Whales at War: Billions in Wagers, a Complete Recap of the High-Leverage Bull vs. Bear Showdown

TechFlow Selected TechFlow Selected

Whales at War: Billions in Wagers, a Complete Recap of the High-Leverage Bull vs. Bear Showdown

James Wynn wrote victory, while the insider paid the price for greed and hesitation.

Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, as Bitcoin gathered momentum to break its all-time high, a billion-dollar-scale battle between bulls and bears erupted on-chain.

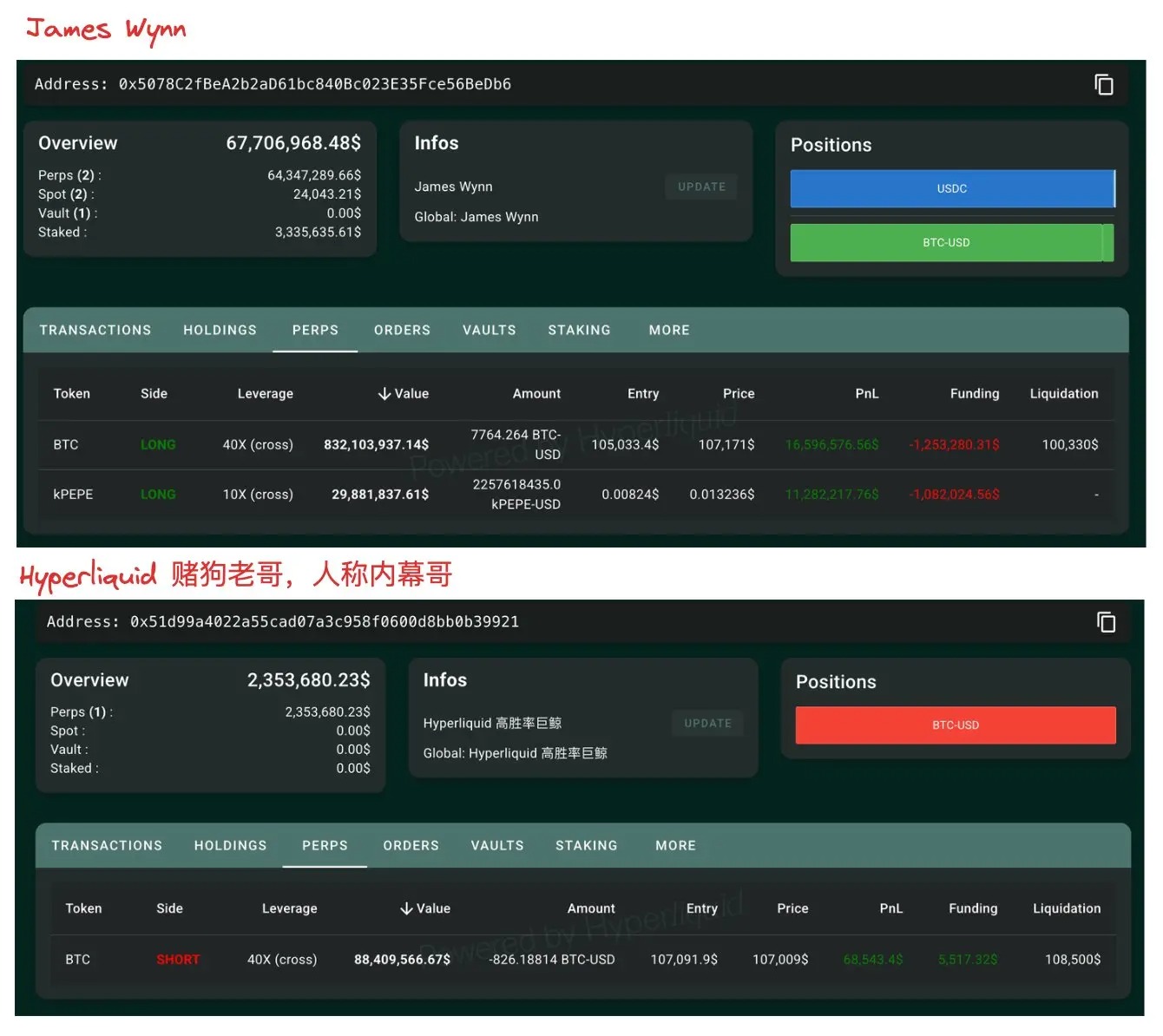

Two aggressive trading giants placed massive opposing bets: legendary trader James Wynn versus the high-win-rate player known as the "Hyperliquid 50x Insider." They opened 40x leveraged BTC positions against each other, instantly capturing intense market attention.

Leverage amplifies gains—and greed. Let's revisit the full story behind this late-night showdown.

Who Are They?

Bull participant James Wynn was once hailed as the "legendary meme coin hunter" of the blockchain world. He started with extremely humble beginnings—originally dubbed the "10U warrior," his wallet transactions hovered around just dozens of dollars. But during the PEPE craze, his strategy shifted dramatically toward aggressive, heavy positioning, earning him instant fame. Riding PEPE’s explosive rally, James Wynn turned an initial investment of $7,644 into over $25 million.

James Wynn’s trading style can be summarized in three words: large position size, high leverage, high frequency. Almost every one of his entries comes with public calls. Recently on long BTC positions, he repeatedly declared, “Bitcoin at $100K is very cheap.”

The bear participant, the “Hyperliquid 50x Insider,” has an even more bizarre background. Since January this year, multiple addresses linked to him have frequently used high leverage on GMX, accumulating around $2.53 million in profits. He is active on gambling platforms Roobet and AlphaPo, has transaction records with ChangeNOW—a crypto exchange favored by hackers—and single-handedly extracted $1.8 million from Hyperliquid, cementing his legendary status.

Regarding his true identity, ZachXBT published an article suggesting the “Insider” is likely connected to William Parker (WP). WP is a career gambler with a history of fraud, previously arrested in Finland for stealing a total of $1 million from two online casinos in 2023. He has repeatedly made headlines in UK media due to hacking and gambling-related fraudulent activities.

Battle Recap

According to data provided by on-chain analyst Ai Auntie, in the early hours of May 21, a legendary on-chain clash quietly began.

⏰ 2 AM–4 AM: Both players load up their positions

At 2 AM, James Wynn moved first, increasing his 40x leveraged long BTC position to 7,764.26 BTC (worth approximately $832 million).

-

Entry price: $105,033.4

-

Liquidation price: $100,330

-

Unrealized PnL at the time: ~$16.59 million

At 4 AM, the Insider entered the bear side with full gambling mode activated. As BTC hit a short-term peak, he reversed course and opened a 40x short:

-

Position size: 826.18 BTC (~$88.41 million)

-

Entry price: $107,091.9

-

Liquidation price: $108,500

-

Unrealized PnL at the time: $68,000

Image source: Ai Auntie

⏰ 2 PM: BTC breaks $107,500, divergence begins

The performance of both positions starts to diverge:

-

James Wynn: Long unrealized profit rises to $19.83 million

-

Insider: Short unrealized loss reaches $375,000

⏰ 3 PM–6:30 PM: James Wynn takes partial profits, gradually reducing position

-

3 PM: Long reduced to 5,625.43 BTC, unrealized PnL $9.43 million, realized profit $10.48 million

-

4 PM: Further reduction to 4,640.26 BTC, unrealized PnL $7.68 million, realized profit $11.92 million

-

6:30 PM: Partial close again, leaving only 2,524.86 BTC, unrealized PnL drops to $2.72 million, cumulative realized profit reaches $14.57 million

By now, James Wynn had reduced his long position from a peak of $832 million down to $268 million, steadily locking in profits.

⏰ 9 PM: Frontlines stabilize—James Wynn holds quietly, Insider stays put

BTC pulls back to $106,500.

-

James Wynn does not immediately re-enter; holds 1,819.58 BTC ($193 million) long, unrealized PnL $2.65 million, realized profit $15.42 million

-

Insider short: 826.18 BTC, unrealized PnL $542,000

⏰ After 11 PM: Peak confrontation—both add positions, tension skyrockets

As BTC broke above $108,000, James Wynn aggressively increased his long, while the Insider topped up collateral and doubled down on shorts:

James Wynn

-

Increased to 7,444.97 BTC ($815 million)

-

Average new entry price: $107,726.7

-

Liquidation price: $101,420

-

Current unrealized PnL: $13.46 million

Insider

-

Short increased to 597.4 BTC ($65.43 million)

-

New entry price: $108,185.5

-

Liquidation price raised to: $112,320 (after adding 2 million USDC margin)

-

Current unrealized loss: $806,000

⏰ 11:30 PM–Midnight: Historic head-on collision, combined positions exceed $1 billion

Near 11:30 PM, James Wynn’s long surpassed $860 million, liquidation price raised to $101,980; the Insider’s short expanded to $101 million, liquidation price at $110,780.

Near 11:45 PM, James Wynn’s long approached $900 million.

Near midnight: James Wynn’s position exceeded $1 billion, reaching the peak of this cycle—the duel reached its climax.

Early Morning Report, May 22: James claims decisive victory

BTC surged through volatility, breaking $110,000 and hitting a new all-time high.

James Wynn continued adding to his long, eventually holding 10,200 BTC worth $1.12 billion, with unrealized profits of $20.19 million.

The Insider, who initially held profitable shorts, kept adding positions in the $106,670–$107,410 range, missing the chance to exit. His 24-hour cumulative loss ballooned to $5.61 million, still holding a 40x short of 449.43 BTC.

In Victory and Defeat, See the Double-Edged Sword of Leverage

James Wynn emerged victorious; the Insider paid the price for greed and hesitation. This "billion-dollar battle" didn’t just shatter records—it sounded a dual alarm on risk and discipline for the entire market.

And similar battles may already be unfolding around us. Current BTC futures open interest has soared to a record high of $80.263 billion. In the past 24 hours, total liquidations in the crypto market reached $407 million, including $240 million in short liquidations and $167 million in long liquidations.

Under high leverage, the line between unrealized profit and liquidation is razor-thin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News