Bitcoin's Dogecoin moment: Wall Street is quietly taking your retirement funds

TechFlow Selected TechFlow Selected

Bitcoin's Dogecoin moment: Wall Street is quietly taking your retirement funds

Everyone is dreaming of catching the next Dogecoin, without realizing the next Dogecoin is actually Bitcoin.

Author: Udi Wertheimer

Translation: TechFlow

I believe Bitcoin is entering a generational development phase unlike anything we've ever seen.

I've been trying to convince people in the crypto space. But they don't get it.

I finally found an example they can understand.

Please read this entire article. It might retire your family

If I'm right, Bitcoin is now in the final stage of a generational shift.

Many—if not most—of the old large holders have already exited this asset. They sold at what they believed was the peak (around $100,000) and have been replaced by new buyers.

This kind of turnover is extremely rare and difficult to achieve. But once it succeeds—and I believe it already has—the result will be a magnitude of growth previously unimaginable.

But you don’t need to imagine what that looks like. Because it’s actually happened before.

The Dogecoin Lesson

Today, Dogecoin is known as the king of Memecoins, the meme everyone dreams of replicating. But few understand what actually happened, how Dogecoin achieved its legendary status, and just how unimaginable the entire process was.

Since its creation in 2013, Dogecoin had always been viewed as a joke within the crypto community. Experienced altcoin traders believed the way to play DOGE was to accumulate during quiet periods for months, then sell to newcomers every few years at 5–10x profits, restarting the cycle during the next lull. A recurring loop.

They’d gone through multiple cycles, buying and selling Dogecoin under one cent, profiting off newbies each time.

But on April 2, 2019, something insane happened

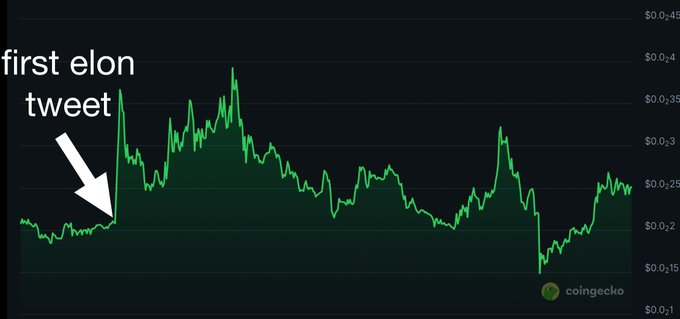

Elon Musk, the celebrity CEO of Tesla and SpaceX, tweeted: “Dogecoin might be my favorite cryptocurrency. It’s very cool.”

That single tweet caused Dogecoin to surge 50%, rising from 0.24 cents to 0.36 cents (note: cents, not dollars).

A 1.5x gain in one day—pretty good, right?

Wrong. That was nothing. Dogecoin was about to rise another 200x from there, nearly overtaking Ethereum.

Yet in July 2019, existing Dogecoin holders couldn't fathom such a future. Doge going from $0.0025 to nearly $1 in just a few years? Absurd. Impossible.

This was a massive event. Crypto natives thought they knew it was big—but they severely underestimated it.

So after the 50% pump, they thanked Satoshi and Elon for the free money, then began dumping.

For a brief moment, their decision was correct

The old holders spent much of that year selling into every rally, feeling smug whenever DOGE failed to break out.

But beneath the surface, something was changing. After the onset of the pandemic, the public learned they could sit at home and try shorting GME on Robinhood—some noticed Robinhood also offered crypto trading.

Back in 2020, Robinhood only listed seven cryptocurrencies: the legacy BTC, techie ETH, and some awkward coins like BCH and ETC. The only fun, cool coin on Robinhood was DOGE.

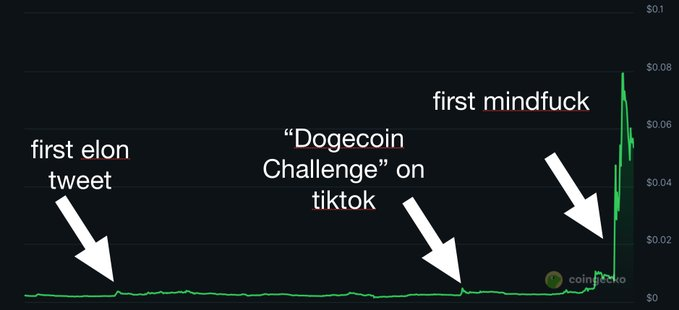

An army of Robinhood meme traders seized the opportunity, launching the wildly popular TikTok trend known as the “Doge Challenge.”

Users were encouraged to share screenshots of their Robinhood accounts showing DOGE purchases. The trend exploded. Everyone started buying.

Just some TikTok users—no big deal...

But Crypto Twitter wasn’t paying attention

In 2020, crypto natives largely ignored Robinhood or TikTok. Most old DOGE holders had no idea what was happening. So whenever the price rose slightly, they sold.

To them, Dogecoin was still just a dumb joke—a coin to sell on rallies and buy on dips to make extra cash.

If you looked at the chart, it reinforced that belief. For most of 2020, the price didn’t move much. Everyone was conditioned to think, “When Elon tweets, we only go up 20%,” because old holders were always there dumping and suppressing the price.

They had no conviction.

But the new holders did

Beneath the surface, TikTok kids kept buying.

The crypto Twitter sphere remained largely blind. The charts told them nothing was happening.

Until January 2021—when Dogecoin sellers finally ran out of coins.

In just two weeks, DOGE surged from $0.008 to $0.08—a 10x gain. Its market cap exploded from $1 billion to $10 billion.

Twitter lost its mind. Group chats blew up. Old whales called each other in the middle of the night. Did you see that?!?!?

"Did you see this?!?!" First Doge awareness collapse

It's hard to put into words how massive this cognitive shock was. Most crypto natives completely broke down—they had almost all owned DOGE at some point in the past seven years, and nearly all had sold. They paid little attention to TikTok trends and had no idea this move had been brewing for months.

But their biggest mistake was yet to come

Eventually realizing that the entire retail world had fallen in love with Dogecoin, some sharp crypto traders started buying back in. There were many tweets boasting about doubling or tripling quickly on DOGE. They felt proud of themselves.

But none of them realized this entire massive movement was merely a warm-up.

Their minds were still anchored to the old DOGE price. Doge was a sub-penny coin. Everyone knew that. If it briefly went above one cent, it was a bubble—we’d use it to accumulate more stablecoins and then exit.

But the new holders had no memory of the old prices

The TikTok and Robinhood youth had no knowledge of the years of pain endured by old Doge holders. In fact, when they zoomed out on the Robinhood chart, they couldn’t even see the historical price action. To them, it was a blank slate, and “Doge to $1” made perfect sense.

Thus, after the old holders rotated out and the CT convinced itself the rally was over between February and April, DOGE exploded another 10x, reaching a final peak of around $0.70.

What happens when sellers run out of coins. Illustrated.

This was 200x higher than the peak of the first Elon-driven rally in 2019. In just two years. TikTok users cashed out huge gains. CT missed the entire move. The best CT traders might have locked in a 3x gain (and made sure to brag about it on timeline for months).

The same thing is now happening to Bitcoin

Granted, today’s Bitcoin is much larger than Dogecoin was back then. But so are the participants. Instead of Robinhood retail traders and TikTok users, we now have institutions, ETFs, and Bitcoin treasury firms like MSTR. Instead of Elon shilling Doge (who wasn’t nearly as famous in 2019), we now have the president of the free world promoting Bitcoin. Perhaps we’ve already—or soon will—have nations buying Bitcoin.

Institutions have been aggressively buying Bitcoin from old holders: the oblivious crypto natives. Crypto natives don’t understand how traditional capital markets work. In fact, they mock them. They don’t want to know. So they’ve completely missed it, continuing to sell around $100,000 because, to them, that number is laughably high.

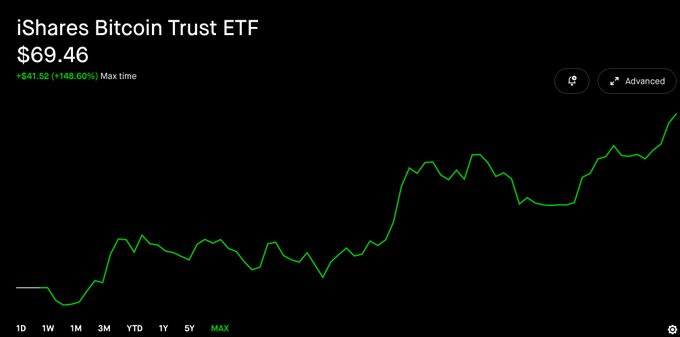

But the new buyers don’t even see that number. $IBIT, BlackRock’s Bitcoin ETF, trades around $70. Its chart starts from the ETF launch date (January 2024), when it was priced at $30. It has only gone up $40! That’s nothing—why not $700?

This is the chart IBIT holders see

And Bitcoin treasury firms like Saylor’s MSTR don’t even look at the unit price of the underlying asset. They measure purchases in dollar value. “Last week we deployed $500 million.” They are completely insensitive to Bitcoin’s price. They just deploy as many dollars as possible. (By the way, MSTR will likely continue doing this at an accelerating pace. If you're sitting there waiting for Saylor to get liquidated, you don’t understand what’s happening. Do your research. It won’t happen in the near term.)

CT and crypto natives thought the move—from $50K to $100K following ETF approval and Trump’s win—was the whole show. I mean, the price stopped going up!

But the truth is, it just takes time to rotate the asset out of old hands. The real move hasn’t even started yet.

Look around

Most of the old Bitcoin maximalists are nowhere to be found. Where are they? Did they vanish?

Most of them sold. They bought houses and boats and left.

Where are the crypto investors? They rotated into ETH and wrote articles about comebacks and staking yields.

What about young speculators? They never held Bitcoin—they’re all trading worthless air memecoins, dreaming of catching the next Doge, unaware that the next Doge is actually Bitcoin.

No one is left. Wall Street bought everyone’s Bitcoin. And they’ve only just begun.

So what happens next?

As you read this, you’re reluctant to believe. You likely know far less about Bitcoin than you think. You know I’ve correctly predicted Bitcoin at every step, day after day, for months—that’s why you’re reluctantly reading this article—but you still don’t want to believe.

So if we revisit the Dogecoin story, our current position is after Elon’s first tweet, after the TikTok “Doge Challenge,” but before the first 10x surge in January 2021.

In other words, Bitcoin is post-ETF, post-Saylor acceleration, post-Trump inauguration, etc. But it’s also pre-anyone believing “this time is really different,” pre-anyone realizing “the sellers have run out of BTC.”

Bitcoin is bigger, so we may not see an immediate 10x, but as I said earlier, I’m highly confident we’ll see $400,000 by year-end. That target might even be too conservative.

You still think this is absurd. But the old holders are out. We have no reason why rapid multiplicative growth can’t happen again.

And this is just the first leg. I believe, just like DOGE, after the first awareness collapse comes a larger, faster, more violent collapse. After the initial $400K target, there will be another 10x or more. That happens when the whole world starts believing (remember when every young person on Earth talked about Doge for a month?). But I don’t want to talk too much about it now. That’s the second collapse. That’s for later.

We are entering the first awareness collapse.

What does this mean for you?

First, you can actually retire on 1 Bitcoin. If you have any chance of acquiring 1 BTC, do it now. Put it away and forget about it. I’m not sure you’ll get this opportunity again.

Second, after acquiring your first Bitcoin, keep buying. Keep stacking. That’s what Wall Street is doing. Do you really think you’re smarter than Wall Street? They’ve been laps around you for the past two years.

Third, now is not the time to wait for price drops. Who will sell? The old holders are already out. They can’t sell to you—they’ve already sold.

Oh, and fourth…

The fate of altcoins

Your altcoins are doomed. There will be pockets of outperformance here and there, and if you’re truly attentive, maybe you’ll catch them. Fast in, fast out, thanks for the scam. But most altcoins will fail to keep up with the massive capital inflows into Bitcoin.

This won’t happen overnight. But if Bitcoin rises 50x to 100x in a relatively short time, no other asset can sustainably keep up—not even revenue-backed ones—unless their revenues also grow 50x, which I think is possible only for early-stage ventures. So if you really want, you can still bet on early-stage ventures.

Interestingly, some large memecoins dream of replicating Dogecoin’s success without understanding why it succeeded. They think that if they copy certain elements—like listing on Robinhood (but this time alongside 500 other tokens), or getting Elon to mention them (which isn’t cool anymore—he does it constantly), or making TikTok videos (nothing close to the spirit of the pandemic era)—they’ll succeed. But the pieces don’t fit. Clearly, Bitcoin is the better narrative.

And the biggest loser in this cycle might be Ethereum. MSTR’s market cap could surpass Ethereum’s. Ethereum will fulfill the prophecy: “No second best,” because it will lose its second-place position to MSTR. Some Ethereum holders are starting to build treasury companies—that’s cute—but they can’t catch up within this cycle.

You should easily spot the problem: the biggest Ethereum bulls are still aiming for a pathetic $4,000 target on timeline, while awkward figures like sassal and eric.eth keep posting garbage daily. The issue is, the old holders are still there. So yes, ETH will have bursts of strength here and there, but only temporary spikes, while overall, the ETH/BTC ratio continues making lower highs as old holders dump on every small bounce.

If Lubin, Tom Lee, and friends keep buying consistently for years, maybe Ethereum finally gets a real run in the next cycle. I don’t think it happens this cycle.

Wall Street is buying all the Bitcoin

Buy some Bitcoin before it’s all taken.

Thank you for paying attention to this matter!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News