Analyzing the $1 billion "reversible financing" mechanism of Flying Tulip: How can retail investors participate?

TechFlow Selected TechFlow Selected

Analyzing the $1 billion "reversible financing" mechanism of Flying Tulip: How can retail investors participate?

Compared to "should I get it," "can I even get it" might be the real issue.

Author: Azuma, Odaily Planet Daily

On September 30, Flying Tulip, a full-stack on-chain exchange created by "former DeFi king" Andre Cronje (AC), officially announced it had completed a $200 million private placement and planned to raise an additional $800 million publicly at a $1 billion valuation, aiming to build a comprehensive platform integrating native stablecoins, lending, spot trading, derivatives trading, and on-chain insurance.

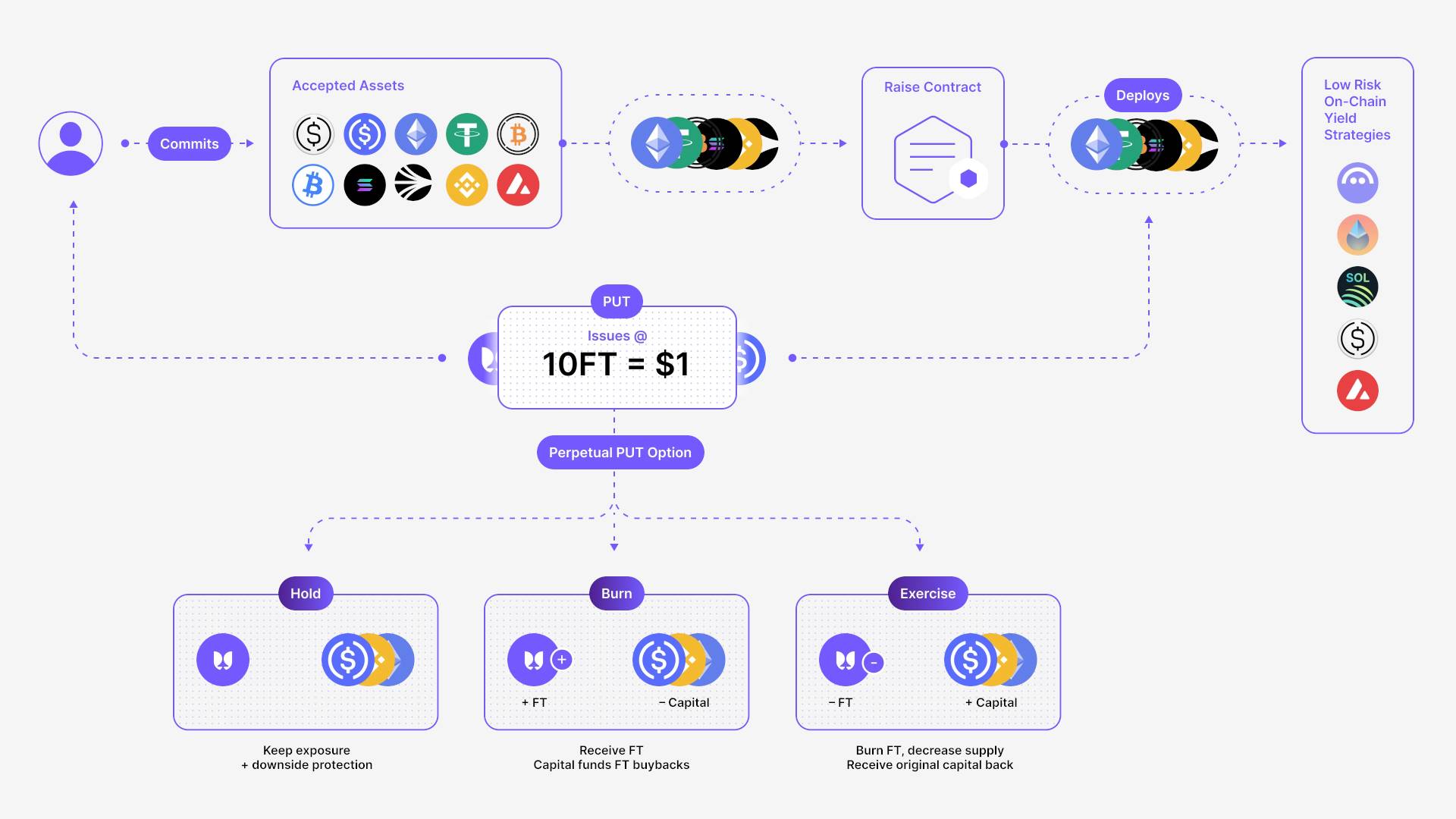

In the funding announcement for Flying Tulip, aside from the eye-catching $1 billion fundraising target, the most notable aspect was its radically different approach to fundraising compared to traditional private or public offerings—specifically, Flying Tulip will offer investors a reversible "redemption" option via perpetual put options, allowing investors to burn FT tokens at any time and redeem their principal in the original contributed assets (e.g., ETH).

However, Flying Tulip's initial announcement on September 30 did not disclose many details about this mechanism. It wasn't until last night that the official project documentation was released, covering detailed designs of products including trading and lending, as well as a thorough explanation of how the "on-chain redemption right" works.

Below is Odaily Planet Daily’s detailed analysis of the project's financing based on Flying Tulip’s official documentation, intended to assist potential investors in making informed decisions.

Key Point One: Total Funding and FT Supply

The maximum supply of FT tokens is fixed at 10 billion, with no inflation—only token burns.

For every $1 invested, investors receive 10 FT tokens. FT tokens will only be minted according to actual raised funds—if only $500 million is raised, then only 5 billion FT tokens will be minted and distributed; when total funding reaches $1 billion, 10 billion FT tokens will have been minted, after which the minting window will close permanently with no future issuance.

Key Point Two: "Redemption" Rights

According to Flying Tulip, after investors contribute funds, their corresponding FT tokens are locked into a "perpetual put option," which grants these token holders a long-term, valid "on-chain redemption right."

Depending on market conditions, investors always have three options for managing their token holdings—Flying Tulip does not impose restrictions on the proportion users can operate, meaning users may freely choose to partially redeem while holding the rest.

-

The first option is passive holding—simply doing nothing, retaining both redemption rights and the potential for FT appreciation. The "perpetual put option" offered by Flying Tulip has no time limit.

-

The second option is redeeming principal, where users can choose to redeem part or all of their initial investment in the exact original asset. Once redemption is selected, the corresponding amount of FT will be permanently burned. For example, if FT trades below its issue price ($0.10) after launch, users can fully redeem their principal to avoid losses.

-

The third option is extracting FT, after which users gain full control over their FT tokens, enabling trading on CEXs or DEXs, or participation in various DeFi opportunities. Upon extraction, the corresponding "perpetual put option" immediately expires, and the capital from the user’s private or public investment is released. Flying Tulip will use these funds for protocol operations and FT buybacks.

It should be noted that any FT purchased on the open market, beyond the initial investment, does not include the "perpetual put option"—meaning secondary market participants do not enjoy the same "redemption" rights as initial investors.

Key Point Three: Use of Raised Funds

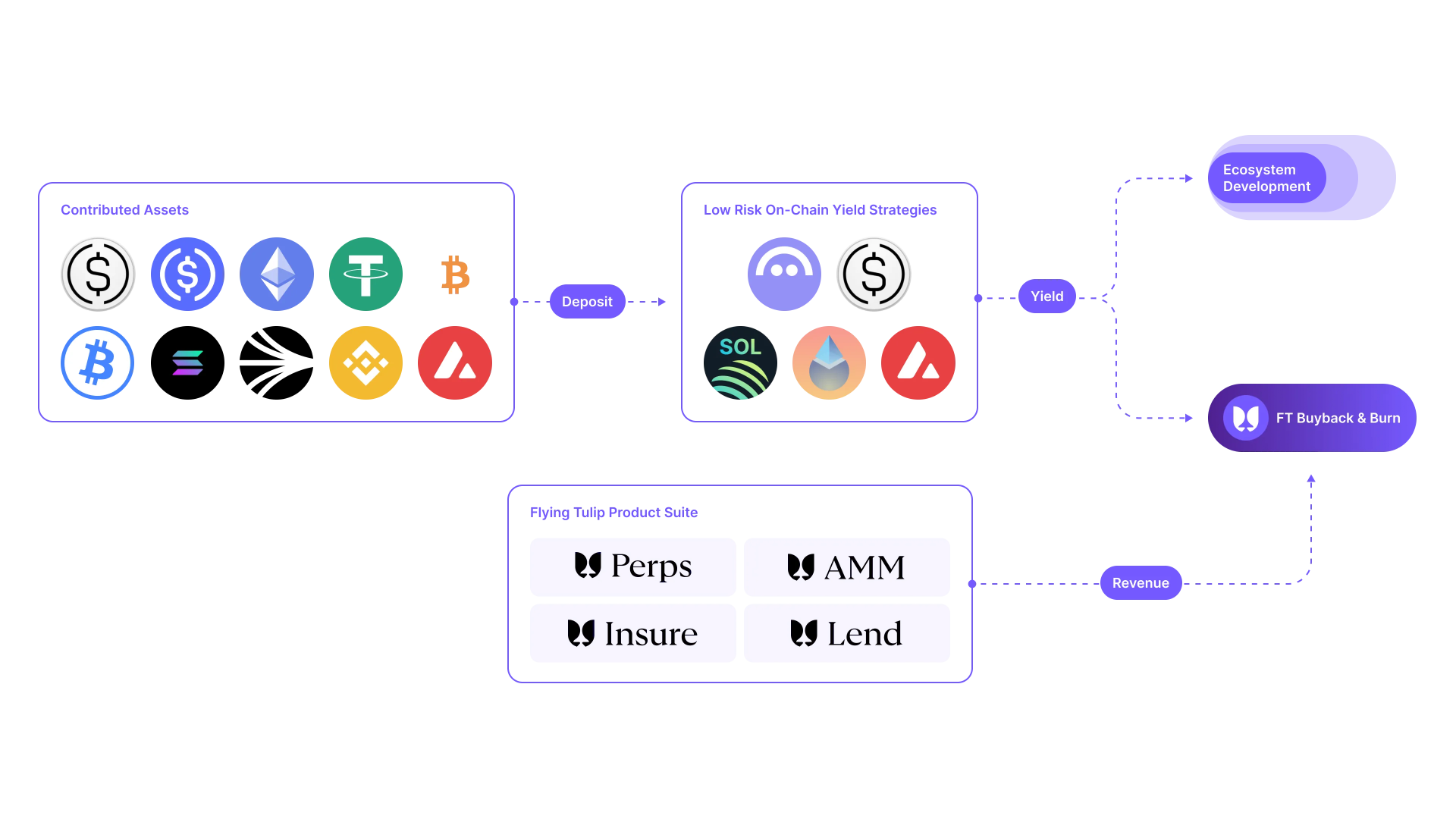

While Flying Tulip promises not to use the raised capital directly, during the lifetime of any "perpetual put option," the corresponding funds will be allocated by Flying Tulip into low-risk on-chain yield strategies (without leverage or cross-chain exposure) to ensure timely fulfillment of investor redemption requests—objectively speaking, this represents a key risk point for Flying Tulip, albeit one of relatively low severity.

Flying Tulip provided examples of yield methods for major supported assets during fundraising: mainstream stablecoins will be deposited into Aave, ETH will be staked as stETH, SOL as jupSOL, AVAX will undergo native staking, and USDe will be staked as sUSDe.

As for the yields generated from these funds, Flying Tulip stated the primary use will be funding ecosystem development, infrastructure, and ongoing operations. Any surplus yield remaining after meeting ecosystem budget needs will be used for continuous FT buybacks and burns.

One clarification needed here is that these yields are not directly tied to incentives for the Flying Tulip team. Revenue for the Flying Tulip Foundation and team comes solely from income generated across all project products (lending, trading, etc.), which will be distributed in a 40:20:20:20 ratio to Foundation / Team / Ecosystem / Incentives.

Key Point Four: How to Participate in Funding

Flying Tulip has disclosed in its official documentation that funding will be supported across five blockchains—Ethereum, Solana, Sonic, BNB Chain, and Avalanche.

-

Ethereum-supported assets: USDC, ETH, USDT, USDe, USDS, USDtb, WBTC, cbBTC;

-

Solana-supported assets: USDC, SOL;

-

Sonic-supported assets: USDC, S;

-

BNB Chain-supported assets: USDC, BNB;

-

Avalanche-supported assets: USDC, AVAX;

The specific start time for fundraising has not yet been disclosed; stay tuned with Odaily Planet Daily for further updates. Additionally, Flying Tulip recently stated on its official X account that due to strong institutional demand for the public sale, users planning to invest over $25 million may contact the team directly for customized custody solutions.

Personal Strategy: Go All In If Possible

To state the conclusion directly: I am inclined to participate aggressively.

First, 100% of FT tokens will be minted at the same price through private or public sales, ensuring equal cost basis for all investors. Second, the "perpetual put option" provides strong downside protection when FT trades at or below $0.10, and even above $0.10, the potential for downside protection offers psychological reassurance to holders. Third, Flying Tulip has designed multiple FT buyback mechanisms, which could support upward price momentum.

Opportunities in the industry offering "principal protection with upside potential" are rare. Rather than debating whether to participate, the real question may be whether one can secure allocation once the public sale opens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News