Another Chinese "ban" rumor: 10-year evolution of fake news in the crypto market

TechFlow Selected TechFlow Selected

Another Chinese "ban" rumor: 10-year evolution of fake news in the crypto market

When enough people believe a piece of fake news will affect the price, it truly will affect the price.

By David, TechFlow

The crypto market has its own version of "The Boy Who Cried Wolf."

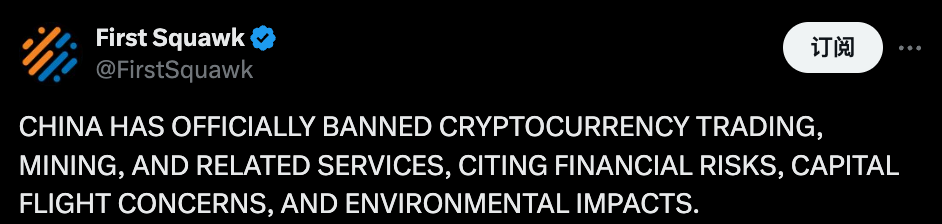

On August 3, First Squawk, a well-known international financial news platform, posted on social media: "China has officially banned cryptocurrency trading, mining, and related services due to financial risks, capital flight concerns, and environmental impacts."

Overseas financial accounts with millions of followers, such as Investing.com (Investing) and Rawsalerts, successively shared this unverified "breaking news." Clearly, using China's alleged ban on cryptocurrencies has become a "traditional trick" for fake news in the crypto market.

Under the comments section of that post appeared a humorous one—Grok, tell me, how many times has China banned cryptocurrency now?

Veteran investors have long grown numb to such fake news, and Bitcoin’s price has also become immune to these rumors.

However, there is indeed an absurd cycle within the crypto market—every so often, a highly influential piece of fake news emerges.

You may be immune to the recurring China-ban narrative, but you might not be immune to all forms of fake news. When enough people believe a false story will affect prices, it actually does influence prices.

China's "ban" is merely the tip of the iceberg when it comes to how fake news affects the entire crypto market. Looking back at the history of the crypto market, major fake news events have genuinely shaped the trajectory of crypto assets.

Behind a single piece of fake news, you can even trace a hidden information dissemination chain.

A Chronicle of Crypto Fake News: From Amateur to Professional, Key Events Recap

-

2017: The Death of Vitalik, Blockchain’s First Lie

If we were to write an evolutionary history of cryptocurrency fake news, June 26, 2017, would undoubtedly be a milestone.

That afternoon, a message appeared on the well-known foreign forum 4chan: "Vitalik Buterin died in a car accident." No source, no evidence, not even plausible details.

Yet this crude rumor triggered the first market crash in crypto history caused by fake news. Within hours, ETH plummeted from $317 to $216 in six hours—a nearly 32% drop.

The Reddit r/ethtrader subreddit was flooded with posts asking, "Is this real?" and "Can anyone confirm?" In Telegram groups, holders debated whether they should sell immediately.

About ten hours later, Vitalik himself debunked the rumor via Twitter, posting a photo holding a piece of paper with the day’s Ethereum block number and hash value—using blockchain itself to prove he was alive.

Vitalik survived—but your portfolio might not have.

The market reaction revealed a harsh truth: in the early Wild West era of crypto, an anonymous post could carry destructive power rivaling an official announcement.

Early fake news creators were mostly amateurs—running so-called insider groups on Telegram or posting on forums like 4chan. It was a market of extreme information asymmetry, where retail investors groped in the dark, and any slight rumor could trigger a stampede.

At that time, fake news was more of a prank by a few individuals, tightly tied to project founders; the market directly linked a founder’s personal safety to a project’s survival.

-

2018: The Goldman Sachs Blunder, Wall Street Abandons Bitcoin

When fake news wears a suit, professionalized "exclusive reports" are far more damaging.

On September 5, 2018, the crypto market was under the shadow of a bear market. At this sensitive moment, the prominent U.S. business website Business Insider published a report with a headline cutting straight to the point: "Goldman Sachs shelves plans for crypto trading desk."

A "trading desk" refers to a department within an investment bank that trades specific financial products for clients. If Goldman Sachs had truly established a crypto trading desk, it would mean institutional clients could buy and sell Bitcoin through Goldman—a milestone seen at the time as mainstream validation for cryptocurrencies. Conversely, "shelving" implied abandonment.

The next day, the plot twisted. When Goldman Sachs CFO Martin Chavez was asked about it at a TechCrunch conference, his response stunned everyone: "I was wondering yesterday when I made that decision? This is fake news."

But the clarification came too late. During those panic-stricken 24 hours, massive numbers of investors had already exited their positions.

According to Cointelegraph’s report at the time, Bitcoin and other digital currencies plunged following this fake news allegedly from "insiders," losing $12 billion in total market cap within an hour, with Bitcoin falling over 6% that day.

-

2021: Walmart-Litecoin Fake Partnership, News-Based Trading Emerges

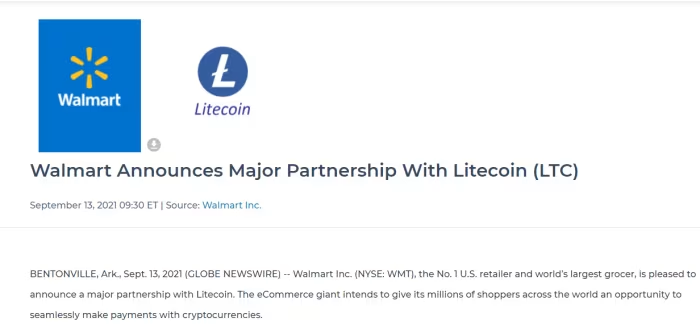

If earlier fake news stemmed from misunderstandings or negligence, the 2021 Walmart-Litecoin partnership hoax on September 13 was outright premeditated crime.

At 9:30 a.m. that day, a press release appeared on GlobeNewswire, one of the world’s largest news distribution services.

The headline was eye-catching: "Walmart Announces Major Partnership with Litecoin." The press release was professionally crafted, complete with Walmart’s official logo, detailed collaboration plans, executive quotes, and even contact info for investor relations.

The release claimed that starting October 1, all Walmart e-commerce sites would offer "payment via Litecoin." It quoted Walmart CEO Doug McMillon saying, "Cryptocurrency will play an important role in our digital strategy."

Soon, some crypto media outlets rushed to cover the news—and crucially, the Litecoin Foundation’s official Twitter account retweeted it.

At a time before "crypto-stock correlation" strategies existed and when crypto hadn’t gone fully mainstream, the market reacted explosively.

Litecoin’s price surged vertically, trading volume spiked. Mainstream media joined the chain—CNBC, Reuters picked up the story. By 10:30 a.m., Litecoin hit its peak, rising over 30%.

But just as the market celebrated, Walmart’s PR team noticed something off. After urgent verification, they issued a statement: This was false—Walmart had no partnership with Litecoin.

After the reversal, Litecoin’s price fell like a free-falling object. But for the masterminds behind it, the game was already over.

Follow-up investigations found abnormal bullish options trading on Litecoin 48 hours before the fake news broke. The manipulators profited millions through meticulous planning.

The terrifying aspect of this incident was its level of professionalism.

From registering similar domains and crafting fake press releases, to timing the release and leveraging official accounts for credibility—each step was precisely calculated. This wasn't a joke like the initial Vitalik death hoax, but a premeditated, organized crime aimed at profiting through news-based trading.

-

2023: Cointelegraph Misreporting, Chasing Clicks Over Truth

October 16, 2023, was a day of reflection for the crypto media industry.

At 1:17 p.m., a screenshot from a Telegram group began circulating in the crypto community. It showed what appeared to be a Bloomberg Terminal screen displaying: SEC has approved BlackRock’s iShares spot Bitcoin ETF.

For crypto investors who had waited years, this was undeniably a historic moment.

Cointelegraph’s social media team saw the message. As one of the world’s largest crypto media outlets, they certainly understood the weight of this news.

But before publishing, they faced a dilemma: spend time verifying thoroughly, risking being scooped? Or publish immediately to capture traffic?

At 1:24 p.m., just seven minutes later, Cointelegraph posted the "breaking news" on its official X account. The tweet was bold: "BREAKING: SEC approves BlackRock spot Bitcoin ETF."

The market reacted instantly and violently. Bitcoin surged from $27,900 to $30,000 in the next 30 minutes—an over 7% jump. Trading volume exploded, putting pressure on exchange servers. The derivatives market went wild—$81 million in short positions were liquidated in the spike.

But excitement quickly turned to doubt. Observant users began questioning:

Why is only Cointelegraph reporting this? Why no announcement on the SEC website? Why is BlackRock silent?

At 2:03 p.m., 39 minutes after posting, Cointelegraph deleted the original tweet. But the damage was done. In less than an hour, the market had completed a full boom-and-bust cycle.

According to the outlet’s subsequent internal report, the error stemmed from broken procedures—the social media editor violated rules requiring editorial approval before posting.

This incident sparked intense debate in the industry. A sharp critique emerged: When media prioritize speed over accuracy, they cease to be media and become tools of market manipulation.

Crypto media face immense pressure. It’s a 24/7 market where news can break anytime. If you’re five minutes late, someone else grabs the traffic. In this environment, “publish first, verify later” is a risky yet highly rewarding choice—but one that may cost credibility.

In traditional finance, major announcements are usually released through official channels with strict disclosure rules. But in crypto, information sources are fragmented and authenticity hard to verify. A single screenshot or tweet can trigger tens of billions in capital movement.

Ironically, when the SEC actually approved Bitcoin ETFs in January 2024, the market’s first reaction wasn’t celebration—but skepticism.

-

2024: The SEC Twitter Hack, Regulators Become Victims Too

In January 2024, the SEC’s official X account posted a fake announcement approving a Bitcoin ETF. According to a later FBI investigation, attackers gained control via SIM-swapping. Bitcoin rose from $46,600 to $47,680 after the fake news, then dropped to $45,627 after the correction.

In October 2024, the FBI arrested suspect Eric Council Jr. Court documents revealed it was a premeditated financial crime—the attacker had built large long Bitcoin positions before releasing the fake news.

Over a decade, crypto fake news evolved from "accidental mistakes" to "deliberate crimes." Technical sophistication, capital scale, and organizational levels have all escalated. You might have dodged one fake news event, but you can’t guarantee escaping the next.

Three Men Make a Tiger: When Truth Gets Diluted

In the crypto market, tracing the origin of fake news is often futile.

When messages like "China bans crypto again" stir the market, widespread reposting, algorithmic amplification, and growing influencer power make it impossible for anyone to pinpoint the original source.

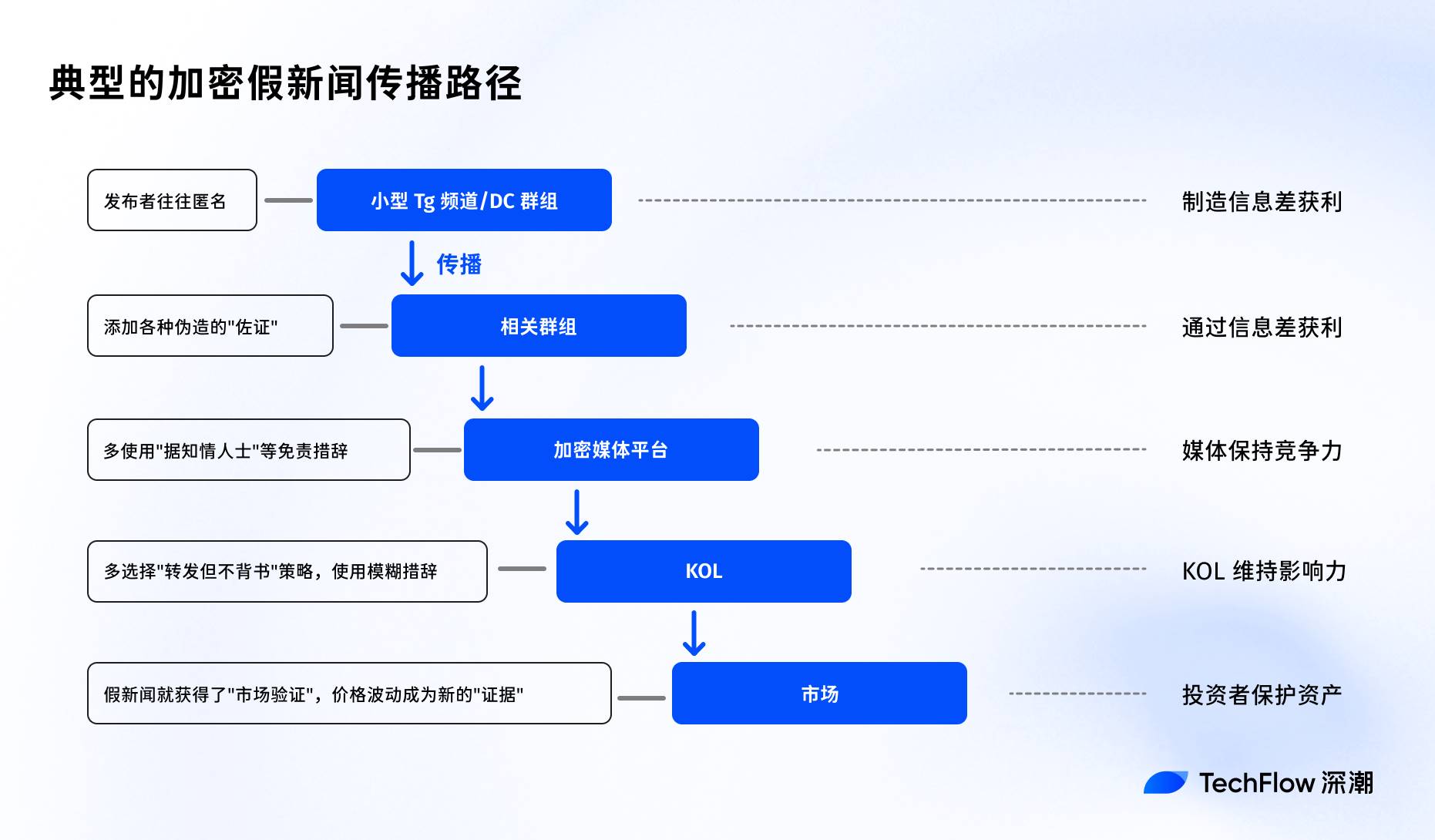

A typical crypto fake news propagation path looks like this:

First layer—origin: Usually small Telegram channels or Discord groups. Tracing back is nearly impossible. Posters often use anonymous accounts and suffer no consequences even if exposed.

Second layer—small circle fermentation: Circulates among niche groups, now adding "evidence"—photoshopped images, fabricated details, seemingly logical but misleading arguments.

Third layer—crypto media platforms: Lend the story a quasi-official tone. Even with disclaimers like "according to insiders," readers often ignore them selectively.

Fourth layer—KOL involvement: When the news spreads widely, influencers must decide: share or not? Most opt for "sharing without endorsing"—using phrases like "rumored" or "reportedly."

Fifth layer—market reaction: Once prices start moving, the fake news gains "market validation." The price drop itself becomes "proof" of authenticity.

After multiple layers of dissemination, tracing the source becomes almost impossible. Each layer adds new "details" and interpretations until the original message is completely diluted.

In the crypto market, rumors can spread irresponsibly and rapidly, while debunking requires rigorous evidence and logic. Spreading fear or exclusive news may create trading opportunities; spreading corrections brings no direct benefit.

Each participant acts rationally based on self-interest, but collectively, these "rational" choices produce an irrational outcome.

The market is fooled by fake news again and again, yet no one seems able or willing to break the cycle.

Perhaps this is the new meaning of "three men make a tiger" in the crypto age: not that three people saying something makes it true, but that when enough people believe it will affect the market, it truly does.

In this process, the truth itself becomes irrelevant.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News