You're missing one of the most significant acquisitions in DeFi history

TechFlow Selected TechFlow Selected

You're missing one of the most significant acquisitions in DeFi history

Who will benefit the most?

Written by: mattdotfi

Translated by: AididiaoJP, Foresight News

Currently, only a few people are paying attention to @LayerZero_Core's acquisition of @StargateFinance, but since such mergers are extremely rare, I believe it's worth a deep dive.

Proposal Summary

LayerZero plans to acquire Stargate’s tokens and treasury (currently backed at $0.1444 per $STG) and dissolve the Stargate DAO, integrating it into the $ZRO-led economic framework.

-

Acquisition price: $0.1675 per $STG, or 0.08634 $STG for every 1 $ZRO.

-

The proposal follows Stargate DAO’s standard process, requiring at least 1.2 million votes with a 70% approval rate to pass.

-

Future excess revenue generated by Stargate will be used to reduce $ZRO circulating supply via buybacks.

Pros and Cons Analysis

This raises a key question: "Who benefits the most?"

In the current scenario, LayerZero and $ZRO holders appear to be the biggest beneficiaries, as this is a liquidity acquisition executed through their token, specifically:

-

Acquiring $STG backed by the Stargate treasury at a modest 16% premium while increasing the number of $ZRO holders.

-

Earning protocol fees (approximately $1.74 million annually according to @DefiLlama), which will be used to repurchase $ZRO on the open market.

-

Vertically integrating $ZRO tokenomics with cross-chain operations (where LayerZero leads), enhancing its utility through buybacks.

What do $STG and $veSTG (locked STG) holders get? Not much:

Due to the recent rise in $ZRO’s price, the exchange discount is low; $STG receives only a slight premium due to market volatility, though there is a clear price floor.

After initial 24-hour discussions, LayerZero decided to pay six months of Stargate revenue to $veSTG holders, as they cannot unlock their tokens before the lock-up period ends.

Drawbacks and Concerns

The situation here is complex, but ultimately boils down to one word: compromise.

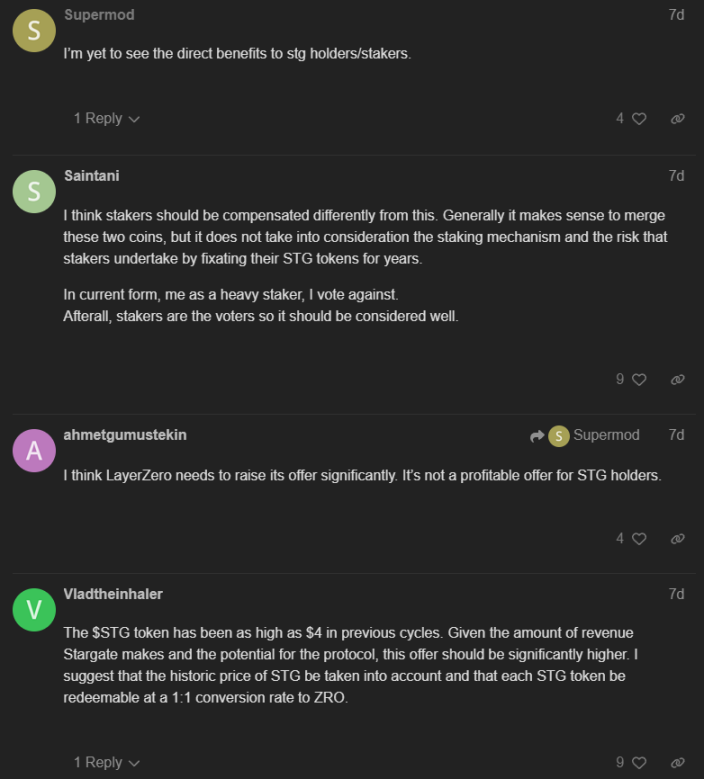

LayerZero stands to gain significantly more under current conditions, while Stargate token holders struggle to feel satisfied. Here are three major issues and uncertainties:

-

How should the fair premium for LayerZero’s acquisition of $STG be calculated?

-

For $STG holders, what is the lesser evil? Continue enduring persistent token selling pressure, or opt for a safe but growth-limited solution?

-

The average lock-up period for $veSTG holders is about one year; if the proposal passes, they receive compensation for only six months—what incentive does that provide?

-

Currently, $STG’s fully diluted valuation (FDV) is less than 10% of $ZRO’s, while $8.1 million worth of $STG is locked in $veSTG form.

Many holders are demanding a 1:1 swap between $ZRO and $STG, but that isn’t reasonable—it would mean they instantly gain a 12x return, while LayerZero would have to spend its entire FDV acquiring a business with a solid treasury but limited revenue.

Personal View

Although I believe the LayerZero team should reevaluate the premium offered to $STG holders and design a more equitable revenue-sharing model for stakers, this acquisition isn't necessarily disastrous for the project.

DAOs primarily rely on income and token emissions to sustain operations, and $STG has crashed over 95% from its all-time high. With only $2 million in annualized revenue, Stargate has limited room for expansion. Moreover, Stargate has always depended on LayerZero’s infrastructure, so integration could make it easier to grow using LayerZero’s tech stack and capital.

Nevertheless, I believe this proposal holds meaning for Stargate, but there's no need to rush to conclusions. The retention and loyalty of $STG holders toward LayerZero will largely depend on how the team handles this matter. Otherwise, they may lose a cohort of potential new loyal $ZRO holders and long-time supporters who stood by Stargate from the beginning.

Update:

The proposal has gone live on Stargate DAO, meeting the minimum threshold, with 2.3 million circulating $veSTG (out of 17 million total) voting "yes" (98% vs. 2% "no").

I don’t consider this a hostile takeover, but at this stage, LayerZero clearly benefits far more than $STG and $veSTG holders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News