iPhone 17 Launch, I Found the Biggest "Apple Mentality" in Crypto is HODLing

TechFlow Selected TechFlow Selected

iPhone 17 Launch, I Found the Biggest "Apple Mentality" in Crypto is HODLing

In the crypto world, the ultimate form of "Think Different" might just be "Think for Yourself".

By David, TechFlow

Today, everyone in the tech world is talking about one thing: the iPhone 17 has launched.

WeChat Moments, Weibo, and Xiaohongshu are flooded with Apple news. Some people stayed up late to watch the launch event; others are calculating whether the price is worth it.

But this year’s discussions have a slightly different tone. Beyond the new product itself, a fresh meme has gone viral across Chinese social media:

"Android mindset" vs. "Apple mindset."

Some summarize that Android users have a “cost-performance mindset”—they compare specs and crunch prices for everything—while Apple users have an “experience mindset,” willing to pay a premium for ecosystem and brand.

Then this meme spread wider and wider, moving from smartphones into all kinds of fields, as people began using these two mindsets to describe different approaches to life.

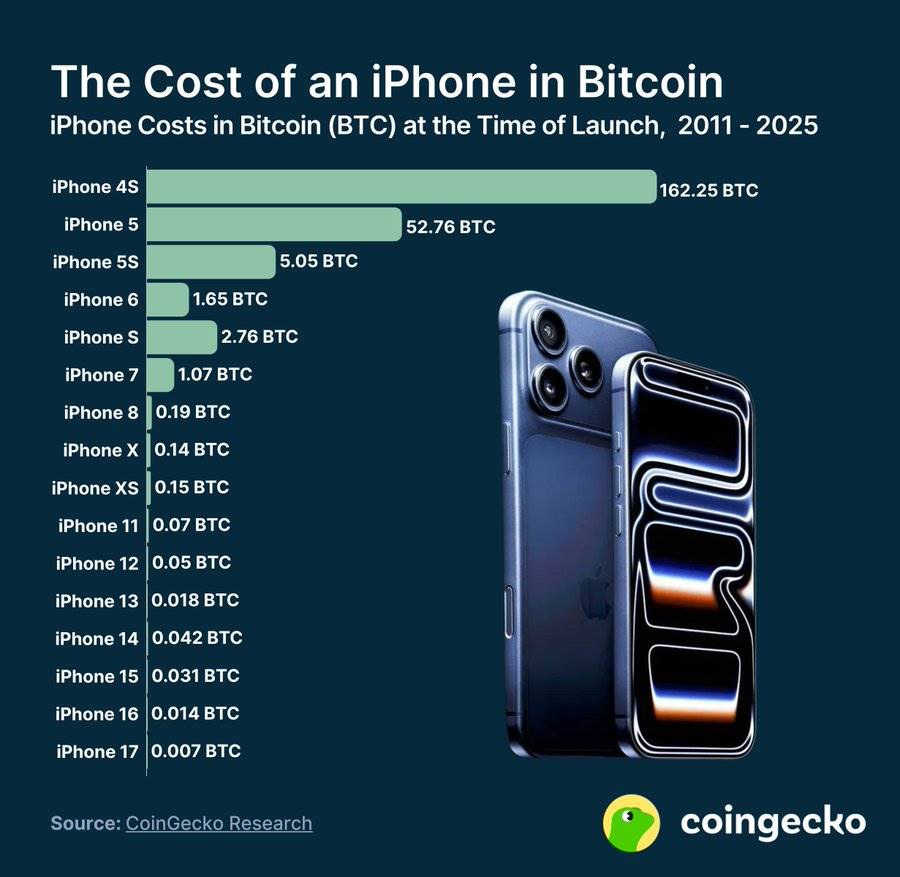

As I was scrolling through these discussions, a chart posted by Coingecko on crypto Twitter popped into my timeline.

In 2011, buying an iPhone 4S cost 162 BTC; in 2024, an iPhone 16 cost only 0.014 BTC. At today's iPhone 17 price, it’s about 0.07 BTC.

I stared at this image for a long time. Whenever we calculate value in crypto terms, we always end up regretting coins we once lost.

While everyone debates “Android mindset vs. Apple mindset,” I found myself wondering: in crypto, what truly constitutes the “Apple mindset”?

If the Apple mindset means believing in a brand or philosophy and holding steadfastly over time, then aren’t those who held BTC from 2011 until now the purest practitioners of the “Apple mindset”?

This thought led me to re-examine many phenomena within the crypto space.

The Mindset Labels in Crypto

Crypto may be the world’s biggest labeling community.

“Diamond hands” or “paper hands,” “Builder” or “Trader,” “value investing” or “speculation”—we’re always categorizing ourselves and others.

Now, the “Android mindset” and “Apple mindset” meme has entered crypto—and surprisingly fits well.

What is the “Android mindset” in crypto?

At its core: gamble.

Believe small capital must take high risks to turn things around. BTC doubling from $9K to $18K takes time, but a meme coin might 10x in a day. They don’t seek steady growth—they aim for class leap.

The logic chain is clear: ordinary people lack resources → must find asymmetric opportunities → new projects and concepts most likely generate alpha → so keep trying, keep rotating.

And what is the “Apple mindset” in crypto?

At its core: accumulate.

Believe time matters more than choice. Not that they don’t want quick profits, but believe chasing trends yields negative expected returns. Rather than losing on 90 out of 100 projects while profiting on 10, better to pick the most certain one and hold long-term.

Their logic is equally solid: markets are unpredictable short-term → most can’t beat the market → BTC is the only asset proven by time → simply holding is winning.

The most typical example? Those “laser eyes” profile pictures, bios often containing just one word: Bitcoin.

Interestingly, both sides often fail to understand each other—even distrust each other.

The Android-minded see Apple-minded people as too conservative. Crypto is supposed to be high-risk, high-reward—if you want stability, why not buy Kweichow Moutai instead?

The Apple-minded see Android-minded ones as dancing on knives—making 10x today, zeroing out tomorrow, likely losing overall when all accounted for.

Both have their beliefs. One side chants WAGMI; the other lives by HODL.

But perhaps it's not about right or wrong—it’s about circumstance.

Can the optimal strategy be the same for a young person entering with $5,000 versus an experienced investor entering with $5 million?

For the former, even if they lose it all, it’s just two months’ salary—but if they win, it could change their life. For the latter, one wrong bet could be catastrophic.

So the Android-minded aren’t wrong: how can you rise without betting? The Apple-minded also stand firm: protecting principal ensures long-term survival.

It’s like asking you: iPhone or Android?

The answer always depends on what you want.

The Curious Mirror of the “Apple Mindset”

On the surface, crypto and the “Apple mindset” should be incompatible.

After all, crypto was born to break monopolies, embrace openness, and drive innovation. Apple, in contrast, represents closed ecosystems, centralized control, and incremental updates. Logically, crypto should naturally reject the “Apple mindset.”

Yet reality is ironic. The most successful coin is precisely the most “Apple-like.”

BTC’s codebase has evolved cautiously for over a decade—doesn’t this resemble Apple’s “toothpaste-squeezing” innovation? Every year people say iPhone is falling behind, yet every year it sells best.

The most devoted BTC community is also the most “Apple-like.”

The arrogance of Bitcoin bulls rivals any Apple fanboy. They have a famous saying:

“Shitcoin is shitcoin”—no matter your innovation or ecosystem, it’s trash in their eyes. And beneath it all lies Satoshi’s legendary quote:

“If you don't believe me, I don't have time to convince you.”

Doesn’t this self-centered attitude mirror the superiority complex of certain Apple users who insist “Android just doesn’t measure up”?

Even more interesting is the market’s current choice. Institutions, public companies, and national reserves are all accumulating Bitcoin. You might call it slow realization, but it’s hard to argue they’re all fools pouring real money into a bad bet.

There’s a deeper logic here: in a highly uncertain market, “boring” might actually be the greatest advantage.

BTC needs no roadmap, no updated whitepapers, no CEO endorsements, not even marketing. It just exists—unchanged for over a decade, boring but reliable.

Yet for most crypto participants, this mindset remains difficult to adopt. The greatest paradox? While loudly championing decentralization and innovation, the market funnels the most capital into the most “conservative” project: BTC.

The “Android Mindset”: Hustle as Instinct

This paradox deserves reflection. Why does a space that celebrates openness and innovation ultimately channel the most money into the most closed and conservative strategy?

Let’s first examine crypto’s “innovation anxiety.”

Every bull market brings a new narrative. 2017: ICOs. 2020: DeFi. 2021: NFTs and GameFi. 2024: Inscriptions and AI. Each starts with claims of “changing the world.”

Where does the anxiety come from? From missing out.

Seeing others achieve financial freedom with SHIB, transform their lives with BAYC, or earn massive gains from early DeFi farming—who wouldn’t feel anxious? So everyone rushes to catch the next wave, terrified of being left behind.

Social media amplifies this anxiety. Open Twitter: endless posts like “Congrats to ×× for another 1000x!” or “×× sector still has 10 alphas!” Not chasing trends feels like a crime, like failing to participate fully in the industry.

But real data is harsh.

How many 2017 ICO projects still exist today?

The more innovations emerge, the more projects go to zero. This has almost become crypto’s iron law. What matters is how much you retain when the tide recedes.

Jumping into the wave is easy; exiting unscathed is hard.

Let’s be honest: if there’s an ultimate “Android mindset” player in crypto, their actual state is exhausting.

Look at these players’ Twitter feeds—you’ll find them tracking: new L2 launches, potential airdrops on which chains, new DeFi pools, floor prices of inscriptions, movements of AI-themed tokens…

During the peak of memes, while others sleep at 3 a.m., they’re scanning blockchains and hunting angles; while others rest on weekends, they’re researching new narratives.

The so-called “scientists,” stripped of filters, are just ordinary people desperately seeking information edges—tired, yet feeling fulfilled.

Ask around: among “Android mindset” players, how many have actually made money?

Most might tell a similar story: 10x gain in Project A, wiped out in Project B; earned $1M in early bull market, gave it all back in bear market; caught one alpha today, stepped on three landmines tomorrow.

At year-end, their balance sheet often looks worse than simply holding BTC from the start.

Why? Because the “Android mindset” has a fatal flaw: information overload. When you try to seize every opportunity, you end up grasping nothing.

When your attention is scattered across 100 projects, your understanding of each is superficial. You think you’re researching, but you’re just browsing. You think you’ve gained an information edge, but what you see is often exactly what others want you to see.

A deeper issue: in this space, for ordinary people, hard work is the only antidote to anxiety.

Deep down, most crypto players know they lack real advantages—no insider info, no technical edge, no large capital. The only thing they can do is “work harder.” But in a PVP market, effort might be the least valuable asset.

Of course, some succeed with the Android mindset.

Those who truly profit usually focus on a niche, have unique information sources, and know when to exit. More importantly, they treat it as a full-time job.

In contrast, “Apple mindset” players live differently.

They might not check prices for months. Their lives revolve outside crypto. They have careers, businesses, personal lives. Crypto is merely one part of their asset allocation.

No right or wrong—only choices. If you have time, energy, and talent, the “Android mindset” might truly suit you.

The Wisdom of Choice

Back to the chart at the beginning.

Priced in BTC, iPhone dropped from 162 BTC to 0.01 BTC over 13 years—a 99.99% decline.

This contrast is striking, but consider a more practical question:

If you were the person in 2011 debating between buying an iPhone 4S or 162 BTC, what would you think now?

In 2011, iPhone was a tangible revolutionary product, while BTC was merely an experiment among geeks. Choosing iPhone was rational; choosing BTC was crazy.

But looking back 14 years later, the rational choice leaves you with obsolete e-waste, while the crazy choice gives you $1.5 million in assets (if you held and never sold).

What does this prove?

Perhaps nothing. Success may just be survivorship bias. Everyone made the choice most suitable for their character at the time—the most reasonable one in hindsight.

There is no right or wrong. Truly, none.

The market rewards truly skilled “Android mindset” players—the ones who find alpha. It also rewards steadfast “Apple mindset” players—the ones who hold beta.

The market punishes the indecisive. So the real question was never which mindset to choose, but: do you know yourself?

Whether you choose iPhone or BTC, whether you follow the “Android mindset” or “Apple mindset,” the most important thing is:

This is your own choice—not someone else’s answer.

After all, in crypto, the highest form of “Think Different” might just be “Think for Yourself.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News