Token 2049 Roundtable Recap: Tom Lee, Joseph Lubin, and Sam Tabar Discuss the Future of Ethereum and DAT

TechFlow Selected TechFlow Selected

Token 2049 Roundtable Recap: Tom Lee, Joseph Lubin, and Sam Tabar Discuss the Future of Ethereum and DAT

Ethereum treasury is not just about "buying ETH," but rather amplifying exposure to ETH through financial engineering.

Compilation: TechFlow

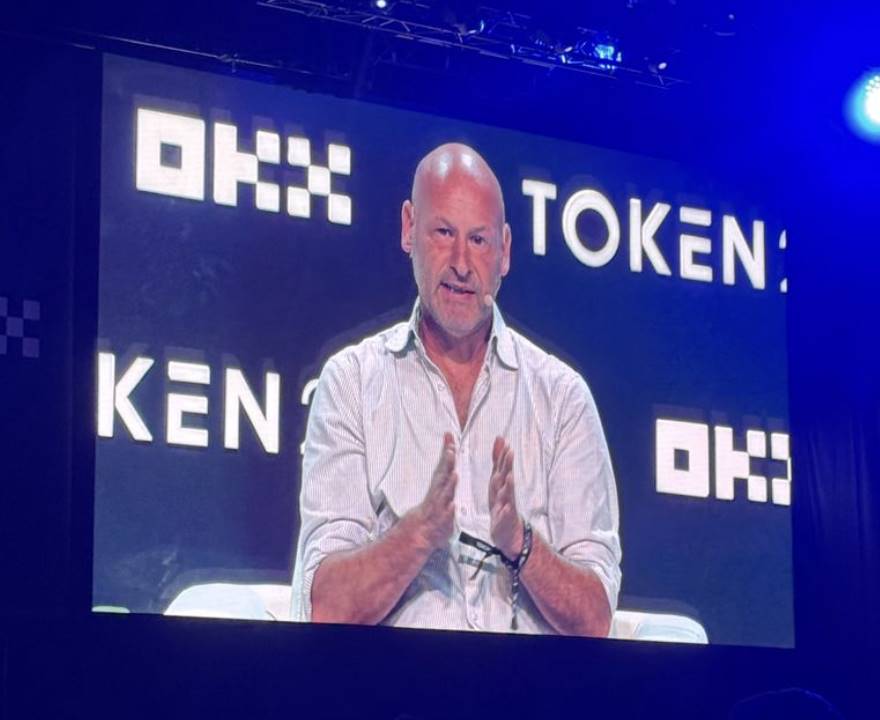

At the Token 2049 summit in Singapore, Cosmo Jiang, Partner at Pantera Capital, hosted a panel discussion titled "The Rise of Digital Asset Treasury."

Tom Lee, Chief Investment Officer of Bitmine; Joseph Lubin, Founder of ConsenSys and Chairman of Sharplink; and Sam Tabar, CEO of Bit Digital, shared their views on Ethereum's future cycles, institutional adoption, and the development path of Digital Asset Treasuries (DATs). This conversation not only revealed each company’s unique positioning but also provided investors with key insights into understanding this emerging asset class.

A TechFlow reporter attended the session and has transcribed and compiled the key points below.

Key Takeaways

-

The beginning of Ethereum's "super cycle"

-

Differentiated paths for DATs

-

Future core competitiveness of DATs lies in capital structure innovation

-

Ethereum treasuries are not just about "buying ETH," but amplifying ETH exposure through financial engineering

-

Future DATs will diversify into multiple types

-

DATs should trade at a premium (>2× NAV)

-

Why Ethereum? The three guests’ answers

Highlights Summary

Tom Lee (Chief Investment Officer, Bitmine)

-

Ethereum is standing at the beginning of a super cycle.

-

In the first phase, any Ethereum treasury’s primary task is acquiring ETH, which remains undervalued. In the second phase, focus shifts to education and infrastructure to support larger-scale on-chain finance. The third phase involves connecting with traditional finance via tokenization, making the treasury a central node. Today, less than 0.1% of institutions hold ETH—we are at a moment similar to 2017.

-

Our core goal is simple: continuously increase the amount of Ethereum held per share (ETH per share).

-

I believe Ethereum-based DATs should indeed trade at a premium. At a fundamental level, they should trade at least at 1× NAV.

-

I believe Ethereum is in a super cycle because both Wall Street and artificial intelligence (AI) are migrating to a neutral and public blockchain network—and that network is Ethereum.

Joseph Lubin (Founder of ConsenSys and Chairman of Sharplink)

-

Sharplink’s long-term strategy is to generate outsized wealth growth for shareholders by building deep, Ethereum-aligned infrastructure.

-

I think in the short term, these DAT companies will have significant strategic overlap, but they’ll differentiate in how they use their Ethereum holdings to generate yield.

-

We believe the mission of DATs isn’t just short-term arbitrage, but participation in a long-term “civilization-building technology” project.

-

From a broader perspective, I believe we’re entering a stage similar to the early days of the internet. Initially, “internet companies” were a new concept, but within years, every company became an internet company. I believe DATs will follow the same path. Soon, almost every business will realize they must do something on-chain.

-

The global economy is gradually moving toward decentralization, and Ethereum technology will become the trust layer for Web3 and the next-generation economic system. For any company or builder, the greatest risk isn’t participating in Ethereum—it’s being absent from it.

Sam Tabar (CEO, Bit Digital)

-

We are positioned across two of the strongest growth curves of our era—digital assets (especially Ethereum) and artificial intelligence (AI)—through our dual strategy of White Fiber and the Ethereum treasury.

-

Michael Saylor is a “financial wizard” in capital structure management, showing the entire industry how innovative leverage can turn balance sheets into strategic weapons.

-

In the future, only treasury companies brave enough to innovate in capital structure will truly survive long-term.

-

There will be many DATs, but frankly, most shouldn’t exist, and many will ultimately fail. Differentiation is key.

-

I believe humanity is currently undergoing two of the greatest transformations: Ethereum is rewriting the financial system, and AI is rewriting society. Both are already happening. Therefore, positioning ourselves to engage with both narratives simultaneously is Bit Digital’s most important strategic direction.

Tom Lee: Ethereum Is Standing at the Beginning of a Super Cycle

On the core theme of “why Ethereum is the centerpiece of the institutional cycle,” Tom Lee, CIO of Bitmine, opened with a bold assertion: Ethereum is standing at the beginning of a super cycle.

In his view, this cycle is not merely a price story, but a structural inflection point triggered by Wall Street and artificial intelligence migrating simultaneously to a public, neutral blockchain. Following this logic, Ethereum-focused digital asset treasuries (DATs) will go through three phases.

"In the first phase, any Ethereum treasury’s primary task is acquiring ETH, which remains undervalued. In the second phase, focus shifts to education and infrastructure to support larger-scale on-chain finance. The third phase involves connecting with traditional finance via tokenization, making the treasury a central node. Today, less than 0.1% of institutions hold ETH—we are at a moment similar to 2017."

Treasury companies first accumulate severely undervalued ETH, then use education and infrastructure to support broader on-chain finance, eventually deeply coupling with the tokenization of traditional finance and becoming a bridge between the two systems.

This means that clearly differentiated Ethereum treasuries will become key conduits when institutions increase allocations to on-chain assets.

Who Is Defining the Next-Generation Ethereum Treasury?

Moderator:

I really appreciate that you all share the same "North Star"—supporting Ethereum. To me, the primary mission of these digital asset treasuries (DATs) is advocating for their underlying token. But when we zoom out, there must be clear distinctions among different DATs. I believe many in the audience are wondering: among the many DATs—BMNR, SBET, BTBT—how should one choose?

As an investor, I’m happy to see healthy competition. So I’d like each of you to share: what makes your approach different? What makes your project unique?

Sam:

Bit Digital has a very unique positioning, for several reasons. There are typically three ways to raise capital for purchasing Ethereum: operating revenue, equity financing, or debt financing.

First, Bit Digital recently took its AI business public. That company is called White Fiber, in which we hold a 71.5% stake. White Fiber is a pure-play AI infrastructure company.

Tom is right—the current "super cycle" is unfolding across two domains: Ethereum and artificial intelligence. Therefore, our strategic positioning is to ride both growth curves: accumulating Ethereum while capturing the growth dividend from White Fiber’s IPO in AI infrastructure.

This means Bit Digital’s balance sheet holds two core assets: AI (White Fiber) and crypto operations. We can selectively divest portions of our White Fiber stake over time, providing a funding source that doesn’t dilute existing shareholders. Meanwhile, rising valuations of White Fiber directly boost Bit Digital’s overall valuation—a win-win.

The second method is equity financing. This is straightforward—companies raise cash by issuing shares, a traditional route.

The third is debt financing, which is particularly interesting. Michael Saylor has shown us a classic example. To successfully operate a treasury business, the capital structure must be creatively designed. Issuing equity is fine, but debt financing deserves more attention. So far, no Ethereum treasury company has truly used a “leveraged strategy” to amplify ETH exposure.

We recognized this gap. This week, we issued unsecured convertible debt. This is significant because secured debt, common in crypto, carries high risk. After experiencing multiple crypto winters, we know that if you collateralize with crypto assets, lenders can seize them during market downturns, forcing the company into bankruptcy.

So we chose unsecured debt financing. It’s safer and provides flexible capital leverage. As of this week, we’ve become the first company to operate an Ethereum treasury using unsecured debt.

In summary, Bit Digital’s three differentiation strategies are:

-

Generating Ethereum capital through real businesses (AI + crypto);

-

Flexibly using equity financing mechanisms;

-

Innovatively using unsecured debt as a leveraged tool.

We are positioned across two of the strongest growth curves of our era—digital assets (especially Ethereum) and artificial intelligence (AI)—through our dual strategy of White Fiber and the Ethereum treasury.

Joseph:

I think in the short term, these DAT companies will have significant strategic overlap, but they’ll differentiate in various ways, especially in how they generate yield from their Ethereum holdings.

Sharplink’s biggest advantage—and what makes us truly unique—is our deep partnership with ConsenSys. ConsenSys is the most comprehensive and deeply rooted company in the Ethereum ecosystem, making it one of the world’s leading blockchain firms. We own the full tech stack and have spent years building the Ethereum protocol itself. We developed Ethereum clients that help maintain the entire network, and we built Layer 2 technology that evolved into Linea, one of today’s leading ZK-EVM Layer 2 solutions.

Beyond that, ConsenSys created MetaMask, the world’s largest non-custodial wallet. Over 100 million users interact with MetaMask annually, with 20–30 million monthly active users. This gives us massive user distribution.

We are also launching a rewards program that will continuously distribute Linea tokens, MetaMask tokens, and other related tokens. This program tightly connects usage across the ConsenSys ecosystem with reward mechanisms, creating a positive feedback flywheel where Sharplink’s ecosystem activity, community engagement, and token economics mutually reinforce growth.

Tom:

For Bitmine, our differentiation strategy is based on three core principles.

First, we always maintain a highly healthy balance sheet, which we call a “fortress sheet.” Currently, Bitmine holds around $600 million in cash reserves, visible in our weekly public reports. This allows us to respond flexibly in two scenarios:

-

When ETH prices drop sharply, we can actively buy;

-

When stock prices weaken, we can protect shareholder interests.

This offensive-defensive balance is precisely why we maintain strong cash positions.

Second, we adhere strictly to a shareholder-first model. For anyone investing in Bitmine stock, the investment thesis must be crystal clear. That’s why we publish monthly company reports and chairman letters, transparently outlining our phased strategy. As you know, Phase One is accumulating 5% of the total global Ethereum supply. Phases Two and Three focus on “seeding the ecosystem” by building infrastructure for Wall Street’s future on-chain financial system.

Third, we place high importance on stock liquidity. Bitmine currently ranks 26th in daily trading volume in the U.S. stock market, with about $2.5 million traded daily, making it the 518th largest publicly traded company in the U.S. This high liquidity attracts institutional investors seeking pure Ethereum exposure. We expect to be included in major index rebalancing lists by June next year, opening up passive allocation opportunities from approximately 15,000 large institutional funds.

Additionally, as we move into native staking on Ethereum, the $12 billion worth of ETH held by Bitmine will generate nearly $400 million in annual pre-tax revenue. At that point, we’ll rank among the top 800 most profitable companies in the U.S.

In summary, our differentiation strategy is keeping the narrative simple and clear, executing transparently, and always ensuring shareholders understand what we’re doing and why.

As Ethereum Goes Mainstream, Who’s Buying the Next-Gen Treasury?

Moderator:

Let me summarize my observations into a more concrete question. Tom, I’d like to ask you: from an investor’s perspective, I often see which patterns work, which don’t, and how things evolve. To me, the key for DATs seems to be attracting attention from mainstream retail investors and traditional financial media—not just native crypto players. So, who are the new buyers you’re currently attracting, and how are you reaching them?

Tom:

Great question. Actually, our investor base is very broad.

If you look at the traditional stock market, retail capital can be divided into four main groups, who together form the most stable buying force:

-

First are institutional investors, accounting for about 30% of the market.

-

Second are U.S. retail investors, including users of platforms like Robinhood and traditional brokerage clients—so there are actually two subgroups within retail.

-

Third are family offices and pension funds—distinct from mutual funds or hedge funds.

-

Fourth are international investors.

At Bitmine, we’ve deeply engaged with all four groups. We now have a large and growing institutional investor base. For example, Cathie Wood’s ARK fund is one of our top ten holders, and she herself is Bitmine’s largest shareholder. We’re proud of this because she’s a visionary investor—initially focused on Bitcoin, but now recognizing Ethereum and Bitcoin as “friends walking side by side.”

Beyond that, we have a massive retail base—over 330,000 shareholders now. We’re also seeing increasing interest from family offices, because our model offers them a leveraged and direct exposure to Ethereum, something previously hard to access. Finally, our international investor base is rapidly expanding. In some countries, Bitmine’s stock trades as high as third place locally, behind only Tesla and other hot stocks.

In summary, we’ve successfully reached all four investor ecosystems—institutional, U.S. retail, family offices, and international investors. This excites us because it means Bitmine is no longer just a “crypto stock,” but has become a vehicle for Ethereum exposure actively embraced by the global mainstream capital markets.

The Maturation of Digital Asset Treasuries

Moderator:

Next, I’d like to ask Joseph. When I look at Sharplink, one thing stands out—your hiring of Joe Shalone, a former BlackRock executive. To me, this symbolizes the maturation of the DAT industry, evolving from crypto-native to professionally institutional-grade management. So how do you think about building your management team? What’s your mindset and experience in recruiting top talent for a DAT?

Joseph:

Yes, Joe came from BlackRock, and he deeply understands how to build efficient platform systems. His defining trait is rigor, especially in cost control. He cares deeply about not wasting a single dollar, ensuring operational expenses remain lean and efficient. At Sharplink, our top priority—short or medium term—is protecting and enhancing shareholder value. This means not only monitoring potential dilution effects but also tracking stock performance. If needed, we’ll repurchase shares—and we can do so without selling any of our Ethereum assets.

This rigorous financial and governance culture is exactly what Joe brought from BlackRock. We’re building our own internal infrastructure based on this philosophy, so all core operations can be executed efficiently and at low cost internally. Long-term, our goal is to serve retail investors, institutions, family offices, and sovereign wealth funds.

Sharplink’s long-term strategy is to create outsized wealth growth for shareholders by building infrastructure deeply aligned with Ethereum’s technology and ecosystem.

We believe this model—combining institutional-grade discipline with long-term, Ethereum-native conviction—is the most effective path to achieving that goal.

Moderator:

Exactly. When evaluating a public company’s value, I always pay close attention to team experience. Many newly formed DAT companies lack executives with public company management backgrounds. But Bit Digital has operated as a public company for some time. Sam, what do you see as the most critical capability to become a qualified, mature public company? And what gaps might other DAT companies still have?

Sam:

I don’t think this is something one person can achieve—it’s not just me. The co-founding team around me is key. Each is like a superhero bringing unique skills: one drives business expansion, another builds institutional processes, another focuses on risk management, and I lead market and strategy. This team composition is like the Avengers—each member delivers when it matters.

I feel incredibly fortunate to work with them.

They’re Not Just Buying Ethereum—They’re Rewriting the Financing Game

Moderator:

Excellent. After all, to me, the core of DATs lies in achieving strategic goals through capital structure management and financial engineering. So let me dig deeper: how do you each think about fundraising at the company level? Do you consider M&A, or further bond or convertible debt issuance? I’d love to hear your perspectives on capital management.

Sam:

This resonates deeply. I mentioned it earlier, but it bears repeating: We must be as creative as possible in capital structure.

Existing shareholder capital is just one of many levers. For instance, this week we issued convertible debt—I was surprised we were the first Ethereum treasury to do so. I thought others would try similar moves. Michael Saylor is a “financial wizard” in capital structure management, showing the entire industry how innovative leverage can turn balance sheets into strategic weapons.

Convertible debt is a powerful financial engineering tool. Relying solely on equity issuance is fine, but that’s a single tool. In the future, only treasury companies brave enough to innovate in capital structure will truly survive long-term.

In other words, traditional methods are no longer sufficient—creative use of financial structures is the core competitiveness of DATs.

Joseph:

Yes, we are exploring structured financing tools like forward contracts and convertibles.

However, these tools require sufficient trading volume and volatility to function—and those conditions are gradually maturing. We’ll make announcements at the appropriate time.

Beyond that, long-term capital stability is crucial. That’s why we’re engaging with family offices, institutional investors, and sovereign wealth funds. Because we believe the mission of DATs isn’t just short-term arbitrage, but participation in a long-term “civilization-building technology” project.

Tom:

We’ve studied MicroStrategy’s approach in great detail at Bitmine.

They’ve executed 21 different financing deals, many of them innovative. They’re practically a textbook case of “financializing” a corporate balance sheet. These staged moves have not only lifted Bitcoin’s price but also enhanced shareholder returns.

Our core goal is simple: continuously increase the amount of Ethereum held per share (ETH per share). When we completed our first PIPE (private investment in public equity) on July 8, our ETH per share was about $4. By August 27 (last reporting date), it had grown to nearly $40. In other words, our strategy is to continuously boost per-share asset value through capital markets activity.

The key enabler is our stock’s high liquidity. Bitmine is currently the 26th most actively traded stock in the U.S., with about $260 million in daily volume, making institutions eager to gain Ethereum exposure through Bitmine.

Of course, this comes with certain characteristics:

-

Ethereum’s volatility is about 50% higher than Bitcoin’s;

-

Bitmine’s implied volatility (IV) is as high as 120, far above the 60 Saylor faced when issuing convertibles.

Because of this, we currently prefer to keep our financing structure simple, avoiding any capital instruments that could dilute shareholders or compete with common stock. Our goal is always maximizing returns for common shareholders, so every BMNR investor benefits.

Going forward, we won’t rule out exploring structured financing like convertibles, especially compound structures like the “staking yield plus convertible” idea Sam mentioned, which is logically sound.

But for now, Bitmine’s strategy is to prioritize market liquidity over volatility for financing. As long as market conditions allow, we’ll continue down this path.

From Crypto Experiment to Corporate Norm: The Future Landscape of DATs

Moderator:

Thank you all for sharing. As someone who’s been investing in this space long-term and even helped drive DAT ecosystem development in its early days, I often bear the burden of defending these models against investor skepticism. They constantly ask me: What risks do these DAT companies face? Why are there suddenly so many? I have my own answers, but I’d like to invite the “founders” here to address these questions.

Let’s go one by one, starting with Joseph. One of the most frequent investor questions is: “Why should I hold a DAT company’s stock instead of buying Ethereum spot?”

You personally hold a large amount of ETH spot—how do you view this question?

Joseph:

Great question. In my view, investing in a DAT is like a leveraged way to invest in Ethereum. If you’re willing to place capital in an Ethereum treasury and hold it over time, you’ll end up with greater Ethereum exposure per dollar invested (more ETH per dollar).

In other words, for retail investors, this is actually a more efficient investment path: DATs amplify the amount of ETH behind each dollar through asset management, capital structure optimization, and reinvestment of yields. So the longer you hold, the more pronounced the compounding effect of the DAT model becomes.

Moderator:

Excellent. Let me extend this with a related question. Now there are more and more DAT companies in the market, and many investors ask, “Why are there so many DATs? What really distinguishes them?”

Sam, what’s your take on this “DAT explosion”? How do you see the landscape evolving?

Sam:

There will be many DATs, but honestly, most shouldn’t exist, and many will ultimately fail.

Differentiation is key.

If you lack a clear positioning, unique strategy, and real execution capability, you’re just noise in the crowd. At Bit Digital, we’re doing everything we can to build real differentiation—not just slogans, but proven through actual capital structure design and strategic execution.

Joseph:

I see this slightly differently. I understand Sam’s point and agree with “survival through differentiation,” but I believe the future of DATs won’t be monolithic. Within the Ethereum ecosystem and even broader crypto world, there will be different categories of DATs:

-

Some will focus on short-term yield, generating returns through staking, liquidity mining, or financialization;

-

Others will be long-term ecosystem builders, focused on supporting the Ethereum protocol, developing infrastructure, and empowering developers;

-

Some will run extension businesses tied to Ethereum, allowing their value to scale with Ethereum’s growth;

-

And there may even be multi-token treasuries managing ETH, L2 assets, and other ecosystem tokens together.

In the end, only a few will truly stand out. Only top-tier DATs will become industry pillars, while others may emerge as regional DATs serving local capital and communities.

From a broader perspective, I believe we’re entering a stage similar to the early days of the internet. Remember when the internet first emerged? Everywhere there were “internet companies”—building websites for traditional businesses, e-commerce platforms, later shifting to mobile.

Initially, “internet companies” were a novel concept, but within years, every company became an internet company. I believe DATs will follow the same path. Soon, almost every business will realize they must do something on-chain—whether on Ethereum L1 or an L2. And to do that, they need to hold tokens, because the only way to participate in protocols is often by holding and using tokens.

So in the future, every company will manage its own token treasury. That’s the direction ConsenSys is focusing on: building a decentralized MetaMask infrastructure for everyone to build upon—MetaMask Consumer for individuals, MetaMask Enterprise for institutions, and perhaps even MetaMask Bank in the future.

By then, the label “DAT company” won’t be a special identity—it will become the norm for all companies, just like “internet company” did decades ago.

Why Ethereum Treasuries Should Trade at a Premium

Moderator:

Alright, here’s the third commonly raised concern. Many believe these DAT companies’ stock prices will long-term anchor to net asset value (NAV), or even trade below 1× NAV. Tom, I really like your previous analytical framework. Could you explain, from a fundamental standpoint, why DATs should theoretically trade at a premium, not a discount?

Tom:

I believe Ethereum-based DATs should indeed trade at a premium. First, at a fundamental level, they should trade at least at 1× NAV—though short-term market fluctuations or sentiment might cause temporary deviations.

But if we factor in staking yields—currently around 3%—that introduces a valuation multiplier. Applying the traditional S&P (Standard & Poor’s) earnings multiple model, assuming a 20× multiple, that 3% yield translates to an additional 0.6× valuation premium.

For example, MicroStrategy has no staking yield, yet its stock trades at 1.6× NAV. That extra 0.6 largely comes from being included in the Russell 1000 Index, attracting massive passive institutional inflows.

Therefore, when Ethereum DATs are eventually included in major indices like Russell 1000 or other mainstream benchmarks, their fair premium could exceed 2× NAV (>2× NAV).

Of course, short-term factors may cause some DAT stocks to trade below NAV temporarily, but I see this as transient. Long-term, there’s a clear “checklist” companies can follow to optimize valuation—transparent disclosures, improved liquidity, stronger yield management, etc. This doesn’t require M&A—every DAT can enhance valuation through internal optimization.

Joseph:

I fully agree with Tom. At this stage, M&A may not be the most effective path. Ultimately, we’ll all accumulate large pools of Ethereum assets, meaning mergers may not add much value. Staying independent while collaborating in key areas might actually enable faster, more stable ecosystem growth.

Why Ethereum?

Moderator:

As a capital markets professional, I naturally favor industry consolidation—it usually means higher capital returns.

Our discussion is nearing its end. Before we wrap up, I’d like to pose one final question. Returning to today’s theme, one core mission of DATs is advocating for the underlying token. If I ask each of you to answer in one sentence: Why Ethereum? What would your answer be? Of course, I’ll leave the length of that “one sentence” up to you.

Tom:

I believe Ethereum is in a super cycle because both Wall Street and artificial intelligence (AI) are migrating to a neutral and public blockchain network—and that network is Ethereum.

Joseph:

The global economy is gradually moving toward decentralization, and Ethereum technology will become the trust layer for Web3 and the next-generation economic system. For any company or builder, the greatest risk isn’t participating in Ethereum—it’s being absent from it.

Sam:

I believe humanity is currently undergoing two of the greatest transformations: Ethereum is rewriting the financial system, and AI is rewriting society. Both are already happening. Therefore, positioning ourselves to engage with both narratives simultaneously is Bit Digital’s most important strategic direction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News