40 million in financing, with Vitalik participating in the investment, Etherealize wants to be Ethereum's "spokesperson"

TechFlow Selected TechFlow Selected

40 million in financing, with Vitalik participating in the investment, Etherealize wants to be Ethereum's "spokesperson"

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

By: Eric, Foresight News

Fortune reported on the evening of September 3, Beijing time, that Etherealize has raised $40 million in funding led by Electric Capital and Paradigm, with participation from Ethereum co-founder Vitalik Buterin and the Ethereum Foundation. Electric Capital and Paradigm have never hesitated to make large investments in the Web3 space—especially within the Ethereum ecosystem—and both have been key supporters of publicly traded Ethereum-related companies. However, it is rare for Vitalik and the Ethereum Foundation to directly participate.

Etherealize reveals little about itself, describing only on X as “the institutional product, BD, and marketing arm for the Ethereum ecosystem,” while its website states a vision of “reimagining Wall Street” and “bringing the world to Ethereum through research, content, and products.” On the product side, Etherealize targets institutional-grade infrastructure, offering issuance, management, settlement of tokenized assets, and corresponding automated compliance infrastructure, with plans to introduce privacy features via zero-knowledge proofs.

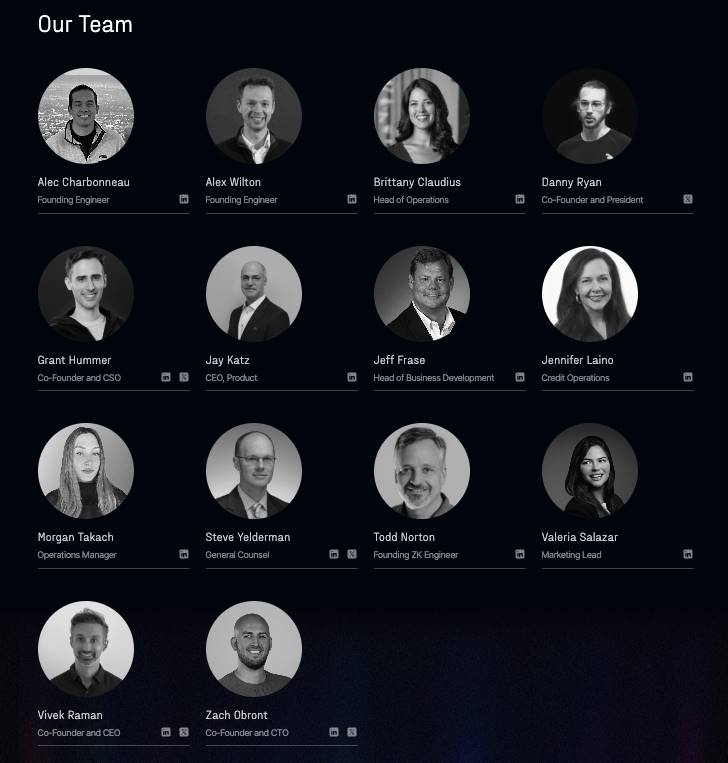

According to Etherealize, it possesses an engineering team deeply familiar with Ethereum, leadership with decades of experience in financial institutions, and access channels to engage with the SEC, Treasury, and Congress to help shape regulations. Western investment firms have long been willing to bet big on large-scale B2B ventures, but such tangible investment in a startup clearly reflects a “bet on people”—and I found some clues in the team’s composition.

The most prominent figure on Etherealize’s team is Danny Ryan, co-founder who made significant contributions to The Merge and the launch of the Ethereum Beacon Chain before leaving the Ethereum Foundation last September. In his farewell note on GitHub, Danny Ryan stated his departure was due to personal reasons, and perhaps at that moment he realized that merely focusing on technical perfection would not propel Ethereum forward—instead, leveraging his technical expertise to support teams capable of bringing Ethereum to the world was the right path.

On the technical side, Zash Obront, Etherealize’s co-founder and CTO, was previously co-founder of Scribe Media, a book publishing service provider. He joined Snowcap Technology in August 2021 as a security researcher; the company specializes in security services for AI, VPN, WIFI, and enterprise systems.

The two other founding engineers responsible for technology also boast impressive backgrounds. Alec Charbonneau previously served as a product manager at Circle—the first “stablecoin IPO”—and later worked as a software engineer at Stellar, which, like Ripple, focuses on payments and settlements. The other engineer, Alex Wilton, served as a product manager at Tesla and Rivian, another electric vehicle company that raised over $10 billion by 2021.

Product CEO Jay Katz has a career closely tied to strategy, having held positions across finance, software, smart hardware, law firms, and consulting firms. LinkedIn shows his actual title is CEO of Lending Market Solutions. Supporting him is credit operations lead Jennifer Laino, who brings extensive financial industry experience, having served as Assistant Vice President at Lehman Brothers, Vice President at Bank of America Merrill Lynch, and advisor at Blackstone Group.

Vivek Raman, co-founder and CEO with years of experience in financial lending, previously held executive roles in credit businesses at Morgan Stanley, UBS, Deutsche Bank, and Nomura. In September 2021, he joined Celsius, the firm that collapsed during the 2022 bear market, as a senior DeFi researcher. Afterwards, Vivek joined BitOoda, a digital asset investment bank that completed its Series A round in early 2023, serving as general manager. At BitOoda, he focused specifically on bringing institutions into the Ethereum and L2 ecosystems.

Clearly, Etherealize’s plan to “bring Wall Street to Ethereum” initially targets the credit sector. I speculate their approach may involve launching on-chain lending and settlement systems using stablecoins and similar instruments. Of course, such products differ from DeFi and may serve exclusively as solutions for financial institutions.

In marketing and operations, Etherealize has chosen individuals with more experience in the Web3 space. Marketing lead Valeria Salazar previously served as Head of Marketing Strategy and Developer & Ecosystem Relations at Phi Labs, while Business Operations Manager Morgan Takach formerly led Strategy and Operations at Polyhedra.

Etherealize’s claim of having a team rich in both Web3 and financial industry experience is no exaggeration, and they’ve perfectly timed their launch amid growing institutional interest in asset tokenization. The idea of reshaping finance with Ethereum is a story that’s been told since the DeFi Summer, and even as traditional institutions begin experimenting with on-chain assets, we still can’t be certain about the ultimate market size for this business. Yet, building a bridge between Ethereum and Wall Street remains a promising direction worth exploring for Ethereum itself.

Beyond specific products, Etherealize explicitly states on its website its intention to act as Ethereum’s “spokesperson” to promote global adoption of Ethereum and the L2 ecosystem. Overall, Etherealize takes over the “go-to-market” function—which the Ethereum Foundation has historically underperformed—from a commercial standpoint, and the actual results will be worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News