From 8 to 9! Huobi HTX platform reserves increase to 9 assets, WLFI added to disclosure list, securing user assets

TechFlow Selected TechFlow Selected

From 8 to 9! Huobi HTX platform reserves increase to 9 assets, WLFI added to disclosure list, securing user assets

Huobi HTX has comprehensively enhanced its capabilities across three dimensions: asset transparency, security protection, and wealth management.

Recently, HTX (formerly Huobi) released its August performance report, ranking first globally in spot trading volume growth, with steady expansion in derivatives trading and strong performance in new asset listings. Meanwhile, HTX increased its reserve disclosure assets from 8 to 9, including WLFI in its proof of reserves. In terms of security, the platform continues to comprehensively safeguard user assets, maintaining consistently high customer service satisfaction.

Reserve Disclosure Assets Increase from 8 to 9; WLFI Included in Proof of Reserves

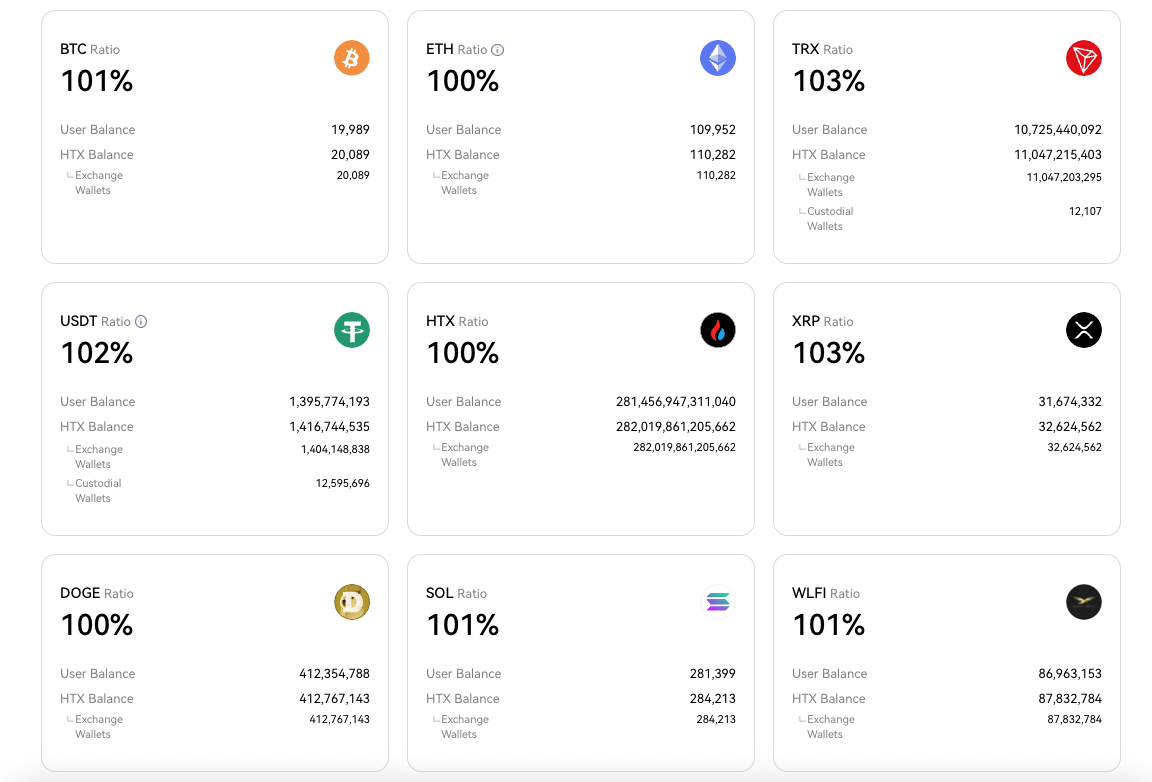

As one of the earliest platforms in the industry to adopt the Merkle Tree verification mechanism, HTX has publicly disclosed its Proof of Reserves (PoR) every month for 35 consecutive months, maintaining industry-leading transparency. As of September 2025, the number of reserve-disclosed assets on the platform has increased from 8 to 9, with the addition of WLFI. Reserve ratios for all major assets have reached or exceeded 100%. Users can visit the “Assets - Proof of Reserves Report” page on the HTX official website at any time to view monthly updated PoR reports.

In terms of security, HTX delivered measurable results in August: issuing 246,126 security alerts to users, effectively preventing potential risks; taking down 40 phishing and counterfeit websites; successfully blocking 9 withdrawal attempts to scam addresses, helping users recover $29,656; handling 16 incidents involving externally stolen funds, freezing $348,300 in related assets; adding 550 new blacklisted addresses, intercepting 8 black address deposits totaling $123,175.

In customer service, HTX’s support team served 251,892 users in August, escalating and resolving 106,266 user issues, primarily focused on core scenarios such as P2P trading and on-chain deposits and withdrawals. User satisfaction remained above 80%, fully reflecting the professionalism and efficiency of the platform’s service capabilities.

Security First: High-Yield Earning Products Gain User Favor

HTX’s security efforts go further—its C2C division launched a dedicated OTC Monthly Risk Report for August, providing a comprehensive overview of security achievements in deposit and withdrawal processes.

Meanwhile, HTX Earn offered interest rate subsidies on multiple stablecoin and major cryptocurrency flexible-term products, with maximum annualized subsidy rates for WLFI reaching up to 20%. Stablecoins such as USDT, USDC, USD1, and USDD offer yields as high as 10–20%, significantly surpassing traditional bank savings or U.S. Treasury returns. For PoS-based cryptocurrencies, HTX Earn yields are on par with on-chain yields, maintaining an industry-leading position. New users trying the platform for the first time also have the chance to receive limited-time welcome offers with 100% APY.

Overall, HTX has全面提升 in three key areas—asset transparency, security protection, and wealth management—gradually building a more resilient and forward-looking crypto ecosystem. Going forward, HTX will continue to focus on users, expand market frontiers, and drive mutual growth between the platform and the broader industry.

About HTX

Founded in 2013, HTX has evolved over 12 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and other services.

As a leading global Web3 gateway, HTX adheres to a development strategy centered on global expansion, ecosystem prosperity, wealth effects, and security compliance, offering comprehensive, secure, and reliable value and services to crypto enthusiasts worldwide.

To learn more about HTX, visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For inquiries, contact glo-media@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News