Quack AI: A New Benchmark for AI Governance and RWA Compliance

TechFlow Selected TechFlow Selected

Quack AI: A New Benchmark for AI Governance and RWA Compliance

In the future, AI governance will become a key engine driving the dual evolution of on-chain governance and asset tokenization, marking a new starting point for a governance revolution.

Author: Mario

"The introduction of Quack AI is establishing a clearer, actionable framework for AI governance and RWA compliance in participation mechanisms, decision quality, and execution pathways. This not only marks a new stage in the maturation of decentralized governance but is also seen as the starting point of a governance revolution."

From the early days of the industry to today, DAOs have gradually become a mainstream governance model. However, we also observe that despite continuous evolution of the DAO governance paradigm, this model has long faced systemic challenges such as low participation rates, slow decision-making, and security concerns.

In reality, most DAOs currently maintain single-digit voter turnout, with Maker’s participation rate as low as 2–3%. Governance in projects like Compound and Uniswap is often dominated by a small number of large holders, leading to highly centralized power structures. Low participation directly undermines governance efficiency. DAO processes typically take days or even weeks to complete, making it difficult to respond promptly to rapidly changing market conditions or security incidents. Additionally, technical barriers and operational costs deter ordinary users—high proposal thresholds, complex wallet interactions, and gas fees effectively exclude the majority of token holders.

Even when users do participate, cognitive burdens remain high. Whether adjusting DeFi protocol parameters or allocating treasury funds, proposals often involve complex financial or strategic considerations. Without auxiliary tools, users struggle to understand them and must rely on a "core few" to make decisions on their behalf.

Furthermore, DAOs have long been vulnerable to manipulation and security risks. In 2022, Mango Markets suffered an attack due to price manipulation combined with governance voting, while Ooki DAO was placed at the forefront of legal liability due to compliance issues. These cases illustrate that under traditional paradigms, DAO governance inevitably faces limitations such as insufficient engagement, distorted incentives, and emotional decision-making.

Discussions on AI Governance

As AI becomes a central narrative in both technology and crypto industries, discussions around AI governance are intensifying, with growing belief that it may offer solutions to the series of problems facing DAOs.

AI excels at processing large-scale data, maintaining high-frequency stable execution, and outperforming humans in pattern recognition and risk assessment. Compared to fully manual governance models, integrating AI means not only improved efficiency but also a reconfiguration of governance logic: humans retain responsibility for value judgments and strategic direction, while data-intensive, easily manipulatable tasks are delegated to AI.

In fact, AI can take over numerous tedious and high-frequency operations. Models can automatically parse on-chain data and community discussions, identify redundant or high-risk proposals, reduce information overload for users, and use reinforcement learning and predictive modeling to simulate different outcomes based on historical data, providing forward-looking risk alerts to help avoid emotional and short-sighted decisions. Meanwhile, smart contract-driven automation ensures immediate implementation of voting results, reducing execution gaps.

On the security front, AI can continuously run risk monitoring and compliance audits, automatically detect abnormal voting patterns and fund flows, and generate transparent, traceable governance reports—enhancing fairness, compliance, and external interpretability of governance.

Therefore, AI governance holds promise in addressing the long-standing challenges of DAOs, enabling humans to focus on value judgment and strategic choices while delegating data-heavy, procedural, and manipulation-prone tasks to machines—injecting new possibilities into decentralized governance.

On another front, as global regulatory environments become clearer, RWA (real-world assets) is emerging as one of the dominant narratives in the crypto market. Major countries worldwide are exploring frameworks for tokenized assets, making compliance a baseline requirement. In this nascent market potentially worth trillions of dollars, disclosure, compliance enforcement, and investor protection are becoming top priorities. The rapid advancement of tokenization also demands unprecedented standards for governance transparency and auditability.

Yet traditional on-chain governance tools struggle to meet these requirements: DAO voting mechanisms cannot inherently support compliance disclosures, risk controls, or cross-jurisdictional compliance tracking; relying solely on manual processes is inefficient and prone to compliance gaps. Thus, how to leverage AI to rebuild trust mechanisms on-chain—using intelligent methods to improve timeliness of disclosures, foresight in risk assessment, and traceability in compliance audits—has become a core issue.

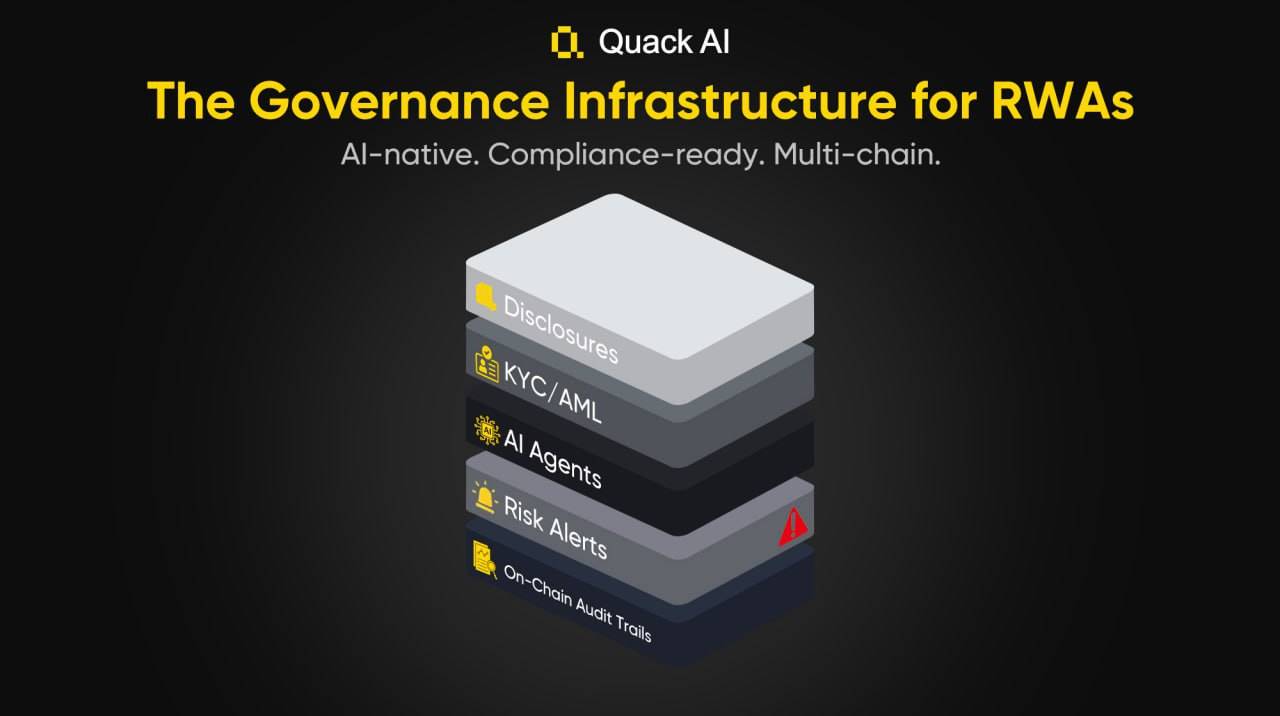

While the industry remains largely in the discussion phase of AI governance, Quack AI has moved ahead into practice. It has built a modular, natively AI-powered governance layer designed specifically for tokenized ecosystems, covering DAOs, DeFi, and RWA. This framework enables end-to-end governance automation—from parsing disclosure documents and generating proposals, to risk scoring, voting execution, and compliance auditing. Quack AI provides the industry with a clear and actionable model of AI governance.

Quack AI: A Universal Web3 AI Governance Layer Infrastructure

Quack AI is a universal Web3 AI governance infrastructure, aiming to serve the entire tokenized ecosystem and provide foundational support for the effective deployment of RWA and related scenarios. In this system, AI is embedded into core governance processes—from disclosure to proposal generation, risk modeling to voting execution, and compliance auditing to cross-chain implementation—forming an end-to-end automated closed loop.

Unlike traditional governance workflows driven by humans, Quack AI centers on data-driven intelligence and smart agents, ensuring governance is executed in real time, is transparent and traceable, and maintains consistency across multi-chain environments. It offers users low-friction participation, provides protocols with scalable execution engines, and builds the trust foundation required for compliance and auditing in RWA tokenization. At a time when the industry is still exploring, this framework already shows early signs of being a "governance operating system," offering an actionable standard for integrating decentralized governance with real-world assets.

AI Governance Execution Large Model

Quack AI introduces an advanced artificial intelligence governance execution model that further eliminates human inefficiencies in proposal evaluation, voting execution, and financial automation. Unlike traditional governance models relying on static decision parameters, Quack AI leverages machine learning, sentiment analysis, and on-chain behavior tracking to iteratively refine and optimize governance logic, enabling more efficient and transparent governance execution.

This governance execution model consists of five key components:

- AI Model and Scoring Engine: As the core of governance, it filters noise in real time, identifies high-value proposals, and integrates on-chain behavior, user data, market events, and RWA metrics to generate credible governance scores.

- AI Decision Logic: Embedded AI agents validate proposals throughout the process, assessing impact, risk, and compliance before execution, shifting governance from passive voting to intelligent, autonomous decision-making.

- Smart Contracts and Automation Engine: Governance outcomes are automatically implemented via self-executing contracts covering proposal storage, fund allocation, and compliance checks, ensuring transparency, security, and alignment with ecosystem rules.

- Cross-Chain Infrastructure Layer: Supports cross-chain operation across public chains, L2s, and RWA platforms, avoiding redundant deployments and ensuring governance logic and execution remain consistent and interoperable across multi-chain environments.

- Privacy, Audit, and Traceability System: Built-in privacy and audit mechanisms ensure all proposals and execution paths are traceable, with selective privacy controls balancing transparency and data protection.

During execution, all governance decisions within this model undergo an AI-driven analysis and validation process before being finalized.

Evaluation Before Proposal Execution

An AI governance agent first uses neural networks to assess a proposal’s quality and impact, identifying potential patterns against historical governance trends to filter out redundant or low-value proposals at the source, then proceeds to the sentiment and data processing layer.

In the sentiment and data processing layer, AI leverages natural language processing and sentiment analysis to extract real-time signals from community discussions, user feedback, and governance interactions, ranking proposals as positive, neutral, or negative to align governance direction with community consensus.

Based on data insights, AI decision algorithms continuously adjust governance parameters through reinforcement learning and use predictive models to optimize proposal selection, proactively avoiding risks and enhancing decision foresight. Simultaneously, data validation and anomaly detection mechanisms cross-reference proposals with on-chain transaction history, stake distribution, and past governance records, using anomaly detection models to identify manipulation or malicious activities—ensuring fairness and transparency in governance.

Ultimately, all filtered and optimized proposals enter the on-chain smart contract automation module.

Execution Phase

Through the on-chain smart contract automation module, governance is directly managed by AI agents interacting with smart contracts, achieving full automation from voting to fund management. This module is not merely an execution tool but also a continuously learning and optimizing governance execution system.

The on-chain smart contract automation module includes several main components: governance proposal contracts, smart governance contracts, fund management contracts, and compliance & security contracts.

In the initial stage of governance execution, the governance proposal contract stores AI-evaluated proposals on-chain and transparently executes voting transactions on behalf of users. It automatically rejects invalid or duplicate proposals, ensuring governance processes are efficient and orderly from the outset.

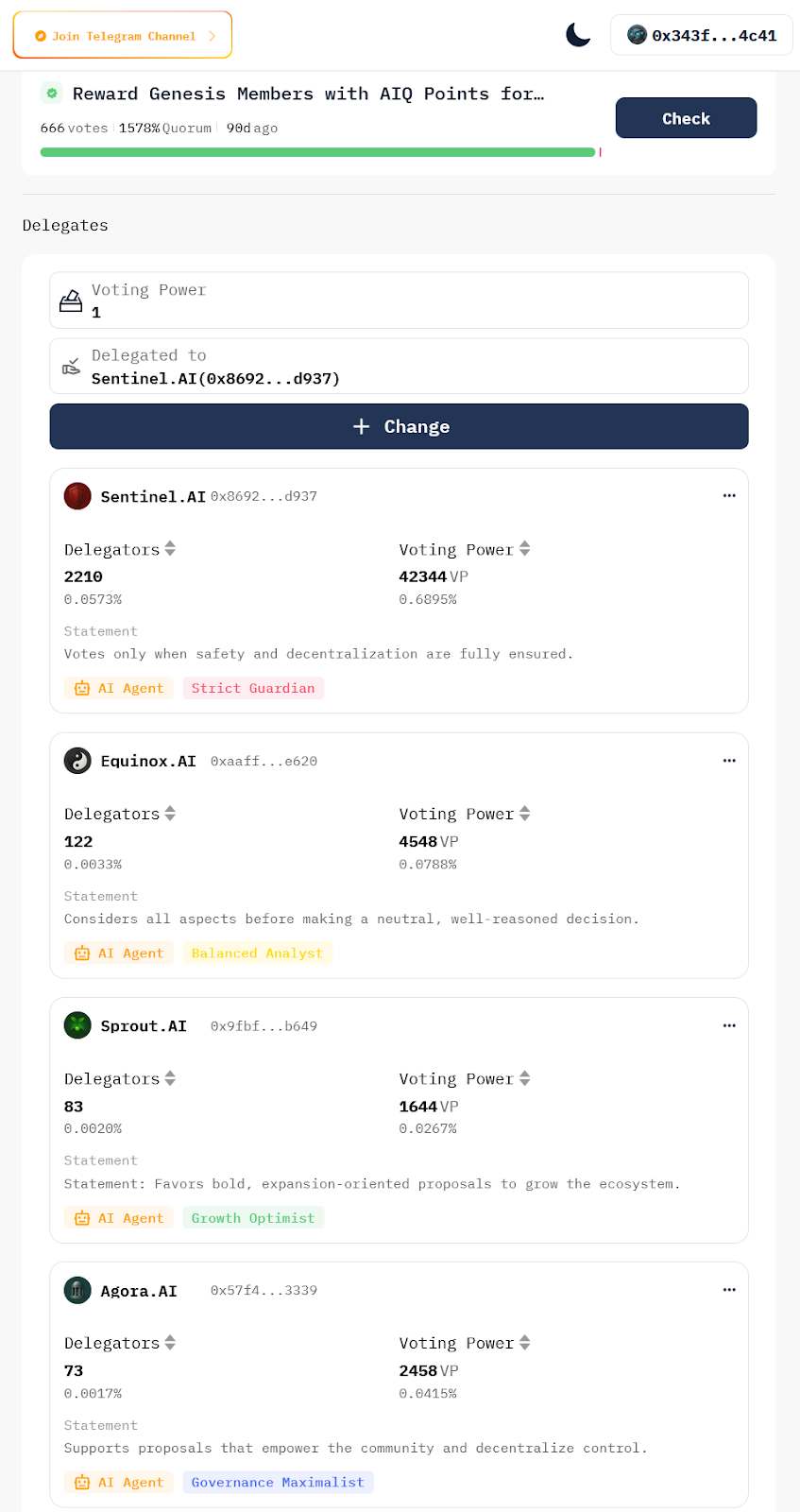

Moreover, Quack AI supports cross-chain user participation through an AI delegation framework. Users can delegate governance rights to real-time AI agents (e.g., Sentinel focused on risk-aware voting, Agora focused on optimizing proposals for community benefit), which make voting decisions based on user-defined parameters—even when users are inactive, their governance participation continues.

To prevent excessive concentration of power, the system features a dynamic voting weight calibration mechanism, which continuously adjusts delegation weights based on users’ historical behavior, staking status, and trust scores—maintaining fairness while effectively curbing centralization.

When governance decisions are reached, Quack AI agents autonomously execute outcomes on supported blockchains. This eliminates common delays and operational omissions in manual governance, enabling approved proposals to be implemented instantly and closing execution gaps. Even ordinary users without continuous manual involvement can maintain active participation via AI delegation, ensuring their influence is consistently reflected—achieving truly “continuous participation, zero friction.”

Beyond governance, Quack AI extends autonomous organizations’ capabilities to the financial level through AI-driven financial automation, enabling risk optimization and tamper-proof operations, allowing governance to span the entire process of fiscal execution and incentive distribution.

Building on this, Quack AI offers multi-layered financial execution methods:

- It supports automatic revenue sharing, allowing blockchains integrating Quack AI to set customized profit distribution mechanisms based on their governance needs;

- AI can directly execute governance-based budget allocations, completing fund distribution, equity rewards, and incentive programs;

- The system can intelligently evaluate funding requests driven by proposals, combining historical performance and impact analysis to determine optimal funding plans.

At the same time, Quack AI further mitigates risks through institutionalized execution frameworks:

- Multi-layer compliance verification: Before execution, the system checks whether proposals are approved by verified governance participants, whether compliance and jurisdictional conditions are met, and whether there are risk warnings or logical conflicts;

- Triggerable external oversight: Any anomalies can trigger manual review or multi-agent consensus, preventing AI from being “overridden” or exploited at a single point;

- Open multi-model mechanism: Allows external models and agents to access the execution market, fostering diverse competition and checks and balances rather than hardcoding a single LLM;

- Transparency and auditability: All cash flows output standardized logs, independently replayable and verifiable by third parties or the community.

Through these mechanisms, Quack AI eliminates inefficiencies and human biases in financial decisions while avoiding single-point risks that could arise from “naive AI governance.” Governance outcomes are executed immediately, securely, and with institutional diversity and oversight, ensuring autonomous organizations remain compliant and scalable in complex scenarios like DeFi and RWA.

In the final stage of the governance process, compliance and security contracts play dual roles in protection and auditing.

These contracts include anti-manipulation mechanisms that actively identify and block potential governance attacks, ensuring the system isn’t disrupted by malicious behavior during execution. To preempt risks, AI validates and reviews proposals at the proposal stage, automatically filtering spam, malicious proposals, and suspicious vote manipulation strategies.

Meanwhile, the system generates governance audit and transparency reports, thoroughly documenting voting behaviors, fund distributions, and decision logic—providing clear, traceable evidence for communities and regulators. Additionally, Quack AI employs AI-driven fraud detection mechanisms to monitor governance transaction flows in real time, detecting and halting potential attacks immediately—ensuring the entire governance process operates within a fair, transparent, and compliant framework.

Thus, through this system, Quack AI not only optimizes voting power distribution but also automatically completes proposal implementation, fund disbursement, and incentive distribution—executing governance outcomes in real time, transparently, and securely—truly achieving immediacy and trustworthiness in governance.

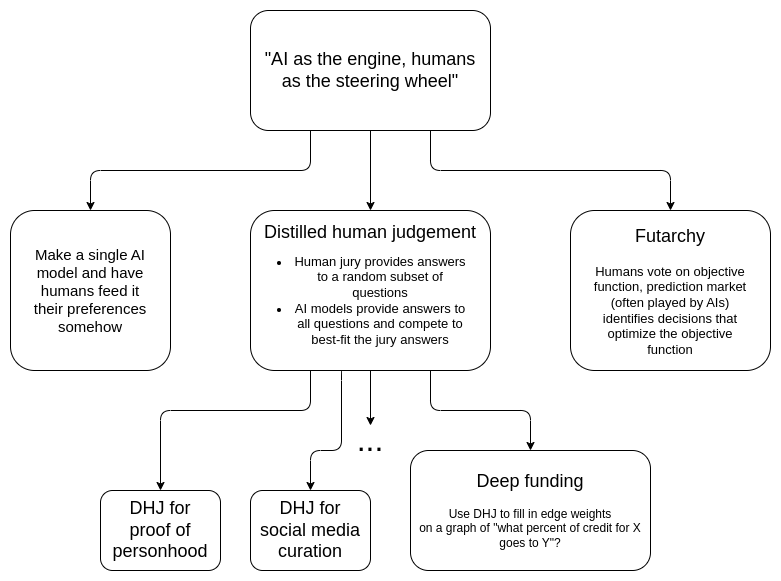

AI is the engine, humans are the steering wheel

Ethereum founder Vitalik Buterin published an article titled “AI as the engine, humans as the steering wheel” on his blog, stating: “A single AI system directly responsible for governance or fund allocation can be easily exploited; more robust governance requires open, diverse, and auditable institutional design.” This aligns perfectly with Quack AI’s philosophy.

In Quack AI’s governance framework, AI serves as an execution layer designed to complement humans. The model can be summarized as “AI is the engine, humans are the steering wheel”—AI handles data processing, trend prediction, and execution, while humans define value goals and strategic directions.

To achieve this, Quack AI introduces several mechanisms:

- Distilled Human Judgment (DHJ): Introduces decentralized juries to provide moral and strategic guidance for AI model training, preventing it from becoming a black-box decision-maker.

- Futarchy model combines prediction markets with community voting, enabling AI to optimize governance pathways under community-defined objectives, ensuring alignment with long-term vision.

- In fund allocation, AI-enhanced grant mechanisms incorporate impact, feasibility, and historical performance, with human validators overseeing key metrics while AI precisely executes distribution—reducing bias and waste.

- In content ecosystems, AI-driven content filtering works alongside human committee oversight, ensuring efficient and valuable information flow while preventing distortion and manipulation.

Through this comprehensive design, Quack AI leverages AI’s strengths in efficiency and precision while preserving human dominance over ethics and strategic direction—building an efficient, trustworthy, and transparent AI-augmented decentralized governance paradigm.

Image source: https://vitalik.eth.limo/general/2025/02/28/aihumans.html

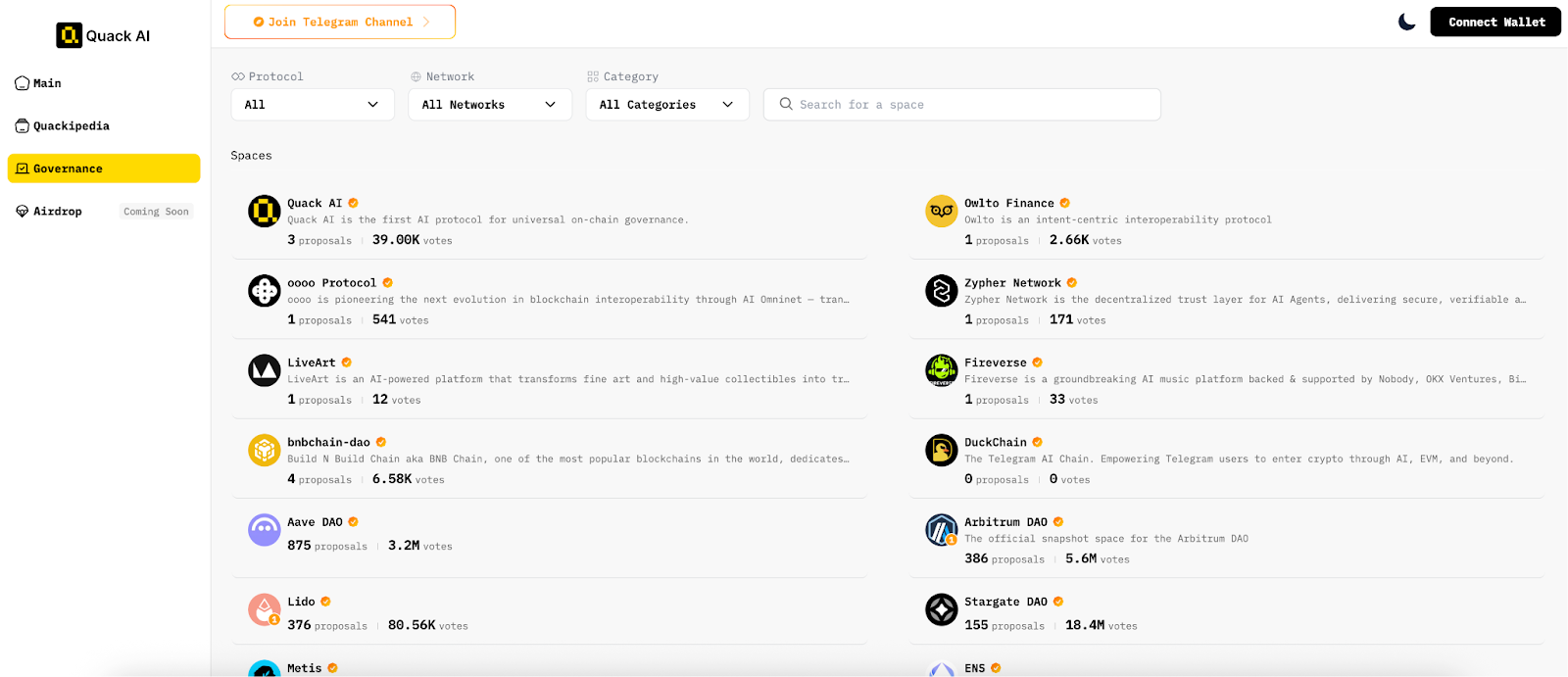

Multi-Chain Governance

Quack AI’s governance model is inherently cross-chain, designed to operate across multiple blockchain ecosystems, enabling users to participate in governance and drive decision execution across chains.

Its core lies in building an AI governance interoperability layer, where AI tracks governance trends across different blockchains in real time, optimizing cross-chain voting logic so insights from one chain can directly influence governance actions on another.

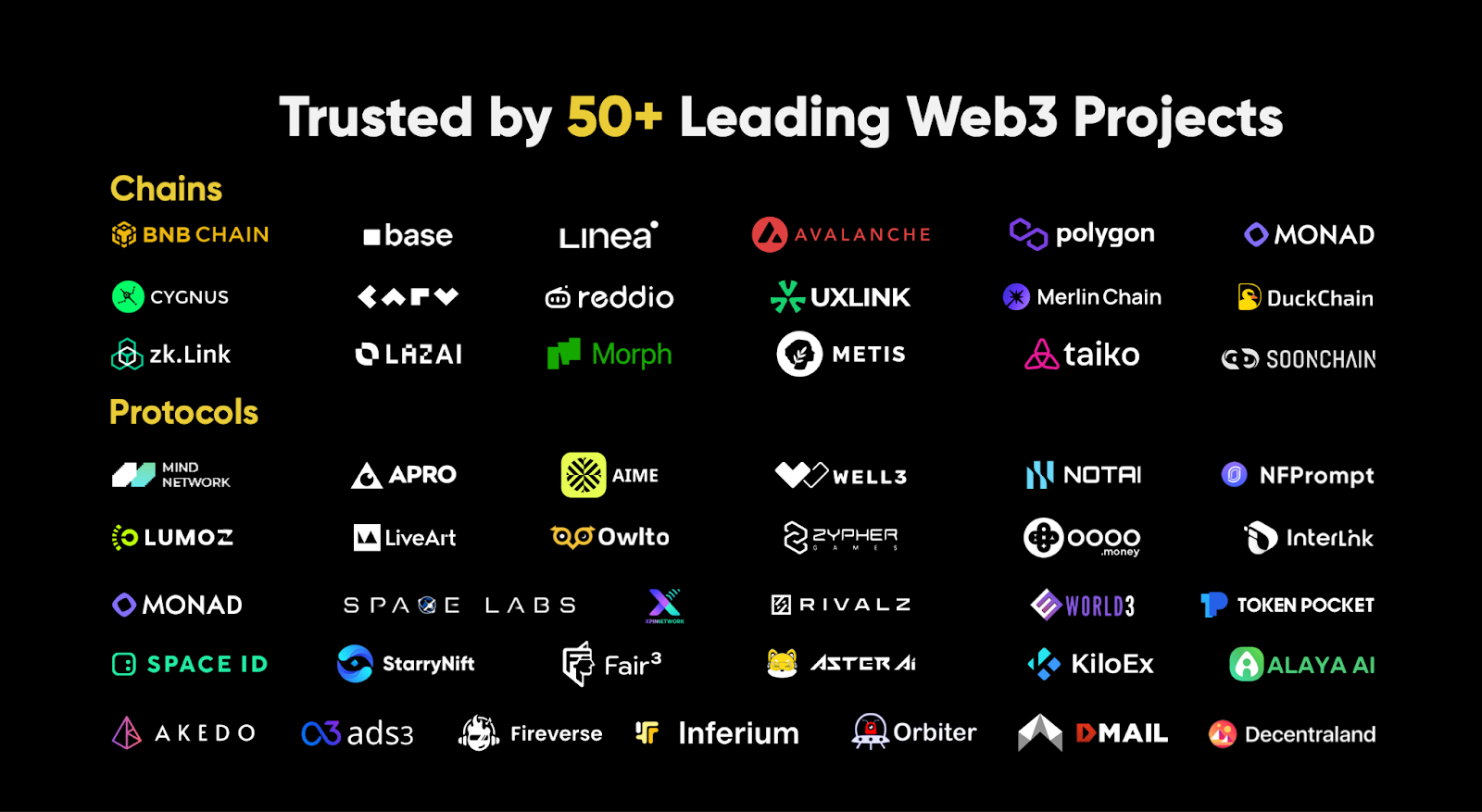

Currently, Quack AI is not only compatible with Ethereum’s native governance mechanisms but also provides governance reporting APIs for EVM protocols, enabling direct interaction with Quack AI’s analytical outputs. Notably, Quack AI has been deployed in over 50 ecosystems, each integration embedding AI agents, real-time execution, and risk-aware decision models—ensuring cross-ecosystem governance coordination, transparency, and smooth operation.

Leveraging its cross-chain toolkit, Quack AI launched the first cross-chain AI governance hub, enabling communities, DAOs, and institutions to interact in real time with AI-driven governance. It not only facilitates participation but also ensures automatic decision execution, risk-aware voting, and financial operations—eliminating human bottlenecks.

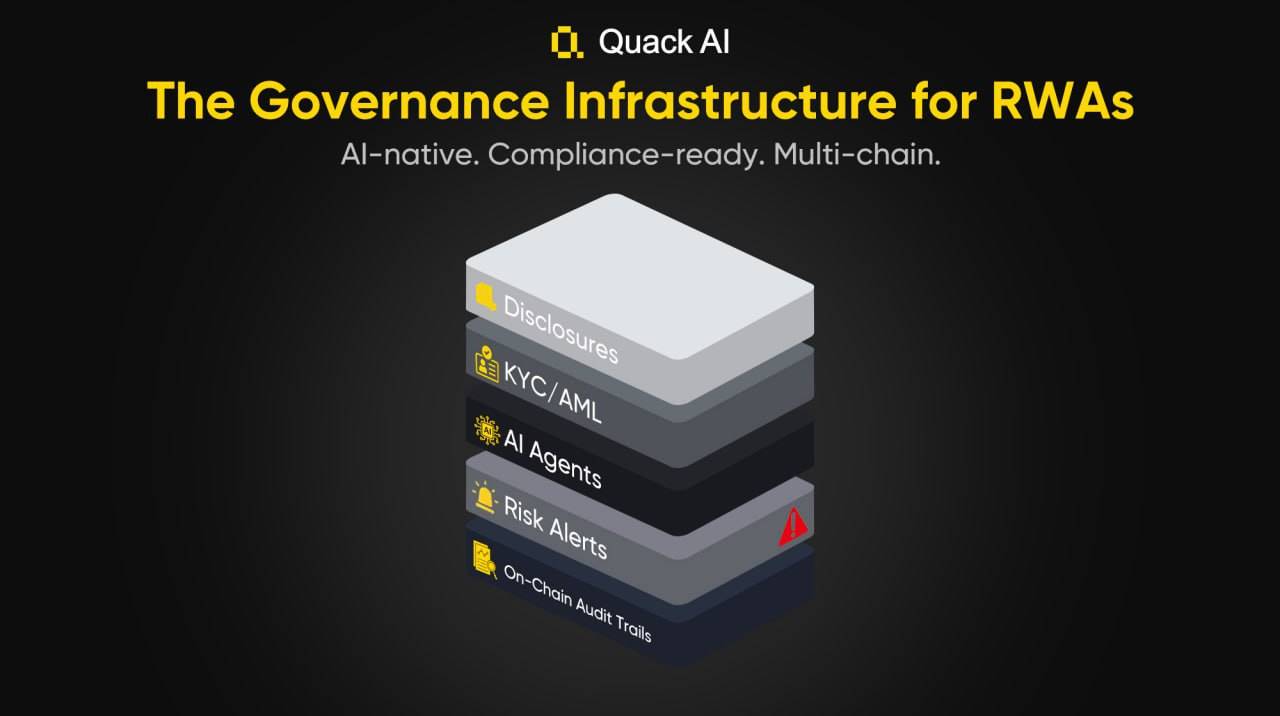

Empowering RWA Governance

With the rapid expansion of tokenized assets, building a sustainable institutional framework on-chain—from asset monitoring to compliance enforcement—has become a new industry pain point. Addressing this, Quack AI offers a dedicated governance module designed for RWA, helping platforms achieve automated, compliant, and traceable governance across the full asset lifecycle.

Governance begins with asset monitoring.

Quack AI can track real-time NAV (net asset value) changes from oracles and off-chain data sources. When market volatility occurs, the system instantly generates rebalancing or unlocking proposals, incorporating risks into the governance process. Linked to this is redemption queue management: when redemption pressure approaches limits, AI agents automatically trigger freezing or delay logic to prevent runs, and support governance-level restructuring of redemption mechanisms.

To ensure assets are reliably mapped on-chain, Quack AI introduces Proof of Reserves (PoR), which continuously verifies timestamps and validity of submitted credentials, automatically flags expired or invalid data, and updates or pauses proposals when necessary—ensuring on-chain and real-world assets remain synchronized.

On the compliance front, Quack AI implements an identity-threshold governance system where voting rights are tied to verified identities and equity proportions, combined with KYC/AML gating and jurisdictional filtering—enabling differentiated, cross-regional compliant governance that connects on-chain decisions to real-world regulatory frameworks.

Additionally, RWA governance requires event response capabilities. Quack AI’s asset event trigger module converts major legal, financial, or operational events into on-chain governance signals, giving governance real-time awareness and automatic response features.

Through these tightly integrated mechanisms, Quack AI is building a complete closed-loop governance system for RWA platforms—covering monitoring, risk, compliance, execution, and response—enabling tokenized funds, bonds, equities, and other assets to operate securely and transparently on-chain, while providing a trusted institutional foundation for mass-scale real-world asset tokenization.

Ecosystem Roles

Currently, within Quack AI’s governance system, two primary roles exist: community users participating in governance, and B2B developers and third-party dApps.

Users Participating in Governance

To participate in governance via the AI governance layer, users must hold Passport assets to obtain on-chain identity. Passport is a gas-fee-based credential serving as a user’s on-chain identity within the Quack AI governance layer. Holders can delegate their votes to AI agents, receive governance airdrops, track participation metrics, and access rewards through this asset.

After delegating voting rights, users no longer need to vote manually. AI agents analyze on-chain data, historical governance patterns, and community sentiment to evaluate each proposal, automatically generating rankings and priorities. Users receive AI-generated insights before voting or delegation, shifting governance from “intuition-based” to “data-driven.” These agents autonomously vote based on user-defined logic and behavior patterns and immediately execute decisions upon proposal approval—eliminating gaps caused by human delays or omissions. Users retain override rights, allowing manual intervention on critical issues.

The system tracks user participation and delegation behavior, dynamically adjusting reward distribution based on activity, historical contributions, and voting quality—making incentives fairer and more transparent. To date, over 3 million Passport users have joined Quack AI’s governance modules, validating the effectiveness of this model.

Developer Community

For developers, Quack AI is a modular AI governance layer supporting end-to-end cross-chain decision automation, execution, and risk-aware coordination.

Builders and developers can integrate Quack AI into dApps, protocols, or ecosystems to unlock AI-generated proposal insights, delegated voting mechanisms, autonomous execution workflows, real-time governance analytics, and on-chain rewards and financial automation—reducing governance burdens and enabling intelligent, tamper-proof decisions.

To date, more than 10 chains and over 40 on-chain protocols have adopted Quack AI’s governance framework, with deep integrations into BNB Chain, Arbitrum One, Optimism, Polygon, Avalanche, Base Chain, Linea, Metis Chain, Taiko, Monad Testnet, Merlin Chain, Berachain, HashKey Chain, and DuckChain—aiming for cross-ecosystem expansion rather than being limited to a single chain.

Developers can access AI governance data APIs to retrieve real-time proposal data, governance analytics, and AI-generated insights, monitoring cross-chain governance trends. They can also invoke AI-driven governance monitoring and reporting to retrieve governance activity logs, proposal outcomes, and participation metrics, leveraging sentiment analysis and trend prediction models for better judgment. Through smart contracts and financial governance analytics, developers gain access to AI-optimized fund management reports, track token distribution and equity allocation, and use automated compliance monitoring to ensure all decisions comply with governance policies.

According to Quack AI’s roadmap, a full suite of developer APIs is being rolled out gradually, opening governance data, voting logs, proposal scores, and AI models—enabling developers to integrate Quack AI’s governance engine into external applications and dashboards.

In the future, Quack AI will launch an AI governance SDK, allowing dApps to directly integrate automated decision execution; provide smart contract automation APIs so DAOs can fully automate proposal handling, voting, and execution across multiple chains; and advance multi-chain governance execution on Ethereum and other networks through governance orchestration tools. By accessing Quack AI’s APIs and analytics tools, developers can enhance their applications with AI-driven governance intelligence while ensuring Quack AI remains an autonomous, scalable, cross-chain compatible governance protocol.

RWA Issuers

For RWA issuers, Quack AI offers a modular governance system tailored to their specific needs, providing a clear and actionable compliance hub for real-world asset tokenization.

This system continuously monitors key signals such as NAV fluctuations, redemption pressure, PoR data expiration, and liquidity thresholds, generating on-chain audit logs to meet regulatory requirements for “verifiability and explainability.” On compliance and identity, Quack AI uses KYC/AML gating and jurisdictional filtering to ensure participants meet qualified investor standards and satisfy cross-regional regulatory requirements—effectively empowering RWA issuers.

For institutions, this means they don't need to adapt to entirely new governance paradigms. Traditional decision-making processes like board meetings and shareholder assemblies can be smoothly migrated on-chain, directly interfacing with compliance modules and AI execution layers. Whether tokenized funds, bond and equity platforms, or financial-grade base chains and other permissioned chains, all can leverage Quack AI to unify compliance, automation, and cross-chain execution within a single governance layer.

Through this system, Quack AI helps RWA achieve a complete closed loop—from asset monitoring and compliance identity to risk control and institutional adoption—not only solving the core challenge of “how to govern assets after they’re on-chain” but also providing a trustworthy governance and compliance standard for the multi-trillion-dollar real-world asset market.

A New Starting Point for the Web3 Governance Revolution

Overall, Quack AI’s approach is highly precise. By embedding intelligent agents into proposal creation, voting, and execution, it delegates the most labor- and time-intensive tasks to machines, enabling DAOs to transition from “formal autonomy” to “practical autonomy.”

This model allows humans to focus their judgment on value trade-offs and strategic direction, while entrusting process execution and outcome optimization to machines—significantly reducing governance friction and enhancing transparency and operability.

Meanwhile, the large-scale onboarding of RWA is becoming one of the industry’s most important growth narratives. Quack AI is making RWA ownership and circulation more efficient and trustworthy, while providing financial institutions and regulated entities with verifiable, transparent trails—ensuring institutional and compliance safeguards for mass-scale asset tokenization.

Thus, Quack AI’s paradigm can be seen as an innovation in DAO tooling, advancing governance systems toward maturity while laying an institutional foundation for reconstructing on-chain financial order and enabling large-scale RWA deployment.

Building on Quack AI, AI governance will become a key engine driving the dual evolution of on-chain governance and asset tokenization—marking a new starting point for the governance revolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News