The Secret Behind mNAV Premium: How Ethereum Became a Corporate "Wealth Machine"?

TechFlow Selected TechFlow Selected

The Secret Behind mNAV Premium: How Ethereum Became a Corporate "Wealth Machine"?

Can enterprises leverage Ethereum to replicate Strategy's Bitcoin success?

Author: Terry Lee

Translation: TechFlow

A meme about crypto reserve holding companies.

Background

In August 2020, MicroStrategy (now renamed Strategy) shocked the financial world by allocating hundreds of millions of dollars in corporate treasury funds into Bitcoin. Once considered unthinkable, this strategy has now become a widespread choice for many public companies to hedge against inflation and unlock value. As Bitcoin solidifies its position in corporate finance, a new question arises: Can alternative cryptocurrencies like Ethereum offer businesses greater growth, innovation, or diversification opportunities? This article will explore why some companies are moving beyond Bitcoin to adopt Ethereum as a treasury asset, and analyze whether this bold strategy can replicate MicroStrategy’s success. By examining higher potential returns, access to innovative blockchain ecosystems, and the long-term sustainability of such an approach, I aim to reveal whether Ethereum could become a sustainable treasury choice for corporations beyond 2025.

Purpose of Writing

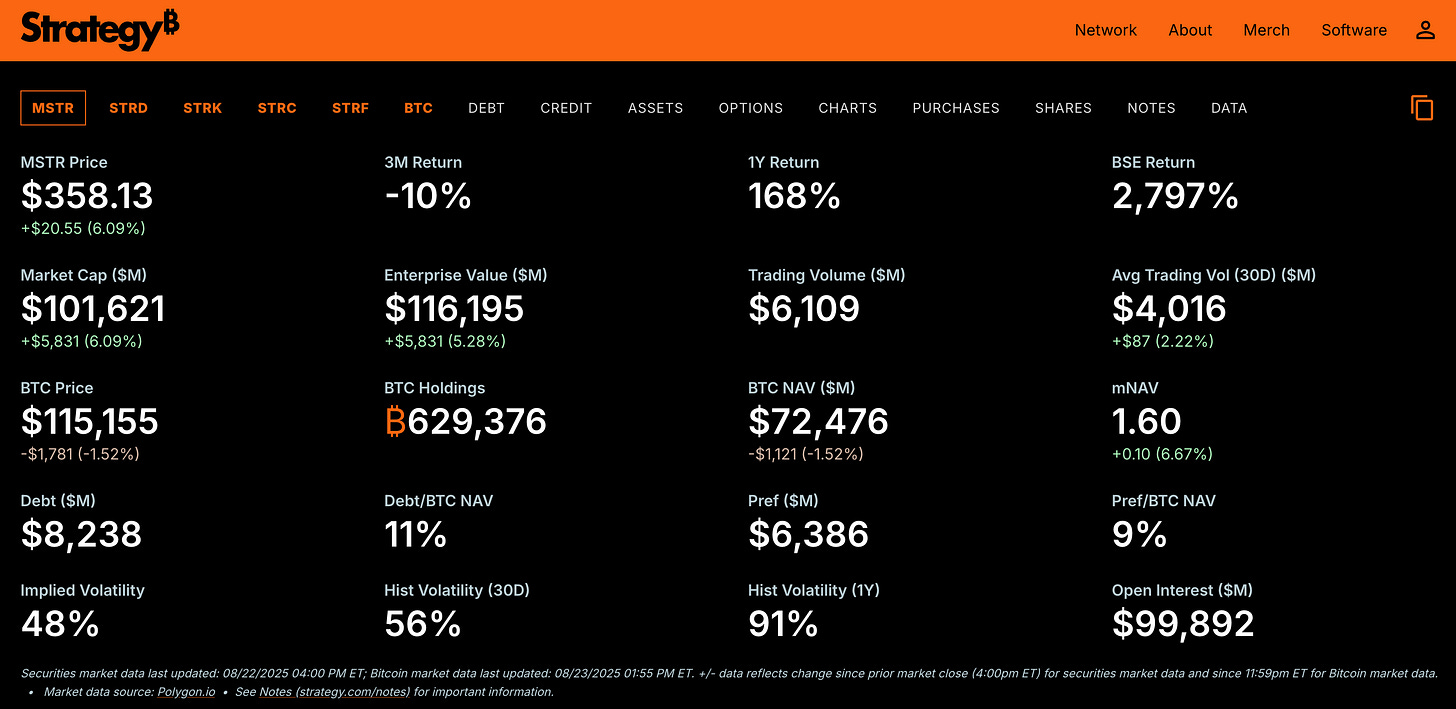

This article aims to examine whether public companies can successfully apply Strategy's leveraged Bitcoin treasury strategy to Ethereum, centering on a key metric called mNAV (market Net Asset Value):

mNAV = Market Capitalisation of Firm / Current value of token holdings

This metric is crucial because it helps readers understand why these treasury-holding companies are so focused on it. The article analyzes why some firms choose Ethereum over Bitcoin, even though Strategy has already proven successful with its holdings of 629,000 BTC (worth $72.5 billion in August 2025) and an mNAV of 1.6. Potential advantages of Ethereum include higher returns (driven by growth potential), diversification beyond Bitcoin’s “store of value” role, and participation in innovative blockchain ecosystems such as Ethereum staking (locking ETH to support the network and earn yield) and decentralized finance (DeFi) applications. Therefore, this article seeks to uncover whether an Ethereum treasury strategy can deliver superior risk-adjusted returns or "alpha," despite higher uncertainty. To assess this, we first analyze how Strategy’s leveraged financing model drives its mNAV premium, offering a blueprint for companies considering Ethereum.

Financing Strategy

Strategy launched its Bitcoin treasury strategy in 2020, primarily driven by the goal of protecting corporate value from inflation and leveraging Bitcoin’s potential as a store of value. According to an article by BCB Group, Michael Saylor cited two main reasons for choosing Bitcoin:

-

Cost of capital: Asset inflation triggered by stimulus policies and low yields on traditional assets (such as bonds) caused the cost of capital to surge to 25%, making traditional assets ineffective at preserving value.

-

IRS tax guidance: The IRS treats Bitcoin as property rather than currency, simplifying tax treatment compared to holding fiat currency.

As Bitcoin prices rose, Michael Saylor generated significant gains by raising capital from investors. The fundraising process can be broadly divided into two parts: (1) equity financing; (2) debt financing;

(1) Equity Financing:

-

At-the-market (ATM) stock sales: Strategy directly sells shares of MSTR Class A common stock into the capital markets—simple and straightforward.

-

Preferred shares: Buyers of convertible bonds receive fixed “X%” dividends but do not have voting rights like common shareholders. Examples include STRF or STRD, which have a face value of $100 and pay a 10% dividend.

(2) Debt Financing:

-

Convertible bonds: These are debt instruments with fixed maturity dates, but include an option allowing bondholders to convert their bonds into shares of MicroStrategy’s Class A common stock at a predetermined price. For example, Strategy’s $3 billion zero-coupon senior convertible notes mature in 2029, allowing investors to convert their bonds into common stock at $672.40 per share. This price represents a 55% premium over the stock price at issuance, thereby delaying equity dilution.

Source: Strategy (https://www.strategy.com/)

Through equity and debt financing, Strategy expanded its Bitcoin reserves to nearly 630,000 BTC, valued at approximately $72.5 billion as of August 2025, while maintaining a market valuation premium reflected in its mNAV of 1.6.

Notably, when mNAV is at a premium (mNAV > 1), Strategy issues new shares at a price higher than the current net asset value per share (NAV). For instance, if mNAV is 1.6 and NAV per share is $100, new shares are sold at $160. The extra $60 raised increases the company’s cash reserves to buy more Bitcoin, boosting total NAV (assets minus liabilities). Since the number of shares does not increase proportionally, NAV per share rises, further strengthening investor confidence and creating a positive flywheel effect.

This leveraged financing strategy enables Strategy to purchase far more Bitcoin than its cash reserves would otherwise allow, achieving an mNAV range of 1.6 to 2.1 in 2025. During this period, its enterprise value (market cap + debt + preferred stock - cash reserves) exceeded the $72.5 billion market value of its 630,000 BTC holdings. As of August 2025, Strategy’s enterprise value was approximately $11.6 billion, with an mNAV of around 1.6 reflecting investor confidence in its ability to increase Bitcoin holdings per share through low-cost financing (e.g., zero-interest convertible bonds and ATM sales).

This financing method is more cost-effective than traditional bank loans, which typically carry higher interest rates. Additionally, by structuring debt as non-recourse, the strategy protects Strategy’s Bitcoin treasury in the event of a sharp decline in Bitcoin prices, limiting creditors’ claims to the terms of the bonds rather than the company’s Bitcoin or other assets. For investors, this leveraged strategy amplifies gains—for example, a 10% rise in Bitcoin price might result in Strategy’s stock increasing by more than 10% due to mNAV premium. However, it also introduces risk: if Bitcoin prices fall, losses are magnified.

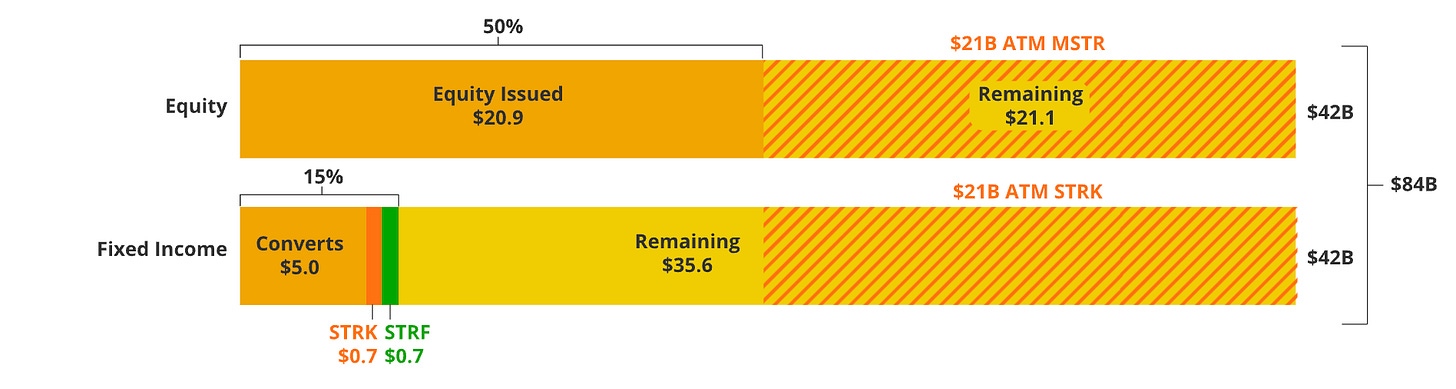

Source: VanEck – Chart shows breakdown of the $84 billion in funding MicroStrategy plans to raise

Strategy’s financing model, as outlined in VanEck’s proposed $84 billion funding plan, demonstrates how leverage sustains high mNAV and provides a reference blueprint for altcoin treasury strategies. The next section explores why public companies are beginning to choose Ether (ETH), whether a leveraged strategy is feasible, and how to balance higher return potential with increased risk. The key to this shift toward Ethereum lies in execution, detailed below.

Why Choose Ether?

Having clarified how Strategy’s leveraged financing model supports its Bitcoin treasury, the next question is whether this approach can be adapted for other altcoins like Ethereum.

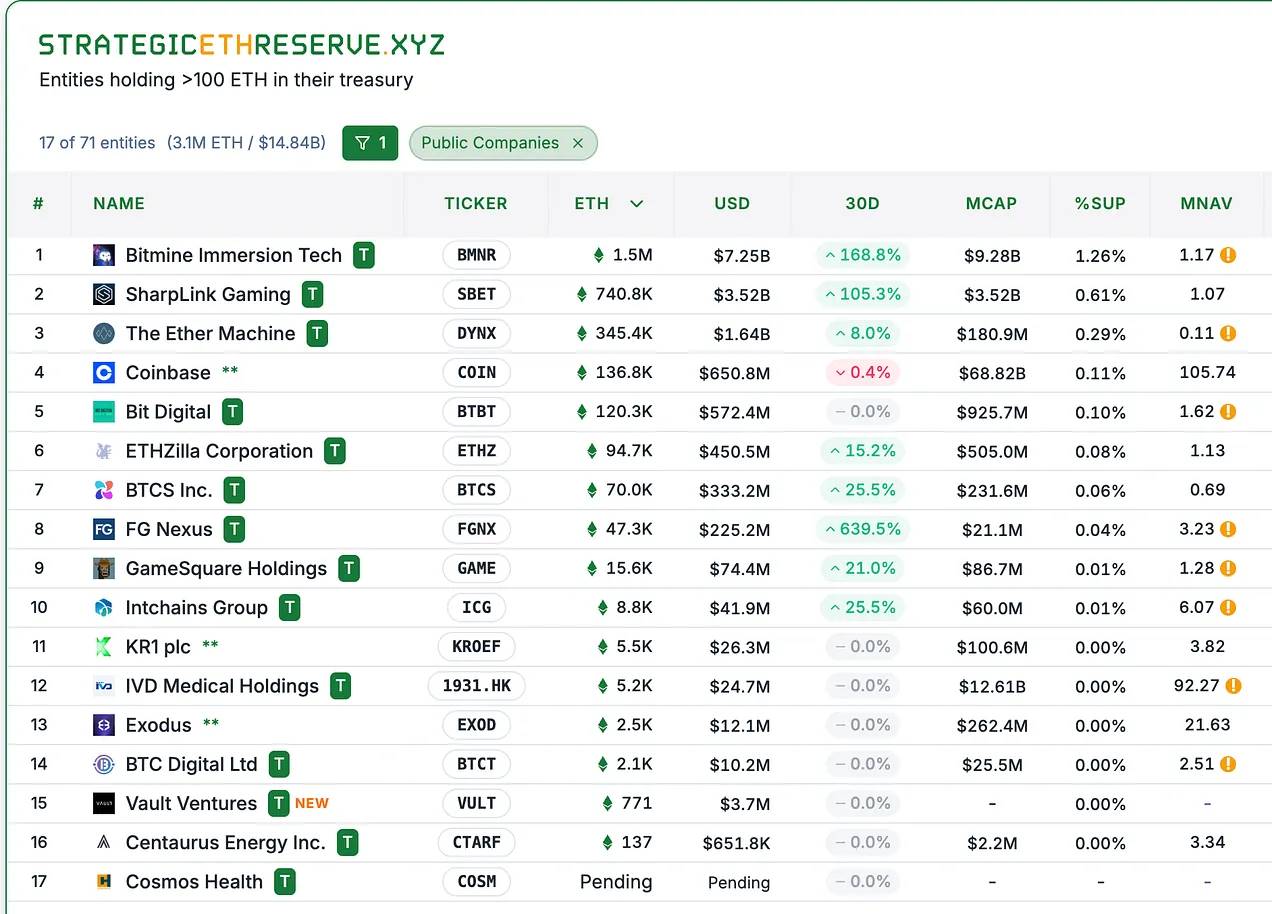

Source: StrategicETHReserve.xyz

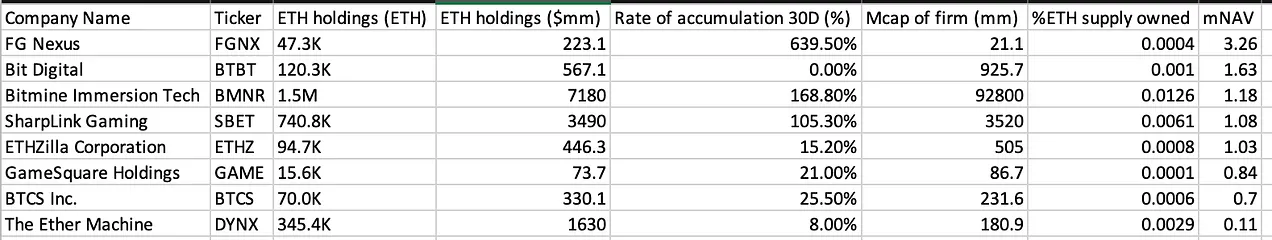

Source: StrategicETHReserve.xyz and GameSquareHoldings (mNAV adjusted to 0.84 for each website).

The above list shows eight publicly traded companies (excluding centralized exchanges like Coinbase). Some operate primarily in cryptocurrency, such as BTCS Inc., which engages in Bitcoin mining, while others enter the space due to management decisions. For example, SBET appointed Joseph Chalom, who previously advanced BlackRock’s digital asset initiatives, as co-CEO.

Based on my research, the overall reasons these companies explore holding Ethereum include the following:

-

Growth potential — Ethereum’s market size is smaller than Bitcoin’s, meaning its growth trajectory may offer higher returns and better risk-adjusted returns for shareholders compared to Bitcoin. For example, as of 2020, Ethereum’s five-year compound annual growth rate (CAGR) was approximately 62.8%. However, past performance is not indicative of future results.

-

Staking rewards — Ethereum offers staking yields, allowing companies to earn additional premiums on their ETH holdings. For instance, assume a company intends to permanently hold $100 worth of ETH with a 20% discount rate (assuming investors expect a 20% annual return on crypto). With a 5% staking yield, the company could achieve a 25% premium on its mNAV solely through staking.

-

Innovation-driven — Companies holding other cryptocurrencies like Ethereum often actively participate in and support ecosystem development, such as Ethereum staking, decentralized finance (DeFi), or scalable decentralized applications (dApps). These activities generate richer added value beyond Bitcoin’s “store of value” function.

-

First-mover advantage — Companies choosing Ethereum can position themselves as pioneers in ETH treasury holdings, similar to Strategy’s breakthrough in 2020, attracting investor attention especially as Ethereum gains institutional recognition. This positioning offers favorable risk-reward dynamics, as demand for Ethereum is expected to grow with increased institutional participation. Some companies even attempt to gain early leadership by becoming the largest corporate holder of Ethereum. This signals market leadership in capital raising and execution of ETH purchases. Such scale and efficient asset acquisition enhance credibility and attract more capital inflows.

Success Factors

On the surface, one might assume these treasury companies succeed due to complex and often opaque models promising exponential growth, claiming that “X” token could increase 100-fold within “N” years. However, I believe the core advantage lies in execution—particularly momentum in accumulation and efficient capital raising—which is critical for sustaining altcoin treasury strategies.

(1) Accumulation Momentum

A company’s ability to raise capital and act aggressively in executing its Ethereum purchase strategy plays a crucial role.

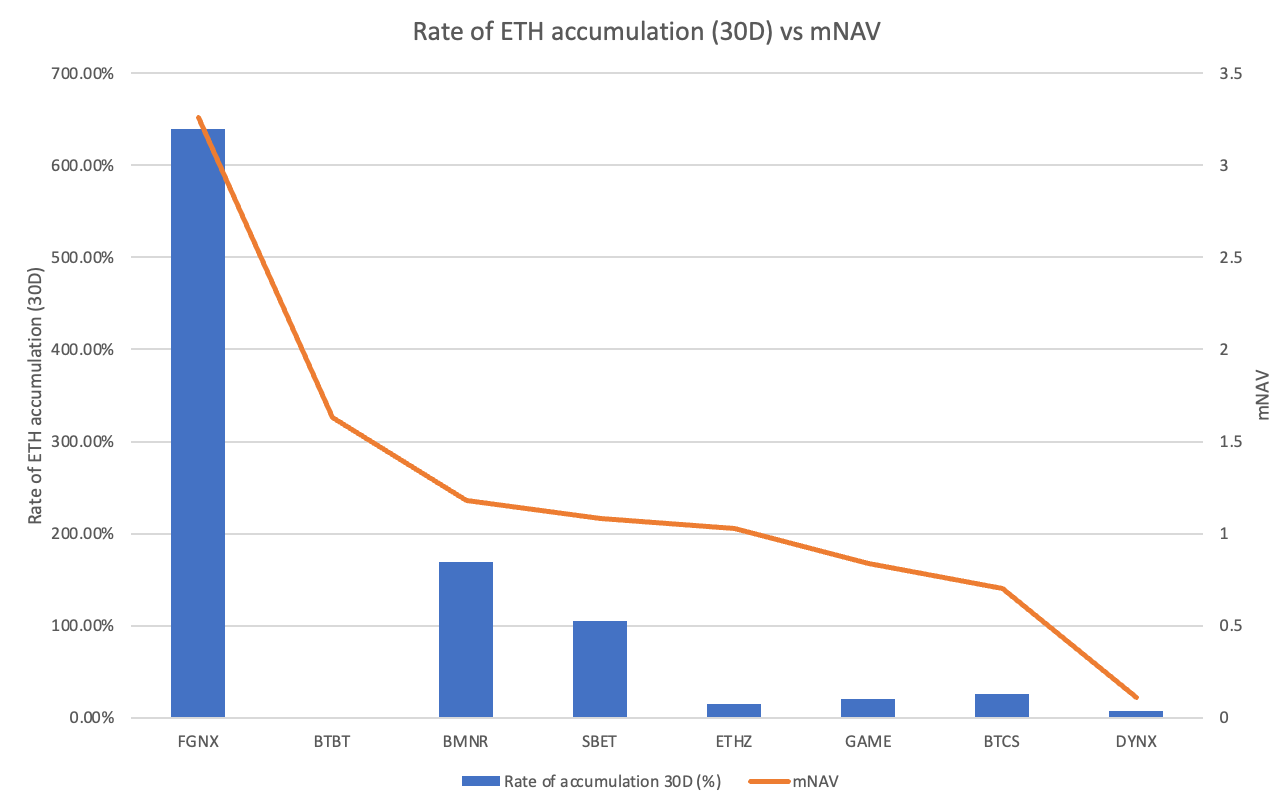

Relationship between Ethereum accumulation speed and mNAV

FGNX stands out with a 639% accumulation rate over 30 days. This figure significantly exceeds others, largely due to FGNX’s recent $200 million investment in Ethereum and its plan announced in July 2025 to acquire 10% of the current Ethereum supply. BMNR and SBET are also notable, with accumulation rates of 169% and 105% respectively, and continue actively building reserves. Other companies like GAME, BTCS, and DYNX show more moderate growth (below 30%), while BTBT has a 0% accumulation rate, indicating no recent Ethereum purchases.

Clearly, except for BTBT, companies with the highest accumulation rates (FGNX, BMNR, SBET) generally maintain higher mNAV multiples (>1), although BTBT is an exception. This may relate to BTBT gradually scaling down its mining operations due to declining profitability and shifting toward an Ethereum treasury strategy—a transition potentially viewed positively by the market.

It’s worth noting that high-accumulation firms continue to command higher net asset value premiums. For example, BMNR has solidified its lead as the largest corporate ETH holder with 1.52 million ETH, thanks to aggressive ATM equity offerings and plans to raise up to $20 billion for further Ethereum purchases. SBET maintains steady accumulation through similar mechanisms. In contrast, slower accumulators like DYNX (holding ~345,000 ETH post-SPAC merger) and BTCS (~70,000 ETH) see limited net gains, with BTCS focusing more on Ethereum dividend distributions rather than pure asset accumulation.

Data suggests that companies like FGNX, BMNR, and SBET, which consistently and aggressively build Ethereum reserves, are seen as reliable ETH asset managers, with mNAV (adjusted net asset value) consistently above 1. Slower accumulators struggle to achieve premium valuations (mNAV < 1), indicating investors care not only about the amount of Ethereum on the balance sheet but also about accumulation momentum.

This pattern reveals a self-reinforcing mechanism: to survive, these companies must excel at raising capital—such as issuing shares at a premium—which boosts NAV per share, attracts more investment, and enables sustainable treasury growth. Conversely, low accumulation momentum may trigger a “death spiral.”

When mNAV approaches or falls below 1, fundraising becomes difficult. Issuing shares at a discount reduces per-share value, creating a vicious cycle that may lead to stagnation or even deeper discounts due to short sellers or capital outflows. This explains why companies like DYNX and BTCS, facing post-merger challenges or adopting less aggressive dividend-focused strategies, struggle to maintain mNAV premiums.

In contrast, the trend among Bitcoin treasuries differs: over 79 public companies now hold more than 4.5% of Bitcoin’s supply, pioneering this movement, but their accumulation pace is slowing. Additionally, about one-third of these companies trade below their net asset value, with premiums shrinking. For example, MSTR’s mNAV once reached 4x but now stands at around 1.61x, despite Bitcoin hitting all-time highs.

This shrinking premium may stem from excessive concentration among Bitcoin holders—leaders like MSTR hold 12 times more Bitcoin than the second-largest holder (MARA)—limiting growth room for others. Meanwhile, Ethereum treasuries remain relatively early-stage, with BMNR holding only twice as much ETH as SBET, leaving a more open competitive landscape.

(2) Financing Strategy

I consider the secondary aspect to be how efficiently these operators raise capital from investors. BMNR’s case is particularly illustrative: it plans to raise up to $24.5 billion ($4.5 billion already raised + $20 billion target). While such moves inevitably dilute existing shareholders, under mNAV premium conditions (>1x), capital raises can translate into net gains in NAV per share—an alchemy made possible by issuing shares at a premium.

This occurs when BMNR issues shares at an mNAV premium (e.g., 1.18) and sells them above NAV (e.g., selling $100 NAV shares at $118). The extra $18 per share increases funds available to buy Ethereum, boosting total NAV (assets minus liabilities) and increasing NAV per share with limited dilution.

This strategy is evident in BMNR’s ATM stock offering program, launched on July 9 with an initial $250 million target, increased to $2 billion by July 24. As of the latest update on August 12, the committed total has risen to $24.5 billion. BMNR plans to acquire 5% of Ethereum’s supply (~6 million ETH), a bolder move than Strategy’s use of $84 billion to buy a smaller portion of Bitcoin’s supply.

With a $10.8 billion market cap, BMNR seeks disproportionate treasury growth. This strategy could push its current mNAV premium (1.2) even higher, creating a positive flywheel: stronger investor confidence enables further capital raises, increasing ETH holdings and NAV per share.

Conversely, if mNAV is below 1 (e.g., DYNX at mNAV 0.11), a company effectively issues shares at a discount ($11 per share vs. $100 NAV), raising only $11 million per million shares—adding minimal ETH reserves while diluting NAV per share to ~$90. This erodes company value, triggering a “death spiral” with worsening discounts, severely harming shareholders. Thus, when a company’s mNAV nears or drops below 1, it may prioritize share buybacks over further ETH purchases to stabilize stock price and shareholder equity.

Conclusion

In summary, while Strategy’s Bitcoin treasury model has set a benchmark by consistently maintaining mNAV above 1, Ethereum presents a compelling alternative for enterprises seeking higher growth, yield, and systemic innovation.

Companies like BMNR, SBET, and FGNX demonstrate the potential for a sustainable treasury model by aggressively accumulating Ethereum and efficiently raising capital under mNAV premium conditions (>1x), mirroring Strategy’s success.

However, as more companies adopt this strategy, competition intensifies, and those failing to meet the threshold—like DYNX and BTCS—may struggle unless new catalysts emerge.

With growing institutional adoption, Ethereum holdings in corporate treasuries surpassed 3 million ETH in 2025, suggesting Ethereum could become a sustainable alternative asset, delivering superior risk-adjusted returns—if companies can successfully avoid the “death spiral” trap.

Ultimately, the future of Ethereum treasuries hinges on execution, and 2025 will be a pivotal year to determine whether this strategy can surpass Bitcoin’s established path.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News