On "Firing Powell": Prediction markets listen to Trump, while interest rate markets listen to Bessent

TechFlow Selected TechFlow Selected

On "Firing Powell": Prediction markets listen to Trump, while interest rate markets listen to Bessent

The current rate market expects only 43 basis points of rate cuts by year-end, a significant drop from 67 basis points in June.

By Long Yue, TechFlow

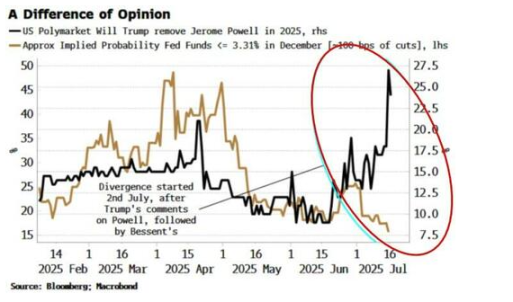

Despite intensifying rumors about Trump firing Federal Reserve Chair Powell, two key financial market "barometers" are sending sharply divergent signals.

Data shows a clear divergence between prediction markets and interest rate markets on the question of Powell's tenure. The latest development is that TechFlow reported Powell will be interviewed on Wednesday, July 16, and Trump has already drafted a dismissal letter. This news has once again driven up betting odds on Polymarket, a prediction platform, for Powell being removed before 2025.

However, the interest rate market reflects significantly less concern over Powell’s early departure than the probability suggested by the Polymarket betting platform. The rate market (Rates Market) refers to the interest rate derivatives market, particularly the federal funds futures market, which reflects expectations for future Fed interest rates through trading prices.

Specifically, following the release of stronger-than-expected U.S. employment data, the rate market actually reduced its bets on rate cuts. Currently, the rate market expects the Fed to cut rates by 43 basis points by year-end, down from 67 basis points at the end of June. More importantly, U.S. Treasury Secretary Bessent previously indicated in an interview that he does not fully endorse President Trump’s sharp criticisms of the Fed. His more moderate stance has provided a stabilizing anchor for the rate market.

As a result, participants in the prediction market continue to amplify Trump’s “dismissal rhetoric,” while rate market traders choose to believe in Bessent’s cautious position and economic data showing persistent upside risks to inflation.

The chart shows the diverging trends between the rate market and prediction market

Market divergence widens

In fact, the prediction market and the rate market have been moving apart since early July.

Prior to early July, the rate cut probabilities implied by interest rate futures were broadly aligned with the odds on Polymarket regarding Powell’s removal. However, this synchronization broke down on July 2.

On July 2, Trump publicly demanded Powell resign, causing related betting odds on Polymarket to rise. At the same time, however, the short-term rate market remained largely unaffected. Additionally, stronger-than-expected jobs data released on July 3 triggered a sell-off in the rate market, as traders began pricing out rate cuts. On the same day, Treasury Secretary Bessent, in an interview, declined to fully support Trump’s remarks about the Fed. His comments further reinforced market caution. Since then, the two curves have moved in opposite directions.

According to Bloomberg macro strategist Simon White, prediction markets typically follow political rhetoric, while rate markets focus more on economic fundamentals and policy signals.

Rate market pricing logic: data and signals first

The behavior of the rate market clearly indicates that traders prefer to filter out political "noise" and focus instead on economic "signals." Recent U.S. employment data suggest underlying economic resilience and upside inflation risks, directly undermining the case for aggressive Fed rate cuts in the near term.

Data show the rate market now expects the Fed to cut rates by 43 basis points by year-end—far below the 67 basis points expected at the end of June.

Besides economic data, the key driver behind this shift is Treasury Secretary Bessent’s stance. As a crucial link between the White House and financial markets, his more moderate comments have been interpreted as a significant signal of policy continuity, tempering the impact of Trump’s more aggressive rhetoric.

But strategist Simon White notes that if any market participants believe Trump’s political will ultimately prevails and succeeds in appointing a more dovish Fed chair, then Polymarket’s odds might be closer to reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News