When fossil whales start dumping, have we hit the peak?

TechFlow Selected TechFlow Selected

When fossil whales start dumping, have we hit the peak?

The way whales exit the market highlights the decline in market transparency and the importance of risk education.

Author: Luke, Mars Finance

In the narrative of financial markets, nothing triggers traders' nerves more than the departure of "smart money." In the crypto world, the smartest money is none other than the so-called "fossil-grade" Bitcoin that has existed since the dawn of time. Recently, the actions of one heavyweight player have plunged the entire market into contemplation and unease.

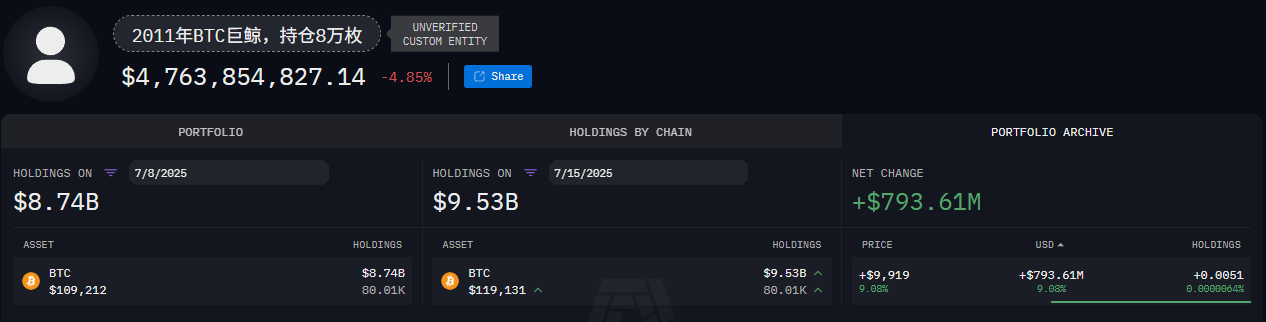

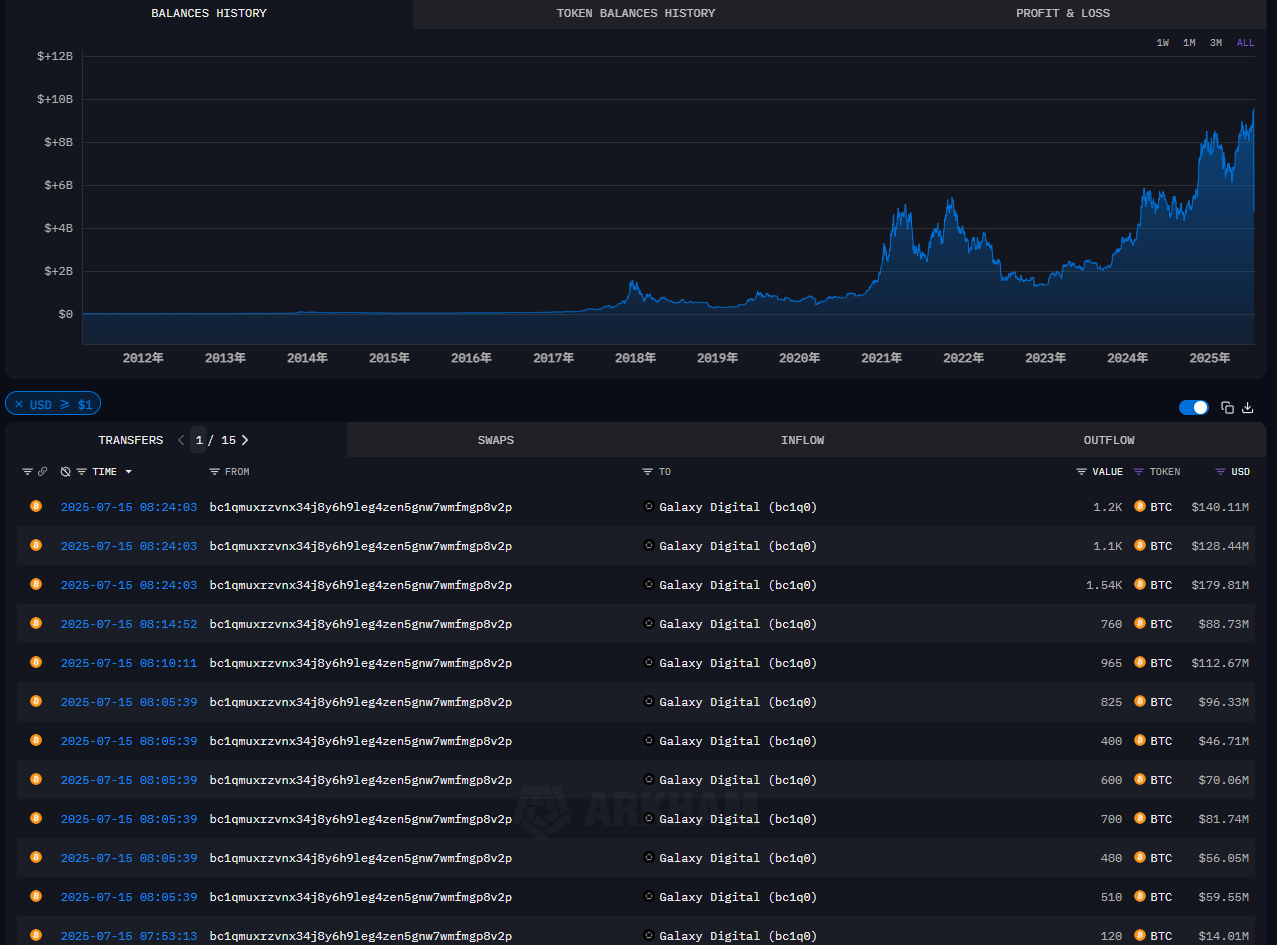

On-chain data shows that a Bitcoin address dormant since 2011—sleeping for fourteen long years—has awoken. But it hasn't merely stirred. Over recent weeks, it has steadily transferred assets outward in a calm, chilling rhythm. To date, this address has moved a total of 35,370 BTC, worth approximately $4.16 billion at current prices. These outflows account for 44.2% of the address’s total holdings.

Nearly half its position—over $4 billion in wealth—is being systematically liquidated by an ancient whale whose cost basis is virtually zero. This series of moves resembles a meticulously choreographed silent play: wordless, yet brimming with dramatic tension. It forces us to confront a question worth millions: when these "living fossils," who have witnessed multiple bull and bear cycles and spanned the entire history of the industry, begin large-scale selling, are we already standing at the market peak?

A Business Pioneer Rational to the Point of Fear

To answer this, we must first clarify the identity of this seller. Whenever an early address stirs, the community's immediate instinct is to point to that mysterious name—Satoshi Nakamoto. However, rigorous on-chain analysis quickly rules this out.

As early as 2013, blockchain researcher Sergio Demian Lerner analyzed the "Patoshi pattern" in early blocks, revealing Satoshi Nakamoto’s unique mining fingerprint. Lerner found that Satoshi mined more like a network guardian than a speculator—consciously controlling and gradually reducing his hash rate to preserve decentralization, with the vast majority of his mined BTC remaining untouched to this day.

The protagonist of our story—the 2011 whale—clearly does not fit the "Patoshi" pattern. His behavior aligns more closely with that of a highly patient and far-sighted "business pioneer." He entered during Bitcoin’s wild frontier era, perhaps driven by belief or speculation, but his ultimate goal was always to monetize this digital fortune at the right moment. Fourteen years of waiting turned a negligible investment into an astonishing asset capable of reshaping global billionaire rankings. Now, he chooses to exit—not out of panic or betrayal, but as a rational economic agent maximizing wealth.

Understanding this makes his actions less mysterious, yet far more alarming. Because he is neither an impulsive retail trader nor a fund manager chasing short-term trends. He is a supreme long-term holder who can ignore short-term volatility and act only at pivotal macroeconomic junctures. When such a participant decides to sell nearly half of his "family heirloom," regardless of whether his motive is profit-taking, estate planning, or otherwise, the act itself sends an undeniable macro signal. He believes the current price justifies giving up half of his future upside—and that speaks volumes.

Professional Exit: A $4.16 Billion Masterclass in "Selling"

Even more thought-provoking is how this sell-off was executed. The whale did not dump tens of thousands of BTC directly onto the order books of any public exchange. He understood that such a massive sell order, if made public, would instantly shatter market confidence, trigger a stampede, and result in execution prices far below market value.

Instead, he chose the most mature solution available in crypto finance today—over-the-counter (OTC) trading. On-chain trails clearly show that this $4.16 billion Bitcoin transfer ultimately landed at Galaxy Digital, the digital asset financial services firm founded by Wall Street veteran Mike Novogratz.

Galaxy Digital’s OTC desk is tailor-made for clients like him. They don’t act merely as intermediaries, but as the "primary counterparty." Using their robust balance sheet, they absorb the 35,370 BTC upfront, offering the seller a guaranteed execution price and thereby transferring all market volatility risk off his shoulders. Then, over the following days, weeks, or even months, Galaxy’s trading team uses sophisticated algorithmic systems to break this massive order into countless untraceable micro-orders, quietly digesting them across multiple global liquidity pools.

This is nothing short of a masterclass in "selling." It reveals a harsh truth: when real whales exit, you may never see that giant sell order on the public book. The selling pressure is real—but hidden by professional financial institutions, fragmented into a continuous, imperceptible drip of daily sell-side pressure that blends into normal market activity.

Novogratz himself has long championed institutional adoption of crypto, claiming the "snowball has started rolling down the hill." Now, his own company is flawlessly executing what may be one of the largest personal Bitcoin liquidations in history—initiated by an ancient whale. This creates a peculiar symbiosis: institutional infrastructure not only paves the way for new capital inflows but also provides perfect cover for old gods to exit gracefully.

Historical Mirror: When Whales and Governments Share the Same Script

This anonymous whale’s strategy is not unique. Another seemingly unrelated entity—the U.S. government—has followed an almost identical playbook when disposing of its seized Bitcoin.

Through crackdowns on darknet markets like Silk Road, the U.S. government became one of the world’s largest Bitcoin holders. How to dispose of these multi-billion-dollar assets without disrupting the market was once a major challenge. In earlier years, the U.S. Marshals Service auctioned Bitcoin publicly, often seeing it snapped up at rock-bottom prices by speculators—resulting in losses of public assets.

Now, the government has learned. On-chain data shows that in recent years, the U.S. Department of Justice has gradually transferred tens of thousands of Silk Road-origin BTC to Coinbase Prime—the institutional custody platform of one of the world’s largest compliant crypto exchanges. The logic mirrors that of our whale: use professional, regulated financial institutions to conduct orderly, low-impact liquidations.

When an anonymous "fossil-grade" whale and the world’s most powerful sovereign entity independently choose the same path for disposing of massive Bitcoin holdings, it signals that an industry standard for handling ultra-large crypto assets has emerged. Its core principles: professionalism, compliance, and risk minimization. Yet for ordinary investors, this also means market transparency is declining in another form. The largest trades are shifting from public markets to private OTC desks, and the price discovery mechanism is being obscured by an institutional "curtain."

Conclusion: Top Signal or Era Transition?

Now, back to our original question: does this mean the market has peaked?

Pessimistically, this is undoubtedly a strong warning. A "ultimate winner" who held Bitcoin for over fourteen years, surviving multiple market cycles, is now cashing out at a scale of billions in yuan. This suggests that, in his view, the current risk-reward ratio no longer justifies long-term holding. Such an exodus of "smart money" is a classic top indicator.

Yet from a broader perspective, the answer may be more complex. This sell-off might not be just a tactical "top escape," but a strategic "era transition."

First, this whale’s exit was facilitated through a highly mature institutional channel. The very system capable of absorbing $4.16 billion in sell pressure can equally support $4.16 billion—or even $41.6 billion—of incoming institutional capital. Old capital may be exiting while new capital flows in, all within the same hidden battlefield.

Second, this could represent intergenerational wealth transfer. A 2011-era participant, after fourteen years, may have compelling personal reasons—regardless of market conditions—to diversify assets or plan wealth succession. His selling may stem more from lifecycle needs than precise market timing.

Thus, labeling this event simply as a "top signal" may be reductive. It is more akin to a historical milestone—marking the end of Bitcoin’s "Wild West era," where every whale move sent shockwaves through the market. Simultaneously, it heralds the true arrival of the "institutional battleground era," where the largest buyers and sellers conduct massive, quiet transactions beyond public view, and market depth and complexity have far surpassed anything before.

For retail investors, this fossil whale’s sell-off is less a clear exit signal than a profound lesson in risk. It reminds us that beneath the surface, market structure is undergoing deep transformation. The oldest, smartest players are leaving—and the way they exit foreshadows that future market rules will be more professional, more complex, and more "opaque." The top may not have arrived yet, but the game has certainly changed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News