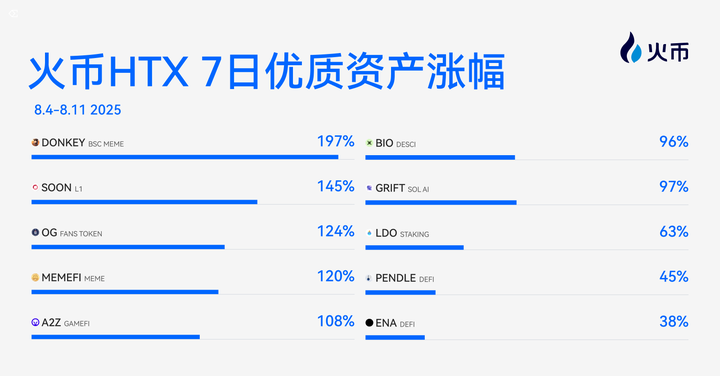

Huobi HTX New Listings Weekly Review (8.4-8.11): DONKEY surges 197%, Meme and ETH ecosystem see broad rally

TechFlow Selected TechFlow Selected

Huobi HTX New Listings Weekly Review (8.4-8.11): DONKEY surges 197%, Meme and ETH ecosystem see broad rally

Great! It's ezi! We're saved!

Over the past week (August 4–August 11), crypto market热点 switched frequently, with both mainstream and emerging sectors advancing in parallel, as capital rapidly shifted between meme assets, public chains, and new narrative-driven sectors. Overall, multiple assets on HTX saw significant gains, trading activity notably increased, certain assets experienced short-term surges driven by single events, while ETH ecosystem assets steadily climbed.

Meme Sector Leads: DONKEY and MEMEFI in the Spotlight

The meme sector maintained its strength this week. Despite high volatility, such assets often generate short-term wealth effects due to low entry barriers, strong community engagement, and viral potential—making them key sentiment indicators amid shifting market focus.

● DONKEY (BSC Meme): surged 197%, topping the weekly gain list. As a trending BSC-based meme asset, it originated from the social meme "CZ jokingly calling himself a donkey," sparking strong community engagement and continuous meme creation, attracting substantial short-term capital. It has become a representative of lightweight on-chain meme assets.

● MEMEFI (Meme): rose 120%. MemeFi is a Web3 social tech game that layers a complex socio-economic system atop PvP and PvE gameplay. By introducing tradable keys to boost rewards, it enhances player engagement. Supported by on-chain interactive events and airdrop anticipation, its price continued climbing throughout the week.

Emerging Narratives and Innovative Sectors Surge: SOON and OG Shine

New narratives—including breakthroughs in blockchain performance, fan economy momentum, fusion of blockchain gaming with decentralized science (DeSci) and AI—are gaining traction, drawing both speculative and long-term investment.

● SOON (L1 Blockchain): up 145%, one of the most watched new L1 projects this week. SOON is a rollup stack designed to deliver top-tier performance for all Layer 1 blockchains. With impressive speed and low-fee test results, along with early ecosystem development, it attracted attention from both blockchain enthusiasts and speculators. The market widely believes that beyond Ethereum and Solana ecosystems, new L1 narratives still hold room for imagination.

● OG (Fan Token): gained 124%, reigniting market enthusiasm for the fan economy. OG Fan Token (OG) is a fan token issued through a partnership between esports club OG and Socios.com. Leveraging traffic from sports and entertainment IPs, on-chain fan economies are active again in this new cycle.

● A2Z (GameFi): up 108%. The GameFi sector has repeatedly drawn attention amid its recovery trend this year. A2Z (Arena-Z) redefines the Web3 gaming experience by offering a simplified, player-first infrastructure based on OP Stack. Its on-chain active users and trading volume both hit new highs this week.

● BIO (DeSci): up 96%, reflecting renewed interest in the decentralized science (DeSci) sector and long-term expectations for blockchain-powered research. Though these projects exhibit clear short-term price volatility, they occupy a unique position in long-term value exploration.

● GRIFT (SOL AI): up 97%, fueled by the fusion of AI and Solana narratives. ORBIT (GRIFT) is an integrated DeFi companion that uses AI agents to coordinate and execute on-chain operations based on users’ natural language inputs. As AI remains a core long-term narrative in the 2025 crypto market, its integration with high-performance blockchains becomes increasingly compelling. Market exploration of AI combined with on-chain data continues to accelerate.

ETH and Ecosystem Assets Rise Steadily, Becoming Core Holdings

Ethereum (ETH) stabilized and rebounded this week, driving continued growth in staking and DeFi core assets, making them reliable portfolio choices.

● LDO (Staking): up 63%, boosted by a revival in Ethereum’s staking ecosystem and rising staking APR. Lido is a liquid staking solution for Ethereum, allowing users to stake ETH without minimum deposits or infrastructure maintenance, while also participating in on-chain activities (e.g., lending) to compound returns.

● PENDLE (DeFi): up 45%, benefiting from renewed institutional interest in yield derivatives. Pendle Finance is a protocol that tokenizes and enables trading of DeFi yields, allowing users to implement various yield management strategies.

● ENA (DeFi): up 38%, rising steadily amid the strong performance of the ETH ecosystem. Ethena is a synthetic dollar protocol built on Ethereum, aiming to provide a crypto-native monetary solution independent of traditional banking infrastructure. Its primary product is Delta-neutral Synthetic Dollars (USDe).

As the August market enters mid-cycle, new opportunities continue to emerge, with overlapping old and new sectors creating rich trading possibilities. High-beta segments like memes, AI, public chains, and GameFi offer platforms for short-term capital, while core assets like the ETH ecosystem stabilize the market foundation. HTX will continue delivering new quality listings and comprehensive market tracking to help users capture wealth effects and promising opportunities in this new cycle.

About HTX

Founded in 2013, HTX has evolved over 12 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and more.

As a global leader in Web3, HTX adheres to a strategic vision of global expansion, ecosystem prosperity, wealth generation, security, and compliance, providing cryptocurrency enthusiasts worldwide with comprehensive, secure, and reliable value and services.

To learn more about HTX, visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For inquiries, contact glo-media@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News