Six Pillars of On-Chain Protocols: HyperEVM Directly Challenges Ethereum

TechFlow Selected TechFlow Selected

Six Pillars of On-Chain Protocols: HyperEVM Directly Challenges Ethereum

Connectivism, the power-law expansion of on-chain assets.

Author: Zuoye

Ethereum is back with DeFi, and Aave/Pendle/Ethena have turned rehypothecation into a leverage amplifier. Compared to the ETH-based on-chain stack during DeFi Summer, the leverage curve supported by stablecoins like USDe has risen more gradually.

We may be entering a warm long cycle. Assessing on-chain protocols will now involve two aspects: first, the inclusion of more asset types, as external liquidity will become more abundant under expectations of Fed rate cuts; second, examining the limits of leverage ratios and corresponding safe deleveraging processes—how individuals can exit safely and how bull markets might end.

TechFlow's Six Protocols: Interaction Between Ecosystems and Tokens

There are countless on-chain protocols and assets, but under the 80/20 rule, we only need to focus on key metrics such as TVL, trading volume, and token price. More precisely, we should concentrate on the few essential protocols critical to the on-chain ecosystem, analyzing their relationships within the broader network to identify those with the highest individual importance, ecosystem connectivity, and growth potential.

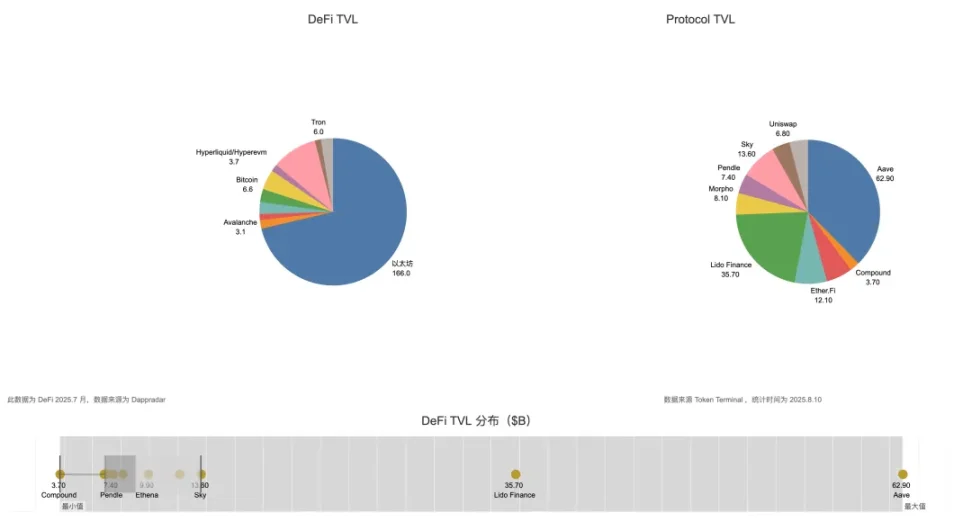

Image caption: DeFi TVL Overview, Image source: @zuoyeweb3

In terms of DeFi TVL composition, Ethereum accounted for over 60% of total DeFi TVL in July, while Aave made up over 60% of Ethereum’s ecosystem TVL—this represents the top 20% in the 80/20 principle. The remaining protocols must have strong ties to these two in order to be considered passive or active beneficiaries.

As the flywheel of the rehypothecation trio spins up, the interconnection between Ethereum, Aave, Pendle, and Ethena goes without saying. Adding Bitcoin into the mix, WBTC, ETH, and USDT/USDC have effectively become foundational DeFi assets. However, similar to Lido, USDT/USDC primarily possess asset attributes but lack substantial ecosystem value. Plasma, Stablechain, and others are just beginning to compete.

To clarify, a protocol can carry multiple values. For example, Bitcoin essentially offers only asset value—everyone needs BTC, but no one knows how to fully utilize the Bitcoin ecosystem (no judgment on BTCFi being a scam here—doge for protection).

ETH/Ethereum, on the other hand, holds dual value: people need both ETH as an asset and the Ethereum network, including EVM, its extensive DeFi stack, and developer infrastructure.

Further categorizing by asset and ecosystem value, we assess each leading protocol’s “necessity”: one point for needed asset attributes, one point for needed ecosystem value. This leads to the following summary:

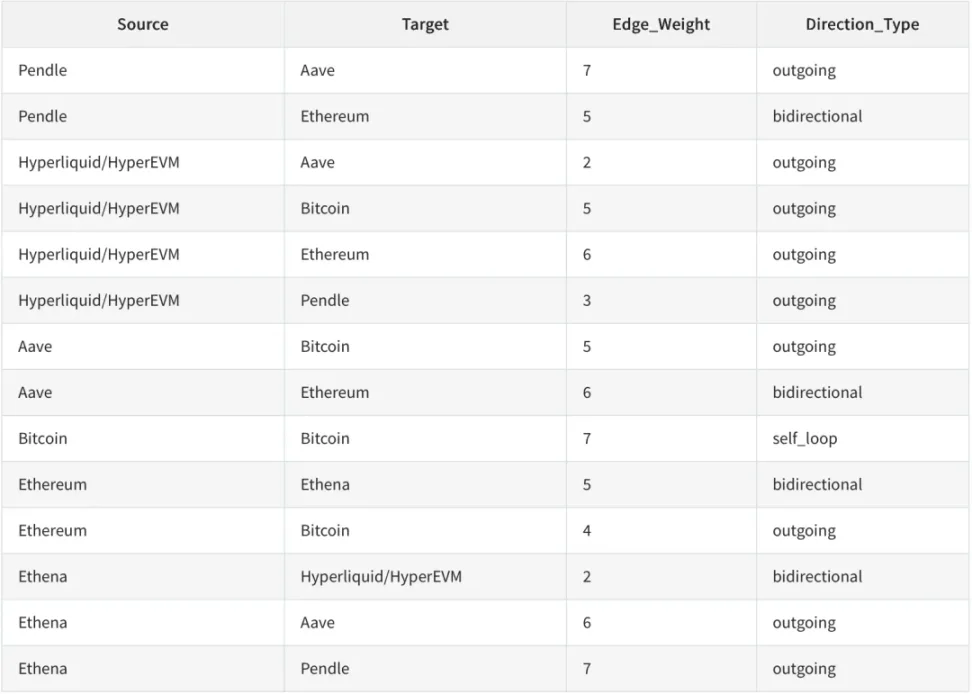

Pendle, Aave, Ethena, Ethereum, HyperEVM, and Bitcoin form the six most tightly linked protocols. Any two of them can be connected directly or through at most one additional protocol or asset.

Let’s briefly explain:

-

Ethena <> HyperEVM: USDe has already been deployed on the HyperEVM ecosystem

-

Pendle <> HyperEVM: $kHYPE and $hbHYPE rank first and third on trending lists

-

Aave <> HyperEVM: Hyperlend accounts for 25% of HyperEVM’s TVL ($500M vs $2B), serving as a friendly fork of Aave that commits to sharing 10% of profits with Aave

-

BTC/ETH are the two most traded assets on Hyperliquid and can be deposited/withdrawn via Unit Protocol

-

Pendle, Aave, and Ethena have effectively merged, though USDe’s asset status is widely recognized, while $ENA lags slightly in ecosystem value

-

Pendle’s new product Boros uses funding rates as its core mechanism, prioritizing BTC and ETH contracts

-

Aave requires WBTC and various forms of ETH, such as staked ETH. Ethereum’s infrastructural ecosystem value is needed by Aave, Pendle, and Ethena, forming on-chain support for ETH prices

-

The most unique aspect is that the Ethereum ecosystem one-way depends on BTC, while the Bitcoin ecosystem doesn’t require any external assets

-

Ethena currently has no direct relationship with Bitcoin/BTC

-

HyperEVM/Hyperliquid is the "most proactive" external ecosystem, giving off strong "I’m here to join the family" vibes

Statistically, these six assets form the tightest network. Introducing any other ecosystem or token would require additional assumptions. For instance, Lido, ranked second in TVL, has weak connections to Hyperliquid and Bitcoin. Moreover, after Pendle shifted from LST assets to YBS, Lido’s internal Ethereum ecosystem synergy weakened.

Using BTC’s maximum score of 7 as the baseline and measuring influence across other protocols, we classify the six assets into three node tiers. Note: this does not reflect their asset value, but rather their relative importance within the ecosystem:

BTC and ETH are the strongest infrastructures—BTC excels in asset value, while ETH’s ecosystem position remains unshakable. You could include Solana to calculate linkage strength, but you’d find it falls short compared to Hyperliquid/HyperEVM’s connection to Ethereum. The core reason lies in Hyperliquid’s inherent trading nature combined with HyperEVM’s closer alignment with the EVM ecosystem.

-

Within Ethereum, Lido/Sky lack sufficient interaction with the existing six protocols

-

Outside Ethereum, Solana/Aptos also show insufficient engagement with the six

Solana needs to build up its own DEX to integrate more external assets, which naturally adds extra steps. SVM’s compatibility with the EVM ecosystem will also be more difficult. In short, everything on Solana must develop independently.

Image caption: Connectivism, Image source: @zuoyeweb3

However, within this network, the Ethereum ecosystem exhibits the strongest synergies: 1 dollar of Ethena originates from ETH hedging, then flows through Pendle and Aave, generating gas fees that ultimately support ETH’s value.

Besides Bitcoin’s natural self-circulation via BTC alone, ETH comes closest to achieving a value loop—but this is the result of deliberate, proactive integration. The Hyperliquid/HyperEVM combination is still evolving. Whether it can successfully link trading (Hyperliquid), ecosystem (HyperEVM), and $HYPE remains to be seen.

This is an entropy-increasing process with growing assumptions: BTC needs only itself, ETH requires ecosystem and token coordination, while $HYPE demands integration of trading, tokens, and ecosystem.

Is There a Limit to DeFi Expansion?

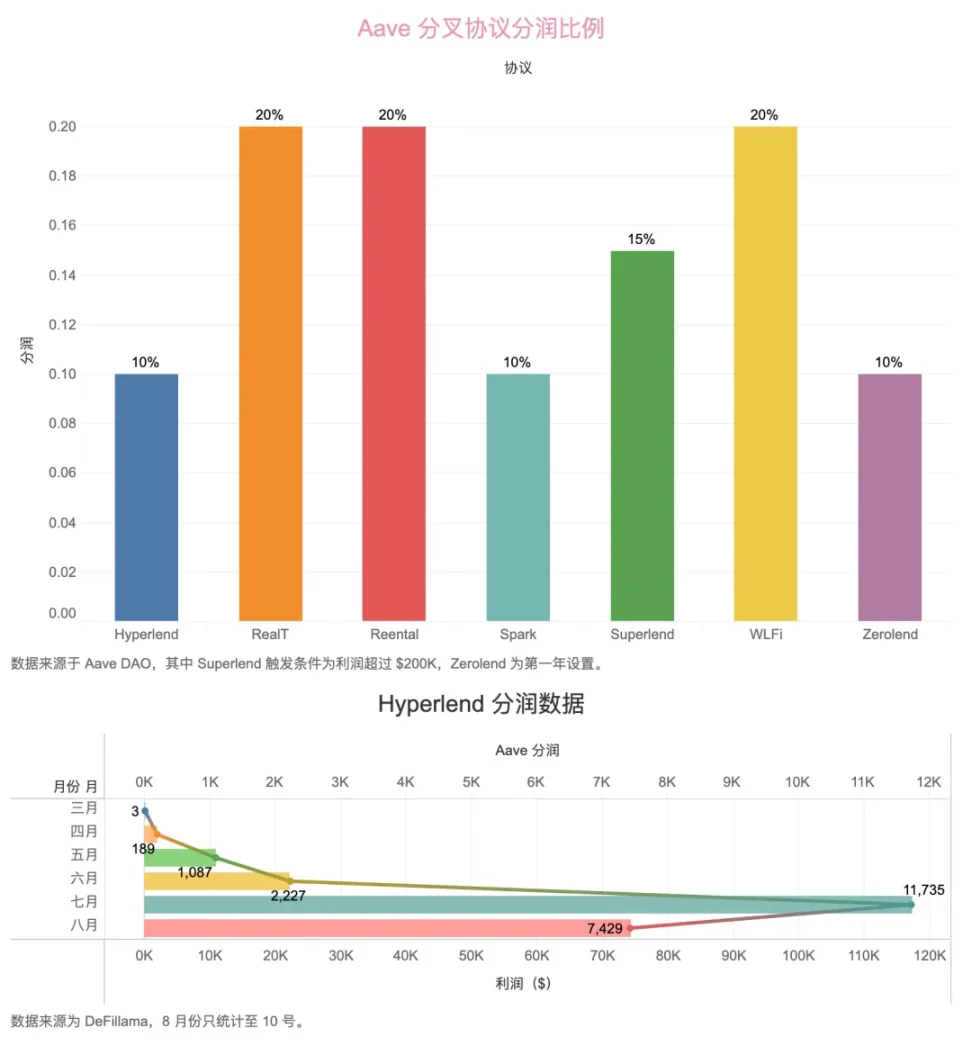

Earlier, we mentioned that Hyperlend must share revenue with Aave. But Aave’s influence extends far beyond that—in fact, Aave is the true protagonist behind the rehypothecation cycles initiated by Pendle and Ethena, serving as the primary leverage engine for the entire system.

Aave is the closest thing to an on-chain infrastructure layer on Ethereum—not because of its TVL dominance, but due to its combination of security and capital depth. For any blockchain or ecosystem launching a lending model, the safest path is a compliant fork of Aave.

Image caption: Aave and Hyperlend revenue sharing setup, Image source: @zuoyeweb3

In Hyperlend’s fork template, sharing 10% of revenue is standard, plus allocating 3.5% of its own token to Aave DAO and 1% to stAave holders. This means Aave effectively sells itself as a service to various ecosystems—a key point where its ecosystem and token values converge.

That said, competition exists. Maple has expanded to HyperEVM, while new lending models like Fluid and Morpho are actively engaging with new assets like YBS. As the strongest challenger to Ethereum’s EVM ecosystem, HyperEVM may not remain cooperative forever.

In terms of proactiveness, Bitcoin and HyperEVM represent absolute opposites. HyperEVM is using HIP3 to draw traditional trading types on-chain, CoreWriter to bridge liquidity between HyperCore and HyperEVM, and Builder Code to empower its own front-end agents.

Additionally, it leverages Unit Protocol and Phantom to connect Solana’s ecosystem funds, absorbing all possible on-chain liquidity—an alternative model of infrastructure expansion.

To summarize:

-

Pendle targets every splittable asset type, expanding beyond perpetuals into broader derivatives markets—essentially, the interest rate swap market

-

Ethena leverages DeFi rehypothecation and treasury strategies centered on $ENA, $USDe, and $USDtb to establish a third pole in stablecoins. While USDT/USDC remain focused on trading and payments, USDe aims to become the risk-free asset in DeFi

-

Aave is already the de facto lending infrastructure, deeply intertwined with Ethereum

-

Bitcoin and Ethereum represent the limits of the blockchain economic system. Their expansion defines the foundation for DeFi growth—how much BTC value can be brought into DeFi determines how much room DeFi has to grow

-

Hyperliquid/HyperEVM have tightly integrated with existing DeFi giants. Despite much lower TVL than Solana, their growth potential is greater. Solana’s narrative hinges on defeating the EVM ecosystem from a Layer 1 perspective

Conclusion

TechFlow's Six Protocols evaluates mutual connectivity—not denying other protocols’ value, but recognizing that high collaboration density exponentially increases capital efficiency and freedom, creating shared prosperity: when one wins, all benefit.

Of course, when one falls, all suffer. This brings us to DeFi’s anchor shift—from ETH to YBS—and its future evolution. ETH, as a high-value asset, enables more aggressive leverage. YBS, like USDe, is naturally more price-stable (not necessarily value-stable), making DeFi built on it structurally more resilient. Barring extreme de-peg scenarios, in theory, this allows for smoother leverage and deleverage curves.

The crypto pantheon has limited seats. New contenders must push forward relentlessly, forge alliances with existing gods, and build the strongest protocol networks to earn their place.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News