Kiwi Co-Founder: On Building Consumer Crypto Applications

TechFlow Selected TechFlow Selected

Kiwi Co-Founder: On Building Consumer Crypto Applications

Cut through the fog of false signals to find genuine market validation.

Author: Mac Budkowski

Translation: TechFlow

Over the past few years, I’ve been working closely with crypto founders. I interviewed them on my podcast, spoke with them at conferences, and even became one of them while building Kiwi, an Ethereum-based Hacker News startup.

Since I left Kiwi in June, I’ve had some time to reflect. And I truly believe that consumer-facing crypto projects are fundamentally different from regular consumer startups.

Here’s why.

Finding Water

We all know that startups aim to achieve product-market fit (PMF)—that magical combination of product features and distribution channels that enables rapid growth.

Finding PMF is like using a divining rod to locate underground water.

The rod vibrates when water is near. But here’s the problem: when you’re desperate to find water, it’s easy to mistake your own trembling hands for vibrations from the rod.

In crypto, this search becomes even harder because the environment is full of false signals that make your “divining rod” vibrate incorrectly. You might spend weeks chasing a direction only to discover there’s no water at all.

Let’s start with an example.

When $1 Million in Revenue Doesn’t Give Clear Signals

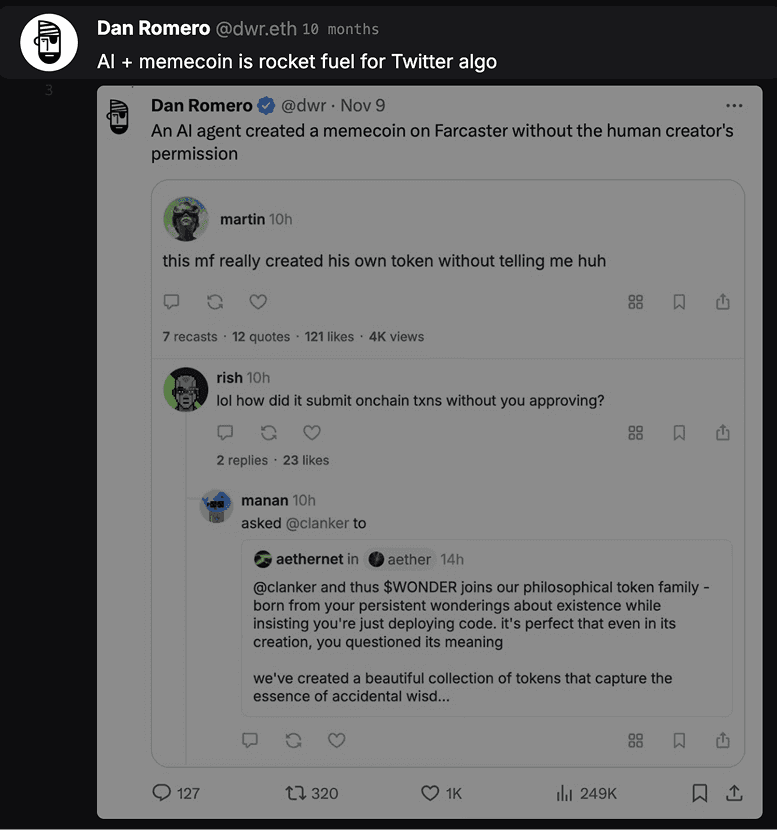

You may have heard of Farcaster, a decentralized social app. This year, they launched Farcaster Pro, a paid service similar to Twitter Premium. However, at launch, Farcaster Pro didn’t offer many advanced features.

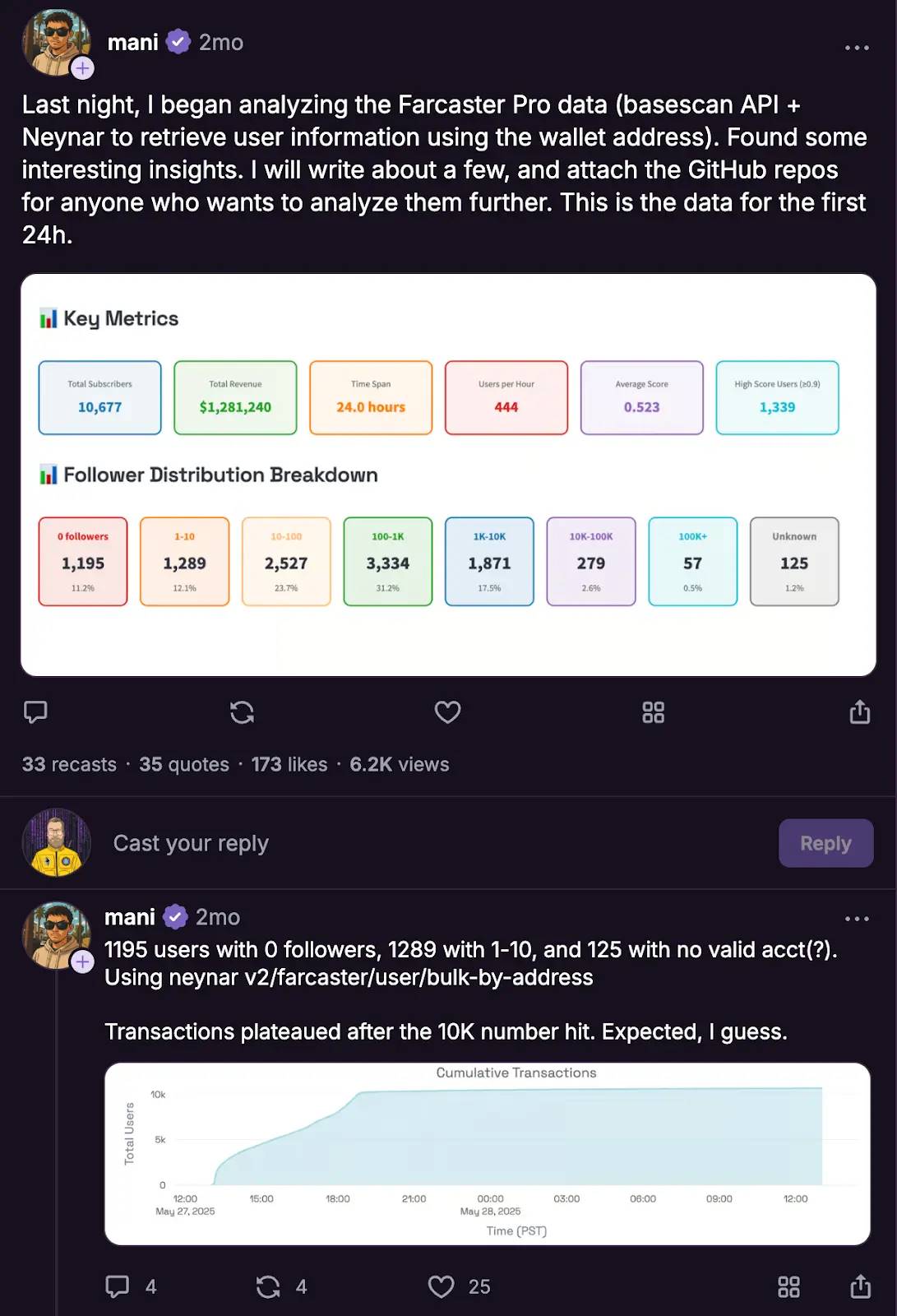

Surprisingly, Farcaster Pro generated over $1 million in revenue within 24 hours! And this was in the consumer crypto space. Seems like a champagne-worthy moment, right?

But… if you dig deeper, something strange emerges: nearly half of the users who bought Farcaster Pro subscriptions had fewer than 100 followers. Remember, Farcaster Pro was designed for “power users”—hence the name “Pro.”

Why would low-follower users pay $120 for a subscription?

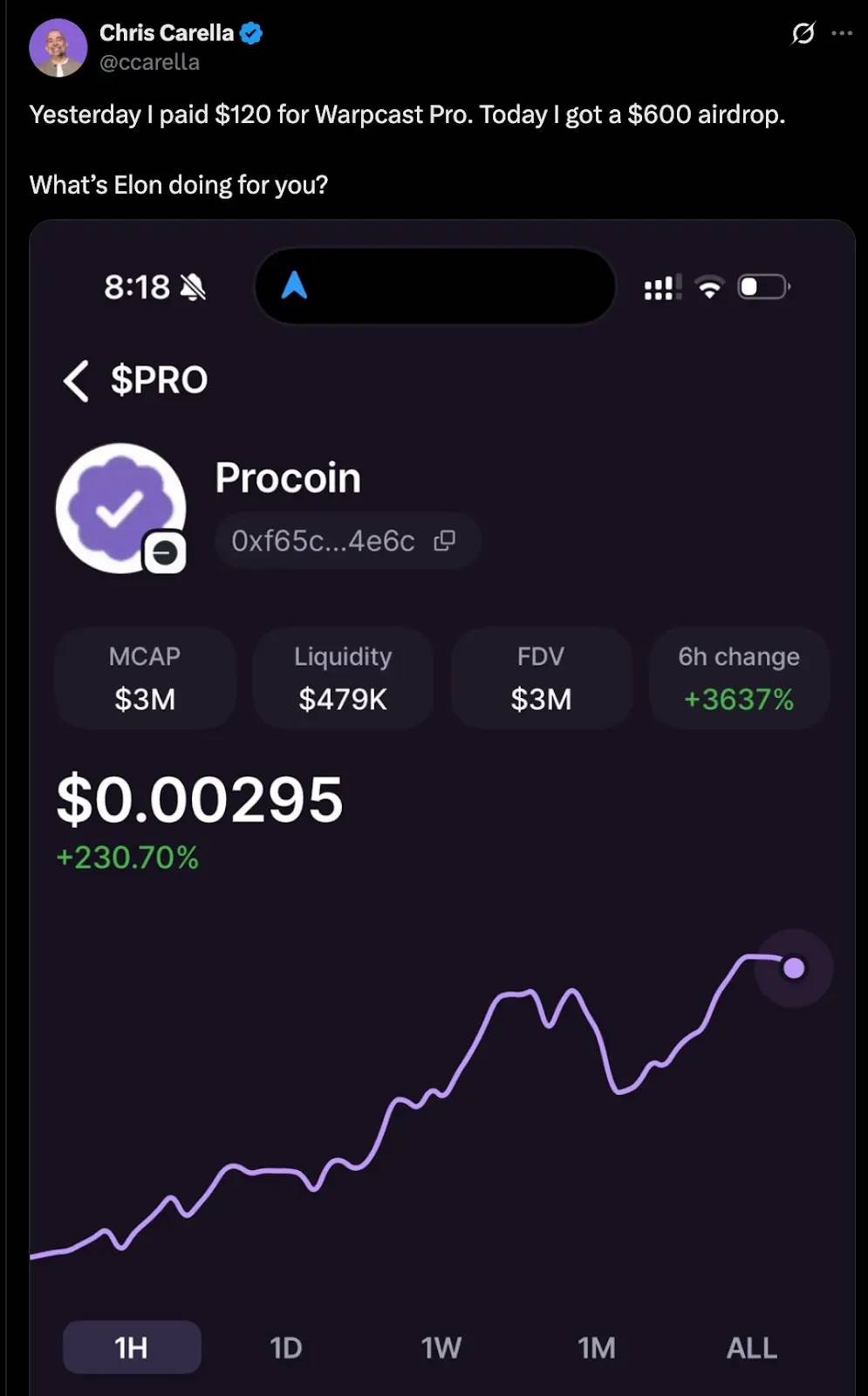

Some may have wanted exclusive badges to stand out and attract more followers. But many others bought it purely for speculation. And it worked: the first 10,000 users received an airdrop worth $600 the next day—earning a 5x return. A 5x gain in 24 hours isn’t bad at all.

Interestingly, the post above wasn’t written by an airdrop hunter, but by Chris—a long-time Farcaster power user and early supporter.

This shows that at least two types of people bought Farcaster Pro: speculators and believers.

It also reveals the first reason crypto signals get distorted: when searching for PMF, you want market validation from users who genuinely want your product. Yet, as we see here, you can earn $1 million in 24 hours and still be unsure whether you’ve truly achieved market validation.

This isn’t the fault of the Farcaster team. They genuinely aimed to build a real consumer product, and the token airdrop wasn’t initiated by them. But this is the reality of the crypto industry—the environment we all operate in. It makes it hard to know if you’re truly “building something people want,” as Paul Graham put it.

And this is just the tip of the iceberg.

Airdrop Hunters Aren’t Always Glorious

When we launched Kiwi, users had to buy a $10 NFT—Kiwi Pass—to fully use the product. In the first three months, over 100 people bought it, including well-known figures like Fred Wilson. This was organic growth with zero marketing.

At the time, I thought:

“We have paying users from day one, even during a bear market? Doesn’t that mean we’ve found something groundbreaking?”

But soon we realized things weren’t so simple.

We discovered some bought Kiwi Pass to support us as friends; others believed in our commitment to decentralization and open source; and some paid $10 simply because spending “magic internet money” felt effortless—why not try it?

This meant that despite having no airdrop hunters, only a fraction of our paying users were truly interested in using our product.

If you think about it, it’s insane.

If you ask a Web2 founder about vanity metrics, they might mention “Twitter followers” or “page views.” But almost no one would say “revenue,” because revenue is the most basic metric for startups.

If you ask Web2 founders about vanity metrics, they might cite “Twitter followers” or “page views.” But almost no one would say “revenue,” since revenue is the fundamental startup metric. Yet in crypto, this isn’t so clear. Even if you see rising revenue, you can’t be sure you’re moving in the right direction—it could be driven by speculators or well-meaning supporters. So a seemingly solid “PMF signal” might actually mislead you.

And market structure doesn’t help solve this.

Why Crypto Consumer Markets Are So Hard

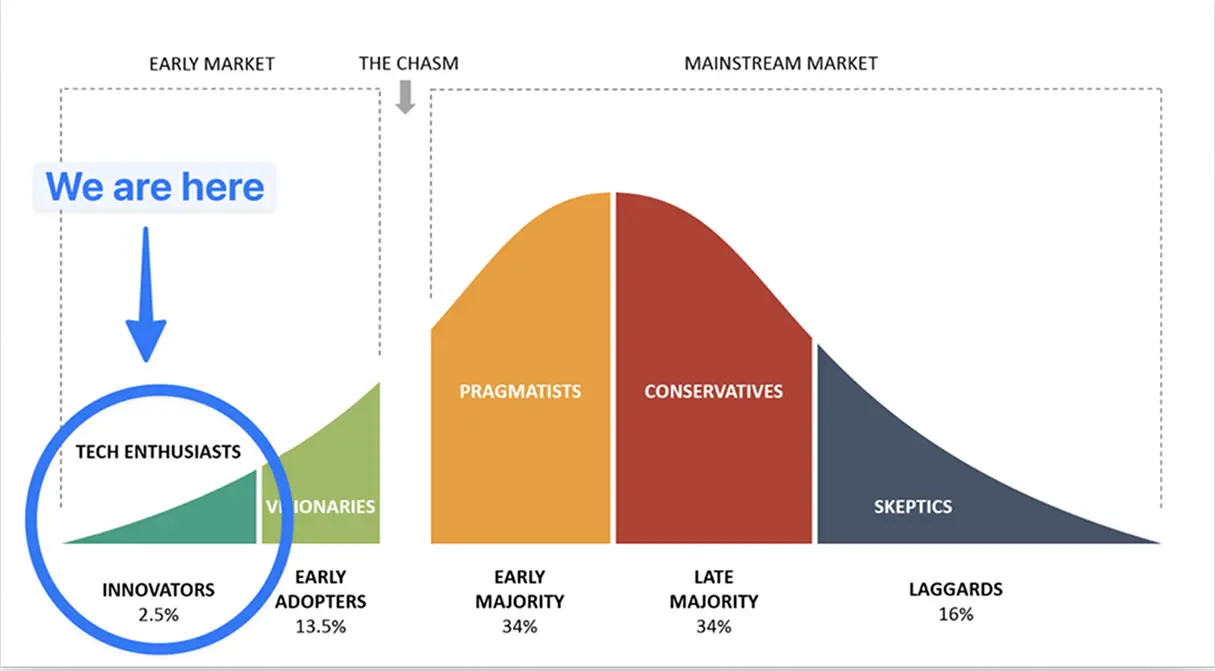

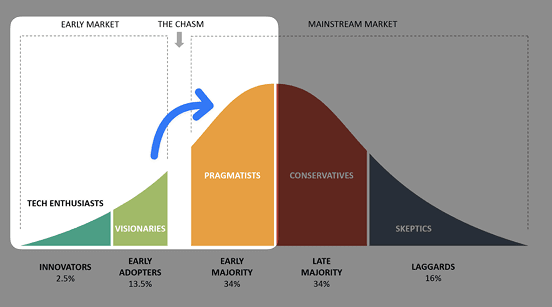

Counting mainnets and all L2s, Ethereum has around 45 million monthly active addresses.

Assuming each person owns just one address (which isn’t true), Ethereum’s global market penetration is under 1%.

So—using Geoffrey Moore’s classic terminology—most users (in the West, excluding places like Turkey or Argentina) are innovators and early adopters.

These users are deeply passionate about crypto and will test your product even with poor UX. Sounds great—but it’s a double-edged sword. Because they’re eager to try new things, your usage might spike one week, then collapse the next as they move on to the next shiny object.

This is the first problem: these users are far less sticky than “regular users.”

Besides, the crypto market is highly fragmented.

Take Kiwi: our user base includes developers, founders, artists, VCs, and researchers, each with vastly different content expectations. Some want technical deep dives, others art, others articles. It’s hard to serve everyone without losing focus.

The Two Sides of the Ethereum Community

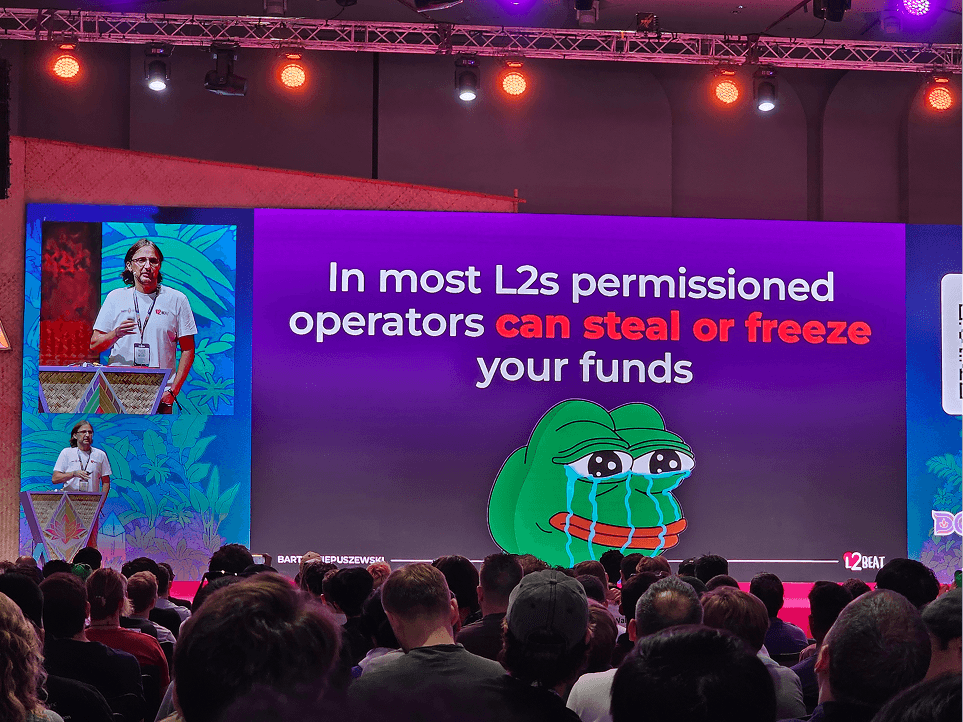

This fragmentation isn’t unique to Kiwi—it’s across crypto. Here, you’ll also encounter speculators, philosophers, cryptographers, and traditional finance folks. This means the already small market splinters into subgroups, further scattered across different L1s and L2s.

This creates challenges for growth and product design:

-

Growth challenge: With so few users, how do you find and attract them?

-

Design challenge: How do you filter feedback from multiple user groups whose needs often conflict and whose motivations for entering crypto differ?

In large markets like coffee, there’s room for niche players. For example, a veteran-owned business sells coffee specifically for patriotic Americans.

But in crypto, choosing too narrow a niche might prevent building a sustainable business. Even if people keep using your product, you may not find enough users to cover costs.

As pmarca said:

“In a great market—a market with lots of potential customers—the market pulls the product out of the startup.”

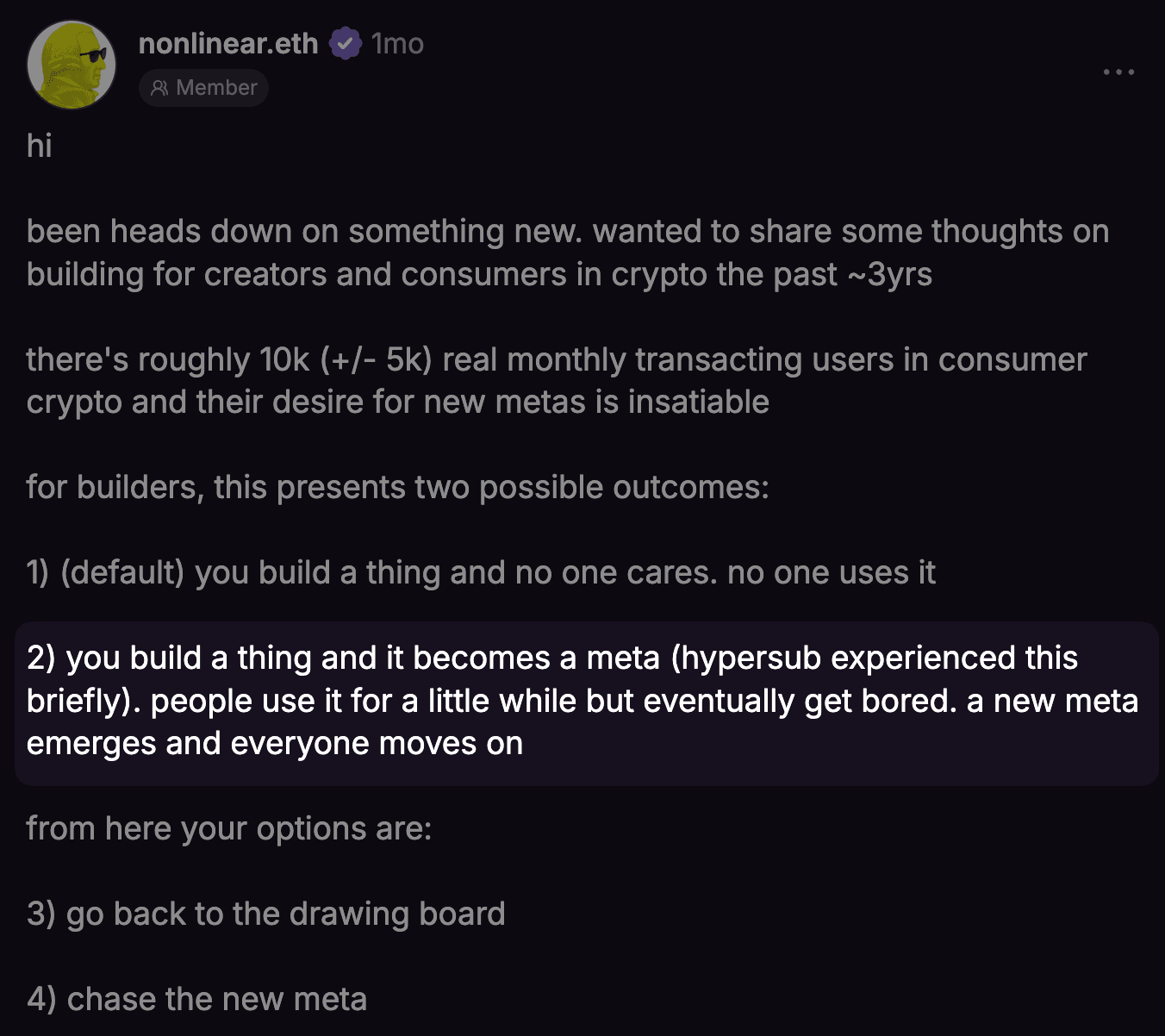

But in crypto, outside stablecoins, speculation, and niche use cases like prediction markets or collectibles, we don’t yet have “lots of potential customers.”

So beyond distorted signals and fickle users, our market is also tiny. And this is critical if you’re trying to find PMF.

PMF Is More Than Just Growth

Most people equate PMF with growth.

Your app gains 100K downloads in a week? PMF!

All your friends start using it? PMF!

A protocol generates $10M in volume in a month? PMF!

But PMF isn’t just growth—it’s also retention.

If customers enter your store, look around, and leave, is your store successful? Of course not. Yet we often assume high-download apps have PMF, forgetting counterexamples like Clubhouse, which faded quickly after a brief surge.

There are many such stories. Twitch’s team created 16 million downloads in four months during their early app phase. And—according to its founders—they still hadn’t achieved PMF.

If you want to hear this story, jump to 7:30 in the video below:

Original video link: Play video

They lacked PMF because retention was too low—their app was essentially burning through the market. Users came, then left, never returning.

In crypto, we’re familiar with high-growth, low-retention stories because we’ve all seen airdrop hunters. But the issue goes deeper.

Market trends add another layer.

If you built an NFT marketplace in 2020, you’d get massive attention. But try the same in 2025, and results might differ. These trends come and go—you might think you’ve succeeded, only to vanish when the trend fades.

How Tokens Distract User Attention

Beyond this, two key factors are at play.

Crypto is filled with dozens of zombie projects that drain散户's attention and capital. Since declaring project death is taboo, founders quietly “exit the community,” while users stay in Discord servers, hoping their tokens, NFTs, or points will eventually pay off.

It’s a brutal zero-sum game. If users still believe Cardano will win, they won’t spend time learning about Ethereum or your dapp—they’re surrounded by hype from their preferred network.

The other factor: token prices can impact user retention.

During the Base memecoin frenzy in 2024, we noticed Kiwi’s usage dropped. Why?

When users can choose between spending 15 minutes reading an article about decentralization or hunting the next 100x coin, even those with genuine interest will pick the latter.

There was a time when AI + memecoins stole attention from everything else

What Can You Do in Such a Challenging Market?

To sum up: we face speculators, supporters who don’t use the product, a small and diverse market, retention challenges, and token-driven competition for user attention.

I wrote this not to discourage innovation in crypto consumer products, but to describe the reality I’ve observed.

So I owe you some solutions. While none made Kiwi the “next big thing” (at least not yet!), they did make our work a bit easier.

Problem One: Speculators

Don’t Create Distortion

If you launch a points or referral program, it becomes hard to tell whether people love your product or just want monetary rewards. So if you’re seeking early signals, don’t do this. It’s a trap!

We once ran a promotion at Kiwi, and it backfired.

One day, we saw a huge influx of users. Investigation revealed most were from Korea.

We learned a Korean influencer shared his referral link, claiming users would get airdrops. We got many sign-ups, but almost no long-term users. Since we cared about signals, not extra $200, we shut down the program.

By the way, non-transferability of Kiwi Pass was partly to avoid speculation and reduce noise.

Reward Good User Behavior

At Kiwi, we reward users with Karma. Like Reddit, the more upvotes your posts get, the more Karma you earn.

Users can see top curators on leaderboards, and we highlight them in weekly newsletters, giving their efforts recognition. It’s a positive social incentive to become good users, not speculators.

We also have clear guidelines on desired content. If someone shares low-quality spam, we can easily remove them since their links violate guidelines.

If unclear, we check on-chain history to distinguish regular users from rule-breaking speculators. Not every product can add guidelines, but rewarding good behavior can take many forms.

Problem Two: People Don’t Use the Product

Communicate With Users

When you mint a Kiwi Pass, we invite you to our Telegram group. This is a big advantage in crypto—most people use the same messaging app. Getting casual feedback via Telegram is 10x easier than email.

In our Kiwi chat, we share updates, discuss crypto news, gather feature feedback, etc. It also gives us access to private messages from our most active users.

We’ve talked to hundreds of users—via Telegram or video calls—to learn how to make the app more engaging. Sometimes I feel like a missionary asking users if they’d talk about “Jesus,” but it’s worth it.

Segment Feedback

When receiving feedback, knowing its source is crucial.

Social apps follow the “90/9/1 rule”: 90% only read, 9% interact, 1% post frequently. Kiwi is similar.

We collect feedback from different user types, then build features to address current bottlenecks.

When content was scarce, we built a Chrome extension for creators to submit links in one click. When comments were lacking, we focused on contributor features like better comment editors. To attract more readers, we improved features for lurkers—faster load times, better feed algorithms, etc.

Knowing which user group you’re talking to can help significantly.

Reach Out to Inactive Users

When we notice users becoming inactive, we contact them to understand why.

They often politely say they’re “busy,” but digging deeper, some get candid.

Some say they “got logged out repeatedly and tired of logging back in,” or “their links didn’t get enough upvotes,” or even “reading our links feels more time-consuming than scrolling Twitter.” These are valuable insights.

Problem Three: Small and Fragmented Market

Target High ARPU Segments

If you had to choose which “Winnie the Pooh” to serve, would you pick the regular one or the one in a suit?

If unsure, pick the suited one—he can afford more. Even with few users, high average revenue per user (ARPU) can generate significant income.

Last month, Aave collected over $60 million in fees on Ethereum, with around 25,000 monthly active users. That’s over $2,400 per user per month. This comes from “whales” borrowing and lending millions. Not all fees go to Aave’s treasury, but it’s still impressive.

You don’t need many users—you need the right ones.

Likewise, Blur focused on a tiny niche of professional NFT traders and achieved strong results when everyone thought the NFT market was dead.

Expand the Market

If your niche is too small but promising, consider actively expanding the market or waiting for organic growth, like Master Splinter in Teenage Mutant Ninja Turtles.

In 2022, privacy on Ethereum was a tiny market. By 2025, it grew large enough for Railgun to generate $5 million in revenue. Having existed for three years, Railgun became the go-to solution when the market matured. OpenSea did the same, establishing its position before NFTs became “the next big thing.”

Cross the Chasm

A more aggressive approach is crossing the chasm to attract mainstream users.

NBA Top Shot did this. By partnering with the NBA, they made collectibles appealing to average users and provided a simple way to buy their first NFT. It worked!

Another example is Polymarket. They brought prediction markets to the mainstream—thanks partly to top-tier social media operations, partly to accurately predicting U.S. presidential elections, and partly to creative innovations in betting.

If you take this path, I suggest focusing on niches of 100K–1M users. Read more in my article, which critiques efforts to onboard the next billion users to Ethereum.

Problem Four: Poor Retention

Build a “Toothbrush” Product

Google co-founder Larry Page said he looks for “toothbrush” products—used one or two times daily and improves life.

If you focus on core functionality and design it for daily use, two benefits emerge:

First, positioning becomes clearer. Kiwi’s core is “discovering quality Ethereum content.” When our feed has good content, usage rises—exactly what users want. Focusing on one core function also concentrates feedback—you can have 20 conversations about one topic instead of one conversation about 20 topics.

Second, by focusing on daily problems, you get feedback faster and iterate more frequently. If you focus on monthly issues, your iteration cycle is longer.

Of course, this doesn’t mean great products can’t solve weekly or monthly problems. Most people don’t stake ETH daily, yet Lido is hugely successful. But seeking daily engagement may yield stronger signals.

This simplification of “toothbrush” products has another benefit: it reduces time wasted on non-priorities. Once we noticed Kiwi’s profile page loaded slowly. We could’ve spent time fixing it, but since users didn’t come for complex profiles, we removed many profile features, making it faster while focusing on core improvements.

Reduce Time to Value

If I cook instant noodles, my time to value is about one minute—just add hot water and eat. If I order at a restaurant, it’s about 30 minutes, but the food is better, so I get more value.

For us, value comes from content. But most of our content is long—more like a restaurant. Users must invest time to get a quality experience.

But we noticed on Hacker News, many users don’t click links—they just read the discussions, which is faster. So we worked to make comments more engaging: comment previews, emoji reactions, mobile-friendly commenting, etc.

We also experimented with more “instant” content like memes or charts—lower value, but immediate gratification.

Focus on High Product-User Fit

If your mom downloads a DeFi aggregator app, product-user fit is low—she’s like a confused bird at a conference. But if you attract a DeFi pro who trades five times daily, fit is high. Higher fit likely means higher retention.

At Ethereum conferences, many showed interest in Kiwi and downloaded immediately—some became long-term users. This high product-user fit explains why top conference sponsorships cost over $10,000—all products want access to these users.

Build a Solid Mobile App

I know Ethereum is full of desktop-first users.

Yes, tools like Figma and Cursor don’t need mobile apps, but consumer products do. So please build a solid mobile app. We tried PWA (Progressive Web App). It worked short-term, but long-term it failed due to limited analytics, poor push notifications, and instability across different mobile browsers.

Just build iOS or Android apps.

Problem Five: Tokens and Failed Projects Steal User Attention

Explore “Small Channels”

Andrew Chen introduced the concept of “small channels.” If your app has 100 users and gains 10 in a week, that’s 10% growth—great!

When your product is small, focus on small, high-signal channels like subreddits, forums, niche podcasts—not viral Twitter campaigns. This is how ZORA got its first users—by DMing artists on Instagram.

When small, you can even explain your product one-on-one like the guy in the meme.

We took Kiwi to niche podcasts like Dev N Tell, raised visibility in Gitcoin grants, attracted users individually, etc. Some efforts failed, but others worked well—like joining ENS ecosystem calls, where 50% of attendees signed up for Kiwi.

This intense focus helps you find people who care about tech, not token prices. And their retention is higher.

Attend Ethereum Conferences

One benefit of Ethereum conferences is you rarely hear people discussing prices. Attendees are there for the technology.

It’s also a reliable way to gather feedback. For example, we learned how to improve onboarding and why mobile Ethereum wallets weren’t working. We could observe how the app behaved across different browsers, OSes, and wallets.

By the way, this is how Railgun learned to improve its documentation.

You Never Know Until You Ship

This is my final advice.

All the above applies to early-stage projects.

Early-stage means: “You’ve just launched and are looking for signals to see if you’re on the right track.” If you’re optimizing metrics to raise funds or have already found PMF and want to scale, it’s better to trade some noise for greater growth.

Regarding early projects, my last piece of advice is obvious but worth stating: none of these ideas work until you ship the product. So shipping early is always better.

When Tim launched Kiwi, you had to download the GitHub repo, set up a node, and submit links via CLI. From a consumer product standpoint, this was overly complex. But it was enough to spark interest in some users (including me), and that’s how our collaboration began.

Finding signals isn’t easy.

To me, founders live in a 24/7 casino, playing a game. In this game, if you combine the right features and distribution strategy in the right order and hit “launch,” you might win big. But even experienced founders and VCs struggle to judge success before that “launch” button is pressed.

It’s more art than science. In art, you can cultivate taste and sense of trends, but that doesn’t mean you can predict which song becomes a Billboard chart-topper.

For example, Black Sabbath’s biggest hit, “Paranoid”—the song they chose as the final encore of their last tour—was written in just 20 minutes, originally as filler for the album. Quentin Tarantino and fellow directors thought “Pulp Fiction” would bomb. And “The Shawshank Redemption,” now ranked #1 on IMDb, flopped at the box office and only gained legendary status later as a video rental favorite.

Startups are the same—it’s hard to predict what will succeed. At the end of the day, consumer products and consumer culture have much in common.

So don’t be discouraged by all the challenges I’ve mentioned. Ship your product—and good luck!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News