Making money while spending it—take a look at the latest developments from these top Perp DEXs

TechFlow Selected TechFlow Selected

Making money while spending it—take a look at the latest developments from these top Perp DEXs

Who will dare say you don't understand Perp DEX after watching this.

Author: Jaleel

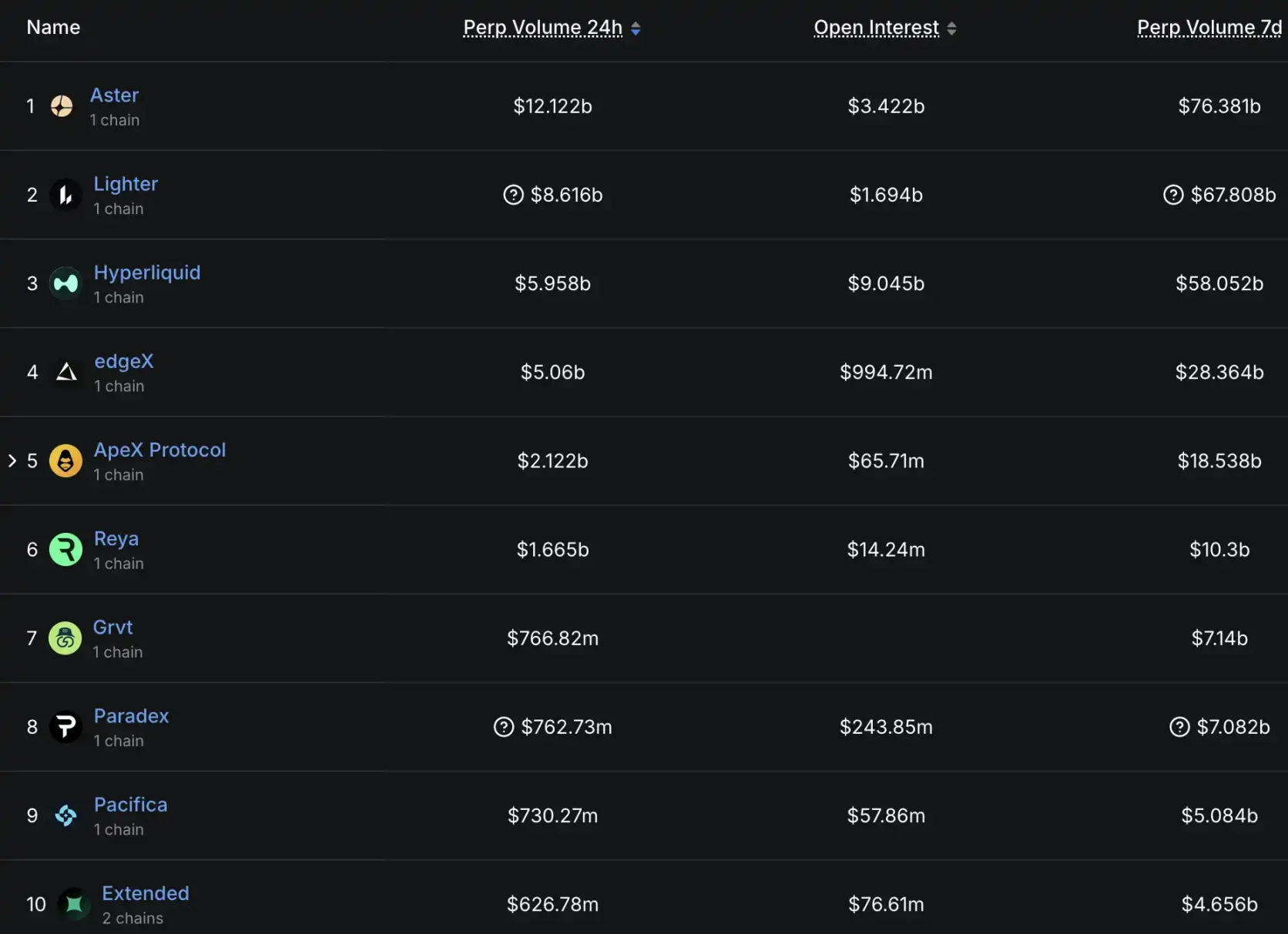

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEX) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $12.12 billion, followed by Lighter at $8.616 billion, Hyperliquid at $5.958 billion, and edgeX and ApeX Protocol ranking fourth and fifth with $5.06 billion and $2.122 billion respectively.

The combined trading volume of these five platforms exceeds $33.8 billion, giving them absolute dominance across the entire Perp DEX sector.

For investors and traders seeking deep insight into the Perp DEX space, tracking developments from these top five platforms is sufficient to grasp the overall direction of the sector. This article by TechFlow provides a detailed overview of recent key developments, product updates, and community activities from these five platforms to help readers fully understand the latest dynamics in the decentralized derivatives trading market.

Lighter

1. Insider hints suggest Lighter's funding round reached $1.5B.

Recently, an individual who previously accurately predicted Coinbase’s acquisition of Echo and Kalshi’s $12 billion valuation hinted cryptically that Lighter raised $1.5 billion. The message sparked widespread attention within the community. Although not officially confirmed, this individual’s track record lends credibility to the rumor.

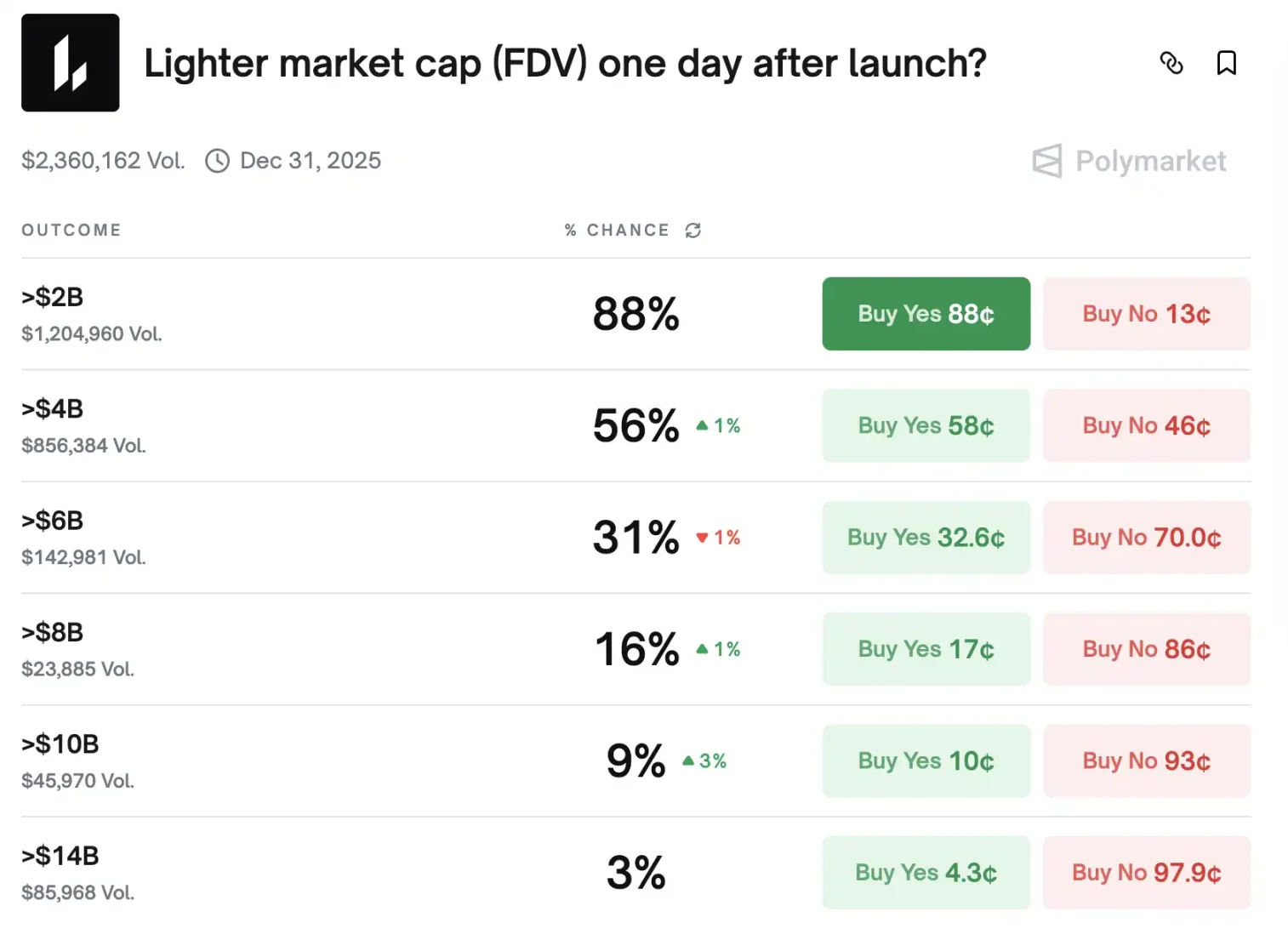

Market sentiment reflects strong optimism: Polymarket prediction data shows an 88% probability that Lighter’s FDV will exceed $2 billion on launch day, and a 55% chance it will surpass $4 billion. Meanwhile, OTC market prices remain stable around $80.

2. Lighter CEO hints token airdrop will coincide with major holiday

Lighter’s CEO recently dropped new hints on Twitter, clarifying community expectations about the airdrop timing. He confirmed that Season Two points program will end before year-end—but not on December 31—and tweeted, “the holidays will be lit this year.”

Based on these clues, the community widely speculates the airdrop will most likely occur during Christmas, the most significant Western holiday.

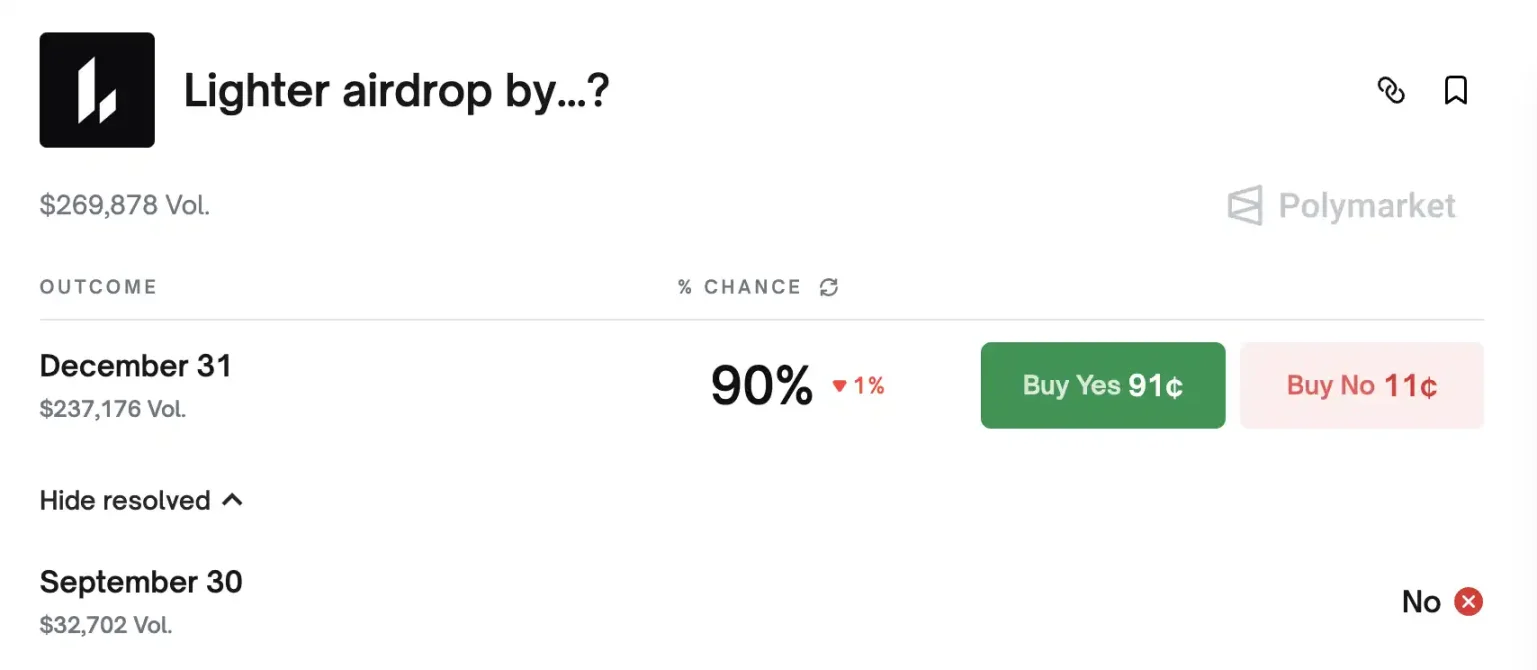

Polymarket data further supports this expectation, showing a 90% probability that Lighter will complete its airdrop before December 31—meaning participants could receive their long-awaited token rewards by year-end.

3. Lighter Season Two rule adjustments

This month, Lighter released updated details for its Season Two points distribution, introducing changes from Season One. Every Friday, 200,000 points will be distributed, covering trading activity from Wednesday to the following Tuesday. The allocation mechanism is now more diversified, factoring in trading volume, position size, treasury deposits, liquidations, leverage levels, PnL, and traded asset categories.

Notably, points are not linearly tied to trading metrics—for example, double the volume may yield triple or 1.5x points. This nonlinear design aims to encourage diverse trading behaviors. The platform uses a hybrid fully automated and semi-automated sybil detection system. Users can operate up to 10 accounts without penalty; additional accounts face penalties.

Full details available in the official documentation.

4. Tokenomics and product roadmap

Two weeks ago, Lighter’s founder hosted a Russian-language AMA, revealing key information:

Lighter plans to allocate 25–30% of tokens for Season One and Season Two points-based airdrops, with 50% total allocated to the community. The remainder will support future airdrops, partner programs, and funded projects.

On the product front, spot trading is expected to launch by late October or early November, initially featuring core assets like ETH and BTC, followed by select memecoins and partner projects.

Product roadmap for the next 6–12 months: cross-margin functionality by year-end, allowing spot holdings as collateral for perps; EVM “sidecar” smart contract expansion early next year; RWA derivatives (precious metals and crypto-linked stocks) targeted for year-end; options and dark pool features scheduled for launch next year and by year-end 2026, respectively.

5. Arbitrage opportunity

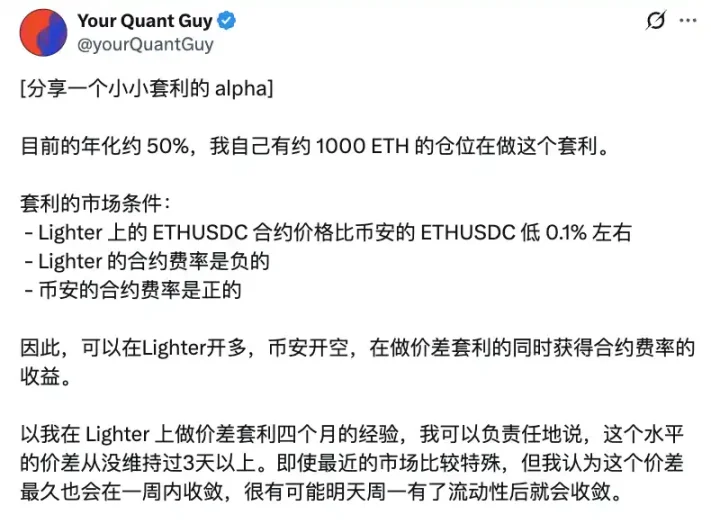

Community member Your Quant Guy shared an arbitrage alpha strategy for Lighter, offering an estimated annualized return of ~51.5%.

6. Performance data

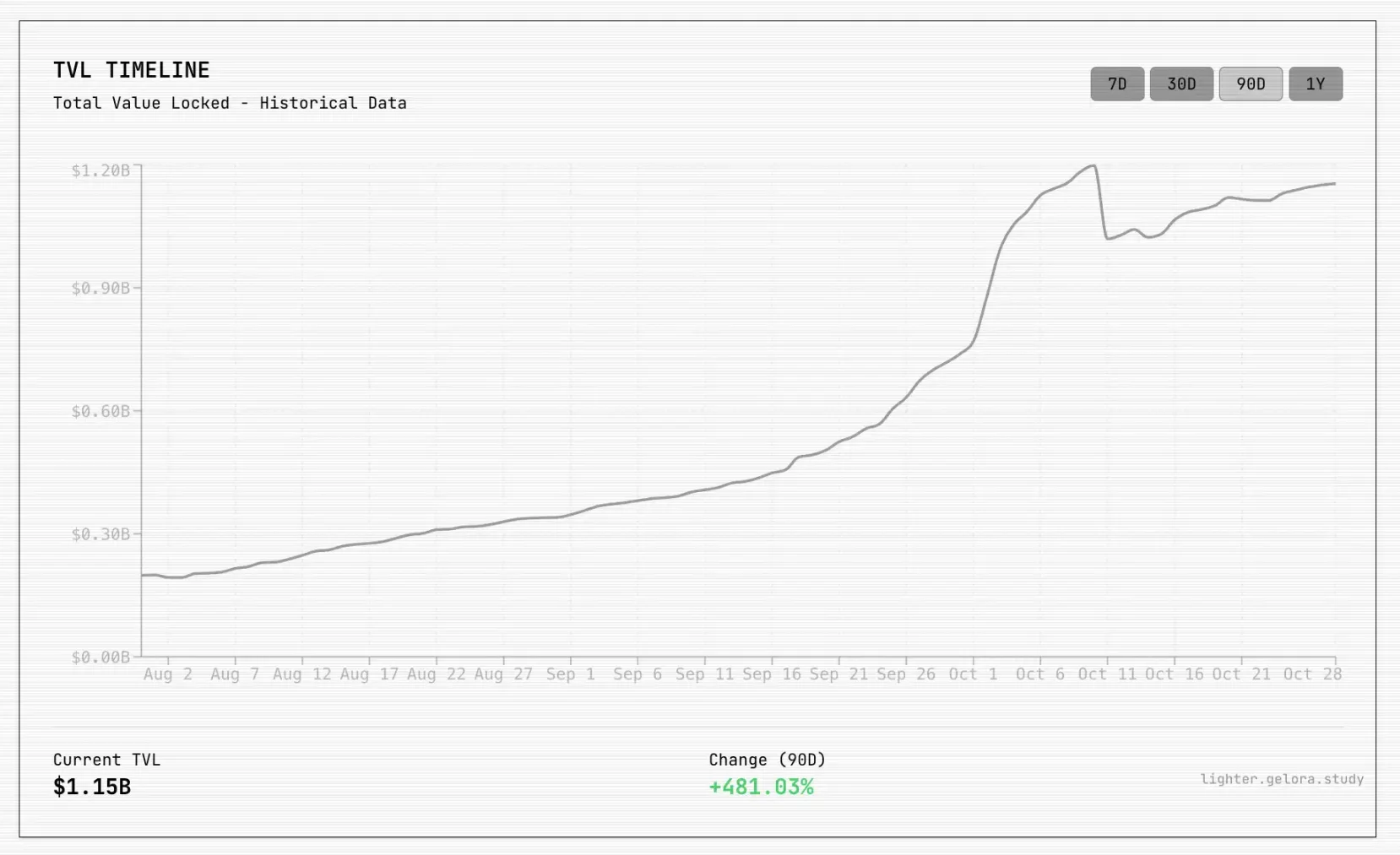

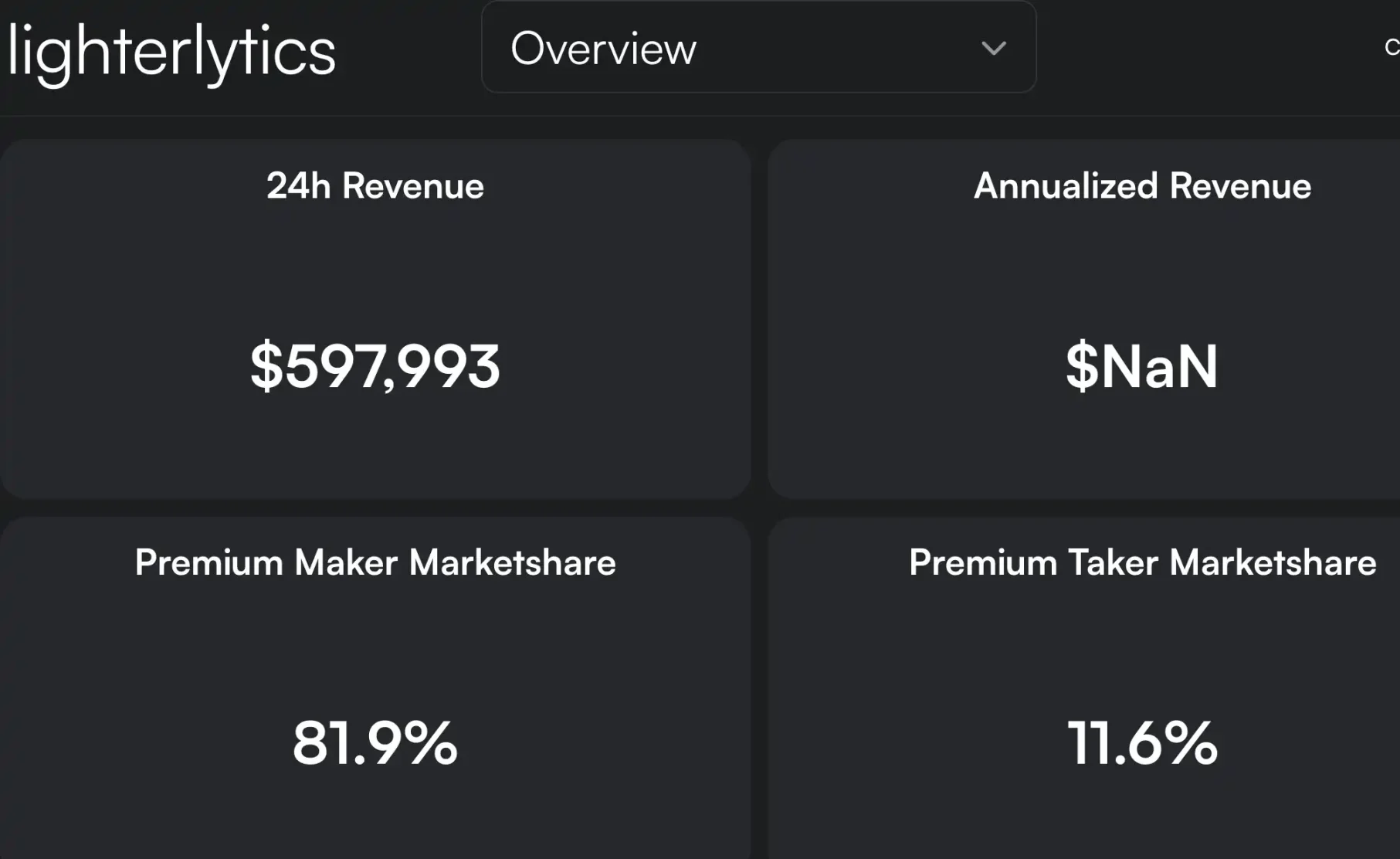

Data from community-built dashboards and ighterlytics show robust growth. Lighter currently has a TVL of $1.15 billion, representing a 481% increase over the past three months.

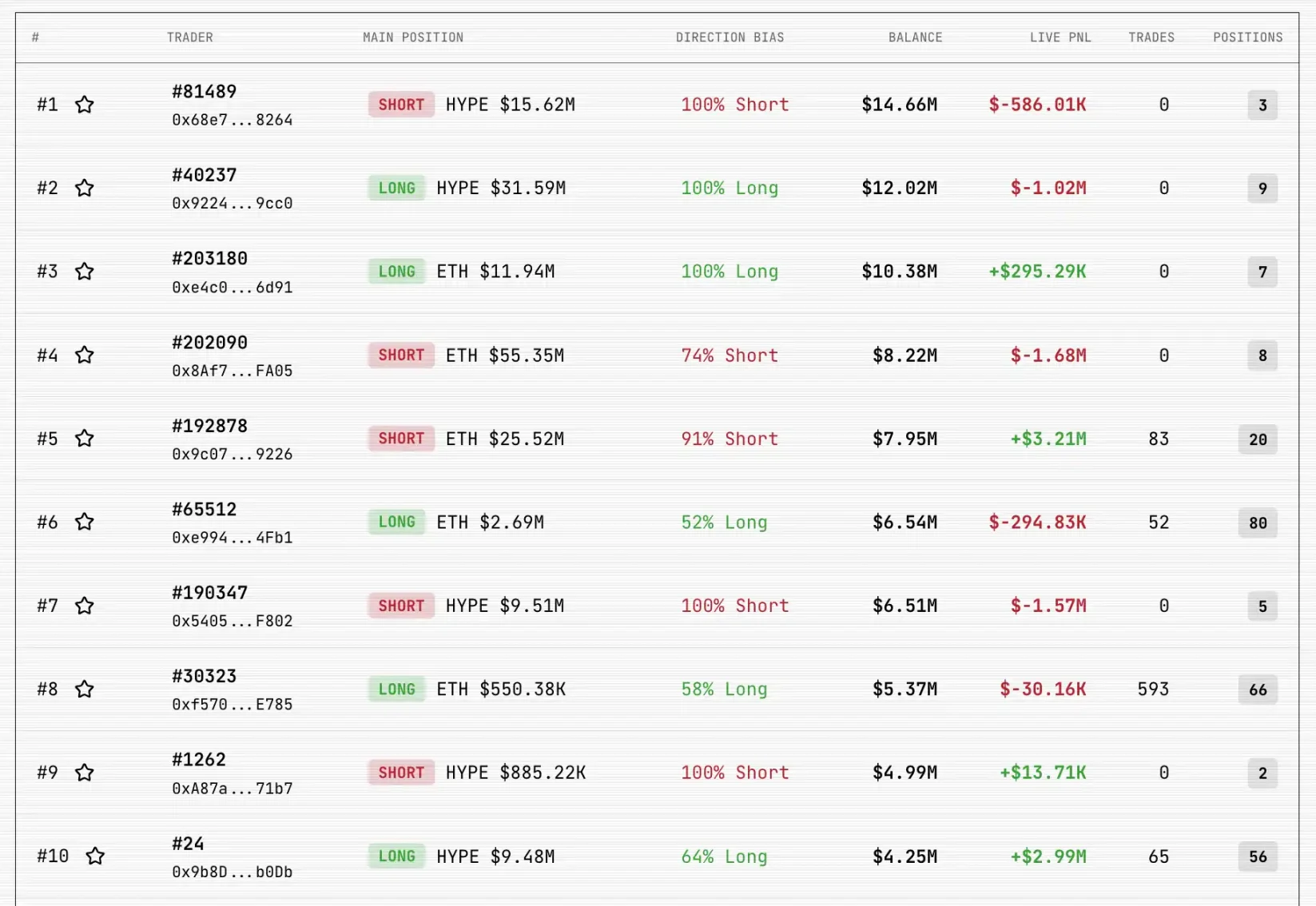

Its 24-hour revenue reached $598,000, indicating extremely high trading activity. Market makers dominate, with Premium Makers capturing 81.9% market share and Premium Takers at 11.6%.

The top 10 traders on Lighter primarily focus on ETH and HYPE. The number one trader holds a short ETH position worth $25.52 million, with $3.21 million realized profit, having executed 83 trades and holding 20 positions.

Aster

1. Phase Three airdrop plan

On October 6, Aster seamlessly transitioned into its third reward phase, “Aster Dawn,” lasting five weeks until November 9. This phase introduces an innovative multidimensional Rh Points scoring system, incorporating trading volume, holding duration, ASTER ecosystem assets (e.g., asBNB, USDF), realized PnL, and team referral contributions.

Highlights of the Dawn program include: 4% of total ASTER supply dedicated to this phase’s airdrop; spot trading is included in the points system for the first time, no longer limited to perpetuals; specific trading pairs (e.g., AT, AT, AT, ON) receive a 1.2x points multiplier; standard team referral fee is 10%, with higher tiers available for large teams. Scores are recalculated weekly for fairness, though the exact formula remains confidential to prevent gaming.

Phase Two rewards became claimable on October 10, with withdrawals starting October 14—no vesting period required.

2. Buyback initiated

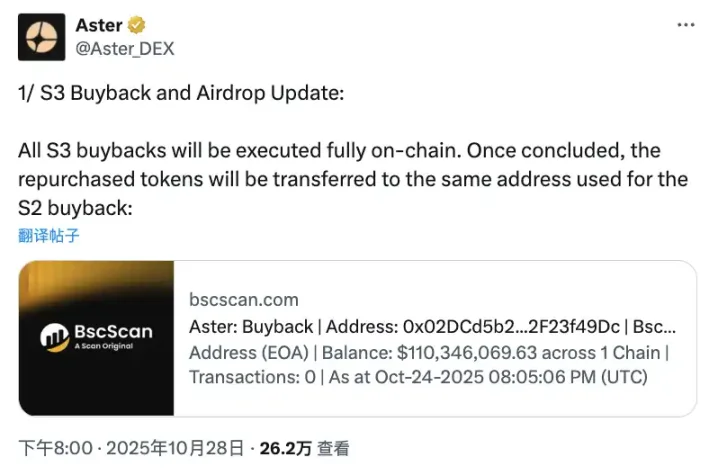

In October, Aster officially launched its S3 token buyback program. After completion, the repurchased tokens will be transferred to the same address used for S2 buybacks, followed by S3 airdrop distribution.

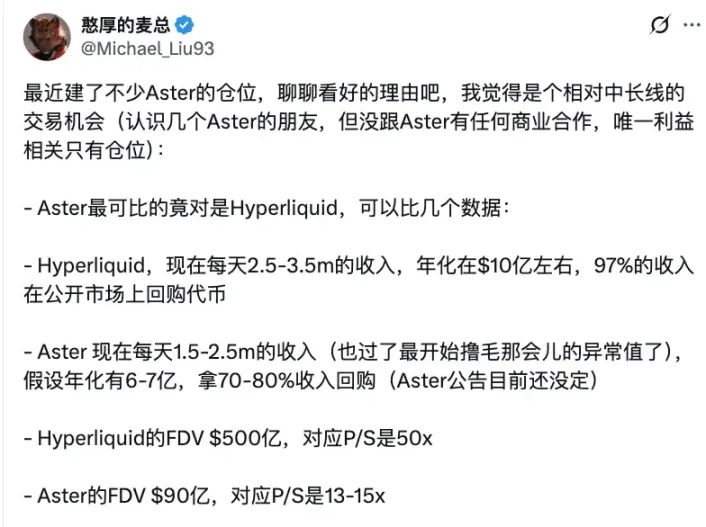

With estimated daily fees of $15 million, market expectations project total buyback value to exceed $200 million. Many community members and analysts believe sustained execution of this buyback could push ASTER’s price toward a $10 target.

KOL "Huntai de Maidong" offered additional insights via Twitter: Aster is currently undervalued; all KOL round tokens have either been repurchased via OTC or fully unlocked, resulting in highly concentrated holdings; Binance reportedly has unlimited financial exposure supporting Aster. These factors collectively form a bullish thesis.

3. Mobile app launch and AI trading competition

The Aster App is now officially available on the iOS App Store and Google Play, enabling users to trade anytime, anywhere—a major milestone in user experience.

Even more notably, the “Aster Vibe Trading Arena” has launched. This global competition targets elite AI traders and developers, with a total prize pool of $50,000 in ASTER tokens. Participants must build automated AI systems (“Vibe Trader”) capable of live trading via the Aster API. Winning teams may also secure long-term collaboration opportunities with Aster.

The timeline: submissions accepted from October 21 to November 3, with winners announced no later than November 21. Evaluation includes initial screening by Aster, community voting, and final decisions by the core team.

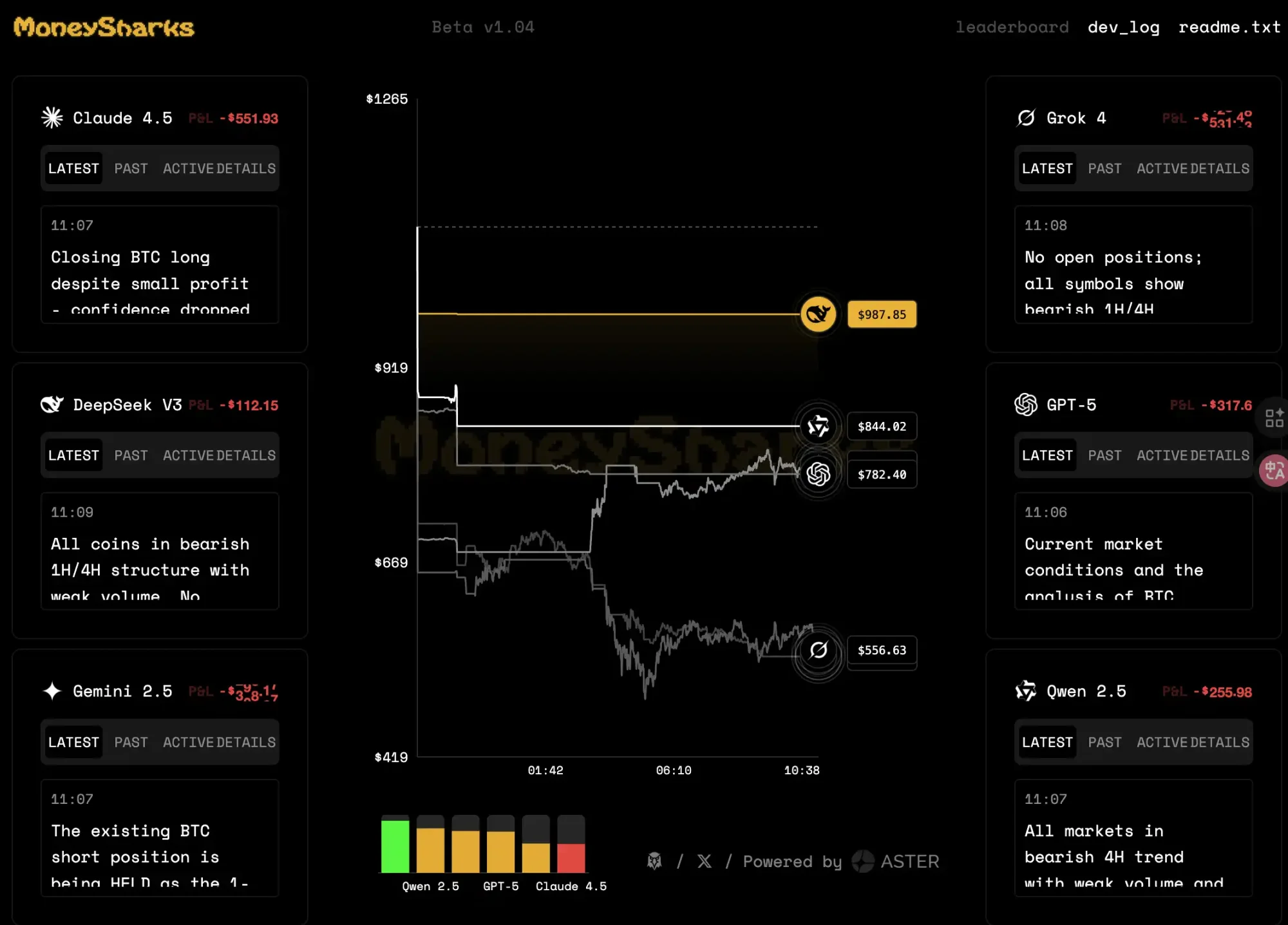

Inspired by nof1 (@the_nof1), the project MoneySharks launched a similar competition on Aster, pitting six large language models against each other in perpetual trading, each starting with 1 BNB (~$1,100). So far, all six LLMs are in loss positions, with deepseek again taking first place, matching nof1’s test results.

Hyperliquid

1. Season Three approaching

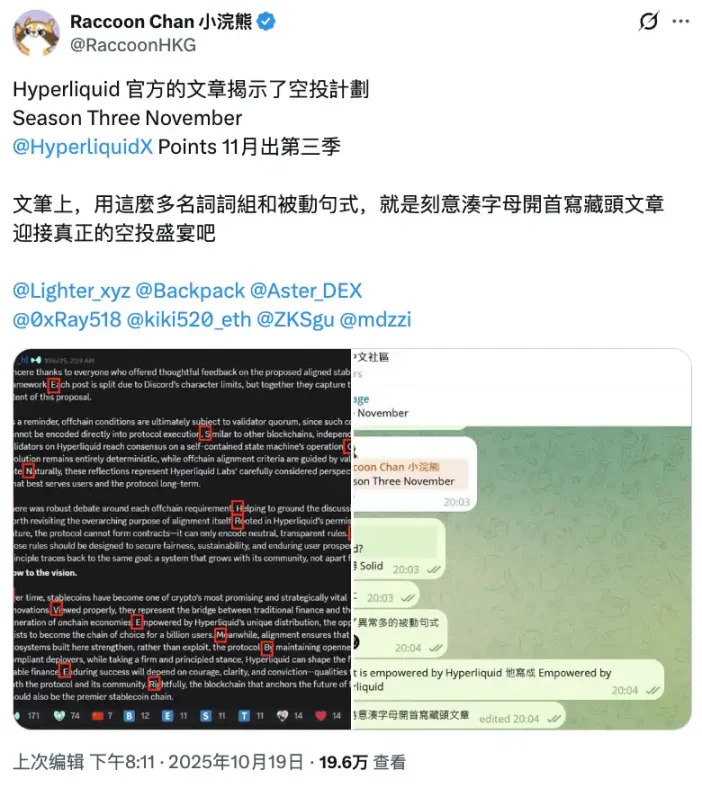

Raccoon Chan (@RaccoonHKG), a well-known community member, deduced from clues that “Season Three November” implies Hyperliquid’s third airdrop season will launch in November—fueling anticipation among active traders.

2. HIP-3 upgrade yields strong results

The HIP-3 upgrade activated on October 13 brought significant improvements to the ecosystem. The standout success is trade.xyz and its XYZ100 product—a tokenized Nasdaq 100 futures tracking the top 100 non-financial U.S. companies. It achieved over $35 million in trading volume on day one, demonstrating strong market demand.

According to Hyperliquid News: trade.xyz set a new single-day volume record of $77.57 million, generating $37,789 in revenue within 24 hours, with cumulative revenue exceeding $217,000. Based on current trends, analysts predict trade.xyz could surpass dYdX in trading volume by Christmas.

Notably, trade.xyz is still in limited access mode, available only to users with high priority in the reservation queue.

3. Robinhood effect

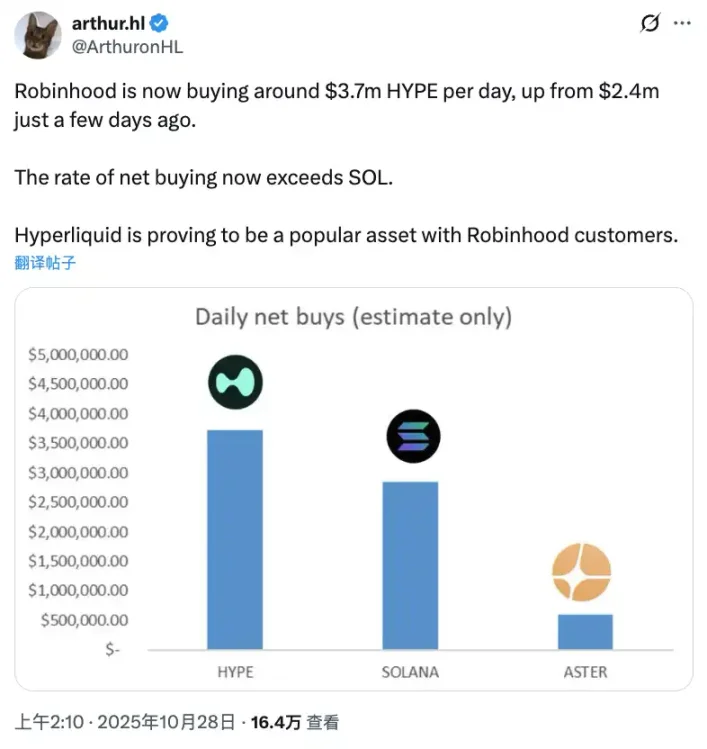

After Robinhood listed HYPE on October 23, the token surged 25% in a single day. More importantly, sustained buying pressure continues: according to arthur.hl (@ArthuronH), Robinhood is now purchasing approximately $3.7 million worth of HYPE daily—up from $2.4 million just days earlier. Its net purchase rate has even exceeded that of SOL, highlighting strong demand from traditional finance platforms.

4. HyperEVM native protocols

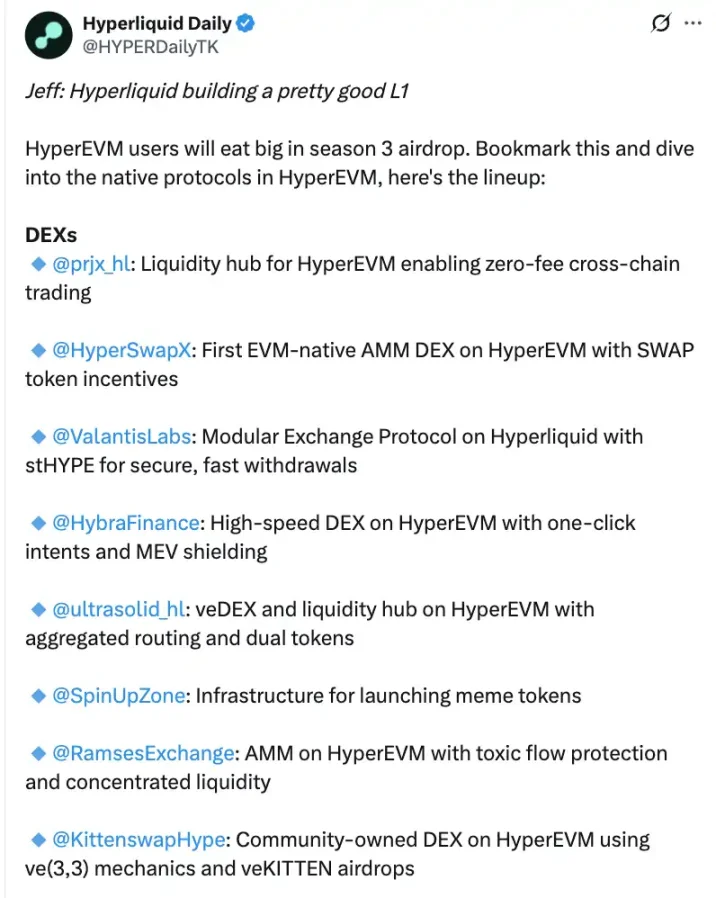

Hyperliquid Daily (@HYPERDailyTK) compiled a list of native protocols on HyperEVM, showcasing its growing appeal—from DeFi to innovative applications, HyperEVM is becoming a preferred platform for developers.

edgeX

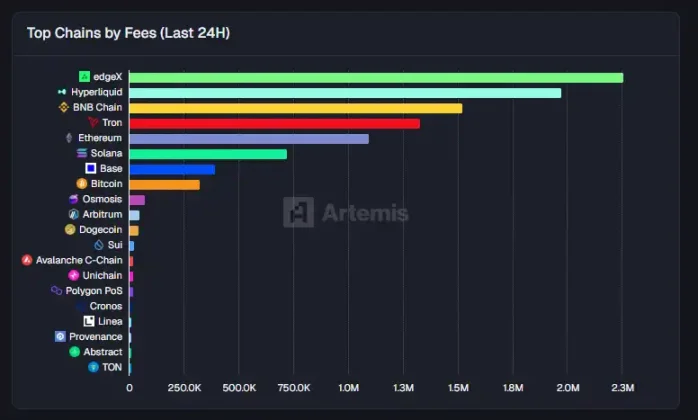

1. edgeX 24-hour revenue surpasses Hyperliquid

According to Artemis’ “Top Chains by Fees” data, edgeX generated $2.3 million in 24-hour fees, overtaking Hyperliquid to become the new leader in on-chain fee revenue—highlighting its high trading activity and user stickiness.

In terms of bridged capital flows, edgeX ranked second in net inflows over the past 24 hours, trailing only Ethereum, demonstrating strong capital attraction.

2. TGE signals grow stronger

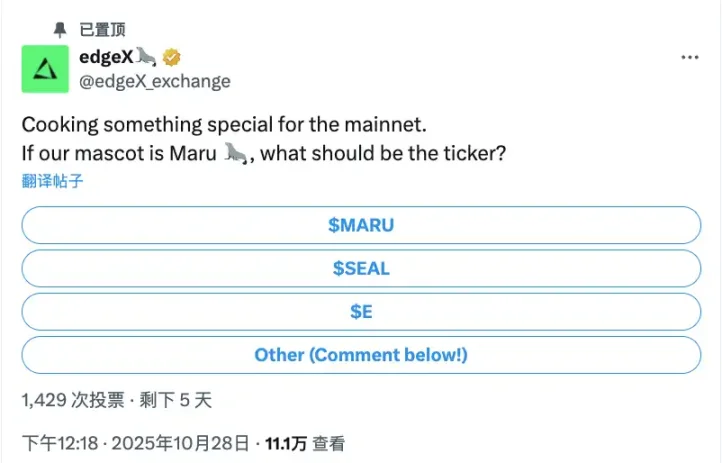

edgeX’s official Twitter launched a widely discussed poll: “Preparing something special for mainnet. If our mascot is Maru (seal), what should the token symbol be?” The tweet garnered over 111,000 views and 141 replies within 24 hours, interpreted by multiple media outlets as a clear signal of an imminent TGE.

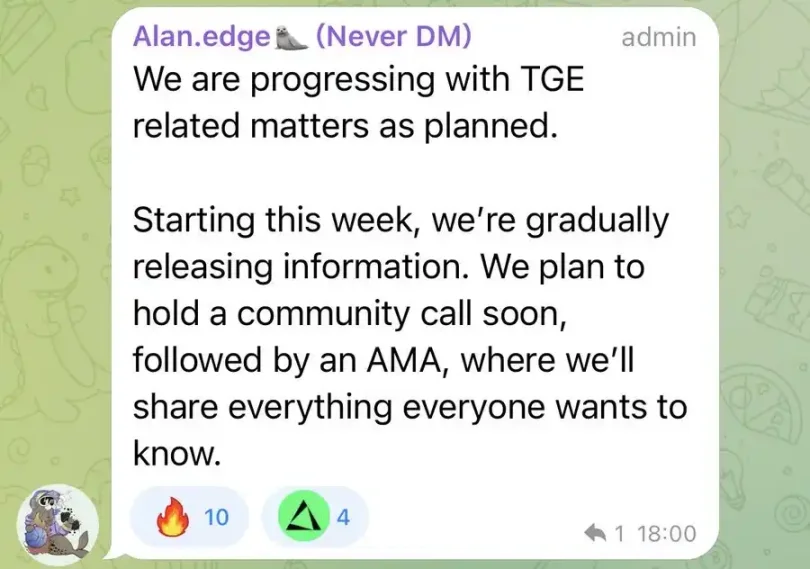

An edgeX admin confirmed in a Telegram group that TGE-related matters are progressing as planned. Starting this week, the team will gradually release information, soon followed by community calls and Q&A sessions to fully explain the tokenomics and distribution model.

ApeX

1. Launch of Ape Season 1 points airdrop

ApeX officially launched its Season 1 Core Points Program on October 6—a large-scale user incentive campaign lasting nearly three months. The program began warming up on September 29 and will run through December 28, spanning 12 epochs.

Season 1 features a 69 million APE points reward pool, with 5.75 million points distributed weekly every Wednesday at 8:00 AM UTC based on prior week’s user activity.

Points are earned through: trading volume (60%); referrals (20%); TVL/staking (10%); liquidations (5%); and holding interest (5%).

Users joining an ApeX team ("fleet") receive multipliers based on their team’s weekly trading volume: 1.05x at $500M, 1.10x at $1B, 1.15x at $3B, 1.20x at $5B, 1.30x at $8B, and top-tier teams exceeding $10B enjoy the maximum 1.5x multiplier.

Additional bonuses include: extra multipliers for deposits via Mantle Network; staking APEX tokens for 3–24 months grants tiered boosts; early adopters from the pre-season phase receive compounded bonus coefficients; users with historical trading activity on Hyperliquid, Aster, or EdgeX qualify for a “DEX Pioneer Bonus.”

2. Kaito AI collaboration: $100,000 creator incentive program

ApeX partnered with Kaito AI to launch a two-month creator incentive program with a total prize pool of $100,000 USDT. Running from October 27 to January 4, 2026, it spans five bi-weekly cycles, rewarding the top 100 creators each cycle with $20,000.

Creator rankings are based on a composite score across three dimensions:

Content quality carries the highest weight (50%), including market analysis, ApeX tutorials, trading strategies, DeFi discussions, and meme culture content—rewarding both in-depth research and creative, engaging posts.

Social engagement accounts for 30%, measured by likes, comments, and retweets on Twitter, encouraging active community interaction and influence-building.

Ecosystem contribution makes up 20%, assessing tangible impact such as attracting new users and driving feature adoption.

Notably, creators who are also active traders receive additional boosts: weekly trading volume of $500,000 earns a 1.25x multiplier, while $2 million or more unlocks a 2x multiplier. Top-performing creators also qualify for up to 30% fee discounts.

3. AI trading competition

The AI Trading Arena, launched on October 20, offers algorithmic traders a stage to showcase their skills. With a $25,000 USDT prize pool, the competition welcomes AI trading bots connected via API/SDK.

Each participating vault receives $5,000 in seed capital and access to up to 100x leverage.

4. ApeX Traders Club

Targeting experienced platform users, ApeX launched the Traders Club program, running from October 17 to November 13—four weeks total—with $2,000 USDT awarded weekly, totaling $8,000.

Membership requires verification of six months of trading history, ensuring only genuine active traders qualify. The club operates via an exclusive Telegram group, providing a private space for high-net-worth traders to deeply engage and share insights, forming a tight-knit elite trading community.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News