How do 99% of unprofitable Web3 projects survive?

TechFlow Selected TechFlow Selected

How do 99% of unprofitable Web3 projects survive?

The harsh reality of today's Web3 market: cashing out through inflated valuations is far easier than building a sustainable business model—and in the end, investors bear the full cost of this "failure."

Author: Ryan Yoon, Tiger Research

Translation: Saoirse, Foresight News

99% of Web3 projects have no cash income, yet many companies continue to spend heavily on marketing and events every month. This article delves into the survival mechanisms of these projects and uncovers the truth behind their "burning cash" model.

Key Takeaways

- 99% of Web3 projects lack cash flow, relying on tokens and external funding rather than product sales to cover expenses.

- Premature token listing leads to surging marketing costs, which undermines the competitiveness of core products.

- The reasonable price-to-earnings (P/E) ratios of the top 1% of projects highlight how the remaining 99% lack real value support.

- Early token generation events (TGEs) allow founders to "cash out" regardless of project success, fueling a distorted market cycle.

- The "survival" of 99% of projects is fundamentally due to systemic flaws built on investor losses rather than corporate profitability.

Prerequisite for Survival: Proven Revenue Capability

“Survival requires proven revenue capability” — this is the most critical warning in today’s Web3 landscape. As markets mature, investors no longer blindly chase vague “visions.” If a project fails to attract real users or generate actual sales, token holders will quickly sell and exit.

The key issue lies in the “runway” — how long a project can sustain operations without profit. Even without revenue, fixed costs such as salaries and server fees must be paid monthly, and teams without income have almost no legitimate means to maintain operational funds.

Cost of fundraising without revenue:

However, this model of “surviving on tokens and external capital” is only temporary. Since assets and token supplies have clear limits, projects that exhaust all funding sources will eventually either shut down or quietly exit the market.

Web3 Revenue Ranking, Source: Token Terminal and Tiger Research

This crisis is widespread. According to data from Token Terminal, globally only about 200 Web3 projects generated at least $0.10 in revenue over the past 30 days.

This means 99% of projects cannot even cover their basic operating costs. In short, nearly all cryptocurrency projects have failed to validate the feasibility of their business models and are gradually declining.

The High Valuation Trap

This crisis was largely inevitable. Most Web3 projects launch tokens based solely on “vision,” often before any actual product exists — a stark contrast to traditional enterprises, which must demonstrate growth potential before an IPO. In Web3, teams instead attempt to justify sky-high valuations only after launching tokens (via TGE).

But token holders won’t wait indefinitely. With new projects emerging daily, if expectations aren't met, holders rapidly sell off. This puts downward pressure on token prices and threatens the project's survival. Consequently, most projects allocate more funds to short-term hype than long-term product development. Clearly, if the product itself lacks competitiveness, even intense marketing will ultimately fail.

At this point, projects fall into a “dilemma trap”:

- If focusing solely on product development: It takes significant time, during which market attention fades and runway shortens;

- If focusing solely on short-term hype: The project becomes hollow, lacking real value foundation.

Both paths lead to failure — projects fail to justify their initial high valuations and eventually collapse.

Seeing Through the Top 1% to Understand the Truth Behind the 99%

Yet, the top 1% of leading projects have demonstrated the viability of the Web3 model through substantial revenues.

We can assess their value using the price-to-earnings ratio (PER) of major profitable projects like Hyperliquid and Pump.fun. PER is calculated as “market cap ÷ annual revenue” and reflects whether a project’s valuation is justified relative to its actual earnings.

Price-to-Earnings Ratio Comparison: Top Web3 Projects (2025):

Note: Hyperliquid's revenue is an annualized estimate based on performance since June 2025.

Data shows that profitable projects have PERs ranging from 1x to 17x. Compared to the S&P 500’s average PER of around 31x, these top Web3 projects are either “undervalued relative to sales” or exhibit exceptional cash flow health.

The fact that successful top-tier projects maintain reasonable PERs highlights how unjustified the valuations of the other 99% truly are — directly proving that most high valuations in the market lack fundamental support.

Can This Distorted Cycle Be Broken?

Why do projects with zero sales still maintain billion-dollar valuations? For many founders, product quality is secondary — the distorted structure of Web3 makes “quick exits” far easier than building real businesses.

The contrasting cases of Ryan and Jay perfectly illustrate this reality:

Founder Comparison: Web3 vs. Traditional Model

Ryan: Choosing TGE Over Deep Development

He pursued a profit-driven path: raising early funds by selling NFTs before game launch; then, while the product was still in a rough development phase, he conducted a token generation event (TGE) based solely on an aggressive roadmap and listed on mid-tier exchanges.

After listing, he used hype to maintain the token price, buying himself time. Although the game was eventually delayed and delivered poor quality, token holders sold off en masse. Ryan officially resigned citing “accountability,” but in reality, he was the true winner —

Outwardly appearing dedicated, he drew a high salary while profiting massively from unlocked token sales. Regardless of the project’s ultimate fate, he quickly accumulated wealth and exited the market.

Jay: Following the Traditional Path, Focusing on Product

He prioritized product quality over short-term hype. However, developing a AAA-grade game takes years, during which his funds gradually ran out, leading to a “runway crisis.”

In the traditional model, founders only see significant returns after the product launches and generates sales. Despite multiple rounds of fundraising, Jay ultimately shut down the company due to insufficient capital before completing development. Unlike Ryan, Jay gained nothing — not only did he make no profit, but he also incurred massive debt and a record of failure.

Who Is the Real Winner?

Neither case produced a successful product, but the winner is clear: Ryan leveraged Web3’s distorted valuation system to accumulate wealth, while Jay lost everything trying to build a quality product.

This is the harsh reality of today’s Web3 market: exiting early via inflated valuations is far easier than building a sustainable business — and ultimately, investors bear the full cost of this “failure.”

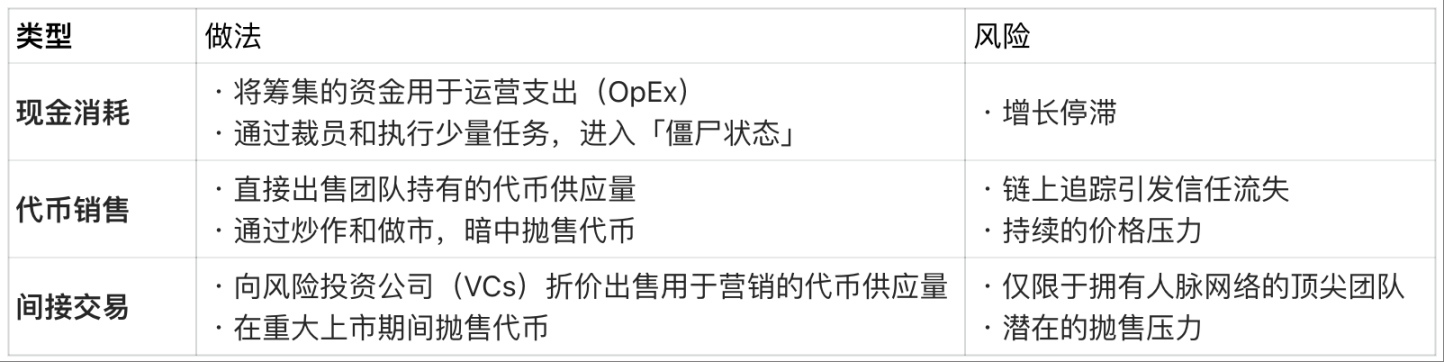

Returning to the original question: “How do 99% of unprofitable Web3 projects survive?”

This brutal truth is the most honest answer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News