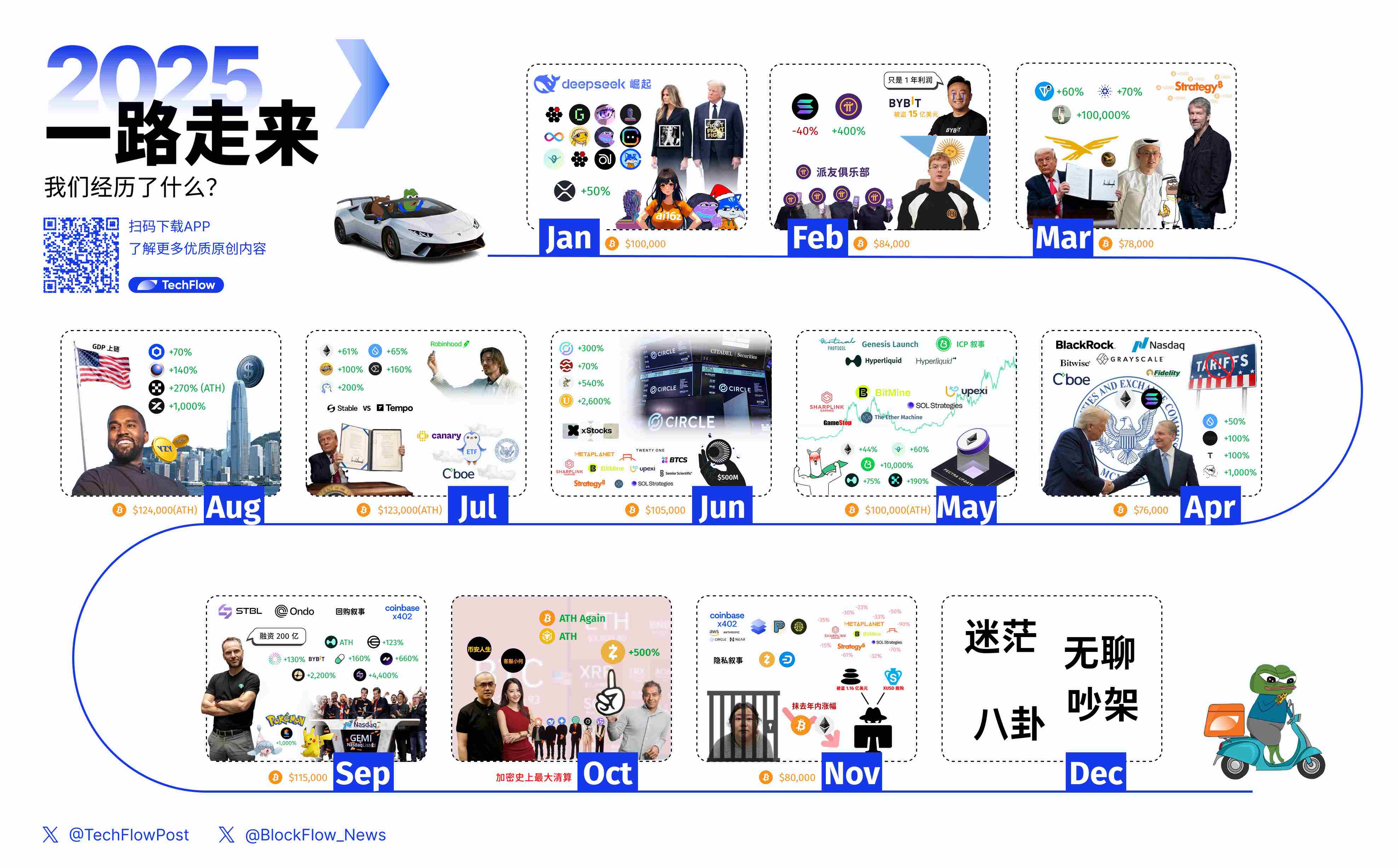

A picture recalling the ups and downs of the crypto world over the past 12 months

TechFlow Selected TechFlow Selected

A picture recalling the ups and downs of the crypto world over the past 12 months

Hope 2026 is kinder to all of us.

Written by: TechFlow

Less than 10 days remain in 2025.

They say one day in crypto equals one year in the real world. But those actually living through it may feel it even more deeply:

This year has passed too quickly—so fast that events from early this year now feel like they happened three years ago.

How did you fare this year? Did you catch a few waves, or were you humbled by the market in a particular month? Is that coin you heavily bet on at the beginning of the year still in your portfolio? Which narrative had you most hyped, and when did that happen?

Many answers might already be blurry.

Crypto markets have extremely short memories. Hot topics from three months ago are no longer discussed today, and confident predictions made back then are now too embarrassing to revisit.

We’ve compiled a complete record of 2025’s market activity, reconstructed month by month: what happened, which tokens surged, and what everyone was talking about.

No predictions, no judgments—just a way to help you recall what we actually went through this year.

January: The Spotlight on AI Tokens and TRUMP

Keywords: AI Agent, Political Meme, Optimism, and the First Cooling-off at Month-End

January’s star was the AI Agent.

AI16Z hit its all-time high of $2.47 on January 2, with a market cap reaching $2.5 billion—becoming the first AI token on Solana to achieve this milestone. Names like AIXBT, ARC, ZEREBRO, GRIFFAIN… were mentioned almost daily at the time.

Political memes also shone brightly. On January 17, $TRUMP’s official token launched, surging from under $1 to an all-time high of $75 within two days, briefly surpassing a $14 billion market cap.

The editorial team faintly recalls waking up to see TRUMP’s insane pump and feeling stunned. Everyone was skeptical at first—was this really official? But as information was confirmed, the idea of a sitting president launching a token became a first for the industry.

In addition, XRP rose 50% this month amid news that Ripple executives met with Trump’s team, sparking market bets that it would be among the first altcoins to get ETF approval.

On the macro front, Trump signed an executive order on January 23: establishing a Digital Assets Task Force, exploring a national crypto reserve, and banning the U.S. from issuing a CBDC. Market sentiment turned highly optimistic.

But the winds shifted at month-end. Around January 20, DeepSeek released a low-cost AI model, directly undermining the crypto AI Agent narrative—many agents suddenly seemed like child’s play in comparison.

Many AI-themed tokens that had just rallied fell back to their starting points in the following weeks.

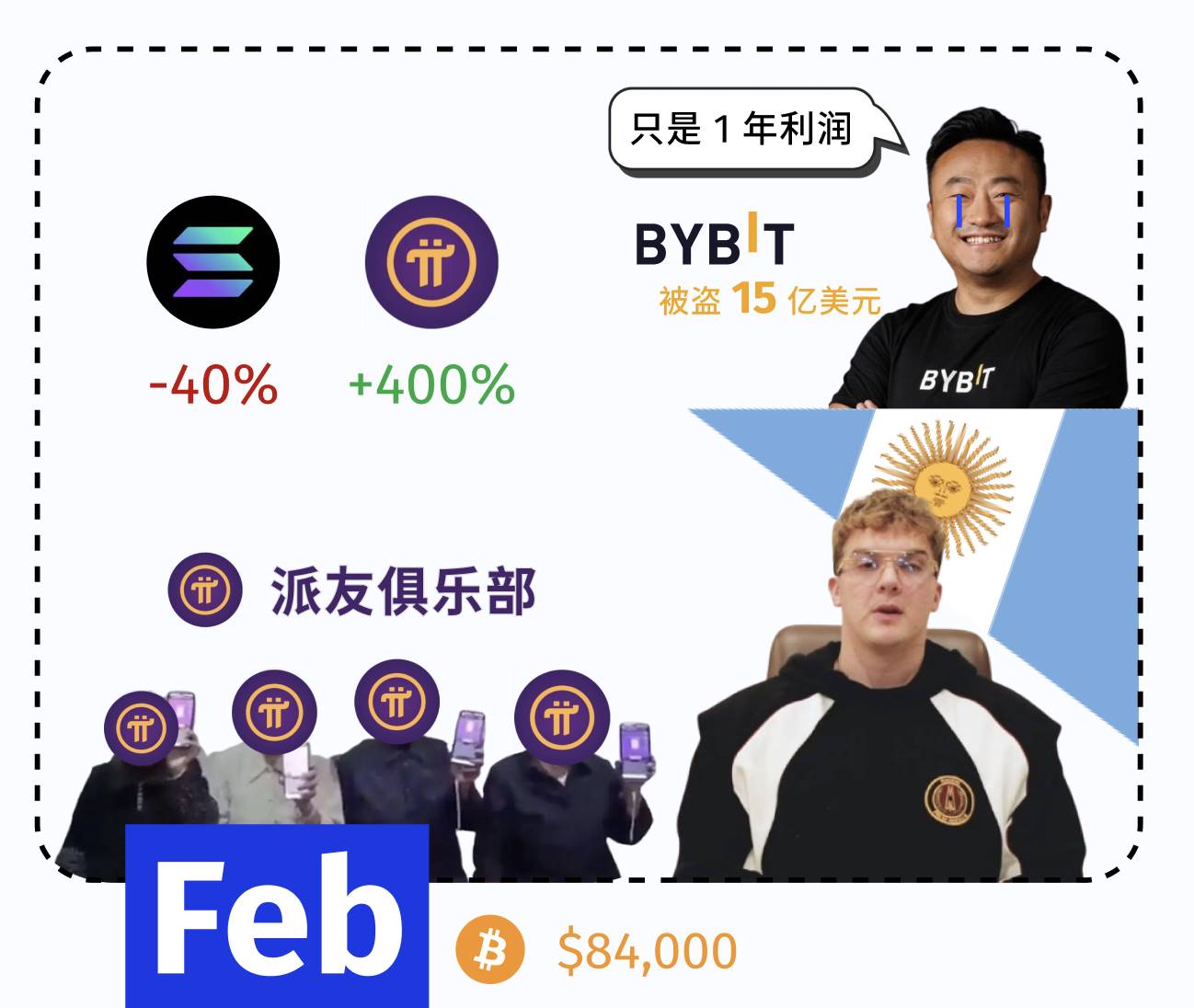

February: LIBRA Scam, Bybit Hack

Keywords: Bybit Hack, $LIBRA Scam, Great Liquidation

On February 21, Bybit suffered the largest cryptocurrency theft in history. North Korea’s Lazarus hackers transferred approximately 400,000 ETH (worth around $1.5 billion) to addresses under their control.

This surpassed FTX’s collapse losses and dwarfed any previous exchange hack.

Meanwhile, trust in political memes completely collapsed this month. On February 14—Valentine’s Day—Argentine President Milei launched a token via social media. It surged to $5 within 40 minutes, hitting a $4.5 billion market cap. Hours later, the price crashed 85%, leaving around 40,000 investors with over $250 million in losses.

Milei later deleted the post and denied involvement. The similarly named TRUMP and his wife’s tokens also gradually declined this month.

From February 24 to 27, Bitcoin experienced its worst three days since the 2022 FTX collapse, dropping 12.6% and triggering nearly $3 billion in leveraged positions being liquidated.

The meme coin sector was halved overall. Solana’s TVL plummeted 30%, falling to its lowest level since November last year.

But there were exceptions. Pi Network officially launched its mainnet on February 20, with its token peaking at $2.98, sparking discussions about “the grassroots project finally cashing out.”

March: Strategic Reserves Left, Tariff Fears Right

Keywords: Strategic Reserve, Tariff Panic, Meme Collapse, MicroStrategy

March marked the start of policy-driven optimism. Trump hosted the first-ever crypto summit at the White House, signing an executive order to establish a “Strategic Bitcoin Reserve.”

Days earlier, he announced on Truth Social that XRP, SOL, and ADA would also be included in the digital asset reserve. ADA surged 70% in a single day, breaking $1, leading many to believe regulatory attitudes had fully shifted.

But policy gains couldn’t hold the market. Trump’s tariff threats triggered trade war fears, causing broad sell-offs in risk assets. The meme sector underwent a collective crash: down 40–60% overall.

BSC unexpectedly became a safe haven. The Middle East-themed meme coin Mubarak surged thousands of times after multiple endorsements from CZ, and BSC’s trading volume briefly exceeded Solana’s.

Meanwhile, Hyperliquid faced its biggest crisis. An attacker manipulated JELLY token prices to short it, putting HLP’s treasury at risk of ~$12 million in losses. Hyperliquid responded by voting to delist the token and force settlement—a centralized resolution by a so-called decentralized exchange. This event led many to reevaluate the definition of DEXs.

Off-chain, Strategy (formerly MicroStrategy) continued accumulating, announcing on March 18 the issuance of $500 million in preferred stock specifically for buying BTC. Bitcoin maximalists’ faith remained unshaken.

April: Policy Shift, Sentiment Recovery

Keywords: Tariff Pause, Regulatory Shift, SOL ETF, Sentiment Reversal

April was a month of sentiment recovery.

On the 9th, Trump announced a 90-day tariff pause. The S&P 500 surged 9.5%—its largest single-day gain since 2008. On the same day, the SEC approved ETH ETF options trading, further improving institutional tools.

Meanwhile, new SEC chair Paul Atkins took office, bringing pro-crypto sentiment and renewed hope to the market.

The total crypto market cap rebounded 10.8% this month. Bitcoin recovered from a low of $76,000 to break $90,000 by month-end.

Canada launched the world’s first Solana spot ETF this month. SUI surged over 50% on news of a Grayscale trust and Mastercard partnership.

Meme coins revived. Fartcoin rebounded hundreds of times to lead the recovery, while RFC (“Elon’s mouthpiece”) gained over a thousandfold.

After the brutal reality checks of February and March, April was the first time many felt, “We’re back.”

May: We're So Back!

Keywords: All-Time Highs, China-U.S. Thaw, DAT Narrative, ICP, Hyperliquid

May was the most bullish month of 2025 so far.

On the 2nd, China and the U.S. reached a 90-day tariff pause agreement, temporarily lifting trade war concerns and driving a broad rebound in risk assets.

On the 7th, Ethereum completed the Pectra upgrade—the biggest hard fork since the 2022 Merge. Though not immediately reflected in price, ETH rose 44% this month, signaling clear market warming.

Elsewhere, Bitcoin broke $110K to hit a new all-time high. Everything was back—crypto markets began thriving across multiple fronts:

The “Digital Asset Treasury” (DAT) narrative for public companies kept heating up. GameStop, SharpLink Gaming, and others began purchasing BTC and ETH, replicating Strategy’s model.

On-chain, new trends emerged rapidly. Believe platform blew up—users could simply tag @launchcoin on X with a token name to launch instantly, birthing the so-called ICP narrative (Internet Capital Markets). Platform token LAUNCHCOIN surged this month.

Virtuals Protocol launched its Genesis Launchpad, reigniting AI token IPO hype—VIRTUAL rose 60%. Kaito’s Yap Points reward system elevated on-chain social to new heights, with its token gaining 190%. “Mouth mining” gradually became a mainstream airdrop strategy.

Hyperliquid’s token HYPE rose 75% this month. Chinese crypto circles belatedly began enthusiastically discussing new DEX models and the so-called “human efficiency ratio”—Hyperliquid generating massive profits with minimal staff.

May was kind to everyone. Everything finally came back to life.

June: DAT Heats Up, Stablecoin Frenzy

Keywords: Circle IPO, DAT Expansion, Stock Tokenization

June saw the stablecoin narrative explode.

On June 5, Circle rang the bell on the NYSE under ticker CRCL, priced at $31 and oversubscribed 25x. By June 23, shares hit a record high of $298.99—nearly nine times the IPO price.

This was a defining moment for native crypto firms on Wall Street and a landmark sign of traditional capital embracing the stablecoin sector.

Four days later, another stablecoin project caused an even bigger sensation. Plasma launched a public sale on Cobie’s Sonar platform, raising $500 million in five minutes.

The cap was raised to $1 billion and filled within 30 minutes. Early investors included Tether’s CEO, Peter Thiel, and Bybit. Market frenzy for “stablecoin infrastructure” exceeded all expectations.

The DAT narrative kept growing. Strategy kept buying. Metaplanet purchased 1,088 BTC in one month. DeFi Development Corp announced a $5 billion equity financing line dedicated to accumulating SOL, branding itself as the “SOL version of MicroStrategy.” SharpLink Gaming continued adding ETH, increasing holdings to 188,000.

On the 30th, another new narrative quietly began: stock tokenization.

Kraken and Bybit both launched xStocks, enabling over 60 U.S. stocks (Tesla, Nvidia, Apple, Microsoft, etc.) to trade as tokens on Solana.

Meanwhile, Hyperliquid solidified its dominance in on-chain derivatives, and Ethereum staking hit an all-time high. Meme coins also had highlights: BANANAS31 began its surge; USELESS, ironically named for being useless, rose over 2,000%.

July: GENIUS Act Passed, BTC and ETH Hit New Highs

Keywords: GENIUS Act, BTC/ETH New Highs, Tokenization Expansion, Stablecoin Chains

On July 18, Trump signed the GENIUS Act—the first federal stablecoin regulation in U.S. history.

Bitcoin didn’t stay idle. It began breaking out on July 10, surpassing $120,000 on July 14—an all-time high—with ETFs recording $1.2B in single-day inflows, a new record.

ETH also raced ahead, hitting a 2025 high of $3,848 on July 21.

Tokenization narratives intensified further. Robinhood launched trading for over 200 tokenized U.S. stocks on Arbitrum, including private equity tokens for OpenAI and SpaceX.

PENGU made headlines by filing for a PENGU ETF—potentially the world’s first ETF to include NFTs.

The stablecoin chain race began. “Stable,” backed by Tether and Bitfinex, revealed its roadmap on July 1, competing with Tempo and Circle’s own Arc.

Among meme coins, SPX6900 rose over 100%, and veteran stablecoin project ENA gained over 160%. Things were looking good.

August: OKB Explosion, BTC Hits New High Again

Keywords: Exchange Token Surge

August felt “okay.”

BTC hit a new high of $124,000 mid-month before pulling back, closing near $108,000. But altcoins were blazing hot—especially exchange tokens, which emerged as the biggest winners.

On August 13, OKX announced a one-time burn of 65.25 million OKB, permanently capping supply from 300 million to 21 million, alongside upgrading its X Layer public chain. OKB surged 170% that day to a new high of $148, then climbed to $255—up nearly 400% from its lows.

Meanwhile, MNT (Mantle) was integrated into Bybit, primarily serving as an RWA-focused public chain. MNT will be used on Bybit as a transaction fee token, similar to a platform coin.

On the 28th, the U.S. Department of Commerce announced a partnership with Chainlink and Pyth to bring macroeconomic data like GDP and PCE onto the blockchain. The news pushed LINK up about 61% in August, while PYTH spiked over 70% that day.

Hong Kong’s stablecoin regulation officially took effect. The “Stablecoin Ordinance” came into force on August 1, with the HKMA opening license applications. Many domestic firms, including JD.com, showed interest (though some later withdrew for unspecified reasons).

Of course, celebrity tokens brought drama. On August 21, Kanye West (Ye) launched the YZY token on Solana, spiking 1,400% to $3 within an hour, briefly pushing FDV to $3 billion—then crashing 80% and fading toward zero.

Ye claimed his Instagram was hacked and the promoted token was fake. Regardless of truth, another celebrity token became a classic case of “fans paying the price.”

SocialFi project ZORA also had its moment, riding Coinbase’s Base App integration and the Creator Coins trend to gain over 100% in August, briefly hitting an ATH of $0.15.

Pump.fun also revived, reclaiming most of Solana’s launchpad market share and earning $46 million in revenue in August.

September: Fed Rate Cut, ASTER Rises

Keywords: Rate Cut, Crypto IPO, Aster

On September 17, the FOMC announced a 25-basis-point rate cut—the first in 2025.

The same month, Tether raised private funding at a $500 billion valuation, once again showcasing its immense financial power—though largely irrelevant to most retail investors.

However, Tether co-founder Reeve Collins launched a new venture: the STBL protocol. It debuted on Binance Alpha on September 16, surging 455% that day with FDV exceeding $1 billion—rising 44x from its lowest to highest point in a month.

Crypto IPOs hit a small peak. On September 11, Figure listed on Nasdaq as the “first RWA stock”; Gemini followed the next day. Wall Street’s attitude toward crypto visibly shifted.

Within the crypto space, the on-chain derivatives arena erupted into a “DEX War.” Aster emerged out of nowhere, with its token surging 2,800% in its first week—briefly surpassing Hyperliquid in seven-day trading volume.

On the token front, PUMP rose 160% this month thanks to aggressive buybacks (over $95M accumulated), hitting an ATH on September 14. AVNT skyrocketed 660% after rapid listings on Upbit and Binance. BNB rose 19.7% following Franklin Templeton’s expansion of the Benji platform. MNT gained 130% due to integration into the Bybit ecosystem.

Coinbase’s x402 protocol was unveiled this month, laying the groundwork for the heated x402 sector in the following two months.

October: Living the Binance Life, Facing Bloody Liquidation

Keywords: Epic Liquidation, Binance Life

October was supposed to be “Uptober.”

The first Chinese meme coin, “Binance Life,” launched on October 4—“Drive a Binance car, live in a Binance community, enjoy the Binance life.” This meme resonated deeply with Chinese-speaking communities, rocketing from zero to a $500 million market cap in five days, up over 3,000%.

For the past seven years, Bitcoin never dropped in October. But 2025 shattered that streak completely.

BTC was still making new highs early in the month, peaking at $126K on October 3. Then, on October 11, an epic-scale liquidation occurred—$19 billion in leveraged positions were wiped out within 24 hours, marking the largest single-day liquidation disaster in crypto history.

From that point, market sentiment and liquidity sharply deteriorated.

Although Naval’s endorsement of Zcash sparked a local rally, the market never regained major momentum afterward. Institutions and retail alike suffered immeasurable losses equally in this wave.

November: Falling with No Tears Left, Privacy Coins Rise Against the Tide

Keywords: BTC $80K, DeFi Blowup, Privacy Rise, x402, Criminal BTC Seized

The October liquidation wave was thought to be the worst—but November proved the market could sink even lower.

BTC plunged from $110K at month-start to $80K, its lowest in seven months. Total crypto market cap evaporated nearly $1 trillion, dropping from $4.2T to $3.2T. BlackRock’s IBIT saw $2.34B in outflows—the largest monthly outflow since the ETF’s inception.

But some profited even in bearish times. Privacy coins unexpectedly became safe havens. ZEC soared from $40 in September to over $600 in November—up more than 1,200%. DASH jumped from $20 to $136, rising over 6x.

The AI payment narrative briefly flared. Coinbase’s x402 protocol enabled AI agents to autonomously pay for services. Ecosystem token PING surged from zero to a $70 million market cap, with PayAI, SANTA, and others catching speculative momentum. But the hype faded quickly, cooling off by month-end.

Meanwhile, “Digital Asset Treasury” (DAT) companies collectively struggled.

Strategy plunged 36% in November. MSCI was evaluating whether to remove Strategy from its index. Other ETH- and SOL-denominated companies also kept falling.

In addition, authorities seized nearly 190,000 BTC linked to fraudsters Qian Zhimin and Chen Zhi, raising market concerns about potential selling pressure and amplifying the label of “crypto = money laundering” once again.

December: Boring, Drama, and Gossip

Ride the e-scooter, deliver this last order. No narratives—just emotions.

Group chats aren’t about positions anymore—they’re about gossip: who ran away, who scammed donations, who fought over profit splits.

Some call this a “silent bear market.” Slowly, silently, it drains everyone’s passion. The only consensus left is: wait. Wait for liquidity to return.

Next year is almost here.

We in crypto don’t know where we’re going—but we’re still on the road.

Hope 2026 is kinder to all of us.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News