Life-or-Death Game with 100x Leverage: Recapping Recent Crazy Bets and Gambles by Crypto Whales

TechFlow Selected TechFlow Selected

Life-or-Death Game with 100x Leverage: Recapping Recent Crazy Bets and Gambles by Crypto Whales

One thought leads to heaven, one thought leads to hell.

By Fairy, ChainCatcher

Starting February 25, Bitcoin entered a period of intense volatility, experiencing sharp "N-shaped" swings within just one week, with price fluctuations exceeding 15%. The Crypto Fear & Greed Index remained persistently in the "fear" zone. While retail traders faced margin liquidation alerts and panic, top-tier whales began sensing the "blood in the water"...

In this market battle, some have precisely timed bottoms and tops to earn millions, while others who bet on the wrong direction suffered devastating liquidations. Who is manipulating the market? And who has fallen victim amid the chaos?

This report dives deep into recent whale activities, decoding how crypto giants play high-stakes capital games on the razor's edge of futures markets.

Liangxi’s 100x Futures Strategy: Dual-Sided Trading + Perfect Timing

On February 25, Liangxi—once dubbed a “scam artist in crypto”—turned $2,000 into $1 million in a short time, earning 600,000 USDT on Weex and realizing 500,000 USDT in real-account profits on OKX.

Based on analysis by X user @sunyangphp, Liangxi’s moves were as follows:

Background: On February 25, ETH exhibited broad-range downward volatility with significant price swings.

Dual-sided trading to profit from volatility

The “dual-sided trading” strategy involves opening both long and short positions simultaneously during volatile sideways markets, using high leverage (tens of times) to amplify gains. Through multiple short-term trades, he captured most of the oscillation profits.

Riding the final crash and then reversing for a bottom catch

He fully captured the last leg of ETH’s sharp drop and precisely reversed to go long at the lowest point.

Quick adaptation at critical moments

During the final plunge, the market briefly rebounded. Liangxi initially misjudged the trend and went long prematurely but quickly realized the error and decisively flipped to short.

50x Leverage Whale: A Lucky Turnaround Driven by Market Timing

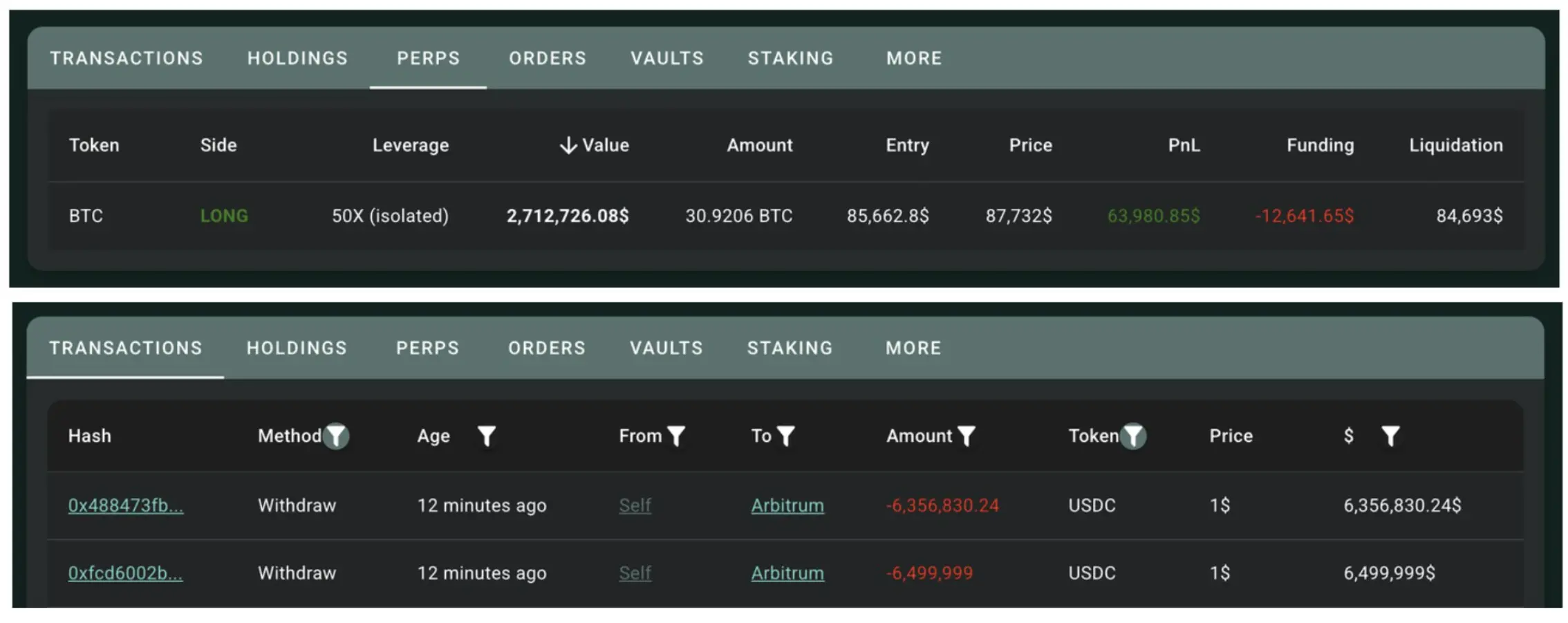

On March 2, a whale leveraged 50x on Hyperliquid to go long on BTC and ETH, turning an initial 6 million USDC into a profit of 6.83 million USD within 24 hours.

Whale address:

0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62

Per @ai_9684xtpa’s summary, the trade breakdown is as follows:

Initial position: 6 million USDC principal, 50x leverage

On March 2, the whale opened over $200 million in long exposure using 50x leverage, including long positions in both BTC and ETH.

-

ETH: 49,384 units, entry price $2,196, liquidation price $2,133.9

-

BTC: 1,260 units, entry price $85,671, liquidation price $84,629

Adding to ETH position (floating loss of $900,000 at the time)

Around 10:30 PM, the whale added 914 ETH and 41 BTC to the long position.

Rebalancing: Partially closing BTC, increasing ETH exposure

Near 11 PM, the whale closed 469.48 BTC longs and shifted heavily into ETH, increasing the ETH long position to 88,510 units.

Market turnaround: Trump’s speech fuels rally

At 11:30 PM, following a speech by Trump, market sentiment surged. BTC broke above $87,000 and ETH surpassed $2,250. The whale’s position flipped from floating loss to gain, with ETH longs generating a $6.46 million unrealized profit.

Gradual profit-taking

The whale first reduced the ETH long position from 88,510 to 22,570 units, then fully exited. Nearly all of the 831.57 BTC longs were also closed out. Total profit within 24 hours: $6.83 million.

(Note: Coinbase executive Conor discovered that funds in this address originated from phishing attacks and were linked to large-scale gambling on Roobet.)

Whale “Set 10 Big Goals First”: Dancing on the Razor’s Edge

The whale known as “Set 10 Big Goals First” once achieved a peak unrealized profit of $700 million—only to lose it all in the end. Amid recent market turbulence, this trader executed another series of extreme high-leverage maneuvers.

According to @ai_9684xtpa’s analysis, the actions were as follows:

Painful capitulation

On February 25, when Bitcoin dropped to $89,000, the whale was forced to sell 1,783.48 BTC at an average price of $89,138—totaling $159 million—while their average entry price had been as high as $100,320.

Shortly after, the whale completely liquidated all 5,185 BTC holdings, suffering a total loss of $24.3268 million. However, they claimed that certain profits weren’t accounted for by tracking software, asserting that core capital remained intact.

Comeback win: $15.38 million profit

On March 1, the whale re-entered the market, going long on 1,698 BTC at an average price of $83,568.65, worth $142 million. The position was fully closed early on March 3, securing a profit of $15.38 million.

Immediate reversal to short, betting on correction

Six hours after closing the long, the whale turned around and opened a massive short position of 2,285 BTC (worth ~$214 million), with $53.45 million in collateral and an average entry price of $93,729. The position was closed near $90,000 for profit.

Switching back to long again (now with $15.62 million in unrealized losses)

After taking profits, the whale rapidly re-established long positions and increased ETH exposure:

-

BTC: Average entry $90,207, holding 2,069 units

-

ETH: Average entry $2,285, holding 10,800 units

Heaven or hell in an instant. Whether it's Liangxi growing from $2,000 to $1 million, the 50x leverage whale making bold bets, or “Set 10 Big Goals First” chasing a $700 million dream only to see it vanish, their trading strategies are nothing short of dramatic.

Every open and close could be a life-changing moment. Their stories represent not only extreme expressions of trading tactics but also ultimate tests of psychological resilience and capital management. The market always offers opportunities—but only those who maintain constant respect for its risks can find a sliver of survival between rags-to-riches legends and zero-balance tragedies.

Risk Warning

The whale trading cases reviewed in this article involve aggressive strategies such as high leverage and high-frequency trading. While these tactics may yield substantial returns under extreme market conditions, they carry exceptionally high risk. Investors are advised to operate cautiously according to their own risk tolerance, manage position sizes prudently, and avoid impulsive decisions driven by market sentiment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News