The Battle for $90,000: Can BTC Lead the Market to Breakthrough Amid Macro Turmoil?

TechFlow Selected TechFlow Selected

The Battle for $90,000: Can BTC Lead the Market to Breakthrough Amid Macro Turmoil?

Next week, markets will seek direction amid the tug-of-war between macro events and expectations of improved liquidity.

Author: Hotcoin Research

Crypto Market Performance

Currently, the total cryptocurrency market capitalization stands at $3.09 trillion, with BTC accounting for 58.43% ($1.8 trillion). The stablecoin market cap is $307.5 billion, up 0.18% over the past seven days—modest growth—with USDT representing 60.46%.

Among the top 200 projects on CoinMarketCap, most have seen gains while a minority declined: BTC rose 1.21% over 7 days, ETH increased by 1.7%, SOL surged 7.8%, RENDER jumped 48.86%, and VIRTUAL gained 7.49%.

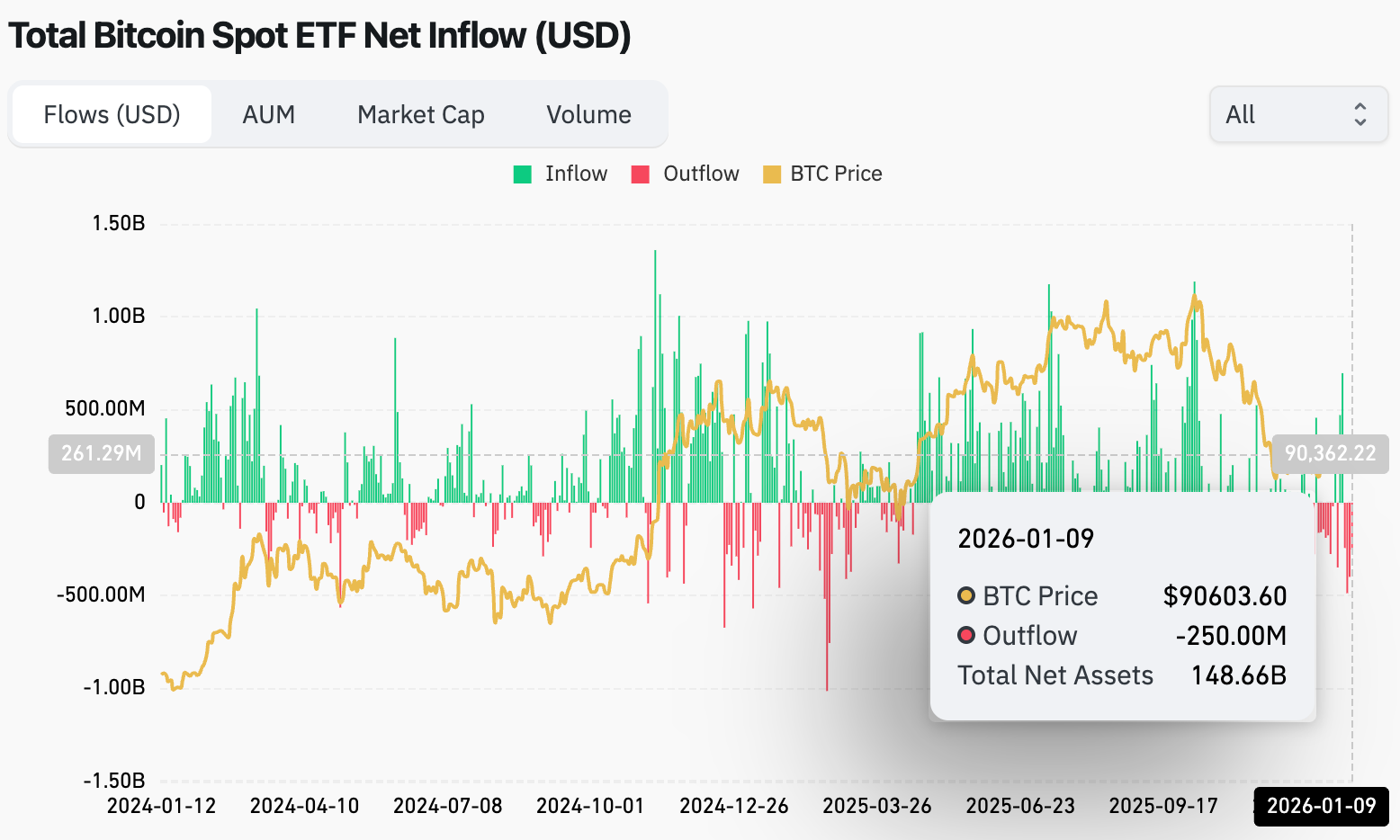

This week, U.S. spot Bitcoin ETFs recorded net outflows of $681 million; U.S. spot Ethereum ETFs saw net outflows of $68.1 million.

Market Outlook (January 12–18):

The current RSI index is 47.56 (neutral zone), the Fear & Greed Index is 26 (unchanged from last week, indicating "extreme fear"), and the Altseason Index is 56 (neutral, higher than last week).

BTC core range: $89,500–94,000

ETH core range: $3,100–3,350

SOL core range: $116–145

The crypto market is expected to remain volatile with a bullish bias next week, with macroeconomic developments acting as the key variable.

Macroeconomic Factors (Decisive Influences):

Fed Chair Nomination: This is the most critical macro factor. Market speculation suggests the nomination could be announced during the week of January 12. If the selected candidate is perceived as "crypto-friendly" or "dovish," it could serve as a strong catalyst for market upside.

U.S. CPI Data (to be released on January 12): This will directly impact market expectations regarding inflation and future interest rate trajectories.

Regulatory & Policy Developments:

Digital Asset Market Structure Act ("Clarity Act"): Progress on Senate voting in the U.S. remains a focal point for market attention.

Next week’s market direction will hinge on the interplay between macro events and improving liquidity sentiment. The optimal strategy is to remain cautious ahead of major announcements, waiting for clear price reactions at key levels before formulating subsequent moves.

Understanding the Present

Weekly Recap: Key Events

- On January 3, after 14:00 Beijing time, loud explosions were reported in Caracas, Venezuela’s capital, triggering air raid sirens and power outages in southern areas near a major military base. The crypto market experienced a notable pullback possibly linked to this incident;

- A CBS News reporter stated on social media that U.S. officials disclosed President Trump had ordered strikes on targets within Venezuela, including military facilities. The post noted, “This move marks the Trump administration’s escalation of pressure against the Maduro regime early Saturday morning”;

- On January 6, according to Business Insider, insider sources accurately bet on Venezuelan President Nicolás Maduro's political future, earning hundreds of thousands of dollars. A congressman attempted to block government officials from engaging in similar speculative activities;

- On January 6, CoinDesk reported that Buck Labs launched its crypto token BUCK, positioned as a “Savings Coin” targeting non-U.S. users, aiming to offer passive yield on USD-denominated crypto assets rather than functioning as a traditional stablecoin;

- On January 7, Bitget TradFi data showed that spot gold and silver began a strong rebound around January 3. At publication, spot gold briefly touched $4,500—just $50 short of an all-time high—while spot silver reclaimed $82, currently trading at $82.40, only 15% below its record high;

- On January 8, the U.S. released December ADP employment data showing moderate labor market recovery. As a result, CME's "FedWatch" tool indicated the probability of a January rate cut dropped to 11.1%, down from 17.7% the previous day;

- On January 7, Falcon Finance announced a new off-chain Bitcoin yield vault designed for BTC holders seeking returns without altering long-term holdings, offering an estimated annual yield of 3%–5%, paid in USDf, Falcon’s dollar-settled asset;

- On January 8, Bank of America upgraded Coinbase’s stock rating to “Buy,” citing accelerating product expansion, strategic shifts, and more attractive valuations. BofA noted Coinbase’s share price had pulled back ~40% from July highs, but product momentum was improving in the second half;

- On January 9, SIFMA, a major Wall Street lobbying group, held a private closed-door meeting with multiple crypto industry representatives to discuss core disagreements in the U.S. Digital Asset Market Structure Act, making progress on DeFi-related provisions.

Macroeconomic Overview

- January 7: U.S. December ADP employment change was +41K vs. expected +47K and prior -32K (revised), missing expectations ("small NFP");

- January 8: U.S. initial jobless claims for the week ending January 3 were 208K vs. expected 210K, with the prior figure revised from 199K to 200K;

- January 9: U.S. December unemployment rate was 4.4%, below the forecast of 4.5% and prior 4.6%;

- January 9: According to CME "FedWatch" data, the probability of a 25-basis-point rate cut by the Fed in January stood at 12.6%, while the probability of holding rates steady was 87.4%.

ETFs

Data shows that between January 4 and January 9, U.S. spot Bitcoin ETFs experienced net outflows of $681 million. As of January 9, GBTC (Grayscale) has cumulatively outflowed $25.365 billion and currently holds $14.711 billion, while IBIT (BlackRock) holds $70.249 billion. The total market cap of U.S. spot Bitcoin ETFs stands at $120.562 billion.

U.S. spot Ethereum ETFs recorded net outflows of $68.1 million.

Looking Ahead

Project Updates

- Applicants for Monad Momentum Round Two will be notified by January 13;

- A special meeting of Nasdaq-listed medical tech firm Semler Scientific will take place on January 13, 2026, to vote on its proposed merger with bitcoin treasury company Strive. Upon completion, the combined entity will hold nearly 13,000 BTC, ranking among the world’s top five corporate Bitcoin holders;

- Aster Phase 4 airdrop eligibility queries open on January 14, 2026, with claim window opening on January 28, 2026;

- BSC mainnet Fermi hard fork upgrade is scheduled to launch on January 14, 2026, at 10:30. This upgrade reduces block intervals from 750ms to 450ms, enhancing network throughput and transaction processing efficiency;

- BitMine plans to hold its annual shareholder meeting at Wynn Las Vegas on January 15, 2026;

- MSCI will decide on January 15, 2026, whether to delist Strategy;

- The UK Financial Conduct Authority (FCA) recently opened a regulatory sandbox for domestic stablecoin issuers wishing to test their solutions. Applications close on January 18.

Key Events

- January 13 at 21:30: U.S. December YoY CPI (unadjusted) release;

- January 15 at 21:30: U.S. weekly initial jobless claims (in thousands) for the week ending January 10.

Token Unlocks

- Aptos (APT): 11.31 million tokens unlocking on January 11, worth ~$21.04 million, representing 0.7% of circulating supply;

- Starknet (STRK): 126 million tokens unlocking on January 15, worth ~$10.95 million, representing 4.83% of circulating supply;

- Sei (SEI): 55.56 million tokens unlocking on January 15, worth ~$6.89 million, representing 1.05% of circulating supply;

- Arbitrum (ARB): 92.65 million tokens unlocking on January 16, worth ~$19.55 million, representing 1.86% of circulating supply;

- ZKsync (ZK): 175 million tokens unlocking on January 17, worth ~$5.79 million, representing 3.16% of circulating supply.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is dedicated to transforming professional insights into actionable investment advantages. Through our flagship reports—Weekly Insights and In-Depth Research—we analyze market trends and uncover emerging opportunities. Our exclusive column Top Pick Coins (powered by AI and expert dual-screening) helps investors identify high-potential assets and reduce trial-and-error costs. Each week, our analysts engage live via streaming to explain market热点 and forecast trends. We believe that informed guidance combined with human-centric support empowers more investors to navigate market cycles and capture value opportunities in Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a disciplined risk management framework to safeguard capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News