How to Conduct Project Research for Beginners?

TechFlow Selected TechFlow Selected

How to Conduct Project Research for Beginners?

Say goodbye to blind following!

Author: le.hl

Translation: Luffy, Foresight News

As an investor, the easiest way to lose money is blindly following trends—entering a project without understanding it, solely based on others' recommendations. I've been there, and that's why I'm sharing my own project research experience.

If you're new to cryptocurrency and need reliable hands-on methods, this article is for you.

Clarify the Project Narrative

Narrative is one of the core elements in the crypto industry—market movements often revolve around narratives. If you want to invest in a project, first understand the narrative behind it. If a project is still clinging to outdated narratives like metaverse or GameFi, it’s unlikely to succeed.

I usually check project narratives on CoinMarketCap and CoinGecko.

Steps:

-

Visit https://coinmarketcap.com/cryptocurrency-category/

-

Enter the project name;

-

Scroll down to the "Tags" section to see the project’s narrative category.

Once you understand the narrative, identify the leading projects in that sector. Observe their recent trading volume changes to gauge momentum, and assess whether your target project can compete. Remember, investing in challengers to the leader often offers better opportunities than chasing already pumped leaders.

Choosing currently popular narratives (like AI, prediction markets InfoFi, etc.) is the best path to profit.

Verify the Project’s Investors

Many people today dislike the term "VC," preferring self-funded projects. But the reality is: if a project has mediocre products, an average team, and isn’t leading any narrative, it needs strong investors to drive growth.

My go-to platform for checking a project’s investors is CryptoFundraising—it displays all key information including investors, team, social accounts, and official website, completely free.

Steps:

-

Visit https://crypto-fundraising.info/

-

Search for the target project;

-

Check funding amount and VC tier.

I’ve found that projects with smaller funding rounds and only 2–3 VCs often outperform those backed by over 20 VCs. It’s like a cake being split too many ways—teams become paralyzed needing consensus from every investor.

VC tier matters greatly. I personally prefer projects backed by: Coinbase VC, a16z, Polychain Capital, Paradigm, GSR.

Examine Project Social Activity

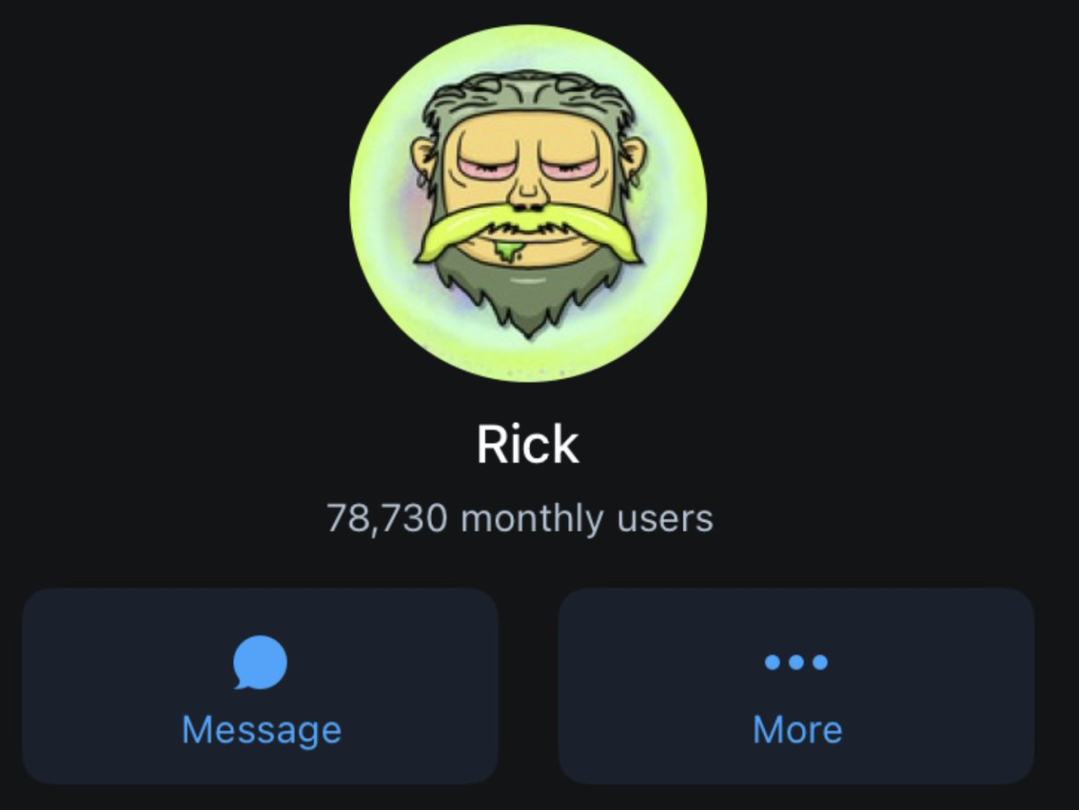

This step is crucial. Avoid any project that disables comments or frequently changes social account names. To check previous names, use the Rick bot on Telegram:

-

Log into Telegram;

-

Send a message to Rickburpbot;

-

Type command: /twit [current handle] to view historical names.

The number of “mutual follows among notable figures” is also worth noting: if over 20 well-known industry figures follow the project, it’s usually a positive sign.

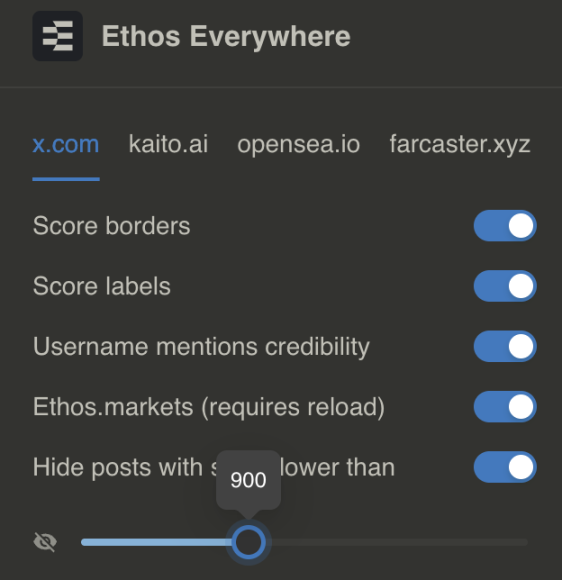

To verify project legitimacy, use Ethos Network:

-

Visit https://app.ethos.network/

-

Install the Chrome browser extension;

-

Set it up to block projects with negative sentiment, so you won’t see disruptive content on X.

You can use this extension for free without an Ethos invite code.

In-Depth Research on Key Dimensions

Founders

I prefer investing in projects where founders are active daily in the crypto community and engage with users. Strong founders believe in their project and are willing to admit mistakes.

Avoid founders who claim community is everything but act elitist or detached—and avoid anonymous founders altogether.

A founder’s behavior often determines the project’s direction post-launch.

Product

Usability is my top criterion. Only simple, user-friendly products gain real adoption and generate revenue.

No matter how flashy the concept (e.g., "quantum blockchain solving world hunger"), if it's complicated to use, no one will care.

Tokenomics

For projects that have issued tokens, be cautious if tokens are allocated to parties unrelated to the project (e.g., distributing to platforms like Binance Alpha for short-term hype without receiving meaningful support). This often leads to TGE failure and poor price performance.

Tokenomics don’t need to allocate all tokens to the community, but must have a clear, transparent vesting schedule for all stakeholders—including the team. Team transparency is always paramount.

To check tokenomics and vesting schedules, use Dropstab:

-

Visit https://dropstab.com/vesting

-

Search for the target project;

-

Analyze price movement after the last token unlock to assess its impact.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News