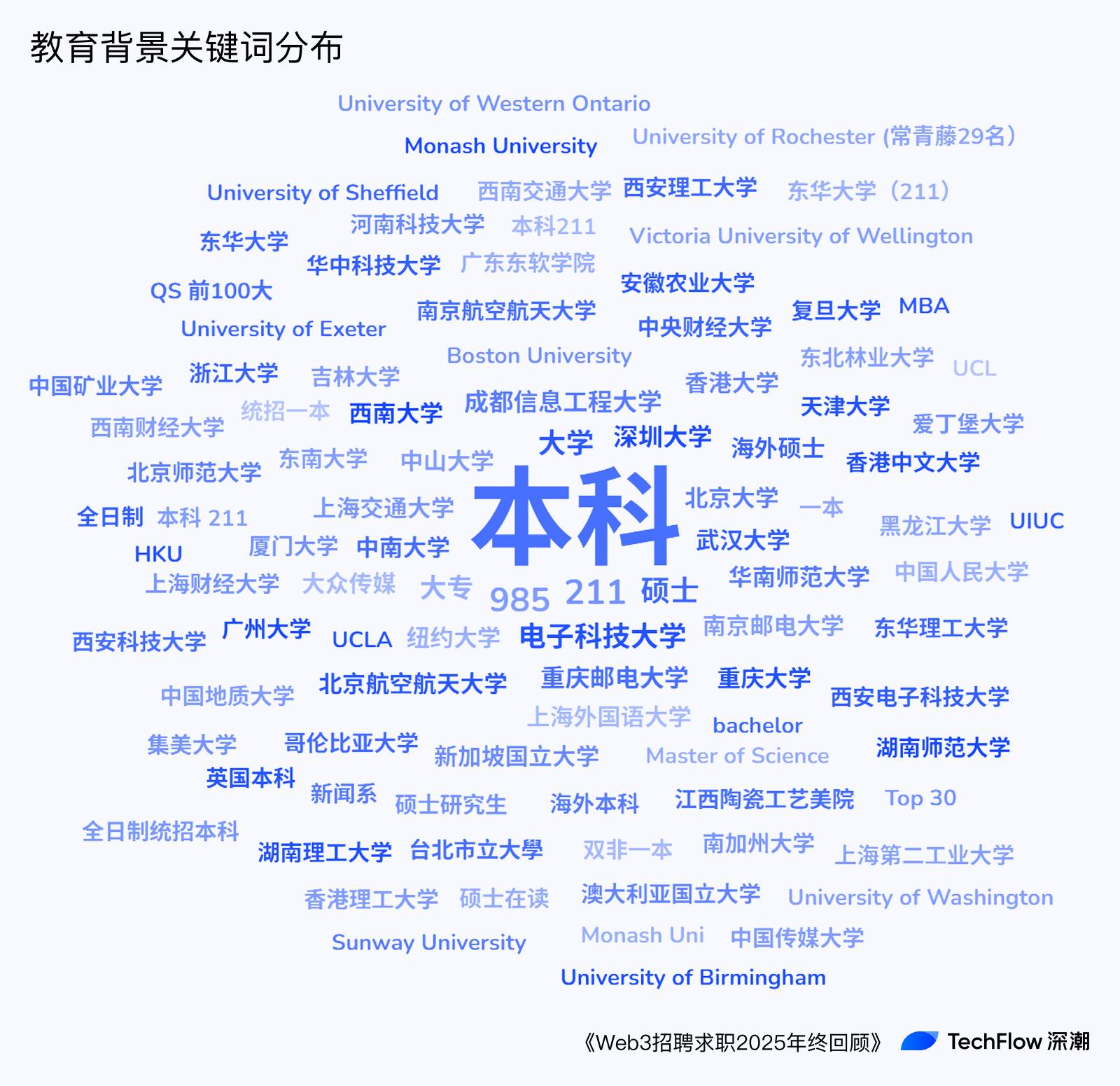

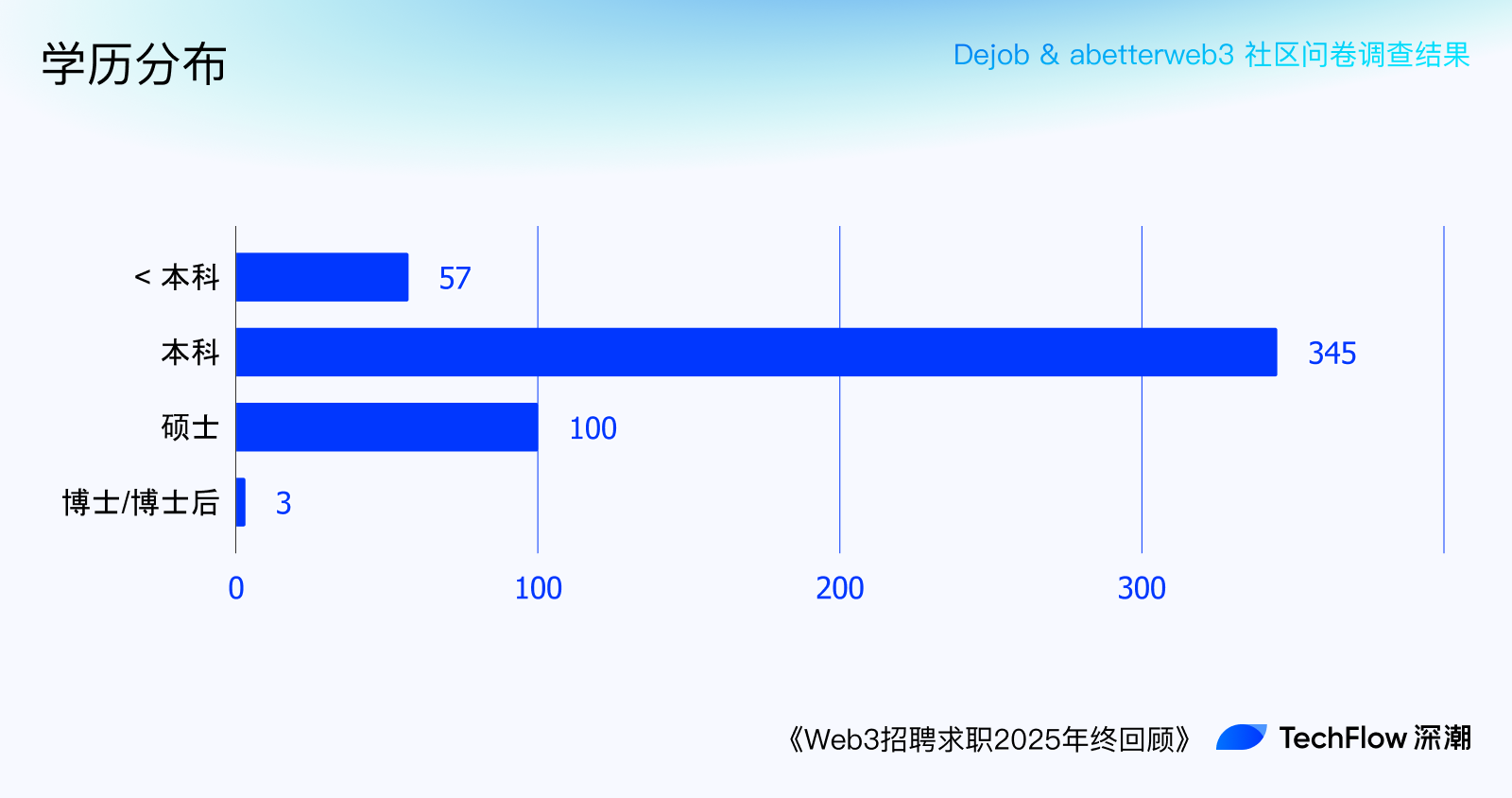

Education: bachelor’s degrees dominate. Neither in hiring nor job-seeking do 985/211 universities hold an absolute majority. Prestigious schools mentioned include Peking University, Wuhan University, NYU, NUS, alongside many regular or even junior colleges.

This suggests Web3 still values ability over pedigree, not yet saturated enough to gatekeep advancement via academic credentials.

Academic backgrounds are diverse. While CS majors dominate, graduates from other disciplines also qualify for design, product, analyst roles.

Salary expectations: among 1,083 valid responses, Chinese-speaking candidates’ expectations fall drastically below global averages—94% expect less than $3,000/month.

Possible reasons:

-

Information gap: given most applicants have limited Web3 experience, they may lack deep understanding of industry salaries, leading to mispricing themselves.

-

Cost of living: many Chinese-speaking job seekers may reside in lower-cost regions like mainland China, Southeast Asia, South America, or Central Europe, leveraging remote work for geographic arbitrage.

-

Industry cycle: since data was collected in December 2025, during a bear market, many urgently need jobs and lower salary demands to increase hiring chances (i.e., intensifying competition).

In short, most Web3 talent today are neither as expensive nor as arrogant as rumored. After years of expansion and awareness, Web3 salaries have largely converged with Web2 levels.

3. Survey Results: The Silent and Humble Majority

From 506 collected practitioner surveys, we gain direct, authentic insights into the industry.

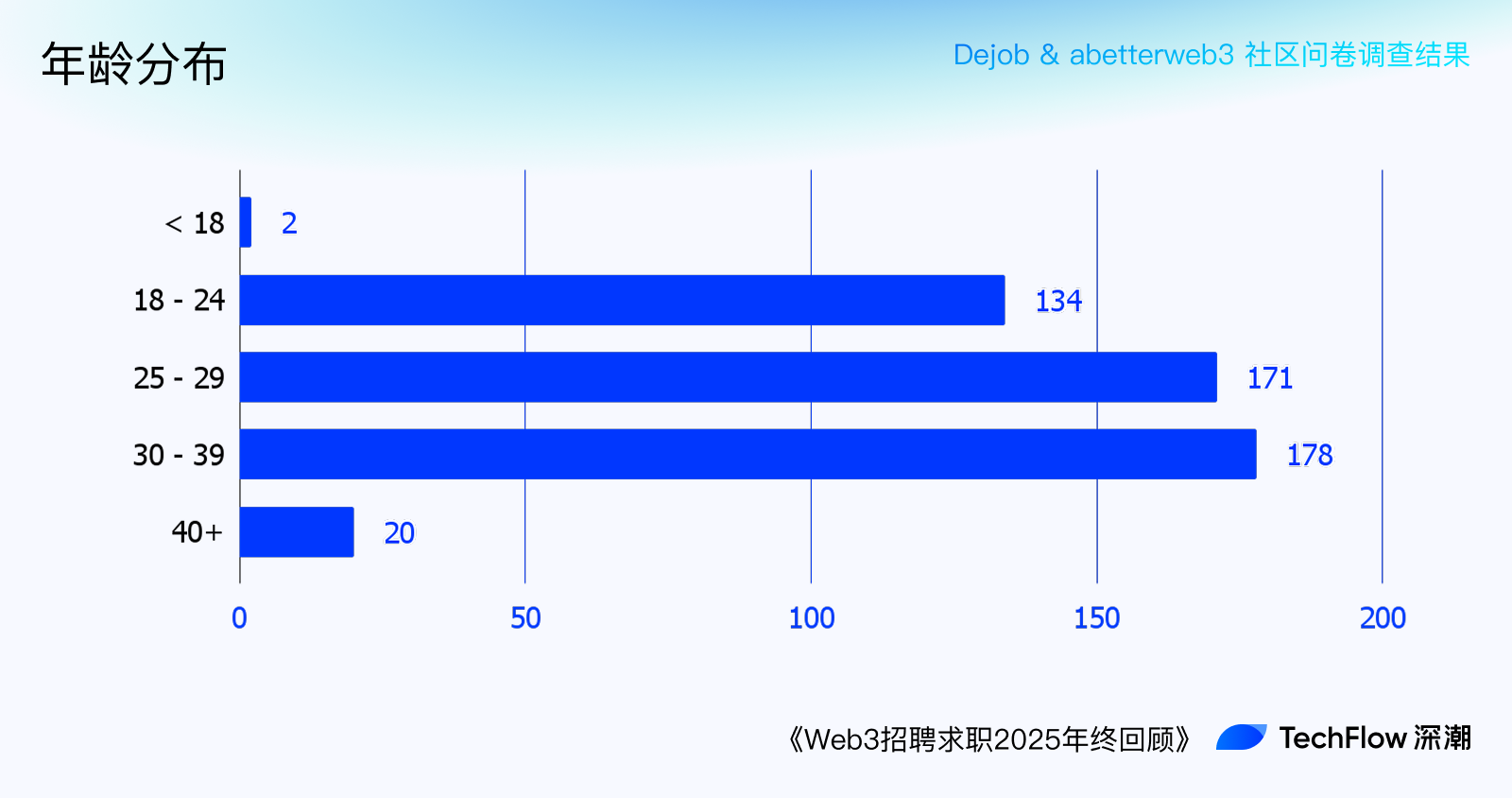

Age distribution: young professionals aged 18–29 form the majority, but mid-career and older practitioners (>30 years) are also substantial.

This may reflect Web3’s milder “age 35 ceiling” compared to traditional tech. Web3 firms prioritize experience, capability, and efficiency, favoring seasoned professionals who can “plug and play” to quickly build products.

Educational background distribution aligns with earlier talent data—mostly bachelor’s degrees, with some below and some holding master’s or PhDs, though the latter two remain uncommon.

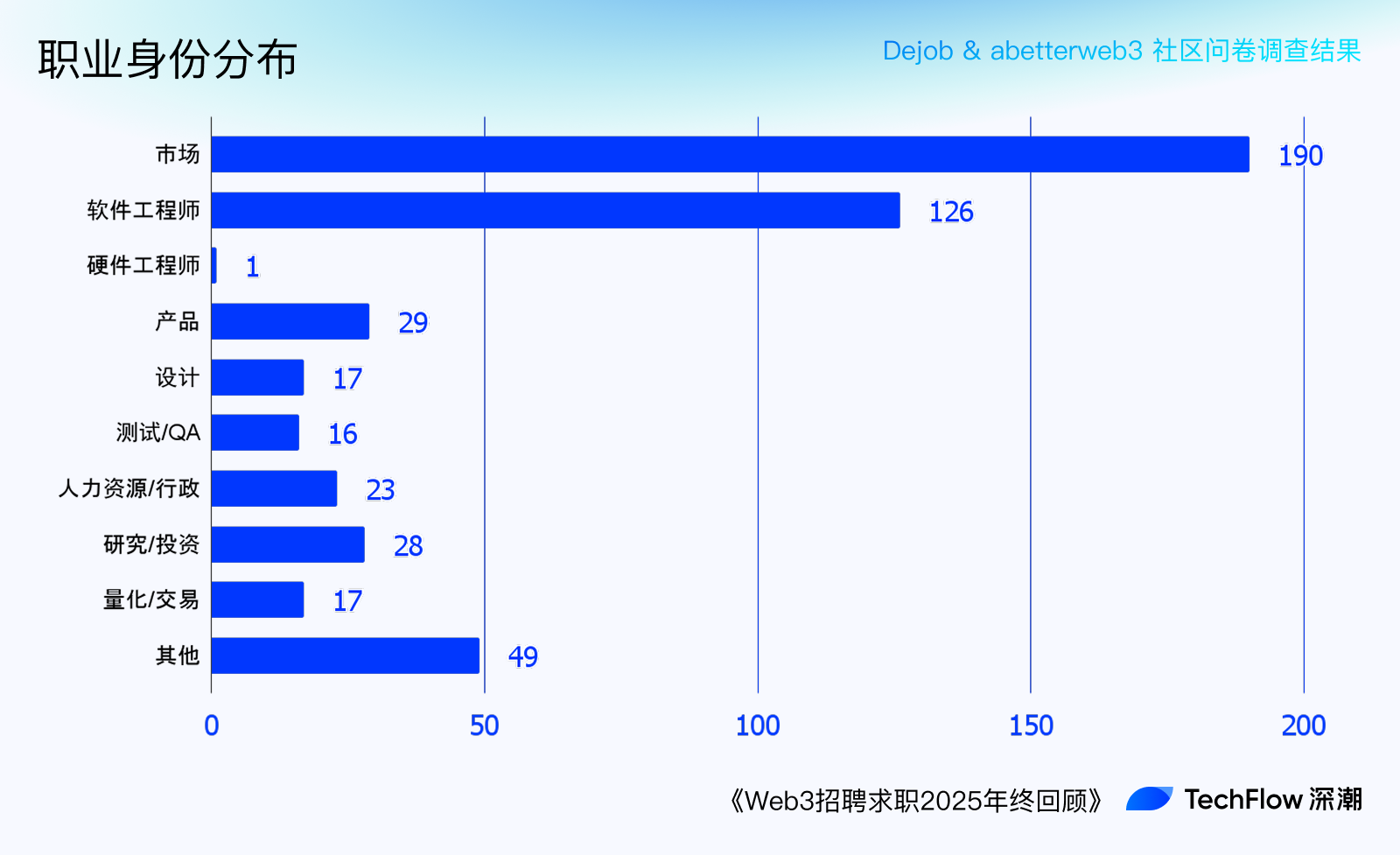

Professional roles: marketing (operations/BD/customer service) leads, followed by developers (frontend/backend/smart contracts/blockchain).

Then come product, HR, research, design, trading. In the “other” category, risk & security and KOLs were frequently mentioned.

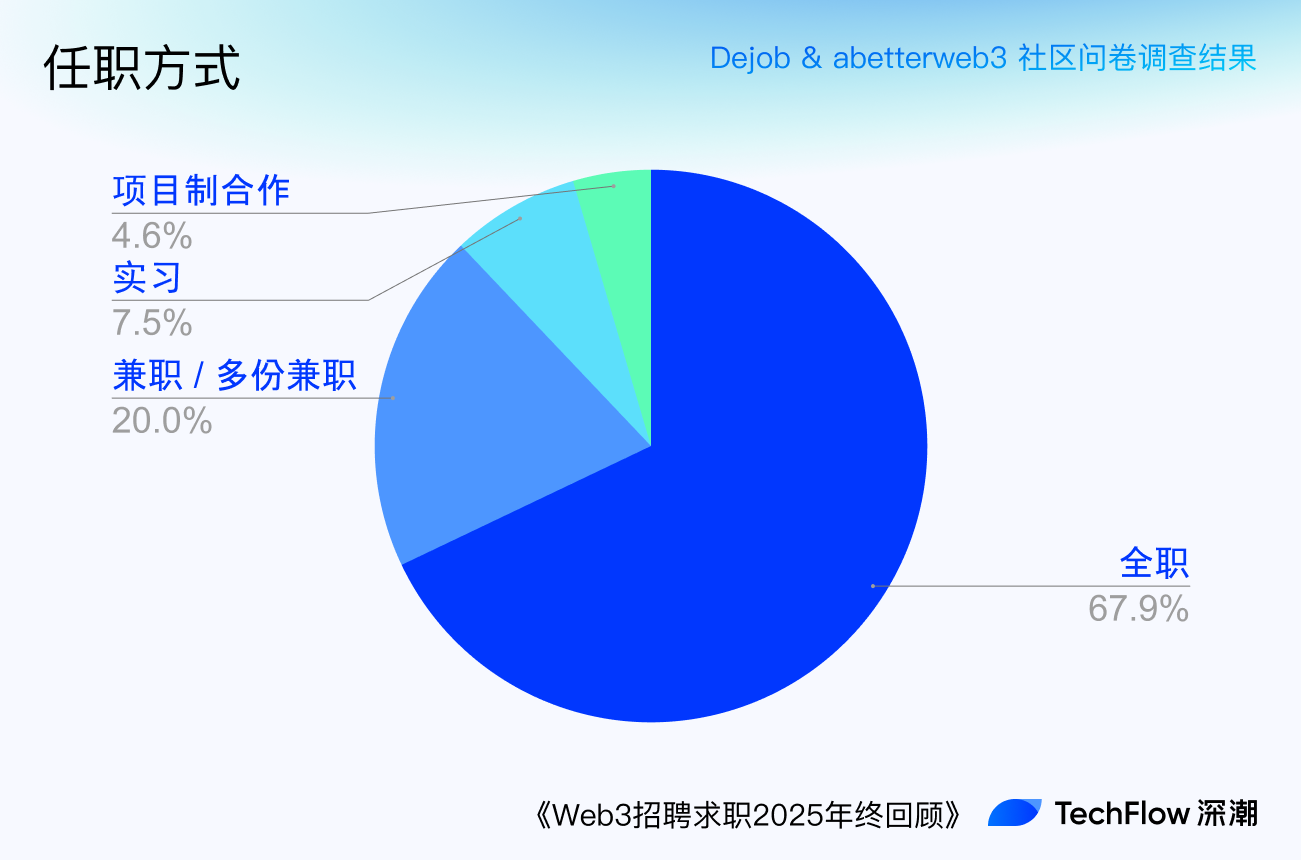

Regarding employment status, only 52% are currently working in Web3. Over 30% are in flexible arrangements.

This reflects how market conditions have impacted corporate HC. It may also reflect unique Web3 business models allowing some (like KOLs and traders) to generate cash flow without formal employment.

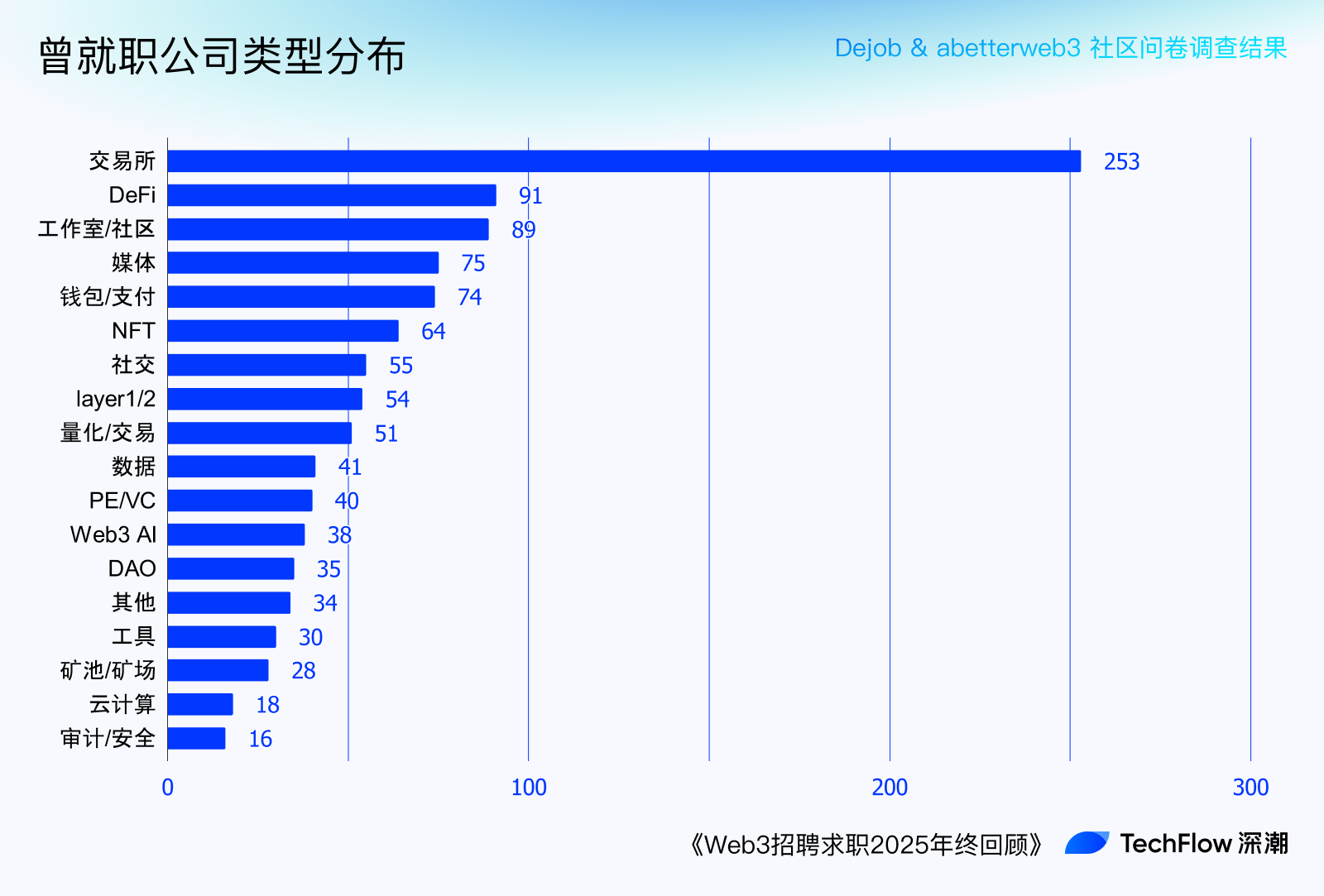

Over half reported prior experience at exchanges, followed by studios/communities, DeFi, media, wallets, etc.

Both talent and job providers show strong Matthew effects, clustering around exchanges.

This partly reflects the industry’s current dilemma: beyond exchanges, revenue potential declines progressively from consumer-facing tools to infrastructure layers.

Remote collaboration tools: given the survey was conducted within Chinese-speaking Web3 job communities, Telegram dominates due to its privacy and usability. Domestic tools like Feishu and WeChat follow, then Google Workspace, Discord, Slack, commonly used by foreign firms.

Income levels: contrary to myths of instant wealth, most Web3 professionals earn less than top-tier internet firms and severely lack long-term incentives (tokens/equity), bonuses, and layoff compensation.

Over 70% earn less than $4,000/month (~28,000 RMB); $10,000 monthly salaries commonly seen on Xiaohongshu are rare.

Nearly half have been laid off; among them, 40% received no severance, and 21% said any compensation fell far short of legal standards (e.g., n+1).

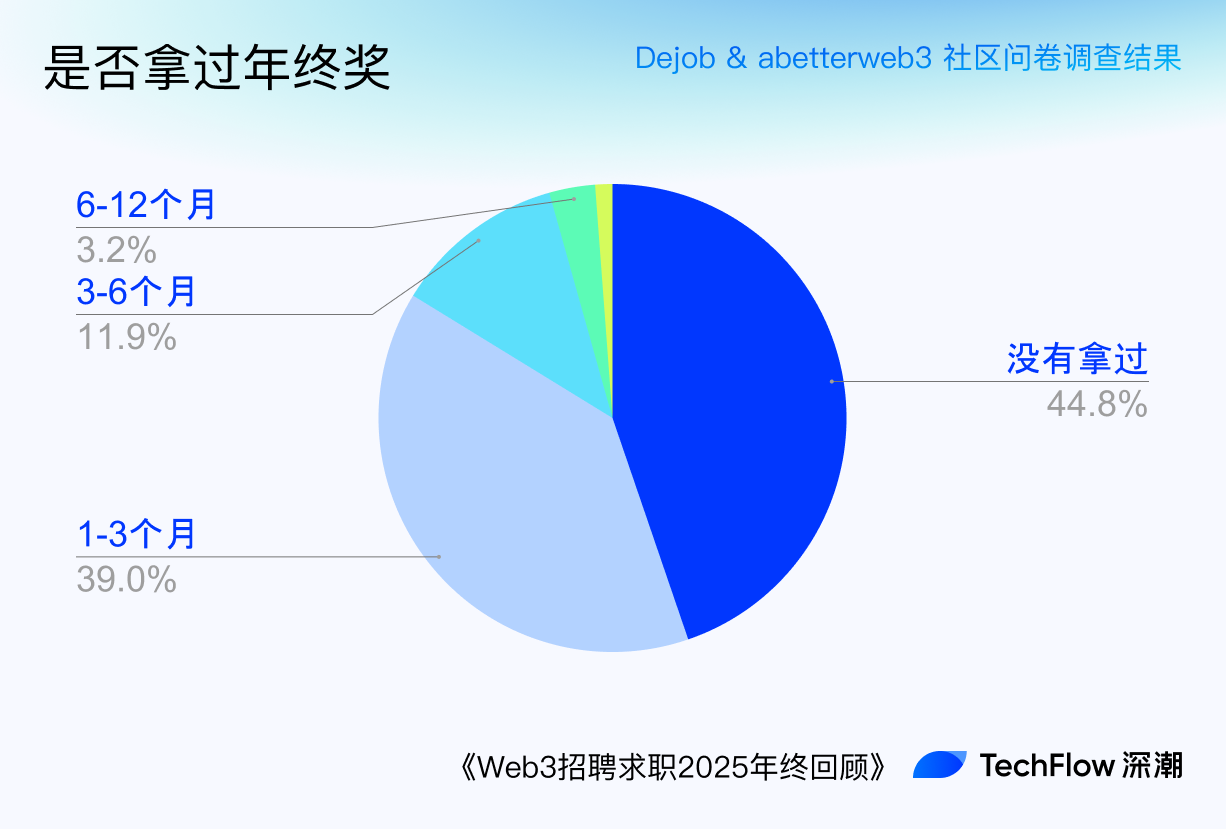

Almost half never received year-end bonuses; among those who did, 1–3 months' salary was typical—on par with most internet firms outside crypto.

On the famed “career path” of token incentives, nearly 70% report receiving none. Even when offered, they rarely exceed 20% of salary.

A quarter reported net financial losses since joining crypto—essentially “paying to work.” Others mostly accumulated around $100K (~700,000 RMB) in wealth.

Yet, despite bleak income prospects, Web3’s strong remote culture offers some relief.

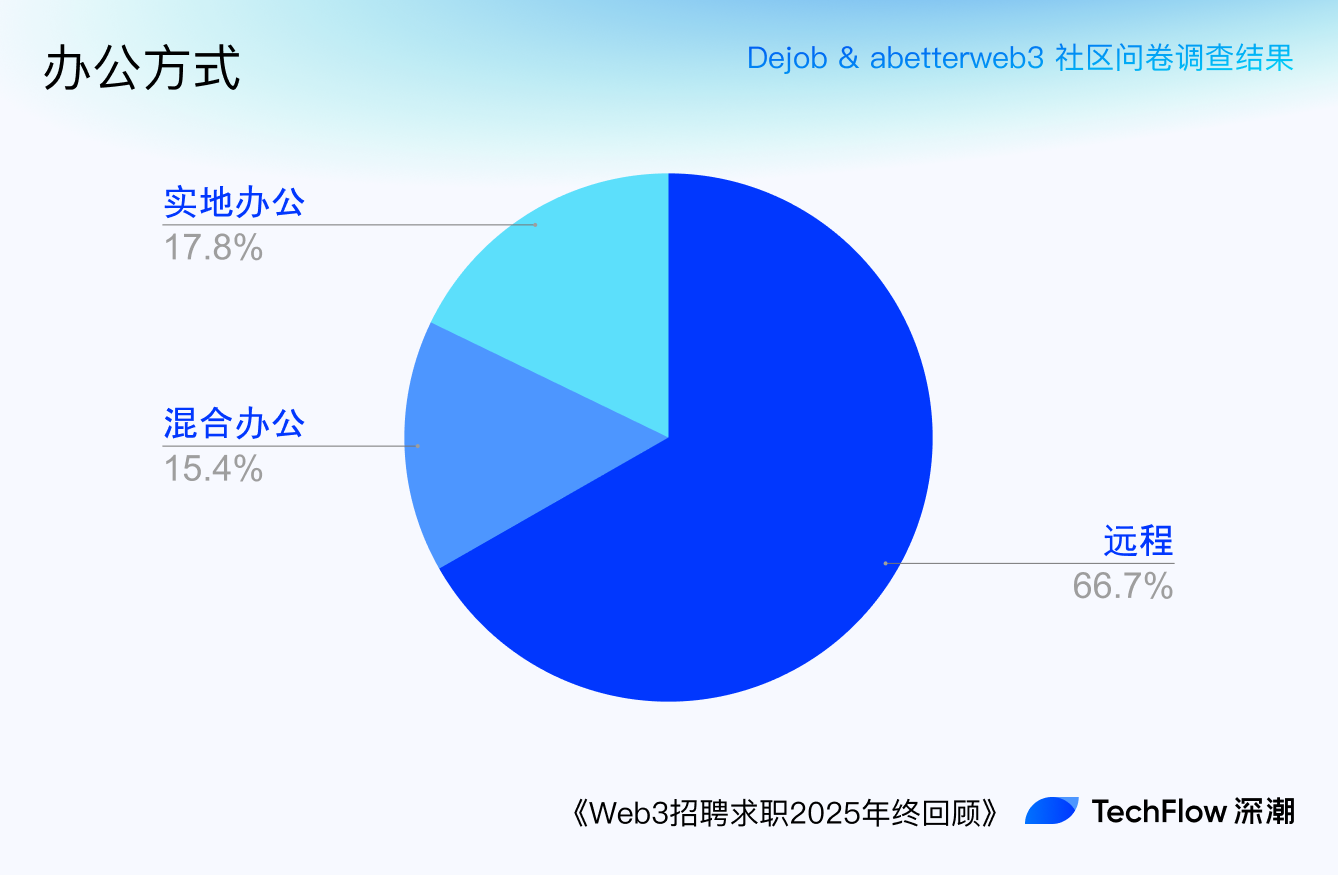

Nearly 70% say their company supports fully remote work; another 15% support hybrid models—offices exist but attendance isn’t mandatory, or employees can work remotely several days a week.

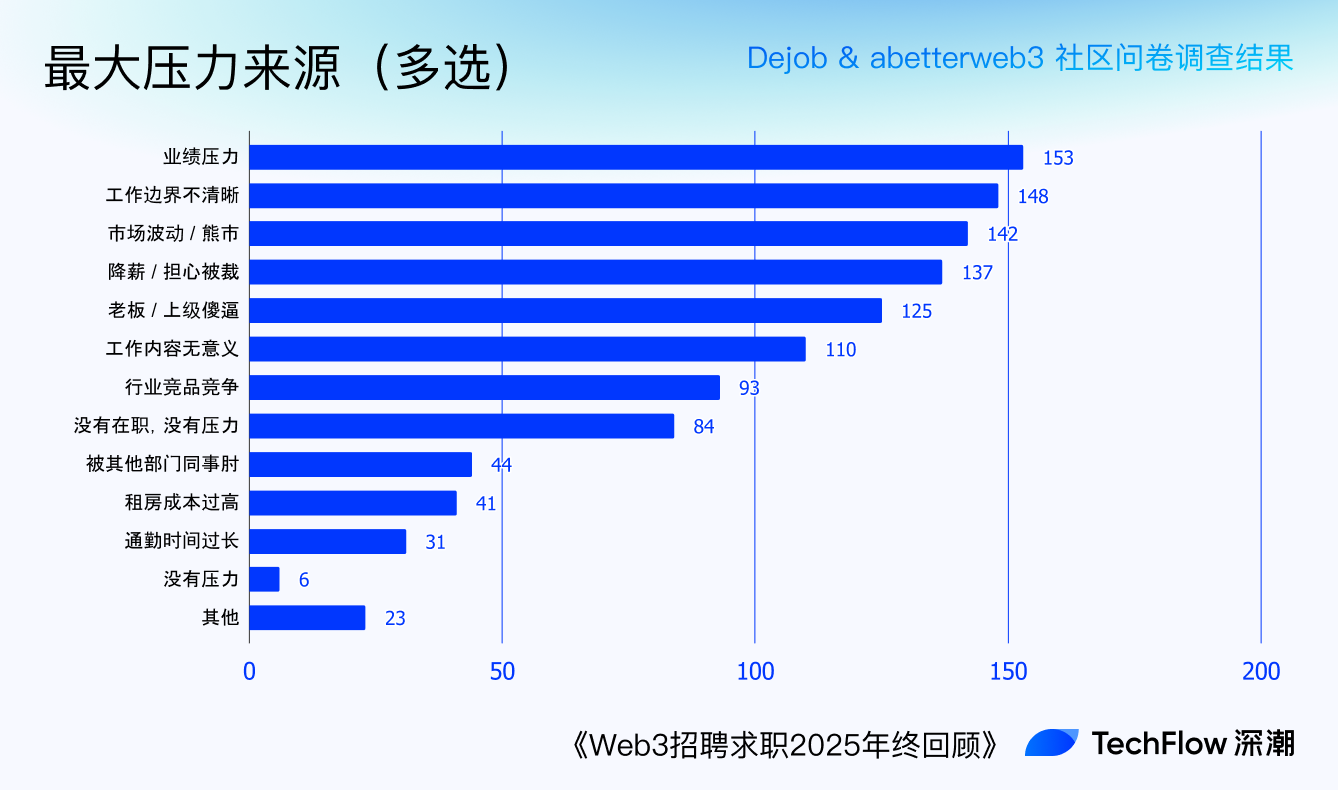

Remote work does alleviate some pain. In the “biggest stress source” question, 31 respondents cited “long commute times.”

Other top stressors: product growth pressure, blurred work boundaries, market volatility, fear of layoffs, and incompetent bosses.

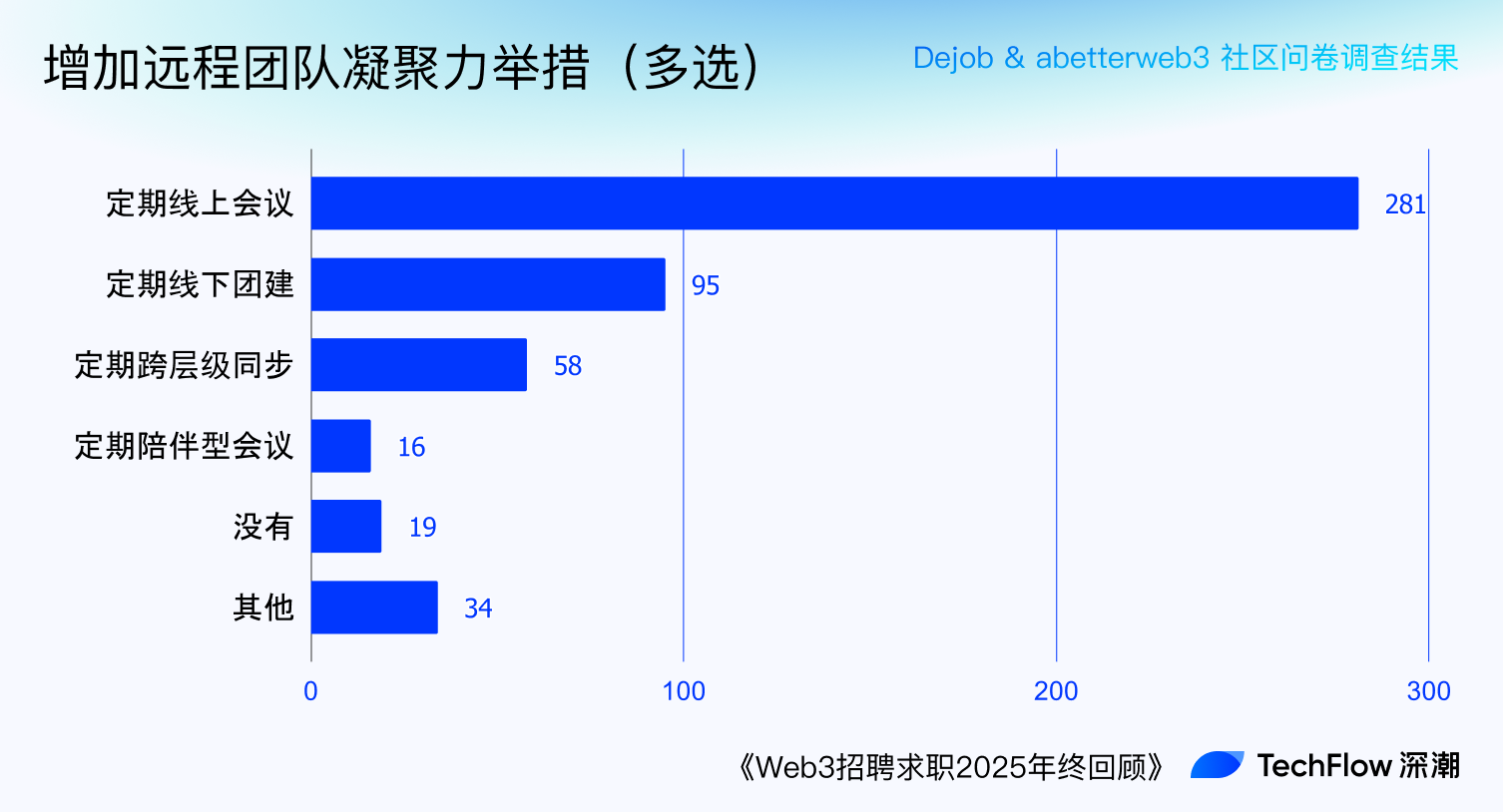

To maintain psychological well-being, many companies take steps to foster team cohesion.

Combined low income and instability drive many to multiple jobs. 20% of respondents have side gigs. This reflects Web3’s tech-driven culture—so long as you solve problems and deliver results, your lifestyle and income sources aren’t policed.

Workload-wise, 80% work 40–50 hours weekly. Thus, Web3 overtime is lighter than many 996/007 sweatshops in Web2.

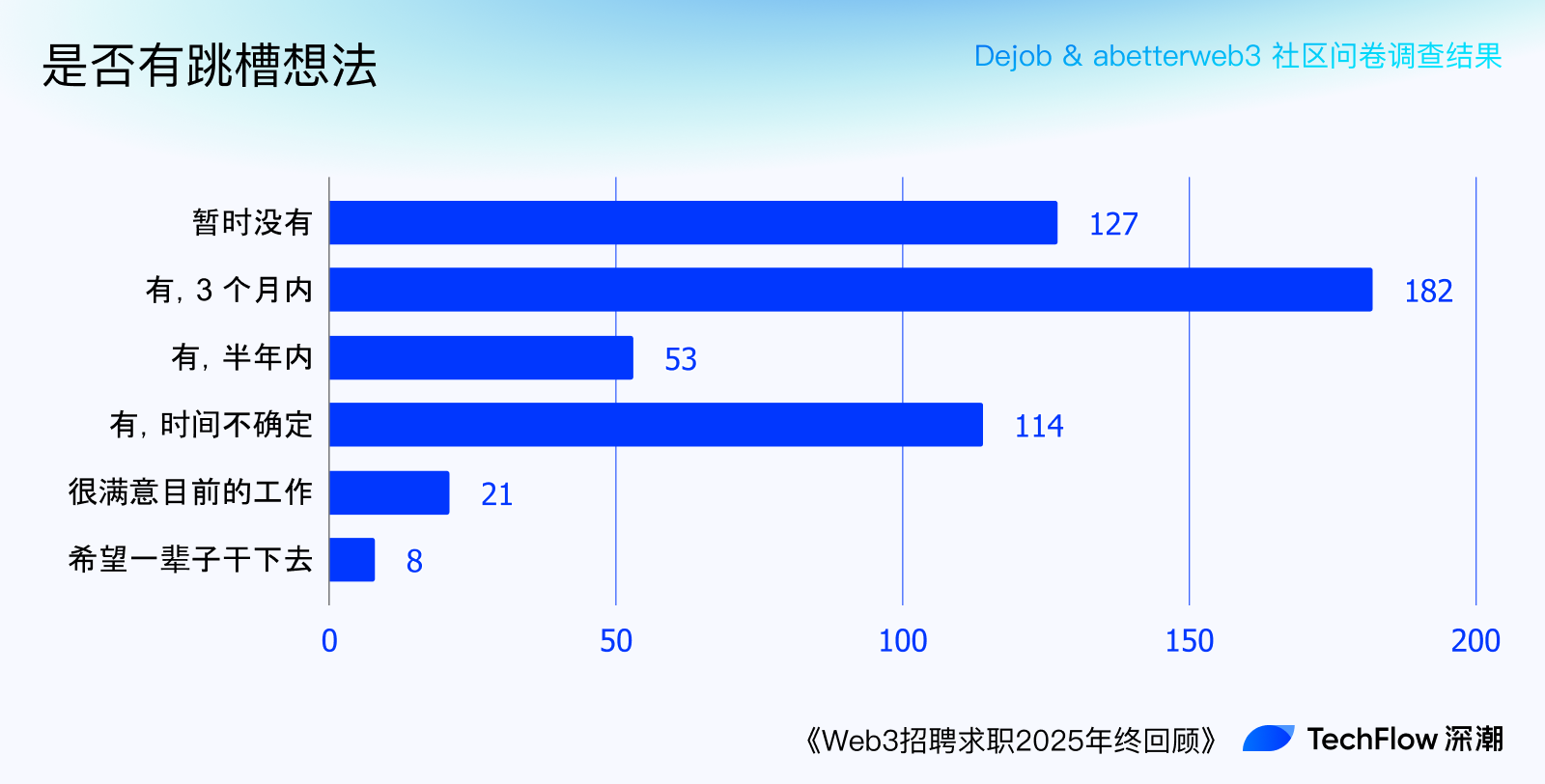

On job switching, over half want to change companies, with 30% planning to do so within 3–6 months. Yet about a quarter feel satisfied, and eight even found a “dream company” they’d like to stay with forever.

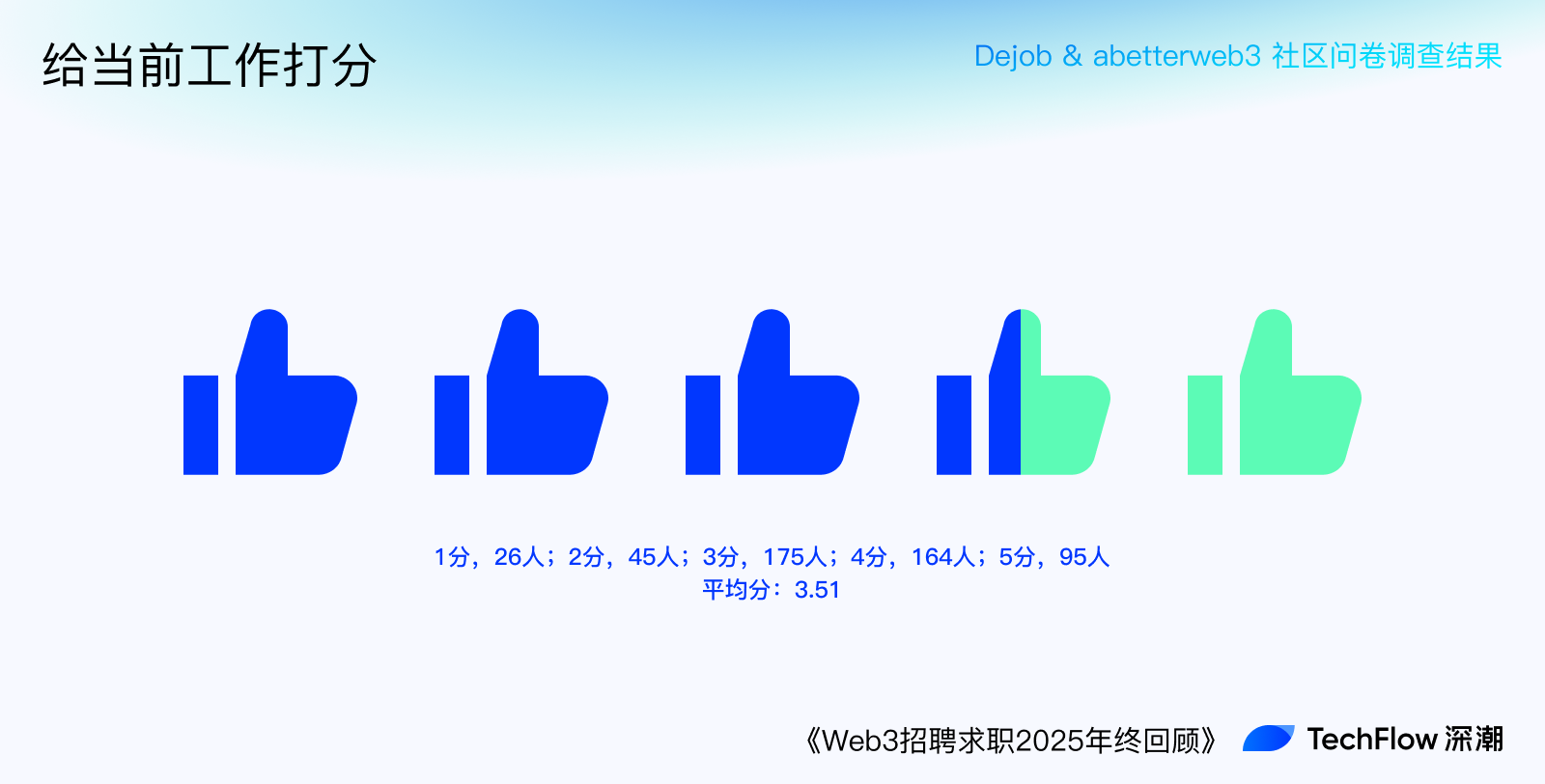

Considering moderate hours, remote flexibility, and side gig options, many rate their current jobs positively. Average self-rating: 3.51 out of 5.

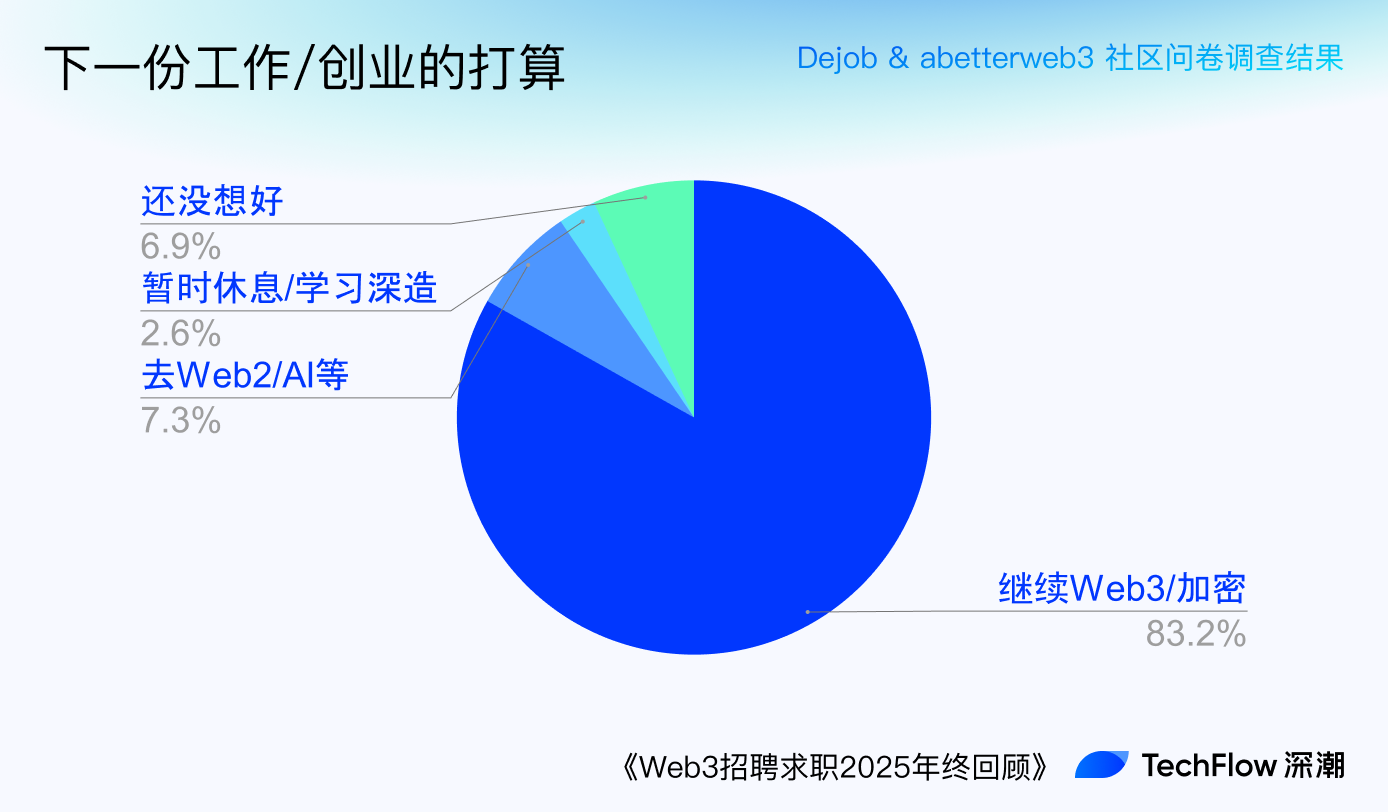

On whether their next job will still be in crypto, over 80% choose to stay, while 7% plan to leave.

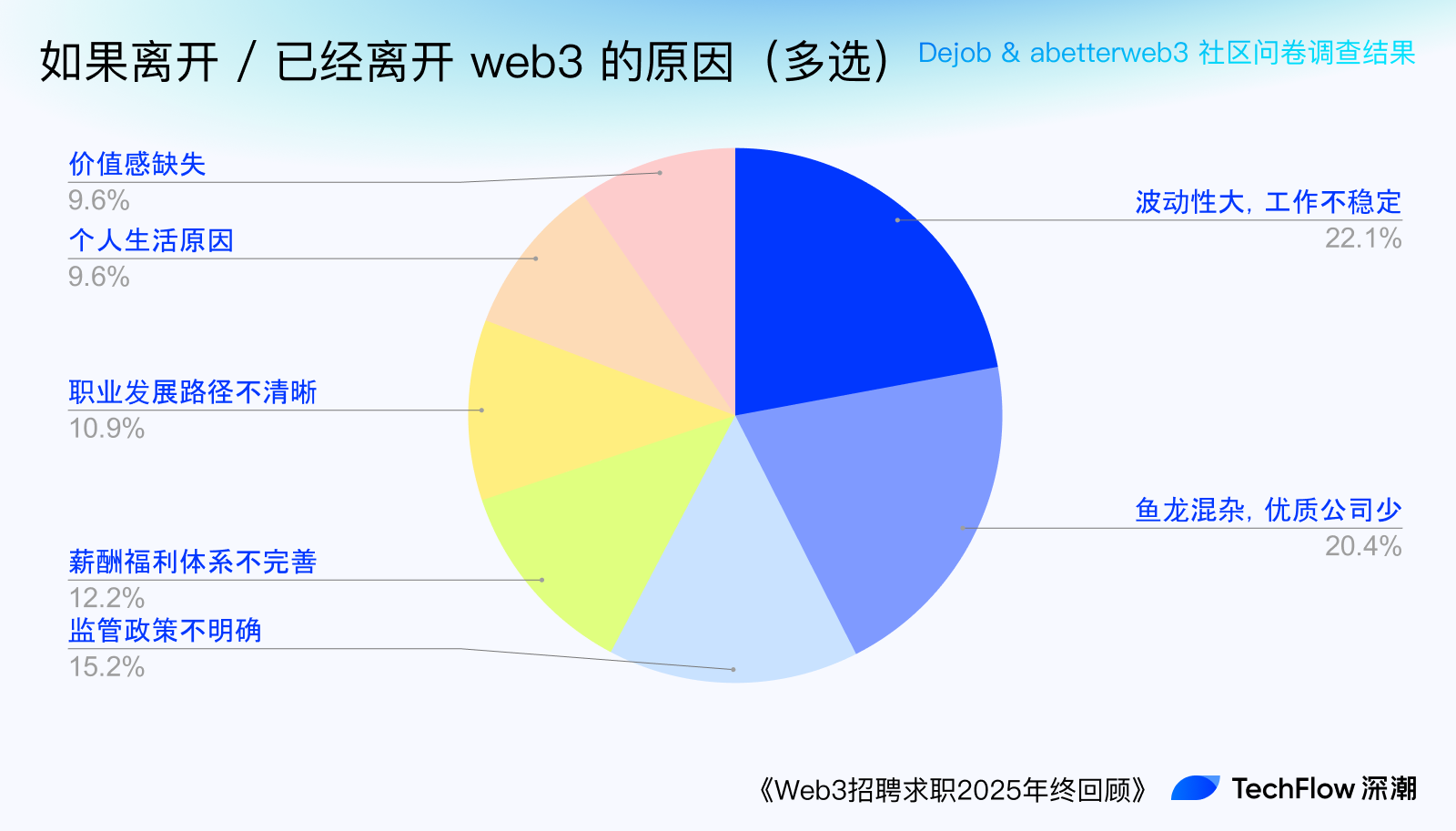

Reasons for leaving reveal the industry’s cold reality.

But all preparation aims at early retirement. When asked “how much wealth would make you consider quitting,” most chose $1M–$5M (~7M–35M RMB)—perhaps the true limit of wealth attainable through employment. Still, 20% chose “no limit,” reflecting confidence in their abilities.

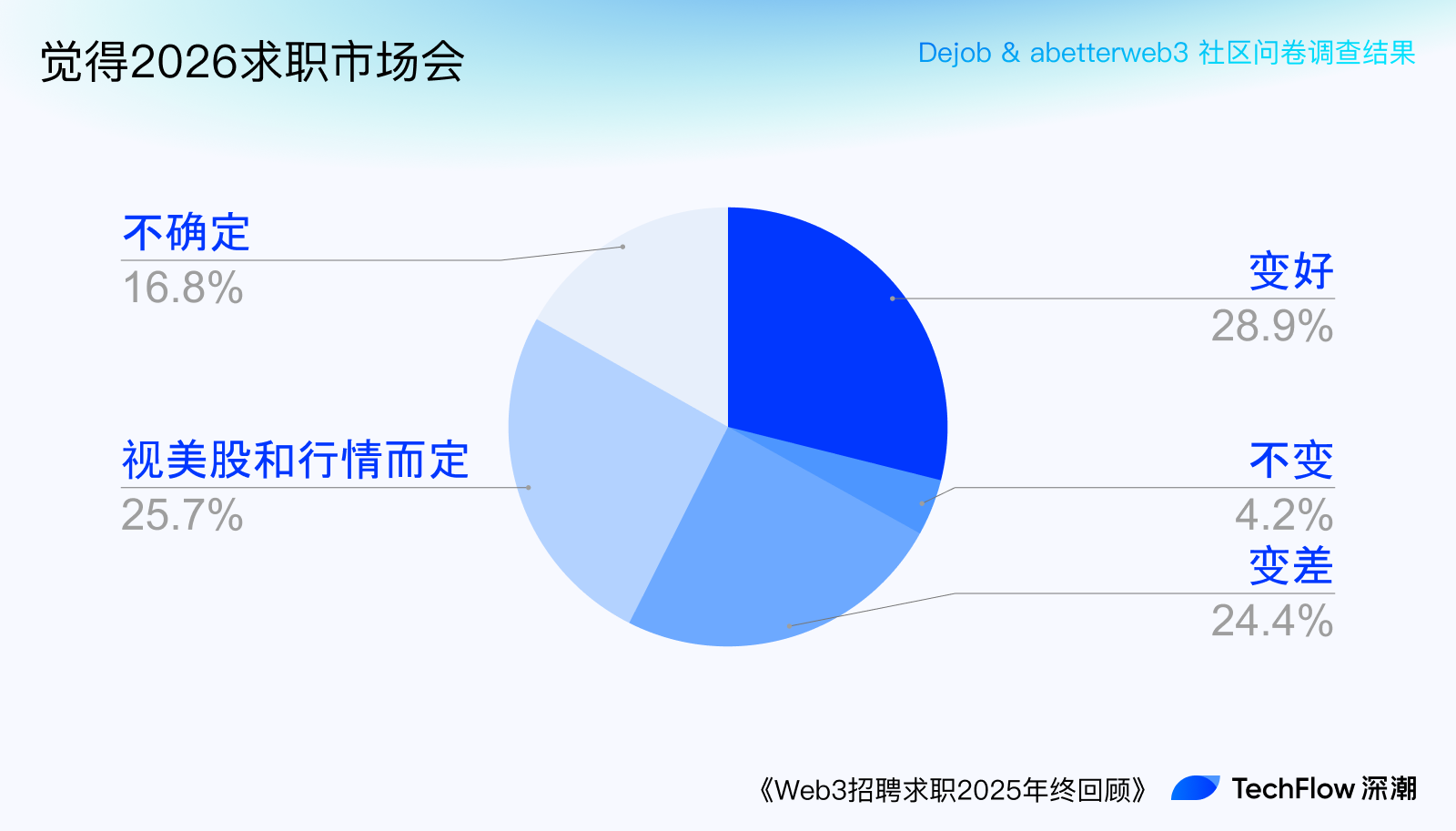

On whether they’re optimistic about the 2026 job market, only 28% believe it will improve, while most remain pessimistic or neutral.

Honest Opinions Section 👀

Beyond the main questions, we added optional ones to capture job seekers’ raw views on current industry firms (for entertainment only).

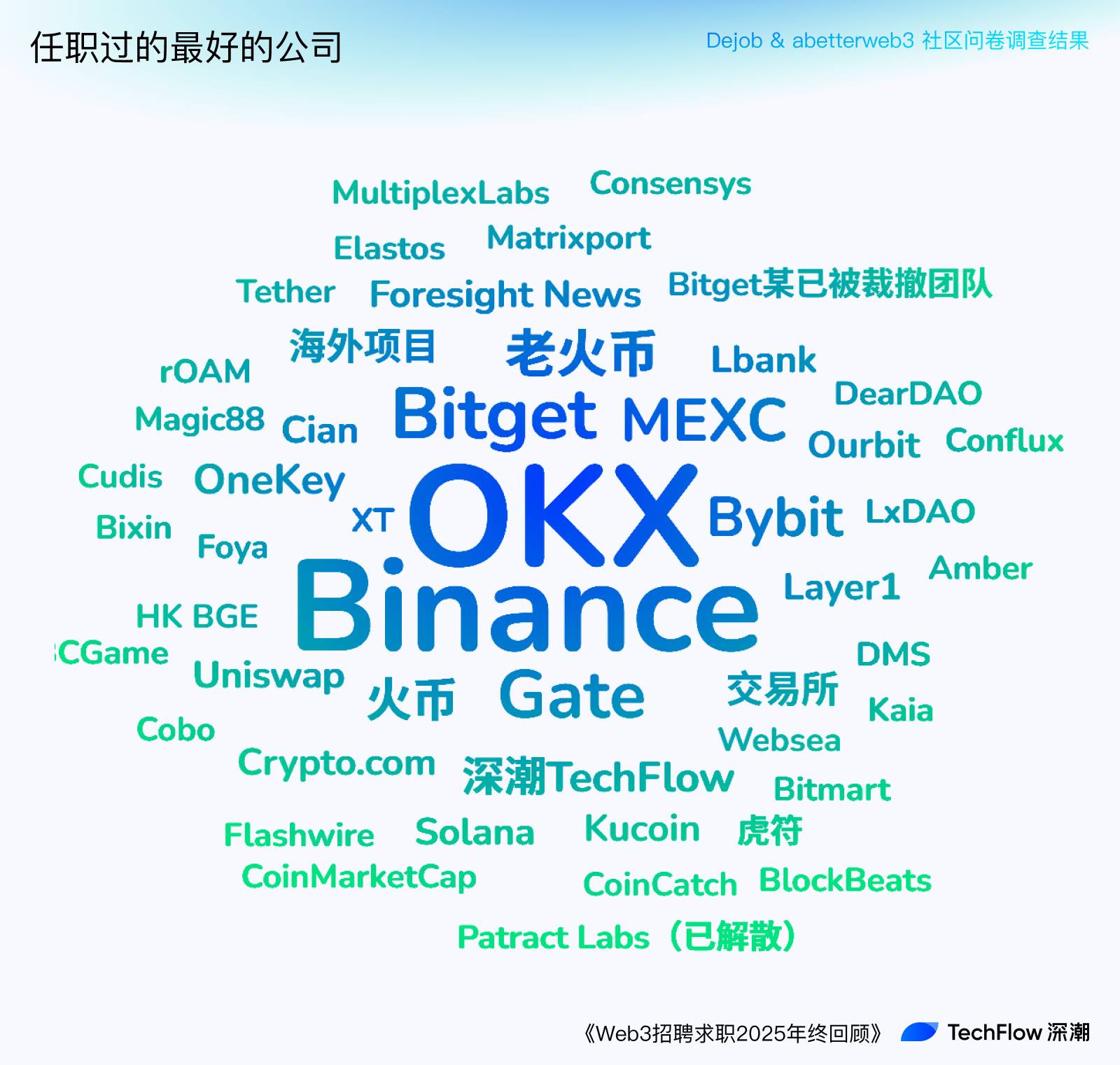

In response to “The best crypto company in your mind,” the top 10 were:

OKX(26), Binance(23), Bitget(10), Gate(9), MEXC(7), Bybit(6), Former Huobi(5), Huobi(4), TechFlow(3), OneKey(3)

Surprisingly, some disbanded teams were mentioned—like Li Lin-era Huobi, a defunct Bitget team, or dissolved Consensus Lab. Perhaps dream companies deserve lifelong nostalgia.

In response to “The worst crypto company in your mind,” the top 10 were:

Gate(43), Bitget(13), OKX(12), MEXC(8), Huobi(7), Binance(5), WEEX(5), CoinW(2), Kucoin(2), Lbank(1)

Some exchanges appear on both best and worst lists—likely because internal divisions vary greatly, with vastly different work experiences depending on team and leadership.

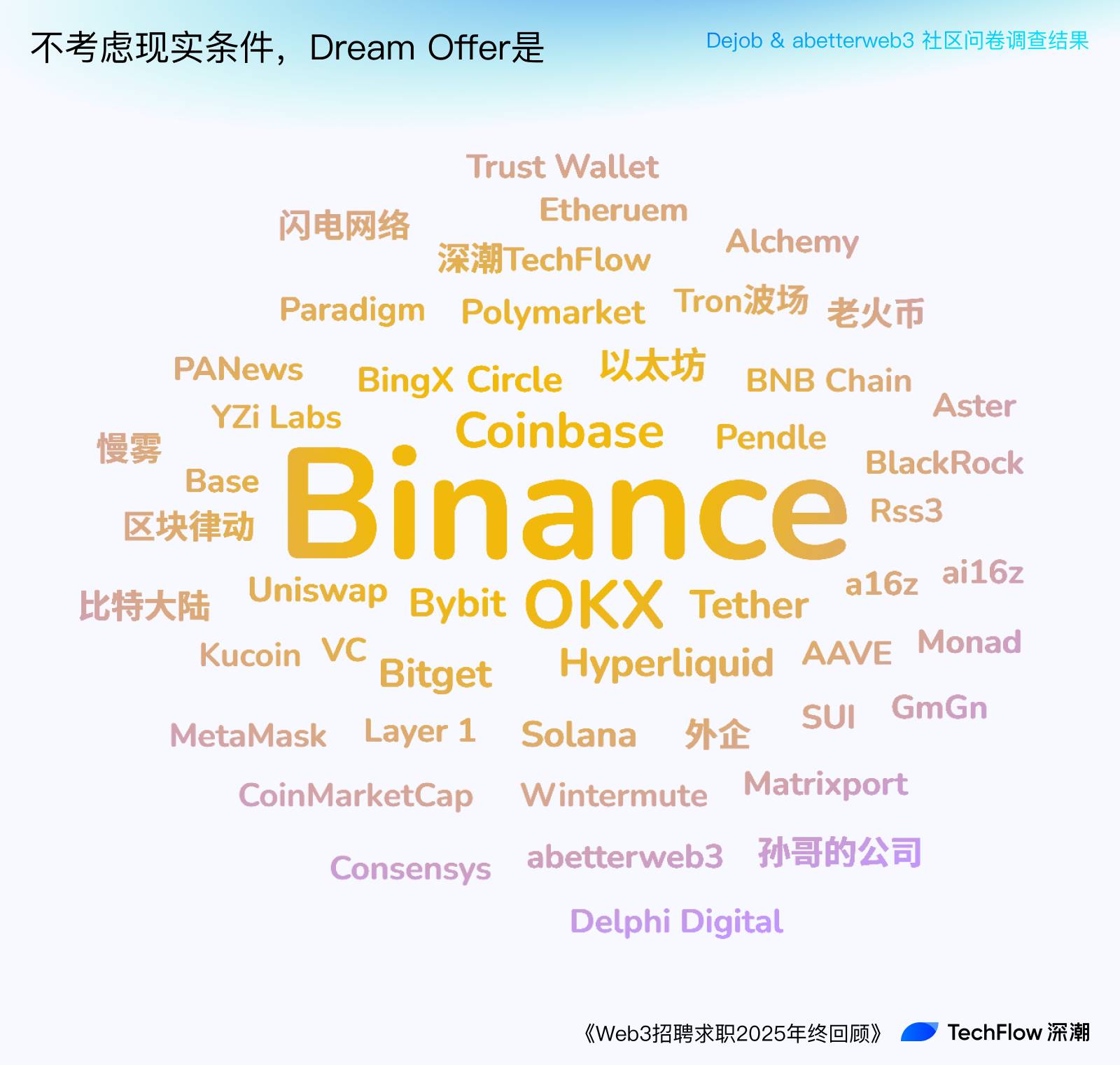

In response to “Which company would you most want to join, regardless of constraints,” the top 10 were:

Binance(177), OKX(50), Coinbase(25), Hyperliquid(11), Bybit(11), Bitget(10), Tether(10), Circle(6), Solana(5), Ethereum(5)

Binance, as industry leader, unsurprisingly tops the list. Acting as “Tencent of crypto,” Binance enjoys both outsider prestige and insider credibility, legitimately boosting careers. Hyperliquid, a non-exchange firm, cracking the top 10 reflects its strong community and desire for non-exchange products. Beyond top exchanges, names of foreign/overseas infra firms significantly increased—reflecting aspirational bias toward foreign companies and disappointment with Chinese teams.

In response to “Which job in crypto do you think earns the most,” frequent keywords included:

Trader(85), KOL(68), BD(47), Exchange(32), Quant(32), Project(27), Developer(20), Contract(17), Market maker(16), Tech(14)

Traders lead, likely because recent erratic markets made many realize that regardless of job or company, directly participating might yield better returns. KOLs follow, possibly due to access to early project tokens, informational advantages, or ability to influence specific assets for profit. Purely technical roles removed from markets were also mentioned—perhaps because to most non-developers, “tech” is an indispensable component for “super individuals” to leapfrog.

For more detailed answers, we’ve shared them publicly in an online document—feel free to explore 👀.

Crypto Career Survey Honest Opinion Responses

Or view the clean version of survey results below ↓

Crypto Career Survey Clean Results Version

Side Note: Traits HRs Value

To help job seekers understand employer perspectives, we interviewed several senior HRs from different companies.

On whether Web3 hiring demand has contracted recently, one exchange HR said that since 2020, handled roles have indeed declined. In 2025, developer HC rarely updates, while BD, marketing, and operations roles constantly cycle. The reason is clear: there aren’t many new features needing development, but growth efforts remain essential.

Another HR noted overall demand hasn’t dropped, but junior roles are decreasing while senior/expert roles grow. A third said demand hasn’t shrunk but hiring bars are rising—especially in education, though not yet as intense as in Web2.

On who makes a strong first impression, HRs agreed on two points: prestigious education and strong background (top firms, relevant experience).

However, there’s survivorship bias: companies able to hire HRs tend to be more mature, so prioritizing education and background is understandable. One HR added that educational requirements vary by role—backend, algorithm, blockchain roles have always had such demands, while others still don’t. Also, Web2 experience helps for R&D roles, but for market/operations roles requiring user empathy, it can be a drawback.

On valued traits, HRs emphasized competence, self-motivation, learning ability, and willingness to embrace Web3. Senior HR Oona said teams prioritize “plug-and-play” problem solvers; as an HR, she evaluates broader “fit,” including intelligence and stability. She also values resume consistency, avoiding candidates with frequent job switches.

On hard-to-fill roles, most said no role is truly impossible to hire for, though hybrid roles—requiring both product sense and technical skills—take longer. But such roles are relatively rare.

Conclusion: The Flame Endures

We hope these data demystify parts of the industry, while preserving a 2025 snapshot. Today, there’s no 2017-style rags-to-riches opportunity, nor the 2021 liquidity feast. Exchanges absorb most employment, while startups across tiers and sectors wait under the sand for the next wind. The get-rich-quick stories on Xiaohongshu or Bilibili are either survivorship bias or tales from the pyramid’s peak. Beneath the surface, the silent majority are ordinary people trying to sustain million- or billion-dollar funding narratives on $2,000–$3,000 salaries.

Even so, over 80% choose to stay. This persistence stems not only from dreams of financial freedom and appreciation for remote, flexible lifestyles, but also from the无奈 of having gone all-in with no way back. The industry’s true face includes middle-aged professionals transitioning from big tech, fresh grads entering crypto due to poor job prospects, and freelancers juggling multiple projects. No utopia of cypherpunks here—just a walled city full of uncertainty, barely alive.

But this article isn’t meant to discredit the industry—it’s a lamppost for future entrants. Maybe after round after round of stories, apps, manipulations, and bubbles, a true promised land will emerge. This industry has never belonged to Wall Street, whales, or old money. Remote culture, anonymous collaboration, efficiency-first, community focus—these real changes have happened and are irreversible. All ordinary people can do is find a ship that won’t sink in this tide.

After every mass extinction, new species arise. After countless proclamations of “the industry is dead,” the companies surviving bear markets, the teams relentlessly refining products, the individuals never ceasing to learn and grow—will be the true and eternal winners.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News