Hotcoin Research Market Insights: The "Big Beautiful" Bill Passes House, US June Nonfarm Payrolls Beat Expectations

TechFlow Selected TechFlow Selected

Hotcoin Research Market Insights: The "Big Beautiful" Bill Passes House, US June Nonfarm Payrolls Beat Expectations

Stablecoins continued to see expansion this week, with net inflows observed in both U.S. spot Bitcoin and Ethereum ETFs.

Author: Hotcoin Research

Cryptocurrency Market Performance

The current total market capitalization of cryptocurrencies stands at $3.32 trillion, with BTC accounting for 64.6%, or $2.14 trillion. The market cap of stablecoins is $255.3 billion, showing a 0.83% increase over the past seven days, with USDT representing 62.45%.

This week, BTC's price showed range-bound volatility, currently trading at $107,945; ETH also exhibited range-bound movement, now priced at $2,512.

Among the top 200 projects on CoinMarketCap, most recorded gains while a minority declined: PENG surged 49.38% over 7 days, BONK rose 27.73%, PLUME increased by 36.98%, and MOODENG gained 31.39%.

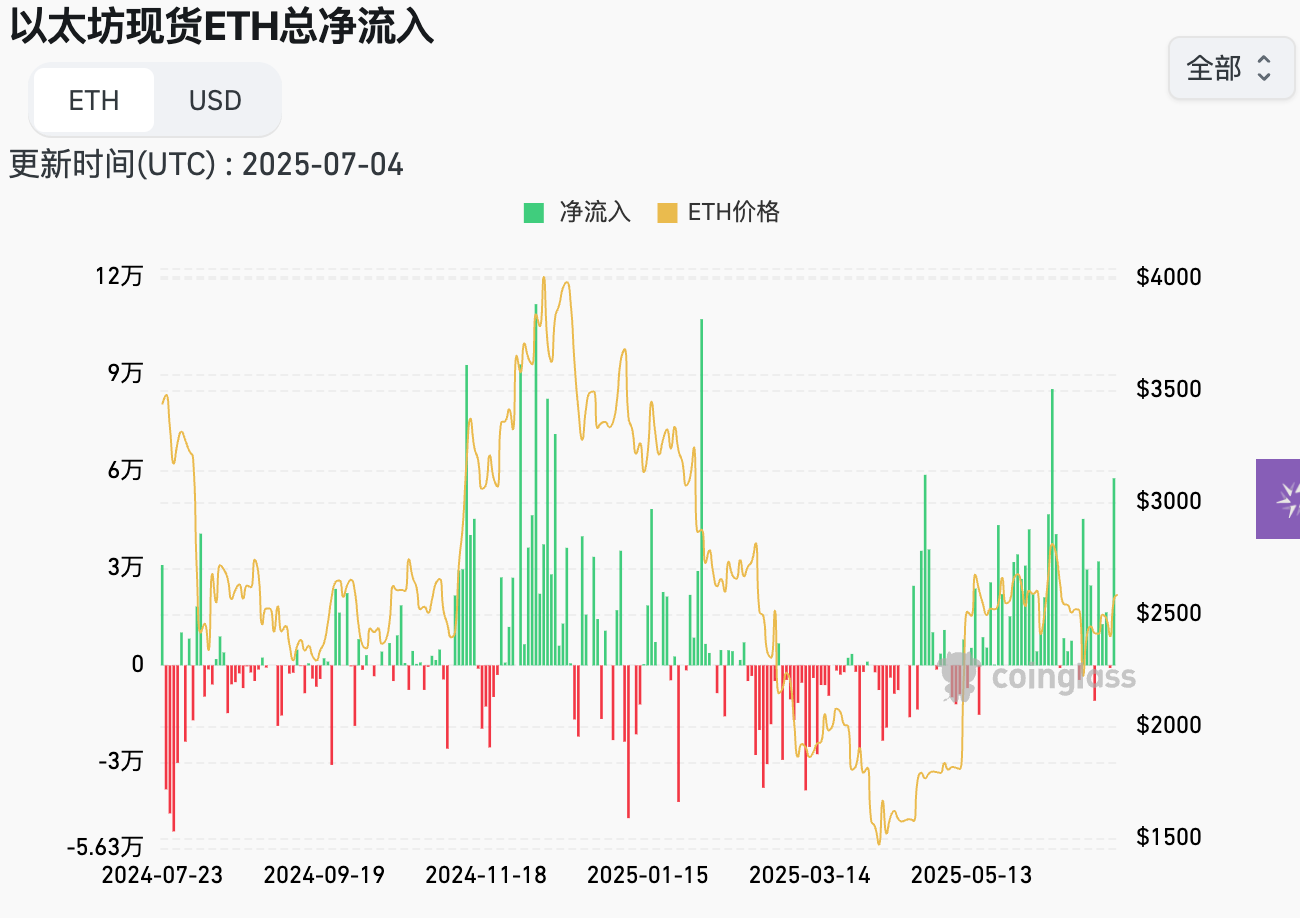

This week, net inflows into U.S. spot Bitcoin ETFs amounted to $770 million; net inflows into U.S. spot Ethereum ETFs reached $219.6 million.

The "Fear & Greed Index" on July 4 stood at 68 (higher than last week), reflecting neutral sentiment for two days and greedy sentiment for five days this week.

Market Outlook:

Stablecoins continued to expand this week, with both U.S. spot Bitcoin and Ethereum ETFs seeing net inflows. Both BTC and ETH remained in a consolidation phase. The RSI index was 47.21, indicating neutrality, while the Fear & Greed Index was primarily in the greedy zone. This week, the U.S. passed the tax reduction and spending "Beautiful Big Bill." June’s non-farm payroll data exceeded market expectations. The probability that the Federal Reserve will hold interest rates steady in July is 78.8%.

BTC’s price range next week is expected to be between $106,000 and $111,000. Pay close attention to the U.S. tariff agreement announcement on July 9, which could be a significant summer event. While its impact on crypto appears less than that of February's events, it still warrants caution. The tokenization wave in U.S. equities is gaining momentum, and Hotcoin has launched a dedicated section for it.

Understanding the Present

Weekly Major Events Recap

1. On June 29, X platform data showed that Trump family-backed crypto project WLFI’s stablecoin USD1 achieved a 24-hour trading volume of $1.25 billion, a record high, ranking third behind Tether (USDT) and USDC;

2. On June 30, Guotai Haifeng released a research report stating that more Hong Kong brokers are expected to enter the virtual asset business. Additionally, as the market enters the earnings season, broker sector profits may exceed expectations. Against the backdrop of stabilizing the stock market, low-valuation and under-allocated large-cap stocks remain recommended. Non-bank large caps should shift from “marginal thinking based on fundamentals” to “aggregate thinking focused on risk-return ratios.” In particular, recent policies encouraging Red Chips and H-shares to return to A-shares benefit Hong Kong’s non-bank large-cap stocks even more;

3. On June 30, REX-OSPREY CEO announced that a Solana ETF supporting staking will begin trading on Wednesday;

4. On June 30, digital brokerage Robinhood (HOOD) announced plans to expand its crypto operations through new initiatives, including developing its own blockchain network on Arbitrum and launching tokenized stock trading. The company today rolled out tokenized stock products on Ethereum Layer 2 network Arbitrum for European users, covering over 200 U.S. stocks and ETFs, enabling full-day weekday trading. In its statement, Robinhood said this move upgrades its European crypto app into an “all-in-one investment platform driven by crypto”;

5. On July 1, according to Bloomberg, a filing submitted Monday revealed that a cryptocurrency firm linked to former U.S. President Donald Trump’s family raised $220 million to purchase Bitcoin and digital asset mining equipment. Named American Bitcoin, the company counts Eric Trump among its supporters. According to filings by Hut 8 Corp., the majority shareholder, American Bitcoin issued new shares to private investors last Friday, with approximately $10 million worth sold in Bitcoin rather than USD;

6. On July 1, CNBC reported that stablecoin issuer Circle (CRCL.K) is applying to establish a national trust bank in the United States;

7. On July 1, PR Newswire reported that Amber International (NASDAQ: AMBR), the crypto financial institution service and solutions provider under Amber Group, announced it has successfully signed private placement subscription agreements totaling $25.5 million, with participation from Mile Green, Harvest Capital, Pantera Capital, Choco Up, and others;

8. On July 2, Cryptoslate reported that during the first half of 2025, public companies collectively purchased 245,510 BTC—more than double the amount acquired by ETFs during the same period (118,424 BTC);

9. On July 2, The Block reported that Ethereum core developer Zak Cole announced via X the formation of a new organization called the Ethereum Community Foundation (ECF), aimed at supporting institutional adoption of Ethereum infrastructure and ultimately driving up ETH prices;

10. On July 3, TheBlock reported that the Trump family has earned approximately $620 million from cryptocurrency projects in recent months, nearly 10% of their $6.4 billion net worth;

11. On July 3, a full committee hearing on crypto market structure will take place next Wednesday, July 9, with Ripple CEO attending;

12. On July 4, market news indicated that Trump’s tax reduction and spending bill (“Beautiful Big Bill”) passed the House of Representatives;

13. On July 4, on-chain investigator ZachXBT posted on social media that UAE authorities have detained Ildar Ilham, founder of decentralized finance protocol WhiteRock Finance, accusing him of orchestrating a $30 million fraud scheme via the gambling platform ZKasino.

Macroeconomic Developments

1. On July 1, Bloomberg ETF analyst James Seyffart released updated predictions on the likelihood of crypto spot ETF approvals by the end of 2025, forecasting a wave of new ETF approvals in the second half of 2025. Approval probabilities for combination/index funds, Litecoin, SOL, and XRP stand at 95%; Dogecoin, HBAR, Cardano, Polkadot, and Avalanche are projected at 90%. SUI has a 60% approval chance, while Tron/TRX and Pengu each have a 50% chance;

2. On July 3, the U.S. reported seasonally adjusted non-farm payrolls for June at 147,000, above the 110,000 expected, with the prior figure revised upward from 139,000 to 144,000;

3. On July 3, the U.S. unemployment rate for June came in at 4.1%, unexpectedly lower. The seasonally adjusted non-farm payroll gain of 147,000 jobs beat general market expectations;

4. On July 4, U.S. President Trump stated he plans to impose tariffs ranging from 60% to 70%, and from 10% to 20%, on different countries. These tariffs will take effect starting August 1. Letters regarding the tariffs will begin being sent this Friday, with 10 to 12 countries expected to receive notifications;

5. On July 2, according to CME's "Fed Watch" data, the probability of the Federal Reserve holding rates steady in July is 78.8%, while the chance of a 25-basis-point rate cut is 21.2%. For September, the probability of unchanged rates is 8.9%, cumulative 25-basis-point cuts stand at 72.3%, and cumulative 50-basis-point cuts at 18.8%.

ETF Updates

Data shows that between June 30 and July 4, net inflows into U.S. spot Bitcoin ETFs totaled $770 million. As of July 4, GBTC (Grayscale) has seen cumulative outflows of $23.288 billion, currently holding $20.146 billion in assets, while IBIT (BlackRock) holds $76.297 billion. The total market cap of U.S. spot Bitcoin ETFs stands at $138.086 billion.

Net inflows into U.S. spot Ethereum ETFs amounted to $219.6 million.

Anticipating the Future

Event Announcements

1. Bitcoin Asia 2025 will be held on August 28–29 at the Hong Kong Convention and Exhibition Centre;

2. WebX Asia 2025 will take place in Tokyo, Japan, on August 25–26, 2025;

3. TOKEN2049 Singapore 2025 will be hosted in Singapore on October 1–2, 2025.

Project Milestones

1. Aethir Edge Tokenomics 2.0 will launch on July 13, introducing a staking-driven rewards mechanism. Users must stake ATH to participate in rewards, categorized into Bronze, Silver, and Gold tiers, with top-tier participants eligible for up to 240 ATH per day.

Key Events

1. The deadline for U.S.-EU tariff negotiations has been extended to July 9;

2. July 8 at 12:30 PM: Reserve Bank of Australia interest rate decision;

3. July 9 at 9:30 AM: China’s June YoY CPI;

4. July 9 at 10:00 AM: Reserve Bank of New Zealand interest rate decision;

5. July 10 at 8:30 PM: U.S. initial jobless claims (in thousands) for the week ending July 5.

Token Unlocks

1. EigenLayer (EIGEN) will unlock 1.29 million tokens on July 9, valued at approximately $1.45 million, representing 0.41% of circulating supply;

2. IOTA (IOTA) will unlock 15.19 million tokens on July 9, valued at $2.37 million, or 0.39% of circulating supply;

3. Movement (MOVE) will unlock 50 million tokens on July 9, valued at about $8.09 million, or 1.92% of circulating supply;

4. Immutable (IMX) will unlock 24.25 million tokens on July 11, valued at around $10.55 million, or 1.31% of circulating supply;

5. Optimism (OP) will unlock 4.47 million tokens on July 11, valued at approximately $2.4 million, or 0.26% of circulating supply;

6. Aptos (APT) will unlock 11.31 million tokens on July 12, valued at about $49.99 million, or 1.75% of circulating supply.

About Us

Hotcoin Research, as the core investment research hub within the Hotcoin ecosystem, is dedicated to providing global cryptocurrency investors with professional, in-depth analysis and forward-looking insights. We have built a three-pillar service system encompassing “trend analysis + value discovery + real-time tracking,” delivering precise market interpretations and actionable strategies through deep dives into industry trends, multi-dimensional evaluations of promising projects, and round-the-clock monitoring of market fluctuations. Supported by weekly dual-updates including the strategy livestream “Top Coin Selection” and the daily news digest “Blockchain Today,” we serve investors at all levels. Leveraging cutting-edge data analytics models and extensive industry networks, we empower novice investors to build solid cognitive frameworks and help institutional clients capture alpha, jointly seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News